Unit - 4

Capital budgeting

Government has several policies to implement in the overall task of performing its functions to meet the objectives of social & economic growth. For implementing these policies, it has to spend huge amount of funds on defence, administration, and development, welfare projects & various other relief operations. It is therefore necessary to find out all possible sources of getting funds so that sufficient revenue can be generated to meet the mounting expenditure.

Planning process of assessing revenue & expenditure is termed as Budget

The term budget is derived from the French word "Budgette" which means a "leather bags; or a "wallet". It is a statement of the financial plan of the government. It shows the income & expenditure of the government during a financial year, which runs generally from 1st April to 31st March.

Definitions of Budget

According to Tayler, "Budget is a financial plan of government r a definite period".

According to Rene, "A budget is a document containing a preliminary approved plan of public revenues and expenditure".’

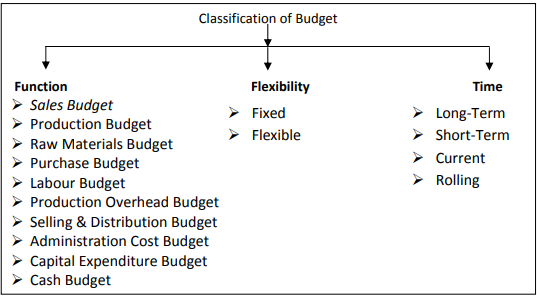

Functional Classification:

- SALES BUDGET: The sales budget is an estimate of total sales which may be articulated in financial or quantitative terms. It normally forms the fundamental basis on which all other budgets are constructed. In practice, quantitative budget is prepared first then it is translated into economic terms. While preparing the Sales Budget, the Quantitative Budget is generally the starting point in the operation of budgetary control because sales become, more often than not, the principal budget factor.

- PRODUCTION BUDGET: The production budget is prepared on the basis of estimated production for budget period. Usually, the production budget is based on the sales budget. At the time of preparing the budget, the production manager will consider the physical facilities like plant, power, factory space, materials and labour, available for the period. Production budget envisages the production program for achieving the sales target. The budget may be expressed in terms of quantities or money or both. Production may be computed as follows: Units to be produced = Desired closing stock of finished goods + Budgeted sales – Beginning stock of finished goods.

- PRODUCTION COST BUDGET: This budget shows the estimated cost of production. The production budget demonstrates the capacity of production. These capacities of production are expressed in terms of cost in production cost budget. The cost of production is shown in detail in respect of material cost, labour cost and factory overhead. Thus, production cost budget is based upon Production Budget, Material Cost Budget, Labour Cost Budget and Factory overhead.

- RAW‐MATERIAL BUDGET: Direct Materials budget is prepared with an intention to determine standard material cost per unit and consequently it involves quantities to be used and the rate per unit. This budget shows the estimated quantity of all the raw materials and components needed for production demanded by the production budget.

- PURCHASE BUDGET: Strategic planning of purchases offers one of the most important areas of reduction cost in many concerns. This will consist of direct and indirect material and services. The purchasing budget may be expressed in terms of quantity or money.

- LABOUR BUDGET: Human resources are highly expensive item in the operation of an enterprise. Hence, like other factors of production, the management should find out in advance personnel requirements for various jobs in the enterprise. This budget may be classified into labour requirement budget and labour recruitment budget. The labour necessities in the various job categories such as unskilled, semi‐skilled and supervisory are determined with the help of all the head of the departments. The labour employment is made keeping in view the requirement of the job and its qualifications, the degree of skill and experience required and the rate of pay.

- PRODUCTION OVERHEAD BUDGET: The manufacturing overhead budget includes direct material, direct labour and indirect expenses. The production overhead budget represents the estimate of all the production overhead i.e., fixed, variable, semi‐variable to be incurred during the budget period.

- SELLING AND DISTRIBUTION COST BUDGET: The Selling and Distribution Cost budget is estimating of the cost of selling, advertising, delivery of goods to customers etc. throughout the budget period. This budget is closely associated to sales budget in the logic that sales forecasts significantly influence the forecasts of these expenses. Nevertheless, all other linked information should also be taken into consideration in the preparation of selling and distribution budget. The sales manager is responsible for selling and distribution cost budget.

- ADMINISTRATION COST BUDGET: This budget includes the administrative costs for non‐manufacturing business activities like director’s fees, managing directors’ salaries, office lightings, heating and air condition etc. Most of these expenses are fixed so they should not be too difficult to forecast. There are semi‐variable expenses which get affected by the expected rise or fall in cost which should be taken into account. Generally, this budget is prepared in the form of fixed budget.

- CAPITAL‐ EXPENDITURE BUDGET: This budget stands for the expenditure on all fixed assets for the duration of the budget period. This budget is normally prepared for a longer period than the other functional budgets. It includes such items as new buildings, land, machinery and intangible items like patents, etc. This budget is designed under the observation of the accountant which is supported by the plant engineer and other functional managers.

- CASH BUDGET: The cash budget is a sketch of the business estimated cash inflows and outflows over a specific period of time. Cash budget is one of the most important and one of the last to be prepared. It is a detailed projection of cash receipts from all sources and cash payments for all purposes and the resultants cash balance during the budget. It is a mechanism for controlling and coordinating the fiscal side of business to ensure solvency and provides the basis for forecasting and financing required to cover up any deficiency in cash. Cash budget thus plays avital role in the financing management of a business undertaken.

FIXED AND FLEXIBLE BUDGET:

- FIXED BUDGET: A fixed budget is prepared for one level of output and one set of condition. This is a budget in which targets are tightly fixed. It is known as a static budget. According to CIMA, “A budget which is designed to remain unchanged irrespective of the level of the activity attained.” It is firm and prepared with the assumption that there will be no change in the budgeted level of motion. Thus, it does not provide room for any modification in expenditure due to the change in the projected conditions and activity. Fixed budgets are prepared well in advance.

- FLEXIBLE BUDGET: This is a dynamic budget. In comparison with a fixed budget, a flexible budget is one “which is designed to change in relation to the level of activity attained.” The underlying principle of flexibility is that a budget is of little use unless cost and revenue are related to the actual volume of production. The statistics range from the lowest to the highest probable percentages of operating activity in relation to the standard operating performance. Flexible budgets are a part of the feed advance process and as such are a useful part of planning. An equally accurate use of the flexible budgets is for the purposes of control.

TIME BUDGET

(a) Long term Budget: These budgets are prepared on the basis of long‐term projection and portray a long-range planning. These budgets generally cover plans for three to ten years. In this regard it is mostly prepared in terms of physical quantities rather than in monetary values.

(b) Short term Budget: In this budget forecasts and plans are given in respect of its operations for a period of about one to five years. They are generally prepared in monetary units and are more specific than long term budgets.

(c) Current Budgets: These budgets cover a very short period, may be a month or a quarter or maximum one year. The preparation of these budgets requires adjustments in short term budgets to current conditions.

(d) Rolling Budgets: A few companies follow the practice of preparing a rolling or progressive budget. In this case companies prepare the budget for a year in advance. A new budget is prepared after the end of each month or quarter for a full year in advance. The figures for the month or quarter which has rolled down are dropped and the statistics for the next month or quarter are added.

MASTER BUDGET

The master budget is a review budget which combines all functional budgets and it may take the form of Financial Statements at the end of budget period. It is also called the operating budget. It embraces the impact of both operating decisions and financing decisions. It provides the necessary plan for operations during the period when all detailed budgets have been completed. A master budget becomes a principal document for the operations of the industry during the period it covers.

Key takeaways

- Types of Budgets are: (i) Sales Budget (ii) Production budget (iii) Financial budget (iv) Overhead’s budget (v) Personnel budget and (vi) Master budget

- In a smaller firm there may be a sales forecast, a production budget, or a cash budget. Larger firms generally prepare a master budget.

Construction project Budget, by definition refers to a quantitative allocation of resources such as Man, Material, Machinery, Minutes, and Money – required for a task in a specified time to complete the project. Allocating and planning these resources at the beginning of a construction project is a must for project managers.

