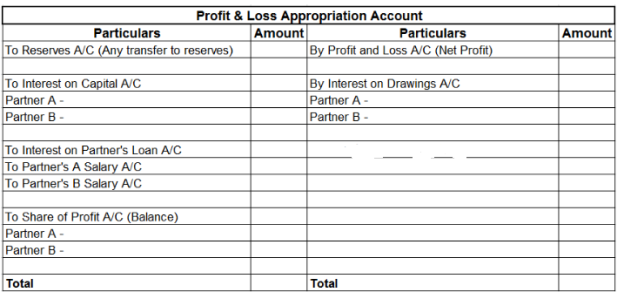

P/L Appropriation account

A partnership firm prepares a special component as part of its final accounts (after the preparation of Profit & Loss A/c) for the purpose of allocation and apportionment of its net profit or loss (along with Interest on Drawings, if any) among different heads, namely Partners’ remuneration (viz. Salary, Bonus, Commission etc.), Interest on Capital etc., and for making transfer to reserves. This component is referred to as the Profit & Loss Appropriation Account. It is that part of the final accounts that records the ‘appropriation items’, i.e., those items that occur only when the firm has sufficient profits.

The different items that appear in the P/L Appropriation A/c are:

- In the debit-side: Partners’ Remuneration (viz. Salary, Bonus, Commission, etc.), Interest on Capital, Transfer to Reserves and Distribution of profits amongst the partners.

- In the credit-side: Net profit (as per P/L A/c ) and Interest on Drawings.

The journal entries for the preparation of Profit and Loss

Appropriation Account are given below:

1. For transfer of the balance of Profit and Loss Account to Profit and Loss

Appropriation Account

(a) In case of Net Profit:

Profit and Loss A/c Dr.

To Profit and Loss Appropriation A/c

(Net Profit transferred to Profit and Loss Appropriation A/c)

(b) In case of Net Loss:

Profit and Loss Appropriation A/c Dr.

To Profit and Loss A/c

(Net Loss transferred to Profit and Loss Appropriation A/c)

2. For Interest on Capital

For transferring on Interest on Capital:

Profit and Loss Appropriation A/c Dr.

To Interest on Capital A/c

(Interest on capital transferred to Profit & Loss Appropriation A/c)

3. For Interest on Drawings

For transferring Interest on Drawings:

Interest on Drawings A/c Dr.

To Profit and Loss Appropriation A/c

(Interest on drawing transferred to Profit & Loss Appropriation A/c)

4. For Partner’s Salary

For transfer of partner’s Salary

Profit and Loss Appropriation A/c Dr.

To Salary A/c

(Salary transferred to profit & Loss Appropriation A/c)

5. For Partner’s Commission

For transferring commission

Profit and Loss Appropriation A/c Dr.

To Commission A/c

(Commission transferred to Profit and Loss Appropriation A/c)

6. For Transfer of agreed amount to General Reserve

Profit and Loss Appropriation A/c Dr.

To General Reserve A/c

(Transfer to General Reserve)

7. For share of Profit or Loss appropriation

(a) If Profit

Profit and Loss Appropriation A/c Dr.

To Partner’s Capital/Current A/c

(Profit transferred to capital/current A/c)

(b) If Loss

Partner’s Capital/ Current A/c Dr.

To Profit and Loss Appropriation A/c

(Loss transferred to capital/current A/c)

Format

|

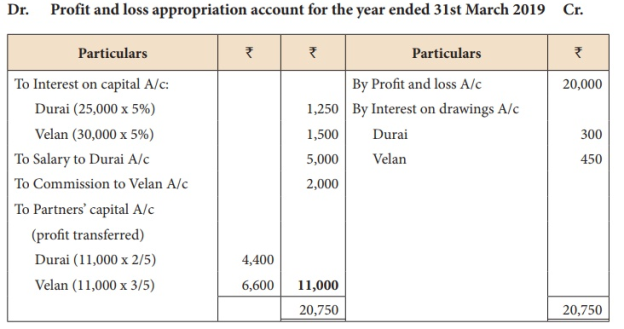

Example 1

Durai and Velan entered into a partnership agreement on 1st April 2018, Durai contributing rs 25,000 and Velan rs 30,000 as capital. The agreement provided that:

a) Profits and losses to be shared in the ratio 2:3 as between Durai and Velan.

b) Partners to be entitled to interest on capital @ 5% p.a.

c) Interest on drawings to be charged Durai: rs 300 Velan: rs 450

d) Durai to receive a salary of rs 5,000 for the year, and

e) Velan to receive a commission of rs 2,000

During the year, the firm made a profit of rs 20,000 before adjustment of interest, salary and commission. Prepare the Profit and loss appropriation account.

