Unit 1

ACCOUNTING STANDARDS & FINANCIAL REPORTING

Meaning of Accounting Standards

Accounting Standards are written policy documents issued by expert accounting body or by the government or other regulatory body covering the aspects of recognition, measurement, treatment, presentation, and disclosure of accounting transactions in financial statements

Classification of Enterprises

The enterprises are classified and labeled as Level I, Level II and Level III companies. Based on this classification and the category in which they fall the Accounting standards are applicable to the enterprises

Level I Enterprises

Enterprises which fall under any one or more category below mentioned are termed as Level I Companies

Level II Enterprises

Enterprises which fall under any one or more category below mentioned are termed as Level II Companies

Level III Enterprises:

Enterprises which do not fall under Level I and Level II, are considered as Level III enterprises

Applicability of Accounting standards

Accounting Standard | Level I | Level II | Level III |

Yes | Yes | Yes | |

Yes | Yes | Yes | |

Yes | No | No | |

Yes | Yes | Yes | |

Yes | Yes | Yes | |

|

|

|

|

Yes | Yes | Yes | |

Yes | Yes | Yes | |

Yes | Yes | Yes | |

Yes | Yes | Yes | |

Yes | Yes | Yes | |

Yes | Yes | Yes | |

Yes | Yes | Yes | |

Yes | Yes | Yes | |

Yes | Yes | Yes | |

Yes | No | No | |

Yes | No | No | |

Yes | Partial | Partial | |

Yes | Partial | Partial | |

Yes | No | No | |

Yes | Yes | Yes | |

Yes | No | No | |

Yes | No | No | |

Yes | No | No | |

Yes | Yes | Yes | |

Yes | No | No | |

Yes | Yes | Yes | |

Yes | Partial | Partial |

International Financial Reporting Standards

The field of financial reporting in India has seen major changes in the last 5 years. As the trade increasingly moves beyond the national boundaries, the compliance and reporting requirements move too. Presenting the financial statements of an entity in accordance with the reporting requirements of every country it has a presence in, is becoming increasingly difficult.

What is IFRS?

The International Financial Reporting Standards (IFRS) are accounting standards that are issued by the International Accounting Standards Board (IASB) with the objective of providing a common accounting language to increase transparency in the presentation of financial information.

What is IASB?

The International Accounting Standards Board (IASB), is an independent body formed in 2001 with the sole responsibility of establishing the International Financial Reporting Standards (IFRS). It succeeded the International Accounting Standards Committee (IASC), which was earlier given the responsibility of establishing the international accounting standards. IASB is based in London. It has also provided the Conceptual Framework for Financial Reporting issued in September 2010 which provides a conceptual understanding and the basis of the accounting practices under IFRS.

Components of Financial Statements under IFRS

A complete set of financial statements prepared in compliance with the IFRS would ideally comprise of the following:

Both these statements may either be combined or shown separately.

The financial statements would sometimes also include a statement of the financial position of an earlier period in the following scenarios:

List of International Financial Reporting Standards (IFRS)

As already discussed, the Standards issued by the IASB are called IFRS. The predecessor body, IASC, had however already issued certain International Standards which are called International Accounting Standards (IAS). These IAS were issued by the IASC between 1973 and 2001. Both IAS and the IFRS continue to be in force. The standards are listed below:

Standard No. | Standard Title |

IFRS 1 | First-time Adoption of International Financial Reporting Standards |

IFRS 2 | Share-based Payment |

IFRS 3 | Business Combinations |

IFRS 4 | Insurance Contracts |

IFRS 5 | Non-current Assets Held for Sale and Discontinue Operations |

IFRS 6 | Exploration and Evaluation of Mineral Resources |

IFRS 7 | Financial Instruments: Disclosures |

IFRS 8 | Operating Segments |

IFRS 9 | Financial Instruments |

IFRS 10 | Consolidated Financial Statements |

IFRS 11 | Joint Arrangements |

IFRS 12 | Disclosure of Interests in Other Entities |

IFRS 13 | Fair Value Measurement |

IFRS 14 | Regulatory Deferral Accounts |

IFRS 15 | Revenue from Contracts with Customers |

IFRS 16 | Leases |

IFRS 17 | Insurance Contracts |

IAS 1 | Presentation of Financial Statements |

IAS 2 | Inventories |

IAS 7 | Statement of Cash Flows |

IAS 8 | Accounting Policies, Changes in Accounting Estimates and Errors |

IAS 10 | Events after the Reporting Period |

IAS 11 | Construction Contracts |

IAS 12 | Income Taxes |

IAS 16 | Property, Plant, and Equipment |

IAS 17 | Leases |

IAS 18 | Revenue |

IAS 19 | Employee Benefits |

IAS 20 | Accounting for Government Grants and Disclosure of Government Assistance |

IAS 21 | The Effects of Changes in Foreign Exchange Rates |

IAS 23 | Borrowing Costs |

IAS 24 | Related Party Disclosures |

IAS 26 | Accounting and Reporting by Retirement Benefit Plans |

IAS 27 | Separate Financial Statements |

IAS 28 | Investments in Associates and Joint Ventures |

IAS 29 | Financial Reporting in Hyperinflationary Economies |

IAS 32 | Financial Instruments: Presentation |

IAS 33 | Earnings per Share |

IAS 34 | Interim Financial Reporting |

IAS 36 | Impairment of Assets |

IAS 37 | Provisions, Contingent Liabilities, and Contingent Assets |

IAS 38 | Intangible Assets |

IAS 39 | Financial Instruments: Recognition and Measurement |

IAS 40 | Investment Property |

IAS 41 | Agriculture |

1. Applicability of Cash Flow Statement

The applicability of Cash flow statement has been defined under the Companies Act, 2013. As per the definition in the act, a financial statement includes the following:

i. Balance sheet.

ii. Profit and loss account / Income and expenditure account.

iii. Cash flow statement.

iv. Statement of changes in equity.

v. Explanatory notes.

Thus, cash flow statements are to be prepared by all companies but the act also specifies a certain category of companies which are exempted from preparing the same. Such companies are One Person Company (OPC), Small Company and Dormant Company.

2. Cash and Cash Equivalents

Cash equivalents are held by an enterprise for meeting its short-term cash commitments instead of the purpose of investment or such other purposes. For investments to qualify as cash equivalents:

1. An investment must be easily convertible into cash and

2. Must be subject to a very low level of risk with respect to changes in its value

Hence, an investment would qualify to be a cash equivalent only when such an investment has a short maturity of three months or less from its acquisition date.

AS 3 Cash Flow Statements states that cash flows should exclude the movements between items which forms part of cash or cash equivalents as these are part of an enterprises cash management rather than its operating, financing and investing activities.

Cash management consists of the investment of excess cash in the cash equivalents.

3. Presentation of Cash Flow

A cash flow statement must depict the cash flows within the period classifying them as-

A. Operating activities.

B. Investing.

C. Financing activities.

Companies must prepare and present cash flows from operating, financing as well as investing activities in such manner that is apt to their business.

Grouping the activities provide information which enables the users in assessing the impact of such activities on the overall financial position of an enterprise and also assess the value of the cash and cash equivalents.

A. Operating Activities

Cash flows from operating activities predominantly result from the main revenue-generating activities of an enterprise.

For example:

(i) Cash received from the sale of goods and services

(ii) Cash received in form of fees, royalties, commissions and various other revenue forms

(iii) Cash paid to a supplier of goods and services

B. Investing Activities

Cash flows from investing activities represent outflows are made for resources intended for generating cash flows and future income.

For instance:

(i) Cash paid for acquiring fixed assets.

(ii) Cash received from disposal of fixed assets (including intangibles).

(iii) Cash paid for acquiring shares, warrants or debt instruments of other companies and interests in JVs.