Every successful construction project is a combination of quality, time, and budget. While quality and time are essential to it, the project budget remains the key factor. Setting up cost estimation helps in planning, coordinating, and executing activities. It also helps a construction manager stay on top of each task while also being aware of the project’s limitations and progress.

What happens if there is no construction project budgeting done?

All construction projects can only be taken forward with a well-planned budget. The measure of the required amount of funds determines the time and nature of the activities involved. The absence of a construction project budget may lead to cost and time overruns.

When a project budget is inaccurately planned, one can expect a lot of situations to occur, and none of them yields a positive outcome. One of them is being unable to deliver the promised project within time and quality. It may significantly affect the contractors as well as the company’s credibility and that of the project site engineers involved in the project.

Most of the construction projects are of higher value, so being able to complete the construction without having to burn all the available resources is fundamental. Thorough research can help a contractor to meet the objectives and requirements of the project. Investing time, in the beginning, can cover all the unexpected losses that one could incur. Planning may seem to be a cost to some construction companies, but it has a lasting impact on the entire project.

This is where a good construction project budgeting and scheduling modules such as the one present in Tactive Construction ERP helps contractors.

What does a good construction project budget software do?

A large number of organizations utilize manual estimating and budgeting excel templates to determine, recognize, break down, and report the budget. These tools may help the project manager with financial reports, figures, and different analysis, but they also consume a lot of human and financial resources.

Today, with the help of a wide range of construction budgeting software, companies can manage their finances, and eliminate redundant processes. They can automate, analyze, and master their financial statements and accounts.

The major benefits of a construction budgeting software are:

- Cost-Effective: Involving budget management software can help reduce a lot of time and energy. It also helps a project manager to control the expenses as and when required. With the right set of features, the software can help keep the project manager on track and alter schedules as well, if required.

- Improves quality of time and money: Cost estimating and budgeting is ‘planning’ – it lets a company decide the amount it can spend on various activities without depleting its assets. To create a significant budget, they compare present and past financial reports. A budget management software for construction companies can make it simpler for the project manager to classify these reports and automate the entire planning process. Since the budgeting software is technically advanced, it spares time as well as resources.

- Helps in building zero-based construction project budgeting: A construction budget should be as accurate as it could be, or it may cause limitations at the time of implementation. A fitting construction budgeting software device can viably help make zero-based budgeting during the beginning of a project, and monitor it as well. In other words, a suitable tool can help encourage construction workers. It can also lead to the proper execution of the project with complete awareness of material, machine, manpower, and cost requirements.

Definition of capital budgeting

Capital budgeting is the process of obtaining best return on investment by evaluating investments and huge expenses. The management selects projects which gives biggest return as compared to investment made in the project. Each project is ranked on the basis of return, so that the company can select projects.

Capital budgeting is also called as investment appraisal. Capital budgeting process includes

- Identifying investment opportunities

- Evaluating investment proposal

- Capital budgeting and apportionment

- Performance review

Capital budgeting is a process of evaluating investments and huge expenses in order to obtain the best returns on investment.

An organization is often faced with the challenges of selecting between two projects/investments or the buy vs replace decision. Ideally, an organization would like to invest in all profitable projects but due to the limitation on the availability of capital an organization has to choose between different projects/investments. Capital budgeting as a concept affects our daily lives.

Let’s look at an example- Your mobile phone has stopped working! Now, you have two choices: Either buy a new one or get the same mobile repaired. Here, you may conclude that the costs of repairing the mobile increases the life of the phone. However, there could be a possibility that the cost to buy a new cell phone would be lesser than its repair costs. So, you decide to replace your cell phone and you proceed to look at different phones that fit your budget!

Objectives

Selecting profitable projects

An organization comes across various profitable projects frequently. But due to capital restrictions, an organization needs to select the right mix of profitable projects that will increase its shareholders’ wealth.

Capital expenditure control

Selecting the most profitable investment is the main objective of capital budgeting. However, controlling capital costs is also an important objective. Forecasting capital expenditure requirements and budgeting for it, and ensuring no investment opportunities are lost is the crux of budgeting.

Finding the right sources for funds

Determining the quantum of funds and the sources for procuring them is another important objective of capital budgeting. Finding the balance between the cost of borrowing and returns on investment is an important goal of Capital Budgeting.

Time value of money is defined as “the value derived from the use of money over time as a result of investment and reinvestment”. Time value of money means that “worth of a rupee received today is different from the worth of rupee to be received in future”. The preference for money now, as compared to future money is known as time preference of money. “Time value of money means that the value of a sum of money received today is more than its value received after some time”, conversely the sum of money received in future is less valuable than it is to-day. The whole set of financial decisions (whether financing decision or investment decision) hinges on the fact that the value of one rupee today is not equal to the value of one rupee at the end of one year or at the end of second year. In other words, we cannot assume that the value of rupee remains the same. This is known as ‘Time Value of Money’.

The whole process can be explained as follows:

Suppose the rate of interest is 10 percent per annum.

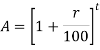

If we receive a sum of Rs. 500 now, it will earn an interest of Rs. 50 in one year and will become equal to Rs. 550 after 1 year. The same sum will earn an interest of Rs. 55 in the second year and will become equal to Rs. 605 after two years. How this money grows at different points of time can be calculated by the following compound interest formula?

Where

A is the maturity/future value of money

P is the principal sum or present value of the money

r is the rate of interest percent

t is the time period for which future sum is being calculated.

How does the value of a given sum of money change over the tine scale is shown in the following figure.

In the above figure, different values are given at different time periods. These are all values of the same Rs. 500 at different points of time, assuming the rate of interest to be 10 percent per annum. The amount of Rs. 500 becomes Rs. 550 after one year, 605 after two years and 805.26 after 5 years. In terms of valuation all sums have equal value.

All these values have been calculated by the above-mentioned compound interest formula. This, well known compound interest formula, can be modified a little to make our working more convenient. Instead of using ‘r’ as rate percent, we use the symbol ‘i’ to indicate rate per rupee.

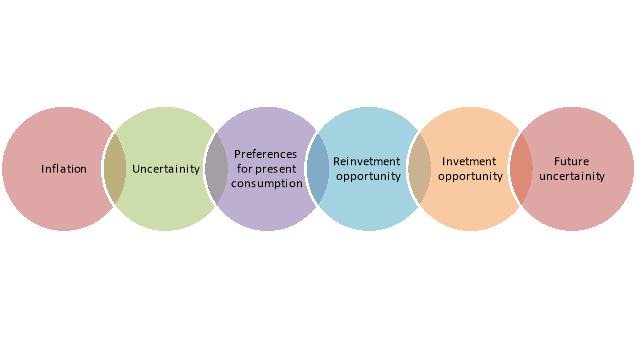

Importance of time value of money

The importance of time value of money is discussed below-

Figure: Importance of time value of money

(i) Inflation

Because of inflationary conditions, the rupee today has a higher purchasing power than rupee in future. As a result, those who have to receive the money prefer to receive the same as early as possible, while those who have to pay the money try to delay the payment.

(ii) Uncertainty

Since the future is characterized by uncertainty, individuals/business concerns prefer to have current income rather than having the same payment at a later date. They have an apprehension that the party making the payment may default due to insolvency or other reasons.

(iii) Preference for Present Consumption

Both due to uncertainty and inflationary conditions, individuals prefer the consumption to future consumption. They do not wish to save for the future by curtailing current consumption.

(iv) Opportunities for reinvestment

Money can be employed to generate real returns. Individual’s business concerns reinvest the money at a certain rate so as to have some yield on it.

(v) Preference for Consumption:

Most people have preference for present consumption over future consumption of goods and services either because of the urgency of their present wants or because of the risk of not being in a position to enjoy future consumption that may be caused by illness or death, or because of inflation.

(vi) Investment Opportunities:

Most individuals prefer present cash to future cash because of the available investment opportunities to which they can put present cash to earn additional cash.

(vii) Future Uncertainties:

One of the reasons for preference of current money is that there is a certainty about it whereas the future money has an uncertainty. There may be chances that the other party (the creditor) may become insolvent.

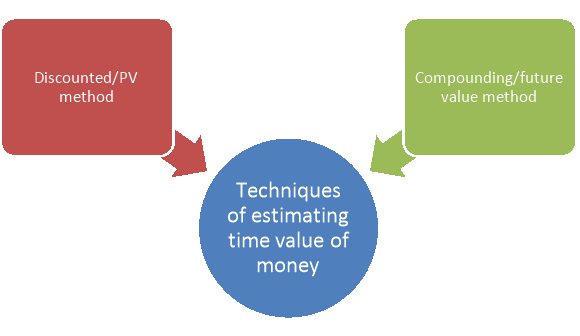

There are two techniques of estimating time value of money

The techniques of estimating time value of money is discussed below-

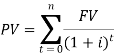

1. Discounting or Present Value Method:

The current value of an expected amount of money to be received at a future date is known as Present Value. If we expect a certain sum of money after some years at a specific interest rate, then by discounting the Future Value we can calculate the amount to be invested today, i.e., the current or Present Value.

Hence, Discounting Technique is the method that converts Future Value into Present Value. The amount calculated by Discounting Technique is the Present Value and the rate of interest is the discount rate.

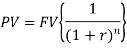

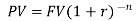

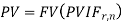

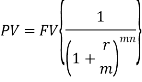

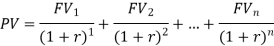

Table: Discounting or present value method for Single and Multiple Cash Flows

Sr. No | Single and Multiple Cash Flows | Formula | Notations Used |

1. | Annually single Cash Flow |    | PV=Present Value FV=Future Value r=Discount rate n=Number of years  |

2. | Multiple times, say m number of times discounting is done |  | PV=Present Value FV=Future Value r=Discount rate n=Number of years m=Number of times discounting is done say quarterly then m=4; half-yearly, m=6 and so on. |

3. | Cash flows of different amounts over the years |   | PV=Present Value FV=Future Value r=Discount rate n=Number of years |

2. Compounding or Future Value Method:

Compounding is just the opposite of discounting. The process of converting Present Value into Future Value is known as compounding.

Future Value of a sum of money is the expected value of that sum of money invested after n number of years at a specific compound rate of interest.

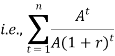

Table: Compounding or Future Value Method for Single and Multiple Cash Flows

Sr. No | Single and Multiple Cash Flows | Formula | Notations Used |

1. | Annually single Cash Flow |   | PV=Present Value FV=Future Value r= Interest rate n=Number of years  |

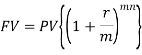

2. | Multiple times, say m number of times compounding is done |  | PV=Present Value FV=Future Value r= Interest rate n=Number of years m=Number of times compounding is done say quarterly then m=4; half-yearly, m=2 and so on. |

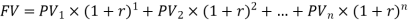

3. | Cash flows of different amounts over the years |   | PV=Present Value FV=Future Value r=Interest rate n=Number of years t=1,2,3,4,… |

Time Value of Money – Formula for Calculating Present and Future Value of Money

A. Present Value:

i. Present Value of a Future Sum:

The present value formula is the core formula for the time value of money; each of the other formulae is derived from this formula.

For example- the annuity formula is the sum of a series of present value calculations.

The Present Value (PV) formula has four variables, each of which can be solved for

is the value at time =0

is the value at time =0

FV is the value at time = n

is the rate at which the amount will be compounded each period

is the rate at which the amount will be compounded each period

n is the number of periods.

The cumulative present value of future cash flow can be calculated by summing the contributions of , the value of cash flow at time =t

, the value of cash flow at time =t

Note that this series can be summed for a given value of n, or when n is . This is a very general formula, which leads to several important special cases.

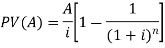

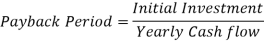

Ii. Present Value of an Annuity for n Payment Periods:

In this case the cash flow values remain the same throughout the n periods. The present value of an annuity formula has four variables, each of which can be solved for –

is the value of the annuity at time=0

is the value of the annuity at time=0 is the value of individual payments in each compounding period

is the value of individual payments in each compounding period equals the interest rate that would be compounded for each period of time.

equals the interest rate that would be compounded for each period of time. is the number of payment periods.

is the number of payment periods.

To get the PV of an annuity due, multiply the equation by (1+i)

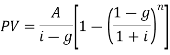

Iii. Present Value of a Growing Annuity:

In this case each cash flow grows by a factor of (1+g). Similar to the formula for an annuity, the present value of a growing annuity (PVGA) uses the same variables with the addition of g as the rate of growth of the annuity (A is the annuity payment in the first period). This is a calculation that is rarely provided for on financial calculators.

Where

To get the PV of a growing annuity due, multiply the equation by

Iv. Present Value of a Growing Perpetuity:

When the perpetual annuity payment grows at a fixed rate (g) the value is theoretically determined just as to the following formula. In practice, there are few securities with precise characteristics, and the application of this valuation approach is subject to various qualifications and modifications.

Most importantly, it is rare to find a growing perpetual annuity with fixed rates of growth and true perpetual cash flow generation. Despite these qualifications, the general approach may be used in valuations of real estate, equities, and other assets.

This is the well-known Gordon Growth model used for stock valuation.

Present Value of Perpetuity:

When n , the PV of a perpetuity (a perpetual annuity) formula becomes simple division.

, the PV of a perpetuity (a perpetual annuity) formula becomes simple division.

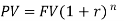

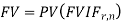

B. Future Value:

i. Future Value of a Present Sum:

The Future Value (FV) formula is similar and uses the same variables.

FV = PV. (1 + i) n

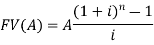

Ii. Future Value of an Annuity:

The future value of an annuity (FVA) formula has four variables, each of which can be solved for

is the value of the annuity at time =n

is the value of the annuity at time =n- A is the value of the individual payments in each compounding period.

is the interest rate that would be compounded for each period of time.

is the interest rate that would be compounded for each period of time. is the number of payment periods.

is the number of payment periods.

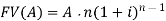

Iii. Future Value of a Growing Annuity:

The future value of a growing annuity (FVA) formula has five variables, each of which can be solved for

Where

is the value of the annuity at time =n

is the value of the annuity at time =n is the value of the initial payments paid at time 1

is the value of the initial payments paid at time 1 is the interest rate that would be compounded for each period of time.

is the interest rate that would be compounded for each period of time. is the growing rate that would be compounded for each period of time

is the growing rate that would be compounded for each period of time is the number of payment periods.

is the number of payment periods.

Key takeaways

- Time value of money is defined as “the value derived from the use of money over time as a result of investment and reinvestment”. Time value of money means that “worth of a rupee received today is different from the worth of rupee to be received in future”.

Simple Interest

Simple interest is quick way of calculating the interest charge on a loan, fixed deposits, savings account. It is calculated on the principal amount. Simple interest is determined by multiplying the daily interest rate by the principal by the number of days.

Formula

SI = P*I*N

Where,

- SI – simple interest

- P= Principal

- I = Interest rate

- N= Number of days

Simple interest applies to automobile loans or short-term loans. However, banks, financial institutions, lenders use compound interest instead of simple interest.

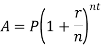

Compound interest

Sometimes the borrower and lender agree to fix up a certain unit of time, say yearly, half yearly or quarterly to settle the previous account. In such case, the amount after first unit of time becomes the principal for the second unit; the amount after second unit becomes the principal for third unit and so on.

After a specific period, the difference between the amount and the money borrowed is called the compound interest

Formula

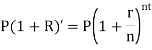

Where,

- A = the future value of the investment/loan, including interest

- P = the principal investment amount (the initial deposit or loan amount)

- r = the annual interest rate (decimal)

- n = the number of times that interest is compounded per unit t

- t = the time the money is invested or borrowed for

Nominal rate of interest is the rate of interest per annum which is compounded yearly, half yearly, quarterly, monthly, n times in a year or continuously.

