UNIT I

Accounting Standards &Financial Reporting

Concepts:

We know that generally accepted accounting principles (GAAP) aim to bring uniformity and comparability to financial statements. In many places, you'll see that GAAP allows different alternative accounting treatments for an equivalent item. For instance, different stock valuations end in different financial statements.

Such practices can lead the intended user within the wrong direction when making decisions associated with his or her field. Given the issues faced by many accounting users, the necessity to develop common accounting standards has increased.

To this end, the Institute of Chartered Accountants of India (ICAI), which is additionally a member of the International Accounting Standards Committee (IASC), formed the Accounting Standards Committee (ASB) in 1977. ASB needed accounting. After detailed investigation and discussion, a draft was prepared and submitted to ICAI. After proper review, ICAI finalized them and notified them of their use within the financial statements.

Meaning of Accounting Standards:

Accounting standards are written statements consisting of rules and guidelines issued by accounting institutions for the preparation of unified and consistent financial statements and other disclosures that affect different users of accounting information. Is.

Accounting standards set the conditions for accounting policies and practices with codes, guidelines, and adjustments that facilitate the interpretation of things contained in financial statements and even their handling within the books.

Nature of Accounting Standards:

Based on the discussion above, accounting standards are often said to be guides, dictators, service providers, and harmonizers within the field of accounting processes.

(I) Useful as A Guide to Accountants:

Accounting standards serve accountants as a guide to the accounting process. They supply the idea for the account to be prepared. For instance, they supply how to value inventory.

(II) Act as a Dictator:

Accounting standards act as a dictator within the field of accounting. In some areas, like dictators, accountants haven't any choice but to settle on practices aside from those listed in accounting standards. For instance, the income statement must be prepared within the format specified by accounting standards.

(III) Act as a Service Provider:

Accounting standards constitute the scope of accounting by defining specific terms, presenting accounting issues, specifying standards, and explaining numerous disclosures and implementation dates. Therefore, accounting standards are descriptive in nature and act as a service provider.

(IV) Functions as a Harmonizer.

There is no bias in accounting standards and there's uniformity in accounting methods. They remove the consequences of varied accounting practices and policies. Accounting standards often develop and supply solutions to specific accounting problems. Therefore, whenever there's a contradiction within the accounting problem, it's clear that the accounting principle acts as a harmonizer and facilitates the accountant's solution.

Purpose of Accounting Standards:

Previously, accounting was wont to record business transactions of a financial nature. Currently, its main focus is on providing accounting information during the decision-making process.

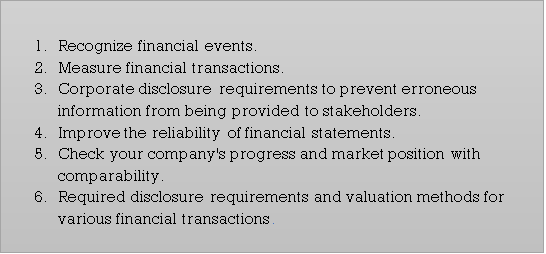

Accounting Standards are required for the following purposes:

(I) To bring Unity to Accounting Methods:

Accounting standards brings equality to accounting methods by proposing standard treatments for accounting issues. For example, AS-6 (revised edition) describes depreciation accounting methods.

(II) To improve the Reliability of Financial Statements:

Accounting is the language of business. The information provided by accountants is often based solely on the information contained in the financial statements, and many users make various decisions about their field. In this regard, financial statements need to provide a true and fair view of business concerns. Accounting standards bring credibility and credibility to different users.

They also help potential users of the information contained in financial statements with disclosure standards that make it easier for even the layperson to interpret the data. Accounting standards provide a concrete theoretical basis for the accounting process. They provide accounting uniformity, make financial statements for different business units comparable in different years, and again facilitate decision making.

(III) Simplify Accounting Information:

Accounting standards prevent users from reaching misleading conclusions and make financial data easy for everyone. For example, AS-3 (revised edition) clearly classifies cash flows in terms of "sales activities," "investment activities," and "finance activities."

(IV) Prevent fraud and manipulation:

Accounting standards prevent management from manipulating data. By systematizing accounting methods, fraud and operations can be minimized.

(V) Assist Auditors:

Accounting standards set the conditions for accounting policies and practices with codes, guidelines, and adjustments for creating and interpreting the items that appear in financial statements. Therefore, these terms, policies, guidelines, etc. are the basis for auditing the books.

The Characteristics of Accounting Standards:

Classification of Companies

Companies are distinguished and labelled as Level I, Level II, and Level III companies. Accounting standards apply to companies supported this classification and therefore the categories to which they apply.

Level I company

Companies that fall under one or more of the subsequent categories are called Level I companies.

- Companies with listed stock or debt securities, whether in or outside India

- Companies listed on equity or debt securities. Board resolution must be available as evidence Banks, including co-operative banks

- Financial organization

- Companies running insurance business

- All commercial, industrial, and business reporting companies with sales in more than Rs that don't include “other income” within the immediately preceding accounting period supported audited financial statements 50 crore.

- All commercial, industrial, and business reporting companies that borrow quite Rs, including public deposits. 10 chlores at any time during the accounting period

- Any of the above holding companies and subsidiaries at any time during the accounting period

Level II Enterprise

Companies that fall under one or more of the subsequent categories are called Level II companies.

- All commercial, industrial, and business reporting companies whose sales (excluding “other income”) within the last accounting period supported audited financial statements exceed rupees. 400,000 rupees but Rs 5 billion

- All commercial, industrial, and business reporting companies that hold borrowings, including public deposits, have larger Rs. 100 million rupees, but rupees. 10 crores at any time during the accounting period

- Any of the above holding companies and subsidiaries at any time during the accounting period

Level III Companies:

Companies that don't fall into Level I and Level II are considered Level III companies.

