Unit 4

Insurance Claim for Loss of Stock

Fire insurance being a contract of indemnity, a claim can be lodged only for the actual amount of the loss, not exceeding the insured value. Following are some of the important points which must be considered.

- Fire insurance is a contract of indemnity. Therefore, the claim will be limited to the actual loss suffered even though the insured value of the goods may be higher.

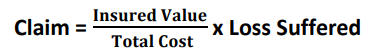

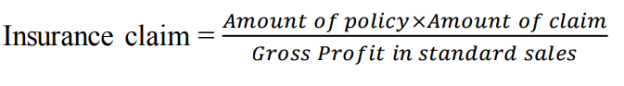

- If the insured value of the stock is less than the total cost, then the average clause may apply, that is the loss be limited to that proportion of the loss as the insured value bears to the total cost. The actual amount would, therefore, be determined by the following formula:

|

One should note that the average clause applies only where the insured value is less than the total cost.

The under mentioned points are relevant:

(1) Where stock records are maintained and such records are not destroyed by fire, the value if the stock as at the date of the fire can be easily arrived at.

(2) Where either stock records are not available or where they are destroyed by the fire the value of the stock at the date of the fire has to be estimated. The usual method of arriving as this value is to build up a Trading

Account as from the date of last accounting year. After allowing for the usual gross profit, the figure of closing stock on the date of the fire can be ascertained as the balancing item.

(3) Where books of account are destroyed the task of building up the Trading Account becomes difficult. In that case information is obtained from the customers and suppliers to ascertain the amount of sales and purchases.

(4) In determining the amount of the claim, credit is given for damaged and salvaged stock.

Concept of under-insurance and average clause

Underinsurance is when a party (the policy holder) insures something for less than its true value. If this happens the insurer can apply ‘average’ and reduce the payment of a claim in line with the percent that the item has been underinsured. Insurers are not liable for more than the proportionate percentage that the item is insured for, however insurers do allow a 20% margin. So… if you insure your contents for only 50% of their true value and a claim arises the insurer can reduce your claim payment by some 30% in line with % of underinsurance.

E.g.:

If your sum insured is = 144,000

But the true/actual value is 200,000 (note: 80% value is $160,000)

And a claim for 100,000 arises, due to underinsurance the insurer could calculate the proportion payable on the claim via an ‘average’ calculation, as follows:

(144,000/160,000)*100,000 = 90,000 less any excess, leaving you to bear the other 10,000 yourself

How does it affect you and your insurance coverage?

Underinsurance and ‘average’ can be applied to any ‘property’ sum insured, including buildings, contents, stock and specified items. It can also be applied to insurance for gross income and rental cover. It is important that you understand that if you underinsure the value of the items or income on your policy, you may be significantly out of pocket at the time a claim arises and you call on your insurance policy.

To avoid being underinsured you should review your sums insured frequently and update your policy as needed throughout the policy period; not just at renewal. A common scenario of underinsurance often occurs when a business has unplanned or unexpected increase in growth or purchase of assets during a policy period and does not adjust their sums insured in line with these asset and income increases. When a claim arises they find they are underinsured and out of pocket. It is your responsibility to ensure that your sums insured reflect the true/actual value of the items and income you wish to insure – for the whole policy period.

Average clause

A fire insurance policy has an average clause mentioned in it which takes care of the cases of the under-insurance. In the fire insurance policy, if the assets are insured for less than their full value, the insured is required to bear a proportion of the loss according to the average clause mentioned in the policy document.

Since the fire insurance policy is a contract of indemnity, the insured cannot claim more than the actual amount of loss caused by the fire.

According to the average clause in the fire insurance policy,

- If the actual cost of the goods/property is higher than the sum insured for such goods/property, then the insured has to bear the difference.

- The insured must bear the cost arising due to the difference between the actual value of goods/property and the amount for which it is insured.

- The insurers or the insurance company will only pay for the rateable proportion of the loss.

- The average clause applies only when the sum insured is less than the actual value of the goods or the property.

