Unit – 3

Terms of Trade

Definition of Terms of Trade:

Trade indices are widely-used instruments to measure the advantages derived by a nation from international trade. Trade indices facilitate in assessing the impact of tirade volume and/or unit value realization on a county’s gains from trade. as an example without any increase in the quantity of goods imported, the rise in the total value of imports implies only a financial burden for a country.

In order to measure gains from international trade, net, gross, and income terms of trade are often used. The terms of trade may be a measure of the relative changes in export and import prices of a nation. It reflects the quantity of imports that a given quantity of exports can buy.

The ‘terms of trade’ of a country are defined because the ratio of the price of its export commodity to the price of its import commodity. just in case of a hypothetical assumption of a two-nation world, the export of a rustic equals its trade partner’s imports wherein the terms of trade of a country are equal to the inverse of the terms of trade of its trade partner.

Since, in the real world, numerous commodities are traded, the terms of trade of a nation are expressed by the ratio of price level of a country’s exports to the price index of its imports. This ratio is usually multiplied by 100 so as to express the terms of trade in percentage. These terms of trade are often mentioned as ‘commodity’ or ‘net barter’ terms of trade.

This concept of the gross terms of trade was introduced by F.W. Taussig and in his view this is often an improvement over the concept of net barter terms of trade because it directly takes into account the volume of trade. Accordingly, the gross barter terms of trade ask the relation of the volume of imports to the volume of exports. Thus,

Tg = Om/Qx

Where

Tg = gross barter terms of trade, Qm = quantity of imports

Qx = quantity of exports

To compare the change within the trade situation over a period of your time, the subsequent ratio is employed

Om1/Qx1: Qm0/Qx0

Where the subscript 0 denotes the base year and therefore the subscript I denotes the current year.

It is obvious that the gross barter tens of trade for a country will rise (i.e., will improve) if more imports may be obtained for a given volume of exports. it's important to notice that when the balance of trade is in equilibrium (that is, when value of exports is adequate to the value of imports), the gross barter terms of trade amount to an equivalent thing as net barter terms of trade.

This can be shown as under:

Value of imports = price of imports x quantity of imports = Pm. Qm

Value of exports = Price of exports x quantity of exports = Px. Qx

Therefore, THE balance of trade is in equilibrium.

Px .Qx = Pm. Qm

Px .Qm = Pm Qx

However, when balance of trade is not it equilibrium, the gross barter terms of trade would differ from net barter terms of trade.

The most widely used concept of the terms of trade is what has been caned the net barker terms of trade which refers to the relation between prices of exports and prices of imports. In symbolic terms:

Tn = Px/Pm

Where

Tn stands for net barter terms of trade.

Px stands for price of exports (x),

Pm stands for price of imports (m).

When we want to understand the changes in net barter tends of trade over a period of time, we prepare the price index numbers of exports and imports by choosing a particular appropriate base year and acquire the subsequent ratio:

Px1/ Pm1 : Px0/ Pm0

Px„ Pm„

where Pxo and Pm0 represent price index numbers of exports and imports within the base year respectively, and Px1) and Pm1) denote price level numbers of exports and imports respectively within the current year.

Since the costs of both exports and imports within the base year are taken as 100, the terms of trade in the base year would be adequate to one

Px0/ Pm0 = 100/100 = 1

Suppose within the current period the price index number of exports has gone upto 165, and therefore the price index number of imports has risen to 110, then terms of trade in the current period would be:

165/110: 100/100 = 1.5:1

Thus, within the current period, terms of trade have improved by 50 pa’ cent as compared to the base period. Further, it implies that if the prices of exports of a country rise relatively greater than those of its imports, terms of trade for it might improve or become favourable.

On the opposite hand, if the prices of imports rise relatively greater than those of its exports, terms of trade for it might deteriorate or become unfavourable. Thus, net barter terms of trade is a crucial concept which may be applied to measure changes within the capacity of exports of a country to buy the imported products. Obviously, if internet barter terms of trade of a country improve over a period of your time , it can purchase more quantity of imported products for a given volume of its exports.

But the concept of net barter terms of trade suffers from some important limitations therein it shows nothing about the changes within the volume of trade. If the prices of exports rise relatively to those of its imports but because of this rise in prices, the quantity of exports falls substantially, then the gain from rise in export prices could also be offset or maybe more than offset by the decline in exports.

This has been well described by saying, “We make an enormous profit on every sale but we don’t sell much”. So as to overcome this drawback, the net barter terms of trade are weighted by the quantity of exports. This has led to the development of another concept of terms of trade referred to as the income terms of trade which shall be explained later. Even so, a net barter term of trade is most generally used concept to measure the power of the exports of a country to buy imports.

In order to enhance upon the net barter terms of trade G.S. Dorrance developed the concept of income terms of trade which is obtained by weighting net barter terms of trade by the volume of exports. Income terms of trade therefore ask the index of the value of exports divided by the price of imports. Symbolically, income terms of trade are often written as

Ty = Px.Qx/Pm

Where

Ty = Income terms of trade

Px = Price of exports

Qx = Volume of exports

Pm= Price of imports

Income terms of trade yields a higher index of the capacity to import of a country and is, indeed, sometimes called ‘capacity to import. this is often because in the long run balance of payments must be in equilibrium the value of exports would be adequate to the value of imports.

Thus, in the long run:

Pm, Qm = Px, Qx

Qm = Px.Qx/Pm

It follows from above that the volume of imports (Qm) which a country can purchase (that is, capacity to import) depends upon the income terms of trade i.e., Px.Qx/Pm. Since income terms of trade may be a better indicator of the capacity to import and since the developing countries are unable to vary Px and Pm. Kindleberger’ thinks it to be superior to the net barter terms of trade for these countries, However, it may be mentioned once more that it's the concept of net barter terms of trade that's usually employed.

