UNIT 3

Introduction of Banking Company

Introduction of Banking Company

Some special provisions concerning Banking Companies were incorporated into the Indian Companies Act of 1913, not until 1936, but these provisions are insufficient to guard the interests of depositors turned out. As a result, Banking companies objected the Banking Regulation Act of 1949, which actually came into effect on March 16, 1949. Of course, this law has been amended several times. However, the Companies Act of 1956 also applies to Banking companies as it is consistent with the provisions of the Banking Regulations Act.

Meaning of Banking Company

According to Sec.5 of the Banking Regulation Act of 1949, a Banking Company accepts deposits from the general public for the purpose of lending or investing and repays them on request or otherwise, checks, checks, orders or other It means pulling out in a way. In short, a Banking Company means or includes a company that operates or does Banking business in India. Therefore, a company engaged in trade or manufacturing that accepts deposits from the public solely for the purpose of financing its business shall not be deemed to be in the Banking business. The words Bank, Banker, and non-Bank Bank cannot be used as part of the name. At the same time, you cannot do Banking in India. However, unless you use one of these a word as a part of its name.

Sec. 8 states that Banking companies may not directly or indirectly handle the sale or purchase of goods or Banking operations, except for legal Banking operations.

Main provisions of the Banking Regulation Law

Prohibition of Transactions (Section 8): According to Section. Under Article 8 of the Banking Regulations Act, Banking companies may not directly or indirectly handle the sale or exchange of goods. However, you may purchase, sell, or barter transactions related to the exchange invoice you received for collection or negotiation.

Non-Bank Assets (Section 9): According to the section. 9, "Banking companies may not hold the acquired real estate for a period of more than 7 years from the date of acquisition, except for their own use. The company shall, within 7 years, to facilitate its disposal. You are allowed to trade or trade such assets. Of course, the Reserve Bank of India may extend the 7-year period to any period not exceeding 5 years for the benefit of depositors.

Management (second 10): Second 10 (a) requires that at least 51% of the total number of members of the Banking company's board of directors consist of persons with special knowledge or work experience in one or more of the following areas: It states that it will not be.

- Accounting;

- Agriculture and Rural Economy;

- Banks;

- Cooperation;

- Economics;

- Treasury;

- Law and

- Small Industries.

The section also states that at least two directors must have special knowledge or work experience in agriculture and rural economy and cooperation. Sec. 10 (b) (1) further states that all Banking companies shall have one director as chair of the board of directors.

Minimum Capital Reserve (Article 11): Article 11 of the Banking Regulation Act of 1949 provides that Banking companies must not start or continue to operate in India. Less than:

(A) Foreign Banking company: In the case of a Banking company established outside India, its paid-up capital and reserves shall be at least Rs 150,000 in addition to its main place of business. 200,000 rupees for business in Mumbai and / or Kolkata.

Must be deposited and stored with RBI in either cash or non-disability approved securities. (I) the amount required above, and (ii) the amount equivalent to 20% of the profits of the year after the expiration of each calendar year with respect to the Indian business.

(B) Bank of India: For Bank of India, the sum of the paid-in capital and reserves must be greater than or equal to the amount listed below.

(I) 5 racks if there are offices in multiple states, 1 rack plus 10 racks for major offices if such offices are in Mumbai and / or Kolkata.

(II) If all offices are in one state and none are in Mumbai or Kolkata

10,000 rupees for the main place of business + 10,000 rupees for each other place of business in the same area where the main place of business is located + 25,000 state for each place of business elsewhere. Such a Banking company does not need to have paid-in capital and reserves in excess of Rs 50,000. Also, a Banking company with only one place of business does not need to have paid-in capital and reserves in excess of $ 50,000.

For such Banking companies If the business is started for the first time after September 16, 1962, the paid-up capital must be at least 50,000 rupees.

(III) All offices in one state, one or more of which are in Mumbai or Kolkata.

Rs 50,000 and $ 25,000 for offices other than Mumbai or Kolkata. Such a Banking company does not need to have paid-in capital and reserves in excess of Rs 100,000.

Capital structure (Section 12): According to Section 12, Banking companies may not operate in India unless the following conditions are met:

Banking Company Financial Report 3

- The entrusted capital is more than half of the authorized capital and the paid-in capital is more than half of the entrusted capital.

- Capital consists of common stock only, or common stock or stock, and preferred stock that may have been issued before April 1, 1944. This restriction does not apply to Banking companies established before January 15, 1937.

- The voting rights of shareholders shall not exceed 5% of the total voting rights of all shareholders of the company.

Payments for commissions, brokerage, etc. (Section 13): According to the section. As shown in Figure 13, Banking companies are permitted to pay directly or indirectly through fees, intermediaries, discounts, or compensation for the issuance of shares in excess of 2½ of the paid-in value of the shares or not.

Dividend payment (Section 15): According to the section. 15, Banking Company shares until all capital costs (including reserves, organization costs, stock sale fees, brokerage, losses incurred, and other expenditure items not represented in tangible assets) are fully written. No dividends will be paid to. Off.

But you don't need a Banking Company —

(A) If the depreciation of the value of the investment in the approved securities is not actually capitalized or otherwise no loss is recorded, the depreciation is amortized.

(B) Depreciate the value of an investment in stocks, bonds or bonds (excluding approved securities) if the depreciation is well prepared to the auditor's satisfaction.

(C) Amortize non-performing loans if appropriate provisions have been made for such debt to the satisfaction of the Banking company's auditors.

Reserve / Legal Reserve (Article 17): According to Article 17, 17, all Banking companies established in India have an amount equal to 20% of their annual net income (profit and loss calculation) before declaring dividends. (Disclosure in writing) shall be remitted to the Reserve Fund. However, the central government may waive this requirement for a specified period of time based on the RBI's recommendations. Tax exemption is granted if the existing reserve and stock premium account is greater than or equal to the paid capital. If the amount from the reserve or stock premium account is to be applied, within 12 days from the date of appropriation, the circumstances related to the appropriation shall be explained and the fact shall be reported to the Reserve Bank.

Cash Reserves (18 Section): Under 18 Section, all Banking Companies (not planned Banks), in the case of India, as cash reserves in cash, on their own, or at Reserve Banks or Indian State Banks or others It shall be maintained in the current account of the Bank of. The amount notified by the central government instead represents at least 3% of the time and demand debt in India. Reserve Banks have the authority to regulate that percentage between 3% and 15% (in the case of planned Banks). In addition to the above, they maintain at least 25% of their total time and claim debt in cash, gold, or non-obstacle approved securities. However, the assets of all Indian Banking companies are at least 75% of the time at the end of the last Friday of the quarter and must claim Indian debt.

Liquidity Criteria (Section 24): According to the Article 24 of the Act, Banking Companies must maintain sufficient liquid assets in their normal business processes. This section states that all Banking companies need to maintain cash, gold, or disability-free approved securities. This is more than 20% of the demand and time debt in India. This percentage may change from time to time by the RBI depending on the economic situation of the country. This adds to the average daily balance maintained by the Bank.

Accounting and Auditing (Sections 29-34A): The above section of the Banking Regulations Act deals with accounting at the time of auditing. All Banking companies established in India have their balance sheets and income statements as well as their last business day at the end of the fiscal year, when the 12-month period expires upon notification in the official bulletin designated by the central government. Need to be created. That year, or according to a third schedule, or as circumstances permit. At the same time, all Banking companies established outside India need to prepare a balance sheet and an income statement related to the Indian branch. We know that Form A of the third schedule deals with the balance sheet format and Form B of the third schedule deals with the income statement format.

Final Account Preparation and Presentation

The Banking company's final account includes the income statement and balance sheet. The fiscal year ends on March 31st of each year. Banks also create a semi-annual account on September 30th each year. The final account must be audited by a legitimate person under the law. All Banking companies must obtain RBI approval for the appointment of auditors. Three copies of the balance sheet and income statement, along with the audit report, must be submitted to RBI within three months of the end of the term. All Banking companies are required to submit three copies of the final accounting and audit report to the company registrar. These accounts will also be announced at the Annual General Meeting of Shareholders for shareholder approval. Banking Company Regulation 1949 also provides that accounting and audit reports should be published in newspapers published where the Banking company is headquartered within six months of the end of the period RBI can inspect accounts books. A unit of a Banking company at any time or at the direction of the central government.

Important Items of Final Accounting

(I) Inter-office Adjustments: The inter-office adjustment balance, if in debt, should be displayed under this heading. Only the net positions of inland and foreign inter-office accounts should be displayed here. To reach the net balance of inter-office reconciliation accounts, aggregate all connected inter-office accounts and display only the net balance for debits, primarily for in transit and unadjusted items must be represented.

(II) Discounted Invoice Rebate: Also known as a pre-received discount, an unexpired discount, or a received but unacquired discount. The treatment is the same as for interest received in advance. Therefore,

a) If only listed on the Trial Balance: The same will appear as a liability and will appear on the balance sheet on the liability side.

b) Given in the adjustment: In that case, the same will be deducted from the income from interest and discounts on the income statement and the same will appear on the liabilities side of the balance sheet.

(III) Call-at-call and short-term notice: Deposits made by a Bank to another Bank that can only be withdrawn after giving notice are called call-at-call and short-term notice. These deposits can be withdrawn by giving notice 24 hours in advance. Money with a sudden notice can also be withdrawn with a 7-day notice.

(IV) Bad debts and Allowance for doubtful accounts: An entry is passed to amortize the bad debts and record the allowance for doubtful accounts in the Bank's books. However, these entries should not be reflected in the Bank's Final Account as they can damage the Bank's reputation and damage public confidence.

Banking regulations allow Banks not to disclose bad debt amortization and allowance for doubtful accounts. The amount of the allowance for doubtful accounts is integrated with the "Provision and Contingency" when debiting the income statement. The amount will be deducted from the prepayment shown on the Balance Sheet. Banks must disclose facts about the existence of provisions in their accounting policy statements.

Provisioning for Advances:

The provision to be made against the advances as per guidelines is given below:

Types of Assets |

|

| Provision to be made | |

(i) | Standard Asset Sub-standard Asset Doubtful Asset (a) On Unsecured Portion (b) On Secured Portion: Doubtful for up to 1 years Doubtful for 1 to 3 years Doubtful beyond 3 years on Doubtful beyond 3 years on Doubtful beyond 3 years on Doubtful beyond 3 years on Loss Assets |

| : | 0.40% of the Balance |

(ii) |

| : | 10% of the Balance | |

(iii) |

|

|

| |

|

| : | 100% | |

|

| : | 20% | |

|

| : | 30% | |

| 31-3-2004 | : | 50% | |

| 31-3-2005 | : | 60% | |

| 31-3-2006 | : | 75% | |

| 31-3-2007 | : | 100% | |

(iv) |

| : | 100% | |

Note:

- If the asset is suspicious, the unsecured portion means the balance reduced by the value of the tangible assets and receivables under DICGC or ECGC.

- Advance payments for time deposits, NSCs, KVPs, and life insurance policies are exempt from provisioning requirements. These advances are not considered NPA.

- Interest payable to NPA should not be recognized as revenue unless realized. Interest expense will be credited to your Interest Suspense Account and charged to NPA. Upon actual receipt, it should be recognized as interest income.

- Delinquency should not be treated as an NPA, but a line of credit for which government guarantees are available. However, such tax exemption is not available for income recognition.

- In the case of advance payments guaranteed by the Export Credit Guarantee Corporation or the Deposit Insurance / Credit Guarantee Corporation, provisions must be recorded only for the balance exceeding the amount guaranteed by these corporations.

- If the advance payment is covered by the CGTSI guarantee, it will be an NPA and there is no need to pay a reserve for the guarantee portion. Unpaid amounts beyond the guaranteed portion must be provided in accordance with the existing guidelines set out by NPA.

Key takeaways:

- Bad assets (NPA) are recorded on the bank's balance sheet after a long period of non-payment by the borrower.

- NPA puts a financial burden on lenders. A significant number of NPAs over a period of time may indicate to regulators that a bank's financial position is at stake.

- NPAs can be categorized as substandard, suspicious, or lost assets, depending on the length of the delinquency period and the likelihood of repayment.

- Lenders have the option of recovering losses, such as obtaining collateral or selling a loan to a debt collection agency at a significant discount.

- A high NPA may not be beneficial to the bank. This is because they are poorly performing assets.

- A high NPA means that the bank has too many loans to function or the bank has no interest income.

- Banks can keep NPA on their books in the hope that they will be able to recover or be ready.

- Otherwise, the bank will completely cancel the loan as a bad debt. However, apart from the NPA, there are many other factors for valuing banks.

- NPA expands to bad assets (NPA). The Reserve Bank of India defines NPA as a prepayment or loan that is overdue for 90 days or more.

- "Assets become bad when they stop generating bank income," RBI said in a 2007 circular.

- To better adapt to international practice, the RBI has implemented a 90-day delinquency standard to identify NPA.

- The year ended March 31, 2004. There are also different types of bad assets, depending on how long the asset was NPA.

The format for creating the final account is described in Schedule 3 of the Banking Regulations Act. The revised format is vertical. The format is:

FORM ‘A’: FORM OF BALANCE SHEET

Balance Sheet of (here enter the name of the Banking Company) as on 31st March (Year)

| Schedule | As on 31.3. — (Current year) | |

CAPITAL AND LIABILITIES |

|

|

|

Capital |

| 1 | |

Reserves and Surplus |

| 2 | |

Deposits |

| 3 | |

Borrowings |

| 4 | |

Other Liabilities and Provisions |

| 5 | |

| TOTAL |

|

|

ASSETS |

|

|

|

Cash and Balances with Reserve |

| 6 | |

Bank of India |

|

| |

Balance with banks and money at |

|

| |

Call and short notice |

| 7 | |

Investments |

| 8 | |

Advances |

| 9 | |

Fixed Assets Other Assets TOTAL Contingent Liabilities Bills for collection | 10 11

12 |

|

| ||

| ||

|

|

|

SCHEDULE 1 — CAPITAL

Particulars | As on...... Current Year |

Capital (Fully owned by Central Government) II. FOR BANKS INCORPORATED OUTSIDE INDIA Capital (i) (The amount brought in by banks by way of start-up capital as prescribed by RBI should be shown under this head) (ii) Amount of deposit kept with the RBI under Section 11(2) of the Banking Regulation Act, 1949 TOTAL III. FOR OTHER BANKS Authorized Capital (shares of …. Each) Issued Capital (shares of …. each) Subscribed Capital (shares of …. Each) Called-up Capital (shares of …. Each) Less: Calls Unpaid Add: Forfeited Shares |

|

TOTAL |

|

SCHEDULE 2 — RESERVES AND SURPLUS

Particulars | As on .... Current Year |

Opening Balance Additions during the year Deductions during the year II. Capital Reserves Opening Balance Additions during the year Deductions during the year III. Share Premium Opening Balance Additions during the year Deductions during the year IV. Revenue and other Reserves Opening Balance Additions during the year Deductions during the year V. Balance in Profit and Loss Account TOTAL (I, II, III, IV and V) |

|

| |

|

SCHEDULE 3 — DEPOSITS

Particulars | As on.... Current Year |

(i) From Banks (ii) From Others II. Savings Bank Deposits III. Term Deposits (i) From Banks (ii) From Others TOTAL (I, II and III) B. (i) Deposits of branches in India (ii) Deposits of branches outside India TOTAL |

|

| |

| |

|

SCHEDULE 4 — BORROWINGS

Particulars | As on ..... Current Year |

(i) Reserve Bank of India (ii) Other Banks (iii) Other Institutions and Agencies II. Borrowing outside India TOTAL (I and II) |

|

| |

|

SCHEDULE 5 — OTHER LIABILITIES AND PROVISIONS

Particulars | As on ..... Current Year |

TOTAL |

|

|

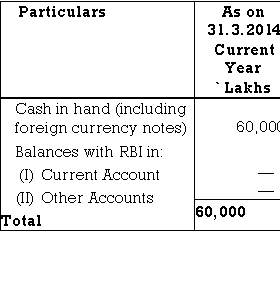

SCHEDULE 6 — CASHAND BALANCES WITH RESERVE BANK OFINDIA

Particulars | As on .... Current Year |

(Including foreign currency notes) II. Balance with Reserve Bank of India (i) In Current Account (ii) In Other Accounts TOTAL (I & II) |

|

| |

|

SCHEDULE 7 — BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE

Particulars | As on .... Current Year |

(i) Balance with banks (a) in Current Accounts (b) in Other Deposit Accounts (ii) Money at call and short notice (a) with Banks (b) with other Institutions TOTAL II. Outside India (i) in Current Accounts (ii) in other Deposit Accounts (iii) Money at call and short notice TOTAL |

|

SCHEDULE 8 – INVESTMENTS

Particulars | As on ..... Current Year |

(i) Government securities (ii) Other approved securities (iii) Shares (iv) Debentures and Bonds (v) Subsidiaries and/or joint ventures (vi) Others (to be specified) TOTAL II. Investments outside India in (i) Government securities (including local authorities) (ii) Subsidiaries and/or joint ventures abroad (iii) Other investments (to be specified) TOTAL GRAND TOTAL (I & II) |

|

SCHEDULE 9 –ADVANCES

Particulars | As on.... Current Year |

(ii) Cash Credits, Overdrafts And Loans payable on demand (iii) Term Loans TOTAL B. (i) Secured by tangible assets (ii) Covered by Bank/Government Guarantees (iii) Unsecured TOTAL C. I. Advances in India (i) Priority Sectors (ii) Public Sectors (iii) Banks (iv) Others TOTAL II. Advances outside India (i) Due from Banks (ii) Due from others (a) Bills purchased and discounted (b) Syndicated Loans (c) Others TOTAL GRAND TOTAL (C. I & II) |

|

| |

| |

| |

| |

| |

| |

| |

| |

|

SCHEDULE 10 – FIXED ASSETS

SCHEDULE 11 – OTHER ASSETS

Particulars | As on.... Current Year |

TOTAL @ In case there is any unadjusted balance of loss, the same may be shown under the item with appropriate footnote. |

|

| |

|

SCHEDULE 12 – CONTINGENT LIABILITIES

Particulars | As on .... Current Year |

(A) In India (B) Outside India V. Acceptances, endorsements and other obligations VI. Other items for which the bank is contingently liable TOTAL |

|

|

FORM ‘B’

FORM OFPROFITAND LOSSACCOUNT

Profit and Loss Account for the year ended 31st March, …

| Schedule No. | Current Year | Previous Year | |

TOTAL II. EXPENDITURE Interest expended Opening expenses Provisions and Contingencies TOTAL III. PROFIT/LOSS Net Profit/Loss for the year (I – II) Profit/Loss (+) brought forward TOTAL (-) IV. APPROPRIATIONS Transfer to Statutory Reserves Transfer to other Reserves Transfer to Government/Proposed dividend Balance carried over to Balance Sheet TOTAL |

13 |

|

|

|

14 | ||||

|

|

| ||

15 |

|

| ||

16 | ||||

|

|

|

| |

|

| |||

|

|

| ||

|

|

| ||

|

|

| ||

SCHEDULE 13 – INTEREST EARNED

Particulars | As on.... Current Year |

Bank of India and other inter-bank funds IV. Others TOTAL |

|

| |

|

|

SCHEDULE 14 – OTHER INCOMES

Particulars | As on .... Current Year |

Less: Loss on sale of land, building and other assets V. Profit on exchange transactions Less: Loss on exchange transactions VI. Income earned by way of dividends etc. from subsidiaries/companies and/or joint ventures abroad/in India. VII. Miscellaneous Income TOTAL Note: Under items II to V Loss, figures may be shown in brackets. |

|

| |

|

SCHEDULE 15 – INTEREST EXPENDED

Particulars | As on..... Current Year |

TOTAL |

|

|

SCHEDULE 16 — OPERATING EXPENSES

Particulars | As on ...... Current Year |

TOTAL |

|

|

Simple Numerical on Preparation of Profit & Loss A/c and Balance Sheet in vertical form

Illustration 1:

From the following information, prepare Profit and Loss Account of South Bank Ltd. as on 31st March 2020.

Particulars | (in ‘000) |

Interest and Discounts | 3045 |

Income from Investments | 115 |

Interest on Balances with RBI | 820 |

Commission, Exchange and Brokerage | 110 |

Profit on Sale of Investments | 1225 |

Interest on Deposits Interest to RBI | 161 |

Payment to and Provision for Employees | 1044 |

Rent, Taxes and Lighting | 210 |

Printing and Stationery | 180 |

Advertisement and Publicity | 95 |

Depreciation | 92 |

Director’s Fees | 220 |

Auditor’s Fees | 120 |

Law Charges | 20 |

Postage, Telegram and Telephones | 70 |

Insurance | 56 |

Repairs and Maintenance | 48 |

Other Information:

(i) Interest and discount mentioned above is after adjustment for the following:

Particulars | (‘000) |

Tax provision for the year | 2,20 |

Provision during the year for doubtful debts | 1,02 |

Loss on sale of investments | 12 |

Rebate on bills discounted | 58 |

(ii) 20% of profit is transferred to Statutory Reserves. 5% of profit is transferred to Revenue Reserve. Profit brought forward from last year 16,000.

Solution:

In the books of South Bank

Profit and Loss Account for the year ended 31st March 2020

Profit and Loss Account for the year ended 31st March 2020

Particulars | Schedule No. | As on 31.3.2020 Current Year |

2. Expenditure Interest Expended Operating Expenses Provision and Contingencies

3. Profit/Loss Net Profit for the year Profit brought forward Total 4. Appropriations Transfer to Statutory Reserve ( 5,19 × 20/100) Transfer to Revenue Reserve ( 5,19 × 5/100) Balance carried over to Balance Sheet Total |

13 |

37,32 |

14 | 9,18 | |

| 46,50 | |

15 | 13,86 | |

16 | 23,65 | |

| 3,80* | |

|  41,31 | |

| 5,19 | |

| 16 | |

|  5,35 | |

| 1,04 | |

| 26 | |

| 4,05 | |

| 5,35 |

* 380 (i.e., 220 + 102 + 58)

SCHEDULE 13 – INTEREST AND DISCOUNT

Particulars | As on 31.3.2020 Current Year |

Interest and Discount | 34,37 |

Income on Investment | 1,15 |

Interest on RBI Deposit | 1,80 |

Others | Nil |

| 37,32 |

SCHEDULE 14 – OTHER INCOME

Particulars | As on 31.3.2020 Current Year |

Commission, Exchange | 8,20 |

And Brokerage |

|

Profit on Sale of Investment | 98 |

(Net) (1,10 – 12) |

|

| 9,18 |

SCHEDULE 15 – INTEREST EXPENDED

Particulars | As on 31.3.2020 Current Year |

Interest paid on Deposits | 12,25 |

Interest to RBI | 1,61 |

| 13,86 |

Particulars | As on 31.3.2020 Current year | |

(i) | Payment to and provisions for employees | 10,44 |

(ii) | Rent, Taxes and Lighting | 2,10 |

(iii) | Printing and Stationery | 1,80 |

(iv) | Advertisement and Publicity | 95 |

(v) | Depreciation on Bank’s Property | 92 |

(vi) | Directors’ Fees, Allowances and Expenses | 2,20 |

(vii) | Auditor’s Expenses | 1,20 |

(viii) | Law Charges | 2,30 |

(ix) | Postage, Telegram and Telephones | 70 |

(x) | Repairs and Maintenance | 48 |

(xi) | Insurance | 56 |

(xii) | Other Expenditure | — |

|

| 23,65 |

SCHEDULE 16 – OPERATING EXPENSES

Illustration 2:

From the following information, prepare a Balance Sheet with necessary Schedules of the Citizen Bank Ltd. as on 31st March 2020 and ascertain Cash Reserves and Statutory Liquid Reserves required:

( in Lakhs)

Particulars | Dr. | Cr. |

Share Capital: 20,00,000 Shares of 10 each |

| 200.00 |

Statutory Reserves |

| 230.00 |

Net Profit before Appropriation |

| 150.00 |

Profit and Loss Account |

| 410.00 |

Fixed Deposit Accounts |

| 520.00 |

Saving Deposit Accounts |

| 450.00 |

Current Accounts |

| 520.00 |

Bills Payable | 30.00 | 1.00 |

Cash Credit |

| 110.00 |

Borrowing from other Banks | 813.00 |

|

Cash in hand | 160.00 |

|

Cash with RBI | 40.00 |

|

Cash with other Banks | 156.00 |

|

Money at call and Short Notice | 210.00 |

|

Gold | 55.00 |

|

Government Securities | 110.00 |

|

Premises | 156.00 |

|

Furniture | 70.00 |

|

Term Loan | 791.00 |

|

| 2,591.00 | 2,591.00 |

Additional Information:

Particulars | |

Bills for collection | 20,00,000 |

Acceptances and endorsements | 15,00,000 |

Claims against the bank not acknowledged as debts | 60,000 |

Depreciation charges: Premises | 1,00,000 |

Furniture | 80,000 |

50% of the Term Loan is secured by Government Guarantees. 10% of Cash Credit is unsecured.

Solution:

Particulars | As on 31.3.2020 Current Year Lakhs |

For Other Bank: |

|

Authorized Capital: …… | — |

Shares of 10 each |

|

Subscribed Called-up and |

|

Paid-up capital: |

|

20,00,000 shares of 10 each | 200.00 |

| 200.00 |

SCHEDULE 1: CAPITAL

SCHEDULE 2: RESERVES & SURPLUS

Particulars | As on 31.3.2020 Current Year Lakhs |

Add: Additions during the year (20% of 150 lakh) Less: Deduction during the year

II. Capital Reserves III. Share Premium IV. Revenue and Other Reserves V. Balance in Profit and Loss A/c |

230.00 30.00 |

260.00 Nil | |

260.00 — — 530.00 | |

790.00 |

SCHEDULE 3: DEPOSITS

Particulars | As on 31.3.2020 Current Year Lakhs |

II. Saving Bank Deposits III. Term Deposits, i.e., Fixed Deposit Account Total | 520.00

450.00 520.00 |

1490.00 |

SCHEDULE 4: BORROWINGS

Particulars | As on 31.3.2020 Current Year Lakhs |

(i) Reserve Bank of India (ii) Other Bank (iii) Other Institutions and Agencies II. Borrowings Outside India Total |

— 110.00 —

— |

SCHEDULE 5: CASH AND BALANCES WITH RBI

Particulars | As on 31.3.2020 Current Year Lakhs |

Total | 160.00 40.00 |

200.00 |

SCHEDULE 6: BALANCE WITH BANKS AND MONEY AT CALL AND SHORT NOTICE

Particulars | As on 31.3.2020 Current Year Lakhs |

(i) Balance with Bank (i.e., Cash with other Banks) (ii) Money at Call and Short Notice II. Borrowings Outside India Total |

156.00

210.00 — |

366.00 |

SCHEDULE 7: INVESTMENTS

Particulars | As on 31.3.2020 Current Year Lakhs |

(i) Govt. Securities (ii) Other, i.e., Gold II. Borrowings Outside India Total | — 110.00 55.00 — |

165.00 |

SCHEDULE 8: ADVANCES

Particulars | As on 31.3.2020 Current Year Lakhs |

II. Cash Credit, Overdrafts and Loans Payable on Demand: Cash Credits Overdrafts III. Term Loans Total B. I. Secured by Tangible Assets (90% of 813 + 50% of 791) II. Covered by Bank/Govt. Guarantors (50% of 791) III. Unsecured (10% of 813 + 100% of 30) Total |

813.00 |

30.00 | |

791.00 | |

1,634.00 | |

1,127.20 | |

395.50 | |

111.30 |

SCHEDULE 9: FIXED ASSETS

SCHEDULE 9: FIXED ASSETS

Particulars | As on 31.3.2020 Current Year Lakhs |

Total | 156.00

70.0.0 |

226.00 |

SCHEDULE 10: OTHER ASSETS

Particulars | As on 31.3.2020 Current Year Lakhs |

Total | — — —

— — — |

— |

SCHEDULE 11: CONTIGENT LIABILITIES

Particulars | As on 31.3.2020 Current Year Lakhs |

Total | 0.60

15.00 |

15.60 |

Notes: (i) Net Profit to be transferred to Statutory Reserve as per Sec. 17: 20% of Net Profit, i.e., 150 lakhs

× 20/100 = 30 lakhs. Thus, the Balance of Profit and Loss Account which is transferred to Balance Sheet:

= Opening Balance + Net Profit – Statutory Reserve

= 410 + 150 – 30 lakhs

= 530 lakhs

(ii) It has been assumed that 90% of the Cash Credit and 50% of the Term Loans are fully secured by tangible assets.

Illustration 3:

From the following particulars, prepare the final accounts of Barnali Bank Ltd.:

Balance Sheet as on 31st March 2020

Particulars | Dr. | Cr. |

Share Capital: |

|

|

1,00,000 Shares of 10 each, 5 paid up |

| 5,00,000 |

Reserve Fund |

| 10,00,000 |

Fixed Deposits |

| 20.00,000 |

Savings Bank Deposits |

| 30,00,000 |

Current Accounts |

| 70,00,000 |

Borrowed from Bank |

| 2,00,000 |

Investments | 30,00,000 |

|

Premises | 12,00,000 |

|

Cash in hand | 60,000 |

|

Cash at bank | 28,00,000 |

|

Money at Call and Short Notice | 3.00,000 |

|

Interest Accrued and Paid | 2,00,000 |

|

Salaries | 80,000 |

|

Rent | 30,000 |

|

Profit and Loss Account (1.4.08) |

| 1,60,000 |

Gross Profit for the year |

| 4,50,000 |

Bills Discounted | 5,00,000 |

|

Bills Payable |

| 8,00,000 |

Loans, Advances, Overdrafts and Cash Credits | 70,00,000 |

|

Unclaimed Dividend |

| 30,000 |

Sundry Creditors |

| 30,000 |

| 1,51,70,000 | 1,51,70,000 |

The Bank has the bills for 14,00,000 as collection for its constituents and also acceptances and endorsements for them amounting to 4,00,000.

Solution:

In the Books of Barnali Bank Ltd.

Profit & Loss Account for the year ended 31st March 2020

Particulars | Schedule No. | As on 31.3.14 Current Year | |

I. Income |

|

|

|

Interest Earned |

| 13 | 4,50,000 |

Other Incomes |

| 14 | — |

| Total |

|  4,50,000 |

II. Expenditure |

|

|  |

Interest Expended |

| 15 | 2,00,000 |

Operating Expenses |

| 16 | 1,10,000 |

Provision and Contingencies |

| — | Nil |

| Total |

|  3,10,000 |

III. Profit/Loss |

|

|

|

Net Profit/Loss for the Year (I – II) |

|

| 1,40,000 |

Profit/Loss brought forward |

|

| 1,60,000 |

| Total |

|  3,00,000 |

IV. Appropriations |

|

|  |

Transfer to Statutory |

|

| 28,000 |

Reserve (20% of Net Profit) |

|

|

|

Balance carried over to Balance Sheet |

|

| 2,72,000 |

| Total |

|  3,00,000 |

Balance Sheet of Barnali Bank Ltd. as at 31st March 2020

Balance Sheet of Barnali Bank Ltd. as at 31st March 2020

Particulars | Schedule No. | As on 31.3.14 Current Year Lakhs |

Capital and Liabilities |

|

|

Capital | 1 | 5,00,000 |

Reserves and Surplus | 2 | 13,00,000 |

Deposits | 3 | 1,20,00,000 |

Borrowings | 4 | 2,00,000 |

Other Liabilities and Provisions | 5 | 8,60,000 |

Total |

|  1,48,60,000 |

Assets |

|  |

Cash and Balance with RBI | 6 | 60,000 |

Balance with another Bank | 7 | 31,00,000 |

And Money at Call and Short Notice |

|

|

Investments | 8 | 30,00,000 |

Advances | 9 | 75,00,000 |

Fixed Assets |

| 10 | 12,00,000 |

Other Assets |

|

| — |

| Total |

|  1,48,60,000 |

Contingent Liabilities |

| 11 |  4,00,000 |

Bills for Collection |

| 12 | 4,50,000 |

SCHEDULE 1: CAPITAL

Particulars | As on 31.3.2020 Current Year Lakhs | |

Authorized Capital: |

|

|

…… Shares of 10 each |

|

|

Called-up Capital |

| 5,00,000 |

1,00,000 Shares of 10 each, 5 paid-up |

|

|

| Total | 5,00,000 |

SCHEDULE 2: RESERVES & SURPLUS

Particulars | As on 31.3.2020 Current Year Lakhs |

Statutory Reserve: | 10,00,000 |

Opening Balance |

|

Add: Transfer from current year’s |

|

Profit | 28,000 |

Capital Reserve | — |

Profit & Loss Account | 2,72,000 |

Total | 13,00,000 |

SCHEDULE 4: BORROWINGS

Particulars | As on 31.3.2020 Current Year Lakhs | |

Borrowings in India: |

|

|

(1) RBI |

| — |

(2) Others |

| — |

Borrowings outside India |

| 2,00,000 |

| Total | 2,00,000 |

SCHEDULE 5: OTHER LIABILITIESAND PROVISIONS

Particulars | As on 31.3.2020 Current Year Lakhs |

Bills Payable Others (including Provisions): Sundry Creditors Unclaimed Dividends Total | 8,00,000

30,000 30,000 |

8,60,000 |

SCHEDULE 6: CASHAND BALANCE WITH RBI

SCHEDULE 6: CASHAND BALANCE WITH RBI

Particulars | As on 31.3.2020 Current Year Lakhs | |

Demand Deposits: |

|

|

(1) From Banks |

| 70,00,000 |

(2) From Others |

| — |

Savings Bank Deposits |

|

|

Term Deposits: |

|

|

(1) From Banks |

| 30,00,000 |

(2) From Others |

| 20,00,000 |

| Total | 1,20,00,000 |

SCHEDULE 7: BALANCE WITH BANK AND MONEY AT CALL AND SHORT NOTICE

SCHEDULE 7: BALANCE WITH BANK AND MONEY AT CALL AND SHORT NOTICE

Particulars | As on 31.3.2020 Current Year Lakhs |

In India (i) Balances with bank (a) in Current Accounts (b) in Other Deposit Accounts (ii) Money at Call and Short Notice Outside India Total |

28,00,000 — — 3,00,000 — |

31,00,000 |

SCHEDULE 8: INVESTMENTS

Particulars | As on 31.3.2020 Current Year Lakhs | |

Investment in India |

| 30,00,000 |

Investment outside India |

| — |

| Total | 30,00,000 |

SCHEDULE 9: ADVANCES

Particulars | As on 31.3.2020 Current Year Lakhs |

Bills Discounted and Purchased |

|

Cash Credits, Overdrafts and Loans | 5,00,000 |

Payable on demand | 70,00,000 |

Term Loans | — |

75,00,000 | |

Total |

SCHEDULE 10: FIXED ASSETS

Particulars | As on 31.3.2020 Current Year Lakhs | |

1. Premises |

| 12,00,000 |

2. Other Fixed Assets |

| — |

| Total | 12,00,000 |

SCHEDULE 11: CONTINGENTLIABILITIES

Particulars | As on 31.3.2020 Current Year Lakhs |

Acceptances, Endorsements and Other Obligations Total |

4,00,000 |

4,00,000 |

SCHEDULE 12: INTEREST EARNED

Particulars | As on 31.3.2020 Current Year Lakhs |

Bills Discounted and Purchased Interest and Discount Received Total |

4,50,000 |

4,50,000 |

SCHEDULE 13: INTEREST EXPENDED

Particulars | As on 31.3.2020 Current Year Lakhs | |

Interest on Deposits |

| — |

Interest on RBI/Inter-bank |

| 2,00,000 |

Borrowings |

|

|

Others |

| — |

| Total | 2,00,000 |

SCHEDULE 14: OPERATING EXPENSES

SCHEDULE 14: OPERATING EXPENSES

Particulars | As on 31.3.2020 Current Year Lakhs |

Bills Discounted and Purchased |

|

Payment to and Provision for Employees |

80,000 |

Rent, Taxes and Lighting | 30,000 |

Total | 1,10,000 |

Illustration 4:

From the following information, prepare the Profit and Loss A/c of Trinity Bank Ltd. for the year ended 31st March 2020.

Particulars | |

Interest on Loan | 25,90,000 |

Interest on Fixed Deposits | 27,50,000 |

Rebate on Bills Discounted | 4,90,000 |

Commission | 82,000 |

Establishment Charges | 5,40,000 |

Discount on Bills Discounted (Net) | 14,60,000 |

Interest on Cash Credits | 22,30,000 |

Interest on Current Account | 4,20,000 |

Rent and Rates | 1,80,000 |

Interest on Overdraft | 15,40,000 |

Director’s Fees | 30,000 |

Auditor’s Fees | 12,000 |

Interest on Saving Bank Deposits | 6,80,000 |

Postage and Telegrams | 14,000 |

Printing and Stationery | 29,000 |

Sundry Charges | 17,000 |

(A) Bad debts to be written off amounted to 4,00,000

(B) Provision for taxation may be made at 55% of net profit. Show your workings.

Solution:

Form B

Profit and Loss Account for the year ended 31st March 2020

Profit and Loss Account for the year ended 31st March 2020

Particulars | Schedule | ||

II. Expenditure Interest Expended Operating Expenses Provisions and Contingencies

III. Profit: Net profit for the year

IV. Appropriations: Transfer to Statutory Reserve (20%) Transfer to other Reserves Proposed Dividend Balance carried over to Balance Sheet |

Total

Total

Total

Total |

13 |

73,30,000 |

14 | 82,000 | ||

|  74,12,000 | ||

15 | 38,50,000 | ||

| 12,22,000 | ||

| 12,87,000 | ||

| 63,59,000 | ||

| 10,53,000 | ||

| 10,53,000 | ||

| 2,10,600 | ||

| — | ||

| — | ||

| 8,42,400 | ||

|  10,53,000 | ||

Note: As particulars given in the question are not balances, it has been assumed that Rebate on Bills discounted is yet to be adjusted and hence it has been deducted from discount on bills discounted.

Note: As particulars given in the question are not balances, it has been assumed that Rebate on Bills discounted is yet to be adjusted and hence it has been deducted from discount on bills discounted.

SCHEDULE 13: INTEREST EARNED

Particulars | |

Interest Discount (Refer to W.N.) Total | 73,30,000 |

73,30,000 |

SCHEDULE 14: OTHER INCOME

Particulars | |

Commission, Exchange and Brokerage Total | 82,000 |

82,000 |

SCHEDULE 15: INTEREST EXPENDED

Particulars | |

Total | 5,40,000 1,80,000 30,000 12,000 14,000 29,000 17,000 4,00,000 12,22,000 |

Working Notes:

- Interest/Discount is calculated as follows

Particulars | |

Interest on Loans | 25,90,000 |

Interest on Cash Credit | 22,30,000 |

Interest on Overdraft | 15,40,000 |

Discount on Bills (Net) | 14,60,000 |

|  78,20,000 |

Less: Rebate on Bills Discounted | 4,90,000 |

Total |  73,30,000 |

|

|

II. Provision for taxation at 55% is calculated as follows

= 74,12,000 – 50,72,000 = 23,40,000

Tax provision = 23,40,000 × 55/100 = 12,87,000/-

Illustration 5:

From the following details, prepare the profit and loss account of Triveni Bank Ltd. for the year ended 31st March, 2020.

Particulars | |

Interest paid on deposits, borrowings etc. | 79,26,660 |

Interest and discount | 1,83,74,725 |

Rentals received | 78,000 |

Net profit on sale of investments | 2,27,000 |

Salaries, allowances, bonus and provident fund

| 97,79,925 |

(Including remuneration of the Chairman and |

|

Managing Director) |

|

Commission and brokerage | 42,00,000 |

Law charges | 72,000 |

Rates and taxes | 46,300 |

Postage and telegrams | 3,26,070 |

Audit fees | 60,000 |

Director’s fees | 36,000 |

Printing and stationery | 2,92,000 |

Depreciation on Bank’s property | 8,20,000 |

Miscellaneous receipts | 40,006 |

Miscellaneous expenditure | 1,65,406 |

Repairs to property | 32,400 |

Telephones and stamps | 4,83,200 |

Advertisement | 2,76,000 |

Insurance and lighting | 3,45,000 |

Bad debts written off | 72,700 |

Unexpired discount (1st April, 2019) | 5,70,000 |

Provision for bad debts (1st April, 2019) | 16,10,000 |

Provision for taxation (1st April, 2019) | 24,00,000 |

During the year Income Tax proceedings of the previous years were concluded and the liability on this account worked out to 22,40,000

The Bank has made an evaluation at the end of the year of the recoverability of its advances and finds itself in the following position:

(a) Unsecured advances to the extent of 60,000 would be full irrecoverable.

(b) Unsecured loans to the extent of 40,00,000 would be doubtful of recovery to the extent of 40%.

(c) Cash credit accounts to the extent of 25,00,000 have been left without the margin due to fall in the value of securities and the accounts to the extent of 10% are likely to become bad.

It is the Bank’s policy to provide fully against the contingency of bad debts. Provision for taxation to remain at 55% of the current profits.

Unexpired discount and interest on bills discounted as on 31st March, 2020 was 7,25,000.

Solution:

In the Books of Triveni Bank

Profit and Loss A/c for the year ended 31st March 2020

Profit and Loss A/c for the year ended 31st March 2020

Particulars | Schedule No. | Year ended 31-3-2020 | |

Interest Earned Other Income

II. Expenditure Interest Expended Operating Expenses Provisions of Contingencies

III. Profit/Loss Net Profit/Loss (-) for the year Profit/Loss (-) brought forward |

Total

Total

Total |

13 |

1,82,19,725 |

14 | 45,45,006 | ||

| 2,27,64,731 | ||

15 | 79,26,660 | ||

16 | 1,27,34,301 | ||

| 11,64,789 | ||

| 2,18,25,750 | ||

| 9,38,981 | ||

| 10,00,000 | ||

| 19,38,981 | ||

Illustration 6:

After writing up the Profit and Loss Account, the General Ledger Balances of S.S. Bank Ltd. as on 31st March, 2020 were as under:

Particulars | |

Share Capital | 59,75,000 |

Bills for Collection | 78,26,181 |

Cash in hand | 1,05,30,783 |

Machinery acquired in satisfaction of a claim | 45,600 |

Cash with RBI | 1,30,25,300 |

Cash with SBI | 50,11,837 |

Equity Shares of ACC Ltd. | 3,81,700 |

4% Govt. Of India Loan, 2007-08 of face value 3,00,000 | 2,40,90,000 |

Bengal Govt. Loan Bonds, 2003 of the face value 75,00,000 | 70,30,400 |

Punjab Govt. Loan Bonds, 2010 of the face value 38,00,000 | 39,56,100 |

Interest accrued on Investments | 1,80,720 |

Profit for the year | 11,30,240 |

Reserve Fund as on 1st April, 2013 | 57,75,000 |

Unpaid dividend | 30,700 |

Debenture | 90,000 |

Borrowings from other Banks | 15,00,000 |

Fixed Deposits | 3,00,60,520 |

Saving Bank Deposits | 2,60,97,616 |

Current Deposits | 3,82,90,782 |

Provision for Taxation | 10,00,000 |

Provision for Doubtful Debts | 5,00,000 |

Balances with other Banks in Current A/c | 10,70,640 |

Loans, Cash Creditors, Overdrafts | 3,96,70,682 |

Bills Payable | 4,77,679 |

Staff Provident Fund | 9,60,785 |

Sundry Creditors | 25,607 |

Unexpired Discount | 20,410 |

Bills Discounted and Purchased | 57,70,577 |

Building | 11,70,577 |

Furniture | 1,30,650 |

Dividend Recoverable | 12,000 |

Profit and Loss A/c credit balance brought forward from the previous year was 12,60,780 out of which appropriations made were 3,58,000 for dividend and 6,12,000 for taxes paid.

The following further information is relevant:

(a) The Authorized Share Capital of the Bank was 1,00,00,000 divided into shares of 100 each, out of which 75,000 shares were issued and subscribed with 80 per share called up.

(b) During the year, additions of 1,20,077 were made to building and 29,620 to furniture, while 7,600 realized on sale of a part of furniture (Book value 7,600). Depreciation on furniture to 31st March 1998 was 30,600 and that on Building was 1,40,500.

Prepare the Balance Sheet of the Banks as on 31st March 2020.

Solution:

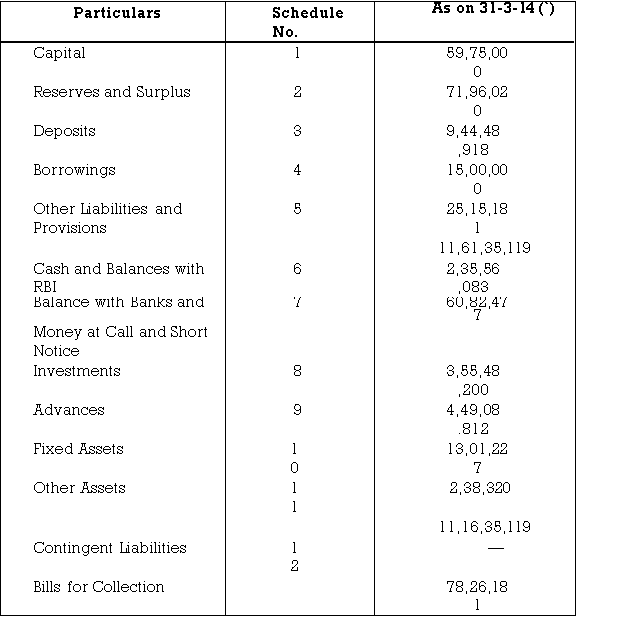

S.S. Bank Ltd.

Balance Sheet as on 31st March 2020

Balance Sheet as on 31st March 2020

SCHEDULE 1: CAPITAL

Particulars | As on 31.3.2020 |

Authorized Capital (1,00,000 shares |

|

Of 100/- each) |

|

Issued, Subscribed and Called-up Capital | 1,00,00,000 |

75,000 shares of 100/- | 60,00,000 |

Each 80/- called up |

|

Less: Calls in Arrears | 25,000 |

Total | 59,75,000 |

SCHEDULE 2: RESERVESAND SURPLUS

Particulars | As on 31.3.2020 |

Add: Additions during the year (i.e., 20% of 11,3,240) II. Balance in Profit and Loss A/c Total |

57,75,000 2,26,048 60,01,048 11,94,972 |

SCHEDULE 3: DEPOSITS

Particulars | As on 31.3.2020 |

Total | 3,00,60,520 2,60,97,616 3,82,90,782 |

9,44,48,918 |

SCHEDULE 4: BORROWINGS

Particulars | As on 31.3.2020 |

Borrowings from other Banks Total | 15,00,000 |

15,00,000 |

SCHEDULE 5: OTHER LIABILITIES AND PROVISIONS

Particulars | As on 31.3.2020 | |

Bills Payable |

| 4,77,679 |

Staff Provident Fund |

| 9,60,785 |

Sundry Creditors |

| 25,607 |

Unexpired Discounts |

| 20,410 |

Unpaid Dividend |

| 30,700 |

Provision for Taxation |

| 10,00,000 |

| Total | 25,15,181 |

SCHEDULE 6: CASH AND BALANCES WITH RBI

Particulars | As on 31.3.2020 |

Total | 1,05,30,783 1,30,25,300 |

2,35,56,083 |

SCHEDULE 7: BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE

Particulars | As on 31.3.2020 |

Total | 50,11,837 NIL

10,70,640 |

60,82,477 |

SCHEDULE 8: INVESTMENTS

Particulars | As on 31.3.2020 |

Total | 3,81,700

2,40,90,000

70,30,400

39,56,100 90,000 |

3,55,48,2000 |

SCHEDULE 9: ADVANCES

Particulars | As on 31.3.2020 |

Total | 3,91,70,682 57,38,130 |

SCHEDULE 10: FIXED ASSETS

Particulars | As on 31.3.2020 |

Building At Cost as on 31-3-97 Add: Addition during the year Less: Depreciation Furniture As Cost as on 31-3-97 Add: Addition during the year

Less: Sales Depreciation

Total |

11,91,000 |

1,20,077 | |

13,11,077 | |

1,40,500 | |

11,70,577 | |

1,39,230 | |

29,620 | |

1,68,850 | |

7,600 | |

30,600 | |

1,30,650 | |

13,01,227 |

SCHEDULE 11: OTHER ASSETS

Particulars | As on 31.3.2014 |

Total | 1,80,720 12,000 45,600 |

2,38,320 |

Working Notes

Particulars |

Profit and Loss A/c 12,60,780 |

Profit as per last Balance Sheet 3,58,000 |

Less: Dividends 6,21,000 |

Tax 2,90,780 |

11,30,240 |

Add: Current Year Profit 14,21,020 |

Less: 20% of Current Year’s profit 2,26,048 |

Total 11,94,972 |

References: