Unit - 3

Contract costing

Engineering management is a specialized form of management concerned with the application in engineering, as a result of the unique personalities and technical nature of engineering.

Engineering management refers to the functional management of technical professionals. Example areas of engineering are product development, manufacturing, construction, design engineering, industrial engineering, technology, production, or any other field that employs personnel who perform an engineering function.

Successful engineering managers typically require training and experience in business and engineering. Technically inept managers tend to be deprived of support by their technical team, and non-commercial managers tend to lack commercial acumen to deliver in a market economy. Largely, engineering managers manage engineers who are driven by non-entrepreneurial thinking, thus require the necessary people skills to coach, mentor and motivate technical professionals.

There are two main accounting methods that construction companies use to record revenue and expenses. One is called the completed contract method and the other is called the percentage of completion method.

Completed Contract Method - In the completed contract method, only completed projects are reflected in the income statement. Costs for uncompleted projects are accumulated in an asset account called Work in Progress. The principal advantage of the completed contract method is that reported revenue is based on final results rather than estimates of unperformed work. The major disadvantage is that it does not reflect current performance when the period of the contract extends into more than one accounting period.

Percentage Completion Method - Revenues and gross profit are recognized each period based upon the progress of the construction, i.e., the percentage of completion. To determine the percentage of completion of a project, simply divide actual costs by estimated costs. Calculating the amount of revenue to claim for the year is determined by multiplying the percentage of completion by the contract price

Financial statements provide financial information at a point in time and changes to assets, liabilities and equities covering a certain time. The following makes up a set of traditional financial statements:

- Balance sheet (a statement of financial position at a specific date, including assets, liabilities and equity);

- Income statement (a statement of operations covering a period such as a month, quarter or year, showing revenues, expenses, income taxes, gains/losses, net income/loss);

- Statement of changes in retained earnings (changes in retained earnings from the previous period, adding in net income/loss for the year and deducting dividends);

- Statement of changes in cash flow (changes in cash balances from the previous period, which shows sources and uses of cash); and

- Notes to the financial statements, which provide additional information for users for clarification purposes.

Role of financial manager in construction financial management

In today’s environment, the role of the financial manager in a construction organization is essential to organizational success, and more importantly, is vital to avoiding failure. That may sound extreme, but in many circumstances, competition is so fierce and margins are so thin, reliable financial information and analysis certainly can make the difference between success and failure.

The construction financial manager’s role may vary from company to company, partly because different financial managers have different skills and personalities. The role also varies depending on the size of the company. A construction financial manager’s background often indicates the areas in which the manager will concentrate. For example, a construction financial manager whose background is in construction operations (estimating and project management) initially will concentrate on the proper recording of job costs. A construction financial manager whose background is in public accounting probably will initially emphasize financial reporting and income tax planning. The financial manager should recognize these influencing factors and make efforts to compensate for any deficiencies.

The skills and personalities of the other members of the management team also affect the role of the construction financial manager. The majority of a company’s administrative work can be performed in any department and will be allocated among departments partly based on the skills and personalities of the respective department managers. For example, most construction financial managers feel that cash management is their responsibility. If the other management team members share this feeling, responsibility for cash management probably will be assigned to the finance department. However, if another management team member feels that responsibility for cash management should be shared, some compromise will be made. To a great extent, sharing of responsibilities depends on the skills and personalities of the management team members. Successful financial managers respect the need for compromise in sharing responsibilities.

As already mentioned, the size of the company frequently affects the role of the financial manager, because roles and responsibilities are more specialized in larger companies than in smaller companies. In small companies, responsibilities are assigned to a smaller group of managers and, accordingly, each manager must handle a wider range of responsibilities. For example, the financial manager in a small company with three senior managers (owner, operations manager and finance manager) will typically be responsible for all administrative and financial tasks. The other two senior managers will typically concentrate on marketing, estimating and project management. In larger companies, with responsibilities assigned to a larger group of managers, each manager will be assigned more specialized responsibilities. For example, the financial manager of a large company with several senior managers often has limited responsibility for administrative tasks involving contact with customers and subcontractors. The department with primary responsibility for customer and subcontractor relations (usually the construction operations department) will prefer to be the primary contact in order to minimize the possibility of misunderstandings between the parties. Because there is no one standard set of construction financial manager responsibilities, each financial manager should be alert for areas of responsibility that are not clearly defined in the organization. The financial manager should take the initiative in assuring that all significant responsibilities are assigned.

Contract costing is a type of job costing in which a contract constitutes a unit of cost. The principles of job costing are applicable to contract costing and embrace the same basic principles of cost ascertainment. It is akin to factory job costing, but varies only in size; and the contract continues for a longer time.

A contractor undertakes a small number of big contracts at a time. For example, builders, civil engineering firms, constructional and mechanical engineering firms etc. adopt this method of costing, also known as terminal costing.

The Terminology of I.C.M.A. Defines Contract Costing as – “that form of specific order costing which applies where work is undertaken to customer’s special requirements and each order is of long duration”.

The Terminology of C.I.M.A. Defines Contract Cost as – “the aggregated costs relative to a single contract designated a cost unit”.

Features

Following are the important features of contract costing:

i) The work is carried out away from contractor’s premises i.e., at the contractee’s work site.

Ii) A contract is usually a big job of long-duration and may continue over more than one accounting period.

Iii) As the contracts are of large size, a contractor usually carries out a small number of contracts in the course of a year.

Iv) Contract work involves too much of risk and uncertainty.

v) A contract undertaken is treated as a cost unit.

Vi) A separate account is prepared for each contract to ascertain profit or loss on each contract.

Vii) Apportionment of profit on contract to different accounting periods is very difficult.

Viii) In case the contract is undertaken of long-duration, a percentage of notional profit depending upon the progress of physical work may be accounted for in each year.

Ix) Most of the materials are specially purchased for each contract.

x) Expenses chargeable to contracts are direct in nature, e.g., electricity, telephone charges, insurance etc.

Xi) Allocation and apportionment of overhead costs is a simple task.

Xii) Specialist’s sub-contractors may be employed for say, electrical fittings, welding works, glass work, plumbing work etc.

Xiii) Plant and equipment may be purchased or hired for the duration of the contract.

Xiv) Nearly all labour will be direct.

Xv) The payment is received depending on the stage of completion of work.

Xvi) A contract usually includes clause for ‘penalty’ for delayed completion.

Xvii) A contract usually includes ‘Escalation Clause’ under which the contractor is compensated for increase in costs on account of inflation.

Xviii) A percentage of the value of work done is deducted from the progress payment as ‘Retention Money’.

Xix) Most of the items of cost are directly chargeable to individual contracts. Administrative overheads and other common costs are apportioned to several contracts on a suitable basis.

Xx) Payments are made on a running account basis depending upon the progress of work as indicated by the certificate of contractor’s architect/ surveyor.

Xxi) A certain amount of profit is taken at the end of the year on incomplete contracts.

Types of contract

There are two types of contract:

(i) Fixed price contract and

(ii) Cost-plus contract

(i) Fixed-Price Contract:

In this type of contract, price is usually fixed and agreed upon in advance. Generally, tenders are invited giving details of the contract to fix up the contract price. As per agreement between the parties, any additional work may be charged separately. There may be a provision in the agreement to allow the contractor to pass to the contractee additional costs incurred due to price rise of materials or wages awards, etc.

(ii) Cost-Plus Contract:

Cost-plus contract is a contract in which price is not agreed upon in advance for one reason or other. This type of contract is entered into when it is impossible to calculate future price or cost with reasonable accuracy because of lack of past records and experience or because of peculiar circumstances, for example, drilling of oil well.

The contract price is ascertained later by adding a fixed percentage of profit to the total cost of the contract. Different items of expenditure to be considered for ascertaining cost of the contract are agreed upon in advance.

Advantages of Cost-Plus Contract:

For the Contractor:

(1) The contractor is assured of a fixed profit margin.

(2) There is no chance of incurring any loss on the contract.

(3) The contractor is not affected by any fluctuations in the market prices of different elements of cost.

(4) Submission of tenders becomes simple.

For the Contractee:

(1) The contractee feels satisfied because the price is based on actual cost.

(2) In an uncertain situation, the contractee is completely protected.

Disadvantages of Cost-Plus Contract:

For the Contractor:

(1) It discourages contractor to take measures for cost reduction because the profit is based on cost. Lower cost will lead to lower profit.

(2) Disputes may arise between the parties.

For the Contractee:

(1) Generally, profit is based on cost. It encourages wasteful expenditure since the higher the cost, the larger will be the profit.

(2) The amount to be paid by the contractee is uncertain because it cannot be determined until the work is completed. It may create certain problems in cash management.

Contract costing procedure

The basic procedure for costing of contracts is as follows:

1. Contract Account:

Each contract is given a distinguishing number and a separate account is opened for each contract.

2. Direct Costs:

Most of the costs of a contract can be allocated direct to contract. All such direct costs are debited to the contract account.

Direct costs for contracts include:

i. Materials,

Ii. Labour and supervision,

Iii. Direct expenses,

Iv. Depreciation of plant and machinery,

v. Subcontract costs.

3. Indirect Costs:

Contract account is also debited with overheads which tend to be small in relation to direct costs. Such costs are often absorbed on some arbitrary basis as a percentage on prime cost, materials, wages etc. Overheads are normally restricted to head office and storage costs.

4. Transfer of Materials or Plant:

When materials, plant or other items are transferred from the contract, the contract account is credited by that amount.

5. Contract Price:

The contract account is also credited with the contract price. However, when contract is not complete at the end of the financial year, the contract account is credited with the value of work-in-progress as on that date.

6. Profit or Loss on Contract:

The balance of contract account represents profit or loss which is transferred to Profit and Loss Account. However, when contract is not completed within the financial year, only a part of the profit arrived at is taken into account and remaining profit is kept as reserve to meet any contingent loss on the incomplete portion of the contract.

Key takeaways

Contract costing is a type of job costing in which a contract constitutes a unit of cost.

Definition

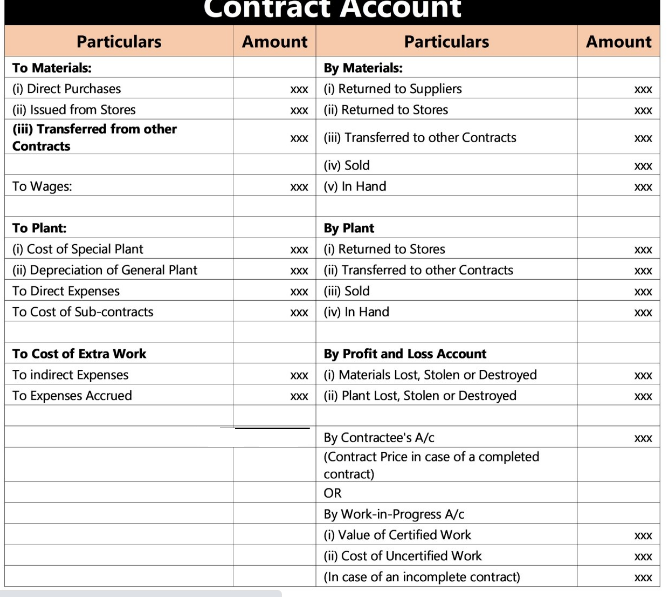

When a contractor has accepted a contract, a separate account is opened for each contract, bringing together all the costs relating to a particular contract. A serial number is assigned to each contract, which is known as a contract account.

Explanation

All expenses incurred in fulfilling a contract (e.g., materials, wages, direct expenses, cost of sub-contracts, cost of special plants, and indirect expenses) are debited to a contract account.

Similarly, expenses accrued or outstanding on the contract at the end of the accounting period are also debited to the contract account. At the end of the accounting period, the following will appear on the credit side of the account:

- Materials returned to the supplier

- Materials and plant returned to store

- Materials transferred to other contracts, stolen, destroyed, sold, or in hand

Materials and plant stolen or destroyed are abnormal losses and should be charged to the profit and loss account.

Similarly, profit or loss arising from the sale of the plant or materials should also be transferred to the profit and loss account by way of abnormal items.

The other items to be shown on the credit side of the contract account are contract price (in completed contracts) and the work-in-progress, which consists of the value of certified work and the cost of uncertified work (in incomplete contracts).

Format

Treatment of 14 various items in the contract account

- Cost of Materials - Materials include (i) materials specifically purchased for the contract; (ii) materials issued from store against material requisition notes. The cost of both these types of materials is debited to the contract account.

Materials returned to store. Whenever materials are issued in excess of requirements, as for instance, cement, sand, pipes, bricks, etc., these are later returned to the store accompanied by a Material Return Note which gives the details of the material returned. Such returned materials are credited to contract account.

Materials at site. At the end of each accounting period, value of materials lying unused at site is credited to contract account and is carried forward for charging against the next period.

2. Cost of Labour - All wages of workers engaged on a particular contract are charged direct to the contract irrespective of the type of work they perform. When several contracts are running at different locations, payroll is normally sectionalised so as to have separate payroll for each contract. Difficulties in costing may be encountered when some workers may have to move from one site to another when a number of small contracts are undertaken. In such situation, it becomes necessary to provide time sheets from which allocations can be made. In order to control labour utilization and prevent fraud in the payment of wages, surprise visits by head office personnel will be necessary.

3. Plant Depreciation - There are two different methods of dealing with depreciation of plant in contract account:

(a) Contract account is debited with the cost of the plant installed. At the end of the year or when the plant is no longer required, the plant is revalued and contract account is credited with this revalued or depreciated figure. In case plant is sold on the completion of the contract, the contract account is credited with its sale proceeds. The net effect of the above debit and credit will be that the contract account will stand debited with the amount of depreciation which is the difference between the value of plant debited and value of plant credited. The method is generally used on long contracts which extend over more than one year because depreciated value of the plant is credited to the contract account and brought down as an opening balance in the next period.

(b) Alternatively, contract account is simply debited with the amount of depreciation. It is usual to use this method when plant is sent to contract only for a short period. For example, mobile crane or bulldozer used in a contract may be charged on this basis. However, when a plant is hired for a contract, a charge for the hire of the plant is debited to the contract as a direct expense.

4. Subcontract Costs - Work of specialized character, for which facilities are not internally available, is offered to a subcontractor. For example, steel work, glass work, painting, etc., is usually carried out by the subcontractors who are accountable to the main contractor. The cost of such work is charged to the contract account.

5. Payment based on Architect’s Certificate- In case the contract is small, full payment is usually made on the completion of the contract. But in case of large contracts, it may take more than one year to complete. In such a case, if no payment is received until the completion of the contract, the financial resources of the contractor could surely become strained. Therefore, a system of progress payments is agreed by parties. In this system, part payments of the contract amount are paid from time to time on the basis of certificate issued by the architects (acting for the contractee), certifying the value of the work satisfactorily completed. Such payments received by the contractor are usually credited to the personal account of the contractee. It should be noted that such payments are not entered in the Contract Account.

6. Work-in-progress — Work Certified and Uncertified

When the contract is not completed till the end of the accounting year, the architect is required to value the work-in-progress. Such work-in-progress is classified into work certified and work uncertified.

Work Certified. This is that part of the work-in-progress which has been approved by the contractee’s architect or engineer for payment. Work certified is valued at contract price (i.e., selling price), and includes an element of profit.

Work Uncertified. This is that part of the work-in-progress which is not approved by the architect or engineer. This is valued at cost and thus does not include an element of profit. Both works certified and uncertified appear on the credit side of the contract account and also on the assets side of the balance sheet.

7. Retention Money and Cash Ratio - It is usual practice not to pay the full amount of work certified. The contractee may pay a fixed percentage, say 80% or 90% of the work certified, depending upon the terms of the contract. This is known as Cash Ratio. The balance amount not paid is known as Retention Money. For example, if cash ratio is 75%, the retention money will be remaining 25%. This retention money is a type of security for any defective work which may be found in the contract later on. This also works as a deterrent for the contractor to leave the contract incomplete, if he finds the contract unprofitable. The retention money may also be adjusted against penalties that become due if the contract is not completed within the stipulated time as per the terms of the agreement.

8. Extra Work - Sometimes the contractor is required to do some extra work like additions or alterations in the work originally done as per agreement. The contractor will charge extra money for such extra work. The cost of such extra work is debited to the contract account and extra price realized is credited to the contract account.

9. Contract Price

The contract price is the agreed price at which the contractor undertakes to execute the contract.

The contract account is credited with the contract price if it has been completed. In such a case, the amount of contract price is debited to the contractee’s personal account and credited to the contract account.

In incomplete contracts, no entry is passed in respect of the contract price.

10. Cost of Sub-Contracts

Generally, work of a specialized character (e.g., road construction, installation of lifts, and use of electrical fittings) is passed onto another contractor by the main contractor.

In such cases, the work performed by the sub-contractor forms a direct charge to the contract concerned, and the sub-contract price paid should be debited to the contract account.

11. Indirect Expenses

Some expenses can’t be directly charged to a particular contract, including the salary of the general manager, the salary of an architect engaged at several contracts simultaneously, the salary of a store-keeper, and store and office expenses.

Since these expenses are incurred for the business as a whole, they are to be apportioned to the different contracts on some equitable basis.

12. Direct Expenses

All expenses that have been incurred specifically for a particular contract (other than material cost and direct wages) are direct expenses, and they should be debited to the contract account.

Examples of direct expenses include hire charges of special plant (not owned), carriage on materials purchased, and travel expenses relating to the contract.

13. Site expenses - Any expense incurred on the site shall also be debited. There may be too many expenses under this head. Apply the principle—Debit all expenses and losses.

14. To labour and wages - It’s an expense so it’s shall be debited to the contract account by applying the principle—Debit all expenses. Any outstanding amount shall be added and any prepaid amount shall be subtracted.

Methods of recording and reporting site accounts between project office and head office

Accounting for branch

Introduction:

A branch may be defined as section of an enterprise, geographically separated from the rest of the business, controlled by head office, and generally carrying on the same activities as of the enterprise. As a business grow, it may open up branches in different towns and cities in order to market its product/services over a large territory and thus increase its profit.

For example, Bata shoe Co. Ltd has branches in various cities all over the country. The same example holds good for a commercial bank also.

As per the provision of Companies Act, branch office in relation to a company means-

a) Any establishment described as a branch by the company; or

b) Any establishment carrying on either the same or substantially the same activity as that carried on by the head office of the company; or

c) Any establishment engaged in any production, processing or manufacture.

It should be mentioned that a branch is not a separate legal entity it is simply a segment of a business. From an accounting standpoint, a branch is a clearly identifiable profit centre. In order to exercise greater control over the branches it is necessary to ascertain profit or loss made by such branches separately. Apart from this, specialised accounting techni9have to be adopted for controlling various branches activities and for their smooth running both at the branch level and at the head office level. The system of accounting varies between different enterprises in accordance with their type of activities, methods of operation and the preference of their managements.

Need for Branch Accounting

Ascertain the profitability of each branch separately for particular accounting period.

Ascertain the financial position of each branch separately at the end of that accounting period.

Assess the progress and performance of each branch

Incorporate the profit or loss made by the branch and its assets and liabilities in the firm's final accounts

Ascertain the requirements of cash and stock for each branch,

Ascertain whether the branch should expend or closed

Types of Branches

From accounting point of view, the branches can be divided into the following main cases:

1) Home Branches:

a) Dependent Branches (Where the head office maintains all the accounts)

b) Independent Branches (Where the branch keeps its own accounts)

2) Foreign Branches:

They almost invariably trade independently and record their transaction in foreign currency.

Dependent Branches

When the policies and administration of a branch are totally controlled by the head office, who also maintains its accounts, the branch is called as dependent branch.

Independent Branches

Independent Branches are those which make purchases from outside, get goods from Head Office, supply goods to Head Office and fix the selling price by itself Thus an independent Branch enjoys a good amount of freedom like an American Son.

Accounting System of Branches

The accounting arrangement of a branch depends upon its size, the type of activities, the methods of operation and the degree of control to be exercised by the head office. There are three main system of accounting for branches transaction, viz.

- Debtors System

- Stock and Debtors System

- Final Account system

This system of accounting is suitable for the small- size branches. Under this, a Branch Account is opened for each branch in the head office ledger. All the transaction relating to that branch is recorded in this account. The branch account is prepared in such a way that it discloses the profit or loss of the branch.

Head office may send goods to branch either at "cost price" or "selling price".

Cost price method: - under this method at the beginning of the year the branch Account is debited with the opening balances of asset such as stock, petty cash, furniture, prepaid expenses, etc. lying with the branch. Similarly, it is credited with the opening balance of liabilities of the branch such as, creditors, ots salary, rent, etc.

The branch is then debited with the amount of goods sent to the branch and other amounts remitted to meet various expenses such as, salaries, rent, rates, taxes, etc. Likewise, the branch account is credited with the return of goods by the branch and receipts from branches. At the year end, Branch Account is debited with the closing values of liabilities and credited with the closing values of assets. The difference between the two sides represents profit or loss for the branch for a particular period.

Debtors Method

Journal entries

1) For goods sent to branch

Branch A/c _______Dr.

To Goods Sent to Branch A/c

(Being goods sent to branch)

2)For goods returned by the branch

Goods Sent to Branch A/c _______Dr.

To Branch A/c

(Being goods returned by the branch)

3) For amount sent to branch for expenses

Branch A/c _______ Dr.

To Bank A/c

(Being cheque sent to branch for expenses)

4) For amount received from branch

Bank A/c _______ Dr.

To Branch A/c

(Being cash or cheque received from branch)

5) For closing goods sent to branch account

Goods Sent to Branch Alc Dr.

To Purchase A/c

(Being balance transferred to Trading Account)

6) For closing balances of assets at the branch

Branch Assets A/c ________ Dr. (Individually)

To Branch A/c

(Being closing balances of assets brought into account)

7) For closing balances of Liabilities at the branch

Branch A/c ________Dr.

To Branch Liabilities A/c (Individually)

(Being closing balances of liabilities brought into account)

8) For transferring Profit or Loss to General Profit and Loss Account

i) If Profit

Branch A/c _______ Dr.

To General Profit and Loss A/c

(Being branch profit transferred to General P & L A/c)

Ii) If Loss

General Profit and Loss A/c ________ Dr.

To Branch A/c

(Being branch loss transferred to General P & L A/c)

The closing balances of branch assets and liabilities are shown in the Balance Sheet

Of the head office. At the beginning of the next year, the entire numbers 6 and 7 are

Reversed so as to show opening balances in the Branch Account.

Stock and Debtors Method:

Under this method accounts relating to branch are maintained in a more comprehensive and detailed manner as compared to Debtors method. This method keeps a better control stock. Under this method separate accounts are prepared for various accounting function

This accounting procedure under this method depends upon the policy of head office with regard to pricing of goods send to branch. Head office may adopt one of the following methods for invoicing goods to branch.

- At cost price to head office.

- At selling price of the branch.

- At cost price plus fixed margin of profit. In this case branch may sell goods at higher or lower than the invoice price.

When goods have been invoiced to branch at cost price.

In this case following accounts are prepared.

a) Branch Stock Account

b) Goods sent to Branch Account

c) Branch Debtors Account

d) Branch Expenses Account

e) Branch Profit & Loss Account

f) Branch Cash Account

I) When goods are sent to the branch (at invoice price)

Branch Stock A/c _____ Dr.

To Goods Sent to Branch A/c

2) When goods are returned by the branch to the H.O. (at invoice price)

Goods Sent to Branch A/c _______ Dr.

To Branch Stock A/c

3) When sales are made by the branch

i) For Cash Sales

Cash A/c _______ Dr.

To Branch Stock A/c

Ii) For Credit Sales

Branch Debtors A/c _______ Dr.

To Branch Stock A/c

4) When Cash is Received from Debtors

Cash A/c ______ Dr.

To Branch Debtors A/c

5) For Sales Returns

Branch Stock A/c ________ Dr.

To Branch Debtors A/c

6) For discount allowed, bad debts, etc.

Branch Expenses A/c ________ Dr.

To Branch Debtors A/c

7) For Shortage of Stock

Branch Adjustment A/c ________ Dr.(with amount of loading)

Branch P & L A/c ________ Dr. (with cost of shortage)

To Branch Stock A/c

For surplus at branch, the reverse entry will be passed.

8) For Branch Expenses paid in Cash

Branch Expenses A/c ______ Dr.

To Cash A/c

9) For Closing Branch Expenses Account

Branch P&L A/c ______ Dr.

To Branch Expenses A/c

10) For Adjustment of Loading on the Opening Stock

Stock Reserve A/c ______ Dr.

To Branch Adjustment A/c

11) For Adjustment of Loading on the Closing Stock

Branch Adjustment A/c ______ Dr.

To Stock Reserve A/c

12) For Adjustment Loading Goods sent to Branch

Goods Sent to Branch A/c ________ Dr.

To Branch Adjustment A/c

13) For Transfer of Gross Profit

Branch Adjustment A/c _______ Dr.

To Branch P & L A/c

References:

- Engineering Economics Management, Dr. Vilas Kulkarni and Hardik Bavishi, S. Chand Publication

- Laws for Engineers, Vandana Bhatt and Pinky Vyas, Pro Care Publisher

- Indian Economy, Gaurav Datt and Ashwani Mahajan, S. Chand Publication

- Industrial Organization & Engineering Economics, T. R. Banga and S. C. Sharma, Khanna Publisher