Unit – 5

Balance of Payment

Features of Balance of Trade:

Various features of balance of trade are explained below:

1. Exports and Imports:

The elements of the balance of trade are exports and imports. Export of products means movement of products from domestic country to foreign country. The vis-a-vis is understood as Imports.

2. Visible Goods:

Balance of trade constitutes imports and exports of products . The important features of the products are that it must be visible, have physical structure, size, shape and form. the products must be seen and touched, counted, measured and weighed.

3. Material Goods:

Goods constitute our imports and exports must be material. It means non- material goods and services won't constitute imports and exports.

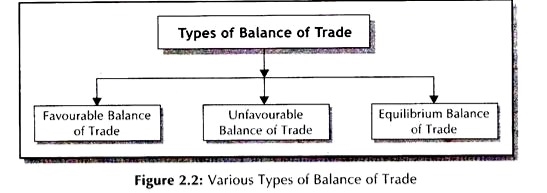

Figure 2.2. Below illustrates various sorts of Balance of Trade:

Let us attempt to understand the varied concepts one by one.

1. Favourable Balance of Trade:

The situation, wherein country’s exports exceed imports may be a situation of favourable or surplus balance of trade.

2. Unfavourable/Deficit Balance of Trade:

Excess of total value of products , imported over the entire value of products exported is termed as unfavourable or adverse or deficit balance of trade.

It may even be expressed as under:

3. Equilibrium in Balance of Trade:

Equality between the entire value of products exported and total value of products imported is termed as equilibrium in balance of trade.

Meaning

The balance of payments of a nation is a systematic record of all its economic transactions with the outer world during a given year.

It is a statistical record of the character and dimensions of the country’s economic relationships with the remainder of the world. consistent with Bo Souderton, The balance of payments is just the way of listing receipts and payments in international transactions for a country. B. J. Cohen says, “It shows the country’s trading position, changes in its net position as foreign lender or borrower, and changes in its official reserve holding.”

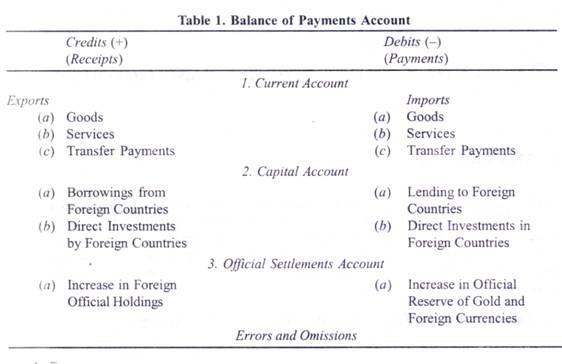

2. Structure of Balance of Payments Accounts

The balance of payments account of a nation is made on the principle of double-entry bookkeeping. Each transaction is entered on the credit and debit side of the balance sheet. But balance of payments accounting differs from business accounting in one respect. In business accounting, debits (-) are shown on the left side and credits (+) on the right side of the balance sheet. But in balance of payments accounting, the practice is to indicate credits on the left side and debits on the right side of the balance sheet.

When a payment is received from a foreign country, it's a credit transaction while payment to a foreign country may be a debit transaction. The principal items shown on the credit side (+) are exports of products and services, unrequited (or transfer) receipts in the kind of gifts, grants, etc. from foreigners, borrowings from abroad, investments by foreigners in the country, and official sale of reserve assets including gold to foreign countries and international agencies.

The principal items on the debit side (-) include imports of products and services, transfer (or unrequited) payments to foreigners as gifts, grants, etc., lending to foreign countries, investments by residents to foreign countries, and official purchase of reserve assets or gold from foreign countries and international agencies.

These credit and debit items are shown vertically within the balance of payments account of a country consistent with the principle of double-entry book-keeping.

Horizontally, they're divided into three categories:

The current account, the capital account, and therefore the official settlements account or the Official assets account.

The balance of payments account of a country is made in Table 1.

There is a marked distinction between the concepts of balance of trade and balance of payments.

Balance of trade refers to the merchandise account of exports and imports only. Balance of payments may be a broader term and it includes balance of trade. it's more comprehensive than the balance of trade.

It includes all international economic transactions and items like merchandise trade, services, banking, insurance, capital flows, buying and selling of gold, etc.

As we know, a country may export and import many items, both visible and invisible. Balance of trade refers to the visible items only. Import or export of products is a visible item because it's an open trade among the countries and may be easily certified ‘by the customs officials.

On the opposite hand, balance of trade is more comprehensive in scope and covers the full debits and credits of all items, visible also as invisible. Thus, the balance of trade is simply a partial study of the balance of payments.

It simply refers to the difference between the value of exports and visible imports. this is often what's represented within the trade or merchandise account section of the current account within the balance of payments statement.

Thus, balance of trade is nothing but a significant component of the balance of payments. However, balance of payments includes aside from balance of trade or merchandise account, the invisible account which is again composed of the services sector and gifts and charities account comprising a spread of invisible items, plus a record of capital account.

In short, balance of trade is a partial picture, while balance of payments may be a complete picture of the country’s international economic relations.

Further, in the accounting sense, balance of trade could also be deficit or surplus. It may, thus, be imbalanced. But balance of payments as an entire must always balance. For that reason, there's an item like “Errors and Omissions” in its structure.

Most of the exports and imports involve finance, i.e., receipts and payments in money. An account of all receipts and payments is termed, balance of payments. “The balance of payments of a country is a systematic record of all economic transactions between the residents of the reporting country and residents of foreign countries during a given period of time” The term ‘residents’ is broadly interpreted as all individuals, businesses and governments and their agencies. International organizations are classified as foreign residents. Economic transactions which enter into the balance of payments record, involve transfer of goods and assets, or rendering services from residents of one country to the residents of the rest of the world.

The balance of payments record is maintained in a standard double-entry book-keeping method. International trade transactions enter into the record as credit and debit. The payments received from foreign countries entry as credit and payments made to other countries as debit. The balance of payments record is shown in table.

Receipts (Credits) | Payments (Debits) |

Exports of goods | Import of goods |

Trade Account Balance | |

Export of services | 2. Imports to services |

Interest, profits and dividends received | 3. Interest, profits and dividends paid

|

Unilateral receipts | 4. Unilateral payments |

Current Account Balance (1 to 4) | |

Foreign investment | 6. Investment abroad |

Short term borrowing | 7. Short term lending |

Medium and long term borrowing | 8. Medium and long term lending |

Statistical discrepancy (Errors and omissions) | |

Capital Account Balance (6 to 9) | |

Overall Balance = Current Account + Capital Account Balance (5 + 10) | |

Change in reserves (-) | 12. Change in reserves (+) |

Total receipts = Total payments | |

The balance of payments account is traditionally dividend into (i) trade account (ii) current account and (iii) capital account. However it can be vertically divided into many more components as per the requirements.

A. Trade Account Balance

It is the different between exports and imports of goods, usually referred as visible or tangible items. Till recently, goods dominated international trade. Trade account balance tells as whether a country enjoys a surplus or comprising consumer and capital goods always had an advantageous position. Developing countries with its exports of primary goods most of the time suffered from a deficit in their trade account except most of the OPEC countries. The balance of trade is also referred as the balance of visible trade or balance of Merchandise trade.

B. Current Account Balance

Current account includes Nos. 1,2,3 and 4 in table no.24.1. They comprise Export and import of goods which are traditionally referred as visible or tangible exports and imports and Export and import of services, also known as invisibles. Services include insurance, transport, banking, income from tourism, etc.

Income received and paid in the form of interest, profits and dividends for lending or investing in other countries.

Unilateral receipts or payments which are also referred as transfer payments include gifts, donations, private remittances etc, received by the residents or paid to residents of other countries. Such receipts and payments do not have any counter obligation i.e. they are received free.

C. Capital Account Balance

The capital account records all receipts and payments that involve the residents of a country changing either their assets or liabilities to residents of other countries. The transactions under this title involve direct investment, portfolio investment and borrowings and lending from and to other countries.

Foreign Investments

Direct investment

Portfolio investment

Short term investment

Short term borrowing

Medium and Long Term Borrowings

Financial Accounts

D. Statistical Discrepancy (Errors and Omissions)

Statistical discrepancy (errors and omissions) reflects transactions that have not been recorded for various reasons and so cannot be entered under a standard hearing but must appear since the full balance of payments account must sum to zero.

E. Overall Balance

Overall balance is obtained by adding up current account and capital account balances.

F. Foreign Exchange Reserves

Foreign exchange reserves in item no.12 shows the reserves which are held in the form of foreign currencies usually in hard currencies like dollar, pound etc., gold and Special Drawing Rights (SDRs). Foreign exchange reserves are analogous to an individual’s holding of cash. They increase he has a deficit. When a country enjoys a net surplus in current and capital accounts combined, it results in a positive balance in overall balance is negative, it leads to decrease in reserves.

G. The Basic Balance

The basic balance is the sum of the current account and capital account, when the two sides of the current and capital accounts are equal i.e. when the difference between the two is equal to zero, the basic balance is achieved. An increase in deficit or reduction in surplus or a move from surplus to deficit is considered worsening of the basic balance.

H. Deficits and Surpluses

The balance of payments always balance in a technical or accounting sense(in a double entry record) The balance in the balance of payments implies that a net credit in any one of the items must have a counterpart net debit in another. When the total credits and debits of all accounts balance, we say the balance of payments balances.

Autonomous flows take place in the ordinary course of foreign trade and they are independent of other items in the balance of payments. Accommodative flows take place to equalize the balance of payments.

Credits $ | Debits $ |

Autonomous receipts 1200 | Autonomous payments 1500 |

a) Autonomous exports (visible and invisible) 800 | a) Autonomous imports (visible and invisible) 1300 |

b) Autonomous unilateral receipts 100 | b) Autonomous unilateral payments 50 |

c) Autonomous capital receipts 300 | c) Autonomous capital payments 150 |

Accommodating receipts 1500 | 2. Accommodating payments Nil |

1500 | 1500 |

Disequilibrium in the balance of payments is the result of imbalance between receipts and payments for exports and imports.

A. Causes of Disequilibrium

Causes and Measures of Disequilibrium!

Overall account of BOP is usually in equilibrium. This balance or equilibrium is merely in accounting sense because deficit or surplus is restored with the help of capital account.

In fact, when we talk about disequilibrium, it refers to current account of the balance of payment. If autonomous receipts are but autonomous payments, the balance of payment is in deficit reflecting disequilibrium in balance of payment.

1. Causes of disequilibrium in BOP:

There are several factors which cause disequilibrium within the BOP indicating either surplus or deficit.

Such causes for disequilibrium in BOP are listed below:

(i) Economic Factors:

(a) Imbalance between exports and imports. (It is the main reason for disequilibrium in BOR),

(b) Large scale development expenditure which causes large imports,

(c) High domestic prices which cause imports,

(d) Cyclical fluctuations (like recession or depression) in general commercial activity

(e) New sources of supply and new substitutes.

(ii) Political Factors:

Experience shows that political instability and disturbances cause large capital outflows and hinder Inflows of foreign capital.

(iii) Social Factors:

(a) Changes in fashions, tastes and preferences of the people bring disequilibrium in BOP by influencing imports and exports;

(b) High population growth in poor countries adversely affects their BOP because it increases the requirements of the countries for imports and reduces their capacity to export.

Monetary measures

1. Deflation

Deflation means falling prices. Deflation has been used as a measure to correct deficit disequilibrium a country faces deficit when its imports exceed exports.

Deflation is brought through monetary measures like bank rate policy, open market operations, etc or through fiscal measures like higher taxation, reduction in public expenditure, etc. Deflation would make our items cheaper in foreign market resulting an increase in our exports. At the same time the demands for imports fall because of higher taxation and reduced income. this is able to build a favourable atmosphere in the balance of payment position. However Deflation are often successful when the exchange rate remains fixed.

2. Exchange Depreciation

Exchange depreciation means decline within the rate of exchange of domestic currency in terms of foreign currency. This device implies that a country has adopted a flexible exchange rate policy.

Suppose the speed of exchange between Indian rupee and US dollar is $1 = Rs. 40. If India experiences an adverse balance of payments with reference to U.S.A, the Indian demand for US dollar will rise. the price of dollar in terms of rupee will rise. Hence, dollar will appreciate in external value and rupee will depreciate in external value. The new rate of exchange could also be say $1 = Rs. 50. this implies 25% exchange depreciation of the Indian currency.

Exchange depreciation will stimulate exports and reduce imports because exports will become cheaper and imports costlier. Hence, a favourable balance of payments would emerge to pay off the deficit.

Limitations of Exchange Depreciation :-

Exchange depreciation will be successful as long as there's no retaliatory exchange depreciation by other countries.

It is not suitable to a country desiring a fixed exchange rate system.

Exchange depreciation raises the prices of imports and reduces the prices of exports. so the terms of trade will become unfavourable for the country adopting it.

It increases uncertainty & risks involved in foreign trade.

It may result in hyper-inflation causing further deficit in balance of payments.

3. Devaluation

Devaluation refers to deliberate attempt made by monetary authorities to bring down the worth of home currency against foreign currency. While depreciation is a spontaneous fall because of interactions of market forces, devaluation is official act enforced by the monetary authority. Generally the international monetary fund advocates the policy of devaluation as a corrective measure of disequilibrium for the countries facing adverse balance of payment position. When India's balance of payment worsened in 1991, IMF suggested devaluation. Accordingly, the worth of Indian currency has been reduced by 18 to 20 in terms of varied currencies. The 1991 devaluation brought the specified effect. The very next year the import declined while exports picked up.

When devaluation is effected, the value of home currency goes down against foreign currency, allow us to suppose the exchange rate remains $1 = Rs. 10 before devaluation. Allow us to suppose, devaluation takes place which reduces the worth of home currency and now the exchange rate becomes $1 = Rs. 20. After such a change our goods becomes cheap in foreign market. this is often because, after devaluation, dollar is exchanged for more Indian currencies which push up the demand for exports. At an equivalent time, imports become costlier as Indians need to pay more currencies to get one dollar. Thus demand for imports is reduced.

Generally devaluation is resorted to where there's serious adverse balance of payment problem.

Limitations of Devaluation:-

Devaluation is successful only if other country doesn't retaliate the same. If

Both the countries opt for the same, the effect is nil.

Devaluation is successful only if the demand for exports and imports is elastic.

In case it's inelastic, it may turn things worse.

Devaluation, though helps correcting disequilibrium, is considered to be a weakness for the country.

Devaluation may bring inflation within the following conditions:-

Devaluation brings the imports down, When imports are reduced, the domestic supply of such goods must be increased to the same extent. If not, scarcity of such goods unleashes inflationary trends.

A growing country like India is capital thirsty. due to non-availability of capital goods in India, we've no option but to continue imports at higher costs. this may force the industries depending upon capital goods to push up their prices.

When demand for our export rises, more and more goods produced during a country would choose exports and thus creating shortage of such goods at the domestic level. This leads to inflation and inflation.

Devaluation might not be effective if the deficit arises thanks to cyclical or structural changes.

4. Exchange Control

It is an extreme step taken by the monetary authority to enjoy complete control over the exchange dealings. Under such a measure, the central bank directs all exporters to surrender their exchange to the central authority. Thus it results in concentration of exchange reserves in the hands of central authority. At the same time, the availability of foreign exchange is restricted just for essential goods. It can only help controlling situation from turning worse. Briefly it's only a temporary measure and not permanent remedy.

A deficit country alongside Monetary measures may adopt the following non-monetary measures too which can either restrict imports or promote exports.

1. Tariffs

Tariffs are duties (taxes) imposed on imports. When tariffs are imposed, the costs of imports would increase to the extent of tariff. The increased prices will reduced the demand for imported goods and at a similar time induce domestic producers to produce more of import substitutes. Non-essential imports are often drastically reduced by imposing a very high rate of tariff.

Drawbacks of Tariffs:-

Tariffs bring equilibrium by reducing the quantity of trade.

Tariffs obstruct the expansion of world trade and prosperity.

Tariffs needn't necessarily reduce imports. Hence the consequences of tariff on the balance of payment position are uncertain.

Tariffs seek to determine equilibrium without removing the root causes of disequilibrium.

A new or a better tariff may aggravate the disequilibrium within the balance of payments of a country already having a surplus.

Tariffs to be successful require an efficient & honest administration which unfortunately is difficult to have in most of the countries. Corruption among the administrative staff will render tariffs ineffective.

2. Quotas

Under the quota system, the govt may fix and permit the maximum quantity or value of a commodity to be imported during a given period. By restricting imports through the quota system, the deficit is reduced and the balance of payments position is improved.

Merits of Quotas:-

Quotas are more effective than tariffs as they're certain.

They are easy to implement.

They are more effective even when demand is inelastic, as no imports are possible above the quotas are more flexible than tariffs as they're subject to administrative decision.

Tariffs on the opposite hand are subject to legislative sanction.

Demerits of Quotas:-

They are not long-run solution as they do not tackle the real cause for disequilibrium.

Under the WTO quotas are discouraged.

Implements of quotas are open invitation to corruption.

Export Promotion

The government can adopt export promotion measures to correct disequilibrium within the balance of payments. This includes substitutes, tax concessions to exporters, marketing facilities, credit and incentives to exporters, etc.

The government can also help to push export through exhibition, trade fairs; conducting market research & by providing the desired administrative and diplomatic help to tap the potential markets.

Import Substitution

A country may resort to import substitution to scale back the quantity of imports and make it self-reliant. Fiscal and monetary measures could also be adopted to encourage industries producing import substitutes. Industries which produce import substitutes require special attention in the kind of various concessions, which include tax concession, technical assistance, subsidies, providing scarce inputs, etc.

Non-monetary methods are simpler than monetary methods and are normally applicable in correcting an adverse balance of payments.

Drawbacks of import Substitution:-

Such industries may lose the spirit of competitiveness.

Domestic industries enjoying various incentives will develop vested interests and invite such concessions all the time.

Deliberate promotion of import substitute industries go against the principle of comparative advantage.

SUMMARY

CORRECTIVE MEASURES

Measures to control deficit in Balance of payments

A. Devaluation

Devaluation aims at influencing the prices of only traded goods and not the general price level. Devaluation refers to an official announcements or an act of monetary authority through which the exchange rate is changed i.e. the value of domestic currency is reduced vis-à-vis foreign currency. For example, if the existing rate is Rs 60 = $1.

B. Depreciation

Depreciation like devaluation lowers the value of domestic currency or increases the value of the foreign currency. Depreciation of a currency takes place in free or competitive foreign exchange market due to market forces. An existing exchange rate, say Rs 60 = $1 may depreciate to Rs70 or more.

C. Deflation

Deflation refers to the process of decline in general price level. It was a method adopted under gold standard.

Deflation leads to expenditure adjustment that is, people in that country spend money mainly on domestic goods and services and less on imports.

D. Direct Controls

Tariffs:

Tariffs are the duties (taxes) imposed on imports. When tariffs are imposed the prices of imports would increase to the extent of tariff The increased prices will reduce the demand for imported goods and at the same time induce domestic producers to produce more of import substitutes. Non- essential imports can be drastically reduced by imposing a very high rate of tariff.

Quotas:

To reduce imports for correcting the deficit in the balance of payments, the government may introduce restrictions on the quantity or volume of goods imported. Quotas may be different types: i) the tariff or custom quota, ii) the unilateral quota iii) the bilateral quota iv) the mixing quota and v) import licensing.

Export Promotion:

The government is required to devise special policy measures to promote exports. Some of the important incentives than the government usually offers are: i) subsidies ii) Tax concessions iii) grants iv) other monetary or non-monetary incentives.

Import Substitution:

Industries which produce import substitutes require special attention in the form of various concessions, which includes i) tax concession ii) technical assistance iii) subsidies iv) providing scarce inputs etc.

Current Account Convertibility of the Rupee:

Under Article VIII, Sections 2, 3 and 4 of the IMF the member countries of the IMF are obliged to revive current account convertibility of their currencies.

(a) Don't have any restrictions on current payments (capital account restrictions are allowed); and

(b) Avoid discriminatory currency practices (including multiple exchange rates).

Current account convertibility is defined because the freedom to buy and sell foreign exchange for the subsequent international transactions:

(a) All payments due in reference to foreign trade, other current business, including services, and normal short-term banking and credit facilities;

(b) Payments due as interest on loans and as net income from other investments;

(c) Payments of moderate amount of amortization of loans or for depreciation of direct investments and

(d) Moderate remittances for family living expenses.

In his budget speech for 1992-1993, the minister of finance of India announced the partial convertibility of rupee on the current account. This measure was a section of the policy of economic reforms and it had been in line with the worldwide trend towards currency convertibility. By 1994, 97 countries including India had acquired Article VIII status on the current account convertibility. more countries have joined them subsequently.

Under the Liberalised rate of exchange Management System (LERMS) introduced in March 1992, 60 percent of all receipts under current transactions comprised of merchandise exports and invisible receipts might be converted at the free market rate quoted by the authorised dealers. just in case of the remaining 40 percent of receipts, the rate applicable was the official rate of exchange.

This provision of 40 percent of total foreign exchange under the current account was meant to cover exclusively the govt requirements and to enable the import of essential commodities. Moreover, the foreign exchange was also to be made available to fulfill 40 percent of the value of the advance licenses and special import licenses.

A major step within the direction of current account convertibility was adopted by India in March 1993, when the foreign exchange budget was abolished; the rate of exchange was unified and; the transactions on trade account were free of exchange control. The determination of rate of exchange of the rupee was left to the market forces.