Due to the presence of the average clause in the fire insurance policy, the liability of the insurance company is reduced as per the application of the proportionate approach. The insurers do not pay the full amount of loss incurred to the insured. The insured is then responsible for the payment of the unpaid claim amount.

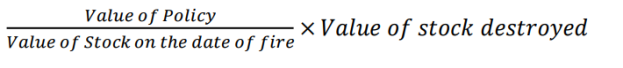

The formula

|

Computation of claim

Steps to claim of loss

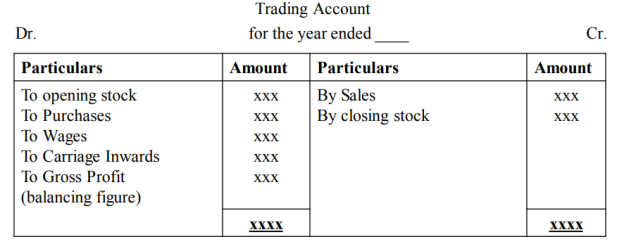

Step 1: Create Trading Account (i.e. Account related to previous year)

|

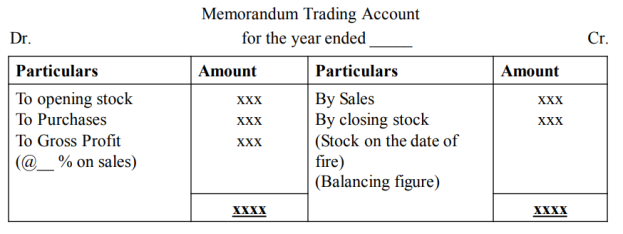

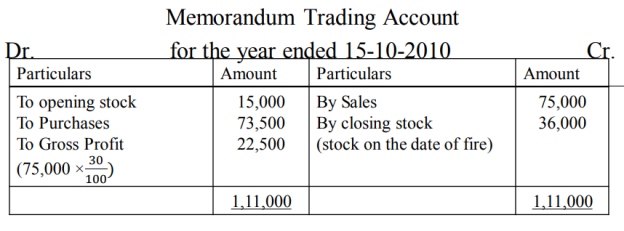

Create Memorandum Trading Account (i.e. Account related to current year till the date of fire)

|

Step 3: Prepare the following working notes:

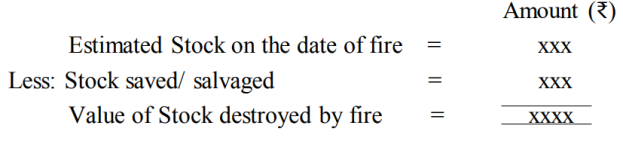

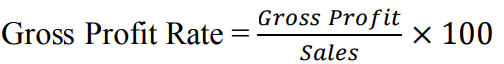

- Calculate Gross Profit Rate:

|

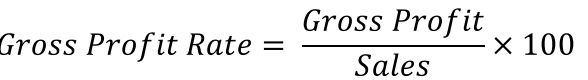

2. Prepare statement of claim

|

3. Calculate Average Clause: (if policy amount is given)

Claim for loss of profit

- Calculate short sales

The short sales are calculated as under

Particulars Rs.

Estimated sales during the period of indemnity xxx

Add: Increase in price (if any) xxx

Less: Actual sales during the period of indemnity xxx

Short Sales xxxx

Short Sales xxxx

Indemnity period = Period during which sales are expected to be affected due to fire, this period is mentioned in policy. The usual period is one year.

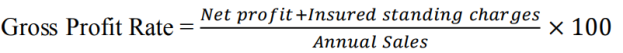

2. Calculate Gross Profit Rate:

|

Standing charges = These are the expenses required to be incurred irrespective of the fact whether the business activities are suspended or not. They includes wages & salary, rent, rates, taxes, insurance, directors fees, auditors fees, interest on loan, etc

3. Calculate Loss of Profit:

Loss of Profit = Short Sales × Gross Profit Rate

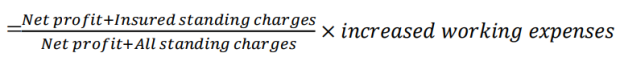

4. Calculate increase in cost of working (Working Expenses):

|

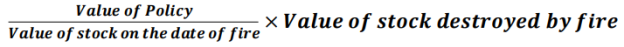

5. Average Clause:

If the amount of the policy is less than the Gross Profit in the standard sales, the amount of claim is reduced in the ratio of amount of policy to Gross Profit in standard sales.

6. Insurance Claim:

|

Key takeaways –

- When a fire occurs, it destroys a number of assets such as building, machinery, furniture, stock, etc. T

- The books of account maintain accounts of all the assets except (usually) stock-in-trade.

- The value of stock on hand on the date of fire, therefore, has to be estimated.

- This is done by ascertaining the cost of goods sold (sales minus the gross profit at the usual rate) and then deducting it from the total of opening stock, purchases, wages and other manufacturing expenses.

Example

A fire occurred in the business premises of Rajesh Traders on 15th October, 2010. from the following particulars, ascertain the loss of stock and prepare a claim for insurance.

Stock on 1-1-2009 Rs.15,300

Purchases from 1-1-2009 to 31-12-2009 Rs.61,000

Sales from 1-1-2009 to 31-12-2009 Rs.90,000

Stock on 31-12-2009 Rs.13,500

Purchases from 1-1-2010 to 14-10-2010 Rs.73,500

Sales from 1-1-2010 to 14-10-2010 Rs.75,000

The stock were always valued at 90% of cost. The stock saved was worth Rs.9,000. The amount of the policy was Rs.31,500, there was an average clause in the policy.

Solution

trading account | |||

Particulars | amount | particulars | amount |

To opening stock | 17,000 | By sales | 90,000 |

To purchase | 61,000 | By closing stock | 15,000 |

To Gross profit | 27,000 |

|

|

| 1,05,000 |

| 1,05,000 |

|

Working Notes:

(1) Calculation of Stock:

Stock is always valued at 90% of cost

(A) Opening Stock = Rs.15,300 – (90%)

=15,300× 10/90

= 1,700 – (10%)

= 15,300 + 1,700 = 17,000

Opening Stock = Rs.17,000

(b) Closing Stock – Rs.13,500 – (90%)

13,500 ×10/90

= 1,500

13,500 + 1,500 = 15,000

Closing Stock = Rs.15,000.

(2) Calculation of Gross Profit Rate:

(Take the values of previous year i.e. Trading Account)

|

=

27,000/90,000 × 100

= 30%

Gross Profit Rate = 30%

(3) Statement of Claim:

Estimated stock on the date of fire = 36,000

Less: Stock saved = 9,000

Value of stock destroyed by fire = Rs.27,000

(4) Calculation of Average Clause:

(As there is policy value given so we have to calculate average clause)

Average Clause =

|

31,500/ 36,000 × 27,000

= 23,625

Average Clause = Rs.23,625

example 2

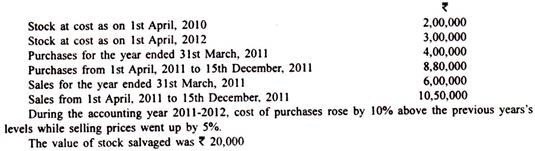

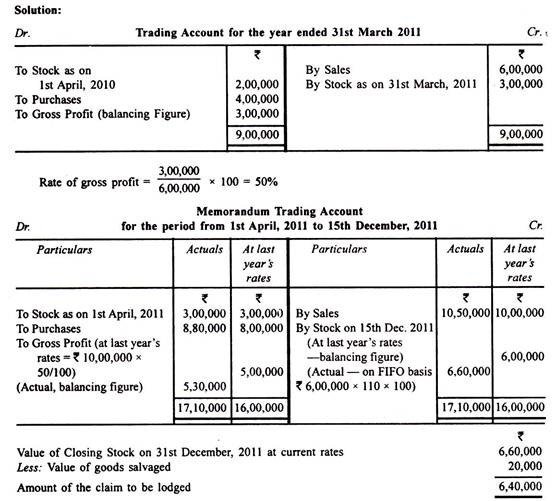

A fire occurred on 15th December, 2011 in the premises of D Co. Ltd. From the following figures, calculate the amount of claim to be lodged with the insurance company for loss of stock:

Example 3

On 15th June

2015, the premises and stock of a firm was destroyed by fire but the accounting records were saved from which the following particulars are available:

Stock on 1.1.2014 73,500

Stock on 31.12.2014 81,900

Purchases for the year 2014 3,98,000

Sales for the year 2014 4,87,000

Purchases from 1.1.2015 to 15.6.2015 1,62,000

Sales from 1.1.2015 to 15.6.2015 2,31,200

The stock salvaged was 5,300. Show the amount of claim.

Solution:

Step 1: Preparation of Last Year Trading Account

trading account for the year ending 31st dec 2014 | |||

Particulars | amount | particulars | amount |

To opening stock | 73,500 | By sales | 487,000 |

To purchase | 398,000 | By closing stock | 81,900 |

To Gross profit | 97,400 |

|

|

| 568,900 |

| 568,900 |

Step 2: Calculation of Rate of Gross Profit on Sales

Rate of G/P = Net Sales/Gross Profit × 100 = 4,87,000/97,400 × 100 = 20%

Step 3: Preparation of Memorandum Trading Account

Memorandum trading account | |||

particulars | amount | particulars | amount |

To opening stock | 81,900 | By sales | 231,200 |

To purchase | 162,000 | By closing stock | 58,940 |

To Gross profit | 46,240 |

|

|

| 290,140 |

| 290,140 |

Step 4: Calculation of Actual Amount of Loss

particulars | amount |

Stock on the date of fire | 58940 |

less: salvaged stock | 5300 |

Actual amount of loss | 53640 |

Step 5: Calculation of Amount of Claim

The problem does not provide any information about the policy amount. Hence, the amount of claim will be the same as actual amount of loss.

The amount of claim = 53,640.

Example 4

A fire broke out in the warehouse of Merchantile Traders Ltd. on 30th Sep., 15. The company desires to file a claim with the insurance company for loss of stock. From the following information prepare a statement showing the amount of claim. The last account of company were prepared on 31.12.14.

Stock on 31.12.14 1,20,000

Sundry debtors on 31.12.14 3,20,000

Sundry debtors on 30.9.15 2,40,000

Cash received from debtors 11,52,000

Purchases from 1.1.15 to 30.9.15 10,00,000

Rate of Gross Profit on sales 25%

Solution

Total debtors account | |||

Particulars | amount | particulars | amount |

To opening balance b/d | 320,000 | By cash received | 1,152,000 |

To credit sales | 1,072,000 | By closing balance c/d | 240,000 |

|

|

|

|

| 1,392,000 |

| 1,392,000 |

|

|

|

|

Memorandum trading account | |||

Particulars | amount | particulars | amount |

To opening stock | 120,000 | By sales | 1,072,000 |

To purchase | 1,000,000 | By closing stock | 316,000 |

To Gross profit | 268,000 |

|

|

| 1,388,000 |

| 1,388,000 |

Statement of claim |

|

|

|

Particulars | amount |

|

|

Closing stock | 316000 |

|

|

less: salvaged | - |

|

|

Amount of claim | 316000 |

|

|

|

|

|

|

References

- Robert N Anthony, David Hawkins, Kenneth A. Merchant,Accounting: Text and Cases.

- McGraw-Hill Education.

- Charles T. Horngren and Donna Philbrick, Introduction to Financial Accounting, Pearson.

- M.C.Shukla, T.S. Grewal and S.C.Gupta. Advanced Accounts,Vol-I, S. Chand & Co.

- S.N.MaheshwariandS.K.Maheshwari, Financial Accounting,Vikas Publishing House.

- P.C. Tulsian, Financial Accounting, Pearson Education.

- Compendium of Statements and Standards of Accounting,The Institute of Chartered

- Accountants of India, New Delhi.

- Rajasekaran, Financial Accounting, Pearson.

- Mukherjee and Mukherjee, Financial Accounting I, Oxford.

- Amitabha Mukherjee, Mohammed Hanif, Financial Accounting I, McGraw Hill Education.