Unit – 6

Foreign Exchange Rate

The following points highlight the four main roles of Foreign exchange rate in Economic development of a country.

Role # 1. Slow Pace of Primary Commodities:

The foremost difficulty that comes in the path of foreign trade is that the growth of primary commodities which forms principal exports of developing countries has been very slow as compared to world trade.

In 1955, primary commodities accounted for 50% of the total exports which in 1977 came down to 35% and again to 28% in 1990 and so on. The causes responsible for this are the increasing tendency of market economies to protect their agriculture, inadequate increase in demand for primary commodities, development of synthetic substitutes etc.

Role # 2. Less Share in World Trade:

It has been noticed that exports of developing economies have been slow to develop. Consequently, the share of developing economies in the total world trade has maintained a downward trend.

Its share which was 31 percent in 1950 came down to 13.9 percent in 1960 and again 5% in 1990. This decline is caused by factors like emergence of trade blocks, restrictive commercial policies and growth of monopolies etc. These trends reflect the fact that developing economies have to face foreign trade as a barrier in the way of development.

Role # 3. Worse Terms of Trade:

In developed markets, the low demand for primary products has led the problem of balance of payment on worse trend in developing economies. Whereas prices of manufactured goods have been on the upward trend in the world market, the prices of primary products are gradually declining.

In this regard, UN report advocated that in the past developing countries could got a tractor by exporting two tonnes of sugar, now the time is that they have to export seven tonnes of sugar to get the same tractor. According to another estimate 1 to 3 percent of the GNP was lost by the developing countries due to decreasing prices of non-oil raw materials during 1990s.

Role # 4. Restrictive Trade Policies:

Restrictive trade policies adopted by industrial countries affect prospects for developing country exports of manufacturers. This is due to the fact that for developing countries markets in industrial countries have become increasingly more important.

For instance, in 1965, industrial countries took 41 percent of developing country exports of manufacturers, by 1990 this had grown to -75%. In 1990 only 3% of world trade in manufacturers was between developing countries.

In short, we may conclude that developing economies face several difficulties in their path of foreign trade. The various multinational initiatives having been mounted to tackle these problems have left them largely resolved. Therefore, in given circumstances, the developing economies have to evolve a suitable trade policy mix that may create export outlets and as well may assure supplies of essential imports.

Under inconvertible paper money standard, there are often two sorts of exchange rates -— fixed and flexible. Under this monetary system of the International monetary fund (IMF), fixed or stable exchange rates are referred to as pegged exchange rates or par values.

In fact, IMF was established with the object of stabilising the rates of exchange, with proper safeguards for adjustments whenever necessary. On the opposite hand, free or flexible exchange rates are left uninterrupted by the monetary authorities to be determined by the forces of demand and supply in the foreign exchange market.

Thus, flexible exchange rates are determined by the conditions of demand for and provide of exchange and are perfectly free to fluctuate consistent with the changes in the demand or supply forces, if there are not any restrictions on buying and selling in the foreign exchange market.

The free or floating rate is allowed to hunt its own level, as no par of exchange is fixed. Sometimes when a currency is floated a former fixed par no longer applies, and therefore the government also doesn't care to enforce it.

Under the system of fixed pars, as adopted by the IMF member nations, the rate of exchange is decided by the govt and enforced either by pegging operation, or by resorting to some sort of exchange control and sometimes by a healthy combination of both these methods.

Under the pegging operation, the govt fixes an official par of exchange and tries to enforce it through central bank or a sort of exchange stabilisation fund which enters foreign exchange market and buy its currency when the market rate falls below the required level and sell it when the rate rises above a specific mark.

This system of pegged rates of exchange is government propped up. There is, however, one major defect in this system that if the market rate of exchange features a consistent tendency to decline, pegging operations would be very expensive, because it would cause a heavy reduction in the exchange reserves of the country concerned.

Recently, therefore, it's been held by many whom the IMF’s system of adjustable stable exchange rates isn't desirable which free or fluctuating exchange rates would be more helpful in adjusting prevailing rates of exchange to their true value.

It is a highly debatable question on whether the fixed rate of exchange system is good or the fluctuating rate of exchange is better.

Difference between Fixed and flexible Exchange Rate!

A study of economic history shows that three different rate of exchange systems are prevailing in the world economy. the first rate of exchange system, popularly called Gold Standard prevailed over 1879-1934 period with the exception of war I years.

Under the gold standard, currencies of various countries were tied to gold (that is, the value of currency of every country was fixed in terms of an exact quantity of gold). With this the rate of exchange between different countries got automatically fixed.

Thus, the gold standard represented fixed rate of exchange system. As explained above, from the end of world war II to 1971, another fixed rate of exchange system, generally referred to as Bretton Woods System prevailed. Under this the US dollar was tied to an exact quantity of gold and therefore the currencies of other countries were tied to dollar or in some countries directly to gold.

