UNIT 2

Single Entry,Sectional and Self balancing ledger

Single entry system

Single entry system of book-keeping is not a system at all. It means recording transactions not according to well defined rules but according to mere convenience. Under the Double Entry System, a transaction must be recorded with both the aspects. If there is debit, there must be a credit and vice-versa. It is not under the single-entry system. Debit and credit may be completed in transactions, while no record at all may be there in respect of a number of transactions. Most transactions are recorded only once without completed double entry. It is all a matter of convenience. Accounts are not maintained. While there is no hard and fast rule; usually only the cash account, bank (sometimes the pass book is treated as sufficient for this purpose) and personal account (that is, account of customers and creditors) are kept. Generally, there will be no accounts to show purchases, sales, assets, incomes and losses and expenses.

Double entry system

Double entry system of accounting deals with two aspects of every business transaction. In other words every transaction has two effects. For ex, a person buys a cold drink from a store and in return pays the money to shopkeeper for the cold drink. This transaction has two effects in terms of both buyer and seller. Buyer cash balance will decrease by the cost of purchase on the other hand he will acquire a cold drink. Seller will have one drink short but his cash balance will increase.

Accounting attempts to record both effect of transaction in the financial statement. This refers to double entry concept. Under this every transaction involves two parties , one party gives the benefit and other party receives it. It is also called dual entity of transaction.

Accounting records the two affects which are known as Debit (Dr) and Credit (Cr).Accounting system is based on the duality principal that for every Debit entry, there will always be an equal Credit entry.

Distinction between Single Entry System and Double Entry System

Basis of Difference | Single Entry System | Double Entry System |

Overview | In the Single Entry system of bookkeeping, only one effect of the transaction is recorded which is related to our business. | In Double Entry system of bookkeeping, only both or all effects of the transaction is recorded in the books of accounts. |

Object | To know or remember the cash, debtors and creditor balance only. | To know every financial term of the business entity. |

Type of Recording | It is an incomplete system of recording the transactions. | It is the complete system of recording the transactions. |

Fraud | In this system, here is very easy to record fraud entry of transactions Because you are not showing the second affected account by the same transaction. | In this system, here is difficult to record fraud entry of transactions Because you are showing the second affected account by the same transaction. |

Error | It is very hard to identify the error in the books. | It is easy to identify the error in the books. |

Accounts Included | Only account related to persons and cash are included. | All accounts are considered in this method. Like the person, real and nominal. |

Acceptance by Taxation department | It is not accepted by the taxation department. | It is accepted. |

Profit/Loss for the year | It requires a lot of labour and time to calculate the Profit/loss for the year. | It is easy to find out the Profit and Loss for the Year. |

Suitable | This system is suitable for only a very small business. | It is suitable for all type of business. |

Cost of Implementation | This system does not require any cost of implementation | This system does require any cost of implementation. |

Users | Only Owner of the Business can use this system because it is not maintained on the particular standard. | All related Parties can use this system because all books are maintained on the standard formats. |

Reconciliation of accounts | Reconciliations of accounts are not possible. | Reconciliations of accounts are possible. |

Key takeaways -

- In the Single Entry system of bookkeeping, only one effect of the transaction is recorded which is related to our business

- In Double Entry system of bookkeeping, only both or all effects of the transaction is recorded in the books of accounts.

Defects of Single Entry System: Preparation of Accounts from Incomplete Records

Single entry system of book-keeping is not a system at all. It means recording transactions not according to well defined rules but according to mere convenience. Under the Double Entry System, a transaction must be recorded with both the aspects. If there is debit, there must be a credit and vice-versa. It is not under the single-entry system. Debit and credit may be completed in transactions, while no record at all may be there in respect of a number of transactions. Most transactions are recorded only once without completed double entry. It is all a matter of convenience. Accounts are not maintained. While there is no hard and fast rule; usually only the cash account, bank (sometimes the pass book is treated as sufficient for this purpose) and personal account (that is, account of customers and creditors) are kept. Generally, there will be no accounts to show purchases, sales, assets, incomes and losses and expenses.

Disadvantages: This Single-Entry system has the following disadvantages:

- Since there is no trail balance, there is no proof of accuracy.

- Profit or losses cannot be ascertained properly because of lack of information about purchases, sales, expenses, etc.