Solution

|

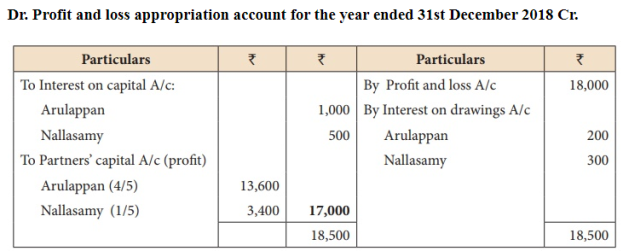

Example 2

Arulappan and Nallasamy are partners in a firm sharing profits and losses in the ratio of 4:1. On 1st January 2018, their capitals were rs 20,000 and rs 10,000 respectively. The partnership deed specifies the following:

a) Interest on capital is to be allowed at 5% per annum.

b) Interest on drawings charged to Arulappan and Nallasamy are rs 200 and rs 300 respectively.

c) The net profit of the firm before considering interest on capital and interest on drawings amounted to rs 18,000.

Prepare Profit and loss appropriation account for the year ending 31st December 2018. Assume that the capitals are fluctuating.

Solution

|

Capital & Current account

Capital account is a personal account for each proprietor. In case of partnership firm there is a separate capital account for each partner. The capital contributed by each partner will be credited to the respective partner’s capital account.

There are two methods of maintaining the capital accounts of the partners in the books of a firm. They are:

- Fixed Capital Method

- Fluctuating Capital Method

Fixed capital method

- In this method, two accounts are maintained representing each partner viz. Capital Account and Current Account.

- Partners’ Capital Account records transactions relating to the introduction of capital and permanent withdrawal of capital.

- Other transactions between the partner and the firm viz. partner’s remuneration, interest on capital, interest on drawings share of profit or loss, etc. are recorded through Partners’ Current Account.

- Since, the balance of the Capital Account remains unaltered from one accounting period to another (except for introduction of capital and withdrawal of capital), this method of maintaining the partners’ capital accounts is referred to as the Fixed Capital Method.

Capital account

Capital Account of each partner continues to show the same balance year after year and changes only if Additional Capital is introduced and withdrawal is made out of the capital.

The Debit Side of this account shows:

- Withdrawal Of Capital

- Closing capital

The Credit Side of this account shows:

- Opening Capital

- Additional Capital

Current account

Current account is maintained to record transactions other than transactions relating to capital such as Drawings against Profit, Interest Allowed on Capital, Interest Charged on Drawings, Salary or Commission Payable to a Partner, Share of Profits/ Losses.

Current Account of each partner is debited with:

- Drawings by a partner against profit

- Interest on Drawings

- Share of Loss

- Transfer of any amount to capital account permanently.

Similarly, Current Account of each partner is credited with:

- Interest on Capital

- Share of Reserves

- Salary, Fees, Commission, Bonus

- Share of Profit

- Transfer of any amount from capital account permanently.

Dr. Partners’ Capital A/C Cr.

Particulars | X | Y | Particulars | X | Y |

To Bank A/C (Capital Withdraw) To Balance c/f

|

|

| By Balance b/f By Bank A/C (Introduction of further capital) |

|

|

|

|

|

|

Dr. Partners’ Current A/C Cr.

Particulars | X | Y | Particulars | X | Y |

To Drawings A/C To Interest on drawings A/C To P/L Appropriation A/C (Share of loss) To Balance c/f

|

|

| By Balance b/f By interest on Capital A/C By Partners’ Salary A/C By Partners’ Commission A/c By P/L Appropriation A/c (Share of Profit) |

|

|

|

|

|

|

Fluctuating capital account

- In this method, a single account is maintained representing each partner viz. Capital Account.

- Partners’ Capital Account records all the transactions entered into between the partners and the firm during an accounting period.

- Since, the balance of the Capital Account regularly changes or fluctuates, this method of maintaining the partners’ capital accounts is referred to as the Fluctuating Capital Method.

Particulars | X | Y | Particulars | X | Y |

To Drawings A/C To Bank A/C (Capital withdrawn) To Interest on drawings A/C To P/L Appropriation A/C (Share of loss) To Balance c/f

|

|

| By Balance b/f By Bank A/C (Introduction of further capital) By interest on Capital A/C By Partners’ Salary A/C By Partners’ Commission A/c By P/L Appropriation A/c (Share of Profit) |

|

|

|

|

|

| ||

| |||||

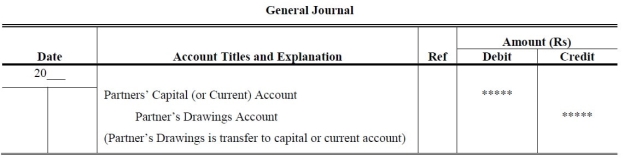

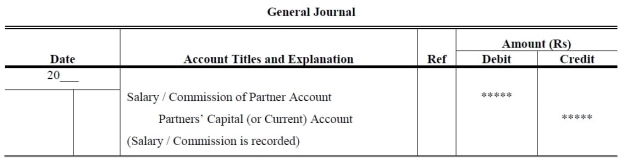

Journal Entries related to Partnership Capital Account

Journal entries are need before preparation of partnership capital accounts.

