UNIT IV

Investment Accounting

What is Investment Accounting?

Accounting for an investment occurs when the funds for the investment product are paid. The exact type of accounting depends on the investor's intent and the proportional size of the investment. Depending on these factors, the following types of accounting may apply:

Maturity Holding Investment

If an investor is willing to hold an investment until maturity (in effect limiting this accounting method to debt products) and is capable of that, the investment is classified as holding to maturity. This investment is initially recorded at acquisition cost and then amortized to reflect the premium or discount at the time of purchase. Investment may also be written down to reflect a permanent impairment. There is no ongoing adjustment to the market value of this type of investment. This approach does not apply to equity instruments because it has no maturity date.

Transaction Security

If an investor intends to sell an investment for profit in the short term, the investment is classified as a trading security. This investment is initially recorded at acquisition cost. At the end of each subsequent accounting period, the recorded investment is adjusted to fair value at the end of that period. Unrealized gains or losses on holdings are recorded in operating income. This investment can be either a liability or a stock.

Available for Sale

This is an investment that cannot be classified as a held-to-maturity security or a trading security. This investment is initially recorded at acquisition cost. At the end of each subsequent accounting period, the recorded investment is adjusted to fair value at the end of that period. Unrealized gains or losses on holdings are recorded in other comprehensive income until sold.

Equity Method

If an investor has significant business or financial control over an investee (generally considered to have an interest rate of at least 20%), the equity method should be used. This investment is initially recorded at acquisition cost. In the subsequent period, the investor recognizes his share of the profit and loss of the investee after the profit and loss within the company is deducted. Also, if the investee issues a dividend to the investor, the dividend will be deducted from the investor's investment in the investee.

Realized Profit / Loss

An important concept in accounting for an investment is whether a profit or loss has been realized. Realized gains, like realized losses, come from the sale of an investment. Conversely, unrealized gains and losses are associated with fluctuations in the fair value of investments that investors still own.

There are situations other than the complete sale of an investment that is considered a realized loss. If this happens, the income statement recognizes the realized loss and reduces the carrying amount of the investment by the corresponding amount. For example, if a security you hold has a permanent loss, the entire loss is considered a realized loss and is amortized. Permanent losses are usually associated with the bankruptcy or liquidity of the investee.

Unrealized gains or losses are not subject to immediate taxation.

This gain or loss will only be recognized for tax purposes if realized through the sale of the underlying security. This means that there may be a difference between the tax base of the security and the carrying amount in the investor's accounting records, which is considered a temporary difference.

AS 13 Investment Accounting Applicability

- AS 13 Investment Accounting does not cover the following:

- Criteria for recognizing dividends, interest, and rents earned on investments covered by AS 9

- Finance or operating lease covered by AS 19

- Investing in retirement benefit plans and life insurance businesses covered by AS 15

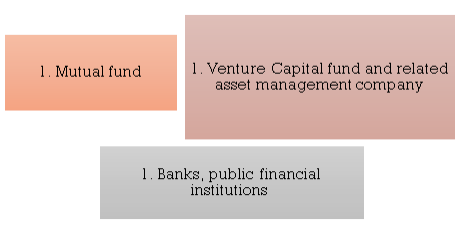

The following, enacted under Central Government Act or State Government Act of 2013, or declared under the Companies Act:

Investment Classification

Investment Cost

- Brokers, Obligations, and Fees – Investment costs include costs associated with brokerage, obligations, and acquisition of fees.

- Non-cash consideration – if the investment is acquired or partially acquired

- Issuance of shares

- Issuance of other securities

- Other assets,

Acquisition Cost is the fair value of issued securities or abandoned assets. The fair value may not be essentially the same as the par value or par value of the securities issued. It may be wise to consider the fair value of such investments acquired, in case it is more obvious.

Interest, Dividends or Other Receivables – Dividends, interest, and other receivables related to an investment are usually considered income and are ROIs (return on investment).

However, under certain conditions, such inflows mean a cost recovery and do not form part of the income. If such allocation is difficult, the cost of the investment is usually reduced within the range of dividends that can be received only if it clearly represents a partial recovery of the cost.

Rights Shares – If the provided rights shares are subsequently subscribed, the cost of the rights shares will be added to the original holdings.

However, if the right is not reserved but is sold, the proceeds from the sale of such right will be transferred to the income statement. However, if the investment is acquired on a lump sum rights basis and the market value of the investment immediately after the loss of rights is lower than the cost of acquiring such an investment, it may be wise to apply the proceeds from the sale of the rights. Reduce the carry-over of investment to market value

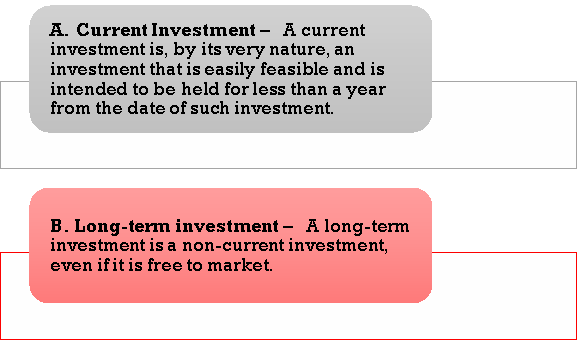

Book Value of Investment

Current investments are determined either by investment category or by individual investment base, but must be recorded in the financial statements at cost or fair value, whichever is lower, rather than on an overall basis.