Income Terms of Trade-

Dorrance has improved upon the concept of the net barter terms of trade by formulating the concept of the income terms of trade. This index takes under consideration the quantity of exports of a country and its export and import prices (the net barter terms of trade). It shows a country’s changing import capacity in reference to changes in its exports.

Thus, the income terms of trade is the net barter terms of trade of a country multiplied by its export volume index. It are often expressed as

Ty = Tc. Qx = Px.Qx/Pm = Index of Export Prices x Export Quantity/Index important Prices

Where Ту is that the income terms of trade, Tc the commodity terms of trade and Qx the export volume index

A.H. Imlah calculates this index by dividing the index of the value of exports by an index of the price of imports. He calls it the “Export Gain from Trade Index.”

Taking 1971 because the base year, if

Px = 140, Pm = 70 and Qx = 80 in 1981, then

Py = 140 x 80/70 = 160

It implies that there's improvement within the income terms of trade by 60 per cent in 1981 as compared with 1971.

If in 1981, Pi = 80, Pm =160 and Qx =120, then

Py = 80 x 120 / 120 = 60

It implies that the income terms of trade have deteriorated by 40 per cent in 1981 as compared with 1971.

A rise in the index of income terms of trade implies that a country can import more goods in exchange for its exports. A country’s income terms of trade may improve but its commodity terms of trade may deteriorate. Taking the import prices to be constant, if export prices fall, there'll be a rise in the sales and value of exports. Thus while the income terms of trade might have improved, the commodity terms of trade might have deteriorated.

The income terms of trade is named the capacity to import. in the long-run, the entire value of exports of a country must equal to its total value of imports, i.e., Px.Qx = Pm.Qm or Px.Qx/Pm = Qm. Thus Px.Qx/ Pm determines Qm which is that the total volume that a country can import. The capacity to import of a country may increase if other things remain the same (i) the price of exports (Px) rises, or (if) the price of imports {Pm) falls, or (Hi) the volume of its exports (Qx) rises. Thus the concept of the income terms of trade is of much practical value for developing countries having low capacity to import.

It’s Criticisms:

The concept of income terms of trade has been criticised on the subsequent counts:

1. Fails to measure Gain or Loss from Trade:

The index of income terms of trade fails to measure precisely the gain or loss from international trade. When the capacity to import of a country increases, it simply means it's also exporting quite before. In fact, exports include the real resources of a country which may be used domestically to improve the living standard of its people.

2. Not associated with Total Capacity to Import:

The income terms of trade index is related to the export based capacity to import and not to the total capacity to import of a country which also includes its exchange receipts. for instance , if the income terms of trade index of a rustic have deteriorated but its foreign exchange receipts have risen, its capacity to import has actually increased, even though the index shows deterioration.

3. Inferior to Commodity Terms of Trade:

Since the index of income terms of trade relies on commodity terms of trade and leads to contradictory results, the concept of the commodity terms of trade is typically utilized in preference to the income terms of trade concept for measuring the gain from international trade.

The concept of commodity terms of trade doesn't take account of productivity changes in export industries. Prof. Viner had developed the concept of single factorial terms of trade which allows changes in the domestic export sector. it's calculated by multiplying the commodity terms of trade index by an index of productivity changes in domestic export industries. It are often expressed as:

Ts = Tc.Fx = Px.Fx/Pm

Where Ts is the single factorial terms of trade, Tc is the commodity terms of trade, and Fx is that the productivity index of export industries.

It shows that a country’s factorial terms of trade improve as productivity improves in its export industries. If the productivity of a country’s exports industries increases, its factorial terms of trade may improve even

Though its commodity terms of trade may deteriorate. for instance , the prices of its exports may fall relatively to its import prices as a results of increase in the productivity of the export industries of a country. The commodity terms of trade will deteriorate but its factorial terms of trade will show an improvement.

It’s Limitations:

This index isn't free from certain limitations. it's difficult to get the necessary data to compute a productivity index. Further, the only factorial terms of trade don't take into account the potential domestic cost of production of imports industries in the other country. to overcome this weakness, Viner formulated the double factorial terms of trade.

The double factorial terms of trade take under consideration productivity changes both in the domestic export sector and the foreign export sector producing the country’s imports. The index measuring the double factorial terms of trade are often expressed as

Td = Tc. Fx/Fm = Px/Fm .Fx/Fm

Where Td is that the double factorial terms of trade, Px/Pm is that the commodity terms of trade, Fx is that the export productivity index, and Fm is that the import productivity index.

It helps in measuring the change in the rate of exchange of a country as a results of the change in the productive efficiency of domestic factors manufacturing exports which of foreign factors manufacturing imports for that country. an increase in the index of double factorial terms of trade of a country means the productive efficiency of the factors producing exports has increased relatively to the factors producing imports in the other country.

Its Criticisms:

1. Not possible to Construct a Double Factorial Terms of Trade Index:

In practice, however, it's not possible to calculate an index of double factorial terms of trade of a country. Prof. Devons made some calculations of changes in the single factorial terms of trade of England between 1948-53. But it's not been possible to construct a double factorial terms of trade index of any country because it involves measuring and comparing productivity changes within the import industries of the opposite country thereupon of the domestic export industries.

2. Required Quantity of Productive Factors not Important:

Moreover, the important thing is that the quantity of commodities which will be imported with a given quantity of exports instead of the quantity of productive factors required in a foreign country to produce its imports.

