Unit - 2

Introduction to Financial Management

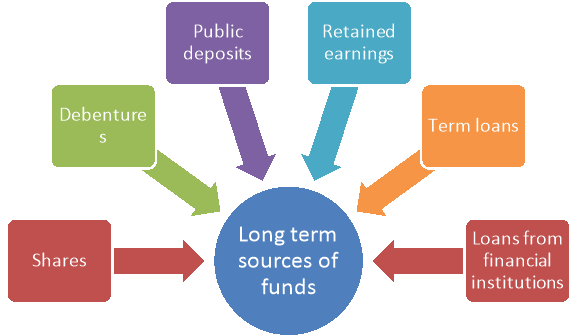

Long term source of finance

Long term funds are required for purchase of fixed/permanent assets of an organization. Some of the popular long term sources of funds are-

The main sources of long term finance are as follows:

Figure: Sources of long term funds

- Shares:

These are issued to the general public. These may be of two types: (i) Equity and (ii) Preference. The holders of shares are the owners of the business.

2. Debentures:

These are also issued to the general public. The holders of debentures are the creditors of the company.

3. Public Deposits:

General public also like to deposit their savings with a popular and well-established company which can pay interest periodically and pay-back the deposit when due.

4. Retained earnings:

The company may not distribute the whole of its profits among its shareholders. It may retain a part of the profits and utilize it as capital.

5. Term loans from banks:

Many industrial development banks, cooperative banks and commercial banks grant medium term loans for a period of three to five years.

6. Loan from financial institutions:

There are many specialized financial institutions established by the Central and State governments which give long term loans at reasonable rate of interest. Some of these institutions are: Industrial Finance Corporation of India (IFCI), Industrial Development Bank of India (IDBI), Industrial Credit and Investment Corporation of India (ICICI), Unit Trust of India (UTI), State Finance Corporations etc. These sources of long term finance will be discussed in the next lesson.

Key takeaways

- Long term funds are required for purchase of fixed/permanent assets of an organisation. Some of such sources are shares, debentures, term loans, public deposits etc.

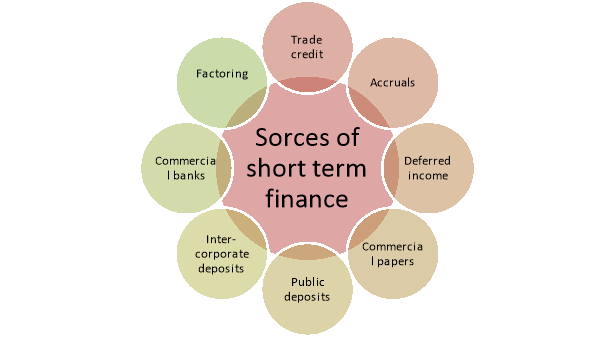

Short term source of finance

Short-term financing is aimed to meet the demand of current assets and pay the current liabilities of the organization. In other words, it helps in minimizing the gap between current assets and current liabilities. There are different means to raise capital from the market for small duration. Various agencies, such as commercial banks, co-operative banks, financial institutions, and NABARD provide the financial assistance to organizations.

Figure: Sources of short term finance

1. Trade Credit:

Trade credit refers to the credit extended by the supplier of goods or services to his/her customer in the normal course of business. It occupies a very important position in short-term financing due to the competition. Almost all the traders and manufacturers are required to extend credit facility (a portion), without which there is no business. Trade credit is a spontaneous source of finance that arises in the normal business transactions without specific negotiation, (automatic source of finance).

2. Accruals:

Accrued expenses are those expenses which the company owes to the other, but not yet due and not yet paid the amount. Accruals represent a liability that a firm has to pay for the services or goods, it has received. It is spontaneous and interest-free source of financing. Salaries and wages, interest and taxes are the major constituents of accruals. Salaries and wages are usually paid on monthly and weekly base, respectively. The amounts of salaries and wages are owed but not yet paid and shown them as accrued salaries and wages on the balance sheet at the end of the financial year. The longer the time lag in–payment of these expenses, the greater is the amount of funds provided by the employees. Similarly, interest and tax are accruals, as source of short-term finance. Tax will be paid on earnings.

3. Deferred Income:

Deferred income is income received in advance by the firm for supply of goods or services in future period. This income increases the firm’s liquidity and constitutes an important source of short-term finance. These payments are not showed as revenue till the supply of goods or services, but showed in the balance sheet as income received in advance.

Advance payment can be demanded by firms which are having monopoly power, great demand for its products and services and if the firm is manufacturing a special product on a special order.

4. Commercial Papers (CPs):

Commercial paper represents a short-term unsecured promissory note issued by firms that have a fairly high credit (standing) rating. It was first introduced in the USA and it is an important money market instrument. In India, Reserve Bank of India introduced CP on the recommendations of the Vaghul Working Group on Money Market. CP is a source of short-term finance to only large firms with sound financial position.

5. Public Deposits:

Public deposits or term deposits are in the nature of unsecured deposits, are solicited by the firms (both large and small) from general public primarily for the purpose of financing their working capital requirements.

6. Inter-Corporate Deposits (ICDs):

A deposit made by one firm with another firm is known as Inter-Corporate Deposit (ICD). Generally, these deposits are made for a period up to six months.

Such deposits may be of three types:

(a) Call Deposits:

These deposits are those expected to be payable on call/on just one day notice. But, in actual practice, the lender has to wait for at least 2 or 3 days to get back the amount. Inter-corporate deposits generally have 12 per cent interest per annum.

(b) Three Months Deposits:

These deposits are more popular among companies for investing the surplus funds. The borrower takes this type of deposits for meeting short-term cash inadequacy. The interest rate on these types of deposits is around 14 per cent per annum.

(c) Six months Deposits:

Inter-corporate deposits are made for a maximum period of six months. These types of deposits are usually given to ‘A’ category borrowers only and they carry an interest rate of around 16 per cent per annum.

7. Commercial Banks:

Commercial banks are the major source of working capital finance to industries and commerce. Granting loan to business is one of their primary functions. Getting bank loan is not an easy task since the lending bank may ask a number of questions about the prospective borrower’s financial position and its plans for the future.

At the same time the bank will want to monitor borrower’s business progress. But there is a good side to this, that is borrower’s share price tends to rise, because investor knows that convincing banks is very difficult. The different types or forms of loans are:

(i) Loans,

(ii) Overdrafts,

(iii) Cash credits,

(iv) Purchasing or discounting of bills and

(v) Letter of Credit.

8. Factoring:

Factoring is one of the sources of working capital. Banks have been given more freedom of borrowing and lending both internally and externally and facilitated the free functioning in lending and investment operations. From 1994, banks are allowed to enter directly leasing, hire purchasing and factoring services, instead through their subsidiaries. In other words, banks are free to enter or exit in any field depending on their profitability, but subject to some RBI guidelines. Banks provide working capital finance through financing receivables, which is known as “factoring”. A “Factor” is a financial institution, which renders services relating to the management and financing of sundry debtors that arises from credit sales.

Key takeaways

- Short-term financing is aimed to meet the demand of current assets and pay the current liabilities of the organization. In other words, it helps in minimizing the gap between current assets and current liabilities.

Equity

Equity financing means exchanging a portion of the ownership of the business for a financial investment in the business. The ownership stake resulting from an equity investment allows the investor to share in the company’s profits. Equity involves a permanent investment in a company and is not repaid by the company at a later date.

The investment should be properly defined in a formally created business entity. An equity stake in a company can be in the form of membership units, as in the case of a limited liability company or in the form of common or preferred stock as in a corporation.

Companies may establish different classes of stock to control voting rights among shareholders. Similarly, companies may use different types of preferred stock. For example, common stockholders can vote while preferred stockholders generally cannot. But common stockholders are last in line for the company’s assets in case of default or bankruptcy. Preferred stockholders receive a predetermined dividend before common stockholders receive a dividend.

Debts and government grants

Lenders of debt capital have senior claim on income and assets of the project. Generally, debt finance makes up the major share of investment needs (usually about 70 to 90 per cent) in PPP projects. The common forms of debt are:

- Commercial loan

- Bridge finance

- Bonds and other debt instruments (for borrowing from the capital market)

- Subordinate loans

Commercial loans are funds lent by commercial banks and other financial institutions and are usually the main source of debt financing. Bridge financing is a short-term financing arrangement (e.g., for the construction period or for an initial period) which is generally used until a long-term financing arrangement can be implemented. Bonds are long-term interest bearing debt instruments purchased either through the capital markets or through private placement (which means direct sale to the purchaser, generally an institutional investor - see below). Subordinate loans are similar to commercial loans but they are secondary or subordinate to commercial loans in their claim on income and assets of the project.

The other sources of project finance include grants from various sources, supplier's credit, etc. Government grants can be made available to make PPP projects commercially viable, to reduce the financial risks of private investors, and to achieve socially desirable objectives such as to induce economic growth in lagging or disadvantaged areas. Many governments have established formal mechanisms for the award of grants to PPP projects. Where grants are available, depending on government policy they may cover 10 to 40 per cent of the total project investment.

Alternative sources

Funding sources also include private equity, venture capital, donations, grants, and subsidies that do not have a direct requirement for return on investment (ROI), except for private equity and venture capital. They are also called “crowdfunding” or “soft funding.”

Crowdfunding represents a process of raising funds to fulfill a certain project or undertake a venture by obtaining small amounts of money from a large number of individuals. The crowdfunding process usually takes place online.

A leverage ratio is an important indicator of financial strength, it sees how much of the company's capital comes from debt and how the company can meet its financial obligations.

- Debt-to-Equity Ratio = Total Debt/Total Equity:

This ratio compares the company’s total debt to its total assets. The higher the debt ratio the more difficult it becomes for the firm to raise debt.

- Equity ratio = (Ordinary Shareholder’s Interest / Total assets) *100:

This ratio measures the strength of the financial structure of the company. A high equity ratio reflects a strong financial structure of the company.

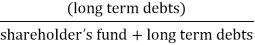

- Capitalization ratio = Long-Term Debt/ (Long-Term Debt + Total Equity):

This ratio measures the debt component of a company’s capital structure. A low level of debt and a healthy proportion of equity in a company’s capital structure is an indication of financial strength.

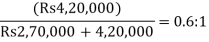

Problem 1:

The company's balance sheet for December 31 is as follows:

Liabilities | Rs | Assets | Rs |

Share capital | 2,00,000 | Land and building | 1.,40,000 |

Profit & loss account | 30,000 | Plant and machinery | 3,50,000 |

General reserve | 40,000 | Stock | 2,00,000 |

12% debenture | 4,20,000 | Sundry debtor | 1,00,000 |

Sundry creditor | 1,00,000 | Bills receivable | 10,000 |

Bills payable | 50,000 | Cash at bank | 40,000 |

| 8,40,000 |

| 8,40,000 |

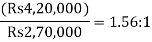

Calculate:

- Debt to equity ratio

Solution:

- Debt to equity ratio=

(or)

Financial markets

A Financial Market is referred to space, where selling and buying of financial assets and securities take place. It allocates limited resources in the nation’s economy. It serves as an agent between the investors and collector by mobilizing capital between them.

In a financial market, the stock market allows investors to purchase and trade publicly companies share. The issue of new stocks are first offered in the primary stock market, and stock securities trading happens in the secondary market.

Types of Financial Markets

The different types of financial markets are explained below in detail.

- Over-the-counter Market: These refer to decentralised financial markets which do not have any physical location. In these markets, trades are conducted directly without any broker. Conducted electronically, these markets handle exchanges pertaining to publicly traded stocks which are not listed in stock exchanges. These markets have fewer regulations in comparison to stock exchanges and therefore also offer lesser functional cost. Typically, these markets are used for trading by small companies which are not available in primary financial markets.

- Bond Market: Bonds are basically securities which allow investors to loan a sum of money. These have a fixed period of maturity and also have pre-determined interest rates. While understanding what are the types of financial markets, students must understand that bond markets sell securities like notes, bills, bonds, etc.

Also known as debt markets, credit markets, and fixed-income markets, these offer financial holdings which are agreement deeds between lenders and borrowers. These agreements note the relevant interest rates, tenures etc.

3. Money Market: These markets trade in highly liquid financial holdings which offer a very short-term maturity tenure (usually lesser than 1 year). While these financial holdings offered by such markets are regarded as highly safe financial holdings, they offer lower interests on the investments.

Usually, these markets record high volume trade between companies which are conducted at a wholesale trade. Retail trading in these markets include individuals and investors who trade in mutual funds, debentures, etc.

4. Derivatives Market: Derivatives are agreed-upon contracts between 2 or even more number of parties based on financial assets or sets of assets. Here assets refer to those of securities, while sets of assets refer to indexes.

Essentially as its name suggests, these are secondary securities whose value depends on primary assets like those of stocks. These financial holdings derive their value from underlying financial tools like bonds, currencies, interest rates, commodities, stocks, etc. While understanding the nature of financial markets, students must understand that derivative markets trade in futures and options contracts.

5. Forex Market: These markets deal with currencies and have its name derived from “foreign exchange markets”. These are most liquid among various financial markets since they allow individuals to directly buy, sell, exchange and even speculate on currencies and their values.

Functions of financial market

- Mobilising Funds: Among the diverse types of functions served by financial markets, one of the most crucial functions is that of mobilisation of savings. Financial markets also utilise this savings investing it for productive use, thereby contributing to capital and economic growth.

- Determination of Prices: Another vital function served by financial markets is that of pricing different securities. Essentially, demand and supply in financial markets along with its interaction between investors determine these pricing.

- Liquidity of Financial Holdings: Tradable assets must be provided with liquidity for its smooth functioning and flow. This is another role of the financial market which goes on to help in the functioning of a capitalist economy. It not only allows investors to easily sell their securities and assets, but also allows them to easily convert them into cash money.

- Ease of Access: Financial markets also offer efficient trading since they bring traders to the same market. As a result, relevant parties do not have to spend any resource, be it capital or time, to find interest buyers or sellers. Additionally, it also provides necessary information related to trading, which also reduces the effort that interested parties must put in to complete their trades.

Money market

Money market instrument is an investment mechanism that allows banks, businesses, and the government to meet large, but short-term capital needs at a low cost. They serve the dual purpose of allowing borrowers meet their short-term requirements and providing easy liquidity to lenders.

Instruments

- Promissory Note:

A promissory note is one of the earliest type of bills. It is a financial instrument with a written promise by one party, to pay to another party, a definite sum of money by demand or at a specified future date, although it falls in due for payment after 90 days within three days of grace.

2. Bills of exchange or commercial bills:

The bills of exchange can be compared to the promissory note; besides it is drawn by the creditor and is accepted by the bank of the debater. The bill of exchange can be discounted by the creditor with a bank or a broker. Additionally, there is a foreign bill of exchange which becomes due for payment from the date of acceptance. However, the remaining procedure is the same for the internal bills of exchange.

3. Treasury Bills (T-Bills):

The Treasury bills are issued by the Central Government and known to be one of the safest money market instruments available. Besides, they carry zero risk, so the returns are not attractive. Also, they come with different maturity periods like 1 year, 6 months or 3 months and are also circulated by primary and secondary markets. The central government issues them at a lesser price than their face-value.

There are three types of treasury bills issued by the Government of India currently that is through auctions which are 91-day, 182-day and 364-day treasury bills.

4. Call and Notice Money:

Call and Notice Money exist in the market. With respect to Call Money, the funds are borrowed and lent for one day, whereas in the Notice Market, they are borrowed and lent up to 14 days, without any collateral security. The commercial banks and cooperative banks borrow and lend funds in this market. However, the all-India financial institutions and mutual funds only participate as lenders of funds.

5. Inter-bank Term Market:

The inter-bank term market is for the cooperative and commercial banks in India who borrow and lend funds for a period of over 14 days and up to 90 days. This is done without any collateral security at the rates determined by markets.

6. Commercial Papers (CPs)

Commercial papers can be compared to an unsecured short-term promissory note which is issued by top rated companies with a purpose of raising capital to meet requirements directly from the market.

They usually have a fixed maturity period which can range anywhere from 1 day up to 270 days.

They offer higher returns as compared to treasury bills. They are automatically not as secure in comparison. Also, Commercial papers are traded actively in secondary market.

7. Certificate of Deposits (CD’s)

This functions as a deposit receipt for money which is deposited with a financial organization or bank. The Certificate of Deposit is different from a Fixed Deposit receipt in two ways. i. Certificate of deposits are issued only of the sum of money is huge. Ii. Certificate of deposit is freely negotiable.

The RBI first announced in 1989 that the Certificate of Investments have become the most preferred choice of organization in terms of investments as they carry low risk whilst providing high interest rates than the Treasury bills and term deposits.

CD’s are also issued at discounted price like the Treasury bills and they range between a span of 7 days up to 1 year.

The Certificate of Deposit issued by banks range from 3 months, 6 months and 12 months.

8. Banker’s Acceptance (BA)

A Banker’s Acceptance is a document that promises future payment which is guaranteed by a commercial bank. Also, it is used in money market funds and will specify the details of repayment like the date of repayment, amount to be paid, and details of the individual to which the repayment is due.

BA’s features maturity periods that range between 30 days up to 180 days.

9. Repurchase Agreements (Repo)

Repo’s are also known as Reverse Repo or as Repo. They are loans of short duration which are agreed by buyers and sellers for the purpose of selling and repurchasing.

However, these transactions can be carried out between RBI approved parties.

Secondary market

A secondary market is a platform wherein the shares of companies are traded among investors. It means that investors can freely buy and sell shares without the intervention of the issuing company. In these transactions among investors, the issuing company does not participate in income generation, and share valuation is rather based on its performance in the market. Income in this market is thus generated via the sale of the shares from one investor to another.

Some of the entities that are functional in a secondary market include –

- Retail investors.

- Advisory service providers and brokers comprising commission brokers and security dealers, among others.

- Financial intermediaries including non-banking financial companies, insurance companies, banks and mutual funds.

Instruments

The instruments traded in a secondary market consist of fixed income instruments, variable income instruments, and hybrid instruments.

- Fixed income instruments

Fixed income instruments are primarily debt instruments ensuring a regular form of payment such as interests, and the principal is repaid on maturity. Examples of fixed income securities are – debentures, bonds, and preference shares.

Debentures are unsecured debt instruments, i.e., not secured by collateral. Returns generated from debentures are thus dependent on the issuer’s credibility.

- Variable income instruments

Investment in variable income instruments generates an effective rate of return to the investor, and various market factors determine the quantum of such return. These securities expose investors to higher risks as well as higher rewards. Examples of variable income instruments are – equity and derivatives.

Equity shares are instruments that allow a company to raise finance. Also, investors holding equity shares have a claim over net profits of a company along with its assets if it goes into liquidation.

As for derivatives, they are a contractual obligation between two different parties involving pay-off for stipulated performance.

- Hybrid instruments

Two or more different financial instruments are combined to form hybrid instruments. Convertible debentures serve as an example of hybrid instruments.

Convertible debentures are available as a loan or debt securities which may be converted into equity shares after a predetermined period.

Credit, bill & income security market

Fixed income securities are a type of debt instrument that provides returns in the form of regular, or fixed, interest payments and repayments of the principal when the security reaches maturity. The instruments are issued by governments, corporations, and other entities to finance their operations. They differ from equity, as they do not entail an ownership interest in a company, but they confer a seniority of claim, as compared to equity interests, in cases of bankruptcy or default.

Examples of Fixed Income Securities

Many examples of fixed income securities exist, such as bonds (both corporate and government), Treasury Bills, money market instruments, and asset-backed securities, and they operate as follows:

1. Bonds

In general terms, they can be defined as loans made by investors to an issuer, with the promise of repayment of the principal amount at the established maturity date, as well as regular coupon payments (generally occurring every six months), which represent the interest paid on the loan. The purpose of such loans ranges widely. Bonds are typically issued by governments or corporations that are looking for ways to finance projects or operations.

2. Treasury Bills

Treasury bills are issued by the US federal government. With maturities ranging from one to 12 months, these securities most commonly involve 28, 91, and 182-day (one month, three months, and six months) maturities. These instruments offer no regular coupon, or interest, payments.

3. Money Market Instruments

Money market instruments include securities such as commercial paper, banker’s acceptances, certificates of deposit (CD), and repurchase agreements (“repo”). Treasury bills are technically included in this category, but due to the fact that they are traded in such high volume, they have their own category here.

4. Asset-Backed Securities (ABS)

Asset-backed Securities (ABS) are fixed income securities backed by financial assets that have been “securitized,” such as credit card receivables, auto loans, or home-equity loans. ABS represents a collection of such assets that have been packaged together in the form of a single fixed-income security. For investors, asset-backed securities are usually an alternative to investing in corporate debt.

Key takeaways

Financial Market refers to a marketplace, where creation and trading of financial assets, such as shares, debentures, bonds, derivatives, currencies, etc. take place. It plays a crucial role in allocating limited resources, in the country’s economy. It acts as an intermediary between the savers and investors by mobilizing funds between them.

Goals of Financial management

There are mainly two goals of financial management-

Figure: Objectives of financial management

(1) Profit Maximization:

According to this approach, all activities which increase profits should be undertaken and which decrease profits should be avoided. Profit maximization implies that the financial decision making should be guided by only one test, which is, select those assets, projects and decisions which are profitable and reject those which are not.

The following arguments are advanced in favour of this approach:

(i) Measurement of Performance

Profit is a test of economic efficiency of a business. It is a yardstick by which the economic performance of a business can be judged.

(ii) Efficient Allocation and Utilization of Resources

Profit maximization leads to efficient allocation and utilization of scarce resources of the business because sources tend to be directed to uses from less profitable projects to more profitable projects.

(iii) Maximization of Social Welfare

Profitability is essential for fulfilling the goal of social welfare also. Maximization of profits leads to the maximization of social welfare.

(iv) Source of Incentive

Profit acts as a motivator or incentive which induces a business organization to work more efficiently. If profit motive is withdrawn the pace of development will be reduced.

(v) Helpful in Facing Adverse Business Conditions

Economic and business conditions go on changing from time to time. There may be adverse business conditions like recession, severe competition etc. Under adverse circumstances a business will be able to survive only if it has some past earnings to rely upon. Hence, a business should maximize its profits when the circumstances are favourable.

(vi) Helpful in the Growth of the Firm

Profits are the major source of finance for the growth of a firm.

However, the profit maximization approach has been criticized on several grounds:

Figure: Disadvantages of profit maximization

(i) Ambiguous:

One practical difficulty with this approach is that the term profit is vague and ambiguous. Different people take different meanings of term profit. For example, profit may be short-term or long-term, it may be before tax or after tax, and it may be total profit or rate of profit. Similarly, it may be returned on total capital employed or total assets or shareholders’ funds and so on.

(ii) Ignores the Time Value of Money:

This approach ignores the time value of money, i.e., it does not make a distinction between profits earned over the different years. It ignores the fact that the value of one rupee at present is greater than the value of the same rupees received after one year. Similarly, the value of profit earned in the first year will be more in comparison to the equivalent profits earned in later years.

(iii) Ignores Risk Factor:

This approach ignores the risk associated with the earnings. If the two firms have the same total expected earnings, but if earnings of one firm fluctuate considerably as compared to the other, it will be more risky.

Investors in general, have a preference for a lower income with less risk in comparison to high income with greater risk. But this approach does not pay any attention to the risk factor.

(iv) Ignores Future Profits:

The business is not solely run with the objective of maximizing immediate profits. Some firms place more importance on growth of sales. They are willing to accept lower profits to achieve stability provided by a large volume of sales.

(v) Ignores Social Obligations of Business:

This approach ignores the social obligations of business to various social groups like workers, consumers, society, Government etc. A firm cannot exist for long when interests of social groups are ignored because these groups contribute to its smooth run.

(vi) Neglects the Effects of Dividend Policy on Market Price of the Shares:

Under this approach the firm may not think of paying dividends because retaining profit in the business may satisfy the goal of maximizing the earning per share.

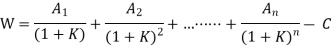

(2) Wealth Maximization:

This approach is now universally accepted as an appropriate criterion for making financial decisions as it removes all the limitations of profit maximization approach. It is also known as net present value (NPV) maximization approach. According to this approach the worth of an asset is measured in terms of benefits received from its use less the cost of its acquisition. Benefits are measured in terms of cash flows received from its use rather than accounting profit which was the basis of measurement of benefits in profit maximization approach. Measuring benefits in terms of cash flow avoids the ambiguity in respect of the meaning of the term profit. Another important feature of this approach is that it also incorporates the time value of money. While measuring the value of future cash flows an allowance is made for time and risk factors by discounting or reducing the cash flows by a certain percentage. This percentage is known as discount rate. The difference between the present value of future cash inflows generated by an asset and its cost is known as net present value (NPV). A financial action (or an asset or a project) which has a positive NPV creates wealth for shareholders and, therefore, is undertaken. On the other hand, a financial action resulting in negative NPV should be rejected since it would reduce shareholder’s wealth. If one out of various projects is to be chosen, the one with the highest NPV is adopted. Hence, the shareholder’s wealth will be maximized if this criterion is followed in making financial decisions.

The NPV can be calculated with the help of the following formula:

Where

W = Net Present Worth

A1, A2 …... An= Stream of cash flows expected to occur from a course of action over a period of time

K = Appropriate discount rate to measure risk and time factors

C = Initial outlay to acquire an asset or pursue a course of action

It has the following advantages in its favour:

(1) It uses cash flows instead of accounting profits which avoids the ambiguity regarding the exact meaning of the term profit.

(2) It gives due importance to the time value of money by reducing the future cash flows by an appropriate discount or interest rate. If higher risk and longer time period are involved, higher rate of discount or interest will be used to find out the present value of future cash benefits. The discount or interest rate will be lower for the projects which involve low risk.

(3) It gives due importance to payment of regular dividends – In this approach financial decisions are taken in such a way that the shareholders receive the highest combination of dividends and increase in the market price of the shares.

(4) It gives due importance to risk factor and analyses risk and uncertainty so that the best course of action can be selected out of different alternatives.

(5) It gives due importance to social responsibilities of the business.

(6) It takes into consideration long-run survival and growth of the firm.

Key takeaways

Financial Management is managerial activity which is concerned with the planning and controlling of the firm’s financial resources. Financial management also refers to the effective planning, organising, and controlling of monetary resources.

Key activities in financial management

Financial managers perform data analysis and advise senior managers on profit-maximizing ideas. Financial managers are responsible for the financial health of an organization. They produce financial reports, direct investment activities, and develop strategies and plans for the long-term financial goals of their organization. Financial managers typically:

- Prepare financial statements, business activity reports, and forecasts,

- Monitor financial details to ensure that legal requirements are met,

- Supervise employees who do financial reporting and budgeting,

- Review company financial reports and seek ways to reduce costs,

- Analyze market trends to find opportunities for expansion or for acquiring other companies,

- Help management make financial decisions.

The role of the financial manager, particularly in business, is changing in response to technological advances that have significantly reduced the amount of time it takes to produce financial reports. Financial managers’ main responsibility used to be monitoring a company’s finances, but they now do more data analysis and advise senior managers on ideas to maximize profits. They often work on teams, acting as business advisors to top executives.

Financial managers also do tasks that are specific to their organization or industry. For example, government financial managers must be experts on government appropriations and budgeting processes, and healthcare financial managers must know about issues in healthcare finance. Moreover, financial managers must be aware of special tax laws and regulations that affect their industry.

Role of financing institutes in construction sector: banking institutions, NBFc, housing finance institutions & others.

Banking institution

Commercial banks are important financial intermediaries serving the general public in any society. In most cases, commercial banks hold more assets than any other financial institution. In some cases, even more than central bank. Apart from their many functions, commercial banks facilitate growth and development. Banks lends in many areas or sectors of the economy. Viewed from the building and construction sector, they contribute to investment, employment creation, and by extension, the process of infrastructure and economic growth.

The building and construction industry in both developed and developing countries may be viewed as that sector of the economy which, through planning, design, construction, maintenance and repair, and operation, transforms various resources into constructed facilities. The types of public and private facilities produced range from residential and non-residential buildings to heavy construction, and these physical facilities play a critical and highly visible role in the process of development. The major participants from the building industry include the architects, engineers, management consultants, general contractors, heavy construction contractors, special trade contractors or subcontractors, and construction workers, along with the owners, operators, and users of the constructed facility.

The commercial banks form an important source by which many investors get funds to finance building and other real property projects. Commercial banks are money creating financial institutions that perform three major functions, namely acceptance of deposits, granting or loans and the operators of the payments and settlements mechanism.

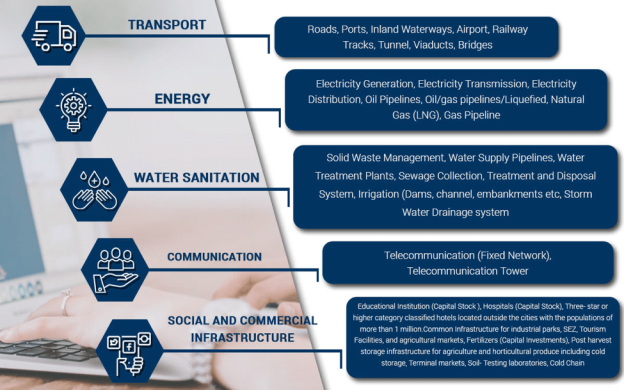

Non banking financial company

The reserve bank of India, having considered it necessary in public interest and being satisfied that, to enable the bank to regulate the credit system to the advantage of the country, it is necessary to have a separate category of Infrastructure Finance NBFC’s category. Infrastructure companies are one the NBFC institution, engaged in the business of providing loans to infrastructure companies. Infrastructure Finance Companies are predominantly engaged in providing loan to the infrastructure sector. The creation of a separate category of NBFC’S (NBFC-IFC), expected to play an important role in banks as a provider of infrastructure finance.

Infrastructure Finance Company is another category of NBFC, or we can say it’s a financial institution engaged in the business of providing loans to infrastructure companies.

According to RBI, “an IFC is defined as a Non-Banking Financial Company if;

- A minimum of 75 percent of its total assets shall deploy in infrastructure loan.

- Net owned funds of Rs. 300 crore or above

- Minimum credit rating ‘A’ or equivalent of CRISIL, FITCH, CARE, ICRA or equivalent rating by other accrediting rating agencies.

- CRAR of 15 percent (with a minimum Tier I capital of 10 percent).

Infrastructure loans means he credit facility extended by NBFCs to a borrower for exposure in the following categories of infrastructure sectors and sub-sectors.

Housing finance institution and others

Housing Finance sector in India has yet to come of age and at par with the ground realties. Housing finance interest rates are highest in the world and still not available to all. Most of the housing finance companies (HFC's) do not give loans to self-employed or to the informal sector. The procedure and document requirements are far too rigid. This is vital sector which can enable a person to buy house.

The impediments in this segment must be addressed and rectified. There are no uniform procedures adopted by the HFC's, each one is having its own set of rules. Many HFC's are making more monies in processing fees. This sector has to restructure and become people friendly. The government can device some incentives to reduce the interest rates on housing loans.

Infrastructure:

A lot of noise is there all around about infrastructure development but to develop them, not only requires funds alone, but the laws and rules &, regulations of various state governments should also be simplified and unified. The National Housing & Habitat Policy has appreciated the fact that legal & regulatory reforms would form the backbone of housing infrastructure.

Key takeaways

Financial managers’ main responsibility used to be monitoring a company’s finances, but they now do more data analysis and advise senior managers on ideas to maximize profits

References:

- Engineering Economics Management, Dr. Vilas Kulkarni and Hardik Bavishi, S. Chand Publication

- Laws for Engineers, Vandana Bhatt and Pinky Vyas, Pro Care Publisher

- Indian Economy, Gaurav Datt and Ashwani Mahajan, S. Chand Publication

- Industrial Organization & Engineering Economics, T. R. Banga and S. C. Sharma, Khanna Publisher