C. Financing Activities

Financing activities are those which brings changes in composition and size of owners capital and borrowings of an enterprise.

For instance:

(i) Cash received from issuing shares or other similar securities

(ii) Cash received from issuing loans, debentures, bonds, notes, and other short-term or long-term borrowings

(iii) Cash repaid on borrowings

4. Cash flow from operating activities

A company must report its cash flows from operating activities using:

1. Direct method – Where all the major classes of cash receipts and cash payments are presented; or

2. Indirect method – Where the net profit or net loss is adjusted for:

a) Effects of transactions that are non-cash in nature such as depreciation, deferred taxes, provisions, etc.

b) Accruals or deferrals of future or past operating cash proceeds or payments

c) Any expense or income related to financing or investing cash flows

5. Cash Flow from Investing and Financing Activities

A company must separately record all the major classes of cash receipts and cash payments which arises from financing and investing activities, barring the ones which need to be reported on the net basis.

A. Cash flow on Net Basis

Cash flows which arise from below-mentioned operating, financing or investing activities might be reported on a net basis:

(i) Proceeds and payments in cash on behalf of a client where cash flows reflect the activities of such client rather than that of the company itself

(ii) Proceeds and payments in cash for items where the amounts are huge, turnover is quick, and maturities are short

Cash flows which arise from each of the below-mentioned activities of any financial enterprise might be reported on the net basis:

(i) Proceeds and payments in cash for acceptances and repayments of deposits having fixed maturities

(ii) Placement and withdrawal of deposits from other financial enterprises

(iii) Loans and cash advances are given to clients/customers and repayment of such loans and advances

B. Foreign Currency Cash Flows

Cash flows that arise from the transactions in the foreign currencies must be recorded in the companys reporting currency by using the below method:

Foreign currency amount * FX rates between the reporting and foreign currency at the date of cash flow.

A rate which approximates actual rate might be used in case the outcome is largely the same as it would have been if the rate at the date of cash flows was used.

The impact of changes in the exchange rate on cash and cash equivalents which is held in the foreign currencies must be reported as a distinct and separate part of the reconciliation of changes in the cash and cash equivalent during the relevant period.

6. Extraordinary Items, Dividends & Interests

The cash flows related to the extraordinary items must be categorized as arising from operating, financing or investing activities as apt and disclosed distinctly.

Cash flows from dividends and interest received and paid must be separately disclosed. Cash flows which arise from dividends and interest received and paid in the case of financial enterprises must be categorized as cash flows from operating activities.

For other enterprises, cash flows which arise from interest paid must be categorized as cash flows from the financing activities whereas dividends and interest received must be categorized as cash flows from the investing activities. Any dividends paid must be categorized as cash flows from the financing activities.

7. Taxes on Income

Cash flows which arise from taxes on income must be disclosed separately and must be reported as cash flows from the operating activities except if they could be explicitly related to investing and financing activities.

8. Acquisitions and Disposal of Business Units including Subsidiaries

The aggregate cash flows which arise from acquisition and from the disposal of business units including subsidiaries must be shown as investing activities and reported separately.

Enterprises must present, in total, with respect to both the acquisitions and disposals of other business units including subsidiaries within the period the followings:

(a) Aggregate purchase or disposal value.

(b) The amount of purchase or disposal value which is discharged by way of cash and cash equivalents.

9. Non-Cash Transactions

Financing and investing transactions which does require cash or cash equivalents must be included in the cash flow statement. Those transactions must be presented elsewhere in financial statements in a way which gives relevant information about such financing and investing activities.

10. Disclosure

Enterprises must disclose, along with management commentary, the amount of substantial cash and cash equivalents held by an enterprise which isnRst available for use.

Commitments that may arise from discounted bills of exchange and other similar obligations that are undertaken by an enterprise are typically disclosed in financial statements by means of notes, even in case the probability of loss is remote.

11. Major differences between AS 3 and Ind AS 7

Particulars | AS 3 Cash Flow Statements | Ind AS 7 Statement of Cash Flows |

Bank Overdrafts | AS 3 it doesnt have any such requirement | Ind AS 7 explicitly includes bank overdrafts as a part of cash and cash equivalents that are repayable on demand |

Cash flow from extraordinary activities | AS 3 necessitates cash flows related to the extraordinary activities to be classified as cash flow arising from operating, financing and investing activities | Ind AS 7 doesnt contain such requirement |

Cash flow from changes in ownership of interests in subsidiaries | AS 3 doesnt have any such requirements | Ind AS 7 needs classification of cash flows which arises from changes in the ownership interests in the subsidiaries which does not result in the loss of control as the cash flows from financing activities |

Accounting for investments in a subsidiary or an associate | AS 3 doesnt have any such requirement | Ind AS 7 requires the use of Cost or Equity method when accounting for investments in a subsidiary or an associate |

Disclosure requirements | AS 3 require fewer disclosure requirements as compared to Ind AS 7 | Ind AS 7 requires more disclosure requirements |

Steps for preparing Cash Flow Statement:

AS 7 Construction Contract describes and lays out the accounting treatment in respect of the revenue and costs in relation to a construction contract. AS 7 Construction Contract is to be used in for the accounting of construction contracts in the financial statements of the contractors.

1. Types of Contracts

A Construction Contract is any contract which is entered into specifically for construction of an asset or a combination of assets that are closely inter-linked or inter-dependent w.r.t. their technology/design/function or the nature of their ultimate purpose or use.

A. Fixed Price Contract

A contract in which the contractor agrees to a fixed contract price. In some cases, there may be an element of cost escalation clause in the contract which is mutually agreed to between the parties.

For example, the parties agree to include a clause in the contract for adjusting the Contract price on the basis of an increase in the cost of raw materials.

B. Cost-plus Contract

A contract in which the contractor is reimbursed for costs incurred or agreed costs, plus a percentage of these costs of a fixed fee.

2. Combining and Segmenting of Construction Contracts

I. Combining of Construction contracts – A group of contracts, either with one or more customers, shall be considered as a single construction contract when all the contracts are negotiated as a single package, are inter-linked and form part of a single project and are performed in a continuous sequence. F

or example, a contract for construction of three similar buildings (similar in all aspects) on a single plot negotiated all at once.

II. Segmenting of Construction contracts – Where a contract includes more than one asset, the construction of each asset should be treated as a separate construction contract when separate proposals have been given for each asset, each asset has been separately negotiated and the costs and revenues of each asset can be identified separately.

For example, a contract for construction of three different buildings on the same plot with different specifications and each building is separately negotiated with the contractor.

3. Revenue from a Contract

The revenue from a contract includes the following to the extent it is probable of generating revenue and is measurable:

i. The initial amount of revenue agreed in the contract;

ii. Claims and incentives on account of variations in contract work;

4. Costs of a Contract

The cost of a contract includes the following:

i. Directly related costs that to the specific contract.

ii. Costs which are generally attributable and allocated to the contract activities.

iii. Other costs which are specifically chargeable to the customer under the terms of the contract.

5. Recognition of Revenue and Cost from a Contract

Where the result or outcome of any contract for construction can be projected, the related contract revenue and contract costs shall be recognized by taking into account the stage of completion of such contract. Expected losses shall be recognized immediately as expenses.

I. In case of a fixed price contract, the outcome can be estimated in a reliable manner when all the following conditions are satisfied:

i. The entire revenue from a contract can be reliably measured.

ii. It is apparent that the economic benefits of such contract will flow to the organization.

iii. Both contract costs and stage of completion can be measured.

iv. Contract costs can be clearly identified for a comparison between actual costs and prior estimates.

II. In case of a cost-plus contract, the outcome can be estimated in a reliable manner when all the following conditions are satisfied:

i. It is probable that economic benefits of the contract will flow to the organization.

ii. Contract costs attributable to the contract can be identified and measured clearly.