3. No Difference between the Double Factoral Terms of Trade and the Commodity Terms of Trade:

Again, if there are constant returns to scale in manufacturing and no transport costs are involved, there's no difference between the double factoral terms of trade and the commodity terms of trade of a country.

4. Single Factoral Terms of Trade is more Relevant Concept:

According to Kindleberger, “The single factoral terms of trade is a far more relevant concept than the double factoral. We are interested in what our factor can earn in goods, not what factor services can command in the services of foreign factors. associated with productivity abroad moreover, is a question of the quality of the goods imported.”

The main factors affecting the terms of trade are as follows:

The terms of trade of a country are influenced by variety of factors which are discussed as under:

1. Reciprocal Demand:

The terms of trade of a country depend on reciprocal demand, i.e. “the strength and elasticity of every country’s demand for the opposite country’s product”. Suppose there are two countries, Germany and England, which produce linen and cloth respectively.

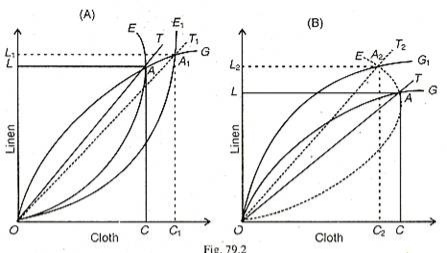

If Germany’s demand for England’s cloth becomes more intense (inelastic), the price of cloth rises more than the price of linen, the commodity terms of trade will move against Germany and in favour of England. On the opposite hand, if England’s demand for Germany’s linen becomes more intense, the price of linen will rise more than the price of cloth, and therefore the commodity terms of trade will move in favour of Germany and against England. this is often explained diagrammatically in Fig. 79.2 (A) and (B) where England’s offer curve and OG is the offer curve of Germany. the point A where the 2 offer curves intersect each other is that the equilibrium point at which ОС of cloth is traded by England for OL linen of Germany. The terms of trade are represented by the slope of the ray ОТ.

Suppose England’s demand for Germany’s linen increases. England will be prepared to sell more cloth for Germany’s linen. the rise in England’s demand is shown by the shifting of its offer curve to the right as OE1 which intersects Germany’s offer curve OG at A, in Panel (A).

Now the new terms of trade are represented by the ray OT1 whereby England exports OC1 units of cloth for OL1 units of linen. The terms of trade have deteriorated for England and improved for Germany.

This is evident from the very fact that England exports CC, more units of cloth in exchange for LL, units of linen. CC, is greater than LL1.

Similarly, in Panel (B), if Germany’s demand for England’s cloth increases, Germany’s offer curve shifts to the left as OG, which intersects England’s initial offer curve OE at A2. Now Germany exports OL2 units of linen for OC-, units of cloth. The new terms of trade, as shown by the slope of ray OT2 indicate that they need deteriorated for Germany and improved for England. this is often evident from the very fact that Germany exports LL, more linen in exchange for CC2 less cloth.

But the terms of trade will depend upon the elasticity of demand of the offer curve of each country.

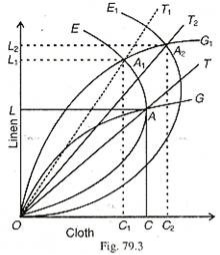

The more inelastic the offer curve of a country, the more unfavourable are the terms of trade for it in relation to the opposite country. On the contrary, the more elastic its offer curve, the more favourable are its terms of trade reference to the opposite country. this is illustrated in Fig. 79.3 where the initial equilibrium terms of trade are represented by ОТ with OE and OG curves intersecting at point A. England trades ОС of cloth with OL of linen of Germany. When the OG curve of Germany shifts to OG1, it cuts the OE curve of England at A1 and the terms of trade line is ОT1. Germany’s offer curve OG1 being inelastic in reference to England’s offer curve OE, Germany’s demand for English cloth is more intense than before. Now Germany offers more linen LL1 against less cloth CC1 of England than at the ОТ line. Thus the terms of trade are unfavourable for Germany and favourable for England.

Now suppose the offer curve of England shifts from OE to 0£, and cuts the OG, curve of Germany at A2. The terms of trade are set at 07″, line. during this case, England’s offer curve OE1 being more inelastic in reference to Germany’s offer curve OG,, England’s demand for German linen is more intense. Therefore, England offers more cloth C1C2 and Germany offers less linen L1L2 than at the OT1 line. This shows that the terms of trade have worsened for England and improved for Germany.

2. Changes in Factor Endowments:

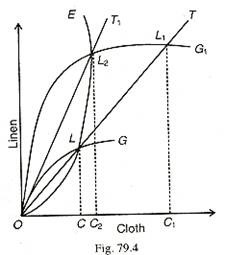

Changes in factor endowments of a country affect its terms of trade. Changes in factor endowments may increase exports or reduce them. With tastes remaining unchanged, they'll lead to changes in the terms of trade. this is often explained with the assistance of Fig. 79.4 where OE is the offer curve of England and OG is that the offer curve of Germany. Before any change in factor endowments, the terms of trade of England and Germany are settled at point L where they trade ОС of fabric for CL of linen. Suppose there's a rise within the supply of Germany’s factors of production. As a result, the new offer curve of Germany is OG1. At the old terms of trade ОТ, Germany would be at point L, where it might export more linen C1L1 and import English cloth ОС1.

