Unit - 1

Construction Economics

Definition and principles

Economics is a study of ‘Choices’ or ‘Choice making’. Choice making is relevant for every individual, families, societies, institution, area, state and nations and for the whole world. It also analyses how a society allocate the limited resources to achieve growth. The word ‘Economics’ originates from a Greek word ‘Oikonomikos’. This Greek word has 2 parts – ‘Oikos’ means ‘Home’ and ‘Nomos’ means Management. Hence Economics means Home management.

Economics has emerged as high level of application due to its basic principle of ‘Choice making for optimization with the given resources of scarcity and surplus’.

Evolution in the definition of Economics

- Wealth definition (1776) by Adam Smith

- Welfare definition (1890) by Alfred Marshall

- Scarcity definition (1932) by Lionel Robbins

- Growth Definition (1948) by P.A. Samuelson

- Modern definition (2011) by A.C. Dhas

Wealth definition

Adam Smith is called as father of economics. He was the first one to put economics in systematic way.

He defined economics as “a science which inquires into the nature and cause of wealth of nations”

Characteristic

- In simple language wealth means money, whereas in economics, it means goods which satisfy human wants.

- It takes into account only material goods

Criticism

- Other scientist called it as dark science or selfish science

- It defined wealth in a very restricted sense

- It emphasized on the means to get rich and how to make money

Welfare definition

In 1890, Alfred Marshall stated that “'a study of mankind in the ordinary business of life; it examines that part of individual and social action which is most closely connected with the attainment and with the use of material requisites of well being”

Characteristics

- It is primarily the study of mankind

- One side it is the study of wealth on the other side study of man

- It considers only ordinary business of life. It is not concerned with other aspects of man’s life like social, religious and political

- It studies the cause of material welfare. It limits the scope welfare which is related to wealth.

Criticism

- It considers economics as social science rather than a human science

- Welfare has wide meaning and in the definition it is not clear

- The definition only link about wealth and welfare which is strongly criticized.

- Definition is classificatory and not analytical. It considers production of material goods alone. But services of teacher, judge do not produce material goods are not considered as economic activity which is a wrong view.

Scarcity definition

According to Lionel Robbins: “Economics is the science which studies human behavior as a relationship between ends and scarce means which have alternative uses.”

He emphasizes on ‘choice under scarcity’. In other words, “Economics is concerned with that aspect of behavior which arises from the scarcity of means to achieve given ends”

Characteristics

- Economics is a positive science

- It brings into consideration new concept – unlimited ends, scarce means and alternate use of means

- Human wants are unlimited. When one wants is satisfied, then several other wants grow up

- Human wants are unlimited but resources are limited

- All scarce means are used for several purposes. e.g. – land is scarce but are used for buildings, cultivation, etc

- It emphases on choice of making of an economic activity

Criticism

- The definition is not dynamic in nature. It discusses the problem of present but not future generation

- It does not take into consideration the possibility of increase in resources overtime

- Not fit for rich counties. It focuses only on limited resources. But resources are plenty in rich countries

- It does not focus on many other economic issue of unemployment, income determination, economic growth and development.

Growth definition

According to Prof. Paul A Samuelson, “Economics is the study of how men and society choose, with or without the use of money, to employ scarce productive resources which could have alternative uses, to produce various commodities over time and distribute them for consumption now and in the future amongst various people and groups of society”

Characteristic

- It is more dynamic approach

- It is not only concerned with allocation of resources but also expansion of resources

- It analyses how growth of resources can be used to satisfy the increasing wants of human

- It is comprehensive in nature both growths oriented as well as future oriented

- It has all the features of earlier definition

- It focuses both on production and consumption activities

Criticism

- It ignored surplus resource condition

Modern definition of economics

Prof. A.C. Dhas defines economics as "The study of choice making by individuals, institutions, societies, nations and globe under conditions of scarcity and surplus towards maximizing benefits and satisfying the unlimited present and future needs.”

In short, the subject Economics is defined as the “Study of choices by all in maximizing production and consumption benefits with the given resources of scarce and surplus, for present and future needs.”

Characteristics

- It considers all the earlier definition of economics

- It covers both macro and micro aspects of economics

- It considers both production and consumption activities.

- It emphasizes Choice Making dimension of economics.

- It aims at obtaining maximum benefits with given resources

- It is suitable in conditions of both scarcity and surplus.

Importance in construction industry

The construction industry is an important sector that contributes more in the economic growth of the country. With the contribution of construction industry to the economic development and economic activities, it contributes a high significant affect in the development of the country. Construction industry is also said to be an investment-led sector where government shows high interest. Government contracts with construction industry for the development of an infrastructure related to health, transport as well as education sector.

Assets, liabilities, balance sheet

The assets on the balance sheet consist of what a company owns or will receive in the future and which are measurable. Liabilities are what a company owes, such as taxes, payables, salaries, and debt. The shareholders' equity section displays the company's retained earnings and the capital that has been contributed by shareholders. For the balance sheet to balance, total assets should equal the total of liabilities and shareholders' equity.

Assets

Assets are the first of three major categories on the balance sheet. Current assets represent the value of all assets that can reasonably expect to be converted into cash within one year and are used to fund ongoing operations and pay current expenses. Some examples of current assets include:

- Cash and cash equivalents

- Accounts receivable

- Prepaid expenses

- Inventory

- Marketable securities

Noncurrent assets are a company’s long-term investments or any asset not classified as current. Both fixed assets, like plant and equipment, and intangible assets, like trademarks, fall under noncurrent assets. Some examples of noncurrent assets are:

- Land

- Property, plant, and equipment

- Trademarks

- Long-term investments and even goodwill

Liabilities

Current liabilities are short-term liabilities that are due within one year and include:

- Accounts payable are a short-term debt owed to suppliers.

- Accrued expenses are expenses that have yet to be paid, but have a high probability of being paid.

Noncurrent liabilities are also listed on the balance sheet and are included in the calculation of a company's total liabilities. Noncurrent liabilities are long-term debts or obligations and unlike current liabilities, a company does not expect to repay its non-current liabilities within a year. Some examples of noncurrent liabilities include:

- Long-term lease obligations

- Long-term debt like bonds payable

Numerical on preparation balance sheet, profit & loss account

Final Accounts are prepared, normally, for a complete period. It must be kept in mind that expenses and incomes for the relevant accounting period are to be taken, while preparing final accounts. If an expense has been incurred but not paid during the period, a liability for the unpaid amount should be created, before finding out the operating result and financial position of a concern. In order to prepare the final accounts on mercantile system of accounting, all expenses and incomes relating to the period, whether incurred or not, received or not, should be brought into the books. For doing this, a concern is required to pass certain entries at the end of the year to adjust the various items of incomes and expenses. Such entries are called adjusting entries.

Accounting Treatment: Trading and Profit and Loss and Balance sheet, together, are called as final accounts. Item appearing in the trial balance appears only once in final accounts, either on the debit or credit. Any adjustment entry requires two postings, debit and credit for the same amount. Important point is students should do the posting (debit and credit) in the concerned accounts, simultaneously. Care is to be exercised that the amount is the same for the total debit and credit.

The following are the important adjustments, which are, normally made at the end of accounting period.

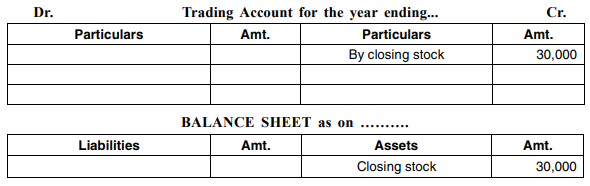

- Closing Stock

Every concern prepares a list of unsold goods at the end of the period and puts value against it.