(1) Transfer of Drawings Journal Entry

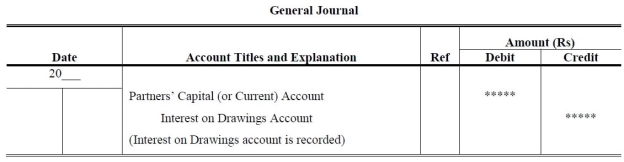

(2) Interest on Drawings Journal Entry

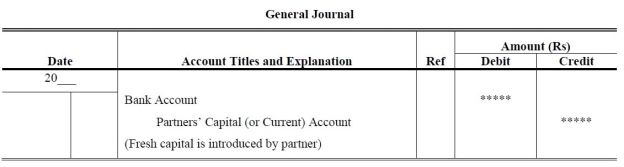

(3) Fresh Capital Introduce Journal Entry

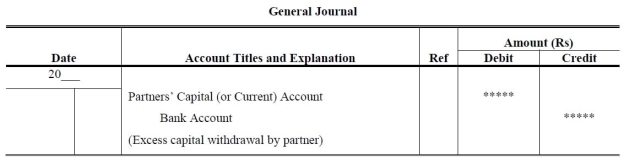

(4) Excess Capital withdrawal Journal Entry

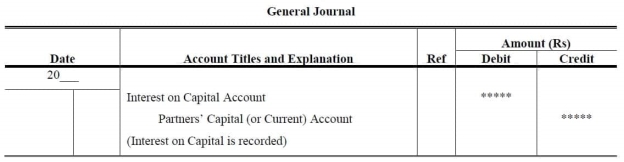

(5) Interest on Capital Journal Entry

(6) Salary / Commission Journal Entry

Difference | Capital account | Current account |

Need | Capital account is maintained in all the cases, whether following Fixed Capital Account Method or Fluctuating Account Method. | Current Account is maintained when Fixed Capital Account is followed. |

Balance of payment | Capital Account will always have a Credit Balance when the Fixed Capital Method is followed. In Fluctuating Capital Account Method, it may have either debit or credit balance. | Balance of Current Account may have a Debit or Credit balance. |

Nature | In case of Fixed Capital, Capital account balance generally remains unchanged from year to year. It changes when further capital is introduced or capital is withdrawn by the partners. | The balance of Current Account changes every year as the all the adjustments are done in this account. |

Capital contribution | The capital contributed by partners is shown in this account. | This account does not show the capital contribution. |

Transactions | Capital Account records the transactions such as Opening capital, Additional capital and Withdrawal of capital. | Current account records the transactions such as Drawings, Interest on Capital, Interest on Drawings, Salary, Commission, Profit or Loss, etc. |

Guarantee – by firm, by partner and both;

Sometimes, a partner is admitted in the firm on guarantee in respect of his minimum share of profit from the business. Such a guarantee can be given even to an existing partner also. Such a guarantee to the incoming partner is given either by:

(a) The firm i.e. by all the old partners in an agreed ratio, or

(b) Some of the old partners or any one of the old partners

When all the partners guarantee that one of the partners shall be given a minimum amount of profit, we should calculate the following two amounts separately:

i. Share of profit of the guaranteed partner as per profit sharing ratio, and

ii. Minimum guaranteed amount of profit of the guaranteed partner.

The higher of the above two is to be given to that partner. The balance of profit (total profit minus profit given to the guaranteed partner) is to be shared by the remaining partners in their respective profit -sharing ratio. When the new partner’s share of profit is more than the guaranteed amount, his actual share of profit is given to him instead of the guaranteed amount of profit.

Different cases of guarantee

- Guarantee by the Firm or by All the Partners of the Firm - In this case, firstly the firm enters the guaranteed amount to the partner in the Profit an Loss Appropriation Account. Then, it distributes the remaining profit among the remaining partners in their remaining ratio.

- Guarantee by One Partner Only - Under this case, firstly the deficiency of profit is calculated for the partner who has received the guarantee. Then, this deficiency is deducted from the share of the partner who has given the guarantee.

3. Guarantee by Other Partners but Deficiency is Borne in a Specified Ratio - Under this case, the deficiency of profit is borne by other partners in a pre-determined ratio (not the remaining profit-sharing ratio).

Correction of appropriation items with retrospective effect

Adjustments in accounting for partnership firms may be needed whenever something relating to the past period has to be corrected or adjusted. For the purpose of their treatment in accounting, these past period corrections can be classified into two

- Re-appropriations – Corrections pertaining to the past periods which involve appropriations only. These correction would may influence the nominal a/c and or partners capital/current account

- Adjustments - Corrections pertaining to the past periods which involve adjustments. These corrections may influence all types of account real, personal and nominal including partners’ capital account.