Long-term investments should always be recorded in financial statements at cost. However, unless it is temporary, if the value of a long-term investment declines, the carrying amount will be reduced to recognize the decline.

Investment Property

Investment property is an investment in land or a building that is not expected to be used or used significantly in the operation of an investment company.

Investment treatment at the time of Disposal

At the time of sale or disposal of the investment, the difference between the carrying amount and the return on sales minus costs is transferred to P & L.

Reclassification of Investment

If a long-term investment is reclassified as a liquid investment, the transfer is made at the carrying amount on the date of the transfer and at a lower acquisition cost. If an investment is transferred from a current investment to a long-term investment, the transfer will take place at the cost or the fair value of the investment on such transfer date, whichever is lower.

Disclosure in financial statements

The following is a disclosure in the financial statements to which AS 13 Investment Accounting applies.

(a) Accounting policies adopted to determine the carrying amount of an investment

(b) Amount included in the income statement below

- Dividends, interest, and rent for investments that separately represent income from long-term investments and current investments. The total income must be stated and the TDS (withholding amount) amount is included in the prepaid tax.

- Changes in the books of profit and loss and investment amount due to disposal of current investment

- Changes in books of profit and loss and investment amount due to disposal of long-term investment

(c) Substantial restrictions on ownership, investment feasibility, remittance of income and sale price

(d) The sum of both quoted and unquoted investments. Provides the total market value of quoted investments.

(e) Other disclosures expressly required by the relevant legislation governing the company.

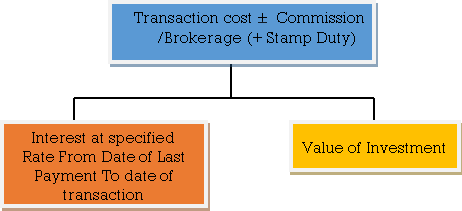

Term of Transactions

The aforesaid securities are generally purchased an sold at the price prevailing at recognized stock exchange through brokers. This is called transaction price.

The Brokers charge as service charge commission / Brokerage which is generally expressed as absolute amount or percentage of transaction price. In case of purchase the amount is added to transaction price. In case of sale, it is deducted from price.

In addition, the buyer of securities is required to pay Stamp Duty.

Thus,

I) Cost of Investment Purchased

Transaction Price | XX |

Add Commission / Brokerage | XX |

Add Stamp Duty | XX |

Total | XX |

This is called four values of Investment.

II) Sale Proceeds of Investment Comprises

Transaction Price | XX |

Less: Commission / Brokerage | XX |

Total | XX |

When Investments are acquired in exchange for any other assets, the Fair Value of Asset exchanged is cost of Investment.

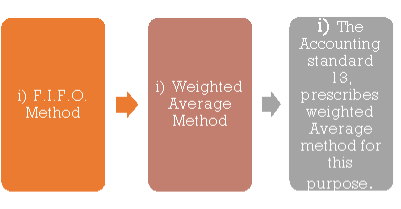

In case of sale, it is also necessary to ascertain Cost of Investment sold.

The cost of investment sold can be arrived as under

The Carrying Amount represents amount at which balance in A/c is carried forward.

The carrying amount to be adopted is

- In case of Long-Term Investment

- Fair value (as above)

2. In case of current Investment

- Fair value (as above)

Or Market Value whichever is lower.

However, in case of long-term investment, if the decline in value of investment is of long-term nature, it is advisable to provide for such loss.

Types of Transactions

- Fixed-interest bearings investment: In case of Fixed-interest bearings investment such as securities, Debentures, Bonds the interest is received by the holder of investment on specific dates- normally half yearly. In such case a special treatment is to be given to interest from date of the transaction. For this purpose, transactions are categorized as

- Cum last payment to interest: This type of transaction mean transaction is inclusive of above referred interest. The cost of investment is to be segregated between interest and value of investment. Thus

B. Ex-Interest: The price is exclusive of interest Hence aforesaid interest is to paid/received in condition to price.

Transaction Price  |

| ||||

Add |

| ||||

| Invest as stated Above | ||||

| |||||

| |||||

| Value of Investment |

| |||

In case the transaction (whether Cum Interest or Ex interest) is not specified, it is assumed that transaction is cum-interest.

The amount received on sell or renouncement is to be treated as Income, as specified in AS-13.

In case of Bonus Shares, the investor has NIL Cost. For purpose of carrying amount, average cost of shares after bonus shares.

However, for purpose of Income Tax computation aforesaid averaging of cost is not to be considered.

