Unit 7

Foreign Exchange Market

FOREIGN EXCHANGE MARKET

MEANING

Definition: The foreign exchange Market is a market where the buyers and sellers are involved within the sale and purchase of foreign currencies. In other words, a market where the currencies of various countries are bought and sold is named a foreign exchange market. The structure of the foreign exchange market constitutes central banks, commercial banks, brokers, exporters and importers, immigrants, investors, tourists. These are the main players of the foreign market.

Currencies are always traded in pairs; therefore the "value" of 1 of the currencies in that pair is relative to the worth of the opposite. This determines what proportion of country A's currency country B can purchase, and the other way around. Establishing this relationship (price) for the global markets is that the main function of the foreign exchange market. This also greatly enhances liquidity in all other financial markets, which is essential to overall stability. The foreign exchange market is an over-the-counter (OTC) marketplace that determines the rate of exchange for global currencies. It is, by far, the most important financial market in the world and is comprised of a worldwide network of monetary centres that transact 24 hours daily, closing only on the weekends. Currencies are always traded in pairs, therefore the "value" of 1 of the currencies therein pair is relative to the value of the opposite.

The following are the key points:

STRUCTURE OF FOREIGN EXCHANGE MARET

The structure of the foreign exchange market constitutes central banks, commercial banks, brokers, exporters and importers, immigrants, investors, tourists. These are the main players of the foreign market; their position and place are shown within the figure below.

.

.

At the bottom of a pyramid are the actual buyers and sellers of the foreign currencies- exporters, importers, tourist, investors, and immigrants. they're actual users of the currencies and approach commercial banks to buy it.

The commercial banks are the second most significant organ of the foreign exchange market. The banks dealing in exchange play a task of “market makers”, within the sense that they quote on a routine the foreign exchange rates for buying and selling of the foreign currencies. Also, they function as clearing houses, thereby helping in wiping out the difference between the demand for and therefore the supply of currencies. These banks buy the currencies from the brokers and sell it to the buyers.

The third layer of a pyramid constitutes the foreign exchange brokers. These brokers function as a link between the central bank and therefore the commercial banks and also between the actual buyers and commercial banks. they're the main source of market information. These are the persons who don't themselves buy the foreign currency, but rather strike a deal between the buyer and therefore the seller on a commission basis.

The central bank of any country is that the apex body within the organization of the exchange market. They work because the lender of the last resort and therefore the custodian of foreign exchange of the country. The central bank has the power to regulate and control the foreign exchange market so on assures that it works within the orderly fashion. one among the main functions of the central bank is to stop the aggressive fluctuations within the foreign exchange market, if necessary, by direct intervention.Intervention within the form of selling the currency when it's overvalued and buying it when it tends to be undervalued.

THE FUNCTIONS OF FOREIGN EXCHANGE MARKET:

1. Transfer Function: the essential and the most visible function of exchange market is the transfer of funds (foreign currency) from one country to a different for the settlement of payments. It basically includes the conversion of 1 currency to another, wherein the role of FOREX is to transfer the purchasing power from one country to another.

For example, if the exporter of India import goods from the USA and the payment is to be made in dollars, then the conversion of the rupee to the dollar are going to be facilitated by FOREX. The transfer function is performed through a use of credit instruments, like bank drafts, bills of foreign exchange, and telephone transfers.

2. Credit Function: FOREX provides a short-term credit to the importers so on facilitate the smooth flow of products and services from country to country. An importer can use credit to finance the foreign purchases. Like an Indian company wants to get the machinery from the USA, pays for the purchase by issuing a bill of exchange within the exchange market, essentially with a three-month maturity.

3. Hedging Function: The third function of a foreign exchange market is to hedge foreign exchange risks. The parties to the exchange are often scared of the fluctuations in the exchange rates, i.e., the worth of 1 currency in terms of another. The change in the rate of exchange may end in a gain or loss to the party concerned.

Thus, because of this reason the FOREX provides the services for hedging the anticipated or actual claims/liabilities in exchange for the forward contracts. A forward contract is typically a three-month contract to buy or sell the exchange for another currency at a fixed date within the future at a price agreed upon today. Thus, no money is exchanged at the time of the contract.