But England might not be willing to trade with Germany at the old terms of trade due to its inability to supply such a lot cloth as its factor endowments and tastes remain unchanged. Thus the terms of trade will choose the new terms of trade line ОT1 where England’s offer curve OE intersects Germany’s new offer curve OG, at point LT At L2, Germany exports C2L2 of linen in exchange for OC2 of fabric from England. Thus the terms of trade have moved against Germany from L to L2, with change in its factor endowments because it exports more linen (C2L2) than before (CL).

3. Changes in Technology:

Technological changes also affect the terms of trade of a rustic . The effect of technological change on terms of trade is illustrated in Fig. 79.5. Suppose there's change in technology in Germany. Before technological change the terms of trade between Germany and England are settled at point L on the ОТ ray where Germany exports CL of linen for ОС of England cloth. With technological change, Germany’s new offer curve is OG, which cuts the terms of trade line ОТ at L1. At now , Germany would like to export less linen (C1L1) and import less cloth (ОС1) than England wants to exchange at the terms of trade ОТ. So Germany’s terms of trade improve when its new offer curve OG, intersects England’s unchanged offer curve OE at L, where the new terms of trade are settled on the line OT1. At L2, Germany is better off because it exports less linen for more of England’s cloth, i.e. C2L2 <ОС2. Its terms of trade have improved with technological change.

4. Changes in Tastes:

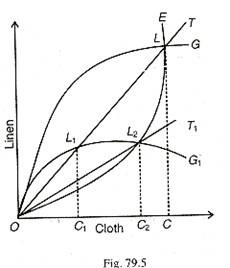

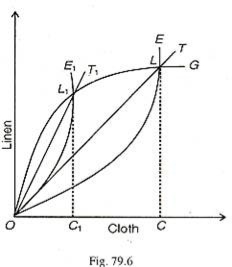

Changes in tastes of the people of a country also influence its terms of trade with another country. Suppose England’s tastes shift from Germany’s linen to its own cloth. during this situation, England would export less cloth to Germany and its demand for Germany’s linen would also fall. Thus England’s terms of trade would improve. On the contrary, a change in England’s taste for Germany’s linen would increase its demand and hence the terms of trade would deteriorate for England. the first case of an improvement in the terms of trade of England is depicted in Fig. 79.6. When England’s tastes change from Germany’s linen to its own cloth, its offer curve shifts up to OE1 and intersect Germany’s unchanged offer curve OG at L1. As a result, England exports only OC1 of cloth in exchange for C1L1 of Germany’s linen. Obviously, England’s terms of trade have improved for now it exchanges less cloth (ОС1) for more linen of Germany (C1L1) i.e. OC1 < C1L1.

5. Economic Growth:

Economic growth is another important factor which affects the terms of trade. The raising of a country’s national product or income over time is named economic growth. Given the tastes and technology in a country, an increase in its productive capacity may affect favourably or adversely its terms of trade.

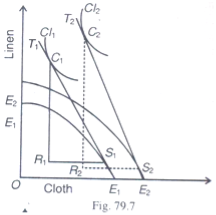

This is illustrated in Fig. 79.7 in terms of the production possibility curves and therefore the community indifference curves of a rustic which experience economic growth. E1E1 is the production possibility curve of England before growth where the slope of T1 shows its terms of trade.

Before growth, it's producing at S, and consuming at C, on the community indifference curve C1. Thus England is exporting R1S1 of cloth and importing R1C1 of linen for Germany. When growth takes place, the production possibility curves E2E2, shifts outward as E2E2. The new terms of trade after growth, as represented by the slope of the line T2, show an improvement when production takes place at point S2 on the production possibility curve E2E1 and consumption at point C, of the community indifference curve CI2. As a result of the improvement in England’s terms of trade, it exports less cloth to Germany in exchange for more linen than in the pre-growth situation. It exports R2S2, which is less than R1S1 and imports R2C2, which is greater than R1C1.

6. Tariff:

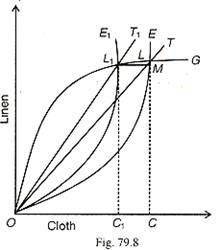

An import tariff improves the terms of trade of the imposing country. this is often explained with the help of Fig. 79.8 where the offer curves of England and Germany before the imposition of tariff are OE and OG respectively. The initial terms of trade are given by the line ОТ. England is exporting ОС of cloth and importing CL of linen from Germany. Suppose a tariff is imposed on Germany’s linen by England. It shifts the offer curve of England from OE to OE1. These changes the terms of trade ОТ to OT1 in favour of England. Now England exports ОС, of cloth in exchange for C1L1 of linen from Germany. It now exports CC1 = (ML1) less of cloth than before and imports ML less of linen. Since the amount of exports reduced as a results of tariff by England is more than the quantity of imports reduced by Germany (ML1 < ML), the terms of trade have definitely moved in favour of England.

7. Devaluation:

Devaluation raises the domestic price of imports and reduces the foreign price of exports of a rustic devaluing its currency in reference to the currency of another country.

The effects of devaluation on the terms of trade are much debated among economists. consistent with Prof. Machlup, “Devaluation is meant to improve the balance of trade. a reduction in the physical volume of imports in reference to the physical volume of exports constitutes an adverse change in the gross barter terms of trade.”

Thus devaluation will be successful as long as the gross barter term becomes adverse. Prof. Robertson favours the use of the concept of the commodity terms of trade to assess the effects of devaluation. To him, if this concept is used, devaluation will cause rise in the prices of imports and fall in the prices of exports in foreign currency, and hence deteriorate the commodity terms of trade. But Prof. Hirch suggests that the proper procedure should be to review price movements in exports and imports in the same currency so as to assess truth effects of devaluation. Both exports and imports prices normally rise within the home currency and fall in the foreign currency.

