UNIT 5

Book Keeping in Cost Accounting

Capacity means the ability of a company to produce a product or provide a service within a given period of time. It is defined by constraints such as space, labor, materials, equipment and access to capital. The term capacity means a “constraint” or upper limit. The most challenging task faced by the manager is to determine the right level of capacity. In case having too much capacity relative to demand means unused capacity and result in increasing the cost. On other hand having too low-capacity means demand of customers is unfulfilled.

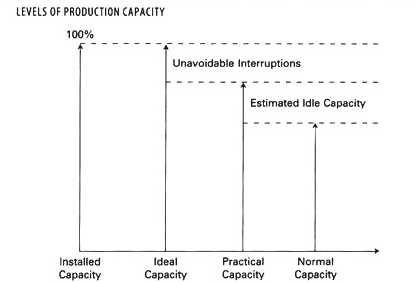

Different types of capacity levels are as follows

- Ideal capacity - when the volume of activity is at its peak performance, with no allowance for operational inefficiency refers to ideal capacity. This is also referred to as theoretical capacity or maximum capacity and is often used as the upper limit for determining capacity limitations. Normal capacity and expected capacity will always be lower than ideal capacity.

2. Practical capacity – practical capacity is also known as human error or "Murphy's law.". It involves the level of capacity a business can operate at that allows for a certain amount of inefficiency. It is based on theory not on actual demand like ideal capacity. It takes into consideration loss due to weather, holidays, repairs and breakdowns. Depending on nature of business practical capacity may be lower or higher than normal or expected capacity. Practical capacity is always lower than maximum or ideal capacity.

3. Normal capacity - normal capacity is based on the theory of operational efficiency. Normal capacity is driven by business demand not by maximum capacity. It is estimated over a two- to three-year period taking into consideration the seasonal and cyclical demand cycle. A rule of thumb is to take normal activity to represent 75% to 90% of practical capacity.

4. Expected capacity – expected capacity is based on actual inputs and is updated version of normal capacity. The capacity is expected to prevail over the next year. This method is more appropriate than normal capacity when environmental conditions prevent reliable forecasts being made for periods in excess of one year.

There is a gap between the 100% maximum of ideal capacity and the more realistic practical capacity due to inevitable but acceptable interruptions. Between practical capacity and normal capacity there is a gap which allows for the contingencies of uncertainty and environmental fluctuations.

Capacity cost

Definition

An expenditure or cost incurred by a company in order to expand its business operations. In other words, these are expenses incurred by an organization to increase its capacity to conduct business operations.

Capacity costs are fixed in nature. Even when the level of output varies they remain constant. This part of a company's expenditure is intended to help expansion and increase activities, or for establishment of premises from where the business operations can be conducted. Irrespective of the level of business activity this expense remains fixed.

It is difficult to avoid costs like insurance, rent payments, property taxes, depreciation on equipment, etc for any business. These are examples of capacity costs. These can be avoided or minimized only by shutting down the business or outsourcing the services.

- Interest on capital –

Different people have different opinion whether to include interest on capital on cost or not. Because depending on the method of capitalization, the concern has to pay interest on capital or not. This means a company raising finance by equity capital only has not to pay interest whereas a company raising finance partly through debenture has to pay interest.

Those companies not paying any interest will have lower cost and companies paying interest will show higher cost of production. Thus the comparison of cost in different companies is difficult to make. Thus for the sake of uniformity, interest paid should be included from cost, or alternatively, interest on the total capital employed (both equity and debenture capital) should be included in cost so that costs become comparable.

Argument for inclusion

- Just like wages are the remuneration paid to labour factor, interest is the remuneration paid on capital. Thus wages form part of production cost, interest must also form part of production cost.

- On borrowed capital, interest paid is included in cost accounts. Under same principle, the notional interest on capital should also be included in cost accounts.

- When interest is included in cost accounts cost comparison and profit evaluation is possible

- It enables in determining the cost of holding the inventory.

- If interest is not included in production then profit is overstated.

- If comparisons are to be made between different processes and operations it is necessary to include interest.

Argument against inclusion

- Interest is the remuneration payable on capital which is profit and should not be included in cost accounts.

- Actual interest paid can be included in cost accounts but not the notional interest

- As market rate vary considerably, it is difficult to determine a fair rate of interest.

- The exact amount of capital upon which interest should be calculated is difficult to determine

- Interest need not be included in determining the comparative cost of installation of a new asset as it is governed by depreciation, repairs and maintenance cost, etc.

- Interest are taken into costing Profit and Loss Account but not to Cost of Production Account as it is the matter of pure finance.

- Inclusion of interest inflates the value of Work-in-Progress and finished stock which implies an inflation of income to that extent.

Thus the arguments in favour of inclusion of interest in cost are mostly theoretical and the arguments against inclusion of interest are based largely on expediency and practical difficulties.

2. Packing expenses –

This expense may be divided into three categories:

- Packing which is necessary for handling of the product e.g., medicines, oil, other liquid products, must be packed to make them saleable and are treated as direct material cost.

- Fancy packing meant to attract customers, e.g., colorful attractive wrappers of cosmetics is a form of advertisement. Fancy packing should be treated as selling overhead.

- Packing that facilitates transportation and handling of products to customers place, e.g., T.V. Sets or refrigerators. Such packing should be treated as distribution overhead.

3. Bad debts –

Bad debts are financial losses and thus excluded from cost accounts according to some accountants. If bad debts are included in cost, it should be treated as selling overhead and on the basis of the credit sales of products it may be apportioned to various products. In case of abnormal amounts of bad debts, which are of exceptional nature, should be included in cost accounts.

4. Research and development cost –

Research and development costs have certain special features which requires different accounting treatments for different circumstances. Therefore, there is no general agreement regarding the treatment of such costs in cost accounts.

The following are the various methods of treating these costs in cost accounts:

a) As Revenue Expenditure:

When the amount is not very heavy this method is usually used. In such a situation, research and development costs are treated as general overhead and apportioned and absorbed accordingly.

b) As Deferred Revenue Expenditure:

Over a period of two or three years when benefits of research and development are to be derived, it is usually treated as deferred revenue expenditure and recovered over a period of two or three years.

c) Transfer to Costing Profit and Loss Account:

The research and development costs are written off to Profit and Loss Account of the period in which expenditure is incurred. When research and development proves unsuccessful and does not produce any tangible results this method is particularly suitable