Applicability of Accounting Standards

Accounting Standard | Level I | Level II | Level III |

AS 1 Disclosure of Accounting Principles | Yes | Yes | Yes |

AS 2 Valuation of Inventories | Yes | Yes | Yes |

AS 3 Cash Flow Statements | Yes | No | No |

AS 4 Contingencies and Events Occurring after the Balance Sheet Date | Yes | Yes | Yes |

AS 5 Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies | Yes | Yes | Yes |

|

|

|

|

AS 7 Construction Contracts (Revised 2002) | Yes | Yes | Yes |

AS 9 Revenue Recognition | Yes | Yes | Yes |

AS 10 Accounting for Fixed Assets | Yes | Yes | Yes |

AS 11 The Effects of Changes In Foreign Exchange Rates (Revised 2003) | Yes | Yes | Yes |

AS 12 Accounting for Government Grants | Yes | Yes | Yes |

AS 13 Accounting for Investments | Yes | Yes | Yes |

AS 14 Accounting for Amalgamations | Yes | Yes | Yes |

AS 15 Employee Benefits (Revised 2005) | Yes | Yes | Yes |

AS 16 Borrowing Costs | Yes | Yes | Yes |

AS 17 Segment Reporting | Yes | No | No |

AS 18 Related Party Disclosures | Yes | No | No |

AS 19 Leases | Yes | Partial | Partial |

AS 20 Earnings Per Share | Yes | Partial | Partial |

AS 21 Consolidated Financial Statements | Yes | No | No |

AS 22 Accounting for taxes on income | Yes | Yes | Yes |

AS 23 Accounting for Investments in Associates in Consolidated Financial Statements | Yes | No | No |

AS 24 Discontinuing Operations | Yes | No | No |

AS 25 Interim Financial Reporting | Yes | No | No |

AS 26 Intangible Assets | Yes | Yes | Yes |

AS 27 Financial Reporting of Interests in Joint Ventures | Yes | No | No |

AS 28 Impairment of Assets | Yes | Yes | Yes |

AS 29 Provisions, Contingent Liabilities and Contingent Assets | Yes | Partial | Partial |

₋ Introduction to AS- 3, AS-12 and AS-19 with simple numerical.

Introduction to AS- 3

Cash flow as per Accounting Standards:

- Applicability of AS3 income Statement

The applicability of the income statement is defined under the businesses Act 2013. As defined by the law, financial statements include:

I. Record

Ii. Profit and Loss Account / Balance Account

Iii. Income statement

Iv. Statement of changes in shareholders' equity, etc.

v. Annotation

Therefore, the income statement must be prepared by all companies, but the law also specifies certain categories of companies that are exempt from an equivalent.

For eg: One Person Company (OPC), Small Company, and Dormant Company.

- OPC means a corporation with just one member.

- SMEs are private companies with a maximum paid-up capital of Rupees. The utmost sales are 500,000 rupees. 2 rolls.

- A dormant company is an inactive company that's established for future projects or simply to carry assets and has no significant transactions.

2. Cash and cash equivalents

Cash equivalents are held by a corporation to satisfy its short-term cash commitment on behalf of an investment or other such purpose. For investments that qualify as cash equivalents:

1. The investment must be easily convertible to cash

2. Must be exposed to a really low level of risk regarding changes in its value

Therefore, an investment is taken into account a debt instrument as long as such investment features a short maturity within 3 months from the date of acquisition.

The AS 3 income statement states that movements between items that form a part of cash or cash equivalents should be excluded. Because these are a part of a company's cash management, not business, financing, and investment activities.

Cash management consists of investing surplus take advantage cash equivalents.

3. View income

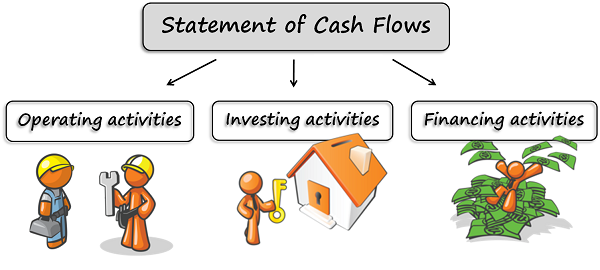

The income statement must represent the cash flows within the amount during which they're categorized as follows:

A. Sales activities

B. Investment

C. Financing activities

Companies got to prepare and present cash flows from operations, financing, and investment activities during a way that suits their business.

Grouping activities provides information that permits users to assess the impact of such activities on the company's overall financial position and to assess the worth of money and cash equivalents.

A. Sales activities

Cash flow from operating activities comes primarily from activities that generate the company's main revenue. For example:

- Cash received from the sale of products and services

- Cash received in fees, royalties, commissions, and various other sorts of revenue

- Cash paid to suppliers of products and services

B. Investment activities

Cash flows from investing activities represent outflows for cash flows and resources aimed toward generating future income. For example:

- Cash purchased the acquisition of fixed assets

- Cash received from the disposal of fixed assets (including intangible assets)

- Cash paid to accumulate shares, warrants or debt certificates of other companies and equity interests in joint ventures

C. Financing activities

Financing activities are activities that change the composition and size of the owner's capital and therefore the company's debt. For example:

- Cash received from the issuance of shares or other similar securities

- Cash received from the issuance of loans, corporate bonds, bonds, bills, and other short-term or long-term debt

- Repayment of debt

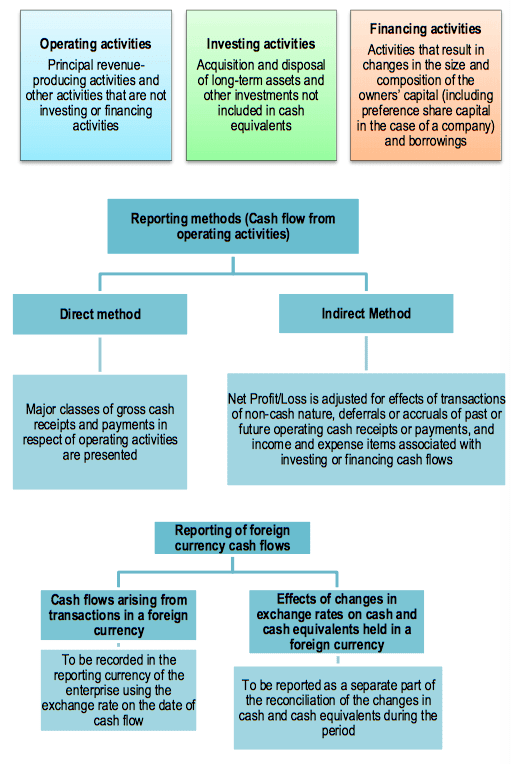

4. Income from operating activities

Companies should report cash flows from operating activities using:

1. Direct method-if all major classes of money receipt and payment are presented. Or

2. Indirect method – If net or loss is adjusted as follows:

a) Impact of non-cash transactions like depreciation, deferred taxes and provisions.

b) Income or deferral of future or past operating cash income or payments

c) Expenses or income related to income financing or investment

5. Income from investment and financing activities

An entity must separately record all major classes of money receipts and payments resulting from financial and investment activities, except people who got to be reported on a net basis.

- Net-based income

Cash flows from any of the subsequent operating, financing or investing activities could also be reported in net form.

- Cash income and payments on behalf of the client if the cash flows reflect the activities of such clients instead of the activities of the corporate itself.

- Revenue and cash payments for products with large amounts, fast sales and short maturities

Cash flows from each of the subsequent activities of a financial company could also be reported in net form.

- Cash income and payments for receipt and repayment of fixed-maturity deposits

- Placement and withdrawal of deposits from other financial companies

- Loans and cash advance payments are provided to Customer / Customer and repayment of such loans and advance payments.

B. Foreign currency cash flow

Cash flows from transactions in foreign currencies should be recorded in the company's reporting currency using the following methods:

Foreign currency amount * FX rates the exchange rate between the cash flow date report and the foreign currency.

If the result is similar to using the cash flow date rate, you can use a rate that is close to the actual rate.

The impact of exchange rate fluctuations on cash and cash equivalents held in foreign currencies must be reported as a separate and separate part of the adjustment of changes in cash and cash equivalents during the period.

6. Special items, dividends and profits

Cash flows related to special items should be categorized as originating from operating, financing, or investing activities, as appropriate and clearly disclosed.

Cash flows from receiving and paying dividends and interest must be disclosed separately. For financial companies, cash flows from receiving and paying dividends and interest should be categorized as cash flows from operating activities.

For other companies, cash flows from interest expense should be categorized as cash flows from financing activities, while dividends and interest received should be categorized as cash flows from investing activities.

7. Tax on income

Income tax cash flows must be disclosed separately and reported as cash flows from operating activities unless they may be explicitly related to investment and financing activities.

8. Acquisition and disposal of business divisions including subsidiaries

Total cash flows from acquisitions and disposals of business units, including subsidiaries, must be viewed as investment activity and reported separately.

An entity must provide a complete of the subsequent for both acquisitions and disposals of other business units, including subsidiaries, within the subsequent period:

(A) Total purchase or disposal

(B) Purchase or disposal price discharged as cash and cash equivalents

9. Non-cash transaction

Financing and investment transactions that do not require cash or cash equivalents should not be included in the cash flow statement. These transactions must be presented elsewhere in the financial statements in a way that provides relevant information regarding such financing and investment activities.

10. Disclosure

An entity must disclose the amount of substantial unusable cash and cash equivalents it holds, along with management commentary.

Commitments that may result from discounted bills of exchange and other similar obligations undertaken by an entity are usually disclosed in the financial statements by note, even if the likelihood of loss is low.

Specimen of Cash Flow Statement:

11. Main differences between AS3 and IndAS7

Details

| AS3 Cash Flow Statement

| Ind AS7 Cash Flow Statement |

Bank Overdrafts

| AS3 does not have such a requirement

| Ind AS 7 explicitly includes bank overdraft as a part of cash and cash equivalents to be repaid for the asking |

Cash Flows from Extracurricular Activities.

| AS3 requires that cash flows related to extracurricular activities be classified as cash flows from operating activities, financing activities, and investing activities. | IndAS7 does not include such a requirement |

Changes in ownership of subsidiary | There are no such requirements for cash flows from changes in ownership of subsidiary AS3

| Ind AS 7 requires a classification of cash flows resulting from changes in ownership of subsidiaries. This will not lose your control as cash. Flow from financial activities |

Accounting for investments in subsidiaries or affiliates .

| AS 3 does not have such a requirement | Ind AS 7 requires the use of the cost method or equity method when accounting for investments in subsidiaries or affiliates |

Disclosure Requirements | AS3 requires less disclosure requirements compared to Ind AS 7. | Ind AS 7 requires more disclosure requirements.

|

Here, we will explain in detail the difference between cash flow analysis and Fund flow analysis.

1. The concept of a fund refers to the actual or conceptual "cash" in cash flow analysis. However, it means either all financial resources or net working capital in the cash flow analysis.

2. Cash flow analysis deals with real cash or assumed cash-only movements. However, the flow of funds is related to all the items that make up the funds: net working capital. Cash is one of the elements of working assets

3. The cash flow statement only shows the causes of changes in cash and bank balances: cash receipts and payments. The cash flow statement shows the cause of the change in net working capital. This is a flexible device designed to disclose and highlight all significant changes in a company's current assets and current liabilities during the study period.

4. Cash flow analysis is a short-term financial analysis tool, but cash flow analysis is relatively long-term.

5. The income statement is consistent with the actual accounting standards. However, in the cash flow statement, data obtained on an accrual basis is converted to a cash basis.

6. The Fund Flow Statement aggregates funds generated from different sources for different purposes in which they are used. However, the cash flow statement starts with the cash balance at the start and reaches the cash balance at the end by processing it with various sources and uses.

7. In cash flow analysis, changes in various current assets and current liabilities are displayed in a separate statement or schedule of changes in working capital to see net changes in working capital. However, in fund flow analysis, such changes are adjusted to match the cash from operating activities to confirm cash from operating activities.

These were the points of difference between cash flow and cash flow, but both calculations have different advantages and limitations. Nonetheless, a careful analysis of the two has important consequences for the enterprise.