III. Percentage of completion method – This method defines the recognition of revenue and cost taking into account the stage of completion of a contract. Under this method, revenue and cost are recognized in the statement of profit and loss in the accounting periods in which the work is performed.

IV. Contract work-in-progress – A contractor may incur costs that relate to future activity in a contract. Such costs are recognized as an asset if it is probable that they will be recovered.

6. Determination of the stage of completion

The stage of completion of a contract may be determined in different ways. Depending on the nature of the contract, the methods may include:

I. The proportion of contract cost incurred w.r.t. the total estimated cost of contract; (for example: if the total cost of the contract is Rs. 30 lakhs and the cost incurred till date is Rs. 15 lakhs, the stage of completion is regarded as 50% complete i.e. 15 lakhs / 30 lakhs).

II. Surveys of work performed; (for example: in a contract for construction of a bridge, the site inspector can do a survey and with regards to the technicalities of the project, inform how much work has been completed).

III. Completion of a physical proportion of contract work (for example: in a contract for construction of a five storey building, if three stories are complete, the stage of completion for the same is regarded as 60% i.e. 3 stories/5 stories).

When the outcome of a construction contract cannot be estimated, the revenue and cost should be recognized only to the extent of contract costs incurred whose recovery is probable.

7. Recognition of Expected Losses

In a situation where it is expected that the total contract costs will exceed total revenue from such contract, the expected losses should be immediately recognized as expenses. The number of such losses shall be determined irrespective of the following:

i. The work has commenced on the contract or not.

ii. The stage of completion.

iii. The number of profits expected to arise on other contracts which are segmented as explained above.

8. Disclosures required in financial statements

An organization should disclose:

i. Contract revenue recognized during the accounting period.

ii. The methods used to determine the contract revenue recognized in the period.

iii. The methods used to determine the stage of completion of contracts in progress.

Following disclosures w.r.t. contracts in progress shall also be given at the reporting date:

i. An aggregate cost incurred and net profits recognized.

ii. The amount received as advances.

iii. The amount kept retentions.

Note:

Advances are amounts received by the contractor before the related work is performed.

Retention is such amounts which are paid only after satisfying the conditions specified in the contract for payment of such amounts.

An organization should present:

i. The gross amount due from customers for contract work as an asset;

ii. The gross amount due to customers for contract work as a liability.

9. Major Differences between Ind AS (IAS) 11 and AS 7

As per Ind AS (IAS) 11 | As per AS 7 |

No mention of borrowing costs specifically | Specifically includes borrowing costs under expenses |

Requires contract revenue to be measured at fair value of the consideration received/receivable | Requires contract revenue recognition at a value of the consideration received/receivable |

Deals with Service Concession Arrangements which is in respect of infrastructure projects on a build-operate-transfer pattern between a public and private enterprise | Does not deal with Service Concession Arrangements |

AS 12 explains how to account for government grants. It is a basic duty of any government to develop the industries and economy.

1. Introduction

To help discharge this duty, the government undertakes promotional activities, provides incentives and grants to businesses. The grants received from the government are in various forms such as subsidy, incentives, duty drawbacks among others.

AS 12 deals with grants given by government but does not covers:

i) The accounting for grants which reflect the effect of price changes

ii) Assistance by the government other than grants like tax exemption, etc

iii) Participation of government in organisation’s ownership.

2. Meaning of Government Grant

The assistance was given by the government in cash or kind with certain specific conditions. These do not include such grants from the government which cannot be measured reasonably.

Also, the transactions with the government which cannot be separately identified from normal trading of the organization are not considered as a grant.

For eg:- Receipt of cash on the sale of packaged drinking water to railways by RsBisleriRs.

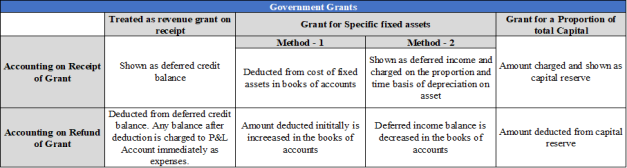

3. Methods of Accounting for Government Grants

There are two methods outlined by the AS to account for the government grants:

I. Capital approach.

II. Income / Revenue approach.

The method of accounting for any grant is always based on the nature of grant received. The grants are recognized only where a certainty exists for the fullfillment of conditions and ultimate collection of such grants.

3.I. Capital Approach

To state simply, these grants are treated as a part of capital or shareholderRss funds. These are such grants which are given as a proportion of total investment in a business.

Ordinarily, the government does not expect a repayment of such grants. Due to this reason, such grants are credited to the capital or shareholderRss funds.

These grants are divided primarily into three types:

A) Non-monetary grants.

B) The proportion of capital in a business.

C) For specific fixed assets.

3.I.A. Accounting of grants as a Proportion of total capital in a business

The non-monetary grants are those which are given in form of resources such as land, building. These grants are usually given at a concessional rate or for free. These grants should be accounted for at the acquisition cost or nominal value (if given free of cost).

3.I.B. Accounting of grants as a Proportion of total capital in a business

Where grants are of such nature that they are treated as a proportion to total capital in a business, they are treated as Capital Reserves and shown as Capital Reserve in the Balance Sheet. This way the amount received will not have any effect on Income Statement or Fixed Assets carrying amount. This means that such amounts cannot be distributed as a dividend to shareholders. Also, they are not eligible to be considered as a deferred income.

3.I.C. Accounting of grants for Specific fixed assets

These are such grants which have a primary condition attached to them:

i. The organization receiving such grants must either Construct, Acquire or Purchase such specific fixed assets for which such grant is given.

ii. Other condition may also be imposed as the type of assets, location of assets, period of acquisition, etc.

Two methods are prescribed for recognition of grants in form of grants for specific fixed assets:

Method 1 – The amount of grant is reduced from the gross amount of the asset to calculate book value. This signifies that the grant is being recognized in profit and loss account as a reduced charge of depreciation over the life of such asset.

Illustration:

ABC Ltd. Purchases a machinery for Rs. 30 lakhs with a useful life of 5 years and Nil salvage value. It gets Rs. 10 lakhs as a grant from the government for this machinery.

a) The gross value of machinery will be shown as Rs. 20 lakhs (30 lakhs – 10 lakhs) in the balance sheet.

b) Rs. 4 lakhs (20 lakhs / Useful life i.e. 5 years) will be charged to profit and loss account each year as a depreciation on this machinery.

Method 2 – The grants are treated as a deferred income in the financial statements. This income is recognized gradually in the profit and loss account over the useful life of an asset or say in the proportion of depreciation on such asset.

Illustration:

ABC Ltd. Purchases a machinery for Rs. 30 lakhs with a useful life of 5 years and Nil salvage value. It gets Rs. 10 lakhs as a grant from the government for this machinery.

a) The Gross value of machinery will be shown as Rs. 30 lakhs in the balance sheet along with Rs. 10 lakhs as Deferred Government Grant.

b) Rs. 6 lakhs (30 lakhs / Useful life i.e. 5 years) will be charged to profit and loss account each year as a depreciation along with an income of Rs. 2 lakhs (10 lakhs / Useful life i.e. 5 years).

3.II. Income Approach

Grants which relate to revenue are credited to the profit and loss account as Other Income. They can also be deducted from the related expenses in the profit and loss account. For example:- Grants for electricity expenses of a manufacturing entity.

4. Refund of Government Grants

There are scenarios where the government grants are to be refunded due to non-fullfillment of certain conditions.

