Unit 3

Consignment Accounting

Consignment accounting is a type of business arrangement in which one person send goods to another person for sale on his behalf and the person who sends goods is called consignor and another person who receives the goods is called consignee, where consignee sells the goods on behalf of consignor on consideration of certain percentage on sale.

Features

- Two Parties: Consignment accounting mainly involves two party’s consignor and consignee.

- Transfer of Procession: Procession of goods transferred from consignor to consignee.

- Agreement: For terms and conditions of the consignment there is a pre-agreement between the consignor and consignee.

- No Transfer of Ownership: Until the consignee sells it the ownership of goods remains in the hands of the consignor. The only procession of goods is transferred to a consignee.

- Re-Conciliation: Consignor sends Pro-forma invoice while consignee sends account sale details and both reconcile their accounts at the end of the year.

- Separate Accounting: In the books of consignor and consignee there is independent accounting done of consignment account. Both prepare consignment account and record the journal entries of goods through consignment account only.

Terms used in consignment account

- Consignor: It is the person that sends goods.

- Consignee: The person who receives the goods is called the consignee.

- Consignment: Consignment is a business arrangement through which the consignor sends goods to the consignee for sale.

- Consignment Agreement: It is legally written communication which defines the terms and conditions of the consignment between the consignor and consignee.

- Pro-Forma Invoice: Pro-forma invoice is the statement forwarded when the consignor sends goods to the consignee, showing details of goods such as quantity, price, etc.

- Non- Recurring Expenses: Expenses that are incurred by the consignor to dispatch the goods from his place to place of the consignee are called non-recurring expenses. These expenses are added to the cost of goods.

- Recurring Expenses: The consignee incurs these expenses after the goods reached his place. These expenses are of maintenance of goods type’s expenses.

- Commission: Commission is the reward for the sale of goods on behalf of the consignor. It is as per the consignment agreement.

- Account Sale: It is the statement forwarded by the consignee to consignor showing details of goods sold, amounts received, expenses incurred, a commission charged, advance payment and balance due and stock in hand, etc.

Difference with sales

CONSIGNMENT | SALE |

Ownership of the goods remains with the consignor. | Ownership of the goods transfer to buyer. |

Consignee can return unsold goods. | Goods sold can be returned only if seller agrees. |

Consignor bears the loss of goods held with consignee. | Buyer have to bear the loss if any after delivery of goods. |

Relationship between CONSIGNOR and CONSIGNEE is that of PRINCIPAL and AGENT. | Relationship between buyer and seller is that of Creditor and Debtor |

Expenses incurred by consignee to keep goods safely are borne by consignor. | Expenses by buyer to keep goods safely is borne by buyer. |

Recording in the books of Consignor – at cost & at invoice price

In consignment, the consignor sends goods to the consignee either at cost price or at a higher price known as invoice price. The accounting procedure used under cost price method is a little bit different from that used under invoice price method.

Cost price method -

- Goods sent by consignor on Consignment:

Consignment A/c Dr.

To Goods sent on Consignment A/c

2. Expenses incurred by Consignor:

Consignment A/c Dr.

To Cash Account.

3. Goods sold by Consignee:

Consignee A/c Dr.

To Consignment Account

4. Expenses incurred by the Consignee:

Consignment A/c Dr.

To Consignee A/c

5. Profit on Consignment:

Consignment A/c Dr.

To Profit and Loss Account

6. Loss on Consignment:

Profit and Loss A/c Dr.

To Consignment A/c

Invoice price method

When a consignor sends goods to consignee at a price higher than the cost price, that is known as invoice price method. It is done if the consignor does not want to disclose the real profit to the consignee. The consignee will not be able to know the cost price if the goods are consigned at above price.

1. For goods sent on consignment

Consignment to.................. A/C..........Dr.(invoice price)

To goods sent on consignment A/C

2. For loading goods sent on consignment

Goods sent on consignment A/C........Dr.(loading amount)

To consignment to......A/C

3. For abnormal loss

Abnormal loss A/C...............Dr.(invoice price)

To consignment to........A/C

4. For loading on abnormal loss

Consignment to......A/C.............Dr.(loading amount)

To abnormal loss A/C

5. For unsold stock

Consignment stock A/C.............Dr.(invoice price)

To consignment to........A/C

6. For loading on unsold stock

Consignment to..........A/C.......Dr. (loading amount)

To consignment stock reserve A/C

7. For goods return by consignee

Goods sent on consignment A/C.............Dr. (invoice price)

To consignment to.....A/C

8. For loading on goods returned

Consignment to.........A/C ........Dr.(loading amount)

To goods sent on consignment A/C

Valuation of unsold stock;

When all the goods have not been sold, it becomes necessary to value the unsold goods. If all the goods are not sold by the Consignee within the accounting period, then the unsold stock is brought into account by the Consignor. The cost of unsold stock or closing stock should be valued at cost to the consignor plus proportionate non-recurring expenses incurred by the consignor and consignee. The unsold stock in the hands of the consignee should be valued on cost price or market price whichever is less. The consignment stock account is an asset and will be shown in the balance sheet.