Points of Difference | Cash Flow | Fund Flow |

Meaning

| This represents the inflow and outflow of cash for a specified period of time, and its equivalent. . | It emphasizes the change in the working capital of a company from the end of one period to the end of another. |

Accounting Ways | Cash flows are accounted for only when liquid cash is included in the form of currency or bank transfers. . | The flow of funds is accounted for based on the generation of funds, not the actual payment or collection |

Utility | Cash flows are used to identify the net cash flow of a business over a specific time period. | The use of cash flows extends to an understanding of a company's overall financial situation. |

Business Position | Analysis Cash flow calculations help identify short-term business liquidity positions. | Cash flow calculations help you assess your long-term business position. |

Disclosures Made | All disclosures regarding cash inflows and outflows are made under cash flows. | Funding flows allow disclosure and identification of all sources of funding and their applications. |

Entry in Annual Financial Statements | It is mandatory to include a cash flow statement in the annual financial statements of a particular company. | It is not legally required to include a cash flow statement in the annual financial statements, and companies can do so to build investor confidence or meet investor demands. |

Use in Budgeting | Cash flow statements and analytics help you budget your business cash. | The income statement and analysis are usually useful for a company's regular capital budgeting . |

AS-12

S 12 describes how to account for government grants. Developing industry and economy is also a fundamental duty of any government.

Preface

To support the fulfilment of this obligation, the government will carry out promotional activities and provide incentives and subsidies to businesses. Grants received from the government come in a variety of forms, including grants, incentives, and disadvantages of obligations. AS 12 deals with government grants, but the following are not covered:

i) Accounting for subsidies that reflect the effects of price fluctuations ii) Government support other than subsidies such as tax exemption iii) Government participation in organizational ownership

Meaning of government subsidies

Assistance was provided by the government in cash or in kind under certain conditions. These do not include government grants that cannot be reasonably measured. Also, transactions with the government that cannot be identified separately from the organization's normal transactions are not considered grants. Example:-Receiving cash by selling packaged drinking water to the railroad by "Birelli".

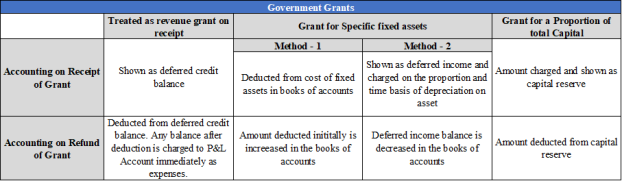

Accounting method for government subsidies

There are two ways outlined by AS to explain government grants:

- Capital approach

- Income / Income Approach

The method of accounting for grants is always based on the nature of the grants received. Grants are only recognized if there is certainty in the fulfilment of the terms and the final recovery of such grants.

Capital approach

Simply put, these grants are treated as part of capital or shareholder funding. These are such grants given as a percentage of the total investment in the business. The government usually does not expect the repayment of such grants. For this reason, such grants are credited to capital or shareholder funds. These grants can be divided into three main types.

A) Non-monetary subsidy B) Percentage of capital in the business C) In the case of specific fixed assets

3. Accounting for grants as a percentage of total capital in the I.A. Non-monetary grants are given in the form of resources such as land and buildings. These grants are usually offered at concessional rates or free of charge. These grants must be accounted for at acquisition cost or nominal value (if provided free of charge).

3. Grants as a percentage of total capital in the IB business In the case of grants of a nature that are treated as a percentage of total capital in the accounting business, they are treated as capital reserves and as capital reserves on the balance sheet. Will be shown. In this way, the amount received does not affect the income statement or the carrying amount of fixed assets. This means that such amounts cannot be distributed as dividends to shareholders. Also, they are not eligible to be considered deferred income.

3. I.C. Accounting for Grants for Specific Fixed Assets These are grants with key terms.

Organizations that receive such grants must build, acquire, or purchase such specific fixed assets to which such grants are granted.

Other conditions may also be imposed, such as asset type, asset location, and acquisition period.

There are two ways to recognize a grant in the form of a grant for a particular fixed asset.

Method 1 – The amount of the grant is deducted from the total asset to calculate the book value. This means that the grant is recognized in the income statement as a reduction in depreciation over the life of such an asset.

Method 2 – Grants are treated as deferred income in the financial statements. This revenue is gradually recognized in the income statement over the useful life of the asset or at the rate of depreciation of such assets.

Income approach

Revenue-related grants are credited to the income statement as "Other Revenues". They can also be deducted from the related costs on the income statement. Example: -A subsidy for the electricity bill of a manufacturing entity.

Government grant refund

There are scenarios where government grants are refunded because certain conditions are not met. The accounting for such grant refunds is as follows:

Disclosure requirements

Accounting policy adopted including the presentation method ii. Nature and scope of government subsidies recognized in financial statements

AS-19

Types of Leases (Finance Lease and Operating Lease)

What is a lease?

A lease is a contract that allows an asset / asset owner to use the asset / asset in exchange for something, usually money or other asset, by another party. The two most common types of leases in accounting are operating leases and finance (capital leases) leases. This step-by-step guide covers all the basics of lease accounting.

Benefits of leasing

- Leasing has many advantages that can be used to attract customers.

- Payment schedules are more flexible than loan contracts.

- After-tax costs are lower because the tax rates are different for lenders and borrowers.

- The lease includes financing 100% of the value of the asset.

- For operating leases, the company creates expenses instead of debt, allowing the company to obtain funding. This is often referred to as "off-balance sheet financing."

Disadvantages of leasing

One of the major drawbacks of leasing is the cost of the agency. In a lease, the lessor transfers all rights to the lessee for a specific period of time, causing moral hazard problems. The lessee who manages the asset is not the owner of the asset, so the lessee may not be able to pay attention to it as if it were his own asset. This separation between asset ownership (lessor) and asset management (lessee) is called the agency cost of the lease. This is an important concept in lease accounting.

What is a finance lease?

Finance leasing is a way of providing finance. In effect, a leasing company (lessor or owner) buys asset for a user (usually called an employer or lessee) and rents them to them for an agreed period of time.

Finance leases are a statement of Standard Accounting Practice 21.

"Practically all risks and rewards of ownership of an asset to a lessee."

This basically means that the lessee is in much the same position as if he had bought the asset.

The lessor charges rent as compensation for hiring the property to the lessee. The lessor retains ownership of the asset, while the lessee uses the asset exclusively (if the terms of the lease are complied with).

The lessee pays a rent that covers the original cost of the asset during the initial or major period of the lease. You are obliged to pay all of these rents, including balloon payments at the end of the contract. When all of this is paid, the lender will recover the investment in the asset.

The customer promises to pay these rents during this period and technically the finance lease is defined as non-cancellable, although it may be possible to terminate early. At the end of the lease

What happens at the end of the primary finance lease term is different and depends on the actual contract, but the possible options are:

- The lessee acts on behalf of the lessor and sells the asset to a third party.

- Assets will be returned to the lessor for sale

- Customer enters secondary lease term

When an asset is sold, the customer may be given a rent rebate equivalent to the majority of the sale price (minus disposal costs), as agreed in the lease agreement.

If the asset is held, the lease enters the second period.

Secondary rentals can be much lower than primary rentals (“pepper cone” rentals). Alternatively, the same rental may continue to be leased monthly.

Finance lease example

Finance leases are commonly used to finance vehicles, especially hard-working commercial vehicles. The company wants the benefits of leasing, but does not want the responsibility to return the vehicle to the lender in good condition.

Besides commercial vehicles, finance leases can be used for many other assets. An example is shown below.

The Health Club was considering investing in new gym equipment. The total loan amount is £ 20,000 and the contract is set to pay for 60 months without deposits. Importantly, the balloon payment was set to £ 0. This means that the client (or most likely a gym user!) Is free to sweat the device, knowing that they are not responsible when concluding the contract. After 60 months the option is to sell the equipment – keep the money made or enter the peppercorn (secondary) rental period in a relatively small amount.

Operating lease

In contrast to finance leases, operating leases do not transfer virtually all risks and rewards of ownership to the lessee. It usually runs for less than the full economic life of the asset, and the lessor expects the asset to have resale value (known as residual value) at the end of the lease term.

This residual value is predicted at the beginning of the lease and the lessor bears the risk of whether the asset will achieve this residual value at the end of the contract.

Operating leases are common when assets such as aircraft, vehicles, construction plants, and machinery have residual value. Customers can use the asset for the agreed term in exchange for rent payment. These payments do not cover the full cost of the asset as in the case of a finance lease.

The operating lease may include other services included in the contract. Vehicle maintenance contract.

Ownership of the asset remains with the lessor and the asset is returned at the end of the lease when the leasing company rehires it under another contract or sells it to release the residual value. Alternatively, the lessee may continue to rent the asset at the fair market rent agreed at that time.

Accounting rules are currently under consideration, but at this time operating leases are off-balance sheet arrangements and finance leases are on the balance sheet. For accounting under international accounting standards, IFRS 16 will bring operating leases to the balance sheet. Learn more about IFRS16.

A common form of operating lease in the vehicle sector is contract employment. This is the most common way to fund company cars and is growing steadily.

Why choose one sort of lease over the other?

This is a complex question, and each asset investment needs to be considered individually to see which type of financing is most beneficial to the organization. However, there are two important considerations. The type and lifetime of the asset, and the way the leased asset is reflected within the organization's account.

Asset type and lifespan

As mentioned above, it is important to remember that in operating leases the risks and rewards of owning an asset remain with the lessor, and in finance leases these are primarily transferred to the lessee.

Very generally, if an asset has a relatively short service life within the business, an operating lease may be a more commonly selected option before it needs to be replaced or upgraded. This is because the asset is likely to hold a significant portion of its value at the end of the contract, thus lowering the rent during the lease term. This is priced to the overall cost of the contract, as the lessor bears the risk in terms of the residual value of the asset.

This “cost of risk” can be significantly reduced for assets that can affect their condition at the time of return to the lessor and therefore have a high degree of certainty in estimating the residual value. Asset types to which this applies include automobiles, commercial vehicles, and IT equipment.

If an asset is likely to have a longer useful life in the business, its residual value consideration is less important as it is likely to be a much smaller percentage of its original value. This may mean that the lessee is willing to take this risk internally rather than paying the lessor. Here, finance leasing is a more obvious choice.

Because the rent paid on a finance lease pays off all or most of the capital, it is often possible to set a secondary lease period and maintain the use of the asset at a significantly reduced cost.

Accounting for finance and operating leases

The treatment of the two different lease types depends on the accounting standards that your organization complies with.

For organizations reporting to International Financial Reporting Standards (IFRS), the introduction of IFRS 16 from 1 January 2019 requires that both operating and finance leases be reflected in the company's balance sheet and income statement. Means. Prior to this, operating leases were treated as "off-balance sheet" items.

Today, most SMEs comply with UK GAAP, which is generally accepted in the UK. Changes in leasing treatment are filtered to companies applying UK GAAP only when converting to the IFRS / FRS 101 Reduction Disclosure Framework instead of FRS 102. The expectation from the FRC is that the earliest adoption in the UK could be 2022/23. But until then, it will monitor and monitor international impact.

For companies that currently need to reflect operating leases in their accounts, the impact is as follows:

Balance Sheet – The lessee must show the “right to use” the asset as an asset and the obligation to pay the lease payments.

As a responsibility.

Income Statement – The lessee displays the depreciation of the asset and the interest on the lease liability. Depreciation is usually done on a straight-line basis.

For companies unaffected by these changes, the ability to raise funds while keeping their assets off-balance sheet can be a factor in deciding whether to choose an operating lease or a finance lease.

Annual investment allowance

Many organizations seek to maximize the benefits of corporate tax by using the Annual Investment Allowance (AIA) when acquiring new assets. These allowances provide the organization with an immediate tax deduction for 100% of the cost of newly acquired assets. Since January 1, 2019, the allowance has increased to £ 1 million annually.

However, to be eligible for this remedy, the asset must be "purchased" rather than "leased". That is, assets financed on both operational and finance leases are not eligible for AIA, but assets acquired using financing methods such as contract purchases and employment purchases.