Effective rate of interest is the rate of interest per annum compounded only once in a year.

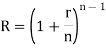

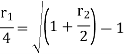

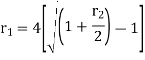

There is a relationship between nominal and effective rate of interest under two different conditions-

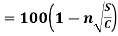

- If compounding is ‘n’ times in a year-

Where ‘r’ is nominal rate and ‘R’ is effective rate.

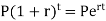

2. If compounding is continuous-

Or

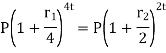

Relationship between two nominal rates-

If interest is compounded quarterly at  percent and the interest is compounded half yearly at

percent and the interest is compounded half yearly at  percent, then the relationship between the two is-

percent, then the relationship between the two is-

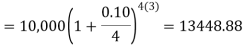

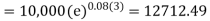

Example: Ronak deposited Rs. 10,000 in a bank for 3 years. Bank gives two offers either 10 percent compounded quarterly or 8% compounded continuously, then which offer is preferable for Ronak?

Sol.

Balance after three years under first offer-

Balance after 3 years under second offer-

So that we can conclude that the first offer is preferable for Ronak.

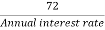

In finance, the Rule of 72 is a formula that estimates the amount of time it takes for an investment to double in value, earning a fixed annual rate of return. The rule is a shortcut, or back-of-the-envelope, calculation to determine the amount of time for an investment to double in value. The simple calculation is dividing 72 by the annual interest rate.

The Rule of 72 formula is as follows:

Doubling time (number of years) =

For example, suppose you invest money and the compounded annual interest rate is 6%. How long will it take for the money to double?

The money will double in 72 / 6 years or 12 years.

Suppose instead you invest money and the compounded annual interest rate is 9%. How long will it take for the money to double?

The money will double in 72 / 9 years = 8 years

Capital Budgeting is one of the appraising techniques of investment decisions. Capital Budgeting is defined as the firm ‘s decision to invest its current funds most efficiently in long term activities in anticipation of an expected flow of future benefits over a series of years.

Charles. T. Horngreen defined capital budgeting as ―” Long term planning for making and financing proposed capital out lay”.

According to Keller and Ferrara, ―” Capital Budgeting represents the plans for the appropriation and expenditure for fixed asset during the budget period”.

Robert N. Anthony defined as ―” Capital Budget is essentially a list of what management believes to be worthwhile projects for the acquisition of new capital assets together with the estimated cost of each product.”

The capital budgeting involves the following steps-

Figure: Capital budgeting process

A) Project identification:

The first step towards capital budgeting is to identify a project for investments. Such projects may be addition of a new product line or expanding the existing one, increase the production or reduce the costs of outputs etc.

B) Project Screening and Evaluation:

In this step the manager conduct research about a project for evaluation of viability of project. This has to match the objective of the firm to maximize its market value. The tool of time value of money comes handy in this step. Also, the estimation of the benefits and the costs needs to be done. The total cash inflow and outflow along with the uncertainties and risks associated with the proposal has to be analyzed thoroughly and appropriate provisioning has to be done for the same.

C) Project Selection:

There is no such defined method for the selection of a proposal for investments as different businesses have different requirements. That is why, the approval of an investment proposal is done based on the selection criteria and screening process which is defined for every firm keeping in mind the objectives of the investment being undertaken. Once the proposal has been finalized, the different alternatives for raising or acquiring funds have to be explored by the finance team. This is called preparing the capital budget. The average cost of funds has to be reduced. A detailed procedure for periodical reports and tracking the project for the lifetime needs to be streamlined in the initial phase itself. The final approvals are based on profitability, Economic constituents, viability and market conditions.

D) Implementation:

Money is spent and thus proposal is implemented. The different responsibilities like implementing the proposals, completion of the project within the requisite time period and reduction of cost are allotted. The management then takes up the task of monitoring and containing the implementation of the proposals.

E) Performance review:

The final stage of capital budgeting involves comparison of actual results with the standard ones. The unfavourable results are identified and removing the various difficulties of the projects helps for future selection and execution of the proposals.

Key takeaways

- Capital Budgeting is one of the appraising techniques of investment decisions. Capital Budgeting is defined as the firm ‘s decision to invest its current funds most efficiently in long term activities in anticipation of an expected flow of future benefits over a series of years.

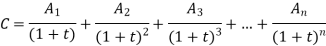

- Net present value –

The net present value method is a classic method of evaluating the investment proposals. It is one of the methods of discounted cash flow techniques, which recognizes the importance of time value of money. It correctly postulates that cash flows arising at time periods differ in value and are comparable only with their equivalents i.e., present values. It is a method of calculating the present value of cash flows (inflows and outflows) of an investment proposal using the cost of capital as an appropriate discounting rate. The net present value will be arrived at by subtracting the present value of cash outflows from the present value of cash inflows. Steps to compute net present value:

(i) Estimation of future cash inflows

(ii) An appropriate rate of interest should be selected to discount the cash flows. Generally, this will be the ―cost of capital‖ of the company, or required rate of return.

(iii) The present value of inflows and outflows of an investment proposal has to be computed by discounting them with an appropriate cost of capital.

(iv) The net value is the difference between the present value of cash inflows and the present value of cash outflows.

The formula for the net present value can be written as:

NPV= C1/(1+k)1 + C2 / (1+K)2 +C3 /(1+k)3 +…………. Cn/(1+K)n – I

Where,

C = Annual Cash inflows,

Cn = Cash inflow in the year n

K = Cost of Capital

I = Initial Investment

The following are the merits of the net present value (NPV) methods:

(i) Consideration to total Cash Inflows: The NPV methods considers the total cash inflows of investment opportunities over the entire life-time of the projects unlike the payback period methods.

(ii) Recognition to the Time Value of Money: This method explicitly recognizes the time value of money, which is investable for making meaningful financial decisions.

(iii) Changing Discount Rate: Due to change in the risk pattern of the investor different discount rates can be used.

(iv) Best decision criteria for Mutually Exclusive Projects: This Method is particularly useful for the selection of mutually exclusive projects. It serves as the best decision criteria for mutually exclusive choice proposals.

(v) Maximization of the Shareholders Wealth: Finally, the NPV method is instrumental in achieving the objective of the maximization of the shareholders’ wealth. This method is logically consistent with the company‘s objective of maximizing shareholders‘ wealth in terms of maximizing market value of shares, and theoretically correct for the selections of investment proposals.

The following are the demerits of the net present value method:

(i) It is difficult to understand and use.

(ii) The NPV is calculated by using the cost of capital as a discount rate. But the concept of cost of capital itself is difficult to understand and determine.

(iii) It does not give solutions when the comparable projects are involved in different amounts of investment.

(iv) It does not give correct answer to a question when alternative projects of limited funds are available, with unequal lives.

2. Internal rate of return –

The internal rate of return method is also a modern technique of capital budgeting that takes into account the time value of money. It is also known as ‘time adjusted rate of return’ discounted cash flow’ ‘discounted rate of return,’ ‘yield method,’ and ‘trial and error yield method’.

In the net present value method, the net present value is determined by discounting the future cash flows of a project at a predetermined or specified rate called the cut-off rate. But under the internal rate of return method, the cash flows of a project are discounted at a suitable rate by hit and trial method, which equates the net present value so calculated to the amount of the investment.

Under this method, since the discount rate is determined internally, this method is called as the internal rate of return method. The internal rate of return can be defined as that rate of discount at which the present value of cash-inflows is equal to the present value of cash outflows.

It can be determined with the help of the following mathematical formula:

Where

C=Initial outlay at time zero.

Future net cash flows at different periods/

Future net cash flows at different periods/

number of years

number of years

rate of discount of internal rate of return.

rate of discount of internal rate of return.

The following steps are required to practice the internal rate of return method:

(1) Determine the future net cash flows during the entire economic life of the project. The cash inflows are estimated for future profits before depreciation but after taxes.

(2) Determine the rate of discount at which the value of cash inflows is equal to the present value of cash outflows. This may be determined as explained after step (4).

(3) Accept the proposal if the internal rate of return is higher than or equal to the minimum required rate of return, i.e., the cost of capital or cut off rate and reject the proposal if the internal rate of return is lower than the cost of cut-off rate.

(4) In case of alternative proposals select the proposal with the highest rate of return as long as the rates are higher than the cost of capital or cut-off-rate.

Advantages of Internal Rate of Return Method

(i) Like the net present value method, it takes into account the time value of money and can be usefully applied in situations with even as well as un even cash flow at different periods of time.

(ii) It considers the profitability of the project for its entire economic life and hence enables evaluation of true profitability.

(iii) The determination of cost of capital is not a pre-requisite for the use of this method and hence it is better than net present value method where the cost of capital cannot be determined easily.

(iv) It provides for uniform ranking of various proposals due to the percentage rate of return.

(v) This method is also compatible with the objective of maximum profitability and is considered to be a more reliable technique of capital budgeting.

Disadvantages of Internal Rate of Return Method:

(i) It is difficult to understand and is the most difficult method of evaluation of investment proposals.

(ii) This method is based upon the assumption that the earnings are reinvested at the internal rate of return for the remaining life of the project, which is not a justified assumption particularly when the average rate of return earned by the firm is not close to the internal rate of return. In this sense, Net Present Value method seems to be better as it assumes that the earnings are reinvested at the rate of firm’s cost of capital.

(iii) The results of NPV method and IRR method may differ when the projects under evaluation differ in their size, life and timings of cash flows.

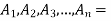

3. Payback period –

It is the most popular and widely recognized traditional methods of evaluating the investment proposals. It can be defined as the number of years to recover the original capital invested in a project. The payback period can be used as accept or reject criterion as well as a method of ranking projects. The payback period is the number of years to recover the investment made in a project. If the payback period calculated for a project is less than the maximum payback period set-up by the company, it can be accepted. As a ranking method it gives the highest rank to a project which has the lowest payback period, and the lowest rank to a project with the highest payback period. Whenever a company faces the problem of choosing among two or more mutually exclusive projects, it can select a project on the basis of payback period, which has shorter period than the other projects. The formula for calculation of payback period method is-

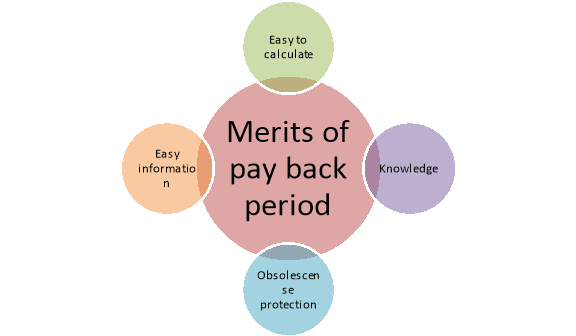

The following are the merits of the payback period method:

Figure: Advantages of pay back method

(i) Easy to calculate: It is one of the easiest methods of evaluating the investment projects. It is simple to understand and easy to compute.

(ii) Knowledge: The knowledge of payback period is useful in decision-making, the shorter the period better the project.

(iii) Protection from loss due to obsolescence: This method is very suitable to such industries where mechanical and technical changes are routine practice and hence, shorter payback period practice avoids such losses.

(iv) Easily availability of information: It can be computed on the basis of accounting information, what is available from the books.

The payback period method has certain demerits:

(i) Failure in taking cash flows after payback period: This method is not taking into account the cash flows received by the company after the payback period.

(ii) Not considering the time value of money: It does not take into account the time value of money.

(iii) Non-considering of interest factor: It does not take into account the interest factor involved in the capital outlay.

(iv) Maximization of market value not possible: It is not consistent with the objective of maximizing the market value of share.

(v) Failure in taking magnitude and timing of cash inflows: It fails to consider the pattern of cash inflows i.e., the magnitude and timing of cash inflows.

4. Average rate of return –

This technique uses the accounting information revealed by the financial statements to measure the profitability of an investment proposal. It can be determined by dividing the average income after taxes by the average investment. According to Soloman, Accounting Rate of Return can be calculated as the ratio, of average net income to the initial investment. On the basis of this method, the company can select all those projects whose ARR is higher than the minimum rate established by the company. It can reject the projects with an ARR lower than the expected rate of return. This method also helps the management to rank the proposal on the basis of ARR.

Accounting Rate of Return (ARR) = Original Investment Average Net Income

OR

Accounting Rate of Return (ARR) = Average Investment Average Net Income

The following are the merits of ARR method:

(i) It is very simple to understand and calculate;

(ii) It can be readily computed with the help of the available accounting data;

(iii) It uses the entire stream of earnings to calculate the ARR.

This method has the following demerits:

(i) It is not based on cash flows generated by a project;

(ii) This method does not consider the objective of wealth maximization;

(iii) It ignores the length of the projects useful life;

(iv) If does not take into account the fact that the profile can be re-invested; and

(v) It ignores the time value of money.

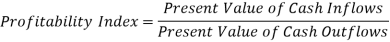

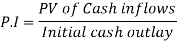

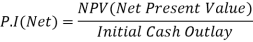

5. Profitable index –

This method is also known as Benefit Cost Ratio. According to Van Horne, the profitability Index of a project is ―the ratio of the present value of future net cash inflows to the present value of cash outflows. If the Profitability Index is greater than or equal to one, the project should be accepted otherwise reject. It can be calculated as follows-

Or

The profitability index may be found for net present values of inflows

The merits of this method are:

(i) It takes into account the time value of money

(ii) It helps to accept / reject investment proposal on the basis of value of the index.

(iii) It is useful to rank the proposals on the basis of the highest /lowest value of the index.

(iv) It takes into consideration the entire stream of cash flows generated during the life of the asset.

This technique suffers from the following limitations:

(i) It is somewhat difficult to compute.

(ii) It is difficult to understand the analytical of the decision on the basis of profitability index.

A project is accomplished by performing a set of activities. For example, construction of a house is a project. The construction of a house consists of many activities like digging of foundation pits, construction of foundation, construction of walls, construction of roof, fixing of doors and windows, fixing of sanitary fitting, wiring etc. Another aspect of project is the non-routine nature of activities. Each project is unique in the sense that the activities of a project are unique and non-routine. A project consumes resources. The resources required for completing a project are men, material, money and time. Thus, we can define a project as an organized programme of pre-determined group of activities that are non-routine in nature and that must be completed using the available resources within the given time limit.

Characteristics

- Objectives: A project has a set of objectives or a mission. Once the objectives are achieved the project is treated as completed.

- Life cycle: A project has a life cycle. The life cycle consists of five stages i.e., conception stage, definition stage, planning & organizing stage, implementation stage and commissioning stage.

- Uniqueness: Every project is unique and no two projects are similar. Setting up a cement plant and construction of a highway are two different projects having unique features.

- Team Work: Project is a team work and it normally consists of diverse areas. There will be personnel specialized in their respective areas and co-ordination among the diverse areas calls for team work.

- Complexity: A project is a complex set of activities relating to diverse areas.

- Risk and uncertainty: Risk and uncertainty go hand in hand with project. A risk-free, it only means that the element is not apparently visible on the surface and it will be hidden underneath. 4

- Customer specific nature: A project is always customer specific. It is the customer who decides upon the product to be produced or services to be offered and hence it is the responsibility of any organization to go for projects/services that are suited to customer needs.

- Change: Changes occur throughout the life span of a project as a natural outcome of many environmental factors. The changes may vary from minor changes, which may have very little impact on the project, to major changes which may have a big impact or even may change the very nature of the project.

- Optimality: A project is always aimed at optimum utilization of resources for the overall development of the economy.

- Sub-contracting: A high level of work in a project is done through contractors. The more the complexity of the project, the more will be the extent of contracting.

- Unity in diversity: A project is a complex set of thousands of varieties. The varieties are in terms of technology, equipment and materials, machinery and people, work, culture and others.

Depreciation

“Depreciation may be defined as the permanent decrease in the value of an asset through wear and tear in use or the passage of time.”

In accounting terms, depreciation is defined as the reduction of recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible.

Buildings, furniture, office equipment, machinery etc. are examples of fixed assets. A land is the only exception as the value of land appreciates with time and thus it does not depreciate. Depreciation allows a portion of the cost of a fixed asset to the revenue generated by the fixed asset.

The Primary meaning of the word depreciation is loss of value through wear and the tear or some other form of material deterioration. The secondary sense of depreciation is the operation of adjusting the book values of assets. It is the practice of the Accountant to reduce their values in the books of accounts as the machines or other assets get old and it is usual to call this as depreciation.

Definition

Depreciation is the diminution in the financial value of the asset owing to wear and tear, effluxion of time, obsolescence or similar cause, the suggestion being other that of gradual deterioration than sudden loss or diminution in value. L.C. Cropper

Depreciation may be defined as the measure of the exhaustion of the effective life of on asset from any cause during the given period Spicer and Pegler

Depreciation features:

(I) Depreciation is a decline in the value of fixed assets (excluding land). The decline in the value of an asset is inherently permanent. Once shrunk, it cannot be restored to its original value.

(Ii) Depreciation is a gradual and continuous process because the value of an asset decreases due to the use of the asset or the expiration of time.

(Iii) It is not an asset valuation process. This is the process of allocating the cost of an asset to its lifetime.

(Iv) Depreciation reduces the book value, not the market value of an asset.

(V) Depreciation is only used for property, plant and equipment. It is not used to waste intangible assets such as amortization of goodwill and depletion of natural resources.

Causes of depreciation

Causes of depreciation may be of two: internal causes and external causes.

Internal Causes of Depreciation

Wear and tear, exhaustion, depletion, deterioration etc. causes depreciation of assets which are internal in nature.

1. Wear and tear

Assets are constantly used in the organization so they diminish their value. Wear and tear represent the difference between the value of an asset when it was bought and its value being used for some time. Although assets are kept in working conditions, a time comes when only scrap value remains.

2. Exhaustion

As time progress assets are bound to lose their value. At the same time, productivity declines. After the elapse of a certain fixed period assets exhaust their value and are found useless. It is true that assets have their definite age.

3. Depletion

Natural resources like mines, quarries and oil wells are of a wasting character. The value of wasting assets declines, as a result of gradual exhaustion. They are consumed gradually. The process of earning income through extraction causes depletion of wasting assets.

4. Deterioration

Deterioration means erosion in value of those assets which have a very short life. Proper repairs and maintenance of these assets cause an additional loss by way of deterioration.

External Causes of Depreciation

Factors external to causes of depreciation include passage of time, obsolescence, permanent fall in market value and weather and accidental elements. These factors are not connected to the asset. Even then they cause depreciation.

1. Passage of time

The utility of some fixed assets is confined to a time frame. Assets such as leasehold property become useless after a period. Assets such as trademark, patents lose their value with the passage of time.

2. Obsolescence

Obsolescence implies the chance of an asset becoming out of fashion. This is a loss arising on account of new invention, technological changes, improvement in production methods, legal restraints etc. These factors make it economical to replace the assets though they are still usable.

3. Permanent fall in the market value

Due to a downfall in their market value assets like investments lose their value. It is only the permanent fall in the value of asset. For depreciation calculation temporary shrinkage in the value of assets should be ignored.

4. Weather and accidental elements

Assets lose their value due to weather, rain, sunshine or any accident like fire, earthquake, flood, tidal forces or similar other disasters. The effect of these factors enters into calculating depreciation.

Types of depreciation

The types of depreciation include-

Straight line method

What is the straight-line method?

The straight-line method is the default method used to evenly recognize the carrying amount of fixed assets over their useful lives. This is used when there is no particular pattern in how an asset is used over time. The straight-line method is the easiest depreciation method to calculate and is highly recommended for use as it causes few calculation errors. The procedure for flat-rate calculation is as follows.

- Determines the initial cost of an asset recognized as a fixed asset.

- Subtract the estimated residual value of the asset from the amount recorded in the books.

- Determines the estimated useful life of an asset. It is easiest to use the standard useful life for each class of asset.

- Divide the estimated useful life (yearly) by 1 to calculate the depreciation rate using the straight-line method.

- Multiply the depreciation rate by the cost of assets (minus salvage value).

- Once calculated, depreciation expense is recorded in accounting records as a depreciation expense account and a credit to the accumulated depreciation account. Accumulated depreciation is against assets. That is, it is paired with the fixed asset account and the depreciation is reduced.

Formula:

Depreciation = (Asset Cost – Net Residual Value) / Service Life

Depreciation rate = (annual depreciation cost x 100) / cost of capital

Straight-line Journal Entries:

1. Purchase of Assets A / c Dr. Xx

To cash / bank / creditor A / cxx

(Purchasing assets)

2. Depreciation of assets A / c Dr.xx

To asset A /cxx

(Assets are subject to depreciation)

3. Transfer depreciation gains / losses A / c Dr. Xx

To depreciation of asset A / cxx

(Asset depreciation is transferred to the profit and loss account)

Example 1

Pensive Corporation will purchase a Procrastinator Deluxe machine for $ 60,000. It has an estimated salvage value of $ 10,000 and a useful life of 5 years. Pensive calculates the machine's annual flat-rate depreciation as follows:

Solution

$ 60,000 Purchase Cost – $ 10,000 Estimated Residual Value = $ 50,000 Depreciable Asset Cost

1/5-year useful life = 20% annual depreciation rate

20% depreciation rate x $ 50,000 depreciation asset cost = $ 10,000 annual depreciation

Example 2

Q. Anil purchased a machine on 1 Apr 2015 for ₹400000. The useful life of the machine is 3 years and its estimated residual value is ₹40000. At the end of its useful life, the machine is sold for 50000. Prepare the necessary ledger accounts in the books of Anil for the year ending 31st December every year. Use SLM.

Ans: In the books of Anil

Machinery a/c

Date | Particulars | Amount |

| Date | Particulars | Amount |

2015 |

|

|

| 2015 |

|

|

01-Apr | To Cash A/c | 400000 |

| 31-Dec | By Depreciation A/c | 90000 |

|

|

|

| 31-Dec | By balance c/d | 310000 |

|

| 400000 |

|

|

| 400000 |

2016 |

|

|

| 2016 |

|

|

01-Jan | To balance b/d | 310000 |

| 31-Dec | By Depreciation A/c | 120000 |

|

|

|

| 31-Dec | By balance c/d | 190000 |

|

| 310000 |

|

|

| 310000 |

2017 |

|

|

| 2017 |

|

|

01-Jan | To balance b/d | 190000 |

| 31-Dec | By Depreciation A/c | 120000 |

|

|

|

| 31-Dec | By balance c/d | 70000 |

|

| 190000 |

|

|

| 190000 |

2018 |

|

|

| 2018 |

|

|

01-Jan | To balance b/d | 70000 |

| 31-Mar | By Depreciation A/c | 30000 |

|

|

|

| 31-Mar | By Cash A/c | 40000 |

|

| 70000 |

|

|

| 70000 |

Depreciation a/c

Date | Particulars | Amount |

| Date | Particulars | Amount |

2015 |

|

|

| 2015 |

|

|

31-Dec | To Machinery A/c | 90000 |

| 31-Dec | By Profit & Loss A/c | 90000 |

|

| 90000 |

|

|

| 90000 |

2016 |

|

|

| 2016 |

|

|

31-Dec | To Machinery A/c | 120000 |

| 31-Dec | By Profit & Loss A/c | 120000 |

|

| 120000 |

|

|

| 120000 |

2017 |

|

|

| 2017 |

|

|

31-Dec | To Machinery A/c | 120000 |

| 31-Dec | By Profit & Loss A/c | 120000 |

|

| 120000 |

|

|

| 120000 |

2018 |

|

|

| 2018 |

|

|

31-Mar | To Machinery A/c | 30000 |

| 31-Dec | By Profit & Loss A/c | 30000 |

|

| 30000 |

|

|

| 30000 |

Working Notes:

Calculation of amount of depreciation

Depreciation = (Cost of Asset – Net Residual Value)/Useful life

= (400000 – 40000)/3 = 120000 p.a.

Written down value method

The various depreciation methods are based on mathematical formulas. This formula is derived from a study of asset behaviour over a period of time. One such depreciation method is the depreciation method. Learn more about this method.

According to the depreciation method, depreciation is charged at a fixed percentage of the book value of the asset. It is also known as depreciation or depreciation because its book value decreases each year.

Since the book value decreases every year, the depreciation amount also decreases every year. This way, the value of the asset never goes to zero.

If you plot the depreciation amount billed this way and the corresponding period on the graph, the line will move down.

This method was previously based on the assumption that the cost of repairing an asset is low and therefore more depreciation costs must be charged. In addition, depreciation costs will decrease as repair costs increase in later years. Therefore, this method puts an equal burden on profits each year for the life of the asset.

However, this method may not provide full depreciation at the end of the asset's useful life if the applicable depreciation rate is not appropriate.

In addition, when applying this method, it is necessary to consider the period of use of the asset. If the asset is used for only two months in a year, depreciation will only be charged for two months.

However, if the asset is used for more than 180 days for income tax purposes, you will be charged full-year depreciation. Income tax rules also allow you to depreciate using the depreciation method.

It is also known as Diminishing Balance Method or Declining Balance Method.

The formula is:

Depreciation Rate

Where n=number of years

S=Salvage value

C=cost of asset

Amount of depreciation=Book Value x Rate of Depreciation

100

Example 1

Q. M/s. Bharat and sons purchased a machine on 1 Apr 2015 for ₹400000 from ABC & Co. And paid ₹100000 on its installation. The useful life of the machine is 3 years and its estimated residual value is ₹40000. On 31st March 2018, M/s. Bharat and sons sell the machinery for 250000.

Charge depreciation as per the W.D.V. Method @10 % p. a. Prepare the necessary ledger accounts in the books of Anil for the year ending 31st December every year.

Ans: In the books of M/s. Bharat and sons

Machinery A/C

Date | Particulars | Amount |

| Date | Particulars | Amount |

2015 |

|

|

| 2015 |

|

|

01-Apr | To ABC & Co. A/c | 400000 |

| 31-Dec | By Depreciation A/c | 37500 |

| To Cash A/c (installation exp.) | 100000 |

| 31-Dec | By balance c/d | 462500 |

|

|

|

|

|

|

|

|

| 500000 |

|

|

| 500000 |

2016 |

|

|

| 2016 |

|

|

01-Jan | To balance b/d | 462500 |

| 31-Dec | By Depreciation A/c | 46250 |

|

|

|

| 31-Dec | By balance c/d | 416250 |

|

| 462500 |

|

|

| 462500 |

2017 |

|

|

| 2017 |

|

|

01-Jan | To balance b/d | 416250 |

| 31-Dec | By Depreciation A/c | 41625 |

|

|

|

| 31-Dec | By balance c/d | 374625 |

|

| 416250 |

|

|

| 416250 |

2018 |

|

|

| 2018 |

|

|

01-Jan | To balance b/d | 374625 |

| 31-Mar | By Depreciation A/c | 9366 |

|

|

|

| 31-Mar | By Cash A/c | 250000 |

|

|

|

|

| By Profit & Loss A/c (loss on sale) | 115259 |

|

| 401625 |

|

|

| 401625 |

Depreciation A/C

Date | Particulars | Amount |

| Date | Particulars | Amount |

2015 |

|

|

| 2015 |

|

|

31-Dec | To Machinery A/c | 37500 |

| 31-Dec | By Profit & Loss A/c | 37500 |

|

|

|

|

|

|

|

2016 |

|

|

| 2016 |

|

|

31-Dec | To Machinery A/c | 46250 |

| 31-Dec | By Profit & Loss A/c | 46250 |

|

|

|

|

|

|

|

2017 |

|

|

| 2017 |

|

|

31-Dec | To Machinery A/c | 41625 |

| 31-Dec | By Profit & Loss A/c | 41625 |

|

|

|

|

|

|

|

2018 |

|

|

| 2018 |

|

|

31-Mar | To Machinery A/c | 9366 |

| 31-Dec | By Profit & Loss A/c | 9366 |

Working Notes:

Calculation of amount of depreciation

Amount of depreciation=

Book Value × Rate of Depreciation/ 100

2015: Depreciation = 500000 x 10/100 x 9/12 = 37500

2016: Depreciation = 462500 x 10/100 = 46250

2017: Depreciation = 416250 x 10/100 = 41625

2018: Depreciation = 374625 x 10/100 x 3/12 = 9366

Calculation of loss on sale of machinery

Loss = Book Value on 1 Jan 2018 – depreciation for 3 months – cash received

= 374625 – 9366- 250000 = 115259

Annuity Method

Under annuity method of depreciation, the cost of asset is regarded as investment and interest at fixed rate is calculated thereon. Had the proprietor invested outside the business, an amount equal to the cost of asset, he would have earned some interest. So as a result of buying the asset the proprietor loses not only cost of asset by using it, but also the above-mentioned interest. Hence depreciation is calculated in such a way as will cover both the above-mentioned losses. The amount of annual depreciation is determined from annuity table.

Annuity method is particularly applicable to those assets whose cost is heavy and life is long and fixed, e.g., leasehold property, land and building etc.

Journal entries for annuity method

1. Charging interest on asset | Asset A/c Dr |

To Interest A/c | |

(Being interest charged on asset) | |

2. Charging depreciation on asset | Depreciation A/c Dr |

To Asset / Provision for Depreciation A/c | |

(Being depreciation charged on asset) | |

3. Transferring depreciation to Profit & Loss A/c | Profit &Loss A/c Dr |

To Depreciation A/c | |

(Being depreciation on asset transferred to Profit & Loss A/c) | |

4. Transferring interest to Profit & Loss A/c | Interest A/c Dr |

To Profit &Loss A/c | |

(Being interest on capital expenditure on asset transferred to Profit & Loss A/c) |

Example 1

Q. A Ltd. Purchased a 5 years lease on 1 April 2013 for ₹500000. It is decided to write off depreciation on lease using the Annuity Method. The rate of interest is presumed to be 6% p.a. The annuity for ₹1 for 5 years at 6% interest is 0.237396. Prepare the Lease A/c and the Profit & Loss A/c for 5 years.

Ans:

Amount of depreciation to be written off every year = 0.237396 x 500000 = 118698

Lease a/c

Date | Particulars | Amount |

| Date | Particulars | Amount |

2013-14 |

|

|

| 2013-14 |

|

|

01-Apr | To Bank A/c | 500000 |

| 31-Mar | By Depreciation A/c | 118698 |

31-Mar | To Interest A/c | 30000 |

| 31-Mar | By balance c/d | 411302 |

| (6% on 500000) |

|

|

|

|

|

|

| 530000 |

|

|

| 530000 |

2014-15 |

|

|

| 2014-15 |

|

|

01-Apr | To Balance b/d | 411302 |

| 31-Mar | By Depreciation A/c | 118698 |

31-Mar | To Interest A/c | 24678 |

| 31-Mar | By balance c/d | 317282 |

| (6% on 411302) |

|

|

|

|

|

|

| 435980 |

|

|

| 435980 |

2015-16 |

|

|

| 2015-16 |

|

|

01-Apr | To Balance b/d | 317282 |

| 31-Mar | By Depreciation A/c | 118698 |

31-Mar | To Interest A/c | 19037 |

| 31-Mar | By balance c/d | 217621 |

| (6% on 317282) |

|

|

|

|

|

|

| 336319 |

|

|

| 336319 |

2016-17 |

|

|

| 2016-17 |

|

|

01-Apr | To Balance b/d | 217621 |

| 31-Mar | By Depreciation A/c | 118698 |

31-Mar | To Interest A/c | 13057 |

| 31-Mar | By balance c/d | 111980 |

| (6% on 217621) |

|

|

|

|

|

|

| 230678 |

|

|

| 230678 |

2017-18 |

|

|

| 2017-18 |

|

|

01-Apr | To Balance b/d | 111980 |

| 31-Mar | By Depreciation A/c | 118698 |

31-Mar | To Interest A/c | 6718 |

|

|

|

|

| (6% on 111980) |

|

|

|

|

|

|

| 118698 |

|

|

| 118698 |

Profit and loss a/c

Date | Particulars | Amount |

| Date | Particulars | Amount |

2013-14 |

|

|

| 2013-14 |

|

|

31-Mar | To Depreciation A/c | 118698 |

| 31-Mar | By Interest A/c | 30000 |

|

|

|

|

|

|

|

2014-15 |

|

|

| 2014-15 |

|

|

31-Mar | To Depreciation A/c | 118698 |

| 31-Mar | By Interest A/c | 24678 |

|

|

|

|

|

|

|

2015-16 |

|

|

| 2015-16 |

|

|

31-Mar | To Depreciation A/c | 118698 |

| 31-Mar | By Interest A/c | 19037 |

|

|

|

|

|

|

|

2016-17 |

|

|

| 2016-17 |

|

|

31-Mar | To Depreciation A/c | 118698 |

| 31-Mar | By Interest A/c | 13057 |

|

|

|

|

|

|

|

2017-18 |

|

|

| 2017-18 |

|

|

31-Mar | To Depreciation A/c | 118698 |

| 31-Mar | By Interest A/c | 6718 |

Sinking Fund Method

Under this method, the amount of depreciation charged every year is transferred to the sinking fund account. This amount is then invested in Government securities. Also, the interest earned on these securities is reinvested.

The amount of depreciation to be charged every year is calculated after considering the element of interest. The interest will be earned on the amount which is invested every year and will remain invested till the useful life of the asset.

The sale proceeds of the old asset and any profit or loss from the sale of investments are transferred to the Sinking Fund Account. The balance in the Sinking Fund Account is then transferred to the Profit and Loss A/c or General Reserve.

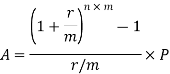

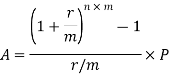

Sinking Fund Formula

The formula for sinking fund is as follows.

Where

- A = Money Accumulated

- P = Periodic Contribution to the sinking fund

- r = Rate of Interest

- n = number of years

- m = number of payments per year

The periodic contribution can be calculated with the following formula

Journal entries

1. For Depreciation | Depreciation A/c | Dr. |

To Sinking Fund A/c |

| |

(Being depreciation on the asset transferred to the sinking fund account) |

| |

2. For transferring depreciation to P&L A/c | Profit and Loss A/c | Dr. |

To Depreciation A/c |

| |

(Being depreciation charged to the profit and loss A/c) |

| |

3. For investing the depreciation amount | Sinking Fund Investment A/c | Dr. |

To Bank A/c |

| |

(Being amount of depreciation invested) |

| |

4. For interest earned | Bank A/c | Dr. |

To Interest on Sinking Fund Investment A/c |

| |

(Being interest earned on the sinking fund investments) |

| |

5. For transferring interest on investment | Interest on Sinking Fund Investment A/c | Dr. |

To Sinking Fund A/c |

| |

(Being interest on Sinking Fund Investment transferred to Sinking Fund A/c) |

| |

6. For sale of sinking fund investment | Bank A/c | Dr. |

To Sinking Fund Investment A/c |

| |

(Being Sinking Fund Investment sold at the end of the useful life of the asset) |

| |

7. For the profit on the sale of investment | Sinking Fund Investment A/c | Dr. |

To Sinking Fund A/c |

| |

(Being profit on the sale of investment transferred to sinking fund) |

| |

8. For loss on sale of investment | Sinking Fund A/c | Dr. |

To Sinking Fund Investment A/c |

| |

(Being loss on sale of investment transferred to sinking fund) |

| |

9. For transferring the book value of the asset | Sinking Fund A/c | Dr. |

To Asset A/c |

| |

(Being the book value of the asset transferred to the sinking fund) |

| |

10. For the transfer of surplus in Sinking fund | Sinking Fund A/c | Dr. |

To General Reserve A/c |

| |

(Being surplus in sinking fund transferred to the General Reserve) |

| |

11. For transfer of deficit in sinking fund | Profit & Loss A/c | Dr. |

To Sinking Fund A/c |

| |

(Being deficit in sinking fund transferred to profit and loss A/c) |

|

Insurance Policy Method

Insurance policy method is just like sinking fund method of depreciation, but in this method, the money is used to pay premium for insurance company. Premium will be charged at the start of the year. Money at the end of maturity can be used to buy a new asset

Journal entries

Insurance policy A/c |

To cash A/c |

To sinking fund A/c |

(Being premium paid at the end of the year) |

Profit and Loss A/c |

To Depreciation A/c |

(Being Depreciation is charged) |

Cash A/c |

To insurance policy A/c |

(Being money received on maturity) |

Insurance policy A/c |

To Depreciation fund A/c |

(Being Transfer of excess amount over premium) |

Depreciation policy A/c |

To Asset A/c |

(Being asset is retired) |

Cash A/c |

To Asset A/c |

(Being scrap is sold) |

Key takeaways

- Depreciation ties the cost of using a tangible asset with the benefit gained over its useful life.

- There are many types of depreciation, including straight-line and various forms of accelerated depreciation.

- Accumulated depreciation refers to the sum of all depreciation recorded on an asset to a specific date.

- The carrying value of an asset on the balance sheet is its historical cost minus all accumulated depreciation.

- The sinking fund method is a depreciation technique used to finance the replacement of an asset at the end of its useful life.

- As depreciation is incurred, a matching amount of cash is invested, usually in government-backed securities.

- The straight-line method is the default method used to evenly recognize the carrying amount of fixed assets over their useful lives

The need for providing depreciation in accounting records arises due to any one or more of the following objectives to be achieved:

- To ascertain true results of operations: For proper matching of costs with revenues, it is necessary to charge the depreciation (cost) against income (revenue) in each accounting period. Unless the depreciation is charged against income, the result of operations would stand overstated. As a result, the Income Statement would fail to present a true and fair view of the result of operations of an accounting entity.

- To present true and fair view of the financial position: For presenting a true and fair view of the financial position, it is necessary to charge the depreciation. If the depreciation is not charged, the unexpired cost of the asset concerned would be overstated. As a result, the Position Statement (i.e., the Balance Sheet) would not present a true and fair view of the financial position of an accounting entity.

- To ascertain the true cost of production: For ascertaining the cost of production, it is necessary to charge depreciation as an item of cost of production. If the depreciation on fixed assets is not charged, the cost records, would not present a true and fair view of the cost of production.

- To comply with legal requirements: In case of companies, it is compulsory to charge depreciation on fixed assets before it declares dividend [Sec. 205(1) of the Companies Act, 1956].

- To accumulate funds for replacement of assets: A portion of profits is set aside in the form of depreciation and accumulated each year to provide a definite amount at a certain future date for the specific purpose of replacement of the asset at the end of its useful life.

References:

- Engineering Economics Management, Dr. Vilas Kulkarni and Hardik Bavishi, S. Chand Publication

- Laws for Engineers, Vandana Bhatt and Pinky Vyas, Pro Care Publisher

- Indian Economy, Gaurav Datt and Ashwani Mahajan, S. Chand Publication

- Industrial Organization & Engineering Economics, T. R. Banga and S. C. Sharma, Khanna Publisher