For shares (variable income bearing securities) For debentures/Preference. Shares (fixed income bearing securities

Shares:

The Shares transactions are of various types

- By Purchase/sale through Broker

- Rights Share

- Bonus Shares

The transaction through Broker may be cum dividend or ex dividend in the same manner as cum interest or ex-interest. However, difference is interest is related to time period. Whereas dividend relate to declared amount.

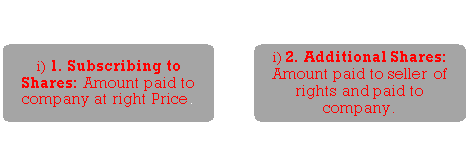

In case of Rights Shares, the issuing company makes offer to shareholder to subscribe and pay for Shares at specific price. Payable directly to company. The Shareholder if desire to Purchase additional shares, can acquire such right from any other shareholder on payment of additional amount called Premium. In case shareholder do not wish to invest, he can sell right and receive premium. The cost of investment in such case is,

Accounting for transactions of purchase and sale of investments with ex and cum interest prices and finding cost of investment sold and carrying cost as per weighted average method (Excl. Brokerage).

Accounting Entries

a. Purchase:

Investment A/c Dr. (Face Value & Amount Column Income A/c Dr. (Income Column)

To Bank A/C

b. Sale:

Bank Dr.

To Investment A/c (Face value & Account Column) To Income (Income Column)

c. Profit / Loss on sale:

For Profit

Investment (Amount Column) Dr.

To Profit or Loss A/c

For Loss

Profit or Loss A/c Dr.

To Investment (Amount Column)

d. Receipt of Income on Due Date

Bank A/c Dr.

To investment A/c (Income column)

e. Receipt of Bonus Shares: Entry only in Face value columns.

Note:

- Face value Column can be fitted as Number column in case of Shares.

- In case transaction for item 1 and 2 above is on due date of payment of interest the entry will not have debit or credit to Income column.

Columnar format for Investment Account.

Investment Account

The investment Account is maintained in multi column form.

The separate columns are:

Date |

Particulars | FV (Rs.) | Income | Investment or capital | Date |

Particulars | FV (Rs.) | Income | Investment or capital |

| To Balance

To Bank (Purchase)

To Profit on Sale

To Profit/ Loss A/c |

|

|

|

| To Bank (Sale)

By Loss on Sale

By Balance |

|

|

|

|

|

|

|

|

|

Note: The Accrued Interest should be shown as Balance in Income Column in case of opening & Closing Balances.

Balance in Income column should be transferred to Profit & Loss A/c.

The accounting policies related to the investment of the selected company are as follows:

1. Reliance Industries Limited (2004-05)

Current investments are recorded at cost and quote / fair value, whichever is lower, calculated for each category. Long-term investments are presented at acquisition cost. Reserves for a decline in the value of long-term investments are made only if management determines that such a decline is not temporary.

2. Larsen & Toubro Limited (2004-05)

Current investments are booked at lower cost or lower market value. The determination of the carrying costs of such an investment is based on a particular identification. Long-term investments, including equity interests in joint ventures of the nature of joint ventures, are expensed in case of a reduction in value if such reductions are of a permanent nature.

3. Tata Steel Limited (2004-05)

Long-term investments are recorded at cost minus provisions for a permanent reduction in the value of such investments. Current investments are booked at lower cost and fair value. If you invest in a partially converted bond for the purpose of retaining only the converted portion of the bond, the face value of the non-converted portion that exceeds the amount realized by the sale of that portion will be treated as part of the cost of that portion. Acquisition of convertible portion of corporate bonds.

Key takeaways:

- Investing means spending money outside the business to earn non-trading income.

- Money is usually invested in corporate government bonds, securities, stocks, corporate bonds, and so on.

- Permanent investments made outside the business to earn regular income are known as trade investments.

- A company may want to invest idle cash purely temporarily (of course, if the rate of return is higher than the cost of capital). This type of investment is known as securities and is treated as a liquid asset.

- Accounting for an investment occurs when the funds for the investment product are paid. The exact type of accounting depends on the investor's intent and the proportional size of the investment.

- Liability securities that a company holds to maturity with the positive will and ability are classified as held-to-maturity securities and are reported at amortized cost after impairment.

- Liability securities and stocks purchased and held primarily for short-term sales are classified as trading securities and are reported at fair value, with unrealized gains and losses included in profits.

- Liability and equity securities that are not classified as held-to-maturity securities or trading securities are classified as sellable securities and are reported at fair value, unrealized gains and losses are excluded from profits and shareholders' equity.

References:

- Advanced Accounts: By M.C. Shukla & S.P. Grewal (S.Chand & Co. Ltd.)

- Advanced Accountancy: By S. P. Jain & K.N. Narang (Kalyani Publishers)

- Advanced Accountancy: By R. L. Gupta & M. Radha Swamy (Sultan Chand & Sons)

- Company Accounts: By S.P. Jain & K.L. Narang

- Advanced Accounts: By Paul Sr.

- Corporate Accounting: By Dr. S. N. Maheshwari & S.K. Maheshwari

- Corporate Accounting: By Mukharji & Hanif

- Accounting Standards –as issued by Institute of Chartered Accountants of India