UNIT II

Internal Reconstruction

What is Reconstruction?

Rebuilding is the process of restructuring a company in terms of law, operations, ownership and other structures by revaluing assets and revaluing liabilities. It refers to the transfer of the business of a company or multiple companies to a new company. Therefore, this means that the old company will be liquidated, and therefore shareholders agree to acquire shares of equal value in the new company. The financial statements do not reflect the true and fair position of the business, as if the company has suffered losses over the years, it will need to be rebuilt and the net worth will be higher than the actual net worth. Hmm.

In other words, "reconstruction" is the dissolution of an existing company and the transfer of its assets and liabilities to a new company established for the purpose of business succession or succession of the existing company. Shareholders of the existing company will become shareholders of the new company. The business content and shareholders of the new company are almost the same as those of the old company.

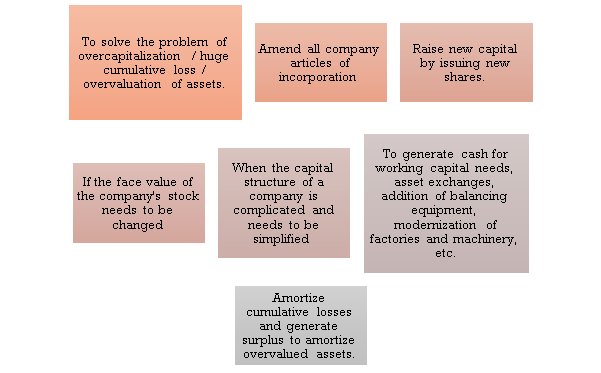

Purpose of Reconstruction

The main purposes of the reconstruction are:

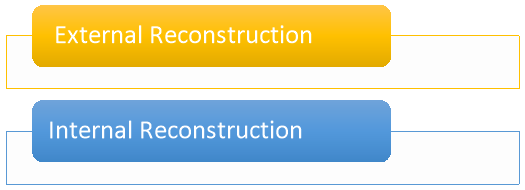

Distinction between internal and external reconstructions

Types of Reconstruction

The company can be rebuilt in one of two ways. These are:

External Restructuring: If a company suffers losses over the past few years and faces a financial crisis, it can sell its business to another newly established company. In fact, the new company was established to take over the assets and liabilities of the old company. This process is called external reconstruction. In other words, external reconstruction means selling the business of an existing company to another company established for that purpose. In the external reconstruction, one company will be liquidated and the other will be newly established. The liquidated company is called the "Vendor Company" and the new company is called the "Purchasing Company". The shareholders of the selling company are the shareholders of the purchasing company.

Internal Restructuring: Internal restructuring refers to the internal restructuring of a company's financial structure. It is also called a restructuring that allows an existing company to survive. In general, equity capital is reduced to amortize the company's past cumulative losses.

Significance of Internal Reconstruction

Internal reconstruction is done by the company in the following cases:

Conditions and regulations regarding Internal Reconstruction

1. Approval by Articles of Incorporation: The company must be approved by the Articles of Incorporation to appeal for capital reduction. The Articles of Incorporation contain all the details of the company's internal affairs and refer to provisions that include how to reduce capital.

2. Passing a special resolution: The company must pass a special resolution before appealing for a capital reduction. Special resolutions will only be passed if a majority of stakeholders agree to internal reconstruction. This special resolution must be signed by the arbitral tribunal and deposited with a registrar appointed under the Companies Act 2013.

3. Court Permission: The company must obtain the court or the court's legitimate permission before starting the capital reduction process. The court will only grant permission if the company is fair and is satisfied with the positive consent of all stakeholders.

4. Borrowing Payment: According to Article 66 of the Companies Act 2013, a company must repay all the amount deposited and its interest before reducing its capital.

5. Creditor Consent: The company that reduces the capital requires the written consent of the creditor. The court requires the company to secure the interests of the dissenting creditors. The company obtains the court's permission after the court determines that the reduction of capital does not harm the interests of the creditors.

6. Announcement: The company must announce according to the instructions of the tribe for a capital reduction. The company must also explain the justification.