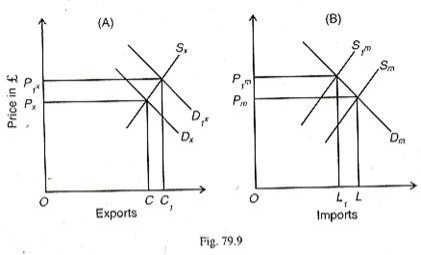

The commodity terms of trade will deteriorate only export prices fall quite import prices in terms of domestic currency. actually , the elasticises of demand and supply for exports and imports of a devaluing country determine deterioration of improvement in its terms of trade. If both the foreign demand for exports and home demand for imports are highly elastic and supplies both to home exports and foreign imports are highly inelastic to price movements, devaluation results in an improvement in the commodity terms of trade. this is explained in Fig. 79.9 (A) and (B).

Suppose English £ (pounds) is devalued in relation to german mark, and therefore the price movements before and after devaluation are taken in pound. The pre-devaluation price of ОС exports is OPx which of OL imports is OPm. The post-devaluation export price rises to OP1x when the demand curve shifts upward to and the import price rises to OP1m with the shifting of the supply curve to the left as S1m. A comparison of Fig. 79.9 (A) and (B) reveals that the export price has risen quite the import price PxP1x > PmP1 in, which while exports have risen from ОС to OC1 imports have fallen from OL to OL1 These prove that the terms of trade have improved for England after devaluation.

I. Free Trade:

International trade that takes place without barriers such as tariff, quotas and foreign exchange controls is known as free trade. Thus, under free trade, goods and services flow between countries freely. In other words, free change implies absence of governmental intervention on worldwide exchange among different countries of the world.

Advantages of Free Trade:

The following arguments have been superior in favour of free alternate policy:

1. Comparative cost advantage

Free exchange is the natural outcome of the comparative fees advantage. It permits an allocation of resources, and manpower in accordance with the principle of comparative advantage, which is just an extension of the principle of division of labour.

“The fact of free exchange establishes an overwhelming presumption that the commodities obtained from abroad in exchange for export are so obtained at lower price than which the domestic production of their equivalents would entail. If this had been not the case, they would not be imported, even under free trade,” says Jacob Viner.

It has been maintained that the gain from free international trade would be the largest due to global specification based totally on comparative advantage. Free trade leads to the most efficient conduct of economic affairs. In a plea for free trade, they additionally said that even if some nations do now not follow the policy of free trade, an industrial country should follow it unilaterally and it will gain thereby.

2. More factor earnings

Under free trade, factors of production will also be able to earn more, as they will be employed for better use. Hence, wages, interest and rent will be higher underneath free trade than otherwise.

3. Cheaper imports:

Free trade procures import at cheap rates. It appears to be an attractive argument in favour of trade at least from the customer’s point of view. However, it ignores the question of employment and the interests of producers in the importing country. Here it has been pointed out that beneath free trade, when consumers gain through lower prices producers also acquire as the factors of production are directed to more gainful and specialised production which gives better earnings.

4. Enlarged market:

Free alternate widens the size of the market as a result of which greater specialisation and a more complex division of labour grow to be possible. This brings about optimum production with costs reduced everywhere, benefiting the world as a whole.

5. Competition:

Free trade policy encourages competition from overseas which induces home producers to become more alert and improve their efficiency.

6. Restricted exploitation:

Free trade prevents growth of domestic monopolies and consumers’ exploitation due to competition from abroad.

7. Greater welfare:

Free trade lets in large varieties of consumption items and improves consumer’s welfare.

Haberler concludes that, “international trade has made a tremendous contribution to the development of less developed countries in the nineteenth and twentieth century’s and can be predicted to make in the future if it is allowed to proceed freely.”

Thus, free trade is the best industrial policy.

(i) Advantages of specialization:

Firstly, free trade secures all the advantages of international division of labour. Each country will specialise in the production of those goods in which it has a comparative advantage over its trading partners. This will lead to the optimum and efficient utilisation of resources and, hence, economy in production.

(ii) All-round prosperity:

Secondly, because of unrestricted trade, global output increases since specialisation, efficiency, etc. make production large scale. Free trade enables countries to obtain goods at a cheaper price. This leads to a rise in the standard of living of people of the world. Thus, free trade leads to higher production, higher consumption and higher all-round international prosperity.

(iii) Competitive spirit prevails:

Thirdly, free trade maintains the spirit of competition of the economy. As there exists the opportunity of intense foreign competition under free trade, domestic producers do not want to lose their grounds. Competition enhances efficiency. Moreover, it tends to prevent domestic monopolies and free the customers from exploitation.

(iv) Accessibility of domestically unavailable items and raw materials:

Fourthly, free trade enables each country to get commodities which it cannot produce at all or can only produce inefficiently. Commodities and raw materials unavailable domestically can be procured through free motion even at a low price.

(v) Greater international cooperation:

Fifthly, free trade safeguards against discrimination. Under free trade, there is no scope for cornering raw materials or commodities by using any country. Free trade can, thus, promote international peace and balance through economic and political cooperation.

(vi) Free from interference:

Finally, free trade is free from bureaucratic interferences. Bureaucracy and corruption are very much related with unrestricted trade. 2.3 Pros and Cons of Trade policy

There are usually significant advantages and disadvantages to reflect on consideration on with any contractual arrangement, so here are the pros and cons of free exchange to consider.