The accounting for such refund of grants is as under:

5. Disclosure Requirements

i. Accounting policy adopted inclusive of the method of presentation

ii. Nature and extent of government grant recognized in financial statements

6. Major Differences between Ind AS (IAS) 20 and AS 12

Ind AS (IAS) 20 | AS 12 |

Requires disclosure of financial statements with indication on other forms of government assistance received. | No requirement as does not deal with other forms of government assistance. |

Recognition of grants directly to the shareholders fund is prohibited. | Grants for non-depreciable assets are required to be shown as a capital reserve under shareholders funds. |

Government grants in the nature of capital contribution are not recognized. | Specifically requires that government grants as capital contribution should be recognized. |

Requires the recognition of non-monetary grants at fair value. | Requires recognition of non-monetary grants at acquisition cost or nominal value. |

The option to deduct the amount of grant from the book value of the asset is not available. | The option to deduct the amount of grant from the book value of the asset is available. |

AS 15 Employee Benefits deals with all the forms of employee benefits, all forms of consideration given by an enterprise in exchange for the services rendered by employees.

1. Applicability of AS 15

AS 15 came into effect from 1st April 2006 and is applicable for Level – 1 Enterprises. However, certain relaxation has been given to the Level – 1 enterprises, depending upon if they have employed 50 or more employees.

Level – 1 Enterprises are those enterprises whose turnover for the last preceding financial year was more than Rs 50 Crores. This also includes any holding or subsidiary company of the same.

2. Employee Benefits

For the purpose of AS 15, an employee is defined as an employee who may provide services to an entity on a full-time, part-time, permanent, casual or temporary basis. AS 15 also includes directors and other management personnel under the definition of employees.

The following can be considered for the establishing an employee relationship:

i. Employment Contracts.

ii. Individuals are considered employees for legal/tax/social security purposes.

iii. There is a huge amount of direction provided by the employer and the necessary tools have been provided by the employer.

iv. Services have to be performed at a location provided by an employer.

3. Short-Term Benefits

Short-term benefits are those benefits which are payable within twelve (12) months after the end of the period in which the service was rendered. These expenses are accounted straightforward as no actuarial assumptions are required to measure the cost.

Short-term benefits are classified into 4 different categories:

i. Regular period benefits (Eg: Salary, Wages etc).

ii. Compensation of short-term absence (Ex: Sick leave, Annual leave, etc).

iii. Bonus/Profit payable within 12 months from the end of the period in which employee rendered services.

iv. Non-Monetary Benefits (ex: Medical Insurance, Housing, etc).

The general criteria of the standard lays down that an enterprise should recognise as an expense (unless another AS permits a different treatment) the undiscounted amount of all short-term employee benefits attributable to services that been already served in the period and any difference between the number of expenses so recognized and cash payments made during the period should be treated as a liability or prepayment (asset) as appropriate.

4. Post-Employment Benefits

The accounting treatment and disclosures for post-employment benefit plan rely upon whether it is a defined contribution or a defined benefit plan.

A. Defined Contribution Plans are the post-employment benefits in which an enterprise pays fixed contributions into a separate fund and will no obligations to pay any amount in future.

Under this plan, the actuarial and investment risk falls upon the employee as there might be a chance that the benefits will be less than expected or the assets will be insufficient to meet expected benefits.

B. Defined Benefits Plans are the post-employment benefits which are not covered by the defined contribution plans.

Under this plan, the actuarial and investment risk falls upon the employer and a very detailed actuarial calculation is performed to determine the charge.

5. Other Long-Term Benefits

There are few other long-term benefits which an enterprise gives to its employees. Some of them are:

i. Long-term paid leave such as sabbatical leave.

ii. Jubilee/Other long-term services.

iii. Long-term disability benefits.

iv. Profit/Bonus which is to be paid to the employee after 12 months for the period in which the service was rendered.

6. Termination Benefits

Termination benefits are those benefits which result in payable if is an enterprises decision to terminate an employees employment or it is the decision of the employee to accept voluntary redundancy in exchange of the benefits Ex: Payments made under Voluntary Retirement Scheme (VRS).

Termination benefits have to be recognized by an enterprise as a liability or an asset only when a detailed formal plan for the termination is approved and a reliable estimate can be made of the obligation to be paid.

7. Accounting Treatment

The accounting treatment for the employee benefits must be recognized in the balance sheet of the enterprise. The amount to be recognized as a defined benefit liability should be the net totals of the following amounts:

i. Present Value of the defined benefit obligations at the balance sheet-

minus

ii. Any past service cost not yet recognized-

minus

iii. Fair Value at the balance sheet date of the plan assets (if any) out of which the obligations are to be settled directly.

If the Fair Value of the plan assets is higher than the liability, then it gives rises to the Net Assets.

As per AS 15 in such a situation, the enterprise should measure the resulting asset at the lower of the amount so determined or the present value of any economic benefits available in the form of refunds from the plans or contributions

As per ICAI “The standard identifies various components of defined employee costs:

a. Current service cost.

b. Interest Cost.

c. The expected return on any plan assets.

d. Actuarial gains and losses.

e. Past service cost.

f. Effects of any settlements or curtailments”

8. Disclosures

If the enterprise is uncertain about the number of employees who will accept the number of termination benefits, then there will be a contingent liability. Such Contingent Liability must be disclosed as per the provisions of AS-29

If an enterprise has to disclose the information about termination benefits for key management personnel, then it has to be disclosed as per AS-18.

9. Actuarial Assumptions and Treatment

An enterprise should consider the actuarial assumptions only if it is unbiased and mutually compatible. The actuarial assumptions have to treated as an enterpriseRss best estimate of the post-employment benefits. The calculation should be prudent and not too conservative.

As per the standard, the following actuarial assumptions should form part:

A. Demographic assumptions about the future of the current and former employees who are eligible for benefits. Such matters are:

i. Employee Turnover Rate.

ii. Plan Members with dependents.

iii. Claim rates under the plan.

iv. Mortality.

B. Financial Assumptions such as the discount rate, future salary, and benefits, expected rate of return on assets, medical benefits costs. It should be based on the market rate as on the date of the balance sheet.

10. Conclusion

Actuarial Gains and Losses comprises of the effects of the difference between the previous and actual actuarial assumptions or the changes in the assumptions. Actuarial Gains or Losses should be determined by profit or loss immediately as income or expense.

Applicability

AS 17, on segment reporting is mandatory in respect of accounting periods commencing on or after 1-4-2001 in respect of enterprises (a) whose equity or debt securities are listed on a stock exchange in India or in process of listing on stock exchange or (b) all other enterprises whose turnover for the accounting period exceeds Rs. 50 crores.

AS 17, is a disclosure standard meaning thereby it involves only disclosure of certain information in the financial statements by way of additional information.

Issue 1 :

AS 17, is applicable to which entities?

As referred in above, AS 17 is mandatory wef 1-4-2001, to (a) companies whose equity or debt are listed on a stock exchange or are in process of listing equity or debt on a stock

exchange or (b) All other commercial, industrial and business reporting enterprises, whose turnover for the accounting period exceeds Rs. 50 crores.

However, the Institute of Chartered Accountants of India, New Delhi, has made the AS applicable to the following enterprises wef 1-4-2004:

Issue 2 :

What happens if an enterprise ceases to be covered by any of the criteria mentioned in Issue 1 above or for the first time no longer qualifies for exemption for year 2004-05?

When an enterprise ceases to be covered by the criteria, as per the amendment made in the AS (as effective from 01-04-2004) the enterprise will not qualify for exemption from the application of this standard, until the enterprise ceases to be covered in any of the above categories for two consecutive years.

Where an enterprise is covered for the first time and the AS becomes applicable from the current period, only current period figures are required to be given meaning thereby previous year figures need not be disclosed.

An enterprise which is not required to disclose segment information, wef 1-4-2004, should disclose the fact that pursuant to the exemption / relaxation given in AS, disclosures are not made in the financial statements.

Issue 3 :

When consolidated financial statements is prepared wherein both single financial statements and consolidated financial statements of parent is given, should segment reporting also be given by the parent in its single financial statements ?

AS mentions, if a single financial report contains both consolidated financial statements and the separate financial statements of the parent, segment information need be presented only on the basis of the consolidated financial statements.