Financial Leasing and Operating Leasing – Key Differences

As you can see, there are some differences between financial and operating leases. Let's look at the important differences between them –

- A financial lease is a type of lease that allows the lessor to use the former asset instead of a long-term, recurring payment. An operating lease, on the other hand, is a type of lease that allows the lessee to use the former asset in exchange for short-term recurring payments.

- Financial leases are leases that need to be recorded under the accounting system. Operating leases, on the other hand, are a concept that does not need to be recorded in any accounting system. For this reason, operating leases are also known as "off-balance sheet leases."

- In a financial lease, ownership is transferred to the lessee. In an operating lease, ownership isn't transferred to the lessee.

- Contracts based on financial leases are called loan contracts / contracts. Contracts based on operating leases are called rental contracts / contracts.

- Once both parties have signed the contract, it is generally not possible to cancel the financial lease. Even after an agreement between the parties, the operating lease can only be revoked during the initial period.

- Financial leasing provides tax credits for depreciation and financing costs. Operating leases provide tax credits for rent payments.

- Financial leases offer asset purchase options at the end of the contract period. With operating leases, there are no such offers.

Finance Lease (Hire Purchase and installment) (Theory)

Meaning of Hire Purchase System

If you purchase a TV for cash, you pay, say, Rs. 15,000. But if you wish to make the payment by instalments of say, Rs. 3,000 each, every year, you may be required to pay four instalments, that is Rs. 20,000 in all. The extra amount of Rs. 3,000 is for interest. If you choose the latter mode of the payment, you should debit Rs. 5,000 to interest and treat the TV as valued at Rs. 15,000 (and not at Rs. 20,000). In case payment is to be made by instalments, there may be two kinds of arrangements. Each instalment may be treated as a ‘hire’ the purchaser becoming the owner only if he pays all the instalments. In other words, property does not pass to him even if one instalment remains unpaid. The seller will have the right to take away the goods in case of default in respect of any instalment. This is known as ‘Hire Purchase’ system.

The other arrangement may be that property passes immediately on the signing of the contract. The seller will not have the right to repossess the goods in case an instalment is not paid. His right will be to sue the purchaser for the money due. This is known as the Instalment System

Instalment system

The installment system is almost the same as the employment purchase system. The main difference between the two is that in the installment payment system, the buyer takes ownership as soon as the contract with the seller is signed. If he fails to pay in instalments, the seller can only get the article back with the help of the court.

Rental purchase and installment payment systems promote active sales of durable consumer goods. Products such as motorcycles, TVs, radios, refrigerators, bicycles and furniture are sold in large quantities through rental purchase and installment payment systems.

The products sold in these systems

- Durable,

- High quality,

- Fashionable

- Standardization; and

- High price.

Benefits of Employment Purchase and Installment Systems

1. Rental purchase and installment payment schemes allow buyers to purchase items that are out of reach.

2. It also allows businesses to find buyers for their products. Companies are not always able to find a cash party for products that are inherently expensive.

3. It expands the market.

4. Middlemen are excluded

5. It helped financial companies develop their business. Today's financial companies are widely funding several articles under the job purchase and installment payment system.

6. The price will be stable.

7. By renting and selling convenient items and luxury items in installments, people's living standards will improve.

8. Sellers can increase their sales. In addition, rental purchases and installment sales are more profitable.

9. Nowadays, most business houses offer many offers, like free gifts, exclusively for rental purchase customers.

Disadvantages of employment purchase and installment payment system

1. Employment purchase and installment payment systems tempt buyers to purchase products that go beyond their means. So it will be a luxury.

2. The buyer pays a very high price for the article under such a scheme. This is because he has to pay interest on his unpaid balance.

3. The need for time is a savings. Plans like buying jobs waste people.

4. Employment purchase price is higher than cash price. Interest is charged to the purchaser of the employment purchase system. Interest rates are often high.

5. If the buyer fails to pay, the goods sold in the rental purchase system will be reclaimed by the rental vendor. Buyers incur huge losses on seized goods.

6. Employment purchases and installment transactions are tedious. You need to conclude a contract and give a guarantee. More legal proceedings are to be passed.

7. The default rate under the employment purchase and installment payment system is higher. This is because only people with inadequate means buy under this system.

8. The purchaser must carry out some legal proceedings. He may have to find a guarantor. The contract must be prepared and signed by both the seller and the buyer, and it must be witnessed. The ownership document remains with the vendor / financial company until the employer liquidates the membership fee.

Interest: In either case (hire purchase or instalment) interest must be separated from the principal sum due. Since payments continue over two or more financial year’s interest must be calculated for each year separately. Usually, information is available regarding cash price and the rate of interest. Calculation of interest then becomes easy.

Summary

Hire Purchase: Property does not pass to him even if one instalment remains unpaid. The seller will have the right to take away the goods in case of default in respect of any instalment. This is known as ‘Hire Purchase’ system. The other arrangement may be that property passes immediately on the signing of the contract. The seller will not have the right to repossess the goods in case an instalment is not paid. His right will be to sue the purchaser for the money due. This is known as the Instalment System.

To ascertain Cash Price, rate of interest and instalments being given. Sometimes the cash price is not given. Since the asset cannot be debited with more than the cash price, it must be ascertained. The process is to take the last year first and separate interest from principal out of the total sum due.

Entries in Books:

Actual Cash Price Paid Method: This method follows a technical approach and does not treat the hire purchaser as owner until he makes the payment of last instalment. Under this method, the asset is recorded at the cash price actually paid.

Books of the Vendor. The vendor follows no special method for recording sales on hire purchase, especially in case of sale of large items. He debits the purchaser with the cash price and credits him with the amount received. Every year the interest due is debited.

Books of Purchaser

First Method. The purchaser can also follow the system adopted by the vendor and make entries like ordinary purchase of an asset. Only, he should credit the vendor with interest due every year and debit him with cash as and when paid. The above given example can be worked out in the following way (ledger accounts.)

Second Method. Under the second method, entries are passed only when payment is due or made. At this time, the vendor is credited with the amount due. Interest for the period is debited to interest Account and the balance (principal) is debited to the Asset Account. On payment, of course, the vendor is debited and Cash (or Bank) credited.