List of the Pros of Free Trade-

1. Free trade increases economic growth for each country.

In the United States, the economy grew at roughly 0.5% more in the course of the 25 years that NAFTA was in place compared to what it would’ve been if the free trade in North America had remain the same. Mexico skilled an increase in job opportunities from the free trade arrangement, while Canada was once able to increase its export opportunities to its neighbours from the south. Although the countries were already changing $1 trillion in goods and services before the agreement, this quantity expanded by over 125% after it went into effect.

2. It provides a more attractive business climate to organizations.

Businesses are often protected when countries are trading with one another frequently. When there is a free trade agreement in place, then these protections start to disappear. This technique creates more of a free market environment where companies are forced to look for new ways to innovate as a way to stay competitive in the marketplace. Instead of allowing for stagnation to happen because there is always a guaranteed income, governments pursuing free trade increase monetary opportunities because they inspire new processes.

3. Free trade will usually lower government spending habits.

One of the ways that a government works to protect its local industry segments is via the use of subsidies. These advantages may include tax incentives, monetary rebates, protective tariffs, and other market manipulations which allow the corporation to function closer to a monopoly then if it were forced to compete on a global stage. Free trade lowers the expenses that for which a government must budget because companies no longer require the same protections. They can become competitive in multiple markets all at once. This spending on protectionism can then be applied to other societal needs.

4. It offers consumers access to a higher level of expertise.

When companies are operating in international affairs, they have greater access to information. This data permits them to create more advantageous best practices that will eventually help them to shop money because they can cut the expenses of their overhead. With the presence of free exchange in the economy, these organizations can then provide access to their experience by way of working with domestic providers who are serving local households. That makes it possible for all people to gain from the expanded trade opportunities.

5. Free trade can improve the safety of workers.

When agencies are reviewing their best practices, then there are a number of sectors that they assessment for improvements. Employee security is generally one of the first beneficiaries of a free trade agreement. This result is particularly relevant when considering the manufacturing, mining, and oil producing industries. When workers can stay safe on the job, then they can remain productive, helping every organization to eventually improve its bottom line.

6. It allows for organizations to switch technologies to one another.

When there is a free trade agreement in place, then the multinational companies make it possible for local organizations to receive access to the latest technologies from their industry. This process makes it possible for the local economy to start growing, which means there are additional job opportunities that begin to develop. The transnational corporations can even help provide training at the domestic level as a way to provide experience to future workers who may want to reach out to the international community one day.

7. Free trade results in higher tiers of overseas direct investment.

When there are fewer restrictions in vicinity for companies who choose to do business overseas, then domestic organizations and local communities benefit from a greater level of foreign direct investment. These funds help to add capital as local industries begin to look at the potential for growth efforts. It is also a way to boost the influence that domestic businesses have within the region.

From the perspective of the United States, this gain of free trade makes it possible to grant a currency of value (namely the U.S. dollar) to developing nations that would normally stay isolated barring an agreement in place.

8. It can provide a direct economic boost to border communities.

When there is a land border between two countries that have a free trade agreement, then the import/export transactions for the two governments occur at the ports of name which exist along this line. This structure has a positive impact on both local economies almost immediately. During the first yr of NAFTA, the apparel and metal industries in Texas saw 13% growth because of the quantity of additional exports that were going across the border to Mexico.

Disadvantages of Free Trade

1. Free trade policy runs smoothly if all the countries follow the same. If some countries do not adopt it, the system cannot work gainfully.

2. Free trade may prove advantageous to developed and technologically advanced nations, but less developed countries are certainly at a disadvantage on account of unfavourable terms of trade.

3. Competition induced under free trade is unfair and unhealthy. Backward countries cannot compete with advanced countries.

4. Gains of trade are not equally distributed under free trade due to unequal state of development of different countries.

5. A country with unfavourable balance of payments finds it difficult to overcome this situation under free trade policy.

6. Free trade may encourage interdependence and discourage self-sufficiency. But, in the depend of defence each country should have self-reliance and self-sufficiency as far as possible.

Despite the clamour of the classical economists about the advantages of the free trade, the policy has both now not been adopted by many countries and abandoned by those who had already adopted it. Economic history indicates that for the final two centuries, international trade has developed with protection.

In brief, restrained trade prevents a nation from reaping the benefits of specialisation, forces it to adopt less efficient production techniques and forces consumers to pay higher prices for the products of protected industries.

Arguments against Free Trade:

Despite these virtues, several humans justify trade restrictions.

Following arguments are often cited against free trade:

(i) Advantageous not for LDCs:

Firstly, free trade may be advantageous to advanced countries and not to backward economies. Free trade has brought enough misery to the poor, less developed countries, if past experience is any guide. India was a classic example of colonial dependence of UK’s imperialistic strength prior to 1947. Free trade concepts have brought colonial imperialism in its wake.

(ii) Destruction of home industries/products:

Secondly, it may ruin domestic industries. Because of free trade, imported goods come to be available at a cheaper price. Thus, an unfair and cut-throat opposition develops between home and foreign industries. In the process, domestic industries are wiped out. Indian handicrafts industries suffered exceptionally during the British regime.

(iii) Inefficient industries remain perpetually inefficient:

Thirdly, free trade can't bring all-round development of industries. Comparative price principle states that a country specializes in the manufacturing of a few commodities. On the other hand, inefficient industries remain neglected. Thus, below free trade, an all-round improvement is ruled out.

(iv) Danger of overdependence:

Fourthly, free change brings in the risk of dependence. A country may additionally face monetary depression if its international trading partner suffers from it. The Great Depression that sparked off in 1929-30 in the US economic system swept all over the world and all countries suffered badly even if their economies were not caught in the grip of depression. Such overdependence following free change becomes also catastrophic during war.