However, since consolidated financial statement is still not a recognised concept under the Companies Act, 1956 and that stand alone Annual report is required to be filed with Registrar of Company, enterprises would be advised to prepare segment reporting in its stand alone financial statements also.

Issue 4 :

What should be included in segment revenue and what is disclosure requirement as to AS?

Segment revenue will include direct sales to external customers, as well as inter-unit transfer to other segment. It will also include all operating revenue whether directly attributable or that can be allocated on a reasonable basis to a segment. Operating revenue will include transactions such as scrap sales, damage or penalty recovery, rent from property and profit on sale of fixed assets, if asset is included under segment assets, export incentives, royalty / licence fees if intangible assets included in segment assets, exchange fluctuation gain if relevant revenue forms part of segment revenue or relates to segment assets or segment liabilities, etc.

Issue 5 :

What is not included in segment expense ?

Interest expense, including interest on loans or advances, general administrative expenses, head office expenses, other expenses that arise at the enterprise level and relate to the whole enterprise (e.g. secretarial, legal, accounting,) income-tax expense, extra-ordinary item as defined in AS 5, loss on sale of investments or losses on extinguishment of debt are not included as segment expense.

However, if any expense relate to the operating activities of the segment and if it can be directly attributed or allocated to the segment on a reasonable basis, then the same should be considered as part of the segment expense.

Issue 6 :

What are segment accounting policies and are they required to be disclosed separately ?

Segment accounting policies are the accounting policies adopted for preparing and presenting the financial statements of the enterprise as well as those accounting policies that relate specifically to segment reporting.

The segment accounting policies would include such as identification of segments, method of pricing inter-segment transfers, basis for allocating revenues and expenses to segments etc.

The Accounting Standard requires that basis of pricing inter-segment transfers and any change therein or any change in accounting policies adopted for segment reporting having material effect on segment information should be disclosed.

Issue 7 :

What would normally constitute non-cash expense other than depreciation and amortization in respect of segment assets those are included in segment expense?

Items such as impairment losses, provision for bad and doubtful debts, write-down of inventories to net realisable value, foreseeable losses on construction contracts, provisioning for restructuring, loss on sale of fixed assets, and similar amounts which are deducted in determining carrying amounts of segment assets are disclosed under non- cash expense other than depreciation and amortization.

Issue 8 :

A Ltd. had a reportable segment in year 02-03, but for 03-04, that reportable segment does not meet the 10% threshold limit. Should A Ltd. continue or drop the segment for reporting in 03-04?

A segment may have been a reportable segment in the prior period but is not a reportable segment in the current period as it no longer meets the 10% threshold limit of revenue, result or assets or other reportable segments may account for more than 75% of the entity revenue. The AS requires A Ltd. to continue the reportable segment of 02-03 also for 03-04, even though its revenue, result and assets no longer meet the 10% threshold limit. Taking a clue about the applicability of Accounting Standards, A Ltd. would be required to disclose for two consecutive years and thereafter cease reporting that segment which does not meet the threshold criteria.

Conversely, if a segment is identified by A Ltd. in 03-04 as a reportable segment, Accounting Standard requires that prior period segment data i.e. 02-03 also be presented unless it is impracticable to do so, even if the 10% threshold were not satisfied in the preceding year.

Issue 9 :

A Ltd. is in one business segment i.e. deals in food business. Also it sells entire production in India. Is A Ltd. required to give information as required under AS 17 ?

If A Ltd. has neither more than one business segment nor has more than one geographical segment, segment information as per AS 17 is not required to be disclosed.

However A Ltd. should do well to disclose, that as it has one business segment, segment information as per AS 17 is not required to be disclosed.

However, should company A Ltd. have turnover spread over geographical segments such as India, USA, UK and Asia other than India and the threshold criteria of 10% or more is met in each of above geographical segment, then A Ltd. will be required to give segment revenue by geographical area even though primary business segment may not be applicable.

Issue 10 :

Is there any difference between the disclosures required under listing agreement clause 41 and that required under AS 17 ?

Listing agreement requires company to give segment reporting on a quarter to quarter basis along with year to date figures. Further, reporting is of segment wise revenue, results and capital employed. Capital employed is defined as segment assets less segment liabilities. The quarterly disclosure format has an elimination column for segment revenue, but there is no elimination column in the segment result. AS 17 has elimination column for segment revenue and segment results.

Further, company has an option to publish consolidated quarterly / half yearly financial results in addition to the unaudited quarterly / half yearly financial results of the parent company. However, the publication of consolidated annual financial results along with stand.

Alone financial results shall be mandatory. Thus, segment revenue, results and capital employed on a consolidated basis is optional for quarterly / half yearly basis.

What is also observed that few companies do not publish segment results stating the same are furnished to stock exchange as required under listing agreement. However, this is not the letter and spirit of the listing agreement.

Under AS 17, a company is required to disclose more information which includes additional information such as reconciliation between segment revenue, results, assets and liabilities with financial statements, method of pricing inter-segment transfers, types of products and services in each business segment, composition of each geographical segment, etc.

Issue 11 :

Are intra-group balances and intra group transactions required to be eliminated while disclosing segment revenue, segment expense, segment assets and segment liabilities?

Segment revenue, segment expense, segment assets and segment liabilities are determined before elimination of inter-segment balances and intra-group balances and intra-group transactions between group entities in different segments.

The standard requires that all inter-segment or in that case intra-group transactions / balances be shown under respective segment and then eliminated only through the Elimination column of Segment disclosures.

However, such balances and transactions while preparing consolidated financial statements under AS 21, are eliminated.

Issue 12 :

What construes a change in accounting policy as referred to in AS 17?

Change in identification of segments, method of pricing inter-segment transfers and changes in the basis for allocating revenues and expenses to segment would amount to changes in accounting policies. Such changes can have a significant impact on the segment information reported but will not change aggregate financial information reported for the enterprise. To enable users to understand the impact of such changes having a material financial effect on the segment information, the Accounting Standard requires to disclose the nature of the change and the financial effect of the change, if reasonably determinable.

Issue 13 :

If fixed assets are revalued, whether fixed assets should be taken at historical cost or at revalued amounts for computing segment assets?

Segment assets are to be disclosed at revalued amounts. Revaluation reserve will not appear anywhere in the segmental disclosure.

Thus, segment whose fixed assets are revalued will show higher capital employed than the segment whose fixed assets appear at cost.

Issue 14 :

Interest, which is included as a part of the cost of inventories, as permitted under AS 16, Borrowing Cost read with AS 2, Valuation of inventories, and those inventories are part of segment assets of a particular segment, whether such interest should be considered as a segment expense?

Since, such interest is resulting from the operating activities of the segment in respect of which such inventories constitute the segment assets, interest on such inventories should be considered as a segment expense.

The amount of such interest and the fact that the segment result has been arrived at after considering such interest can be disclosed by way of a note to the segment result.

This standard establishes requirements for the disclosure of:

a) Related party relationships; and

b) Transactions between a reporting enterprise and its related parties.

The requirements of this Standard apply to the financial statements of each reporting enterprise as also to consolidated financial statements presented by a holding company.

What is the meaning of Related party?

As per AS 18, Related party means “at any time during the year, one party has an ability to:

Control the other party

Exercise significant influence over the other party in making financial and/or operating decisions

Control means:

1. Ownership, direct or indirect, of more than 50% of the voting power of an enterprise,

2. In case of company – control of the composition of the board of directors

In case of any other enterprise – control of the composition of the corresponding governing body

3. Substantial interest in voting power and the power to direct the financial and/or operating policies of the enterprise

Who is covered under Related party relationships?