- Since accounts relating to assets (furniture, office equipment, etc.) are not maintained, there is no control over such assets. This may result in wastages and misappropriation.

- The Balance Sheet (called Statement of Affairs here) can be prepared only with difficulty and that look without sufficient accuracy.

- Useful comparison for the guidance of management cannot be made because relevant information will generally be missing.

Incomplete records

The records maintained according to the single entry system are known as Incomplete Records. Small firms such as grocery shops, general stores, food joints, etc. keep their books on the single entry system.

Features

- It is an irregular process of recording transactions.

- Personal transactions of owners might be recorded in the cash book.

- To determine profit or loss or for taking any other data, certain figures can be obtained only from the original vouchers such as sales or purchase invoice, etc. Therefore, dependency on original vouchers is necessary.

- Many companies lack consistency as they maintain records according to their preference and requirements.

Method to ascertain profit from incomplete records

- Capital comparison method

- Conversion method

Capital comparison method – this method is known as net worth method or statement of affairs method.

Closing capital – opening capital = profit.

While preparing accounts from incomplete records, if sufficient information is not available regarding expenses and income to ascertain the profit while preparing P&L a/c, its better to follow the capital comparison method to arrive at a profit as given below

| Rs. |

Capital at the end of the year | Xxx |

Add: Drawings during the year | xxx |

|

|

Less: Flesh Capital introduced | xxx |

Less: Capital in the beginning of the year | Xxx |

Profit during the year | xxxx |

Under this method two statements of affairs are prepared. One at the beginning of the period for finding out the opening capital and other at the end of the period for finding out the closing capital. But necessary adjustment are made for drawings made by the proprietor, additional capital introduced during the year, interest on drawings and on capital for ascertaining the true profit.

HOW TO ASCERTAIN CAPITAL?

Capital is really assets minus liabilities. Under the Single Entry System also, capital is ascertained in this manner. Statement of Affairs (not at all different from balance sheet) is prepared and assets and liabilities put on the proper sides. The difference between assets and liabilities is capital. Personal account and cash account are usually maintained and hence the amount of sundry debtors, cash balance, bank balance and sundry creditors will be readily available. The amount of other assets can be ascertained only by physical inspection.

CONVERSION METHOD

This Method is to be used when the summary of cash transactions are given: -

Under conversion method, Trading & Profit & Loss Account & Balance sheet can be prepared by converting the single entry system in to Double entry system.

For converting single entry system in to Double entry system the missing items are to be found out by preparing the relevant ledger Account.

STEPS FOR CONVERSION INTO DOUBLE ENTRY

If the books are maintained on Single Entry basis, they can be converted into double entry basis but with good deal of effort. Assuming that accounts of cash, bank, customers and suppliers have been maintained, the following steps will be necessary:

- Take the statement of affairs at the end of previous year. Open all accounts (except those already opened) with proper balances.

- Go through the cash book (or cash and bank accounts). Excepting transaction, with customers and suppliers (these transactions must have been posted already) others should be posted to proper accounts. Cash sales will be on the debit side of the Cash Book.

- Credit Sales plus Cash Sales give you total sales. Examination of the credit side of the Cash Book will also reveal wages, carnage inwards, etc., which will be debited to the Trading Account. Thus all information to prepare Trading Account becomes available and gross profit will be ascertained.

- This is put on the credit side of the Profit and Loss Account. Credit side of the Cash Book reveals expenses. These expenses after proper adjustments (for expenses prepaid or outstanding) will be debited to the Profit and Loss A/c.

- Debit side of the Cash Book will reveal income (such as sale of old newspapers.) These will be put on the credit side of the Profit and Loss A/c. The profit and Loss A/c should also be debited with any depreciation which has to be written off. Thus net profit or net loss can be ascertained. Thus will be transferred to the Capital Account.

- Preparation of Balance Sheet is easy. The previous Statement of Affairs will reveal the various assets. The assets adjusted for depreciation and disposal (see debit side of Cash Book) and new acquisition (see credit side of the Cash Book) will be put in the Balance sheet at the end of the year. The balance for cash, debtors, stock and creditors will be given as at the end of the year. These will put down in the Balance Sheet.

- Capital will be as per previous Statement of Affairs adjusted for net profit or net loss and drawings (see credit side of Cash Book).