On February 1994, the RBI announced the liberalisation of exchange control regulations upto a specified limit relating to- (a) foreign currency accounts of exchange earners, (b) basic travel quota, (c) studies abroad, (d) gift remittances, (e) donations, and (f) payments thanks to certain services rendered by foreign parties. Some more relaxations on current account payments were announced by RBI on August 19, 1994 in respect of various schemes associated with foreign currency non-resident accounts.

The rupee was made fully convertible on the current account of the balance of payments in August 1994. The Indian exporters to the Asian Clearing Union (ACU) countries and receiving export proceeds in rupee or in Asian Monetary Union (AMU) or within the currency of the participating country, were allowed to receive payments in any permitted currency through banking channels, provided it's offered by the overseas buyer within the ACU country.

The relaxations were made also in respect of the discharge of foreign exchange for foreign travel, interest income on Non-Resident Non-Reparable (NRNR) rupee deposits and remittances to relatives abroad. The reserve bank of India announced some major relaxations in exchange control in January 1997. The monetary ceilings prescribed for remittance of foreign exchange for a large range of purposes were removed and authorised dealers could now allow remittances for those purposes without prior clearance from the RBI.

Capital Account Convertibility of the Rupee:

Full convertibility of rupee wasn't introduced by the govt as it was risky in the conditions of huge deficit on current account faced by the country. Moreover, the intention was also to form the foreign exchange available at low prices for creating essential imports.

The cautious approach in respect of full convertibility of rupee was fully justified in sight of the Mexican crisis and subsequent East Asian crisis. the complete convertibility of rupee required the capital account convertibility of rupee together with the current account convertibility.

Capital account convertibility implies the right to transact in financial assets with foreign countries without restrictions. When there's completely free capital account convertibility, an Indian can dispose of his assets in India and take the money out of the country without hindrance.

Although the rupee isn't fully convertible on capital account, yet in respect of some elements, it had convertibility on capital account even earlier. as an example , capital account convertibility existed before for foreign investors and Non-Resident Indians for undertaking direct and portfolio investment in India.

In addition, Indian investments abroad upto U.S. $ 64 million were eligible for automatic approval by the RBI subject to certain conditions. No doubt, capital account convertibility may result in the large inflow of capital but, if the conditions are unfavourable within the home country, there's grave risk of capital flight from the home country, greater volatility in exchange rates and interest rates and wide fluctuations in exchange reserves. it's therefore prudent to undertake capital account convertibility only sometime after experimenting with the present account convertibility.

The full convertibility of currency, including also capital account convertibility, should be introduced only after some preconditions are met:

(i) There should be domestic macro-economic stability.

(ii) The domestic enterprises should have reasonable degree of competitiveness.

(iii) The country should have trade-oriented development strategy and adequate incentives for export growth.

(iv)The country should have an appropriate industrial policy and a favourable investment climate.

(v) The country should have comfortable current account position.

(vi)The country should have adequate exchange reserves.

Merits:

The full convertibility of currency has the subsequent chief merits:

(i) The convertibility or floating of rupee would indicate truth value of it.

(ii) If the free market rate were above the official rate of exchange, the profitability of exports would increase. As a result, the exporters would be induced to boost exports.

(iii) just in case the exportable products have high import-content, to that extent, a better market-determined rate of exchange can reduce profitability of exports. In such a situation, the import substitution would receive a boost not only in respect of exportable products but also in other imported products.

(iv) a higher rate of exchange of rupee can stimulate the remittances by the Non-Resident Indians (NRIs).

(v) As a results of full convertibility of rupee, the illegal remittance wouldn't remain attractive and, consequently, larger remittances from abroad would happen through proper channel.

(vi) If, alongside convertibility, there's liberalisation of import of gold, there would be an efficient deterrent to the smuggling of gold.

(vii) The fully convertible currency may result in automatic self-balancing of total foreign receipts and payments.

(viii) Full convertibility of rupee will enable the Indian investors to carry internationally diversified investment portfolio.

Demerits:

Full convertibility of rupee has some demerits:

(i) If difficulty arises in keeping the current account balance under control, the free market rate of exchange is probably going to rise steeply.

(ii) If full convertibility causes appreciation of rupee, the possibility of reduction in exports can't be ruled out.

(iii) If there's appreciation of rupee, consequent upon its free convertibility, the imports are likely to increase and have adverse effect on BOP deficit.

(iv) If the complete convertibility causes depreciation of rupee, the import prices are likely to increase. As a result, the inflationary pressures can get intensified.

(v) Full convertibility of rupee can greatly strengthen the speculative tendencies and consequent instability within the whole system.