1. Holding companies, subsidiaries and fellow subsidiaries;

2. Associates and joint ventures of the reporting enterprise;

3. Investors in respect of which reporting enterprise is an associate or a joint venture;

4. Individuals owing direct or indirect interest in the voting power of the reporting enterprise that gives them control or significant influence over the enterprise, and relatives of any such individual;

5. Key management personnel and his relatives; and

6. Enterprises over which any person, who is a key management personnel or has direct and indirect interest in voting power, can exercise significant influence

Why do we need Related party disclosures?

1. Requirement of statutes: The statutes governing an enterprise often require disclosure of related party transactions in the financial statements.

2. To reflect that transaction may not be at arms length price: Without related party disclosures, there is a general presumption that transactions reflected in the financial statements are on an arms length basis i.e. the transaction occurs between two unrelated parties and is not affected by any relationship.

3. Effect on Financial position and operating results: The operating results and financial position of an enterprise may be affected by a related party relationship even if related party transactions do not occur. The mere existence of the relationship may be sufficient to affect the transactions of the reporting enterprise with other parties

4. Recording of all possible transactions: Related party transactions needs to be disclosed as sometimes, transactions would not have taken place if the related party relationship had not existed.

What needs to be disclosed under AS 18?

The reporting enterprise should disclose the following:

1. The name of the transacting related party;

2. A description of the relationship between the parties;

3. A description of the nature of transactions;

4. Volume of the transactions either as an amount or a part thereof;

5. Any elements of the related party transactions which is necessary for an understanding of the financial statements;

6. Outstanding amount from related parties at the balance sheet date;

7. Provisions for doubtful debts due from related parties at the balance sheet date; and

8. Amounts written off or written back of debts due from or to related parties.

Cases when disclosure is not required

1. Intra-group transactions

2. Enterprises who have statutory requirement of confidentiality

3. Related party relationships of State-controlled enterprises with other state-controlled enterprises

Examples of Related party transactions

The following are examples of the related party transactions in respect of which disclosures may be made by a reporting enterprise:

a) Purchases or sales of goods (finished or unfinished);

b) Purchases or sales of fixed assets;

c) Rendering or receiving of services;

d) Agency arrangements;

e) Leasing or hire purchase arrangements;

f) Transfer of research and development;

g) License agreements;

h) Finance (including loans and equity contributions in cash or in kind);

i) Guarantees and collaterals; and

j) Management contracts including for deputation of employees.

Case studies on AS 18

Case Study 1: For ABC Ltd.

Transactions | Amount (in Rs.) |

Sales to XYZ Ltd., a subsidiary | 2,00,000 |

Sales to PQR Ltd., a subsidiary | 3,00,000 |

Purchase from DEF Ltd., a subsidiary | 6,00,000 |

Purchase from LMN Ltd., a joint venture | 1,00,000 |

Solution: Disclosure required as per AS 18

Transactions | Amount (in Rs.) |

Sales to subsidiaries | 5,00,000 |

Purchase from Subsidiaries | 6,00,000 |

Purchase from joint venture companies | 1,00,000 |

Case Study 2: A Ltd holds 75% of voting power of B Ltd and B Ltd owns 50% voting interest in C Ltd. Further, A Ltd also holds 25% of the voting interest in C Ltd. Would A Ltd deemed to have control over C Ltd or would it only be considered as exercising significant influence?

Solution: A Ltd would be considered to control C Ltd. As per AS 18, control includes ownership, directly or indirectly, of more than 50% of the voting power of another enterprise. As A Ltd is a majority shareholder B Ltd, therefore, it has control over it. Further, as A Ltd and B Ltd together are majority shareholders (i.e. 50% + 25%) in C Ltd. A Ltd has indirect control over it. Accordingly, A Ltd has the ability to control C Ltd, indirectly via the share ownership in B Ltd apart from its individual shareholding in C Ltd.

Comparison between AS 18 and Ind AS 24

Particulars | AS 18 | Ind AS 24 |

Definition of Related party relationship | It uses the term “relatives of an individual” | It uses the term “a close member of that persons family” |

Definition of State controlled enterprises | It is an enterprise which is under the control of the Central Government and/or any State Government(s) | There is an extended coverage of Government Enterprises, as it defines a government-related entity as an entity that is controlled, jointly controlled or significantly influenced by a government |

Coverage of Key Management Personnel in Related party relationships | Existing AS 18 covers key management personnel of the entity only | Ind AS 24 covers key management person of the parent as well |

Coverage of entities that are post employment benefit plans as Related parties | Existing AS 18 does not specifically covered entities that are post employment benefit plans, as related parties | Ind AS 24 specifically includes post employment benefit plans for the benefit of employees of an entity or its related entity as related parties |

Disclosure of information by Government related entities | Existing AS 18 presently exempts the disclosure of such information | Ind AS 24 requires disclosures of certain information by the government related entities |

Disclosure of Volume of the transactions | Existing AS 18 gives an option to disclose the “Volume of the transactions either as an amount or as an appropriate proportion” | Ind AS 24 requires “the amount of the transactions” need to be disclosed |

AS-19 deals with the accounting policies applicable for all types of leases except certain listed below.

A lease is a transaction whereby an agreement is entered into by the lessor with the lessee for the right to use an asset by the lessee in return for a payment or series of payments for an agreed period of time.

What kind of leases are not covered under this standard?

This Standard is not applicable to:

(a) Lease agreements for exploring or using natural resource. Ex Oil, gas, timber, metals and other mineral rights.

(b) Licensing agreements. Ex Motion picture films, video recordings, plays, manuscripts, patents and copyrights.

(c) Lease agreements for use land.

There are two types of leases:

1. Finance Lease.

2. Operating Lease.

Finance Lease: A lease in which all risks and rewards are transferred to the owner of assets. The title may or may not eventually be transferred.

Examples of Finance Lease are:

1. Lease in which Assets is transferred to lessee at the end of lease term.

2. Lease term in which lessee has the option to purchase the assets form lessor at the price which is lower than fair price on the date when option become exercisable.

3. Lease term Covers complete economic life of the asset even if title is not transferred.

4. Lease term in which present value of the minimum lease payments is equal to or substantially covers the fair value of the leased asset.

5. Leased asset is of a specialized nature. Ex Ambulance (the lessee can use it without major modifications being made).

Operating Lease: Any other lease other than finance lease is considered as an Operating Lease.

Accounting in the books of Lessee in case of Finance Lease

1. At the inception of lease, lessee will recognize the lease as assets or liability at an amount equal to the fair value of leased assets.

2. Apportion the lease payments into finance charge and reduction in outstanding liability.

3. Allocate finance charge to the periods during lease term.

4. Pass journal entry for depreciation.

Disclosure in case of Finance Lease

1. Assets acquired on Lease should be shown separately.

2. For each leased assets, show net carrying amount at the balance sheet date.

3. Provide reconciliation between Minimum Lease Payment at balance sheet date and their present value.

4. Disclose total of minimum lease payment at balance sheet date and their present value for:

a) Not later than one year.

b) Later than one year but not later than five year.

c) Later than five years.

5. Future minimum sublease payment expected to receive at balance sheet date.

6. General description of lessee significant leasing arrangements.

Accounting in the books of Lessee in case of Operating Lease

Lease payment is recognized as an expense in the profit and loss account.

Disclosure in case of Operating Lease

1. Future lease payment for the following period.

a) Not later than one year.

b) Later than one year but not later than five years.

c) Later than five years.

2. Total Expected future lease payment.

3. Lease payment recognized in the statement of Profit and Loss for the period.

4. General Description of Lessee significant leasing arrangements.

Accounting in the books of Lessor in case of Finance Lease

1. Lessor to record assets in the books of account at an amount equal to net investment in Lease.

2. Record finance income based on pattern reflecting constant periodic rate of return.

3. Estimate unguaranteed residual value used in computing lessor gross investment in lease.

4. If there is any reduction in estimated unguaranteed residual value then revise the income allocation over the remaining lease term. Reduction in respect to amount already recognized to be recognized immediately. Upward adjustment to be ignored.