The following method are considered while valuing unsold stock:

Cost Price Of Goods Consigned.................................XXX

Add: Expenses incurred by consignor:

Freight.........................................................................XXX

Carriage.......................................................................XXX

Insurance on goods dispatch......................................XXX

Docks dues....................................................................XXX

Export/Import duties....................................................XXX

Loading and unloading charges...................................XXX

Add: Consignee's expenses:

Unloading charges.....................................................XXX

Landing charges........................................................XXX

Import duty................................................................XXX

Octroi.........................................................................XXX

Godown rent etc........................................................XXX

Total Cost..................................................................XXX

Cost of unsold stock = (Total Cost/Total Quantity) X Unsold Quantity

Alternative Method,

Cost Of Unsold Stock

= (Cost of goods sold+Proportionate of all expenses/Total Quantity) X unsold stock

Treatment and valuation of abnormal & normal loss.

Normal Loss− Due to inherent characteristics of goods like evaporation, drying up of goods, etc normal loss may occur. It is included in the cost of goods sold and the closing stock by inflating the rate per unit but not separately shown in the consignment account.

Abnormal Loss −An abnormal loss may occur due to any accidental reason. To calculate actual profitability it is credited to the consignment account.

Calculation of value of abnormal loss

Cost of abnormal loss (net expected selling price if it is less than the cost price) | xxx |

Add: proportionate expenses of consignor (all expenses / net goods spent on consignment *abnormal loss) | xxx |

Add: proportionate expenses of consignee (all expenses incurred by consignee till the goods reach his premise * abnormal loss/ goods received by him) | Xxx |

Value of abnormal loss | Xxx |

Less insurance claim | Xxx |

Net abnormal loss | xxx |

- Amount of abnormal loss credited to consignment account

- Insurance claim is credited to abnormal loss account

- Balance of abnormal loss transferred to profit and loss account

- In case of abnormal loss in transit, the proportionate expenses of consignee are not added.

Types of commission paid by the consignor to the consignee

Ordinary commission

The commission charged by the consignee on the gross sale proceeds is known as ordinary or simple commission. It is calculated at fixed percentage of total sales.

Commission = Gross sales X Fixed rate percent of commission

Special commission

In normal practice, if a consignee sell the goods at the price higher than the normal selling price, he will entitled a commission for excess amount realized over the normal selling price. The commission provided on the excess amount realized over the normal selling price is known as special commission.

Del credere commission (with and without bad debt) - use of Consignment Debtors A/C.

Del credere commission is related to credit sales. This type of commission which a consignor offers to the consignee who guarantees the collection of payment from credit customers. It acts like a credit insurance to consignor in the case when a customer becomes insolvent or fails to make payment due to some other reason.

Calculation

Del credere commission is paid to the consignee in addition to his ordinary commission. Del credere commission is computed at a certain pre agreed percentage of total gross sale proceeds.

For example, the cash sales are 5,000 and credit sales are 2,500. If an ordinary commission of 10% and a delcredere commission of 5% are allowed to consignee, the two types of commission would be computed separately as follows:

Ordinary commission = (5,000 + 2,500) × 0.1

= 750

Del credere commission = (5,000 + 2,500) × 0.05

= 375

Entries related to credit sales

When a delcredere commission is not given to consignee

Entries in the books of consignor:

- At the time of credit sales:

Consignment debtors A/C Dr

Consignment A/C Cr

II. At the time of collection of debtors:

Cash/Bank A/C [Dr]….Collection by consignor

Consignee A/C [Dr]…..Collection by consignee

Consignment debtors A/C [Cr]

III. Entry for bad debts/discount allowed:

Bad debts/Discount allowed A/C [Dr]

Consignment debtors A/C [Cr]

IV. At the time of closing bad debts/discount allowed account:

Consignment A/C [Dr]

Bad debts/Discount allowed A/C [Dr]

Entries in the books of consignee

(1). At the time of credit sales:

No entry

(2). At the time of collection of debtors:

Cash/Bank A/C [Dr]

Consignor A/C [Cr]

(3) Entry for bad debts:

No entry

When a delcredere commission is given to consignee

Entries in the books of consignor

(1). When credit sales are made

Consignee A/C [Dr]

Consignment A/C [Cr]

(2). Entry for bad debts:

No entry – when delcredere commission is allowed to the consignee, the consignor has nothing to do with bad debts.

(3). For consignee’s ordinary and del credere commission:

Consignment A/C [Dr]

Consignee A/C [Cr]

Entries in the books of consignee

(1). When credit sales are made:

Consignment debtors [Dr]

Consignor A/C [Cr]

(2). At the time of collection of debtors:

Cash/Bank [Dr]

Consignment debtors [Cr]

(3). Entry for bad debts:

Bad debts A/C [Dr]

Consignment debtors A/C [Cr]

(4). Entry for closing bad debts account

Consignee adjusts the amount of bad debts against his commission from consignment. The bad debts are debited to the commission received account. At the end of the year, the net balance of commission received account is transferred to the profit and loss account. This is done by means of the following two journal entries:

- The following entry closes the bad debts account to commission received account:

Commission received A/C [Dr]

Bad debts A/C [Cr]

ii. The following entry closes the commission received account to profit and loss account:

Profit and loss A/C [Dr]

Commission received A/C [Cr]

Recording in the books of Consignee

The consignee receives the goods from the Consignor. To the consignee it is an inward consignment. An inward consignment is the receipt of goods by the Consignee from the Consignor for the purpose of sale on commission basis. Consignee is not the owner of the goods.

Journal entry

- When the goods is received

No entry

The Consignee is not the owner of the goods. He does not purchase the goods. Hence he does not include this in his book.

2. When Expenses are Incurred by the Consignee:

Consignor Account Dr.

To Bank Account

(Being expenses paid on consignment)

3. Advance Remitted to Consignor by Cash/Cheque/Bills Payable:

Consignor Account Dr.

To Cash/Bank/Bills Payable A/c

(Being advance paid to Consignor)

4. When consignee sold the goods

(a) For cash sales:

Bank Account Dr.

To Consignor Account

(Being the cash sales of consignment)

(b) For credit sale:

Consignment Debtors Account Dr.

To Consignor Account

(Being the credit sales of consignment)

5. When the Commission is Due:

Consignor Accounts Dr.

To Commission Account

(Being commission earned on sale of consignment)

6. When the Consignee Collected the Debt from Consignment Debtors:

Bank Account Dr.

To Consignment Debtors A/c

(Being the Collection of consignment debts)

7. For Bad Debts if Any:

(a) If Del Credere Commission is not paid:

Consignor Account Dr.

To Consignment Debtors A/c

(Being bad debt incurred on sales)

(b) If Del Credere Commission is paid:

Bad Debts Account Dr.

To Consignment Debtors A/c

(Being bad debts incurred on consignment sales)

(c) Bad debts is transferred to his Profit & Loss Account:

Del Credere Commission Account Dr.

To Bad Debts Account

(Being bad debts transferred to Del Credere Commission Account)

8. Closing of Del Credere Commission and Commission Account:

Commission Account Dr.

Del CredereCommission account Dr.

To profit and loss account

(Being commission account and balance of delcredere account is closed by transferring to profit and loss account)

9. Settlement of account with consignor

Consignor account Dr.

To cash/ bank/ bills payable account

(Being the amount due to consignor is settled)

Key takeaways

- Consignment sales are the sale of products by consignment to a third party.

- The party selling the consignment product receives a portion of the profit as a flat rate or commission.

- Selling under consignment arrangements can be a low-fee, low-time investment method for selling goods and services.

- Most consignment dealers and online dealers offer the terms, but some are willing to negotiate.

- If you don't have a physical store or online marketplace to sell your products, consignment is a good workaround.

Example 1

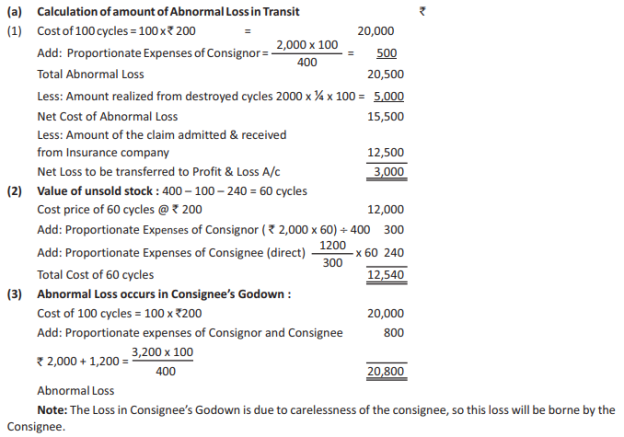

Bharat Cycles Ltd. of Mumbai sent 400 cycles @ Rs 200 per cycle to Chandra & Sons of Udaipur. Consignee paid Rs 1,400 carriage and Rs 600 for insurance. On the way due to truck accident 100 cycles are fully destroyed and only ¼ of purchase price is received from them. Then Chandra & Sons sold 240 cycle @ Rs 250 per cycle and sent the demand draft after deducting Rs 1,200 for octroi, 600 for sales expenses, and Rs 2400 for his commission. Consignor got Rs 12,500 from insurance Co. for abnormal loss. Calculate the value of abnormal loss and unsold stock. (a) if abnormal loss occurs in transit of goods (b) if abnormal loss occurs at consignee's godown.

Solution

Example 2

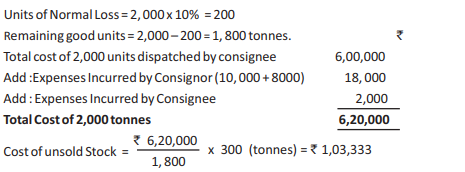

Mr. Rakesh of Mumbai sent 2000 tons of Coal on consignment @ Rs 300 per ton. Consigner paid Rs10,000 carriage and Rs 8,000 for wages. Consignee spent Rs 2,000 for expenses. Mr. Deepak received 10 per cent less coal. Deepak sold 1500 ton coal @ Rs 400 per ton. Calculate value of unsold stock.

Solution

Example 3

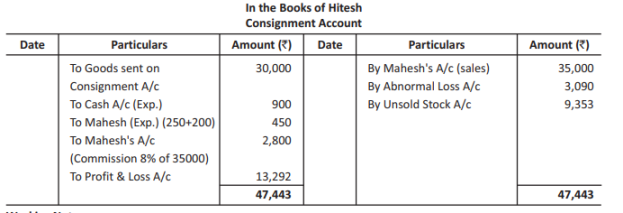

Mr. Hitesh of Bangalore consigned goods to Mr. Mahesh of Ajmer on 1 January, 2015 for Rs 30, 000 at cost price. Consignor paid for carriage and insurance Rs 900. Due to heavy rain fall 10% goods was damaged. Consignee paid clearing charges Rs 250, godown rent Rs 200. On 20th February 2015 consignor received Rs 2500 from Insurance Company. Consignee sent Account sale showing that 2/3 of the remaining goods sold in cash for Rs 35000 and received Rs 500 from damaged goods. Consignee sent remaining amount through bearer. Consignee will receive 8% commission on total sales. Prepare in the books Hitesh, Consignment Account and Abnormal Loss Account.

Solution

Example 4

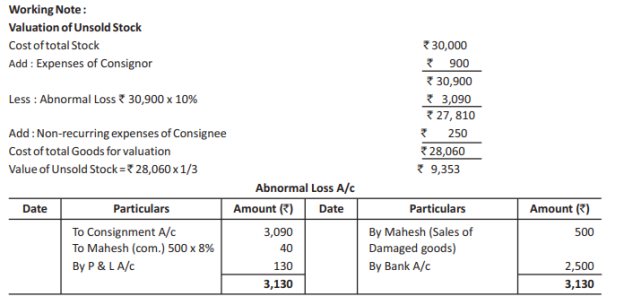

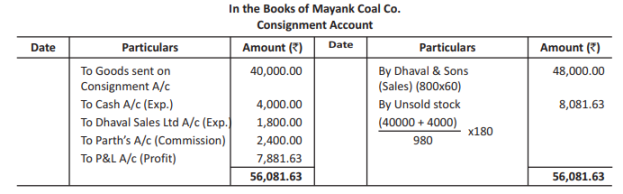

Mayank Coal Co. consigned to Dhaval Sales Ltd. 1000 quintal coal @ Rs 40 per quintal. He paid loading 500, railway freight Rs 3500. Dhaval Sales Ltd. sold 800 quintal coal @ Rs 60 per quintal and paid sales exp. Rs 1600, fire insurance Rs 200. Agent received 5% commission on sales, consignee reported a shortage of 20 quintals coal on the whole consignment. Prepare Consignment Account in the books of Consignor and calculate the value of unsold stock

Solution

Example 5

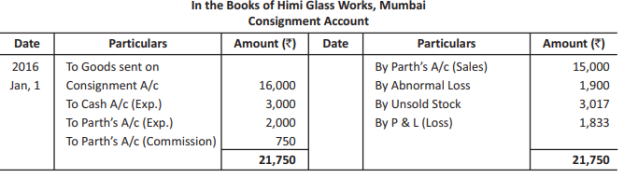

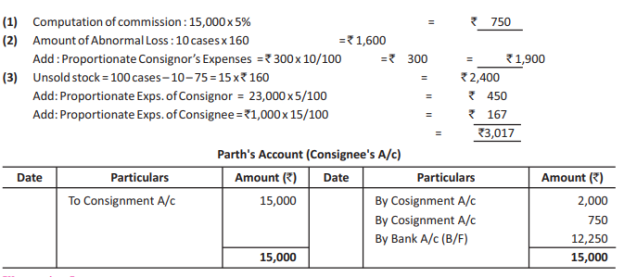

On 1 January 2016, Himi Glass Works of Mumbai consigned to Parth of Bhilwara 100 cases at Rs 16000 on cost. He paid Rs 1000 Railway freight, Rs 2000 wages. During transit 10 cases were lost and remaining cases were received by Parth. He paid octroi Rs 1000, sales expenses Rs 500, godown rent Rs 500. Parth sold 75 cases @ Rs 200 per case. Parth received 5% commission on sales and remaining amount was sent to consignor by consignee.

Prepare Consignment and consignee’s account in the books of Himi Glass Works.

Solution

Goods are sometimes sent to the customers on approval basis. Goods sent on ‘approval’ means goods sent to the customers with the option to the buyer to retain or return the goods within a specified period. The ownership of the goods is passed only when the buyer gives his approval or if the goods are not returned within that specified period.

When the Business sends goods casually on Sale or Return:

When the transactions are few, the seller treats the transactions as an ordinary sale. If the goods are returned a reverse entry is passed to cancel the previous transaction. If, at the year–end, goods are lying with the customer entry for sales made earlier is cancelled and the value of the goods with the customers treated as closing stock.

Journal Entries

When goods are sent

Sundry Debtors A/c Dr. (Invoice Price or Selling Price)

To Sales A/c

When goods are returned or rejected

Sales A/c Dr. (Invoice Price or Selling Price)

To Sundry Debtors A/c

When goods are accepted

No Entry ( When goods are sent on Sale or Return basis the normal entry for sale has been already recorded , and hence on goods accepted by the Customers again no entry is required to be passed .

When unapproved goods are existing on the last day of the year

- Sales A/c Dr.

To Sundry Debtors A/c (Invoice Price or Selling Price)

(When the above unapproved goods are returned in future no entry will be passed to record the same)

2. Should be included in Closing stock and valued at Cost or Market Value whichever is lower

Stock with Customers on sale or Return A/C.-----Dr.

To Trading A/C

When the Business sends goods frequently on Sale or Return Basis:

In this method a specially ruled Sale or Return Journal is maintained. Entries for goods sent, goods returned and goods approved are recorded in the same book. Entry for approved goods is posted to the individual Debtors A/c and the total is posted to the credit of Sales A/c.

When the Business sends Goods numerously on sale or return:

When transactions are numerous, the seller keeps the following additional books

a) Sale or Return Day Book and

b) Sale or Return Ledger

The Ledger contains the accounts of the customers and the ‘Sale or Return’ A/c. Both these books are Memorandum Books

The following entries are recorded in the Sale or Return Book

When goods are sent

Customer A/c Dr.

To Sale or Return A/c

When goods are approved / Returned

Sale or Return A/c-------Dr.

To Customer A/c

When the goods are approved entry for the same is made in the Sales Book

Key takeaways –

- Goods sent on ‘approval’ means goods sent to the customers with the option to the buyer to retain or return the goods within a specified period

References

- Robert N Anthony, David Hawkins, Kenneth A. Merchant, Accounting: Text and Cases.

- McGraw-Hill Education.

- Charles T. Horngren and Donna Philbrick, Introduction to Financial Accounting, Pearson.

- M.C.Shukla, T.S. Grewal and S.C.Gupta. Advanced Accounts, Vol-I, S. Chand & Co.

- S.N.Maheshwari and S.K.Maheshwari, Financial Accounting, Vikas Publishing House.

- P.C. Tulsian, Financial Accounting, Pearson Education.

- Compendium of Statements and Standards of Accounting, The Institute of Chartered

- Accountants of India, New Delhi.

- Rajasekaran, Financial Accounting, Pearson.

- Mukherjee and Mukherjee, Financial Accounting I, Oxford.

- Amitabha Mukherjee, Mohammed Hanif, Financial Accounting I, McGraw Hill Education.