Operating Lease

In contrast to finance leases, operating leases do not transfer virtually all risks and rewards of ownership to the lessee. It usually runs for less than the full economic life of the asset, and the lessor expects the asset to have resale value (known as residual value) at the end of the lease term.

This residual value is predicted at the beginning of the lease and the lessor bears the risk of whether the asset will achieve this residual value at the end of the contract.

Operating leases are common when assets such as aircraft, vehicles, construction plants, and machinery have residual value. Customers can use the asset for the agreed term in exchange for rent payment. These payments do not cover the full cost of the asset as in the case of a finance lease.

The operating lease may include other services included in the contract. Vehicle maintenance contract.

Ownership of the asset remains with the lessor and the asset is returned at the end of the lease when the leasing company rehires it under another contract or sells it to release the residual value. Alternatively, the lessee may continue to rent the asset at the fair market rent agreed at that time.

Accounting rules are currently under consideration, but at this time operating leases are off-balance sheet arrangements and finance leases are on the balance sheet. For accounting under international accounting standards, IFRS 16 will bring operating leases to the balance sheet. Learn more about IFRS16.

A common form of operating lease in the vehicle sector is contract employment. This is the most common way to fund company cars and is growing steadily.

Why choose one sort of lease over the other?

This is a complex question, and each asset investment needs to be considered individually to see which type of financing is most beneficial to the organization. However, there are two important considerations. The type and lifetime of the asset, and the way the leased asset is reflected within the organization's account.

Asset type and lifespan

As mentioned above, it is important to remember that in operating leases the risks and rewards of owning an asset remain with the lessor, and in finance leases these are primarily transferred to the lessee.

Very generally, if an asset has a relatively short service life within the business, an operating lease may be a more commonly selected option before it needs to be replaced or upgraded. This is because the asset is likely to hold a significant portion of its value at the end of the contract, thus lowering the rent during the lease term. This is priced to the overall cost of the contract, as the lessor bears the risk in terms of the residual value of the asset.

This “cost of risk” can be significantly reduced for assets that can affect their condition at the time of return to the lessor and therefore have a high degree of certainty in estimating the residual value. Asset types to which this applies include automobiles, commercial vehicles, and IT equipment.

If an asset is likely to have a longer useful life in the business, its residual value consideration is less important as it is likely to be a much smaller percentage of its original value. This may mean that the lessee is willing to take this risk internally rather than paying the lessor. Here, finance leasing is a more obvious choice.

Because the rent paid on a finance lease pays off all or most of the capital, it is often possible to set a secondary lease period and maintain the use of the asset at a significantly reduced cost.

Accounting for finance and operating leases

The treatment of the two different lease types depends on the accounting standards that your organization complies with.

For organizations reporting to International Financial Reporting Standards (IFRS), the introduction of IFRS 16 from 1 January 2019 requires that both operating and finance leases be reflected in the company's balance sheet and income statement. Means. Prior to this, operating leases were treated as "off-balance sheet" items.

Today, most SMEs comply with UK GAAP, which is generally accepted in the UK. Changes in leasing treatment are filtered to companies applying UK GAAP only when converting to the IFRS / FRS 101 Reduction Disclosure Framework instead of FRS 102. The expectation from the FRC is that the earliest adoption in the UK could be 2022/23. But until then, it will monitor and monitor international impact.

For companies that currently need to reflect operating leases in their accounts, the impact is as follows:

Balance Sheet – The lessee must show the “right to use” the asset as an asset and the obligation to pay the lease payments.

As a responsibility.

Income Statement – The lessee displays the depreciation of the asset and the interest on the lease liability. Depreciation is usually done on a straight-line basis.

For companies unaffected by these changes, the ability to raise funds while keeping their assets off-balance sheet can be a factor in deciding whether to choose an operating lease or a finance lease.

Annual investment allowance

Many organizations seek to maximize the benefits of corporate tax by using the Annual Investment Allowance (AIA) when acquiring new assets. These allowances provide the organization with an immediate tax deduction for 100% of the cost of newly acquired assets. Since January 1, 2019, the allowance has increased to £ 1 million annually.

However, to be eligible for this remedy, the asset must be "purchased" rather than "leased". That is, assets financed on both operational and finance leases are not eligible for AIA, but assets acquired using financing methods such as contract purchases and employment purchases.

Introduction to IFRS - Fair Value Accounting.

International Financial Reporting Standards

The field of monetary reporting in India has seen significant changes over the last five years. As trade moves more and more across national borders, so do compliance and reporting requirements. It's becoming increasingly difficult to display an entity's financial statements in accordance with the reporting requirements of all countries during which it exists.

What is IFRS?

International Financial Reporting Standards (IFRS) is an accounting principle issued by the International Accounting Standards Board (IASB) with the aim of providing a standard accounting language for increasing the transparency of the presentation of monetary information.

What is the IASB?

The International Accounting Standards Board (IASB) is an independent body established in 2001 and is solely liable for establishing International Financial Reporting Standards (IFRS). It's a continuation of the International Accounting Standards Committee (IASC), which was previously given responsibility for establishing international accounting standards. The IASB is predicated in London. It also provides the Conceptual Framework for Financial Reporting, published in September 2010, to supply a conceptual understanding and foundation of accounting practices under IFRS.

Components of Monetary Statements under IFRS

A complete set of monetary statements prepared in accordance with IFRS ideally consists of:

- Statement of monetary position at the top of the amount – more commonly referred to as the “balance sheet”

- Earnings report and Other Comprehensive earnings report for the Year – Other comprehensive income includes profit and loss items that aren't recognized within the earnings report to suits other relevant criteria.

Both of those statements are often combined or displayed separately.

- Statement of Changes in Shareholders' Equity – This includes adjustments between the amounts displayed at the start and end of the year.

- Income statement for that period

- Budget notes – Includes summary of serious accounting policies and other explanatory information in accordance with them.

In the following scenarios, the financial statements may include a press release of monetary position for the previous period.

- When a corporation applies accounting policies retroactively.