There are several dealers within the foreign exchange markets, the foremost important amongst them are the banks. The banks have their branches in several countries through which the exchange is facilitated; such service of a bank is named as Exchange Banks.

MEANING OF INTERNATIONAL CAPITAL MOVEMENTS:

The international trade and therefore the movements of productive resources like labour, capital and technology are substitutes for each other. a relatively capital-abundant country just like the united states can export either capital-intensive commodities or export capital itself.

The conditions of capital-scarce countries require them to either import capital-intensive goods or procure the desired flow of capital from abroad. The movement or flow of financial resources from one country to a different either for the adjustment of BOP disequilibrium or for expanding the production frontier during a country denotes international capital flow or movement.

It is necessary to differentiate the international capital movements from the payments for imports. The capital movements may either be meant for financing the deficits in the BOP or for bringing about a net increase in productive capacity within the economy. In the latter situation, the international capital movements are often treated as a factor of production. If the sufficient inflow of capital fails to take place from abroad, the productive activity is likely to be adversely affected.

In this connection, it must be recognised that only real capital movements are significant from the point of view of the allocation of resources. It means the countries looking on the inflow of foreign capital to keep up and/or to raise the extent of economic activity should have capital inflow of the magnitude which is quite the offset of the domestic price movements.

The international capital movements have continued to take place over centuries. Historically, the development of Britain, the U.S.A., Canada, Australia and lots of other countries took place by virtue of foreign capital. The century preceding worldwar I was the “golden age” of private investment activity. During that period, Britain, the us , France and Germany became increasingly industrialised through large scale foreign investments.

Apart from these countries, the recipients of foreign investment during that period included several countries of Europe, Latin America, Canada, Asia and Africa. During the inter-war period, the major development was that the us got transformed from a net international debtor into a significant net creditor country.

The depression of 1930’s caused a sharp decline within the international trade and capital movements on account of disorganization of international monetary apparatus and intensification of tariff, trade and exchange restrictions.

In the decade of 1930’s, there have been extensive defaults on interest and amortization payments due from foreign borrowers, both private and governmental. During the period after Second World War, there has been a substantial increase within the capital flow from the advanced to the LDCs.

These capital movements have taken place on private account through multinational corporations (MNCs), on bilateral government to government basis and on multilateral basis through international monetary and financial institutions like International Bank for Reconstruction and Development, International monetary fund, International Finance Corporation and therefore the regional financial institutions like the Asian Development Bank.

CLASSIFICATION OF INTERNATIONAL CAPITAL INFLOW AND OUTFLOW OF FOREIGN EXCHANGE

There is often the subsequent main classification of international capital movements:

(i) Home and Foreign Capital:

The investments undertaken by the residents of the home country in foreign countries denote the home capital. On the opposite, the investments undertaken by the foreigners within the home country signify the foreign capital. Within the first case, there's a movement of capital from home country to abroad and within the latter case, there's a capital movement from abroad to the home country.

In the BOP account, the inflow of capital from abroad is that the credit item whereas the outflow of capital to foreign countries is that the debit item. The difference between the debits and credits on account of capital movements represents the net foreign investment which can be either positive or negative.

(ii) Government and private Capital:

The government capital refers to the lending and borrowing from foreign countries by the govt. of a given country. On the other , the landings made by the private individuals and institutions to the foreigners and borrowing by them from abroad signify the private capital. The private capital transfers from one country to another are many often guaranteed by the govt. or central bank of the borrowing country.

(iii) Short-Term and Long-Term Capital:

Short- term international capital movements consist of such credit instruments that have a maturity of but one year. The short term capital movements can occur through currency, demand deposits, bills of exchange, commercial papers and time deposits upto a maturity of 1 year.

The short-term capital movements bring about some important changes within the money supply of a country. These changes take place within the kinds of primary, secondary and tertiary effects-

Firstly, the capital movements may result within the BOP deficit or surplus. If there's a BOP deficit, there's some contraction in domestic money supply. On the contrary, the BOP surplus leads to an expansion in money supply. These changes in funds represent a primary change.

Secondly, the short-term capital movements can cause changes within the reserve position of the commercial banks. because the reserves get affected, there are often changes within the capacity of these banks to expand or reduce deposits and credits. These are often considered as secondary changes in money supply. During this connection, however, an assumption has been made that the commercial banks don't already have excess reserves with them.