Opening Balance sheet/Statement of Affairs: if not given (For Ascertaining Opening Capital)

Cash/Bank A/c: If agreed summary is not given. To ascertain the closing Balance of Cash/Bank)

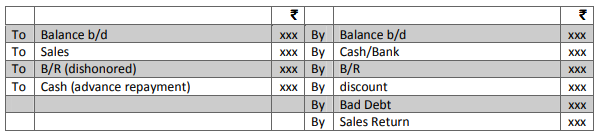

Total Debtors Account: To ascertain either Credit Sales or Closing Balance or Opening Balance of Debtors or Cash received from Debtors.

*All the relevant figures will be given in the question except any one of the above

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | XX | By Cash & Cheque Received | XX |

To Credit sales | XX | By Discount Received | XX |

To Discount Allowed | XX | By Bills Receivable (Drawn) | XX |

To Creditors (Dishonour of B/R Endorsed) | XX | By Return Inwards | XX |

To Bank (Cheque Dishonoured) | XX | By Bad Debts Written Off | XX |

To Bills Receivable (Dishonoured) | XX | By Balance c/d | XX |

TOTAL | XX | TOTAL | XX |

The following items will not affect Total Debtors Account: -

a) Cash sales

b) Reserve for discount on Debtors

c) R.D.D

d) Bad Debt previously written off but now recovered.

e) Bills receivable Honoured

f) Bills receivable Dishonoured

g) Bill receivable endorsed

h) Bills receivable sent to bank for collection

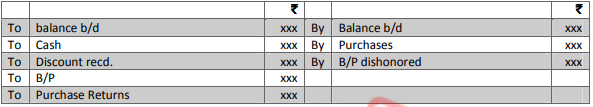

Total Creditors Account: To ascertain either Credit Purchases or Closing Balance or Opening Balance of Creditors or Cash paid to Creditors.

*All the relevant figures will be given in the question except any one of the above

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Cash/Bank Account | XX | By Balance b/d | XX |

To Discount received | XX | By Credit Purchase | XX |

To Bills Payable (Accepted) | XX | By Bank Account (Dishonoured of Cheques) | XX |

To Bills Receivable (Endorsed) | XX | By Bills Payable (Dishonoured) | XX |

To Return Outwards | XX | By Debtors (Dishonour of bills receivable endorsed) | XX |

To Balance c/d | XX |

|

|

TOTAL | XX | TOTAL | XX |

The following items will not affect total Creditors Account: -

a) Cash Purchase

b) Reserve for Discount on Creditors

c) Bills Payable honoured

Note: - if bills receivable Endorsed it is debited to creditors A/c on dishonoured of B/R endorsed Creditor's A/c. is credited by debiting Debtors A/c.

Bills Receivable Account: To ascertain Either Opening Balance or Closing Balance or Bills Drawn.

*All the relevant figures will be given in the question except any one of the above

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | XX | By Cash/Bank (Honouring) | XX |

To Debtors a/c for B/R received | XX | By Cash/Bank (Discounting) | XX |

|

| By Debtors (Dishonoured) | XX |

|

| By Discount (Discounting) | XX |

|

| By Creditors (B/R ENDORSED) | XX |

|

| By Bank for Collection | XX |

|

| By Balance c/d | XX |

TOTAL | XX | TOTAL | XX |

Bills Payable Account: To ascertain Either Opening Balance or Closing Balance or Bills Accepted.

*All the relevant figures will be given in the question except any one of the above

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Cash/Bank. (Honouring) | XX | By Balance b/d | XX |

To Creditors (Dishonoured) | XX | By Creditors for Bills Payable accepted | XX |

To Balance c/d | XX |

|

|

TOTAL | XX | TOTAL | XX |

Key takeaways

- The records maintained according to the single entry system are known as Incomplete Records

- Single entry system of book-keeping is not a system at all. It means recording transactions not according to well defined rules but according to mere convenience

Concept of sectional balancing, preparation of control accounts

Self-balancing and sectional balancing are synonymously used, but still there are some differences between the two. Under self-balancing, all the ledgers are self-balanced whereas, under sectional balancing, only general ledger is made self-balancing. Thus for the same, a control account is maintained in the general ledger for each of the purchases and sales ledger.

These are called Purchase Ledger Control Account or Total Creditors Account and Sales Ledger Control Account or Total Debtors Account. The accounts of all credit customers (i.e., debtors) are taken out of the General Ledger and placed in the Debtors Ledger. In the place of the individual debtors accounts so taken out, an account known as ‘Total Debtors Account’ showing, in total, all the transactions with the credit customers is prepared in the General Ledger, similarly, the accounts of the creditors are taken out of the General Ledger and put in the Creditors Ledger. In the place of all the creditors accounts so taken out, a ‘Total Creditors Account’ is prepared in the General Ledger. These two total accounts and the remaining accounts will from the General Ledger.

Thus a firm will have three Ledgers:

- General Ledger: Containing all the usual accounts except those relating to debtors and creditors but containing instead of a Total Debtors Account and a Total Creditors Account.

- Debtors Ledger: Containing accounts of individual debtors only.

- Creditors Ledger: Containing accounts of individual creditors only.

The total accounts in the General Ledger are posted in totals, where as the individuals’ accounts in the Debtors or Creditors Ledger are posted with the individual transactions and, therefore, the total of the balances of individual customers or creditors should be equal to the balance shown by the Total Debtors Account or the Total Creditors Account respectively.

Total debtors account- The balance shown by the Total Debtors Account on any date should agree with the total of the debit in Debtors Ledger, at that date. If not, there is some mistake either in the Total Debtors Account or the individual accounts.

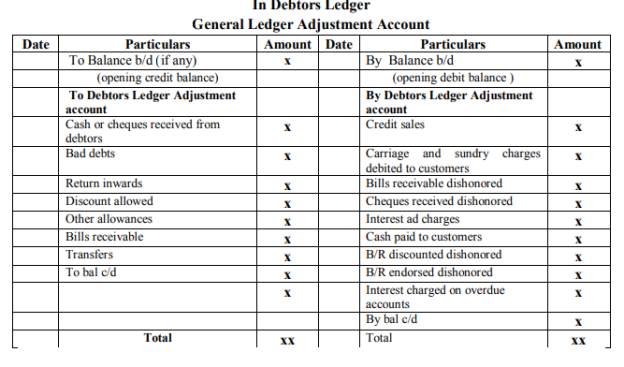

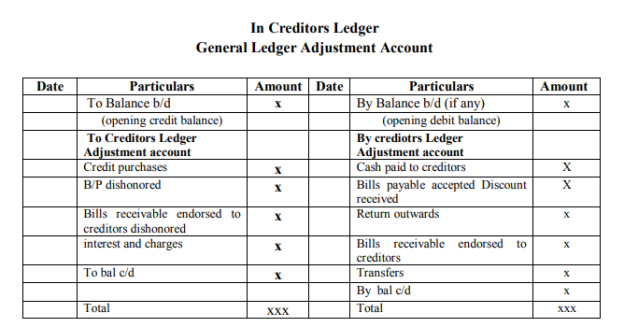

|

Total creditors account – it is the summary of the individual creditors accounts prepared in a general ledger. The Credit Balance of the Total Creditors Account on any date should agree with the total of the credit balance in the individual creditor’s accounts as found in the Creditors Ledger. If so it may be concluded that there is no mistake in the total creditors account or in the individual creditors accounts.

|

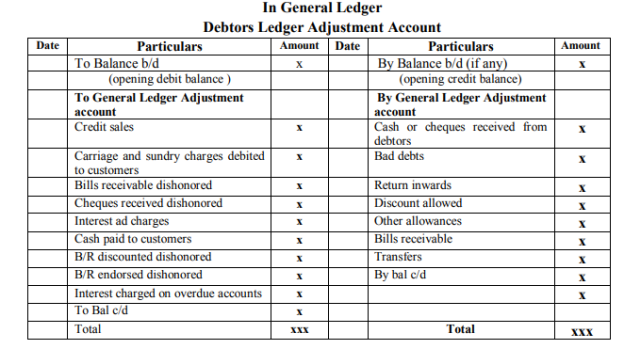

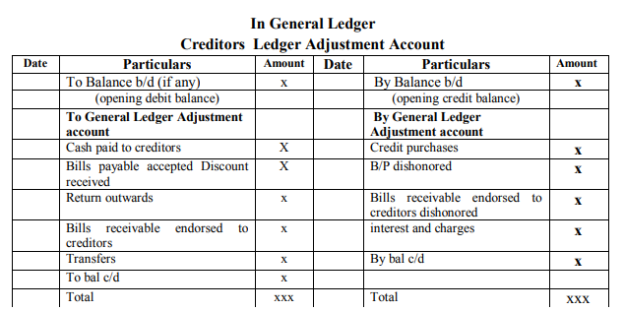

Self balancing ledger

A self-balancing ledger is one whose balances, when extracted, form a complete trial balance. In other words, each ledger is self-balancing. Under this system, each ledger is maintained under double entry principle, i.e., the principle of double entry is completed within the ledger itself.

Naturally, the ledger which contains a double entry is also provided with a corresponding credit entry, and vice versa. This is done with the help of an account, viz., General Ledger Adjustment Account (to be maintained in Debtors and Creditors Ledgers), and also two other accounts, viz., Debtors/Sales Ledger Adjustment Account and Creditors/Purchases Ledger Adjustment Account (to be maintained in General Ledger). Thus, these three accounts are to be maintained under self-balancing system.

Therefore, the three ledgers have the following accounts:

(1) Sales/Debtors Sold Ledger deals with:

- Accounts relating to trade debtors; and

- General Ledger Adjustment Account.

(2) Purchases/Creditors Bought Ledger deals with:

- Accounts relating to trade creditors; and

- General Ledger Adjustment Account.

(3) General/Nominal Ledger deals with:

Accounts relating to nominal, real and personal (other than trade debtors and trade creditors stated above); Debtors Ledger Adjustment Account and Creditors Ledger Adjustment Account

Advantages

(i) Errors can be detected quickly and without checking the other ledgers only the connected ledger can be checked. Thus, it saves time, money and labour and, therefore, delay in balancing is minimised.

(ii) This system is the best one for detecting frauds and errors relating to accounts committed by the clerks. As a result, this system distinguishes efficient employees from inefficient ones.

(iii) A complete trial balance can be compiled by taking the debtors and creditors balances or by taking the general ledger balances which facilitate the preparation of both the interim accounts and the final accounts without abstracting the individual personal ledger balances.

(iv) Since this system provides sub-division of work among the different employees, work can be done quickly.

(v) In order to keep the confidential information relating to the proprietor’s capital, reserves, profit etc., a private ledger may be prepared which is kept by the proprietor or by his trustworthy person and the balances of such ledgers are incorporated in the trial balance.

(vi) By taking the balances from Debtors Ledger Adjustment Account and Creditors Ledger Adjustment Account recorded at the end of the general ledger, management may be informed about the amounts owing to or by the business and the necessary decision can be taken for the purpose.

Recording process

- Normally, the accounts of individual debtors are maintained recording credit sales, cash collections, discounts, bad debts, etc in debtor’s ledger or sales ledger. The general ledger adjustment account in the sales ledger gives the summary of all these transactions in a reverse manner.

- Similarly in bought ledger, general ledger adjustment account gives a summary of all transactions of the brought ledger in a reverse manner.

- Against these ledger adjustment accounts, two other adjustment accounts are maintained in the general ledger to complete the double entry.

- Creditors ledger adjustment accounts

- Debtors ledger adjustment accounts

- In this way all the general ledgers, sales ledger and bought ledgers are made self balanced.

Preparation of adjustment accounts

The system on which entries are made in the adjustment account is described below

- Debtors ledger - Under self-balancing system, two types of entries are to be passed, one is usual double entry and the other self-balancing entry. As soon as the transaction takes place, the usual double entry is to be passed by debiting one account and crediting the other, i.e., one account relates to Debtors Ledger and the other relates to General Ledger.

- Creditors ledger - The same principle is, however, applied in the case of Creditors Ledger, i.e., the usual double entry function is to be maintained. In short, two types of entries—one relates to Creditors Ledger and the other relates to general ledger—are to be passed.

|

|

|

|

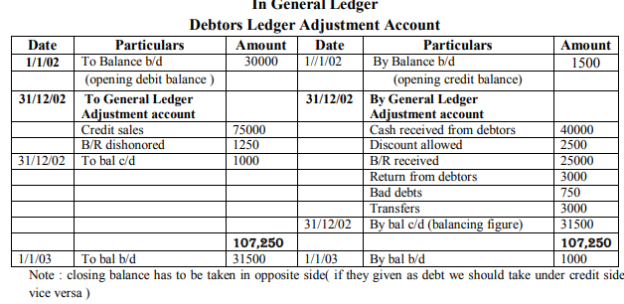

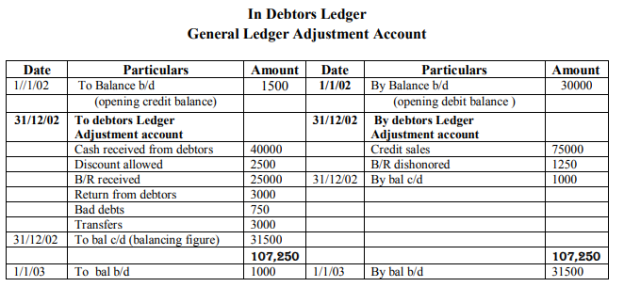

Example 1

From the following transactions prepare the necessary ledger adjustment accounts in the respective ledgers as on 31/12/2002

Balance of debtors on 1/1/02 (Dr) Rs.30000

Balance of debtors on 1/1/02 (Cr) Rs. 1500

Credit sales Rs.75000

Cash received from customers Rs 40000

Cash sales Rs 35000

Discount allowed Rs.2500

Bills receivable received Rs.35000

Bad debts written off Rs. 750

Return from debtors Rs.3000

B/R dishonored Rs. 1250

Bad debts previously written off now recovered Rs 1000

Transfer from creditor ledger Rs.3000

Bills receivable discounted Rs.3000

Provision for doubtful debts Rs,2000

Balance of debtors on 31/12/02 (Cr) Rs.1000

Solution

|

|

Example 2

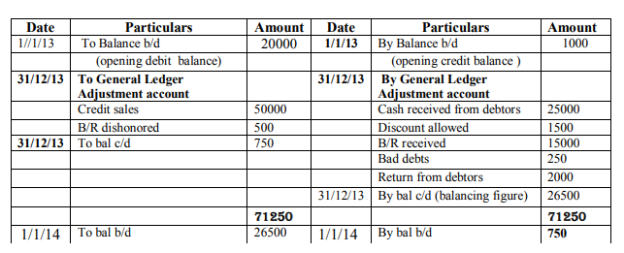

From the following transactions prepare debtor ledger adjustment accounts in general ledgers as on 31/12/2013.

Balance of debtors on 1/1/13 (Dr) Rs.20000

Balance of debtors on 1/1/13 (Cr) Rs.1000

Credit sales Rs.50000

Cash sales Rs 15000

Cash received from debtors Rs 25000

Discount allowed Rs.1500

Bills receivable received Rs.15000

Bad debts written off Rs. 250

B/R dishonored Rs. 500

Return from debtors Rs.2000

Provision for doubtful debts Rs,3000

Balance of debtors on 31/12/13(Cr) Rs. 750

Solution: In General Ledger

Debtors Ledger Adjustment Account

|

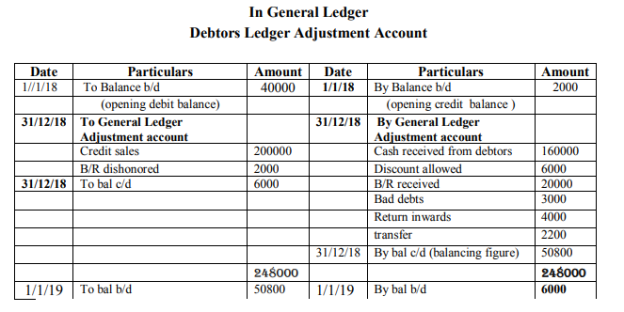

Example 3

From the following prepare the debtors ledger adjustment account under self balancing system in general ledger

Balance of debtors on 1/1/18 (Dr) Rs.40000

Balance of debtors on 1/1/18 (Cr) Rs.2000

Credit sales Rs.200000

Cash received from debtors Rs 160000

Discount allowed Rs.6000

Return inwards Rs.4000

Bad debts written off Rs. 3000

Bills receivable received Rs.20000

B/R dishonored Rs. 2000

Provision for bad debts Rs,2000

Transfer from creditors ledger to debtor’s ledger Rs.2200

Closing credit balance of debtors Rs.6000.

Solution

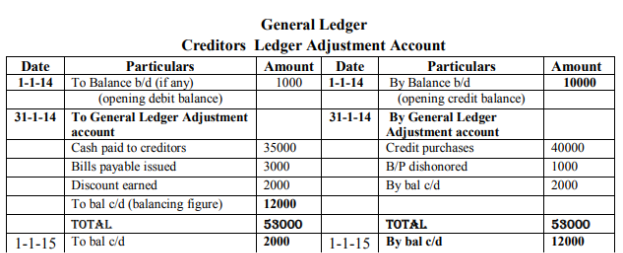

Example 4

From the following prepare the creditors ledger adjustment account under self balancing system in general ledger

Debit balance of creditors (1-1-2014) Rs.1000

Credit balance of creditors (1-1-2014) Rs.10000

Credit purchase Rs. 40000

Cash purchase Rs. 20000

Cash paid to creditors Rs 35000

Discount received Rs. 2000

Bills payable issued Rs. 3000

Bills payable dishonored Rs. 1000

Debit balance of creditors (31-1-2014) Rs. 2000

Solution

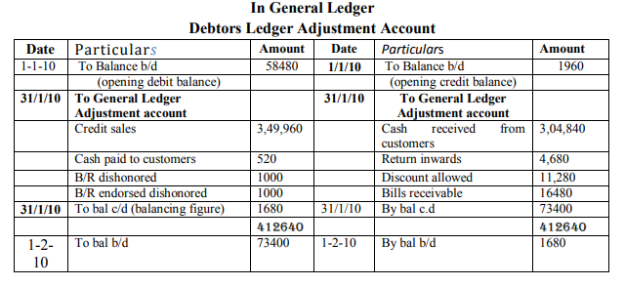

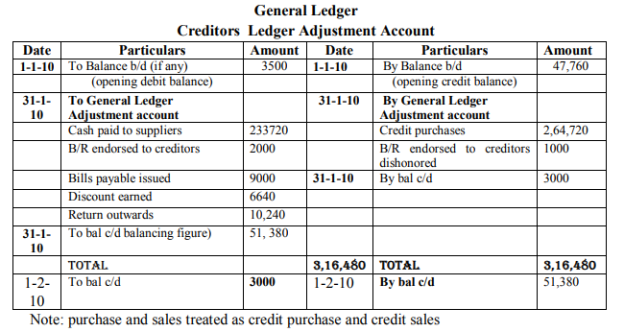

Example 5

From the following particulars as extracted from the books of Bhima prepare debtors ledger adjustment account and creditors ledger adjustment account:

January 1. 2000

Balance of bought ledger (Dr) Rs 3500

Balance of bought ledger (Cr) Rs 47760

Balances of sold ledger (Dr) Rs. 58480

Balances of sold ledger (Cr) Rs.1960

January 31, 2000

Purchases Rs. 264720

Return outwards Rs 10240

Sales Rs 349960

Return inwards Rs 4680

Cash received from customers Rs 304840

Discount allowed thereon Rs 11280

Cash paid to suppliers Rs 233720

Discount earned thereon Rs 6640

Cash paid to customers Rs 520

Bills receivable Rs 16480

Bills payable Rs 9000

Bills receivable dishonored Rs 1000

Bills receivable discounted Rs 2000

Bills receivable endorsed to creditors Rs 2000

Bills receivable endorsed dishonored Rs 1000

Bought ledger balances (Dr) Rs. 3000

Sold ledger balance (Cr) Rs 73400

Solution

Key takeaways –

- A self-balancing ledger is one whose balances, when extracted, form a complete trial balance.

- Under this system, each ledger is maintained under double entry principle, i.e., the principle of double entry is completed within the ledger itself.

References

- Robert N Anthony, David Hawkins, Kenneth A. Merchant, Accounting: Text and Cases.

- McGraw-Hill Education.

- Charles T. Horngren and Donna Philbrick, Introduction to Financial Accounting, Pearson.

- M.C.Shukla, T.S. Grewal and S.C.Gupta. Advanced Accounts, Vol-I, S. Chand & Co.

- S.N.Maheshwari and S.K.Maheshwari, Financial Accounting, Vikas Publishing House.

- P.C. Tulsian, Financial Accounting, Pearson Education.

- Compendium of Statements and Standards of Accounting, The Institute of Chartered

- Accountants of India, New Delhi.

- Rajasekaran, Financial Accounting, Pearson.

- Mukherjee and Mukherjee, Financial Accounting I, Oxford.

- Amitabha Mukherjee, Mohammed Hanif, Financial Accounting I, McGraw Hill Education.