- When a corporation retroactively adjusts an item during a budget. Or

- When a corporation reclassifies items in financial statements.

List of International Financial Reporting Standards (IFRS)

As already discussed, the quality issued by the IASB is named IFRS. However, its predecessor, the IASC, had already issued certain international standards called International Accounting Standards (IAS). These IAS were issued by the IASC between 1973 and 2001. Both IAS and IFRS are still valid. The standards are as follows:

Standard No. | Standard Title |

IFRS 1 | First-time Adoption of International Financial Reporting Standards |

IFRS 2 | Share-based Payment |

IFRS 3 | Business Combinations |

IFRS 4 | Insurance Contracts |

IFRS 5 | Non-current Assets Held for Sale and Discontinue Operations |

IFRS 6 | Exploration and Evaluation of Mineral Resources |

IFRS 7 | Financial Instruments: Disclosures |

IFRS 8 | Operating Segments |

IFRS 9 | Financial Instruments |

IFRS 10 | Consolidated Financial Statements |

IFRS 11 | Joint Arrangements |

IFRS 12 | Disclosure of Interests in Other Entities |

IFRS 13 | Fair Value Measurement |

IFRS 14 | Regulatory Deferral Accounts |

IFRS 15 | Revenue from Contracts with Customers |

IFRS 16 | Leases |

IFRS 17 | Insurance Contracts |

IAS 1 | Presentation of Financial Statements |

IAS 2 | Inventories |

IAS 7 | Statement of Cash Flows |

IAS 8 | Accounting Policies, Changes in Accounting Estimates and Errors |

IAS 10 | Events after the Reporting Period |

IAS 11 | Construction Contracts |

IAS 12 | Income Taxes |

IAS 16 | Property, Plant, and Equipment |

IAS 17 | Leases |

IAS 18 | Revenue |

IAS 19 | Employee Benefits |

IAS 20 | Accounting for Government Grants and Disclosure of Government Assistance |

IAS 21 | The Effects of Changes in Foreign Exchange Rates |

IAS 23 | Borrowing Costs |

IAS 24 | Related Party Disclosures |

IAS 26 | Accounting and Reporting by Retirement Benefit Plans |

IAS 27 | Separate Financial Statements |

IAS 28 | Investments in Associates and Joint Ventures |

IAS 29 | Financial Reporting in Hyperinflationary Economies |

IAS 32 | Financial Instruments: Presentation |

IAS 33 | Earnings per Share |

IAS 34 | Interim Financial Reporting |

IAS 36 | Impairment of Assets |

IAS 37 | Provisions, Contingent Liabilities, and Contingent Assets |

IAS 38 | Intangible Assets |

IAS 39 | Financial Instruments: Recognition and Measurement |

IAS 40 | Investment Property |

IAS 41 | Agriculture |

Key takeaways:

- Accounting may be a necessary function for deciding, cost planning, and economic performance measurement, no matter the dimensions of the business.

- Professional accountants follow a group of commonly accepted accounting principles (GAAP) when preparing financial statements.

- The Financial Accounting Standards Board (FASB) sets accounting rules for public and personal companies and non-profits within the us.

- The relevant organization, the Governmental Accounting Standards Board (GASB), sets the rules for state and local governments.

- In recent years, the FASB has worked with the International Accounting Standards Board (IASB) to establish compatible standards around the world.

- Accounting standards are a general set of principles, standards, and procedures that define the basis of financial accounting policies and practices.

- Accounting standards apply to the overall financial position of a company, including assets, owners, income, expenses and shareholders' equity.

- Banks, investors and regulators rely on accounting standards to ensure that information about a particular entity is appropriate and accurate.

- International Accounting Standards were replaced by International Financial Reporting Standards (IFRS) in 2001

- Currently, the United States, Japan and China are the only major capital markets with no IFRS obligations.

- Since 2002, US GAAP has been working with the Financial Accounting Standards Board to improve and integrate US GAAP and IFRS.

- Accounting standards have been introduced to improve the quality of financial information reported by companies.

- IFRS is a set of international accounting standards that specify how certain types of transactions and other events are reported in financial statements.

- Some accountants consider the methodology to be the main difference between the two systems. GAAP is rule-based and IFRS is principle-based.

- The main reason for creating a cash flow statement is that a company's income statement is always accrued and profits may appear on the income statement, but the cash received from these profits runs the business. Because there is less possibility to do. Or vice versa.

- The cash flow statement must report cash flows over the period categorized by operating, investing, and financing activities.

- Cash flows related to special items should be categorized as originating from operating, investing or financing activities as appropriate and disclosed individually.

- A lease is a contract that allows an asset / asset owner to use the asset / asset in exchange for something, usually money or other asset, by another party.

- The two most common types of leases in accounting are operating leases and finance (capital leases) leases.

- One of the major drawbacks of leasing is the cost of the agency. In a lease, the lessor transfers all rights to the lessee for a specific period of time, causing moral hazard problems

- Finance leases are a statement of Standard Accounting Practice 21.

- The lessor charges rent as compensation for hiring the property to the lessee.

- The lessor retains ownership of the asset, while the lessee uses the asset exclusively (if the terms of the lease are complied with).

- Finance leases are commonly used to finance vehicles, especially hard-working commercial vehicles.

- Operating leases are common when assets such as aircraft, vehicles, construction plants, and machinery have residual value.

- Financial leasing provides tax credits for depreciation and financing costs. Operating leases provide tax credits for rent payments.

References:

- Advanced Accounts: By M.C. Shukla & S.P. Grewal (S. Chand & Co. Ltd.)

- Advanced Accountancy: By S. P. Jain & K.N. Narang (Kalyani Publishers)

- Advanced Accountancy: By R. L. Gupta & M. Radha Swamy (Sultan Chand & Sons)

- Company Accounts: By S.P. Jain & K.L. Narang

- Advanced Accounts: By Paul Sr.

- Corporate Accounting: By Dr. S. N. Maheshwari & S.K. Maheshwari

- Corporate Accounting: By Mukharji & Hanif

- Accounting Standards –as issued by Institute of Chartered Accountants of India