Thirdly, the short term capital movements can cause variations within the reserves of a central bank. If the central bank of a rustic operates on the basis of its reserves and it's able to expand open market investments within the event of an expansion in its reserves and vice-versa, there are often changes in money supply. Such changes are often treated because the tertiary changes within the supply of money.

Both under gold and inconvertible paper standards, the short-term capital movements resulted from the international differentials within the rates of interest. The rate of interest movements induces the speculators to undertake investments or disinvestments within the foreign exchange markets to make speculative gains.

In this connection, it's presumed that the central bank, commercial banks and other institutions within the market are willing to require risk and speculate on the idea of their expectations concerning the variations within the rates of interest in different countries.

Whether the short-term capital movements induced by the activities of speculators will have a destabilising or stabilising effect depends upon the extent of rate of interest and discount rate differences and expectations of the speculators concerning the future changes within the interest and discount rates.

The long-term capital movements occur through credit instruments having a maturity of quite one year. Long-term capital movements occur through the purchase or sale of long term securities or bonds. These sales or purchases could also be undertaken by the individuals or corporations within the foreign countries or by foreign individuals or corporations within the home country. The long- term capital movements can also happen within the type of loans procured from the international financial institutions like IMF and IBRD.

(iv) Direct and Portfolio Capital:

Foreign direct investment (FDI) means the direct investment by foreign capitalists and business institutions in other countries. The essence of foreign direct investment is that the ownership, control and management of business are vested with the foreign investors.

The foreign direct investments can assume different forms:

(a) The formation of a concern in which the foreign investors or foreign companies have a majority share.

(b) The formation of a subsidiary of a concern of the investing country within the capital-importing country.

(c) The organization of a firm in the capital-importing country that's financed fully by some established concern within the investing country.

(d) The creation of fixed assets by the nationals of the investing country within the capital-importing country.

(e) The setting up of an autonomous corporation by the investing country for the specific purpose of operating other concerns.

Such concerns or firms which operate in different countries and are under a centralized management are termed as transnational corporations (TNCs) or multi-national corporations (MNCs).

Portfolio investment or portfolio capital consists mainly of investment within the kind of holding of transferable securities, shares or debentures by the foreign investors. just in case of this type of investment, the foreign investors have only the ownership of capital. The control and management rests with the capital-importing country. The foreign investors are entitled to dividends or interests on their holdings of equities, bonds or debentures.

The capital-importing countries naturally have a preference for portfolio investments, whereas the investing countries have a preference for the foreign direct investments.

Factors Influencing International Capital Movements:

The international capital movements or flows are influenced by the subsequent main factors:

(i) Rate of Interest:

Changes in capital both in short and long periods are greatly influenced by the changes within the rates of interest (short or long rates). The capital flow takes place from a rustic where the interest rates are low to those countries where the interest rates are relatively high and vice-versa. Ohlin affirmed that the difference in interest rates between countries is perhaps the most important stimulus to export and import of capital.

(ii) Marginal Efficiency of Investment:

If the expected rate of return over cost related to a given dose of investment in foreign country is higher compared with the rate in home country, there'll be outflow of capital to the foreign country. On the opposite, the lower expected rate of return over cost or the marginal efficiency of investment (MEI) than within the home country will result in an inflow of capital from abroad.

(iii) Bank Rate:

The variations in bank rate by the central bank have effect upon the structure of interest rates within the money market. an increase in bank rate within the home country will cause a rise in both short-term and long-term interest rates.

As these rates rise above the corresponding rates within the foreign countries, the home country will be able to attract short-term and long-term capital flows from abroad. a reduction in bank rate will lower the short and long term interest rates. As these rates fall below the levels of interest rates abroad, there'll be outflow of capital to foreign countries.

(iv) Speculation:

The speculative activities of the operators within the exchange market also can result in capital movements. Speculation could also be with respect to either interest rates or exchange rates. When speculators anticipate a rise in interest rates within the home country relative to such an expectation abroad, the security prices are expected to fall by a greater extent within the home country than abroad. this may make the speculators transfer funds from home country to abroad.

If the interest rates in home country are expected to fall more than in foreign country, the speculators will transfer funds from the foreign countries to the home country. The speculation in exchange rates too influences capital movements between the countries. If the currency of home country is expected to depreciate, the speculators will move funds from the home country to the foreign country, the currency of which is expected to rule stronger. An anticipated devaluation is likely to induce the flight of capital from the devaluing country.

There is a greater possibility of such capital flight when variation in exchange rates can take place freely rather than within a narrow band. On the other, if the speculators anticipate a revaluation (a rise in rate of exchange of home currency relative to foreign currency) of the home currency, the inflow of capital may take place from abroad.

(v) Foreign Capital Policy:

The capital movements are affected also by the foreign capital policy of the govt of a country. If there's regime of restrictions upon foreign capital, the inflow of foreign capital will remain clogged. On the opposite, a liberal policy during this regard can induce a substantial inflow of capital from the foreign countries.

vi) Economic and Political Conditions:

If a country has well-developed economic infrastructure, including means of transport and communications, power, market structures and financial institutions, along side political stability, peace, law and order, the foreign investors are induced to undertake investments within the home country during a larger measure.

However, if such economic and political conditions don't exist, there'll be little possibility of inflow of foreign capital. There's rather a danger that even the indigenous investors will prefer to invest in foreign countries resulting in a flight of capital.

(vii) Exchange Control Policy:

The existence of stiff exchange control measures tend to prevent the inflow of capital from abroad and also adversely affect the flow of trade. A liberal policy in this respect are often more helpful within the expansion of trade and induce the inflow of capital to the home country.

(viii) Tax Policy:

If the tax rates on personal incomes and corporate profits are high, the foreign investments, both direct and portfolio are likely to be discouraged. The lower tax rates, on the other hand, can have a stimulating effect upon the capital inflow from abroad.

Output and Welfare Effects of International Capital Flows:

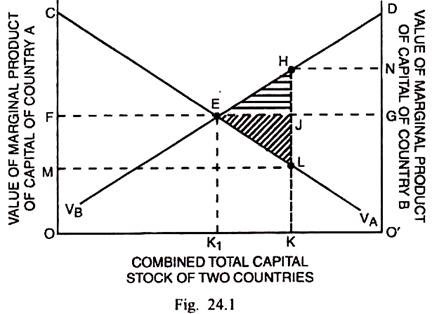

The international capital flows result in output and welfare effects upon the investing and host countries. It's supposed that country A is that the investing country and B is that the host country. The welfare and output effects on account of transfer of capital from A to B are often analysed through Fig. 24.1.

In Fig. 24.1, OO’ is the combined total capital stock of the two countries A and B. Originally OK is the capital stock of country A and O’K is the capital stock of country B. VA is that the value of marginal product of capital curve for country A and VB is the value of marginal product of capital curve of country B. Both the curves slope negatively indicating that the marginal products of capital within the two countries are diminishing. the value of marginal product of capital represents the return or yield on capital.

The investing country A, in isolation, invests its entire capital stock OK domestically at a yield KL or OM. the entire product is OCLK. Out of it, OKLM goes to the owners of capital and therefore the rest MLC to the owners of the other factors like land and labour. Country B (host country), in isolation, invests its entire capital stock O’K domestically at a yield O’N or HK. Out of the entire product O’DHK, O’NHK goes to capital and therefore the remaining DHN to the opposite co-operating factors.

If the free international movement of capital is permitted, there'll be flow of capital from country A to country B because of higher yield or return on capital from country B than during a. If KK1 capital flows from country A to B, the return on capital within the two countries gets equalised (EK1= OF = O’G)

In this situation, the total product in country A is OCEK1. Thereto should be added K1EJK because the total return on foreign investments. The total national income amounts to OCEJK. It shows a net gain for country A as EJL. The total return to capital increases to OFJK and therefore the return to other factors decreases to CEF.

In the case of host country B, there's an inflow of capital from foreign country A to the extent of KK1. The rate of return on capital falls from O’N to O’G. The entire product in country B rises from O’ DHK to O’ DEK1. Thus the total product during this country rises by K1EHK. Out of it, K1EJK goes to the foreign investors. The net gain in total product accruing to country B is EJH. The entire return to domestic owners of capital falls from O’NHK to O’GJK. The total return to other factors rises from DHN to DEG.

Considered from the viewpoint of either the countries taken together or the whole world, the total product increases from OCLK + O’DHK to OCEK1 + O’DEK1 or the addition in total product of the whole world amounts to EJL + EJH = ELH. Thus the international capital flows raise the efficiency within the allocation of resources internationally and therefore the world output and welfare get increased. Greater is that the steepness of the curves VA and VB, the greater are often the gain from the international capital flows.

OTHER EFFECTS OF INTERNATIONAL CAPITAL FLOWS:

Apart from the effects of international capital movements on output and welfare, there can be some other effects which are analysed below:

(i) Effect on Employment of Labour:

If it's assumed that the two factors of production—labour and capital, were fully employed earlier, there would be a rise in total and average return to capital and a decrease within the total and average return to labour within the investing country after the transfer of capital. (See Fig. 24.1). The investing country though, on the entire, gains from foreign investments; there's a redistribution of domestic income from labour to capital.

In the host country, there's a gain from capital flows within the form of redistribution of income from capital to-labour. If there's a but full employment situation within the investing country, the transfer of capital is likely to depress the extent of employment. However, within the host country, the employment may expand. it's precisely due to this reason that the organisedlabour within the us is opposed to the U.S. investments abroad.

(ii) Effect after all of Payments:

The international capital movements affect the BOP of the investing and host countries. The year in which transfer of capital is formed, the BOP deficit appears for the investing country. On the other hand, there's an improvement within the BOP for the host country therein year. The foreign investment programme of the us during 1960’s caused a huge BOP deficit for it that led to the restrictions on us foreign investments from 1965 to 1974.

However, the initial capital transfer and spending abroad by the investing country end in increased exports of capital goods, spares and other products. There's also subsequent flow of profits to the investing country after a lapse of 5 to 10 years on an average. But within the long run there also can be possibility of replacement of exports and imports of the investing country.

That makes the long-run effect of capital transfer for investing country as uncertain while its short-run or immediate effect is negative for it. As regards the host country, the effect of capital transfer on BOP is positive.

(iii) Effect on Taxes:

The effect of transfer of capital may arise for both investing and host countries from different rates of taxation and foreign earnings within the different countries. If the rate in investing country is 50 per cent and in host country is 40 percent, the firms within the former will undertake investment within the latter or reroute foreign sales through subsidiaries so as to pay lower tax rates.

If the foreign earnings are repatriated by the firms of the investing country to the country of origin, the investing country will collect a tax of only 10 percent (because the most countries have the agreements to avoid double taxation). therefore the transfer of capital can cause shrinkage of tax base and decline within the amount of tax collected. there's an expansion of tax base and rise in tax collection, on the opposite, within the host country.

(iv) Effect on Terms of Trade:

The capital transfer can affect the terms of trade through effects on output and therefore the volume of trade. there's likelihood of terms of trade turning in favour of the investing country and against the host country.

(v) Effect on Technological Lead:

Prior to the international capital transfer, the technological gap between the investing and therefore the host countries could be quite wide. But the transfer of package of resources including plants and equipment, spares, technological know-how, scientific management, use of patents and brand names etc. brings about a narrowing down of the technological lead that the investing countries earlier had over the host countries.

(vi) Effect on Host Country’s Control over the Economy:

The large scale capital transfers and expansion within the activities of the host countries usually place some constraints on their ability to conduct and control their own economic policies.

THE MEANING OF EURO-DOLLAR:

By Euro-dollar is meant all U.S. dollar deposits in banks outside the United States, including the foreign branches of U.S. banks. A Euro-dollar is, however, not a special type of dollar. It bears the same exchange rate as an ordinary U.S. dollar has in terms of other currencies.

Euro-dollar transactions are conducted by banks not resident within the us . for example, when an American citizen deposits (lends) his funds with a U.S. Bank in London, which can again be wont to make advances to a business enterprise within the U.S., then such transactions are stated as Euro-dollar transactions. All Euro-dollar transactions are, however, unsecured credit.

Euro-dollars have inherited existence on account of the Regulation issued by the Board of Governors of the U.S. Federal Reserve System, which doesn't permit the banks to pay interest to the depositors above a certain limit.

As such, banks outside the us tend to expand their dollar business by offering higher deposit rates and charging lower lending rates, as compared to the banks inside the U.S. Increase or decrease within the potential for Euro-dollar holdings, however, depends, directly upon U.S. deficits and surplus, respectively.

EURO-DOLLAR MARKET:

Euro-dollar market is that the creation of the international bankers. It's simply a short-term market facilitating banks’ borrowings and lending’s of U.S. dollars. The Euro-dollar market is principally located in Europe and basically deals in U.S. dollars.

But, during a wider sense, Euro-dollar market is confined to the external lending and borrowing of the world’s most vital convertible currencies like dollar, pound, sterling, Swiss franc , French franc , deutsche mark and therefore the Netherlands guilder.

In short, the term Euro-dollar is used as a common term to include the external markets in all the major convertible currencies.

Euro-dollar operations are unique in character, since the transactions in each currency are made outside the country where that currency originates.

The Euro-dollar market attracts funds by offering high rates of interest, greater flexibility of maturities and a wider range of investment qualities.

Though Euro-dollar market is wholly unofficial in character, it's become an indispensable a part of the international monetary system. It's one of the largest markets for short-term funds.

FEATURES OF THE EURO –DOLLAR MARKET

The Euro-dollar market has the subsequent characteristics:

1. it's emerged as a truly international short-term money market.

2. it's unofficial but profound.

3. it's free.

4. it's competitive.

5. it's a more flexible capital market.

Original customers of the Euro-dollar market were the business firms in Europe and therefore the far east which found Euro-dollars a cheaper way of financing their imports from the us, since the lending rates of dollars within the Euro-dollar market were relatively less.

The Euro-dollar market has two facts:

(i) It's a market which accepts dollar deposits from the non-banking public and gives credit in dollars to the needy non-banking public.

(ii) Its an inter-bank market in which the commercial banks can adjust their foreign currency position through inter-bank lending and borrowing.

The existence of Euro-dollar market during a country, however, depends on the freedom given to the commercial banks to hold, borrow and lend foreign currencies — especially dollars — and to exchange them at fixed official rate of exchange .

BENEFITS OF THE EURO-DOLLAR MARKET:

Following benefits seem to have accrued to the countries involved within the Euro-dollar market:

1. It’s provided a truly international short-term capital market, owing to a high degree of mobility of the Euro-dollars.

2. Euro-dollars are useful for the financing of foreign trade.

3. it's enabled the financial institutions to have greater flexibility in adjusting their cash and liquidity positions.

4. Its enabled importers and exporters to borrow dollars for financing trade, at cheaper rates than otherwise obtainable.

5. It’s helped in reducing the profit margins between deposit rates and lending rates.

6. It's enhanced the quantum of funds available for arbitrage.

7. Its enabled monetary authorities with inadequate reserves to extend their reserves by borrowing Euro-dollar deposits.

8. It's enlarged the facilities available for short-term investment.

9. It's caused the levels of national interest rates more like international influences.

EFFECTS OF EURO DOLLAR MARKET ON INTERNATIONAL FINANCIAL SYSTEM:

1. The position of dollar has been strengthened temporarily, since its operations of borrowing of dollars have become more profitable rather than its holdings.

2. It facilitates the financing of balance of payments surpluses and deficits. Especially, countries having deficit balance of payments tend to borrow funds from the Euro-dollar market, thereby lightening the pressure on their foreign exchange reserves.

3. Its promoted international monetary cooperation.

4. Over the last decade, the expansion of Euro-dollar has helped in easing of the world liquidity problem.

SHORTCOMINGS OF THE EURO-DOLLAR MARKET:

The major drawbacks of the Euro-dollar market could also be mentioned as under:

1. It may lead banks and business firms to overtrade.

2. It may weaken discipline within the banking communities.

3. It involves a grave danger of sudden large- scale withdrawal of credits to a country.

4. It rendered official monetary policies less effective for the countries involved.

In fact, the Euro-dollar market has created two major problems for an individual country dealing in it. Firstly, there's the danger of over-extension of the dollar credit by domestic banks of the country; consequently, high demand pressure on the official foreign exchange may take place.

Secondly, the Euro-dollar market appears as another channel for the short-term international capital movement for the country, so that the country’s volume of outflow or inflow capital may increase which can again endanger the foreign exchange reserves and therefore the effectiveness of domestic economic policies.

It has destabilisation effect. It increases the pressure on rate of exchange and official foreign exchange reserves. This might require additional liquidity. If such additional reserves aren't provided, it may endanger existence of the present gold exchange standard.

Above all, the Euro-dollar market has caused the growth of semi-independent international interest rates, on which there are often no effective control by one country or an institution.

ADVANTAGES OF FOREX MARKET

The biggest financial market within the world is that the biggest market because it provides some advantages to its participants. Some of the main advantages offered are as follows:

1. Flexibility

FOREX exchange markets provide traders with tons of flexibility. This is often because there's no restriction on the amount of money which will be used for trading. Also, there's almost no regulation of the markets. This combined with the actual fact that the market operates on a 24 by 7 basis creates a very flexible scenario for traders. People with regular jobs also can enjoysForex trading on the weekends or within the nights. However, they can't do an equivalent if they're trading within the stock or bond markets or their own countries! it's for this reason that Forex trading is that the trading of choice for part time traders since it provides a flexible schedule with least interference in their full time jobs.

Transparency: The FOREX market is big in size and operates across several time zones! Despite this, information regarding FOREX markets is definitely available. Also, no country or central bank has the ability to single handily corner the market or rig prices for an extended period of your time. Short term advantages may occur to some entities due to the time lag in passing information. However, this advantage can't be sustained over time. The size of the FOREX market also makes it fair and efficient.

2. Trading Options

FOREX markets provide traders with a wide variety of trading options. Traders can trade in many currency pairs. They even have the choice of stepping into spot trade or they might enter into a future agreement. Futures agreements also are available in different sizes and with different maturities to satisfy the wants of the FOREX traders. Therefore, FOREX market provides an option for each budget and each investor with a special appetite for risk taking.

Also, one must take into account the very fact that FOREX markets have a huge trading volume. More trading occurs within the FOREX market than anywhere else within the world. It's for this reason that FOREX provides unmatched liquidity to its traders who can enter and exit the market during a matter of seconds any time they feel like!

3. Transaction Costs

FOREX market provides an environment with low transaction costs as compared to other markets. In comparison on a percentage point basis, the transaction costs of trading in FOREX are extremely low as compared to trading in other markets. This is often primarily because FOREX market is largely operated by dealers who provide a two way quote after reserving a spread for themselves to hide the risks. Pure play brokerage is very low in FOREX markets.

4. Leverage

FOREX markets provide the most leverage amongst all financial asset markets. The arrangements within the FOREX markets provide investors to lever their original investment by as many as 20 to 30 times and trade the market! This magnifies both profits and gains. Therefore, even though the movements within the FOREX market are usually small, traders find you gaining or losing a big amount of cash because of leverage!

DISADVANTAGES OF FOREX MARKET

It would be a biased evaluation of the FOREX markets if attention was paid only to the advantages while ignoring the disadvantages. Therefore, within the interest of full disclosure, some of the disadvantages are listed below:

1. Counterparty Risks

FOREX market is an international market. Therefore, regulation of the FOREX market may be a difficult issue because it pertains to the sovereignty of the currencies of many countries. This creates a scenario wherein the FOREX market is largely unregulated. Therefore, there's no centralized exchange which guarantees the risk free execution of trades. Therefore, when investors or traders enter into trades, they also have to be cognizant of the default risk that they're facing i.e. the risk that the counterparty might not have the intention or the ability to honor the contracts. FOREX trading therefore involves careful assessment of counterparty risks also as creation of plans to mitigate them.

2. Leverage Risks

FOREX markets provide the maximum leverage. The word leverage automatically implies risk and a gearing ratio of 20 to 30 times implies a lot of risk! Given the very fact that there are no limits to the amount of movement that would happen within the FOREX market during a given day, it's possible that an individual may lose all of their investment during a matter of minutes if they placed highly leveraged bets. Novice investors are more at risk of making such mistakes because they do not understand the quantity of risk that leverage brings along.

3. Operational Risks

FOREX trading operations are difficult to manage operationally. This is often because the FOREX market works all the time whereas humans do not! Therefore, traders need to resort to algorithms to protect the value of their investments once they are away. Alternatively, multinational firms have trading desks spread all across the world. However, which will only be done if trading is conducted on a really large scale.

Therefore, if a person doesn't have the capital or the know how to manage their positions when they are away, FOREX markets could cause a big loss of value within the nights or on weekends.