Difference between Internal Reconstruction and External Reconstruction

Basis For Comparison | Internal Reconstruction | External Reconstruction |

Meaning | Internal reconstruction refers to the method of corporate restructuring wherein existing company is not liquidated to form a new one. | External reconstruction is one in which the company undergoing reconstruction is liquidated to take over the business of existing company. |

New company | No new company is formed. | New company is formed. |

Use of specific terms in Balance Sheet | Balance Sheet of the company contains "And Reduced". | No specific terms are used in the Balance sheet. |

Capital reduction | Capital is reduced and the external liability holders waive their claims. | No reduction in the capital |

Approval of court | Approval of court is must. | No approval of court is required. |

Transfer of Assets and Liabilities | No such transfer takes place. | Assets and liabilities of existing company are transferred to the new company. |

The main difference between internal reconstruction and external reconstruction

Due to the difference between internal and external reconstructions, the subsequent points are relevant:

- Internal restructuring is often defined as a restructuring of a corporation without liquidating an existing company and establishing a replacement one. On the opposite hand, external restructuring may be a sort of corporate restructuring that liquidates an existing company and creates a replacement company so as to continue the business of the prevailing company.

- A new company won't substitute the interior reorganization. Conversely, a replacement company are going to be established for external reconstruction and therefore the business of the prevailing company is going to be appropriated.

- Internal restructuring reduces the company's capital, and external liabilities like bond holders and creditors waive their debt at a reduction. On the opposite hand, external reconstruction doesn't reduce the company's capital.

- Internal reconstruction requires court approval and court confirmation, as a discount in capital stock can affect shareholder rights. On the contrary, external reconstruction doesn't require such approval.

- If the corporate goes through an indoor rebuilding process, the record created after the method will include the term "And Reduced". In contrast, within the case of external reconstruction, no particular term is employed on the record.

- In internal reconstruction, no new company are going to be established, so there'll be no transfer of assets or liabilities.

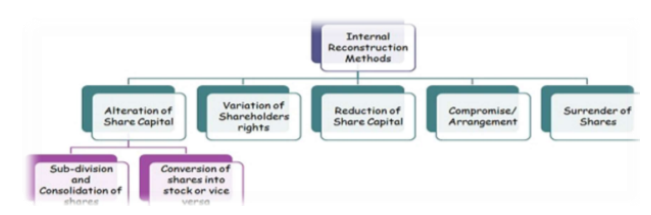

Internal Reconstruction Method

There are various methods of internal reconstruction, shown in the form shown in the following figure.

There are various methods of internal reconstruction, shown in the form shown in the following figure.

1. Alteration of Share Capital

If approved by the Articles of Incorporation, the limited liability company may change (change) the capital clause of the Articles of Incorporation. There are various ways to change stock capital:

1. Increase in stock capital due to issuance of new shares

2. Reverse Stock Split

Consolidation refers to the conversion of shares with a smaller par value to shares with a larger par value.

Example: His 5000 shares of Rs. 10 pieces can be integrated into a stock of 500 rupees. 100 each.

3. Stock Split

Subdivision is the conversion of high par value stocks to low par value stocks.

Example: 5000 shares of Rs. Each 100 can be split into 50000 shares of Rs. 10 each.

4. Equity of Shares

The company can convert its shares into shares. Stocks can be fractions that are not possible in the case of stocks. Central government approval is required to convert shares into shares.

5. Transfer of Shares

Reconstruction plans may require shareholders to relinquish some of their ownership. Such a waiver may be issued prior to immediate cancellation or to satisfy some of the company's creditors.

6. Cancellation of Unissued Shares

If the company cancels unissued shares, it does not need to pass an accounting entry. The authorized share capital of the company will be the amount of unissued shares currently cancelled.

About Stock Split and Consolidation

If approved by the Articles of Incorporation, the company may, by passing a normal resolution, decide at the General Assembly to split or consolidate the shares into an amount less or higher than the amount stipulated in the Articles of Incorporation. The ratio of paid-in to unpaid shares will continue to be the same as for the original shares.

Notifications identifying changes must be submitted to the Registrar within 30 days of the changes.

For example, a company with capital of 10,000,000 split into 10,000 shares and paid 75 for every 100 shares decides to split 100 shares of 100 shares into 10 shares to recognize capital. Each. The resulting entry passed in such a case is —

| Dr. | Cr. | |

| |||

Equity Share Capital ( 100) A/c | Dr. | 7,50,000 |

7,50,000 |

To Equity Share Capital ( 10) A/c |

| ||

(Being the sub-division of 10,000 shares of 100 each with 75 paid up thereon into 1,00,000 shares of 10 each with 7.50 paid up thereon as per the resolution of shareholders passed in the General Meeting held on...) | |||

Similar entries are passed when consolidating a smaller amount of stock into a larger amount of stock.

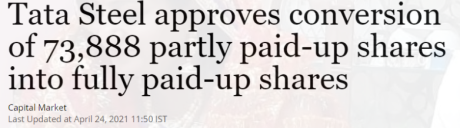

Conversion of Fully Paid-In Shares to Shares and Conversion of Shares to Shares

According to Article 61 of the Companies Act 2013, a company may convert fully paid-in shares into shares and convert the shares back into shares. If approved by the Articles of Incorporation, the company may, by passing a normal resolution, convert the fully paid shares into shares and reconvert the shares into shares at a general meeting of shareholders. Stock is the integration of equity capital into one of his units that can be split into aliquot parts. A stock is a fully paid bundle of stock that, for convenience, can be split into any amount and transferred to any fraction and subdivision, regardless of the original par value of the stock. He cannot have one share of equity capital, but he can transfer any amount of shares. However, in reality, the company limits the transfer of shares to multiples, such as 100 times his. Companies can convert fully paid shares into shares. When the company converts its shares into shares, the bookkeeping items only record the transfer from the stock capital account to the stock account. Another share registration will be initiated where the details of the member's holdings are entered and the annual returns change accordingly.

Example

C Ltd. Split the authorized capital of 5,000,000 into 100 shares each on March 12, 20X1, of which 4,000 were issued and paid in full. In June 220X2, the Company converted the issued shares into shares. Decided to do. However, in June 20X3, we reconverted the shares to his 10 shares and paid in full.

Pass an entry to show how equity capital appears in the balance sheet notes, such as 31-12-20X1, 31-12-20X2, 31-12-20X3.

Journal Entries

20X2 |

| |||

June | Equity Share Capital A/c | Dr | 4,00,000 |

|

| To Equity Stock A/c |

|

| 4,00,000 |

| (Being conversion of 4,000 fully paid Equity Shares of 100 into 4,00,000 Equity Stock as per resolution in General meeting dated…) |

|

|

|

20X3 |

|

|

|

|

June | Equity Stock A/c | Dr | 4,00,000 |

|

| To Equity Share Capital A/c |

|

| 4,00,000 |

| (Being re-conversion of 4,00,000 Equity Stock into 40,000 shares of 10 fully paid Equity Shares as per Resolution in General Meeting dated...) |

|

|

|

Notes to Balance Sheet

|

|

As on 31-12-20X1 | |

1. Share Capital |

5,00,000 |

Authorized | |

5,000 Equity Shares of 100 each | |

Issued and subscribed |

|

4,000 Equity Shares of 100 each fully called up | 4,00,000 |

As on 31-12-20X2 | |

1. Share Capital |

5,00,000 |

Authorized | |

5,000 Equity Shares of 100 each | |

Issued and subscribed |

|

Equity Stock-4,000 Equity Shares of 100 converted into Stock | 4,00,000 |

As on 31-12-20X3 | |

1. Share Capital |

5,00,000 |

Authorized | |

50,000 Equity Shares of 10 each | |

Issued and subscribed |

|

40,000 Equity Shares of 10 each fully called up | 4,00,000 |

Changes in Shareholder Rights

Under Article 48 of the Companies Act 2013, if a company issues different types of shares and grants such shares different rights or privileges, the rights relating to dividends, voting rights, etc. may be changed in any way. I will. This is done by the written consent of his three or more owners of her quarter of the issued shares of that type, or by a special resolution adopted at another meeting of the owners of the issued shares of that type. I will. (a) If the company's memorandum or articles of incorporation include provisions for such variations. Or (b) if there is no such provision in the Memorandum of Understanding or the Articles of Incorporation, or if such changes are not prohibited by the terms and conditions of issuance of shares of that class, provided that changes made by a shareholder of one class are the rights of another shareholder. When Impacting Regarding the type of shareholders, the consent of three-quarters of the other types of shareholders shall also be obtained and the provisions of this section shall apply to such changes.

For example, a company may (a) Change the dividend rate of preferred stock or (b) Convert cumulative preferred stock to non-cumulative preferred stock without changing the amount of equity capital by going through the following journal: can.

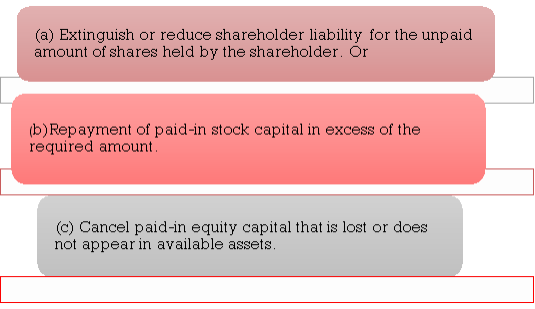

Reduction of Stock Capital

Article 66 of the Companies Act 2013 provides procedures for reducing stock capital. Subject to court confirmation of the company's application, the company may, by special resolution, reduce its share capital in the following ways:

In general, the reduction of equity capital occurs when a company suffers continuous losses over a long period of time and is not truly reflected in its assets. In such cases, the capital reduction scheme must amortize the portion of the capital that has already been lost.

This reduction is a shareholder sacrifice, and the amount of the reduction or sacrifice is credited to a new account called a capital reduction account (or restructuring account). The accounting process is as follows.

(a) Shareholders' liability to extinguish or diminish their liability for the accrued amount of shares held by the shareholders

The shareholders are not required to pay the accrued amount of their shares in the future. For example, a company decides to reduce 10 per share from 10 to 7.5 by cancelling the unpaid amount of 2.5 per share. The entry in this case looks like this:

Share Capital (Partly Paid-Up) Account Dr. ( 7.5 X No. of Shares)

To Share Capital (Fully Paid-up) Account ( 7.5 X No. of Shares)

(b) If the paid-in excess capital is refunded: If the company is unable to secure profitability, it may decide to refund the paid-in capital as excess to shareholders. For example, if a company with 10 fully paid shares each decides to refund 2 shares per share to make 8 fully paid shares, the entry would be:

Share Capital Account ( 10) Dr. ( 10 X No. Of Shares)

To Share Capital Account ( 8) ( 8 X No. of Shares)

To Sundry Shareholders Account ( 2 X No. of Shares) Sundry Shareholders Account Dr. ( 2 X No. Of Shares)

To Bank Account ( 2 X No. of Shares)

(c) If lost or hidden paid-in capital is cancelled:

Share Capital Account Dr. ( 90 X No. of Shares)

To Capital Reduction Account

(90 X No. Of Shares)

Reduction of Payment Price

Only-Here, the nominal value of the stock remains the same and only the payment price is reduced. For example, a shareholder can agree to reduce the paid-in capital of £ 100 per share to £ 10 paid-in capital per share. The sacrifice is 90 and the entry is

Share Capital Account Dr. ( 90 X No. of Shares)

To Capital Reduction Account

(90 X No. Of Shares)

Reduction of both Nominal Value and Paid-In this case, both the paid-in capital and the nominal value of the stock are reduced. Continuing with the above example, the entry looks like this:

Share Capital Account ( 100 Share) Dr. ( 100 X No. of Shares)

To Share Capital ( 10 Share) ( 10 X No. Of Shares)

To Capital Reduction Account ( 90 X No. Of Shares)

Therefore, such processing debits from the original Equity Capital Account, closes it, and deposits the amount treated as paid into the new Equity Capital Account. And credit the difference to the capital reduction account. A certified copy of the court order and minutes approved by the court must be submitted by the Registrar.

Compromise / Arrangement

A compromise and arrangement scheme are an agreement between a company and its members' external debt in the event that the company faces financial problems. Therefore, such arrangements also involve the sacrifice of shareholders, creditors, creditors, or all.

The accounting treatment in some cases is as follows:

a) If shareholders waive their right to claim reserves and cumulative profits:

Reserves Account Dr. (With the amount of To Reconstruction Account reserves)

b) Settlement of external debt with less amount: Other debt, such as creditors, may agree to accept a smaller amount in lieu of final settlement. The treatment will be as follows.

Outside Liabilities Account Dr. (With the amount of sacrifice)

Provision Account, if any Dr. made by creditors, debenture

To Reconstruction Account holders etc.)

Transfer Of Shares

This method splits the shares into smaller amounts of shares and lets shareholders transfer the shares to the company. These shares will be allocated to bondholders and creditors to reduce their debt. Abandoned shares that have not been used will be cancelled by being transferred to the reconstruction account.

Note: Issues regarding the internal rebuild method above are described after Section 3, "Entry in case of internal rebuild".

Entry For Internal Rebuild

Regarding the reconstruction plan adopted (by a special resolution confirmed by the court), the following items will be passed:

1. An increase in the value of an asset or a decrease in the amount of an liability must be debited to the relevant account and credited to the capital reduction account (or reconstruction account).

2. Eliminate all overvaluation of assets by amortizing all fictitious assets (including goodwill and patents), crediting relevant accounts, and debiting reduction (or restructuring) accounts. To do. You can use the reserves on your company's books for this purpose. If there is a balance left in the capital reduction (or reconstruction) account, it should be transferred to the capital reserve account.

Here are some things to keep in mind when creating the balance sheet for a rebuilt company:

(a) The word "and Reduced" must be added after the company name

Only if the court has so ordered.

(b) For fixed assets, the depreciation amount under the reconstruction plan must be presented for 5 years.

Legal Aspect

Internal restructuring plans should be constructed by careful examination of assets and liabilities and proper valuation. This includes compromises or arrangements between the company and its members or creditors. However, when planning an internal reconstruction, you need to pay attention to the following aspects –

1. Any form of change in equity capital should be considered in accordance with the M / A & A / A provisions and, if necessary, the company should change his M / A & A / A provisions.

2. The company must notify the company register within 30 days of the resolution being passed.

3. SEBI sanctions may be required.

4. A board resolution is required to make any changes.

Conclusion

A company restructuring is the process by which a company changes the organizational structure or processes of its business. Therefore, in the process of internal reconstruction, only the rights of shareholders and creditors are changed with a certain reduction of capital, and the rights and claims of corporate bond holders are outside the scope of the internal reconstruction procedure. The process of external reconstruction is managed by the process of "merger by the nature of the merger" under the Companies Act 2013. New stock capital without reduction of stock capital.

Accounting Entries

Capital Reduction Account is opened in the ledger to give effect of sacrifice made by shareholders & others as well as to write off accumulated losses, fictitious assets, & change in values of assets/liabilities.

Sacrifice by Shareholders:

- When the face value of share is changed

Share capital A/c (old) Dr.

(With paid up value of old shares)

To Share Capital A/c (new)

(With paid up value of new shares)

To Capital Reduction A/c (With difference)

2. When face value of share is not changed, only paid up value is changed

Share Capital A/c Dr.

To Capital Reduction A/c

(With the amount of reduction)

3. When shares are Consolidated

Share Capital A/c (say Rs. 10) Dr.

To Share Capital A/c (say Rs. 100)

4. When Shares are Subdivided

Share Capital A/c (say Rs. 100) Dr.

To Share Capital A/c (say Rs. 10)

5. When shares are converted into stock

Share Capital A/c Dr

To Share Stock A/c

Assets:

6. When the value of any asset is appreciated

Asset A/c (increase in value) Dr.

To Capital Reduction A/c

7. When the value of any asset is depreciated

Capital Reduction A/c Dr

To Asset A/c (decrease in value)

8. When recorded assets are disposed of/sold

Bank A/c Dr.

Capital Reduction A/c (if loss) Dr

To Assets A/c

To Capital Reduction A/c (if Profit)

(Note: Any profit or loss on sale should be transferred to Capital Reduction A/c)

9. When an unrecorded asset is sold off

Bank A/c Dr.

To Capital Reduction A/c

(Note: entire amount received on sale is profit as asset was unrecorded)

Liabilities:

10. When any sacrifice is made by the creditors

Creditors A/c (with sacrifice) Dr.

To Capital Reduction A/c

11. When any sacrifice is made by the Debenture Holders

Debentures A/c (decrease in value) Dr.

To Capital Reduction A/c

12. When new debentures are exchanged for old debentures

Old Debentures A/c Dr.

To New Debentures A/c

13. When recorded liability is paid for

Liability A/c Dr.

Capital Reduction A/c(if loss i.e paid more)Dr

To Bank A/c

To Capital Reduction A/c(if profit i.e paid less)

(Note: Any profit or loss should be transferred to Capital Reduction A/c)

14. When contingent liability/unrecorded liability/ Preference share dividend is paid

Capital Reduction A/c Dr.