(v) Penetration of harmful foreign commodities:

Finally, a country might also have to change its consumption habits. Because of free trade, even harmful commodities (like drugs, etc.) enter the domestic market. To prevent such, restrictions on change are required to be imposed.

In view of all these arguments against free trade, governments of less developed countries in the post-Second World War period have been inspired to resort to some sort of change restrictions to safeguard national interest.

List of the Cons of Free Trade

1. It reduces the tax revenues that are available to the government.

A free trade agreement creates a shift in how price enters the society. Before there is an implementation of this contract type, goods and services increase revenues for the authorities thru the use of tariffs and fees. Once this agreement goes into effect, then the money flows to the firms instead. It then becomes the government’s duty to collect taxes from the profits and revenues earned from the new structure. That is why many smaller countries try to avoid free trade. They often war to replace the revenues that import tariffs and miscellaneous charges generate for them.

2. Free trade can reduce the influence of native cultures.

As free alternate starts offevolved to go into the isolated areas of a country, the indigenous cultures which are present there can sometimes struggle to adapt to the changing realities. There may be a want to access the resources which are available locally to these tribes for the “greater good” of the rest of the country. If the decision is made to pursue this need, then it is no longer unusual for local communities to be uprooted. Their exposure to new population groups can then end result in disease, suffering, and even death in extreme circumstances.

3. It can begin to degrade the value of domestic natural resources.

Countries that have already gone thru their industrial revolution will typically have fewer natural resources on hand to them when compared to the developing world. That creates the purpose of pursuing a free trade agreement in the first place. These emerging market countries do not have the equal environmental protections in location because they have not experienced the same pollution challenges as the developed world.

That is why free trade agreements can frequently lead to the depletion of natural assets via mining, bushes operations, and mineral extraction. It does not take lengthy for the fields and jungles of a developing country to be reduced to wasteland because of strip-mining and deforestation efforts.

4. Free trade can motivate negative working conditions.

The minimal month-to-month wage for garment workers in the United States in 2017 was once $1,864. If a free trade agreement was created with the nations of Southeast Asia, then companies ought to take gain of the lower minimum monthly wage in Bangladesh. Companies were required to pay their employees a minimal salary of $197 per month. Now imagine that you have 10,000 people who are producing apparel items for you. Where would it be cheaper to manufacture your items?

The difficulty is more than one of wages. It is also a concern about working conditions. The creating world does no longer have the same protections in location for workers. Some places do not even have restrictions on youth labour. Although a free trade agreement can encourage local development that improves this issue, there is no guarantee that it will happen.

5. It can eliminate the presence of domestic industries.

When there is a multinational company trying to do business in a local community, then the mom-and-pop shops have no way to compete. That is because the companies which are involved in multiple markets can operate on a larger scale than small domestic businesses. Even though the giants of every industry work with small businesses to inspire a healthy economy, it is the Wal-Mart and Amazon of the world which can usually offer consumers a better price. If a customer has the desire to purchase the identical item from a family-owned enterprise at $6 or one from Wal-Mart for $2, the latter preferences generally wins out.

6. Free trade can motivate the theft of intellectual property.

When the United States and China put together a free trade agreement, there was a belief on the American aspect that it would be feasible to expand business opportunities exponentially with market get admission to overseas. Then the truth of the state of affairs hit. Chinese companies, which are all often owned with the aid of the government, required Americans to signal over their intellectual property rights as a way to gain access to the market. It created a internet win for China and a internet loss on the U.S. side because if the American businesses refused, the Chinese ones just stole it anyway.

7. It can result in greater job outsourcing.

Let’s go back to that idea where a garment industry association should pay employees $1,600 less per month by using shifting production from the United States to Bangladesh. Even if there are greater logistics issues to worry about after the job outsourcing occurs, there is nothing in location to stop the company from reaping significant rewards. That is why tariffs are often in place from the very start. It creates a disincentive for companies to outsource their labor, and then import the product back to consumers at the equal price. U.S. manufacturers did that after the introduction of NAFTA because of the differences in labor cost too

The pros and cons of free change are generally effective because it creates a system that is closer to a free market with the countries involved with the contract. Although there are challenges to consider, especially with a poorly-written agreement, it is the consumer who wins at the stop of the day. When they have access to more innovation and expertise, then they can have their problems solved more effectively.

By protection we mean restricted trade. Foreign trade of a country may also be free or restricted. Free exchange eliminates tariff while protective trade imposes tariff or duty. When tariffs, duties and quotas are imposed to preclude the inflow of imports then we have blanketed trade this potential that authorities intervenes in trading activities.

Thus, safety is the anti-thesis of free trade or unrestricted trade. Government imposes tariffs on ad valorem basis or imposes quota on the extent of goods to be imported. Sometimes, export taxes and subsidies are given to domestic goods to protect them from foreign competition. These are the various types of protection used via modern governments to restrict trade.

Now an essential query arises what forces the authorities to defend trade? What are the chief arguments for protection? Can safety deliver all the items that a state needs?

Arguments for Protection:

The concept of protection is not a post-Second World War development. Its origin can be traced to the days of mercantilism (i.e., sixteenth century). Since then a number of arguments have been made in favour of protection.

The case for safety for the creating nations acquired a robust assist from Argentine economist R. D. Prebisch and Hans Singer in the 1950s.

All these arguments can be summed up below three heads:

(i) Fallacious or dubious arguments;

(ii) Economic arguments; and

(iii) Non-economic arguments.

(i) Fallacious Arguments:

Fallacious arguments do no longer stand after scrutiny. These arguments are doubtful in nature in the sense that each are true. ‘To keep money at home’ is one such unsuitable argument. By restricting trade, a united states of america want now not spend cash to purchase imported articles. If each nation pursues this goal, ultimately global exchange will squeeze.

(ii) Economic Arguments:

(a) Infant industry argument:

When the enterprise is first established its fees will be higher. It is too immature to reap economies of scale at its infancy. Workers are no longer only inexperienced but also much less efficient. If this child enterprise is allowed to develop independently, truly it will be unable to compete efficaciously with the already set up industries of other countries.

Thus, an infant industry desires safety of a temporary nature and over time will trip some kind of ‘learning effect’. Given time to develop an industry, it is quite possibly that in the near future it will be capable to develop a comparative advantage, withstand foreign opposition and survive without protection.

It is something like the dictum: Nurse the baby, shield the child, and free the adult. Once an embryonic industry receives matured it can withstand competition. Competition improves efficiency. Once efficiency is attained, protection may be withdrawn. Thus, an underdeveloped country attempting to have rapid industrialization desires protection of certain industries.

However, in real practice, the infant industry argument, even in LDCs, loses some strength. Some economists propose manufacturing subsidy alternatively than safety of positive infant industries. Protection, as soon as granted to an industry, continues for a long time. On the different hand, subsidy is a temporary measure since continuance of it in the next year requires approval of the legislature.

Above all, expenditure on subsidy is subject to financial audit. Thus, protection is something like a “gift”. Secondly, safety saps the self-sufficiency outlook of the included industries. Once protection is granted, it becomes difficult to withdraw it even after reaching maturity. Those capacity infant industries, even after maturity, get ‘old age pension’.

In different words, infant industries become too a whole lot dependent on tariffs and other countries. Thirdly, it is difficult to discover conceivable comparative advantage industries. A time length of 5 to 10 years may additionally be required by an industry to achieve maturity or self-sufficiency. Under the circumstances, infant industry argument loses force.

In view of these criticisms, it is said by experts that the argument “boils down to a case for the removal of boundaries to the increase of the infants. It does no longer exhibit that a tariff is the most efficient means of attaining the objective.”

These counter-arguments, however, do not deter us to support the boom of infant industries in less developed nations by ability of tariff, as a substitute than subsidies.

(b) Diversification argument:

As free trade will increase specialisation, so included trade brings in diversified industrial structure by setting up newer and range of industries through protective means, a country minimizes the chance in production. Comparative advantage precept dictates slim specialization in production.

This sort of specialisation is no longer solely undesirable from the viewpoint of monetary development, however also a risky proposition. Efficiency in production in some products through some nations (e.g., espresso of Brazil, milk product of New Zealand, oil of Middle East countries) results in overdependence on these products.

If conflict breaks out, or if political relations between international locations change, or if recessionary demand circumstance for the product grows up abroad, the economies of these industries will be appreciably injured. Above all, this kind of unbalanced industrial increase goes in opposition to the spirit of national self-sufficiency. Protection is the reply to this problem. A government encourages numerous industries to enhance through protective means.

However, a counter-argument runs. Politics, rather than economics, may be the criterion for the selection of industries to be protected in order to produce diversification at a reasonable cost. But, one must now not ignore economics of protection.

(c) Employment argument:

Protection can raise the stage of employment. Tariffs may reduce import and, in the process, import-competing industries flourish. In addition, import- substituting industries—the substitution of domestic production for imports of manufactures—develop. The strategy of import-substituting industrialisation promotes home enterprise at the price of foreign industries.

The important arguments in aid of protection can be quickly summarised as follows:

i. The Infant Industry Argument. There are many industries in a country that are in their infancy, but have a potential to grow. In the short-term, these industries may be too small to obtain economies of scale. Without protection, these infant industries will not survive competition from abroad. Protection will allow such industries to grow and become greater efficient.

ii. Protection is required to prevent the institution of a foreign- based monopoly so as to prevent mutualisation of resources.

iii. Protection is required to prevent dumping and other unfair trade practices by means of foreign producers.

iv. Trade restrictions are imposed to reduce the have an impact on of trade on customer tastes. Some restrictions on trade can also be justified in order to minimize ‘producer sovereignty’ of the MNCs.

v. Protection helps to reduce reliance on goods with little dynamic potential. Many countries have traditionally exported primary commodities. The world demand for these commodities is profits inelastic and thus grows relatively slowly. In such cases, free change is now not an engine of growth.

vi. Protection is required to unfold the risks of fluctuating markets. Greater diversity and increased self-sufficiency can limit these risks.

vii. Trade restrictions additionally assist a united states of america to enhance its terms of trade by using exploiting its market power.

viii. Protection is required to take account of externalities. Free trade tends to reflect private expenses ignoring the associated externalities. Trade restrictions could be designed to deflect these externalities.

ix. Restrictions are required to stop the import of hazardous goods

Arguments against Protection

Protection, however, imposes value on a nation also. This can be summarised as follows:

i. Protection to achieve some goal can also be at a very high opportunity cost. Other things being equal, there will be a internet loss in welfare from limiting trade. Due to this reason, any acquire in government revenue or profits to firms would be outweighed by a loss in consumer’s surplus.

ii. Restricting trade is unlikely to be a first-bed answer to the problem, considering it involves charges of side-effect.

iii. Restricting change may additionally have destructive world multiplier effects.

iv. Protection might also encourage retaliation.

v. Protection might also allow inefficient corporations to continue to be inefficient.

vi. Restrictions might also involve considerable forms and maybe even corruption.