5. Initial direct cost associated with the lease to be recognized immediately in the profit and loss account or can be spread over the lease term.

Disclosure in case of Finance Lease

1. Provide reconciliation between gross investment in lease at balance sheet date and present value of minimum lease payment. Also disclose the same as-

a) Not later than one year.

b) Later than one year, but not later than five year.

c) Later than five year.

2. Unearned finance income.

3. Unguaranteed residual value.

4. Accumulated provision for uncollectible minimum lease payment receivable.

5. Contingent rent recognized in statement of profit and loss account.

6. General description of leasing arrangement.

7. Accounting policy adopted for in respect of initial direct cost.

Accounting in the books of Lessor in case of Operating Lease.

1. Lessor should record assets in balance sheet under fixed assets.

2. Lease income to recognize in statement of profit and loss account.

3. Cost incurred including depreciation to be recognized in statement of profit and loss account.

4. Check for impairment and provide for in book as per GAAP.

Disclosure in case of Operating Lease

1. For each class of assets accumulated depreciation, accumulated impairment and carrying amount at the balance sheet date.

2. Depreciation recognized in the statement of profit and loss account.

3. Impairment losses recognized in the statement of profit and loss account.

4. Impairment loss reversed in the statement of profit and loss account.

5. Future minimum lease payment under for each of the following periods:

a) Not later than one year.

b) Later than one year but not later than five year.

c) Later than five years.

6. Total contingent recognized in the statement of profit and loss account.

7. General description of leasing arrangement.

Sale and Leaseback Transaction

1. If sale and leaseback transaction results in finance lease: Any excess or deficiency over carrying amount should be deferred and amortized over the lease term in proportion to depreciation of the leased assets.

2. If sale and leaseback transaction results in operating lease: Any excess or deficiency over carrying amount should be recorded immediately in book of account:

a) If the sale price is below fair value, the loss is compensated by future lease payments at below market price, it should be deferred and amortized in proportion to the lease payments over the period for which the asset is expected to be used

b) If the sale price is above the fair value, the excess over fair value should be deferred and amortized over the period for which the asset is expected to be used

Difference between AS19 and IAS17

Basis | AS 19 | IAS 17 |

Lease of lands | AS 19 is not applicable to lease of lands | IAS17 contains specific provisions dealing with leases of land and building |

Residual value | The term “Residual Value” is defined in AS 19 | IAS 17 does not define “Residual Value” |

Inception and commencement | Though both the terms are used at some places in AS 19, these terms are not defined and distinguished | IAS 17 makes a distinction between inception of lease and commencement of lease |

Recognition of lease | AS 19, such recognition is at the inception of the lease | As per IAS 17, the lessee shall recognize finance leases as assets and liabilities in balance sheet at the commencement of the lease term |

Adjustment of lease payments | Not Dealt by AS 19 | IAS 17 deals with adjustment of lease payments made during the period between inception of the lease and the commencement of the lease term |

Guidance | No Guidance | IAS 17 provides guidance on accounting for: · incentives in the case of operating leases, and Evaluating the substance of transactions having the legal form of a lease and determining whether such an arrangement contains an element of lease |

Upward revision | AS 19 prohibits upward revision of unguaranteed residual value, during the term of the lease | IAS 17 permits upward revision of unguaranteed residual value, during the term of the lease |

Method of Amortization | In case of a sale and leaseback transaction (in case of finance lease), AS 19 requires the excess of sale proceeds, over the carrying amount of the asset, to be deferred and amortized by the seller (lessee) over the tenure of lease, in proportion to depreciation of the leased asset | IAS 17 also specifies that in case of a sale and leaseback transaction (in case of finance lease), the excess of sale proceeds, over the carrying amount of the asset, to be deferred and amortized by the seller (lessee), but it does not specify the method of amortization |

Classification of lease | These matters are not addressed in the existing standard | IAS 17 requires current/non-current classification of lease liabilities if such classification is made for other liabilities also |

Attribution of lease rentals | AS 19 does not provide for the same | IAS 17 states that in case of operating lease, if escalation of lease rentals is attributable to the expected general inflation so as to compensate the lessor for expected inflationary costs shall not be straight lined |

Initial direct costs | AS 19 requires the initial direct costs, incurred by the lessor(in case of operating lease), to be either charged off, at the time of incurrence or to be amortized over the lease period | IAS 17 states that the initial direct costs, incurred by the lessor (in case of operating lease), shall be included in the carrying amount of leased asset and amortized as an expense, over the lease period |

Difference between IAS 17 and IFRS 16:

IAS17 requires all lease rentals to be charged to the statement of profit and loss account on straight line basis in case of operating lease unless another systematic basis is more appropriate if payment to lessor is not made on straight line basis.

IFRS 16: In case of operating lease, all lease rentals shall be charged to the statement of profit and loss as per the lease agreement unless the payments to the lessor are structured to increase in line with expected general inflation to compensate for the lessors expected inflationary cost associated with the lease. If payments to the lessor vary because of factors other than general inflation, then this condition is not met.

Conclusion: In case of IAS17 if there is inflation component in the lease rentals then we must calculate all the expected rentals and have to charge the same in statement of profit and loss equally over the term of lease and we have to transfer that excess/deficient to lease equalization account.

Earnings per share(EPS) is a financial ratio that provides information regarding earnings available on each equity share held in a company.

This ratio acts as an important financial tool to improve the comparability between two or more companies, as well as between two or more accounting periods.

AS 20 entails the process of calculation of Earnings per share.

There are two types of EPS which are to be reported by enterprises on the face of the statement of profit & loss account even if the amounts disclosed are negative (a loss per share).

1. Basic EPS.

2. Diluted EPS.

1. Basic EPS

Basic EPS = Net profit or loss attributable to equity shareholders / Weighted average number of outstanding equity shares

Earnings – Basic (Numerator)

Net profit or loss for the period as defined under AS 5 which is shown here:

Particulars | Amount |

Earnings before tax | XXX |

(+) extraordinary items (income) | XXX |

(-) extraordinary items (expenses) | (XXX) |

(-) tax attributable to the period | (XXX) |

(-) preference dividend * | (XXX) |

Profit for the purpose of calculating EPS | XXX |

*the preference dividend deducted for the period is:

(a) the amount of any preference dividends on non-cumulative preference shares provided for the period; and

(b) the full amount of the required preference dividends for cumulative preference shares for the period, whether or not the dividends have been provided for. The amount of preference dividends for the period does not include the amount of any preference dividends for cumulative preference shares paid or declared during the current period in respect of previous periods.

Per share – Basic (Denominator)

For calculating basic earnings per share, the number of equity shares should be the weighted average number of equity shares outstanding during the period.

The time-weighting factor = Number of days for which the specified share is outstanding / Total number of days in the period

Example 1: Number of shares outstanding as on 01-01-2010 are 2000. Fresh issue of 600 shares for cash on 31-05-2010. Buy back of 300 shares on 01-11-2010.

Solution: The weighted average outstanding number of shares = (2000 x 12/12) + (600 x 7/12) – (300 x 2/12) = 2300 shares

Example 2: Opening balance of shares as on 01-01-2010 is 2000 shares. On 31-10-2010, issue of 600 shares of Rs. 10 each, Rs. 5 paid up.

Solution: As per AS 20, partly paid up equity shares should be calculated in the ratio of amount paid up to face value (amount paid / face value).

The weighted average outstanding number of shares = (2000 x 12/12) + (600 x 5/10 x 2/12) = 2050 shares

Example 3: On 01-01-2010, 2 Lac equity shares of Rs. 10 each fully paid up. On 30-06-2010, fresh issue of 2 lac equity shares of Rs. 5 each fully paid up.