Change in relationship with partners with retrospective effect

Partners may decide to change the inter relationship between themselves with retrospective effect. Retrospective = concerned with or related to the past.

Such change to be incorporated into the books of accounts can be called re appropriation if the change would affect only nominal account or partner’s capital/ current account only. The net effect of the nominal account balances is the net profit which ultimately find its way into capital.

Key takeaways

- A partner is admitted in the firm on guarantee in respect of his minimum share of profit from the business.

- Capital account is a personal account for each proprietor

- Current Account is maintained when Fixed Capital Account is followed

- Current account is maintained to record transactions other than transactions relating to capital such as Drawings against Profit, Interest Allowed on Capital, Interest Charged on Drawings

- Profit & Loss Appropriation Account is that part of the final accounts that records the ‘appropriation items’

Any change in existing agreement of partnership amounts to reconstitution of a firm. As a result, the existing agreement comes to an end and a new agreement comes into existence and the firm continues.

Occasion when reconstitution of a firm can take place: reconstitution of the firm can take place on the following occasions

- Change in profit sharing ratio of existing partner. A change in profit sharing ratio basically implies the purchase of profit by one partner from another partner.

- Admission of a new partner – a partner can be admitted as a new partner only with the consent of all the existing partner unless otherwise agreed upon.

- Retirement of an existing partner

- Death of a partner

Admission of a partner

When a business enterprise requires additional capital or managerial help or both for expansion of the business it may admit a new partner to enhance its existing resources. In case of a sole proprietorship, it is converted into a partnership on the admission of a new person as an owner of the business enterprise. According to the Partnership Act, 1932, no new partner can be introduced into a firm without the consent of all the existing partners. On admission of a new partner, the partnership firm is reconstituted with a new agreement.

Adjustment Regarding Profit Sharing Ratios

The new partner acquires his share in profits from the old partners. It means, on the admission of a new partner, the old partners sacrifice a share of their profit in favour of the new partner. As a result, the profit sharing ratio in the new firm is decided mutually between the existing partners and the new partner. The incoming partner acquires his/her share of future profits either incoming from one or more existing partner.

Example: A and B are two partners sharing their profit in the ration of 4 : 3. The admitted C as a partner for 1/7 share in profit. Calculate the new profit sharing ratios of all the partners.

Solution:

Let total Profit = 1

New partner’s share = 1/7

Remaining share = 1 – 1/7 = 6/7

A’s new share = 4/7 of 6/7 = 24/49

B’s new share = 3/7 of 6/7 = 18/49

C’s Share = 1/7

The new profit sharing ratio of A, B and C is:

= 24/49 : 18/49 : 1/7

= 24/49 : 18/49 : 7/49

= 24 : 18 : 7

Sacrificing Ratio

The ratio in which the old partners agree to sacrifice their share of profit in favour of the incoming partner is called sacrificing ratio. Some amount is paid to the existing partners for their sacrifice. The amount of compensation is paid by the new partner to the existing partner for acquiring the share of profit which they have surrendered in the favour of the new partner.

Sacrificing Ratio is calculated as follows:

Sacrificing Ratio = Existing Ratio – New Ratio

Following cases may arise for the calculation of new profit sharing ratio and sacrificing ratio:

Case 1: Only the new partner’s share is given.

In this case, it is presumed that the existing partners continue to share the remaining profit in the same ratio in which they were sharing before the admission of the new partner. Then, existing partner’s new ratio is calculated by dividing remaining share of the profit in their existing ratio. Sacrificing ratio is calculated by deducting new ratio from the existing ratio.

Example: Rohit and Mohit are partners sharing profit in the ratio of 3 : 2. They admit Sumit as a new partner for 1/5 share in profit. Calculate the new profit sharing ratio and sacrificing ratio.

Solution:

Calculation of new profit sharing ratio:

Let total Profit = 1

New partner’s share = 1/5

Remaining share = 1 – 1/5 = 4/5

Rohit’s new share = 3/5 of 4/5 = 12/25

Mohit’s new share = 2/5 of 4/5 = 8/25

Sumit’s Share = 1/5

The new profit sharing ratio of Rohit, Mohit and Sumit is:

= 12/25 : 8/25 : 1/5

= 12/25 : 8/25 : 5/25

= 12 : 8 : 5

Calculation of Sacrificing Ratios

Rohit Sacrificed = 3/5 – 12/25 = 15 – 12/25 = 3/25

Mohit Sacrificed = 2/5 – 8/25 = 10 – 8/25 = 2/25

Sacrificing Ratio = 3 : 2

Sacrificing ratio of the existing partners is same as their existing ratio.

Case 2: When new partner acquired his/her share of the profit from the existing partner in a particular ratio.

It means the incoming partner has purchased some share of profit in a particular ratio from the existing partners.

Example: Neha and Parteek are partners, sharing profit in the ratio of 3 : 2. They admit Nisha as a new partner for 3/10 share in profit. She acquires this share as 2/10 from Neha and 1/10 share from Parteek. Calculate the new profit sharing ratio and sacrificing ratio.

Solution:

Neha’s and Parteek existing ratio is 3 : 2

Neha’s new share = 3/5 – 2/10 = 4/10

Parteek’s new share = 2/5 – 1/10 = 3/10

Nisha’s share = 3/10

The new profit sharing ratio of Neha, Parteek and Nisha is

= 4/10 : 3/10 : 3/10

= 4 : 3 : 3

Case 3: Existing partners surrender a particular portion of their share in favour of a new partner.

In this case, sacrificed share of the each partner is ascertained by multiplying the existing partner share in the ratio of their sacrifice. The share sacrificed by the existing partners should be deducted from his existing share. Therefore, the new share of the existing partners is determined. The share of the incoming partner is the sum of sacrifice by the existing partners.

Example: Him and Raj shared profits in the ratio of 3 : 2. Jolly was admitted as a partner. Him surrendered 1/4th of his share and Raj 1/3rd of his share in favour of Jolly. Calculate the new profit sharing ratio.

Solution:

Him’s Old Share = 3/5

Share surrendered by Him = 1/4

Him’s sacrifice = 1/4 of 3/5 = 3/20

Him’s new share = 3/5 – 3/20 = 9/20

Raj’s old share = 2/5

Share surrendered by Raj = 1/3

Raj’s sacrifice = 1/3 of 2/5 = 2/15

Raj’s new share = 2/5 – 2/15 = 4/15

Jolly’s share = Him’s sacrifice + Raj’s sacrifice

= 3/20 + 2/15 = 17/60

Therefore, the new profit sharing ratio of Him, Raj and Jolly will be 27 : 16 : 17

Treatment of goodwill

The term goodwill means the value of the reputation of a firm in respect of the profit earned in future over and above the normal profit. Goodwill is the result of the efforts made by the existing partners in the past. Therefore, on the eve of the admission, the new partner who is going to acquire the right to share future profits must compensate the existing partners by making payment to them. This amount is called the share of goodwill.

Methods of Calculating Goodwill

The following are the key methods of calculating goodwill:

1. Average Profit Method

2. Super Profit Method

3. Capitalisation Method

Average Profit Method

Under this method, the goodwill is valued at agreed number of ‘years’ purchase of the average profits of the past few years. It is based on the assumption that a new business will not be able to earn any profits during the first few years of its operations. Hence, the person who purchases a running business must pay in the form of goodwill a sum which is equal to the profits he is likely to receive for the first few years. The goodwill is calculated as follows:

Value of goodwill = Average Profit × Number of year of purchase

Example: The profit for the last five years of a firm were as follows year 1999 5,00,000;

year 2000 4,45,000; year 2001 4,50,000; year 2002 3,98,000 and year 2003 4,00,000. Calculate

goodwill of the firm on the basis of 4 years purchase of 5 years average profits.

Solution:

Years Profit

1999 5,00,000

2000 4,45,000

2001 4,50,000

2002 3,98,000

2003 4,00,000

Total 21,93,000

Average Profit = Total Profit/No. of years

= 2,19,3000/5 = 4,38,600

Goodwill = Average Profit × No. of years Purchased

= 4,38,600 × 4 = 17,54,400

Super Profit Method

The goodwill under the super profits method is ascertained by multiplying the super profits by certain number of years’ purchase.

Normal profit = Capital employed* Normal rateof return/ 100

Super Profit = Actual Profit – Normal Profit

Example: A firm earns profit of 65,000 on a capital of 4,80,000 and the normal rate of return in similar business is 10%. Then the normal profit is 48,000 [10% of the 4,80,000]. The actual profit is 65,000.

Solution:

Super profit = Actual profit – Normal profit = 65,000 – 48,000 = 17,000

If value of Goodwill is calculated by 3 years’ purchase of super profit then goodwill is equal to: = 17000 × 3 = 51,000

Capitalized method - Goodwill under this method can be calculated by capitalizing average normal profit or capitalizing super profits.

- Capitalization of average profit method - Under this method goodwill is determined by deducting Actual Capital Employed (i.e., Net Assets as on the valuation date) from the capitalised value of the average profits on the basis of normal rate of Return (also known as value of the firm or capitalised value of business)

Goodwill = Capitalised Value – Net Assets of Business

Steps

- Calculate Average future maintainable profits

- Calculate Capitalised value of business on the basis of Average Profits

- Calculate the value of Net Assets on the valuation date

- Calculate Goodwill

Goodwill = Capitalised Value – Net assets of business.

2. Capitalization of super profit method - The goodwill under this method is ascertained by capitalizing the super profits on the basis of normal rate of return. This method assesses the capital needed for earning the super profit.

Example: A firm earns a profit of 25,000 and has invested capital amounting to 2,20,000. In the same business normal rate of earning profit is 15%. Calculate the value of goodwill with the help of Capitalisation of super profit method.

Solution:

Actual profit = 25,000

Normal profit = 2,20,000 x 10/ 100 = 22,000

Super Profit = Actual Profit – Normal Profit = 25,000 – 22,000 = 3,000

Goodwill = Super profit × 100/normal rate of profit = 3,000 × 100/15 = 20,000

Goodwill (Premium) Paid Privately

If the goodwill premium is paid privately by the new partner to the old partners outside the business then the same is not recorded in the books of accounts and hence no journal entry is recorded.

Goodwill/Premium brought in Cash by the New Partner and retained in the Business

When, the new partner brings his/her share of goodwill in cash, the amount brought in by the new partner is transferred to the existing partner in the sacrificing ratio. If there is any goodwill account in the balance sheet of existing partner, it will be written off immediately in existing ratio among the partners. The journal entries are as follows:

1. For bringing premium (share of goodwill)

Cash/Bank A/c Dr

To Goodwill A/c

2. For transferring goodwill to the capital accounts of the old partners in their sacrificing ratio.

Goodwill A/c Dr

To Sacrificing Partner’s Capital A/c (Individually)

However, instead of these two entries one can record only one entry given below:

Cash/Bank A/c Dr

To Sacrificing Partner’s Capital A/c (Individually)

Example: Tanaya and Sumit are partners in a firm sharing profit in the ratio 5 : 3. They admitted Gauri as a new partner for 1/5th share in the profit. Gauri brings 20,000 for her share of goodwill. Make journal entries in the books of the firm after the admission of Gauri. The new profit sharing ratio will be 3 : 1 : 1.

Solution:

Books of Tanaya, Sumit and Gauri

Date | Particulars | L.F. | Debit Amount (Rs) | Credit Amount (Rs.) |

| Bank A/C Dr. To Goodwill A/C (Cash brought by Gauri for her share of goodwill)

|

| 20,000

20,000 |

20,000

2,500 17,500 |

Goodwill A/c Dr. To Tanaya’s A/c To Sumit’s A/c (Goodwill brought by Gauri transferred to the capital accounts of Tanaya and Sumit in their sacrificing ratio) |

Working Notes:

Tanaya’s old share = 5/8

Tanaya’s new share = 3/5

Tanaya’s sacrificing ratio = 5/8 - 3/5 = 1/40

Sumit’s old share = 3/8

Sumit’s new share = 1/5

Sumit’s sacrificing ratio = 3/8 – 1/5 = 7/40

Sacrificing ration will be 1 : 7

Adjustment Regarding Revaluation of Assets and Liabilities

At the time of admission of a new partner, it is always desirable to ascertain whether the assets of the firm are shown in books at their current values. In case the assets are overstated or understated, these are revalued. Similarly, a reassessment of the liabilities is also done so that these are brought in the books at their correct values. At times there may be some unrecorded assets with the business, these are also recorded and similarly if there is any unrecorded liability which the firm has to pay, the same is also recorded. For revaluation of assets and recording of unrecorded assets and for the reassessment of liabilities and recording of unrecorded liabilities the firm prepares an account in its book called Revaluation Account. Any gain or loss on revaluation of assets and reassessment of liabilities is transferred to the capital accounts of the old partners in their old profit sharing ratio. The revaluation account is credited with increase in the value of assets and decrease in the value of liabilities because it is a gain. Similarly, decrease of assets and increase in the value of liabilities is debited to revaluation account because it is a loss. Unrecorded assets are credited and unrecorded liabilities are debited in the revaluation account. If the revaluation account shows a credit balance then it indicates gain and if there is a debit balance then it indicates loss. Gain on revaluation or loss on revaluation will be transferred to the capital accounts of the old partners in old ratio.

The following journal entries are recorded on revaluation of assets and reassessment of liabilities.

(i) For increase in the value of Assets

Asset A/c Dr.

To Revaluation A/c

(Increase in the value of Assets)

(ii) For decrease in the value of Asset

Revaluation A/c Dr.

To Asset A/c

(Decrease in the value of Assets)

(iii) For increase in the value of Liabilities

Revaluation A/c Dr.

To Liabilities A/c

(Increase in the value of Liabilities)

(iv) For decrease in the value of Liabilities

Liabilities A/c Dr.

To Revaluation A/c

(Decrease in the value of Liabilities)

(v) For unrecorded Assets

Asset A/c [unrecorded] Dr.

To Revaluation A/c

(Unrecorded asset recorded at actual value)

(vi) For unrecorded Liability

Revaluation A/c Dr.

To Liability A/c [unrecorded]

(Unrecorded Liability recorded at actual value)

(vii) For transfer of gain on revaluation

Revaluation A/c Dr.

To Existing Partner’s Capital/Current A/c

(Profit on revaluation transferred to capital account in existing ratio)

(viii) For transfer of loss on revaluation

Existing Partner’s Capital/Current A/c Dr.

To Revaluation A/c

(Loss on revaluation transferred to capital account in existing ratio)

Retirement of partner

An outgoing partner means a partner who has retired from a firm. The firm is reconstituted by the remaining partners. Section 32 contemplates three ways in which a partner may retire from the firm, viz., (i) he may retire at any time with the consent of all other partners; (ii) where there is an agreement between the partners about retirement, a partner may retire in accordance with the terms of that agreement; (iii) where the partnership is at will, a partner may retire by giving to his partners a notice of his intention to retire. Section 32 clearly comprehends a situation where a partner may retire without dissolving the firm.

Computation of New Profit Sharing Ratio and Gaining Ratio

As soon as a partner retires the profit sharing ratio of the continuing partners get changed. At the time of retirement or death of a partner, the share of retiring/deceased partner is acquired by existing partners, on the basis of agreement among them. In the absence of information, the continuing partners take the retiring partner’s share in their profit sharing ratio or in an agreed ratio. The ratio in which retiring partner’s share is distributed amongst continuing partners’ is known as “gaining ratio”.

Gain of continuing partner = New share – Old share

Example: Sita, Rita and Raj are partners sharing profits in the ratio of 5:3:2. Due to some personal reasons Sita retires from the partnership. Calculate the new profit sharing ration and gaining ratio of remaining partners.

Solution:

1. Calculation of new profit sharing ratio: In order to calculate new ratio of Rita and Raj, it is assumed that Sita’s share of 5/10 will be taken up by Rita and Raj in their old profit sharing ratio

Rita’s new share = 3/10 +(5/10*3/5) = 30/50

Raj’s new share = 2/10 +(5/10*2/5) = 20/50

Therefore, the new profit sharing ration id 3:2

2. Calculation of gaining ratio: Gaining ratio = New share – Old share

(i) Rita’s gain = 3/5 – 3/10 = 3/10

(ii) Raj’s gain = 2/5-2/10 = 2/10

Adjustment Regarding Goodwill

At the time of retirement or death of a partner the retiring partner is entitled to his share of goodwill because the goodwill has been earned by the firm with the efforts of all the existing partners. The valuation of goodwill will be done as per the agreement among the partners. It is possible that company will earn some profit in near future because of the existing goodwill of the company. Therefore, the retiring/deceased partner should be compensated for the same by the continuing partners in their gaining ratio. For this purpose, the retiring/deceased partner’s capital will be credited. In this case the following journal entry is recorded:

Remaining partner’s capital A/c (in the gaining ratio) Dr

To Retiring/deceased partner’s capital A/c

(Retiring partner’s share of goodwill adjusted to remaining partners in the gaining ratio)

Revaluation of Assets and Liabilities

In case of retirement or death of a partner the assets and liabilities of the firm should be revalued in the same way as at the time of admission of a partner. At the time of retirement/death some of the assets or liabilities may not have been shown at their current values. To ascertain the net profit and loss on revaluation of assets and liabilities Revaluation A/c is prepared.

The following journal entries are passed for the revaluation of assets and liabilities:

(i) For increase in the value of Assets

Asset A/c Dr.

To Revaluation A/c

(Increase in the value of assets)

(ii) For decrease in the value of Asset

Revaluation A/c Dr.

To Asset A/c

(Decrease in the value of assets)

(iii) For increase in the value of Liabilities

Revaluation A/c Dr.

To Liabilities A/c

(Increase in the value of Liabilities)

(iv) For decrease in the value of Liabilities

Liabilities A/c Dr.

To Revaluation A/c

(Decrease in the value of Liabilities)

(v) For unrecorded Assets

Asset A/c [unrecorded] Dr.

To Revaluation A/c

(Unrecorded asset recorded at actual value)

(vi) For unrecorded Liability Notes

Revaluation A/c Dr.

To Liability A/c [unrecorded]

(Unrecorded Liability recorded at actual value)

(vii) For transfer of gain on revaluation:

Revaluation A/c Dr.

To All Partner’s Capital A/c (Old ratio)

(Profit on revaluation transferred to capital account in old profit sharing ratio)

(viii) For transfer of loss on revaluation:

All Partner’s Capital Dr.

To Revaluation A/c

(Loss on revaluation transferred to capital account in existing ratio)

Joint life policy

The term Joint Life Policy means an insurance policy taken out by the partnership firm on the joint lives of all the partners. The amount of such a policy is payable by the Insurance Company either on death of any partner or on maturity whichever is earlier. The main objective behind taking out such a policy by the partnership firm is to mobilise funds to settle the claims of the deceased partner in case of death of a partner without affecting the Working Capital of the business.

Accounting Treatment for Joint Life Policy

There are two ways to record the Joint Life Policy transactions by the firm:

1. Treated as an expense of firm: Under this method the premium paid is treated as a business expense. The premium is chargeable to the profit and loss account.

Accounting entries in the books of the firm will be as follows:

(a) For payment of premium:

Joint life policy premium Dr.

To Bank A/c

(b) For transfer of premium paid to profit and loss account at the end of the year:

Profit and loss A/c Dr.

To Joint life policy premium

On the maturity of the policy, if the death takes place before the due date of the premium, the premium will not be paid in the year of death. This would imply that entry for payment of premium would not be recorded. On maturity, the insurance policy will be surrendered to register the claim with the insurance company and sum assured will be collected.

For this following entries are to be recorded:

(i) On the death of partner, for making claim with the insurance company

Insurance Company/Insurance claim receivable A/c Dr.

To Joint Life Policy

(ii) For Claim duly received from Insurance Co. on the date of receipt

Bank A/c Dr.

To Insurance Co./Insurance claim receivable A/c

(iii) Claim due will be distributed among existing partners (including outgoing)

Joint life policy Dr.

To All partner’s capital A/c (individually)

2. When premium paid is treated as an asset at an amount equal to the surrender value of joint life policy In such a case, Joint Life Policy Account will appear in the books of the firm which must be shown as an asset in the Balance Sheet at its present value i.e. surrender value.

Following accounting entries are to be recorded in this case:

(i) 1st Year: On the date when policy is taken and premium is paid.

Joint Life Policy Dr.

To Bank A/c

(ii) At the end of first year, the joint life policy account will show the balance which is Notes equal to its surrender value. The difference between the premium paid and surrender value will be transferred to profit and loss account.

Profit and loss A/c Dr.

To Joint Life Policy

Second year and onwards, the entries (i) and (ii) shall be repeated until the last year.

In the last year, i.e., the year of death, entry no. (i) will be recorded only if death takes place after the due date of premium and entry no. (ii) will not be recorded at all.

(iii) On maturity of policy or in the event of death, entry for making the insurance claim will be:

Insurance company A/c Dr.

To Joint Life Policy

(iv) On the date of receipt when insurance company pays the insurance claim due:

Bank A/c Dr.

To Insurance Company

(v) Balance standing in Joint Life Policy account is distributed among all partners in profit sharing ratio.

Balance in Joint Life Policy account = Total claim due – (Surrender value of the policy in the previous year + premium paid during the current year).

Death of a partner

Partnership stands dissolved on the death of a partner. The rights of the legal representatives of the deceased partner depend on the provisions of the partnership deed. The claim of the deceased partner is determined as per the provisions of the partnership deed which is normally purchased by the surviving partners and they continue to carry on the business as usual. The claim of the deceased partner is either paid immediately or transferred to Loan Account in the name of his legal representatives. The claim is usually determined on the same basis as that of a retired partner taking into account his share in the accumulated profits of the firm, goodwill, profit/ loss on revaluation of assets/liabilities and so on.

The key difference between the retirement and death of partner is that normally the retirement takes place at the end of an accounting period whereas death can occur at any time. Hence, in the case of death of a partner his claim shall include:

- share in the profits of the firm up to the date of death

- interest on his capital up to the date of death

- share in the proceeds of joint life policy (if any) in addition to his share in the accumulated profits

- goodwill, etc.

On the death of a partner, the accounting treatment regarding goodwill, revaluation of assets and reassessment of liabilities, accumulated reserves and undistributed profit are similar to that of the retirement of a partner.

Key takeaways

- When a business enterprise requires additional capital or managerial help or both for expansion of the business it may admit a new partner to enhance its existing resources

- An outgoing partner means a partner who has retired from a firm. The firm is reconstituted by the remaining partners.

- Partnership stands dissolved on the death of a partner

References

- Robert N Anthony, David Hawkins, Kenneth A. Merchant,Accounting: Text and Cases.

- McGraw-Hill Education.

- Charles T. Horngren and Donna Philbrick, Introduction to Financial Accounting, Pearson.

- M.C.Shukla, T.S. Grewal and S.C.Gupta. Advanced Accounts, Vol-I, S. Chand & Co.

- S.N.Maheshwari and S.K.Maheshwari, Financial Accounting, Vikas Publishing House.

- P.C. Tulsian, Financial Accounting, Pearson Education.

- Compendium of Statements and Standards of Accounting, The Institute of Chartered

- Accountants of India, New Delhi.

- Rajasekaran, Financial Accounting, Pearson.

- Mukherjee and Mukherjee, Financial Accounting I, Oxford.

- Amitabha Mukherjee, Mohammed Hanif, Financial Accounting I, McGraw Hill Education.