To Bank A/c/ Eq sh cap/ Pref sh cap/ Debentures Etc.

(Note: No entry is required for amount foregone against such liability)

15. When provision for taxation, Capital Reserve, Securities Premium is utilised

Provision for Taxation A/c Dr.

Capital Reserve A/c Dr.

Securities Premium A/c Dr.

To Capital Reduction A/c

Writing off Losses:

16. When capital reduction is utilised for writing off fictitious assets, losses and excess value of other assets

Capital Reduction A/c Dr.

To P/L A/c

To Goodwill A/c

To Preliminary Expenses A/c

To Discount on Shares/Debentures A/c

To Other Assets A/c

To Capital Reserve A/c (if any balance is left)

Reconstruction Expenses

17. When Reconstruction expenses are paid

Capital Reduction A/c Dr.

To Bank A/c

Share Surrender:

18. When shares are surrendered

Share Capital A/c Dr

To Share Surrender A/c

19. When surrendered shares are converted into preference shares

Share Surrender A/c Dr.

To Preference Share Capital A/c

20. When surrendered shares are issued to creditors/payment of any liability

Share Surrender A/c Dr.

To Share Capital A/c

Creditors/Liability A/c Dr.

To Capital Reduction A/c

(Note: Profit or Loss on scheme to be transferred to capital Reduction A/c)

21. Cancellation of Shares not issued(balance in Share surrender A/c)

Share Surrender A/c Dr.

To Capital Reduction A/c

Issue of shares to public

22. When finance is raised by issue of shares

Bank A/c Dr.

To Share Capital A/c

Proforma:

Capital Reduction A/c

Particulars | Rs. | Particulars | Rs. |

To P & L A/c (Loss written off) To Goodwill A/c (Written off) To Preliminary expenses A/c (Written off) To Discount on Shares/Debentures (Written off) To Assets A/c (Decrease in value) To Bank A/c (payment of unrecorded liability) To Bank A/c (payment of Reconstruction Expenses) To Bank A/c (Refund of Directors Fees) To Capital Reserve (Balancing figure) | XX XX

XX

XX

XX

XX

XX XX XX | By Share Capital A/c (Amount of reduction) By Debentures A/c (Amount of Reduction) By Creditors A/c (Amount of Sacrifice) By Assets A/c (Increase in value) By Bank A/c (sate of unrecorded assets) | XX

XX

XX

XX

XX |

| XXX |

| XXX |

Key takeaways:

- The term restructuring refers to the restructuring of a company's capital structure, including the reduction of both shareholder and creditor claims against the company.

2. A sick company (deficit company) may be taken over by a profitable company, but in the event of a huge loss, the assets are overvalued or undervalued, in which case the company may head for rebuilding.

3. In short, rebuilding means that a company with an unhealthy balance sheet but a promising future rebuilds its assets and liabilities.

4. It can be an external or internal reconstruction.

5. We can rebuild internally or externally.

6. This means that two types of rebuilding are possible.

7. External reconstruction of an external restructuring, a new company will be set up to take over the business of an existing company that suffered huge losses and was in poor financial condition. The vendor company will be liquidated and its business will be taken over by the new company.

8. Internal reconstruction the company's capital structure is reorganized to bring new life to the company. This includes changes, reductions and restructurings of the company's equity capital.

9. Internal restructuring means a reduction in capital to cancel paid-in equity capital that was lost in the course of the business, that is, not represented by the actual value of the asset.

10. Companies can reduce their equity capital in the following ways:

- Amortization of lost capital

- Refund of paid-in capital surplus.

- Reduce member liability for unpaid capital.

References:

- Advanced Accounts: By M.C. Shukla & S.P. Grewal (S.Chand & Co. Ltd.)

- Advanced Accountancy: By S. P. Jain & K.N. Narang (Kalyani Publishers)

- Advanced Accountancy: By R. L. Gupta & M. Radha Swamy (Sultan Chand & Sons)

- Company Accounts: By S.P. Jain & K.L. Narang

- Advanced Accounts: By Paul Sr.

- Corporate Accounting: By Dr. S. N. Maheshwari & S.K. Maheshwari

- Corporate Accounting: By Mukharji & Hanif

- Accounting Standards –as issued by Institute of Chartered Accountants of India