It is to be remembered that stock is valued at cost or market price, whichever is less.

Closing Stock appears below the Trial Balance as an adjustment entry: Normally, closing stock appears as an adjustment entry in the problem and is given at the end of the trial balance. For example, if the value of stock at the end of the period is Rs. 30,000 and is shown below the trial balance, then the following adjusting entry will be passed:

Closing Stock A/c …Dr 30,000

To Trading Account 30,000

The two-fold effect of this entry will be:

- Stock will have a debit balance. Being a real account, it will be shown on the assets side of the Balance Sheet.

- Closing stock will be shown on the credit side of the Trading Account.

Closing Stock appearing in Trial Balance: Sometimes, opening and closing stock are adjusted through purchases. In this case, closing stock (debit balance) appears in the Trial Balance. Closing stock, under this case, will not be shown on the credit side of the Trading Account but will be shown on the assets side of Balance Sheet only. Remember, any entry appearing in the Trial Balance appears only once either on the debit side or credit side, depending on the nature of the transaction. Closing stock is a real account, hence appears on the assets side of the balance sheet.

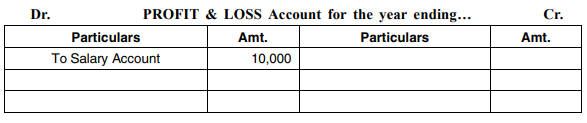

2. Outstanding Expenses

There are certain expenses, which have been incurred but not paid. These expenses are called outstanding expenses. For example, salary to the clerk Rs. 1,000 is due for the month of December. Books are closed at the end of December. In order to bring this transaction into accounts, the following adjustment entry will be passed:

Salary Account…...Dr. Rs.1, 000

To Outstanding Salary A/c. Rs. 1,000

The two-fold effect of this entry will be:

- Outstanding salary will be added to salary, if any, on the debit side of Profit & Loss Account.

- Outstanding Salary Account, being personal and having credit balance, will be shown on the liabilities side of the Balance Sheet.

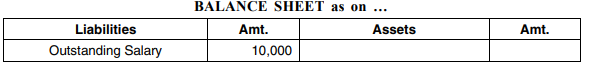

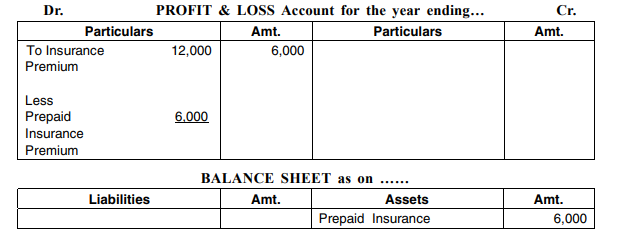

3. Prepaid or Unexpired Expenses

Those expenses which have been paid, in full, but their utility or benefit has not expired during the accounting period are called prepaid or unexpired expenses. In other words, amount has been paid even for the period subsequent to the balance sheet date. For example, annual premium Rs. 12,000 is paid on 1st July, where accounting year closes on 31st December. Rs. 6000 will be insurance paid in advance. To bring this into account, the following adjusting entry will be passed:

Prepaid Insurance Premium Account…...Dr. Rs.6, 000

To Insurance Premium Rs.6, 000

The double effect of this adjusting entry will be:

- Prepaid insurance will be deducted from the insurance premium on the debit side of the Profit & Loss Account.

- Prepaid insurance, being personal account and having debit balance, will be shown on the assets side of the Balance Sheet.

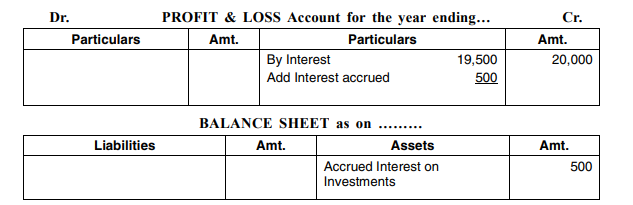

4. Accrued Income

Income earned but not received during the accounting period is called accrued Income.

Suppose, the interest on investments shown in the trial balance is Rs. 19,500.

The adjustment may run like this. Interest @10% is due on investments of Rs. 10,000 for 6 months, though accrued, has not been yet been received.

This interest Rs. 500 will be accrued income. In order to bring this into account, the following adjusting entry will be passed:

Accrued Interest on Investments Account …...Dr. Rs. 500

To Interest on Investment Account Rs. 500

The two-fold effect of this entry will be:

- Interest on Investment account (accrued interest) will be added to the interest account on the credit side of the Profit & Loss Account.

- Accrued interest, being personal account and having debit balance, will be shown on the debit side of the Balance Sheet.

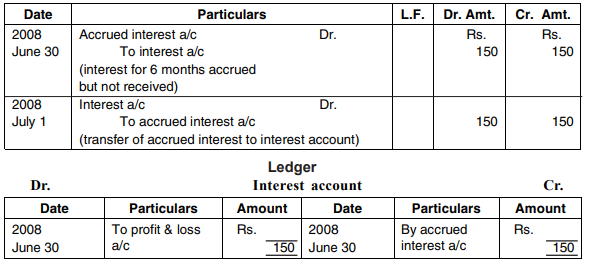

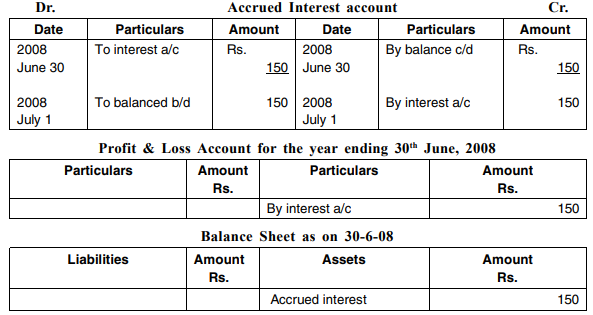

Illustration No. 1

On the 1st January, 2008 Nilesh lent Rs 5,000 @ 6% per annum. Interest is receivable on 31st December each year. The accounts are closed on 30th June each year.

Give journal entries on 30th June, 2008 and 1st July, 2008 and show the ledger, profit & loss account and balance sheet 30th June, 2008.

Solution:

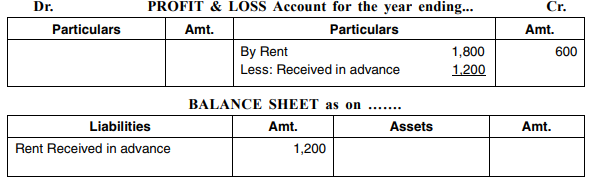

5. Unearned Income or Income Received in Advance

Sometimes, the amount received in respect of an income during the year pertains, partially, to the next year. Suppose a landlord corrects rent for one quarter, in advance, and closes his account on 30th June each year. Suppose, a tenant has occupied a house on 1stJune and pays Rs. 1,800 as rent for 3 months. The landlord must not treat the whole of the rent received as income for the current year. Two months’ rent pertains to the next year and should be credited to the Profit and Loss Account of next year. This will ensure that the income for the current year is not overstated. The required entry is:

Rent Account…. Dr Rs.1,200

To Rent Received in Advance AccountRs.1,200

In the Profit and Loss Account and the Balance Sheet, the item will be shown as indicated below:

The Rent Received in Advance Account will be transferred to the Rent Account in the next year.

This principle should be applied to all incomes, which pertain wholly, or partially to the next year. Other examples can be the fees received from students, before the summer vacation or subscription received in respect of a magazine. The fees applicable to the period after the close of the accounting year or the subscription for copies, to be supplied after the end of the year, should be credited to unearned income account by debit to the account of the students’ fees or the subscription. This will ensure that the income for the current year is not overstated.

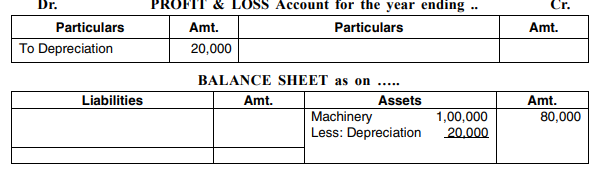

- Depreciation

The value of fixed assets goes on reducing year by year because of wear, tear and efflux of time. This fall in the value should be treated as a loss or expense, to be considered before profit or loss is ascertained. The value to be shown in the Balance Sheet must also be, suitably, reduced. To continue to show it at the old figure will be overstating the assets. Depreciation is usually computed on the basis of the life of the assets. Suppose, a machine costs Rs. 1,00,000 and has a life of 5 years. Then, each year 1/5th of the cost, i.e., Rs. 20,000 should be treated as an expense; only the remaining amount is to be shown in the balance sheet. The entry is:

Depreciation Account …Dr.20,000

To Machinery Account 20,000

Depreciation is debited to the Profit & Loss Account. In the final accounts, the item will figure as shown below:

Depreciation appearing in Trial Balance: In this case, depreciation entry has, already, been passed, before preparation of the trial balance. In that case only, the Depreciation Account will figure in the trial balance itself. The concerned asset will appear at its reduced value since the amount of the depreciation would have been credited to it. In such a case, no further adjustment will be necessary; the Depreciation Account will be transferred to the debit of the Profit & Loss Account like other expenses.

Again, it is reminded if any entry appears in the trial balance, only once it appears in the financial statements. Here, it appears in profit &loss account. Only Adjustment involves two entries.

Pro rata depreciation: While computing depreciation, the period for which the asset is used should be kept in mind. Suppose, a machine is purchased on 1st January, 2008 for Rs. 10,000 and another machine is purchased on 30th June, 2008 for Rs. 6,000: the rate of depreciation is 10%. Accounts are closed at the end of the calendar year. The depreciation for 2008 will be Rs. 1,300 as shown below:

Rs.

On Rs. 10,000 for one year @10% 1,000

OnRs.6,000 for six months@10% 300

OnRs.6,000 for six months@10% 300

1,300

Treatment in case of Loose Tools: In some cases, like loose tools, depreciation is arrived at by comparing the value on two dates. Suppose loose tools were valued at Rs. 2,300 on 1st January, 2008andatRs.2,100on31stDecember,2008, the depreciation will be Rs.200.

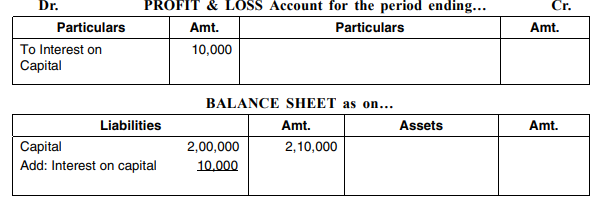

6. Interest on Capital

The proprietor may wish to ascertain his profit, after considering the interest for the amount invested in the firm. Suppose, the capital is Rs. 2, 00,000 and the rate of interest is 5%. Then, the interest will be Rs. 10,000. It will be treated like other expenses and debited to the Profit and Loss Account; the amount will also be credited to the Capital Account. The entry is:

Interest on Capital Account …Dr.10, 000

To Capital Account 10,000

In the final statements of account, the item will appear as shown below:

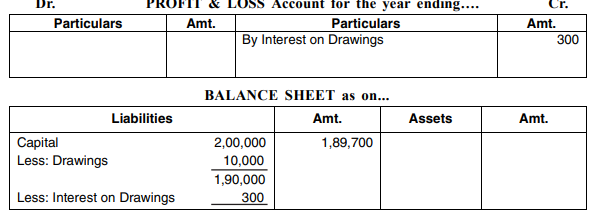

Interest on Drawings

The proprietor may also realize that when he draws money for private use, the firm loses interest as funds for business are reduced. Therefore, the proprietor’s capital may be debited with the interest on the money drawn by him. Interest will depend on the amount and the date of withdrawal concerned. In absence of information about the date of drawings, it should be assumed that the drawings were made, evenly, throughout the year; therefore, interest should be charged for six months on the full amount. Suppose, capital is Rs. 2, 00,000 and the total drawings are Rs.10,000. The rate of interest is 6%onthedrawings.

The average amount of drawings on which interest is to be charged is Rs. 5,000. So, interest @ 6% on drawings Rs. 5,000 will be Rs. 300. The entry to be passed is:

Interest on Drawings ...Dr. Rs.300

To Profit & Loss Account Rs.300

It will be shown as follows:

Drawings and Interest on drawings are reduced from Capital account.

Drawings and Interest on drawings are reduced from Capital account.

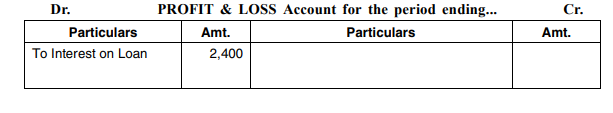

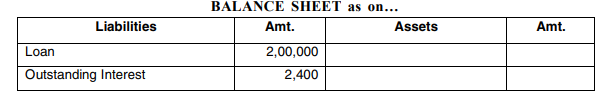

7. Interest on Loan

Interest must be paid on loans, whether there is profit or loss. It is calculated by reference to the rate of interest agreed to be paid by the firm. Suppose a loan of Rs. 20,000 is taken on 1st May 2008 at 18%, if the accounts are closed on 31st December, the interest for the year will be Rs. 2,400 i.e., Rs. 20,000 × 18/ 100 × 8/ 12. The amount of the interest, if not paid, is to be credited to the Outstanding Interest Account. The debit entry will be to the Interest on Loan Account. The entry is:

Interest on Loan Account …. Dr. Rs.2, 400

To Outstanding Interest Account Rs. 2,400

The item will figure as follows in the final accounts:

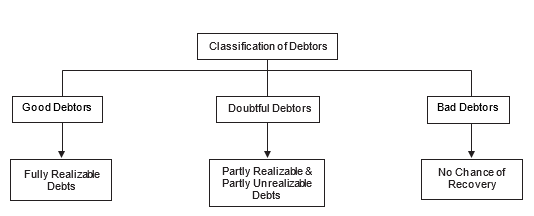

8. Classification of Debtors

Once goods are sold on credit, debtors appear in accounts. In place of debtors, bills receivable may also appear. Debtors and bills receivable represent the amounts to be received by the firm for the credit sales made. All debtors and bills receivable may not be realizable. Where recovery is impossible, those amounts are to be written off as bad debts. Against likely bad debts, provision is required to be made. Both bad debts and provision for bad debts reduce the profits of the firm.

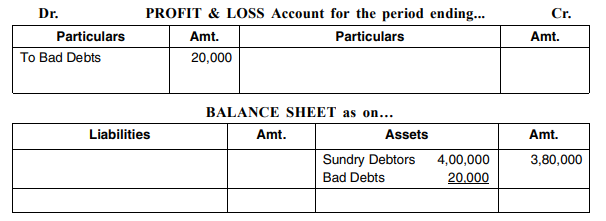

9. Bad Debts

Credit sales have become a must these days and bad debts occur, when there are credit sales. Bad Debt is a loss to the business and a gain to the debtor. The following journal entry should, therefore, be passed in the event of a debt becoming bad.

Bad Debts A/c Dr.

To Debtor’s Personal A/c

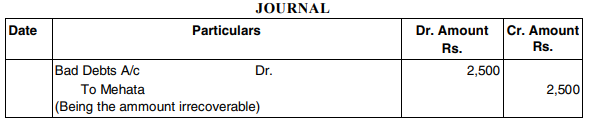

Illustration No. 2

Kalyan & Co. Has been running its cloth business. At the end of Dec. 2008, the firm’s books of accounts show the debtors at Rs. 4,00,000. Out of those debtors, Rs. 20,000 have been recognized as bad debts as those debtors have become insolvent.

Show the position in the financial statements.

Solution:

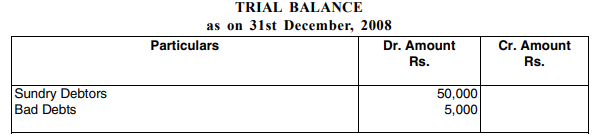

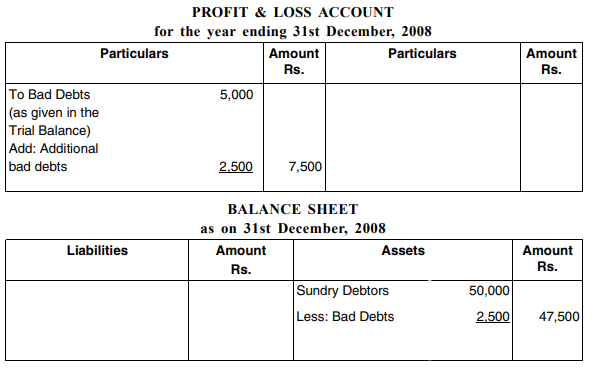

Illustration No. 3

Following are the extracts from Trial Balance of a business.

Additional information: Mehata, one of the debtors became insolvent and it was learnt on 31st December, that out of the total debt of Rs. 5,000 only Rs. 2,500, will be recovered from him. No adjustment has so far been made.

You are required to pass necessary adjusting entries and show how the items will appear in the Final Accounts of the business.

Solution:

Note: Bad debts, appearing in Trial Balance, have already seen provided for. Now, the adjustment relates to additional bad debts for the amount appearing in sun dry debtors.

10. Provision for Bad and Doubtful Debts

Prudent accounting principle is to make provision for expected losses and not to take credit for expected profits.

All credit sales would not be realized in the year in which the sales are made. Sales may be made in one year and actual realizations may happen in the succeeding year. A firm, therefore, makes provision at the end of the accounting year, for likely bad debts, which may happen during the course of the next year. The simple reason is all collections do not occur in the same year in which sales are made. Some sales are likely to become bad in the course of the next year. So, the proper course would be to charge such likely bad debts in that accounting year in which sales have been made, since, the profit on such sales has been considered in the year in which the sales have been made.

The following journal entry is passed for creating a provision for bad debts.

Profit & LossA/c Dr.

To Provision for Bad and Doubtful Debts

The provision for bad debts is charged to the Profit & Loss Account and is deducted from debtors in the Balance Sheet.

Calculation of Provision for Bad and Doubtful Debts: Normally, problem states the % of Provision for Bad and Doubtful Debts. On which amount of debtors, this % of Provision for Bad and Doubtful Debts is to be calculated?

- From debtors, first deduct total bad debts from debtors. Bad debts are that amount, appearing in the trial balance and any further provision that may be required in the adjustment for bad debts.

- On the balance amount of debtors only, Provision for Bad and Doubtful Debts is to be calculated. Reason is simple. Once, debt becomes bad, it would be written off. So, bad debts amount is already excluded from debtors. The balance amount of debtors is only good debts, expected to be realized. Even this amount may not be totally recoverable and for this reason only, Provision for Bad and Doubtful Debts would be created.

Provision for Bad and Doubtful Debts is to be calculated on that amount of debtors, after deducting bad debts. Provision for Bad and Doubtful Debts is not to be calculated on the total amount of debtors.

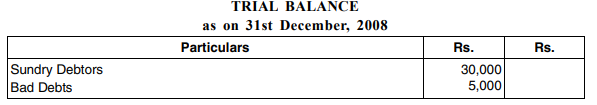

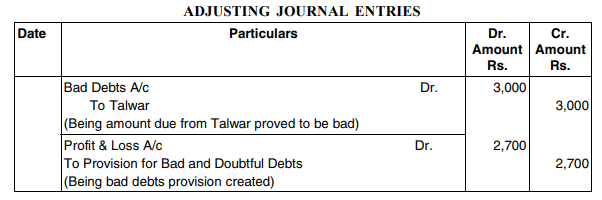

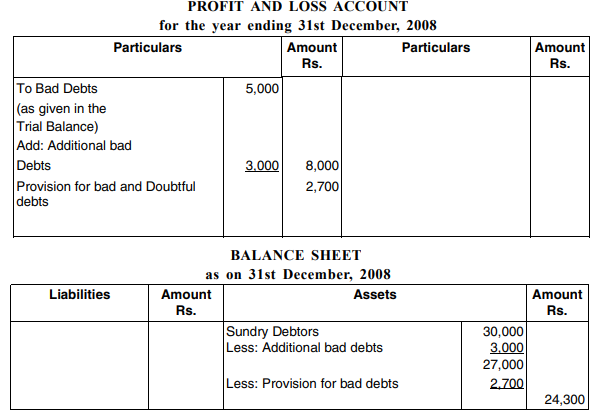

Illustration No. 4

Following are the extracts from the Trial Balance of a firm.

Additional Information:

1. After preparing the Trial Balance, it is learnt that a debtor, Talwar has become insolvent and therefore, the entire amount of Rs3,000 due from him was irrecoverable.

2. Create10%provision for bad and doubtful debts.

You are required to pass necessary adjusting entries and show how the items will appear in the firm’s Balance Sheet.

Solution:

The provision for bad debts created at the end of the accounting year is carried forward to the next year. At the end of the next year, suitable adjusting entry is passed for keeping the provision for doubtful debts at an appropriate amount to be carried forward.

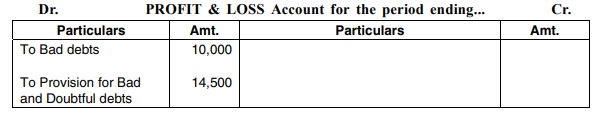

Illustration No. 5

Kishore & co. Has been a running garment business. At the end of Dec, 2007, the firm’s books of accounts show the debtors at Rs. 3, 00,000. Out of those debtors, Rs. 1,000 are not traceable and to be treated as bad debts. By practice, over the years, it has been noticed that the business loses money even on the expected realizations from the good debtors too. The business adopts a consistent policy of making a provision of 5% on the expected good debtors towards bad and doubtful debts.

Show the position in the financial statements.

Solution:

Note: Provision for Bad and doubtful debts is to be made on Rs. 2,90,000 but not on Rs. 3,00,000 as Rs. 10,000 has already, been removed as bad debt from sundry debtors. Chance of becoming bad is on the balance amount only i.e., Rs.2, 90,000.

Presentation in Accounts for Bad Debts & Provision for Bad and Doubtful Debts: Students, in particular non-commerce people, often experience difficulty when both bad debts and provision for bad doubtful debts are to be made, in particular, when the trial balance is already showing the provision for bad and doubtful debts.

Trial balance is showing the provision for bad and doubtful debts. So, this was the balance for bad and doubtful debts at the end of the last year, which has been carried forward.

Follow the simple approach:

- Show bad debts and provision for bad and doubtful debts, separately, in Profit and Loss Account. Do not club them up.

Presentation in Profit & Loss account:

- If the current year’s provision for bad and doubtful debts, required to be made, is more than the provision for bad and doubtful debts shown in the trial balance, show the additional provision on the debit side of the profit and loss account as this is an additional expense.

- Is the current year’s provision for bad and doubtful debts, required to be maintained at the end of the year, is less than the provision for bad and doubtful debts shown in the trial balance? Show the excess provision (Last year’s provision in shown Trial Balance– provision required to be maintained in current year) on the credit side of the profit and loss account. This is an income, as the earlier estimated expense is no longer needed to be continued.

Presentation in Balance Sheet:

Deduct first provision for bad debts and later provision for bad and doubtful debts, required to be maintained at the end of the year, from the debtors in the balance sheet.

The following problem explains the treatment of higher provision for bad and doubtful debts:

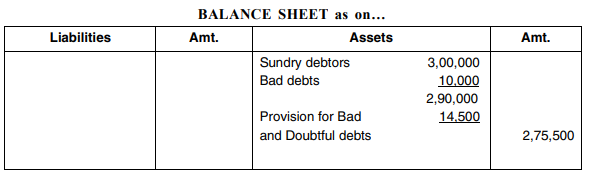

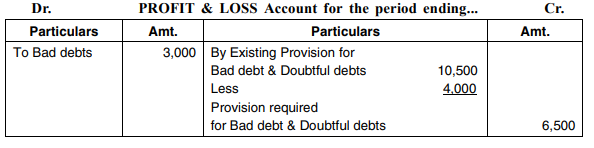

Illustration No. 6

At the end of the year 2008, Radhi & Co. Has observed that their the debtors are Rs. 5, 00,000. Out of those debtors, Rs. 5,000 are not traceable and to be treated as bad debts. By practice, over the years, it has been noticed that the business loses money on the expected realizations from the good debtors too. The business adopts a consistent policy of making a provision of 5% on the expected good debtors. Provision for bad and doubtful debts stand at Rs. 14,500 at the end of Dec, 2007.

Show the position in the financial statements.

Solution:

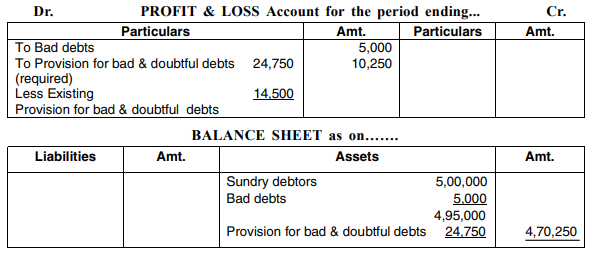

The following illustration shows the presentation when provision for bad debts, now, needed is lower than the existing provision in the trial balance:

Illustration No. 7

At the end of the year 2008, Dimpy & Co. Has observed that their the debtors are Rs. 2,00,000. Out of those debtors, Rs. 3,000 are to be treated as bad debts. Provision for bad & doubtful debtsRs.4,000isneededattheendofDec,2008.

Provision for bad & doubtful debts stand at Rs. 10,500 at the end of Dec, 2007. Show the position in the financial statements.

Solution:

11. Accidental Losses

Stock of goods may also be destroyed or damaged by fire, etc. As a result, the value of the closing stock will be lower than otherwise. This will reduce the amount of the gross profit and, in turn, net profit, automatically. It is always better to ascertain the gross profit, which would have been earned, in absence of the loss since this enables the firm to judge its trading operations, properly. This will be possible if the amount of the loss of goods is credited to the Trading Account and debited to the Profit and Loss Account. By this entry, the increases in the gross profit will be neutralized by the debit to the Profit and Loss Account and thus the net profit will not be affected.

The entries to be passed, say, in case of fire, are as follows:

Loss of goods by Fire Account ……Dr.

To Trading Account.

If there is an insurance policy to cover the goods concerned, part or the whole amount of loss may be admitted by the insurance company. The amount received or agreed to be paid by the insurance company will be credited to the Loss of Goods by Fire Account. The remaining amount only will be transferred to the Profit and Loss Account as a write off as this would be the final loss due to accident.

(ii) Profit and Loss Account …. Dr. To Loss of goods by Fire Account

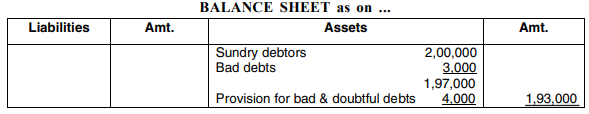

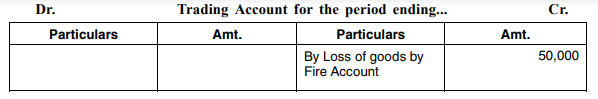

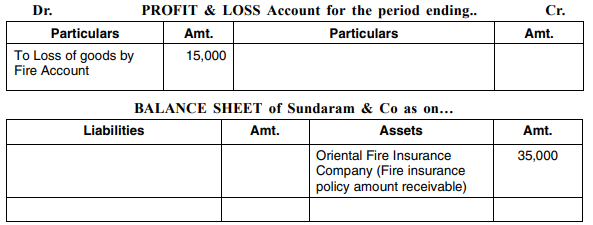

Illustration No. 8

Sundaram & Co. Has lost stocks in a fire accident Rs. 50,000. Amount admitted by Oriental Fire insurance company under the fire insurance policy is Rs. 35,000. The claim amount is yet to be received from the insurance company. Show the presentation in the Trading, Profit and Loss Account and Balance Sheet.

Solution:

Note: Out of a loss of Rs. 50,000, Oriental Fire insurance company has admitted the claim for Rs. 35,000. Sundaram & Co. Can recover Rs. 35,000 only from the Oriental Fire insurance company. Hence, the net loss due to fire accident Rs.15, 000 has been written off to Profit and Loss Account.

12. Commission Payable on Net Profits

Sometimes, Company may provide an incentive to the manager in the form of commission on profits to improve profitability of the company. Suppose the profit earned by the firm is Rs. 80,000, without considering the commission; commission is 5%. The commission will be then Rs. 4,000. The profit will be reduced to Rs. 76,000. The entry to be passed will be to debit the Profit and Loss Account and credit the Commission Payable Account. This account will be a liability and shown in the balance sheet.

Sometimes, commission may be on the net profits of the company. If the rate of the commission is 5%, then the profit remaining after the commission should be Rs. 100. In such an event, the profit before the commission should be Rs. 105. In other words, commission is Rs. 5 out of every Rs. 105 profit, before the commission.

The formula to calculate the commission in such a situation is: 5/105 × Profits before the commission.

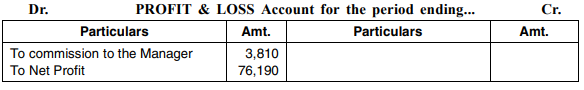

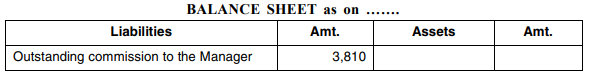

Illustration No. 9

Kalyan & Co. Agrees to pay a commission 5% on net profits to its manager. The profit before commission is Rs. 80,000. The commission has not yet been paid by the company to its manager.

Show the necessary entries in the financial Statements.

Note: The manager is entitled to a commission of 5% on net profits. So, before deducting commission, profits should be Rs. 105 to enable him to get a commission of Rs. 5. The commission will be Rs. 3,810, i.e., Rs. 80,000 × 5/105. The profit after the commission is Rs. 76,190 and Rs.3, 810is5%ofthisfigure.

If the commission is calculated, directly, on Rs. 80,000, it will be wrong as the remaining profit would be Rs. 76,000 and 5% of Rs. 76,000 is not Rs. 4,000.

Difference between microeconomics and macroeconomics

Micro Economics

Microeconomics (Greek prefix micro-meaning "small") is a department of economics that research the conduct of people and groups in making choices approximately the allocation of scarce assets. "Interaction among those people and groups"

Microeconomics is a observe of character, family, and company conduct in choice making and aid allocation. It usually applies to the marketplace for items and offerings and offers with non-public and economic problems.

Meaning

Microeconomics is a observe of character, family, and company conduct in choice making and aid allocation. It usually applies to the marketplace for items and offerings and offers with non-public and economic problems.

Microeconomics is a department of economics that research the conduct of people and groups in making choices approximately the allocation of scarce assets and their interactions among people and groups.

This is taken into consideration to be fundamental economics. Microeconomics may be described as a discipline of financial evaluation that research the financial conduct of character units, which include people, precise households, or precise companies.

The production of goods and services is based on the allocation of scarce resources.

Efficient Goods Distribution – It investigates issues related to

(a) product pricing,

(b) factor pricing, and

(c) economic welfare.

a. Product pricing – Includes product pricing under monopoly, perfect competition, etc., taking into account supply, demand, production costs, and more.

b. Factor Pricing-Prices factor inputs such as land, labor, capital, and organization in the form of rent, wages, interest, and profits, respectively.

c. Economic Welfare – It includes research on the greatest interests for producers and the greatest interests for consumers.

Macroeconomics

The term "macro" was first utilized in economics by Frisch in 1933. However, it came from the 16th and 17th century mercantilists as a methodological approach to economic problems. They were interested in the entire economic system. In the 18th century

Physiocrats adopted it in the table economy, showing a "cycle of wealth" (i.e., net production) among the three classes represented by the peasant, landowner, and barren classes.

Malthus, Sismondi and Marx within the 19th century addressed macroeconomic issues. Walrus, Wicksell and Fisher contributed modernly to the development of pre-Keynes macroeconomic analysis.

Certain economists such as Cassel, Marshall, Pigoubian, Robertson, Hayek, and Hortley developed the Quantity Theory of Money and General Price Theory in the decade following World War I. However, Keynes eventually developed a general theory of income, output, and employment. I have credibility in the wake of the Great Depression.

Economics is the science of producing, exchanging, and consuming various commodities in the economic system. It is a rare resource that can reduce the abundance of human welfare. The central focus of economics is the choice between resource depletion and its alternative uses. The word "economics" comes from the Greek words "oikos" (house) and nemein (manage), which means to manage a household with limited funds.

Macroeconomics is a crucial concept that considers the entire country and works for the welfare of the economy.

1. Business cycle analysis

Timing of economic fluctuations helps prevent or prepare for financial crises and long-term negative situations.

2. Formulation of economic policy

The fiscal and monetary policy system relies entirely on an extensive analysis of the country's macroeconomic situation.

3. Reduce the effects of inflation and deflation

Macroeconomics is primarily aimed at helping governments and financial institutions prepare for a country's economic stability.

4. Promote material welfare

This economic stream provides a broader perspective on social or national issues. Those who want to contribute to the welfare of society need to study macroeconomics.

5. Regulate the economic system

It continues to guarantee or check the proper functioning and actual position of the country's economy.

6. Solve economic problems

Macroeconomic theory and problem analysis help economists and governments understand the causes and possible solutions to such macro-level problems.

7. Economic development

By utilizing macroeconomic data to respond to various economic conditions, the door to national growth will be opened.

Basic problems of an economy along with case studies

Problem 1. What to produce and in what quantity?

The first significant problem of the financial system is determining which items and offerings to supply and in what quantity. This consists of the allocation of scarce sources associated with the composition of overall manufacturing withinside the financial system. Due to the dearth of sources, society has to determine what merchandise to supply, inclusive of wheat, cloth, roads, televisions, power and buildings.

Once the nature of the product to be produced is determined, the quantity is determined. Tonnage of wheat, number of televisions, millions of kilowatts of electricity, number of buildings, etc. Due to the lack of economic resources, the question of the nature and quantity of goods should be determined based on: Social priorities or preferences.

If society prioritizes the production of more consumer goods than it does now, it will be less in the future. A high priority for capital goods means less consumer goods now and in the future. However, due to lack of resources, if one product is mass-produced, another product must be mass-produced.

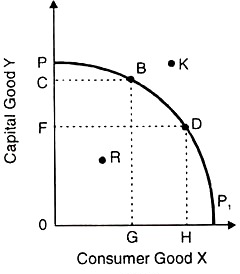

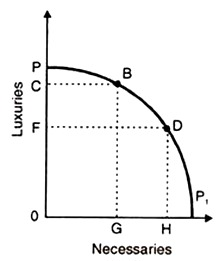

This problem can also be explained using a productivity curve, as shown in Figure.

Suppose the economy produces capital goods and consumer goods. In determining the total output of an economy, society must choose that combination of capital and consumer goods that is in harmony with its resources.

The combination R inside the productivity curve PP1 is not selectable as it reflects the economic inefficiency of the system in the form of resource unemployment. Nor is it possible to select a combination R that is outside the scope of society's current productivity. Society lacks the resources to create this combination of capital and consumer goods.

Therefore, you should choose from combinations Â, E, or D that give you the highest level of satisfaction. If society decides to have more capital goods, it chooses combination B. If you need more consumer goods, choose Combination D.

Problem # 2. How to produce these products?

The next fundamental issue of the economy is determining the technology and methods used to produce the goods needed. This issue depends primarily on the availability of resources within the economy.

If you have a lot of land, it may be extensive farming. If you are short on land, you can use intensive tillage methods. If you have a large workforce, you may use labor-intensive technology. On the other hand, in the case of labor shortage, capital-intensive methods may be used.

The technology used also depends on the type and quantity of products produced. Producing capital goods and large-scale products requires complex and expensive machinery and technology. Simple consumer goods and small products, on the other hand, require small, inexpensive machines and relatively simple technology.

In addition, it is necessary to decide what goods and services will be produced in the public sector and what goods and services will be produced in the private sector. However, when choosing from different production methods, it is necessary to adopt methods that bring about efficient allocation of resources and improve the productivity of the economy as a whole.

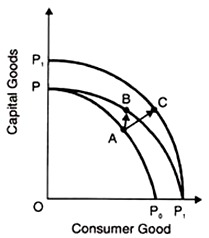

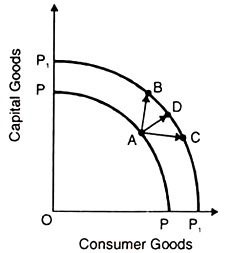

Suppose the economy is producing a certain amount of consumer and capital goods at point A on the PP curve in Figure. Considering the supply of elements, adopting new production technology will improve the production efficiency of the economy. As a result, the PP0 curve shifts outward to P1P1.

This will produce more consumer and capital gods from point A on the PP0 curve to point С on the PP, creating a new productivity curve and the economy will produce more of both commodities from point A. Go to.

Problem # 3. For whom is the product produced?

The third basic issue to be decided is the distribution of goods among the members of society. Basic consumer goods and necessities, luxury comfort, and distribution between households are based on the distribution of national income.

Anyone who has the means to buy goods may have it at that time. The rich make up the majority of luxury goods, and the poor may have more of the basic consumer goods they need. This problem is shown in Figure. Here, the productivity curve PP shows the combination of luxury goods and necessities.

At the point В of the PP curve, the economy has created a lot of luxury for the wealthy and less needed for the art. On the other hand, at point D, we are increasing the OH required for the poor and decreasing the need for the rich.

Problem # 4. How efficiently are your resources being used?

This is one of the key fundamental issues of the economy. Because, after making the previous three decisions, society needs to make sure that its resources are being fully utilized. When economic resources are wasted, we must find ways and means to make full use of them.

If the laziness of resources such as human resources, land and capital is due to male allocation, society needs to adopt such financial, financial or physical measures to remedy this. This is shown in Figure. Here, the productivity curve PP reflects the idle resources in the economy at point A, and the productivity curve P1P1 reflects the full utilization of resources at point  or C.

Society produces more capital goods at point Â, more consumer goods at point C, or full employment at point D in an economy where available resources are fully utilized. Decide whether to produce both at the level. It is characterized by technical efficiency or full employment.

To keep it at this level, the economy must constantly increase production of some goods and services by giving up on others.

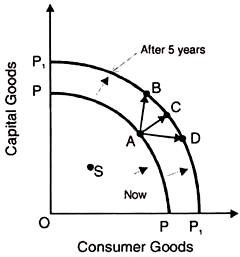

Problem # 5. Is the economy growing?

The last and most important issue is determining whether the economy is growing or stagnant over time. If the economy is stagnant at any point within the productivity curve, as shown in Figure, then you need to move to the productivity curve PP. This causes the economy to produce more consumer and capital goods.

Economic growth occurs through higher capital formation rates, which consist of replacing existing capital goods with new and more productive ones, either by adopting more efficient production technologies or through innovation.

This shifts the productivity curve outward from PP to P1P1. The economy moves from point A on the P1P1 curve to В or С or D, for example after 5 years. Point С represents a situation in which both consumer and capital goods are mass-produced in the economy. Economic growth allows the economy to have more of both commodities.

Key takeaways:

- Economics is defined because the science that deals with the assembly, distribution and consumption of products and services.

- The nature of economics deals with the question of whether economics falls into the category of science or art.

- Science deals with systematic studies of causality. In science, facts and numbers are collected and systematically analyzed to reach specific conclusions.

- It is said that "knowledge is science and action is art." Economic theory is used to solve various economic problems in society. Therefore, it can be inferred that not only social science but also economics is an art.

- Economists use different economic theories to solve different economic problems in society.

- Microeconomics examines individual economic activities, industries, and their interactions.

- Basic problems of an economy.

- The first central issue of the economy is deciding which goods and services to produce and in what quantity.

- The next fundamental issue of the economy is determining the technology and methods used to produce the goods needed.

- The third basic issue to be decided is the distribution of goods among the members of society

- This is one of the key fundamental issues of the economy. Because, after making the previous three decisions, society needs to make sure that its resources are being fully utilized. When economic resources are wasted, we must find ways and means to make full use of them.

- The last and most important issue is determining whether the economy is growing or stagnant over time.

8. Microeconomics studies individual and business decisions, while macroeconomics analyzes decisions made by countries and governments.

9. Microeconomics has been a bottom-up approach, focusing on supply and demand, and other forces that determine price levels.

10. Macroeconomics takes a top-down approach, looks at the economy as a whole, and tries to determine its course and nature.

Structure of construction industry

A construction company’s organizational structure refers to both the arrangement of job roles and the reporting and operational relationships between and within these roles. A variety of roles and responsibilities – including marketing, purchasing, human resources, finance, pre-construction tasks and construction operations – most often make such a corporate structure organized according to departments, functions or areas of responsibilities most appropriate to organizational design.

Functional Design Characteristics

Functional departmentalization is an example of a traditional, hierarchical organizational structure. Defining characteristics include horizontal separation of the various departments and functions, well-defined lines of control and top-down communications. For example, authorities and communications flow from the business owner to the management team to project managers or superintendents and finally to rank-and-file construction employees.

A main reason most construction companies group roles that require similar knowledge and skills into a functional organizational structure is that it increases operational efficiency and promotes the development of departmental expertise.

Departmental Horizontal Separation

The size of a construction company determines the degree of horizontal separation. Although the business owner assumes a general management role regardless of the size of the business, the business owner’s roles and responsibilities are often greater in a small construction company. In addition, while larger construction companies most often include a higher degree of horizontal separation, smaller companies may combine similar roles.

For example, small companies may combine marketing and development, and community affairs into a single business development department, while a larger company might separate these into two distinct departments.

Directional Communication Patterns

A main disadvantage of a departmentalized organizational structure is that it can lead to situations in which department goals, such as risk management and construction operations, become more important than overall strategic company objectives. In addition, coordination of work efforts across departmental boundaries may become more difficult or confusing the larger a construction company becomes.

Directional communication patterns characteristic of a departmentalized organizational structure may contribute to the development of these situations. For example, horizontal communications most often only take place between staff members of equal or comparable rank, while vertical patterns typically relate to a business’s internal chain-of-command. In the absence of a good horizontal communication system, this could lead to lower-ranking project managers or superintendents continually finding themselves answering to multiple senior department heads.

Inter-Departmental Organizational Design

Specific job roles follow the same hierarchical structure, decision-making and communications flow. For example, authorities in a hierarchical structure in the construction operations department might flow from the operations department head to project executives to project managers to project superintendents. The degree of authority, however, depends on company policies and often on the size of the business.

In some construction companies, the project superintendent might focus solely on organizing, planning and scheduling a construction project, leaving all responsibilities associated with site supervision to the project or site manager. In others, however, the project supervisor might take a more direct field supervision role, requiring the project or site manager to follow and administer higher-level decisions.

Economies of road and buildings

Roads are the arteries through which the economy pulses. By linking producers to markets, workers to jobs, students to school, and the sick to hospitals, roads are vital to any development agenda. Since 2002, the World Bank has constructed or rehabilitated more than 260,000 km of roads. It lends more for roads than for education, health, and social services combined. However, while roads bring economic and social benefits, they can also come with social costs such as pollution or deforestation. The Amazon rainforest is crisscrossed by almost 100,000 km of roads—enough to circle the Earth two and a half times. And the transport sector accounts for about 23 percent of global energy-related carbon dioxide emissions and a significant share of local particle pollution. Such tradeoffs need to be weighed when planning any intervention.

Roads make a crucial contribution to economic development and growth and bring important social benefits. They are of vital importance in order to make a nation grow and develop. In addition, providing access to employment, social, health and education services makes a road network crucial in fighting against poverty. Roads open up more areas and stimulate economic and social development. For those reasons, road infrastructure is the most important of all public assets.

Surveys show that adequately maintaining road infrastructure is essential to preserve and enhance those benefits. But a backlog of outstanding maintenance has caused irreversible deterioration of the road network. If insufficient maintenance is carried out, roads can need replacing or major repairs after just a few years. That deterioration spread across a road system very quickly results in soaring costs and a major financial impact on the economy and citizens.

Management of the road asset involves the application of engineering, financial and management practices to optimize the level-of-service outcome in return for the most cost-effective financial input. Indeed, the main objective is simply to apply the right treatment at the right time to achieve the desired level of service, indicating that the road infrastructure is a financial asset for society and the economy.

Economies irrigation and power

Irrigated farming is a traditional agricultural practice developed over the centuries in countries with a hot climate. Many generations have expended important material and financial resources for the development of irrigation. In droughty regions, artificial increase of soil moisture content (using irrigation systems) is frequently the only measure capable of meeting the demands of the local population and industry for crop and animal products. Land irrigation improves the water−salt balance of the soil and sustains its economic fertility.

Irrigation farming involves a higher level of agricultural production standards, as compared to dry farming. Its specificity is the use of two principal means of production land and water in a single technology of crop production. From the viewpoint of economics, the increase in productivity in irrigation farming is due to capital investment into the fertility of irrigated areas.

An irrigation system (IS) is a technological synthesis of water management and agriculture, realized through transportation of water from a source to an irrigated field. Therefore, the economics of IS is closely related to the economics of water management and agriculture.

The construction and management of ISs have been continuously improved through application of science and technology. This can now be regarded as an independent branch of economic activity in the field of land development and land reclamation.

The productivity of agricultural land under natural conditions is mainly determined by the land category, soil quality, and climatic conditions. The effect of irrigation on land productivity differs across the world regions and depends on the natural level of soil moistening. In the droughty regions of Asia, Africa, the Middle East, and South America, the potential productivity of agricultural land increases significantly with artificial irrigation, in combination with other agricultural practices.

Irrigated areas constitute about 17% of the total farmland in the world and provide 50% of the global agricultural produce. In the Middle Eastern countries, irrigated fields yield 70% of the agricultural produce.

The volume of irrigation water conveyed to a field dictates the engineering parameters of the IS. This volume is calculated from data on the water budget of the soil and water consumption of each crop. Increase in crop yield from irrigation in the zone of insufficient precipitation is much higher than that in zones where rainfall is plentiful. In droughty regions, irrigation increases the productivity of the land by a factor of two or more.

The objective of irrigated is to decrease dependence of agriculture on climatic conditions. In tropical and subtropical regions, irrigation farming makes it possible to produce agricultural commodities (grain, fodder, vegetables, and fruits) all the year round. Though expenditure of labor, financial, and material resources per unit area of irrigated farmland are higher than those in dry farming, the gain in yield makes irrigation farming economically attractive.

In irrigated farming, water is an essential element of production. By period of water supply, two types of irrigation are distinguished: seasonal irrigation (SIr) and continuous irrigation (CIr).

SIr depends on the number and duration of rainy and dry seasons, and the height of floods. Water for irrigation is accumulated by the establishment of 30 to 40 cm high earth embankments on fields, and by construction of dams in order to retain rainwater and floodwater. This type of irrigation is widespread in southern and south-eastern Asia.

CIr makes use of rivers, water reservoirs, wells, and other water sources via the construction of a complex irrigation system, including mechanical or gravity water extraction, inter-farm conveying channels, networks of farm channels, gutters, and pipelines delivering water to particular fields, and irrigation equipment to ensure appropriates rates and timing of irrigation.

Economies of port and aviation

The sectors of port and aviation are very important for the growth and development of any economy. This is because they involve handling of both commuter as well as cargo traffic. In India, the government has taken several initiatives for the growth of these sectors. But a lot more is to be done given the potential of both these sectors.

Port sector

As per a report of India Brand Equity Foundation (IBEF), the cargo traffic attended by Indian ports in 2015 were of value 1,052 Million Metric Tonnes (MMT) which is going to increase to 1,758 MMT by 2017. Though the increase is not very significant but it is important to sustain the growth for which cooperation between the private sector and the government is needed. The government has declared several initiatives for the betterment of the sector. Prominent among them include the Sagarmala initiative wherein the government plans to invest 70,000 crore for development of 12 major ports in the next five years. The initiatives like Sagarmala provide wonderful opportunities of public private partnerships.

Out of the ports operational in India, major ports are registering a steady growth as compared to minor ports. According to an IBEF report, major ports saw a 4.6% yearly increase of cargo traffic. The value rose to 264.73 million tonnes during April -August in 2016. The report also gave the segment wise percentage of the cargo traffic attended at ports which stands as P.O.L.(Port of Loading) at 32.44 %, coal at 24.09%, container traffic at 19.65%, other cargo at 12.68 %, iron ore at 4.6% and other liquids at 4.13%.Regarding minor ports, a report by ICRA (Information and Credit Rating Agency)states that there has been a decline in volumes of cargo handling by 1% in the Financial Year (FY) 2016.The drop is of 18% in iron ore, 11% in other cargo and 8% in coal volumes.

In such a scenario, the economists are of the view that the government needs to consider issues related to both major and minor ports. It should devise port specific plans to make them profitable. This would ensure business for minor as well as major ports. The government is increasing its budgetary allocation for the sector on a regular basis. For instance, the revised estimate of the Budget 2016-17 had 450 crore for the Sagarmala project which has been increased to 600 crore in the Budget estimate of 2017-18. But then it is important to review the success of projects regularly and subsequently address the shortcomings. The government also needs to pay attention to the concerns of the private companies regarding availability of liquidity. Together with banking institutions, the government can devise mechanisms which can benefit all parties.

Regarding foreign investments, a report by the Department of Industrial Policy and Promotion (DIPP) under Ministry of Commerce and Industry states that Foreign Direct Investment (FDI) received by the Indian ports sector between April 2000 and March 2016 was of value $1.64 billion. The experts feel that the investment in the sector can increase from the foreign shores in future as the government has allowed 100 % FDI. The quantity of investment will only vary depending on global economic situation.

Economists are of the view that investments from abroad will serve several purposes. It will bring in the required technologies necessary for the upgradation of the cargo handling capacity of the existing ports. Also, by virtue of the new investments, permanent assets will be created in form of establishment of new ports. Economic activity will be escalated. Also, with buzzing economic activity taking place at the ports, foreign trade will increase.

Aviation

International Air Transport Association (IATA) in a report has estimated that India which is currently at ninth position will become the third largest aviation marketplace replacing the United Kingdom by 2026.With several governmental initiatives in place along with eager participations from the private sector, the aviation sector has bright prospects.

Both the cargo and passenger traffic segment is showing steady increase in capacity. According to a report by Department of Industrial Policy and Promotion (DIPP), Ministry of Civil Aviation, the passengers carried by scheduled domestic airlines have increased by 29% from 148 million during April 2012 to March 2014 to 190 million in April 2014 to March 2016.Also a latest report from the Directorate General of Civil Aviation (DGCA) states that total passenger traffic increased by 23.10 % to 90.36 million during January to November 2016. This shows that there is no dearth of passengers for the airline’s companies. In fact, a vast price conservative market is lying untapped. Both luxury and low-cost carriers can cater to this market by lowering the price of air tickets.

Regarding cargo handling, a report from Airport Authority of India (AAI) shows that the international and domestic freight traffic both have registered a growth of 8.2% and 4.7% respectively leading to an increment of 6.9% in total freight traffic during April to June 2016-17 as compared to April to June 2015-16.

Also due to government allowance of 100% FDI in airports and nonscheduled air carriers under automatic route, the FDI inflow has substantially increased in the sector. The report by DIPP states that the rate of FDI has grown by 605% from $61.84 million during April 2012 to March 2014 to $435.81 million from April 2014 to March2016.

Further, the government initiatives like framing a concrete National Civil Aviation Policy (NCAP) 2016, launching of UDAN (Ude Desh ka Aam Naagrik) scheme, development of Maintenance, Repair and Overhaul (MRO) sector in India related to aviation will act in boosting the sector. The provisions of Budget 2017-18 like development of some selected airports of tier two cities under the PPP mode, modification of Airport Authority of India Act for enhanced usage of land assets will pave way for more sectoral investments.

Key takeaways

A construction company’s organizational structure refers to both the arrangement of job roles and the reporting and operational relationships between and within these roles

References:

- Engineering Economics Management, Dr. Vilas Kulkarni and Hardik Bavishi, S. Chand Publication

- Laws for Engineers, Vandana Bhatt and Pinky Vyas, Pro Care Publisher

- Indian Economy, Gaurav Datt and Ashwani Mahajan, S. Chand Publication

- Industrial Organization & Engineering Economics, T. R. Banga and S. C. Sharma, Khanna Publisher