However, in 1971 thanks to large and persist deficit in balance of payments of the united states. Bretton Woods system also broke down. Since then, the flexible or what's also called floating rate of exchange system has been existing but even during this flexible or floating exchange rates the govt (or the Central Bank) of the countries intervenes to keep the international value of their currencies (i.e., exchanges rate) within certain limits.

Therefore, even in the post 1971 period, the rate of exchange system isn't purely flexible and has therefore been called Managed Float System.

The demand for and provide of exchange, currency within the economy supports to work out the exchange conversion rate. The demand and provide of foreign currency in the economy is determined by prices prevailing within the domestic and foreign marketplace for the respective goods, commodities and services, the worth elasticity of products, and services, and also the movement of capital from one market to the another.

Additionally, to some extent the speculative activities within the foreign exchange market, future expectations of rate of exchange s then on also impact the foreign exchange currency exchange rate.

If the demand and provide of foreign currency is equal within the domestic market, then the speed of exchange would generally be in equilibrium. in the economical terminology, it's described as par-value of exchange.

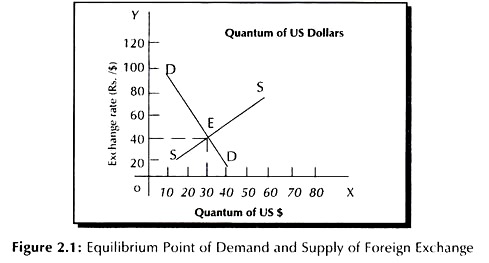

The impact of demand and supply of foreign currency on the exchange rate is shown within the diagram as per Figure 2.1:

In the diagram, dollar’s demand (as DD curve) and supply (SS curve) with reference to Indian Rupees are shown. V-axis indicates Indian Rupees per unit of the US dollar and the X-axis indicates the quantum folks dollar available within the economy at a particular point of your time . The equilibrium point (point E) achieved where DD and SS curves intersect one another . At point E, the value of 1 US dollar is worth Indian Rs. 40.

It also can be concluded that, as the value of dollar increases, the value of the domestic currency, i.e., Indian Rupees decreases. Reversely, the value of local national currency will be higher in compare to foreign currency, when the domestic country’s balance of payments is favourable with respective counter party country.

The purchasing power parity theory was propounded by Professor Gustav Cassel of Sweden. According to this theory, rate of exchange between two countries depends upon the relative purchasing power of their respective currencies. One popular macroeconomic analysis metric to compare economic productivity and standards of living between countries is purchasing power parity (PPP). PPP is an economic theory that compares different countries' currencies through a "basket of goods" approach. According to this concept, two currencies are in equilibrium—known as the currencies being at par—when a basket of goods is priced the same in both countries, taking into account the exchange rates.

Meaning: The theory aims to determine the adjustments needed to be made in the exchange rates of two currencies to make them at par with the purchasing power of each other. In other words, the expenditure on a similar commodity must be same in both currencies when accounted for exchange rate. The purchasing power of each currency is determined in the process.

Description: Purchasing power parity is used worldwide to compare the income levels in different countries. PPP thus makes it easy to understand and interpret the data of each country.

Example: Let's say that a pair of shoes costs Rs 2500 in India. Then it should cost $50 in America when the exchange rate is 50 between the dollar and the rupee.

Suppose in the USA one $ purchases a given collection of commodities. In India, same collection of goods costs 60 rupees. Then rate of exchange will tend to be $ 1 = 60 rupees. Now, suppose the price levels in the two countries remain the same but somehow exchange rate moves to $1=61 rupees.

This means that one US$ can purchase commodities worth more than 46 rupees. It will pay people to convert dollars into rupees at this rate, ($1 = Rs. 61), purchase the given collection of commodities in India for 60 rupees and sell them in U.S.A. for one dollar again, making a profit of 1 rupee per dollar worth of transactions.

This will create a large demand for rupees in the USA while supply thereof will be less because very few people would export commodities from USA to India. The value of the rupee in terms of the dollar will move up until it will reach $1 = 60 rupees. At that point, imports from India will not give abnormal profits. $ 1 = 60 rupees and is called the purchasing power parity between the two countries.

Thus, while the value of the unit of one currency in terms of another currency is determined at any particular time by the market conditions of demand and supply, in the long run the exchange rate is determined by the relative values of the two currencies as indicated by their respective purchasing powers over goods and services.

In other words, the rate of exchange tends to rest at the point which expresses equality between the respective purchasing powers of the two currencies. This point is called the purchasing power parity. Thus, under a system of autonomous paper standards the external value of a currency is said to depend ultimately on the domestic purchasing power of that currency relative to that of another currency. In other words, exchange rates, under such a system, tend to be determined by the relative purchasing power parities of different currencies in different countries.

In the above example, if prices in India get doubled, prices in the USA remaining the same, the value of the rupee will be exactly halved. The new parity will be $ 1 = 120 rupees. This is because now 120 rupees will buy the same collection of commodities in India which 60 rupees did before. We suppose that prices in the USA remain as before. But if prices in both countries get doubled, there will be no change in the parity.

In actual practice, however, the parity will be modified by the cost of transporting goods (including duties etc.) from one country to another.