Solution: The weighted average outstanding number of shares = (2,00,000 x 12/12) + (2,00,000 x 5/10 x 6/12) = 2,50,000 shares

Example 4: Net profit for the year 2010 is Rs. 18 lacs. Net profit for the year 2011 is Rs. 60 lakhs. Number of equity shares outstanding till 30-09-2010 is 20 lacs. Bonus issue on 01-10-2011 = 2 (new): 1(old). Calculate EPS for the year 2011 and adjusted EPS for the year 2010.

Solution: As per AS 20, when bonus shares are issued during the year, it should be calculated in the weighted average from the beginning of reporting period irrespective of issue date. Therefore, the bonus issue is treated as if it had occurred prior to the beginning of the year 2010, the earliest period reported.

Particulars | Amount (in Rs.) |

Net profit for the year 2010 | 18,00,000 |

Net profit for the year 2011 | 60,00,000 |

Number of equity shares outstanding till 30-09-2011 | 20,00,000 |

Bonus issue on 01-10-2011 | 20,00,000 x 2 = 40,00,000 |

Earnings per share for the year 2011 | 60,00,000 /(20,00,000 + 40,00,000) = Re. 1 |

Adjusted Earnings per share for the year 2010 | 18,00,000 / (20,00,000 + 40,00,000) = Re. 0.30 |

Example 5: Net profit for the year 2010 is Rs. 11,00,000 and for the year 2011 is Rs. 15,00,000. Number of shares outstanding prior to right are 5,00,000 shares. Right issue of one new share for each five outstanding at right issue price of Rs. 15. Last date to exercise rights is 01-03-2011. Fair value of one equity share immediately prior to exercise of rights on 01-03-2011 is Rs. 21. Compute basic EPS for the year 2011 and adjusted EPS for the year 2010.

Solution: As per Para 22, Theoretical ex-rights fair value per share

= (Fair value of all shares prior to rights + Right issue proceeds) / Number of shares outstanding post right issue

= {(Rs. 21 x 5,00,000 shares) + (Rs. 15 x 1,00,000 shares)} / 5,00,000 shares + 1,00,000 shares = Rs. 20

Bonus element = Fair value per share prior to exercise of rights / Theoretical ex-rights value per share = 20 / 21 = 1.05

Computation of Earnings Per Share | ||

Particulars | 2010 | 2011 |

EPS for the year 2010 as originally reported: Rs. 11,00,000/5,00,000 shares | Rs. 2.20 |

|

EPS for the year 2010 as restated for rights issue: Rs. 11,00,000/(5,00,000 shares x 1.05) | Rs. 2.10 |

|

EPS for the year 2011 including effects of right issue Rs. 15,00,000 / {(5,00,000 x 1.05 x 2/12) + (6,00,000 x 10/12)} |

| Rs. 2.55 |

For calculating diluted earnings per share, the net profit or loss for the period attributable to equity shareholders and the weighted average number of shares outstanding during the period should be adjusted for the effects of all dilutive potential equity shares.

Earnings – Diluted (Numerator)

For calculating Diluted EPS, the numerator used for basic EPS should be adjusted by the following, after considering any attributable change in tax expense for the period:

a) any dividends on dilutive potential equity shares which have been deducted in arriving numerator of basic EPS;

b) interest recognized in the period for the dilutive potential equity shares; and

c) any other changes in expenses or income that would result from the conversion of the dilutive potential equity shares.

Per share – Diluted (Denominator)

For calculating diluted earnings per share, the number of equity shares should be the aggregate of the weighted average number of equity shares which would be issued on the conversion of all the dilutive potential equity shares into equity shares.

Diluted earning per share is calculated in the case of potential equity share like convertible debentures, convertible preference shares, options etc. Potential equity shares are diluted if their conversion into equity shares reduces the earning per share and if it increases, then they are considered as anti-dilutive.

Example:

Particulars | Amount |

Net profit for the current year | Rs. 1,00,00,000 |

Number of equity shares outstanding | 50,00,000 |

Basic EPS | 1,00,00,000/50,00,000 = 2 |

Number of 12% convertible debentures of Rs. 100 each Each debenture is convertible into 10 equity shares | 1,00,000 |

Interest expense for the current year | Rs. 12,00,000 |

Tax relating to interest expense (30%) | Rs. 3,60,000 |

Particulars | Amount |

Adjusted Net profit for the current year | Rs. (1,00,00,000 + 12,00,000 – 3,60,000) = Rs. 1,08,40,000 |

Number of equity shares resulting from conversion of debentures | 10,00,000 |

Number of equity shares used to calculate diluted earnings per share | 50,00,000 + 10,00,000 = 60,00,000 |

Diluted earnings per share | 1,08,40,000/60,00,000 = Rs. 1.81 |

Comparison between Ind AS33 and AS 20

Basis | IND AS 33 | AS 20 |

Extraordinary items | EPS is required to be disclosed without extraordinary items. | EPS is required to be disclosed with and without extraordinary items. |

Disclosure | Requires the disclosure of basic and diluted EPS from continuing and discontinued operations separately. | Does not require disclosure of basic and diluted EPS from continuing and discontinued operations separately. |

Put options | Provides additional clarity and guidance on aspects like options held by entity on its own shares like: written put options, purchased options, etc. | Does not deal with these aspects |

AS 21- Consolidated Financial Statements should be applied in preparing and presenting consolidated financial statements for a group of enterprises under the sole control of a parent enterprise.

Applicability of AS 21 Consolidated Financial Statements

This standard must be applied when accounting for investment in subsidiaries in a separate financial statement of the parent.

It is to be noted that while preparing a consolidated financial statement, other standards also stay relevant in a similar manner as for standalone statements.

This accounting standard doesnRst deal with:

Presentation of Consolidated Financial Statements

A parent company presenting its consolidated financial statements must present these statements along with its standalone financial statements.

The users of financial statements of a parent company are typically concerned with and are required to be educated about, the results of operations and financial position of not only the company itself but also of that group together.

This requirement is served by offering the users of financial statements –

(a) Standalone financial statements of a parent; and

(b) Consolidated financial statements that provide financial information about the business group as that of a lone enterprise without respect to the legal restrictions of the distinct legal entities.

Scope of Consolidated Financial Statements

A parent company which presents its consolidated financial statements must consolidate all of its subsidiaries, foreign as well as domestic. Where a company doesnRst have any subsidiary, however, has associates and/or joint ventures such company also needs to prepare consolidated financial statements as per Accounting Standard 23 – Accounting for Associates in Consolidated Financial Statements and Accounting Standard 27 – Financial Reporting of Interests in JVs respectively.

Exclusion of Subsidiaries

A Subsidiary must be excluded from the consolidation when:

In a consolidated financial statement, investments in such subsidiaries must be accounted for as per AS 13 – Accounting for Investments. Reasons for which a subsidiary isnt included in the consolidation must be disclosed in such consolidated financial statements.

Consolidation Procedures

While preparing a consolidated financial statement, the parent company’s financial statements and its subsidiaries must be combined line by line by totaling together similar items such as assets, liabilities, income, and expenses.

For consolidating financial statements in a way to present financial information about a group as that of a lone enterprise, the below-motioned steps must be taken:

(i) amount of equity which is attributable to the minorities at the date on which such investment in the subsidiary is done; and

(ii) minorities share of the movements in equity from the date the relationship of parent-subsidiary came in to force.

Where carrying investment amount in a subsidiary is different from the cost, such carrying amount is to be considered for the above calculations.

Accounting for Investments in the Subsidiaries in Separate Financial Statement of the Parent

In a parent companys separate financial statements, the investments made in subsidiaries must be accounted for as per AS 13 – Accounting for Investments.

Disclosures in the Financial Statements

Following disclosures must be made w.r.t. AS 21 Consolidated Financial Statements: