UNIT II

Business Income

Introduction

One of the most important accounting concepts is the "income concept". Similarly, measuring business income is an important function of an accountant.

Payments received on behalf of services or goods are commonly referred to as income. For Q, the salary an employee receives is his income. There may be different types of income, such as total income, net income, national income, personal income, etc., but here we are more interested in business income. The surplus income for the expenses incurred is called "business income".

Purpose of net income

The key objectives of net income are:

Definition of income

The most authentic definition is given by the American Accounting Association as follows-

According to the American Accounting Association, you need to realize income as business income. For Q, increasing the value of a company's assets is not enough to be a business income, so the assets are actually being disposed of.

Accounting Period

Measuring income concerns requires a period of time, not a point in time. Creditors, investors, owners, and governments all require systematic accounting reports at regular and appropriate intervals. The maximum interval between reports is one year. This helps businessmen take corrective action.

The concept of accounting period is directly related to the concept of matching and the concept of realization. Without one of them, it was not possible to measure the income of concern. Based on the concept of matching, costs are determined in a specific accounting period (usually one year), matched with revenue (based on the concept of realization), and the result is profit or loss in the accounting period.

Calculation of business income

There are two ways to calculate your business income-

Balance Sheet Approach

The comparison between a company's closing price (assets minus outsider's liabilities) and its starting value for the accounting period is called the balance sheet approach. The above values deduct additional capital and add additional drawings when calculating a company's business revenue. Since then, income is calculated with the help of the balance sheet, hence the name balance sheet approach.

Transactional Approach

Transactions are primarily related to the production or purchase of goods and the sale of goods, and all these transactions are directly or indirectly related to revenue or expense. Therefore, the surplus recovery of income spent on selling, producing or purchasing goods is a measure of income. This system is widely adopted by companies that have adopted double-entry bookkeeping.

Measurement of Business Income

There are two factors that can help you estimate your income-

2. Cost- Cost is an expired cost. The costs consumed in the process of generating revenue are expired costs. Expenses tell us-how assets are reduced as a result of the services performed by the business.

Revenue measurement

Revenue measurement is based on the concept of accrual accounting. The accounting period in which revenue is generated is the period in which revenue is generated. Therefore, receiving cash and earning money are two different things. Income is only earned when it is actually realized, not necessarily when it is received.

Expense measurement

Concept of Capital and Revenue

Introduction

Accounting aims in ascertaining and presenting the results of the business for an accounting period. For ascertaining the periodical business results, the nature of transactions should be analyzed whether they are of capital or revenue nature. The Revenue Expense relates to the operations of the business of an accounting period or to the revenue earned during the period or the items of expenditure, benefits of which do not extend beyond that period. Capital Expenditure, on the other hand, generates enduring benefits and helps in revenue generation over more than one accounting period. Revenue Expenses must be associated with a physical activity of the entity. Therefore, whereas production and sales generate revenue in the earning process, use of goods and services in support of those functions causes expenses to occur. Expenses are recognised in the Profit & Loss Account through matching principal which tells us when and how much of the expenses to be charged against revenue. A part of the expenditure can be capitalised only when these can be traced directly to definable streams of future benefits.

The distinction of transaction into revenue and capital is done for the purpose of placing them in Profit and Loss account or in the Balance Sheet. For Q: revenue expenditures are shown in the profit and loss account as their benefits are for one accounting period i.e. in which they are incurred while capital expenditures are placed on the asset side of the balance sheet as they will generate benefits for more than one accounting period and will be transferred to profit and loss account of the year on the basis of utilisation of that benefit in particular accounting year. Hence, both capital and revenue expenditures are ultimately transferred to profit and loss account.

Revenue expenditures are transferred to profit and loss account in the year of spending while capital expenditures are transferred to profit and loss account of the year in which their benefits are utilised. Therefore, we can conclude that it is the time factor, which is the main determinant for transferring the expenditure to profit and loss account. Also, expenses are recognized in profit and loss account through matching concept which tells us when and how much of the expenses to be charged against revenue. However, distinction between capital and revenue creates a considerable difficulty. In many cases borderline between the two is very thin.

Considerations in Ascertaining Capital and Revenue Expenditures

The basic considerations in distinction between capital and revenue expenditures are:

2. Recurring nature of expenditure: If the frequency of an expense is quite often in an accounting year then it is said to be an expenditure of revenue nature while non-recurring expenditure is infrequent in nature and do not occur often in an accounting year. Monthly salary or rent is the Q of revenue expenditure as they are incurred every month while purchase of assets is not the transaction done regularly therefore, classified as capital expenditure unless materiality criteria define it as revenue expenditure.

3. Purpose of expenses: Expenses for repairs of machine may be incurred in course of normal maintenance of the asset. Such expenses are revenue in nature. On the other hand, expenditure incurred for major repair of the asset so as to increase its productive capacity is capital in nature. However, determination of the cost of maintenance and ordinary repairs which should be expensed, as opposed to a cost which ought to be capitalised, is not always simple.

4. Effect on revenue generating capacity of business: The expenses which help to generate income/ revenue in the current period are revenue in nature and should be matched against the revenue earned in the current period. On the other hand, if expenditure helps to generate revenue over more than one accounting period, it is generally called capital expenditure.

When expenditure on improvements and repair of a fixed asset is done, it has to be charged to Profit and Loss Account if the expected future benefits from fixed assets do not change, and it will be included in book value of fixed asset, where the expected future benefits from assets increase.

5. Materiality of the amount involved: Relative proportion of the amount involved is another important consideration in distinction between revenue and capital.

Capital Expenditures and Revenue Expenditures

As we have already discussed, capital expenditure contributes to the revenue earning capacity of a business over more than one accounting period whereas revenue expense is incurred to generate revenue for a particular accounting period. The revenue expenses either occur in direct relation with the revenue or in relation with accounting periods, for Q cost of goods sold, salaries, rent, etc. Cost of goods sold is directly related to sales revenue whereas rent is related to the particular accounting period. Capital expenditure may represent acquisition of any tangible or intangible fixed assets for enduring future benefits. Therefore, the benefits arising out of capital expenditure last for more than one accounting period whereas those arising out of revenue expenses expire in the same accounting period.

Solved Qs

ILLUSTRATION 1

State with reasons whether the following statements are ‘True’ or ‘False’.

(1) Overhaul expenses of second-hand machinery purchased are Revenue Expenditure.

(2) Money spent to reduce working expenses is Revenue Expenditure.

(3) Legal fees to acquire property are Capital Expenditure.

(4) Amount spent as lawyer’s fee to defend a suit claiming that the firm’s factory site belonged to the plaintiff’s land is Capital Expenditure.

(5) Amount spent for replacement of worn out part of machine is Capital Expenditure.

(6) Expense incurred on the repairs and white washing for the first time on purchase of an old building are Revenue Expenses.

(7) Expenses in connection with obtaining a license for running the cinema are Capital Expenditure.

(8) Amount spent for the construction of temporary huts, which were necessary for construction of the Cinema House and were demolished when the cinema house was ready, is Capital Expenditure.

A1:

(1) False: Overhaul expenses are incurred to put second-hand machinery in working condition to derive endurable long-term advantage. So it should be capitalised.

(2) False: It may be reasonably presumed that money spent for reducing revenue expenditure would have generated long-term benefits to the entity. It becomes part of intangible fixed assets if it is in the form of technical know-how and tangible fixed assets if it is in the form of additional replacement of any of the existing tangible fixed assets. So, this is capital expenditure.

(3) True: Legal fee paid to acquire any property is part of the cost of that property. It is incurred to possess the ownership right of the property and hence a capital expenditure.

(4) False: Legal expenses incurred to defend a suit claiming that the firm’s factory site belongs to the plaintiff are maintenance expenditure of the asset. By this expense, neither any endurable benefit can be obtained in future in addition to that what is presently available nor will the capacity of the asset be increased. Maintenance expenditure in relation to an asset is revenue expenditure.

(5) False: Amount spent for replacement of any worn-out part of a machine is revenue expense since it is part of its maintenance cost.

(6) False: Repairing and white washing expenses for the first time of an old building are incurred to put the building in usable condition. These are the part of the cost of building. Accordingly, these are capital expenditure.

(7) True: The Cinema Hall could not be started without license. Expenditure incurred to obtain the license is pre-operative expense which is capitalised. Such expenses are amortised over a period of time.

(8) True: Cost of temporary huts constructed which were necessary for the construction of the cinema house is part of the construction cost of the cinema house. Therefore, such costs are to be capitalised.

ILLUSTRATION 2

State with reasons whether the following are Capital or Revenue Expenditure:

(1) Expenses incurred in connection with obtaining a license for starting the factory for Rs. 10,000.

(2) Rs. 1,000 paid for removal of Inventory to a new site.

(3) Rings and Pistons of an engine were changed at a cost of Rs. 5,000 to get fuel efficiency.

(4) Money paid to Mahan agar Telephone Nigam Ltd. (MTNL) Rs. 8,000 for installing telephone in the office.

(5) A factory shed was constructed at a cost of Rs. 1,00,000. A sum of Rs. 5,000 had been incurred in the construction of temporary huts for storing building material.

A2:

(1) Money paid Rs. 10,000 for obtaining license to start a factory is a capital expenditure. This is an item of expenditure incurred to acquire the right to carry on business.

(2) Rs. 1,000 paid for removal of Inventory to a new site is revenue expenditure. This is neither bringing enduring benefit nor enhancing the value of the asset.

(3) Rs. 5,000 spent in changing Rings and Pistons of an engine to get fuel efficiency is capital expenditure. This is an expenditure on improvement of a fixed asset. It results in increasing profit-earning capacity of the business by cost reduction.

(4) Money deposited with MTNL for installation of telephone in office is not expenditure. This is treated as an asset and the same is adjusted over a period of time against actual telephone bills.

(5) Cost of construction of building including cost of temporary huts is capital expenditure. Building is fixed asset which will generate enduring benefit to the business over more than one accounting period. Construction of temporary huts is incidental to the main construction. Such cost is also capitalised with the cost of building.

Capital Receipts and Revenue Receipts

Just as a clear distinction between Capital and Revenue expenditure is necessary, in the same manner capital receipts must be distinguished from revenue receipts.

Receipts which are obtained in course of normal business activities are revenue receipts (e.g., receipts from sale of goods or services, interest income etc.). On the other hand, receipts which are not revenue in nature are capital receipts (e.g. receipts from sale of fixed assets or investments, secured or unsecured loans, owners’ contributions etc.). Revenue and capital receipts are recognised on accrual basis as soon as the right of receipt is established. Revenue receipts should not be equated with the actual cash receipts. Revenue receipts are credited to the Profit and Loss Account.

On the other hand, Capital receipts are not directly credited to Profit and Loss Account. For Q, when a fixed asset is sold for Rs. 92,000 (cost Rs. 90,000), the capital receipts Rs. 92,000 are not credited to Profit and Loss Account. Profit/Loss on sale of fixed assets is calculated and credited to Profit and Loss Account as follows:

Sale Proceeds Rs. 92,000

Less: Cost Rs. 90,000

Profit Rs. 2,000

ILLUSTRATION 3

Good Pictures Ltd., constructs a cinema house and incurs the following expenditure during the first year ending 31st March, 2016.

1. Second-hand furniture worth Rs. 9,000 was purchased; repainting of the furniture costs Rs. 1,000. The furniture was installed by own workmen, wages for this being Rs. 200.

2. Expenses in connection with obtaining a license for running the cinema worth Rs. 20,000. During the course of the year the cinema company was fined Rs. 1,000, for contravening rules. Renewal fee Rs. 2,000 for next year also paid.

3. Fire insurance, Rs. 1,000 was paid on 1st October, 2015 for one year.

4. Temporary huts were constructed costing Rs. 1,200. They were necessary for the construction of the cinema. They were demolished when the cinema was ready.

Point out how you would classify the above items.

A3:

1. The total cost of the furniture should be treated as Rs. 10,200 i.e., all the amounts mentioned should be capitalised since without such expenditure the furniture would not be available for use. If Rs. 1,000 and Rs. 200 have been respectively debited to the Repairs Account and the Wages Account, these accounts will be credited to the Furniture Account.

2. License for running the cinema house is necessary, hence its cost should be capitalised. But the fine of Rs. 1,000 is revenue expenditure. The renewal fee for the next year is also revenue expenditure but pertains to the next year; hence, it is a prepaid expense.

3. Half of the insurance premium pertains to the year beginning on 1st April, 2016. Hence such amount should be treated as prepaid expense. The remaining amount is revenue expense for the current year.

4. Since the temporary huts were necessary for the construction, their cost should be added to the cost of the cinema hall and thus capitalised.

ILLUSTRATION 4

State with reasons, how you would classify the following items of expenditure:

1. Overhauling expenses of Rs. 25,000 for the engine of a motor car to get better fuel efficiency.

2. Inauguration expenses of Rs. 25 lakhs incurred on the opening of a new manufacturing unit in an existing business.

3. Compensation of Rs. 2.5 crores paid to workers, who opted for voluntary retirement.

A4:

1. Overhauling expenses are incurred for the engine of a motor car to derive better fuel efficiency. These expenses will reduce the running cost in future and thus the benefit is in form of endurable long-term advantage. So this expenditure should be capitalised.

2. Inauguration expenses incurred on the opening of a new unit may help to explore more customers. This expenditure is in the nature of revenue expenditure, as the expenditure may not generate any enduring benefit to the business over more than one accounting period.

3. The amount paid to workers on voluntary retirement is in the nature of revenue expenditure. Since the magnitude of the amount of expenditure is very significant, it may be better to defer it over future years.

ILLUSTRATION 5

Classify the following expenditures and receipts as capital or revenue:

A5:

ILLUSTRATION 6

Are the following expenditures capital in nature?

A6:

Key takeaways:

Preface: -

A non-manufacturing entity is a trading entity that buys and sells goods for commercial purposes without changing the form of the goods.

These entities do not process goods.

(A) Income Statement: -This financial statement will be prepared at the end of the year.

The income statement is divided into two parts due to non-manufacturing concerns.

Trading Account: -

At the end of the year, every company needs to make sure it is a profit or a loss. This is done in two steps (I), where you find the gross profit (or total loss) and then the net profit (or net loss).

Gross profit is an excess of net sales (that is, sales-revenue) that exceeds the cost of sales.

The cost of goods sold is equal to the starting inventory + the purchase during the year + the inward freight-the ending inventory of the goods.

The usual way to check your gross profit is to use an account called a trading account.

For a trading company whose business consists only of buying and selling, the trading company is debited as follows:

The value of the starting inventory, the purchases made during the year. And

Other costs incurred to bring the purchased goods to the company's factory or to make the goods available for sale.

Qs of such costs are freight charges, customs duties and octroi taxes on the purchase of goods.

In manufacturing, all expenses incurred before a product is ready for sale are debited to the transaction account.

Qs include the purchase of raw materials, the wages paid to workers, the fuel and electricity used to operate machines, and the transportation at the time of purchase.

When it comes to selling, you need to consider the following: -If an item has been sold but not yet shipped, the item sold should not be included in the final inventory. Such items should be kept apart.

If the goods' assets have not yet been passed on to the buyer, they should not be treated as a sale. In such cases, the entry for sale should be cancelled.

The sale of goods received on behalf of another person should not be treated as a sale. Such sales must be credited to the shipper's account. If your sale is already credited to your sales account, you need to pass the following entry:

Sales account-Dr ****

To the shipper's account ****

The sale of fixed assets or investments should be excluded from the sale. Therefore, if an old asset is sold, it should not be credited to the sales account. If credited, you need to pass the following entry:

Sales account — Dr. ****

To the asset account ****

Goods sent at the time of approval: -Goods sent on an "approved" or "sell or return" basis are the delivery of goods to customers with the option to retain or return the goods within a specified time period. Means If there are few such transactions, these transactions will be accounted for as regular sales. If at the end of the year the item is still lying to the customer and the specified period has not yet expired, the original entry created for sale will be cancelled. Like the usual closing price, such goods are considered in stock at the customer on behalf of the seller and are valued at cost.

Format of TRADING ACCOUNT for the year ended 31st March, 20…

Particulars | Amount | Particulars | Amount |

To Opening Stock To Purchase (Cash+Credit) ***** Less: Purchase Return ***** Goods withdrawn for personal use ***** Goods distributed by way of free sample ***** Goods given as charity ***** To Customs Duty To Octroi Duty To Excise Duty To Freight inward To Carriage inward To Wages and Salaries To Rent & Taxes (Factory building.) To Factory Lighting (electricity) To Power & Fuel To Gross Profit carried To Profit & Loss A/c | ******

****** ****** ****** ****** ****** ****** ****** ****** ****** ******

****** | By Sales ***** Less: Sales Return *****

By Abnormal Loss (if any) Loss by fire ***** Loss by theft etc. *****

By Closing Stock

By Gross Loss trad. to P & L A/c |

******

******

******

******

|

TOTAL | ****** | TOTAL | ****** |

The P & L account starts with a credit from the trading account for debits if there is total profit or total loss. All expenses that are not debited to the trading account are then debited to the P & L account. If there is income or profit, for Q, the rent he received on the on-premises sublet. Interest on the investment, discounts received from the supplier, these are credited to the income statement.

Format of Profit and Loss Account (For the year ending on----)

Particulars | Amount | Particulars | Amount |

To Gross Loss b/d To Salaries & Wages To Salaries to Proprietor/ Partners'/ Directors' To Bonus To Rent, Rates & Taxes To Freight & cartage outward To Electricity Exp. To Repair & Maintenance To Insurance Premium To Staff Welfare exp. To Pension & Gratuity To Compensation to workmen To Audit Fees To Printing & Stationery To Postage, Telegram & Telephone To Commission, Brokerage & Discount To Travelling Exp. To Conveyance Exp. To Entertainment Exp. To Sales promotion Exp. To Advertising & Publicity (including free sample distribution) To discount allowed To Bad Debts To Interest To Bank Charges To Legal Charges To General Exp. To Packing Expenses To Motor Car Expenses. To Depreciation: On Building ***** On Plant & machinery ***** On Furniture & Fixture etc. *****

To Loss on sale of fixed assets To Loss on sale of investment To Abnormal loss: Loss by theft Loss by fire Loss by Embezzlement To Provision for Doubtful Debts To Provision for Taxation To Net Profit trd. to Capital A/c | ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ****** ******

****** ******

****** ****** ****** ****** ****** ****** | By Gross Profit b/d By Profit on Sale of fixed assets By Profit on Sale of investment By Interest By Dividend By Commission By Discount By Rent By Sale of Scraps By Miscellaneous Income

By Net Loss trd. To Capital A/c | ****** ****** ****** ****** ****** ****** ****** ****** ****** ******

****** |

Total | ****** | Total | ****** |

(B) Position Statement: -A position statement consists primarily of assets, liabilities, and a balance sheet showing the capital of the business. It is provided to give you a better understanding of additional financial statements such as cash flow statements, earnings per share financial statements, and value-added financial statements. Financial statements that show your financial position are called Balance sheets.

Key takeaways:

Meaning, Characteristics and Accounting of non-profits

A non-profit organization is an organization established for the purpose of social welfare and the promotion of social arts and culture. These are usually founded as charities with a motive for service. The trustee manages these organizations. Members of the organization elect a trustee. Non-profits raise funds from their members and the general public to achieve their goals.

The main motivation for these organizations is to provide services. But they may eventually benefit. In general, these organizations do not manufacture, buy, sell, or provide services for goods. Therefore, they do not need to prepare trading and P & L A / c. They credit the funds they receive to the Capital Fund or the General Fund A / c.

Accounting for non-profit organizations

As we know, non-profits do not trade goods or provide profitable services. However, they also need to keep good records of income, expenses, assets, and liabilities. Their main sources of income are donations, subscriptions and grants. Therefore, most of their transactions are done through cash or bank accounts.

Appropriate books, firstly because members and contributors are accountable, and secondly because the law requires the government to maintain adequate books so that they can manage grants appropriately. Must be maintained. Proper accounting also reduces the risk of fraud and embezzlement. In addition to your ledger and cash book, you also need to maintain an inventory ledger. The stock ledger also maintains a complete record of all fixed assets and consumables.

In non-profit accounting, instead of maintaining Capital A / c, these organizations maintain Capital Fund or General Fund A / c. They deposit surpluses, lifetime membership fees, donations, heritage, etc. into this account.

Non-profits are also required to prepare final accounts or financial statements at the end of the fiscal year in accordance with accounting principles. The final account for these organizations consists of:

Receipts and payments A / c: An overview of cash and bank transactions. This will help you create a balance sheet A / c and a balance sheet. You must also submit it to the Social Registration Bureau along with your balance sheet A / c and balance sheet.

Balance A / c: Similar to P & L A / c, check for any surplus or deficiency.

Balance Sheet: Create in the same way as the balance sheet for profit motivation concerns.

Question

Ashraya is an organization working to improve and improve the welfare of street children. It sponsors their food and clothing. We also provide basic education to children. Its sources of income are donations, subscriptions and government grants. Identify the type of organization that states the reason. Also mention the accounting procedures you should follow.

Solution-

Ashraya is a non-profit organization. It works for the well-being of children and society. The sources of income are donations, grants and subscriptions from members. Therefore, it is clear that it works for service purposes, not for commercial purposes.

However, non-profits also need to maintain proper accounting books. Financial statements help to win donations from current and future contributors. Financial statements also help you receive grants from various authorities.

Below are the financial statements they prepare at the end of the year.

Characteristics or characteristics of non-profit organizations

Entity: There is a separate legal entity promoted by an individual.

Purpose: To promote cultural, educational, religious and professional purposes and to serve the general public.

Ownership: Established as a charity or trust. Therefore, it is owned by an individual or a group of individuals.

Financial Statements: Every year, we prepare financial statements that include balance sheets, balance sheets, and balance sheets.

Funds: The members and donors will provide the necessary items for operation as admission fees, membership fees, subscription fees, and donations. It is supplemented by surplus from the business.

Receipts and payment accounts: An overview of cash and bank transactions over a specific period. Created from a cashbook at the end of the fiscal year. All cash receipts are entered on the debit side and all cash payments are entered on the credit side.

Feature:

Format of Receipts and payment Account

Receipt Dr.

| Rs. | Payment Cr.

| Rs. |

To the opening balance (bal b / d.) Cash on hand Cash at the bank To capital receipt (subscription) In the case of the previous year This year For next year To Grant for a specific purpose To general grants To general donations To Rent received To dividend To receive with interest For a lifetime membership fee To sell fixed assets Balance c / d (overdraft) Balance b / d (opening bal.)

Total

|

_____ _____ | By salary By rent By repair By investment By audit fee By Due to miscellaneous expenses By insurance By drawings By Bank overdraft By building By book By loan By balance c / d (settlement balance) Cash on hand Cash at the bank

Total |

______ ______ |

Features:

Format of Income and Expenditure

Expenditure Rs. | Income Rs. |

To salary: Added: Finally, unresolved Less: Conspicuous at first To Rent To insurance premiums To printing and stationery To sports expenses To the electricity bill To the loss due to the sale of furniture To miscellaneous expenses To newspapers and periodicals To depreciation: Furniture Sports material To the surplus on the balance sheet

Total

| By subscription By Admission fee By sports fee By Sale in old newspapers By Due to interest in investment By Deficit (taken on the balance sheet)

Total |

Q7:

Create a balance account for the same period from the following balance accounts for the year ending March 31, 2017 at People's Club.

Receipt and Payment Account

Dr. Cr.

Expenditure | Rs. | Income

| Rs. |

Balance c / d bank Subscription: 2015 6,750.00 2016 45,000.00 2017 2,250.00 Donations Hall rent Interest on bank deposits Admission fee

Total

| 1,12,500.00

54,000.00 9,000.00 1,350.00 2,025.00 4,500.00

1,83,375.00

| Purchasing Furniture Salary Telephone Bill Electric Bill Shipping and Stationery Book Purchase Expense Entertainment 5% Government Purchase Paper Miscellaneous Expenses Balance C / D Cash Bank

Total | 22,500.00 9,000.00 1,350.00 2,700.00 675.00 11,250.00 4,050.00 36,000.00 2,700.00

1,350.00 91,800.00

1,83,375.00 |

The following information is available:

Expenditure | Rs. | Income

| Rs. |

Salary 9,000 Add: Unprocessed 6,750 Telephone bill electric bill Shipping and stationery Entertainment fee 4,052.00 Add: Unprocessed2,250.00 Miscellaneous expenses Furniture miscellaneous expenses on Depreciation expenses Surplus

Total

|

15,750.00 1,350.00 2,700.00 675.00

6,302.00 6,300.00 2,700.00

1,687.50 31,837.50

63,000.00 | Subscription Donations Admission fee (50% of 4500) Bank interest 2,025 Added: Unpaid interest 675 Interest in investment Hall rent

Total | 46,800.00 9,000 2,250.00

2,700.00 900 1,350

63,000.00 |

A7:

Income and Expenditure A/C

Balance sheet overview

Balance preparation for non-trade or non-profit concerns is the same as balance sheet preparation for trading companies. You have all the liabilities and assets as of the date the organization created the balance sheet. Excess assets that exceed liabilities are called capital funds or general funds. Creating a balance sheet for non-profits.

Non-profit Balance Sheet: General Financial Resources

For non-profits, capital is accumulated during the year along with receipts and receipts of capital capitalized by further increasing the surplus or reducing the deficit. At the beginning of non-trading concerns, there is no formal capital fund. In such cases, the surplus earned that year constitutes a year-end capital fund.

Non-profit balance sheets are created in the same way as companies do. Organizational assets are recorded on the right and liabilities are recorded on the left. Non-profits do not use the term capital. Instead, general or cumulative funds are displayed on the balance sheet.

NPOs may also create special funds such as prizes and match funds. Its purpose is to meet the costs associated with the purpose for which it was created. The amount of income invested from these funds is generated only in the funds, not in the balance account.

Accounting for general financial resources and preparation of balance sheet

Let's understand the format of the non-profit balance sheet from the following figure, which we will consider in the below question.

Q8. How do you view your subscription amount on your non-profit balance sheet from the following Receipt and Payment accounts and additional information?

Receipt | Rs. | Payment

| Rs. |

To subscription

| 25,000 |

|

|

Additional Information-

1) Unpaid subscriptions from the previous year Rs.2000

2) Unpaid subscriptions for this year Rs.1500

3) Subscriptions are Rs received in advance at the end of the previous year. 1000

4) Subscription is Rs received in advance at the end of this year. 1200

A8:

Start of Balance Sheet

Liabilities | Rs. | Assets

| Rs. |

Pre-subscription (previous year) out. | 1,000

1,000 ________ 2,000 | Subscription (previous year)

| 2,000

________ 2,000 |

Liabilities | Rs. | Assets

| Rs. |

Advanced Subscription (Next Year)

|

1,200

1,200 | Unprocessed Subscription (This Year) Unpaid subscription (previous year)

|

1,500 2,000

3,500 |

Calculate Sports material debited to Income & Expenditure a / c. Yearly. It ended on March 31, 2007, based on the following information. The amount paid for sports material during the year. It was Rs.19,000

Details Inventory of sports materials Creditors of sports materials

| 1 = 4 = 2006 (Rs.) 7,500 200 | 31.3.2007 (Rs.) 6,400 2,600 |

A9:

Option 2. Rs.20700

Description: Amount debited to income and expenditure as consumption of sports materials = payment amount + starting inventory-ending inventory-starting creditor + ending creditor. Amount debited to income and expenses = 19000 + 7500-6400-2000 + 2600 = Rs. 20,700

Q10.The non-profit has received Rs.10,000 as an admission fee for new members. If 20% of the fee needs to be capitalized, what is the amount of the fee that needs to be displayed in the balance account?

A10:

Option 2 Rs.8000

Description: These are the fees collected from all members upon enrolment in membership. Once you become a member of society or a club, you will only be paid once by new entrants. It is treated in two ways: -when capitalized, it appears on the debt side's balance sheet. -If it is considered a receipt for income, it will be displayed in the income and expenditure account on the income side. Therefore, Rs. 20% means Rs. 2000 (10,000 * 20%) appears on the balance sheet on the debt side and the balance of Rs. 8000 is displayed in the income and expenditure account on the income side.

Q11: Prize Rs.10000, Prize Investment Interest Rs.1000, Prize Payment Rs.2000, Prize Investment Rs.8000. What will happen to that treatment?

A11:

Option 4. Rs.9000, Rs on the debt side. 8000 on the asset side

Description: The balance sheet calculation looks like this: -Prize-9000 Addition: -Interest 1000 deduction for prize investment: -Prize payment 2000 Debt side amount = Rupee. 9000 prize investment Rs. 8000 is displayed on the asset side.

Q12. Bell, a non-governmental non-profit organization, received special pledged funding from a donor to another non-governmental non-profit medical organization during its annual campaign. How does Bell need to record these funds?

A12:

Option 2. Increased assets and increased liabilities

Description: Bell, a non-governmental NPO, is responsible for the funds for the annual campaign and is recorded on the balance sheet. And if the organization pledges this fund to another non-governmental NPO, it becomes a property of the Bernon government. Organisation recorded on the asset side of the balance sheet.

Q13. From the information below, we will calculate the amount of stationery that will be posted to the Income and Expenditure account of the Cultural Association of India for the year ending March 31, 2018.

Details Stationery inventory Stationery creditors | 1.4.2017 (Rs.) 21,000 11,000 | 31.3.2018 (Rs.) 18,000 23,000 |

Stationery purchased in the year ended March 31, 2018 was Rs 75,000. Also, please present relevant items on the social balance sheet as of March 31, 2018.

A13 :

Stationery Account

Dr. |

|

| Cr.

|

Details | Rs. | Details | Rs. |

To Balance b / d | 21,000 | By income and expenditure in balance A / c | 78,000 |

To Bank balance | 75,000 | Balancing figure |

|

|

| By balance c / d

| 18,000

|

Total | 96,000 | Total | 96,000 |

Balance sheet as of March 31, 2018

Liabilities | Amount | Assets | Amount |

Stationery Creditors | 23,000 | Stationery Inventory | 18,000 |

Q14. From the information below, we will calculate the amount of the subscription that will be credited to the 2007-2008 balance account.

Amount | |

Subscriptions received for year | 50,000 |

Outstanding subscriptions on March 31, 2007 | 20,000 |

Unprocessed subscriptions on March 31, 2008 | 6,000 |

Subscriptions pre-received on March 31, 2007 | 8,000 |

Subscriptions received in advance on March 31, 2008. The 2006-07 delinquency is still 1,500. | 9,000

|

A14:

Particulars | Amount |

Subscriptions received for year | 50,000 |

(+) March 31, 2008 Unprocessed Subscriptions (6,000 – 1,500) | 4,500 |

(+) Subscriptions received in advance on March 31, 2007 | 8,000 |

(-) Subscription received in advance on March 31, 2008 | (9,000) |

(-) Unprocessed subscriptions on March 31, 2007 (20,000 – 1,500) | (18,500)

|

Revenue from 2007-08 subscription | 35,000 |

Q15. Find out the cost of drugs consumed in 2015-16 from the following information:

Particulars | Amount (Rs) |

Purchase price of medicine | 3,70,000 |

Creditors of purchased medicines April 1, 2015 March 31, 2016 | 25,000 17,000 |

Drug inventory April 1, 2015 March 31, 2016 |

62,000 54,000 |

Pre-pharmaceutical supplier April 1, 2015 March 31, 2016 |

11,500 18,200 |

A15 :

Particulars | Amount |

Payment for drug purchase | 3,70,000 |

(-) Decrease in drug creditors in 2016 (25,000 – 17,000) | (8,000) |

(-) Increase in drug advance payments in 2016 (18,200 – 11,500) | (6,700) |

2016 drug purchase | 3,55,300 |

(+) Starting inventory of pharmaceutical products on April 1, 2015 (-) End of stock of pharmaceutical products on March 31, 2016 | 62,000 (54,000) |

= Medicines consumed in 2016 | 3,63,000 |

Q16. From the following receipt and payment accounts for the Cricket Club and the additional information provided, prepare the balance sheet for the year ending December 31, 2018 and the balance sheet for that date.

Receipt and Payment Accounts

Year ending December 31, 2018

To bal b/d | Rs. |

| Rs. |

- Cash | 3,520 | By Maintenance | 6,820 |

-Bank | 27,380 | By tableware | 2,650 |

-Time deposit @ 6% | 30,000 | By Match cost | 13,240

|

To subscription (2017 including Rs 6000) | 40,000 | By salary

| 11,000 |

To admission | 2,750 | By Transportation | 820 |

To Donation | 5,010 | By maintaining the lawn | 4,240 |

To Interested in time deposit | 900 | By Stamps | 1,050 |

To Tournament Fund | 20,000 | By purchasing cricket products | 9,720 |

To Sale of tableware (book value Rs. 1200) | 2,000 | By Miscellaneous expenses

| 2,000 |

|

| By Investment | 5,700 |

|

| By Tournament costs | 18,800 |

|

| By Balance c / d: -Cash -Bank |

2,200 23,320 |

|

| Time deposit | 30,000 |

| 1,31,560 |

| 1,31,560

|

Additional Information:

A17:

Cricket Club Income and Expenditure Account

Year ended December 31, 2018

Expenditure | Rs. | Income | Rs. |

| ||

To Maintenance | 6,820 | By Subscription | 40,000 |

| ||

To transport | 820 | less: Rec. Last year | 6,000 |

| ||

To Lawn Maintenance | 4,240 | Add: untreated this year | 8,000 | 42,000 | ||

To match cost | 13,240 | By Admission fee | 2,750 | |||

To Salary | 11,000 |

| By Donations | 5,010 | ||

Add: Outstanding |

1,000 |

12,000 | By Interest on time deposits |

900 |

| |

To Postage stamps: |

| Added: Unpaid due | 900 | 1,800 | ||

Balance at the beginning |

750 |

| By Gain on sale of tableware (2000-1200) |

800 | ||

Add: Purchase | 1,050 |

|

|

|

| |

Less: Closing Inventory |

(900) |

900 |

|

|

| |

To cricket goods: |

|

|

|

|

| |

Beginning balance Added: Buy Less: Closing price

|

3210 9720 (2800) |

10,130 |

|

|

| |

To miscellaneous expenses | 2,000 |

|

|

| ||

To income that exceeds expenditure (Bal Fig) |

2,210

|

|

|

| ||

Total | 52,360 | Total | 52,360 | |||

Balance sheet

As of December 31, 2018

Liabilities | Amount | Assets | Amount | ||

Tournament Fund Less: Tournament costs | 20,000

18,800 |

1,200 | Cash Bank Time deposit Investment

| 2,200 23,320 30,000 5,700 | |

Unpaid salary |

| 1,000 | Crockery

| 2,650 | |

Capital (balance Fig) Added: Surplus | 72,660

2,210 |

74,870 | Interest accrued on time deposit | 900 | |

|

|

| Subscription expiration date 2017 (6600-6000) 2018 |

600 8000 |

8,600 |

|

|

| Stamps and stationery |

900 | |

|

|

| Cricket product inventory |

2,800 | |

Total | 77,070 | Total | 77,070 | ||

Key takeaways:

The Nature of Depreciation

Depreciation can be defined as a measure of the depletion of an asset's lifetime due to any cause during a particular time period. -Spicer and Pegler.

“Depreciation is a measure of the consumption, consumption, or other loss of value of a depreciable asset resulting from use, time wasted, or obsolescence due to changes in technology or market. During that time, you will be assigned to charge a significant portion of the depreciation amount for each accounting period. Depreciation expense includes the depreciation of assets with a predetermined useful life. "

-Accounting Standard-6 (revised), issued by ICAI.

Depreciation features:

Causes of depreciation:

1. Normal physical wear and tear:

The normal use of an asset causes it to physically deteriorate, resulting in a decrease in the value of the asset.

2. Time outflow:

Certain intangible assets, such as trademarks, patents and copyrights, have a fixed lifespan. The value of these assets diminishes over time, whether or not they are used by a company.

3. Obsolescence:

R & D brings innovation in the form of better, technologically advanced machines that dispose of older machines, even if they can be physically performed.

In that case, the market price of certain assets such as computers and automobiles may fall permanently. This reduces the value of older machines. Obsolescence is the loss that results from aging an existing asset and replacing it with a new and improved model of that asset.

4. Accident:

Accidental destruction or damage can reduce the value of an asset.

The accounting concept of Depreciation

Fixed assets are long-term assets. They help produce goods and services. However, when an asset is in use, normal wear, time spills, and obsolescence reduce the value of the asset. This reduction in the value of fixed assets is known as depreciation. Understand the concept of depreciation.

Assets owned by a company for the production and supply of goods and services, expected to be used for more than a fiscal year, and have a limited useful life are called depreciable assets.

When you purchase a fixed asset, it is recorded in your books at its original cost or purchase price. Organizations use this fixed asset to earn or generate revenue for several fiscal years before selling or discarding the asset.

Therefore, you must allocate a portion of your purchase or acquisition costs by fiscal year until you use it. This allocation of costs is called depreciation. Depreciation is an organizational expense.

For A, a Setu company buys a machine for £ 2,000,000, uses it for 10 years and then sells it for £ 400,000. Therefore, the cost of a machine for business use is £ 1600,000 (£ 2000000-400000). Now, for every 10 fiscal years you've been using this machine, you need to allocate this £ 1600,000 cost as a project cost. This cost is a depreciation cost of £ 160,000 (1600000/10).

In other words, the concept of depreciation is the cost of getting a service from the use of an asset. You need to match the depreciation cost of a fixed asset with the revenue for the year in which it was used. Therefore, depreciation is charged as an income statement expense.

Factors in the measurement of Depreciation

As already mentioned, depreciation is not an attempt to record changes in the market value of an asset, but a systematic allocation of the total cost of the depreciable asset (capital investment) to the expense (income and expenditure) over the useful life of the asset. The value of some assets can increase in the short term, but the depreciation process continues. Based on the principle of matching, a reasonable portion of capital expenditure (that is, the cost of an asset) should be charged to revenue during the useful life of the asset.

Depreciation-

The calculation of depreciation expense for the accounting period is affected as follows:

It is worth mentioning here that of the three factors, two are based on mere estimation and only one is actually based. Therefore, the depreciation calculation is an estimated loss on the value of the asset, not the actual exact reduction in the value of the asset.

The following is a detailed description of each of the above elements.

1. Actual cost of the asset:

The actual cost or acquisition cost means the acquisition cost of the asset and includes all incidental costs required to return the asset to its current state and location. As of such costs are installation costs, internal transportation, or capital-based costs incurred to improve such assets.

2. Estimated useful life of the asset:

The estimated useful life of an asset is one of the following:

3. Estimated residual value or scrap value of the asset:

The salvage value or scrap value is the expected value that may be realized when an asset is sold or exchanged at the end of its estimated useful life. If residual value is important, it should be considered in the depreciation calculation. However, insignificant residual value can be ignored in the depreciation calculation.

Depreciation is an ongoing process, but we do not record depreciation daily. In fact, the total depreciation expense charged on an asset is the prepaid expense paid by the entity at the time of acquisition of the asset.

In other words, this expense should be treated like a deferred expense, and only adjustment entries should be passed each year to claim reasonable and appropriate depreciation for income statement revenue.

Here are some other factors that influence the measurement of depreciation:

Methods of computing depreciation: Straight line method and Diminishing Balance Method; Disposal of Depreciable assets – change of method.

Straight line method

What is the straight-line method?

The straight-line method is the default method used to evenly recognize the carrying amount of fixed assets over their useful lives. This is used when there is no particular pattern in how an asset is used over time. The straight-line method is the easiest depreciation method to calculate and is highly recommended for use as it causes few calculation errors. The procedure for flat-rate calculation is as follows.

Formula:

Depreciation = (Asset Cost – Net Residual Value) / Service Life

Depreciation rate = (annual depreciation cost x 100) / cost of capital

Straight-line Journal Entries:

1. Purchase of Assets A / c Dr. xx

To cash / bank / creditor A / c xx

(Purchasing assets)

2. Depreciation of assets A / c Dr. xx

To asset A /c xx

(Assets are subject to depreciation)

3. Transfer depreciation gains / losses A / c Dr. xx

To depreciation of asset A / c xx

(Asset depreciation is transferred to the profit and loss account)

Q18. Pensive Corporation will purchase a Procrastinator Deluxe machine for $ 60,000. It has an estimated salvage value of $ 10,000 and a useful life of 5 years. Pensive calculates the machine's annual flat-rate depreciation as follows:

A18:

$ 60,000 Purchase Cost – $ 10,000 Estimated Residual Value = $ 50,000 Depreciable Asset Cost

1/5-year useful life = 20% annual depreciation rate

20% depreciation rate x $ 50,000 depreciation asset cost = $ 10,000 annual depreciation

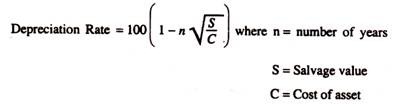

Diminishing Balance Method

The various depreciation methods are based on mathematical formulas. This formula is derived from a study of asset behaviour over a period of time. One such depreciation method is the depreciation method. Learn more about this method.

According to the depreciation method, depreciation is charged at a fixed percentage of the book value of the asset. It is also known as depreciation or depreciation because its book value decreases each year.

Since the book value decreases every year, the depreciation amount also decreases every year. This way, the value of the asset never goes to zero.

If you plot the depreciation amount billed this way and the corresponding period on the graph, the line will move down.

This method was previously based on the assumption that the cost of repairing an asset is low and therefore more depreciation costs must be charged. In addition, depreciation costs will decrease as repair costs increase in later years. Therefore, this method puts an equal burden on profits each year for the life of the asset.

However, this method may not provide full depreciation at the end of the asset's useful life if the applicable depreciation rate is not appropriate.

In addition, when applying this method, it is necessary to consider the period of use of the asset. If the asset is used for only two months in a year, depreciation will only be charged for two months.

However, if the asset is used for more than 180 days for income tax purposes, you will be charged full-year depreciation. Income tax rules also allow you to depreciate using the depreciation method.

The formula is:

Amount of depreciation= Book Value x Rate of Depreciation

100

Disposal of Depreciable assets – change of method

Accounting policies and principles need to be applied consistently when recording financial transactions. This is the principle of consistency.

At the end of each fiscal year, management should consider depreciation methods. If there are significant changes in the pattern of future economic returns from the asset, the depreciation method will also need to change.

Accounting Standard 1-According to the disclosure of accounting policies, changes in depreciation methods are changes in accounting estimates. Therefore, footnote quantification and full disclosure are required. You also need to disclose the legitimacy of the change and its economic impact.

Therefore, the depreciation method can be changed without or with a retroactive effect. The lack of retroactive impact means that no adjustments have been made to past entries and only future depreciation will be billed in the new way. While having a retroactive effect, it means that the depreciation amount charged will be adjusted from the date of purchase of the asset.

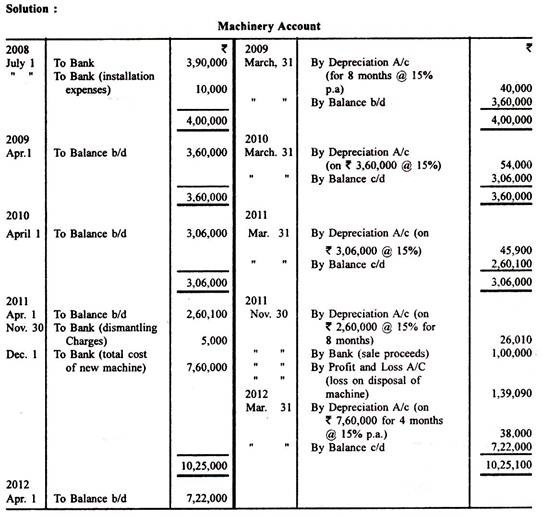

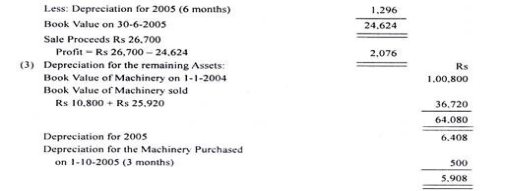

Q19. On July 1, 2008, a company bought a machine for Rs 3,90,000 and spent Rs 10,000 on its installation. We have decided to provide depreciation at 15% per year using the write-down method. On November 30, 2011, the machine was dismantled at a cost of 5,000 rupees and then sold for 1,00,000 rupees.

On December 1, 2011, the company acquired a new machine and put it into operation at a total cost of Rs 7,60,000. The new machine was depreciated on the same basis as the previous machine. The company closes its books on March 31st each year.

A19

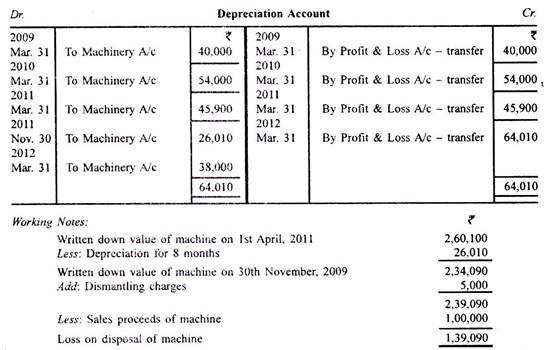

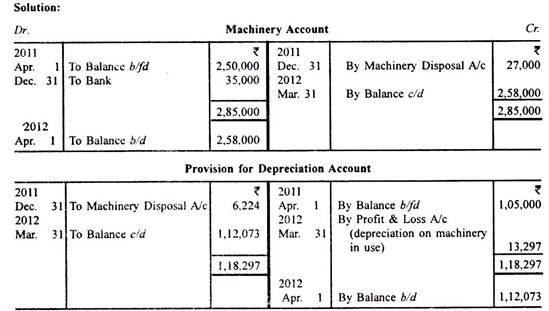

Q20. The cost of the machine used by the company on April 1, 2011 was Rs 250,000, while the depreciation cost for that day was Rs 1,05,000. The company provided depreciation at 10% of the reduced value.

Two machines purchased on December 31, 2011 and October 1, 2008, Rs. 15,000 and Rs. 12,000, respectively, were discarded due to damage and replaced with two new machines, Rs. 20,000 and Rs. 15,000, respectively. I had to.

One of the discarded machines sold for Rs 8,000. On the other hand, the Rs 3,000 was expected to be feasible.

Shows the accounts related to the company's ledger for the year ended March 31, 2012.

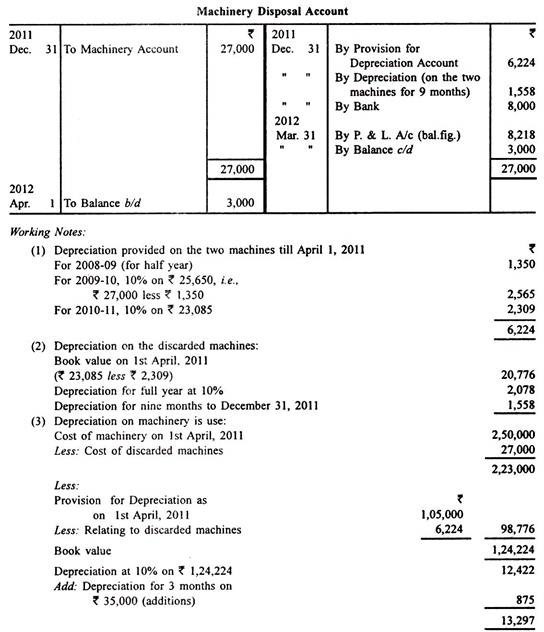

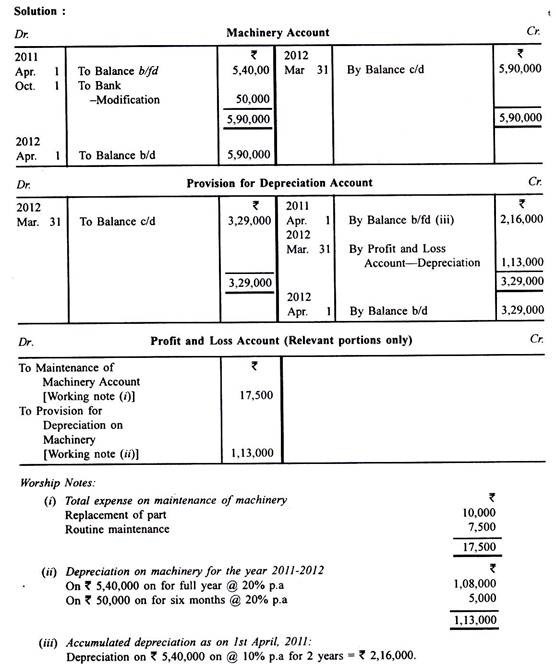

Q21. Metropol Ltd. purchased the machine on April 1, 2009 for Rs 5,40,000. Depreciation is billed at an annual rate of 20% on a straight-line basis.

On October 1, 2011, a change was made to improve technical efficiency at a cost of 50,000 rupees, which was expected to extend the useful life of the machine by two years. At the same time, important components of the machine were replaced at a cost of 10,000 rupees due to excessive wear.

The cost of regular maintenance during the fiscal year ending March 31, 2012 is Rs 7,500.

Shows for the year ending March 31, 2012:

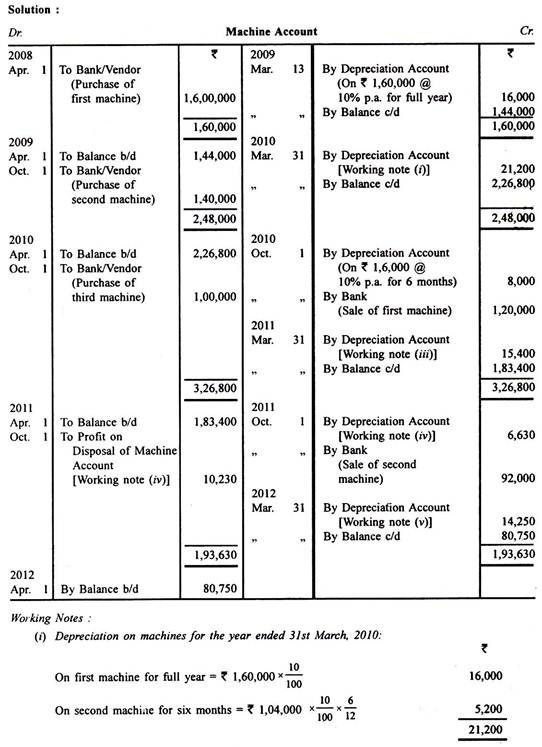

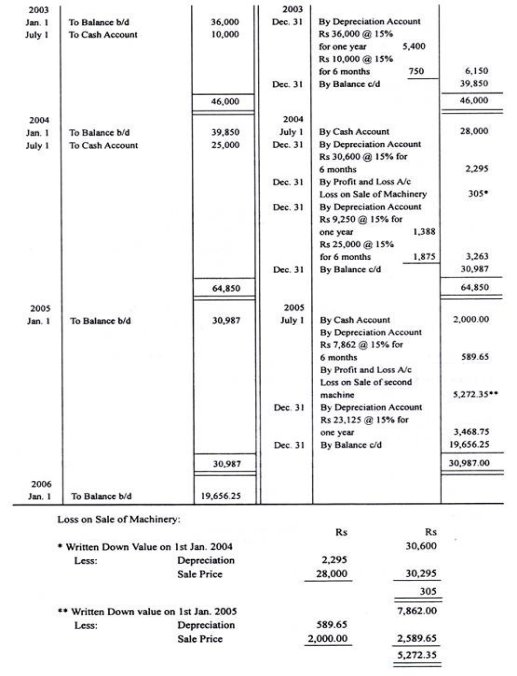

Q22. X Co. Ltd. purchased the machine on April 1, 2008 for Rs 1,60,000. On October 1, 2009, another machine was acquired. for Rs 1,40,000. On October 1, 2010, the first machine sold for Rs 1,20,000. On the same day, another machine was purchased for Rs 1,00,000. On October 1, 2011, the second machine sold for Rs 92,000.

The depreciation rate on March 31 was 10% of the original cost. On March 31, 2011, the depreciation billing method was changed to the depreciation method, with a rate of 15%.

Prepare machine accounts for the years ending March 31, 2009, 2010, 2011, and 2012.

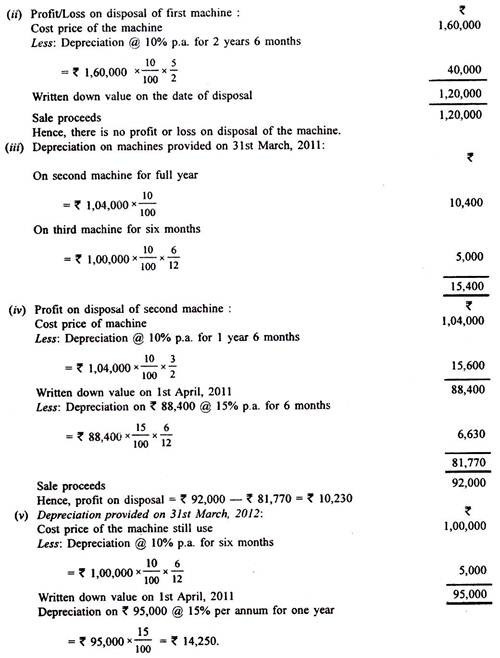

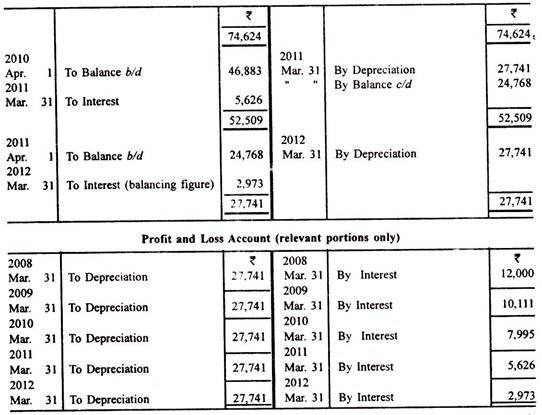

Q23. The lease will be purchased on April 1, 2007 for 5 years at a cost of Rs 1,00,000. It is proposed to depreciate the lease by the pension law, which charges 12% interest. Shows the 5-year lease account and related entries in the P & L account.

A23 :

A reference to the pension table indicates that Re will be depreciated. Under the 15-year pension law, you must claim 12% interest and amortize the total of Re. 0.277410. To amortize Rs 1,00,000, you need to amortize Rs 1,00,000 x 0.277410, or Rs 27,741 each year.

From the A above, you can see that the amount depreciated as depreciation is higher than in the straight-line or instalment payments, but because of the interest, it does not ultimately affect the income statement. Assets that are debited are credited to the income statement. Therefore, the pension law only pays attention to the amount of money spent on the use of assets: lost costs and interest.

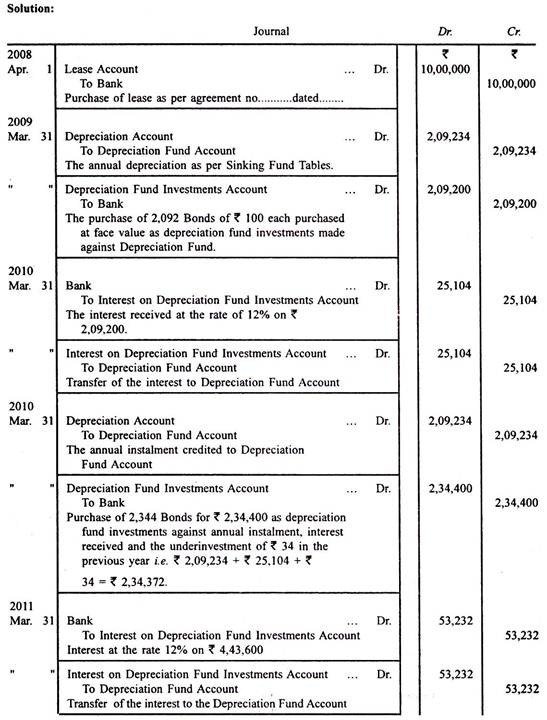

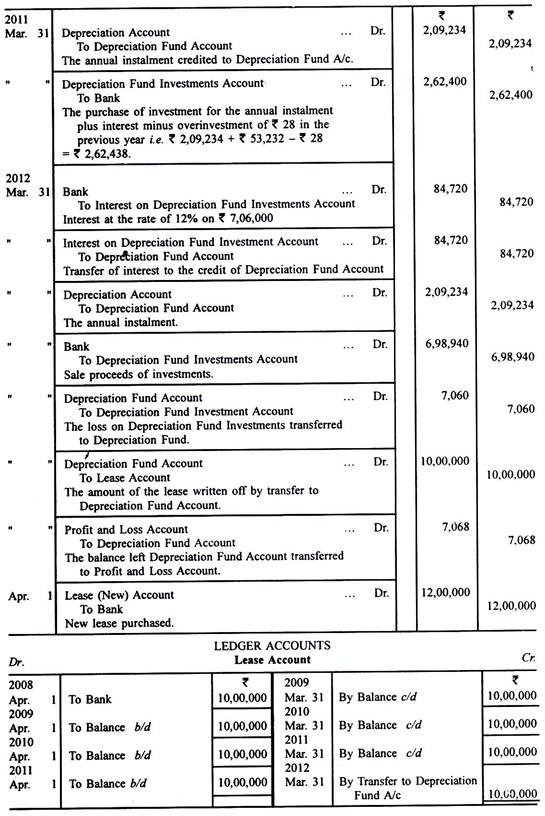

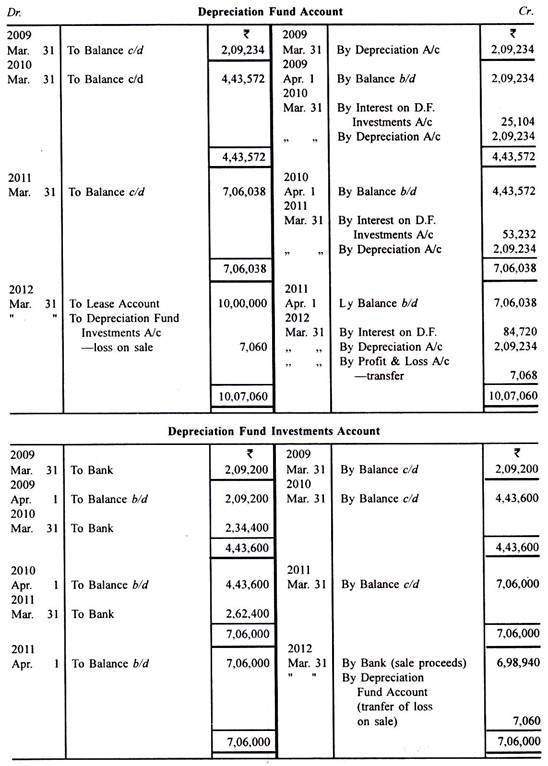

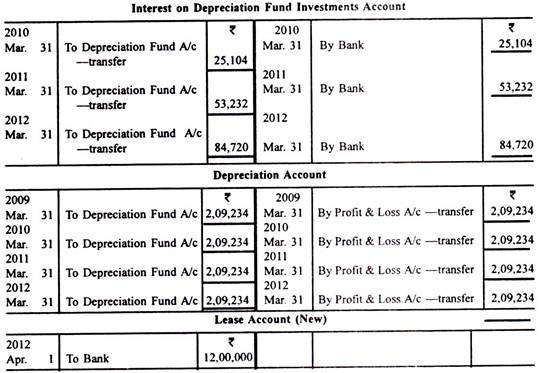

Q24. A company purchased a four-year lease for Rs 10,00,000 on April 1, 2008. By establishing a depreciation fund, it has been decided to offer a lease exchange at the end of four years. The investment is expected to be of interest at 12%. The table of the sinking fund is Re. Investing 0.209234 each year will generate Re. 12% per year at the end of 4 years 1. The investment was made in a 12% bond of Rs 100 available at par. Interest was received on March 31st of each year.

On March 31, 2012, the investment was sold for Rs 6,98,940. On April 1, 2012, the same lease was renewed for another four years with a payment of Rs 12,00,000.

View journals and specify important ledger accounts to record the above.

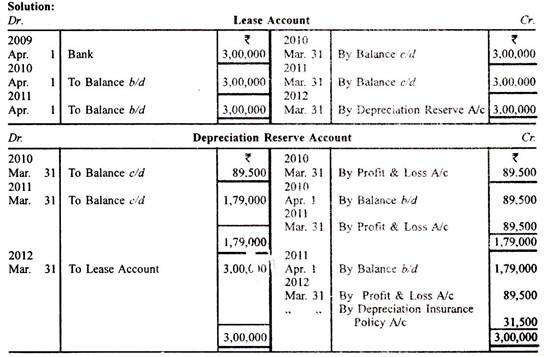

Q25. A company bought a three-year lease on April 1 for Rs 3,000,000. In 2009, we decided to offer a replacement under an insurance policy of Rs 3,000,000. The annual premium is 89,500 rupees.

On April 1, 2012, the lease will be renewed for another 3 years at Rs 330,000. Display the required ledger accounts.

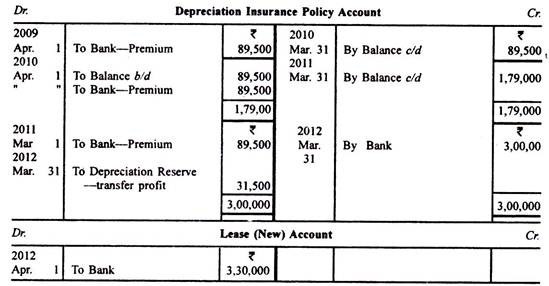

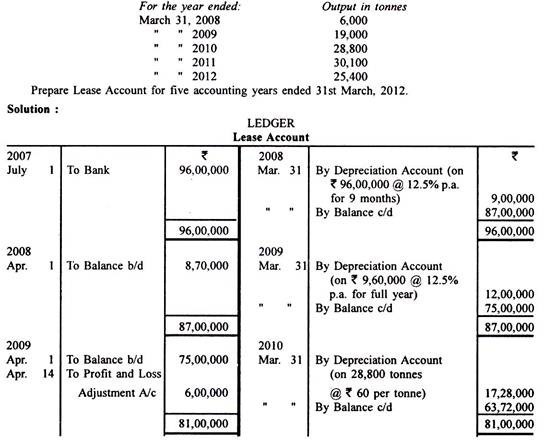

Q26. Experts estimated that the mine contained a total of 160,000 tonnes of minerals. On July 1, 2007, P leased the mine for eight years and paid the owner Rs 96,00,000 with the above estimate in mind.

P has decided to offer depreciation at an annual rate of 12.5% on a straight-line basis. However, in April 2009, we decided to switch to the depreciation method because we thought it would be more appropriate. He passed the required adjustment entry on April 14, 2009.

The output for the first five fiscal years of the lease is as follows:

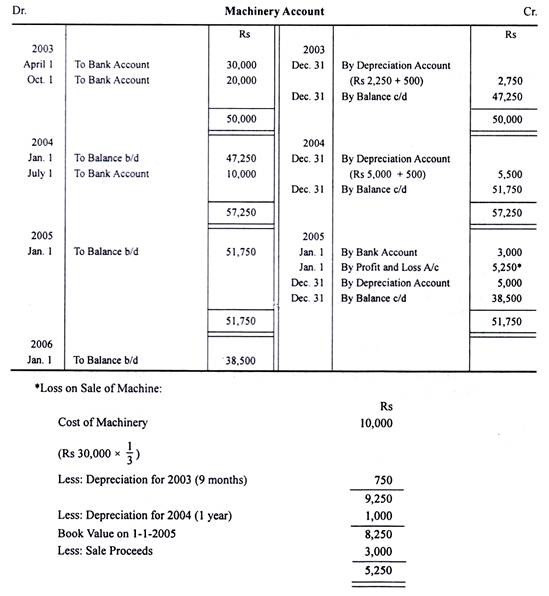

Q27. Companies whose financial year purchased on April 1, 2003 may be a civil year. the worth of the machine is 30,000 rupees.

I bought another machine for 20,000 rupees on October 1, 2003 and 10,000 rupees on Dominion Day, 2004.

One-third of the machines installed on January 1, 2005 and April 1, 2003 were abolished and sold for Rs 3,000.

Shows how machine accounts appear within the company's books. The machine may be a fixed instalment method @ 10% p.a. Depreciated by.

A27:

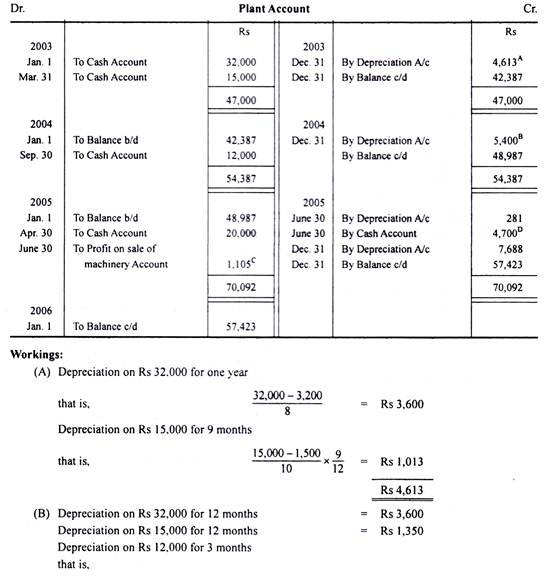

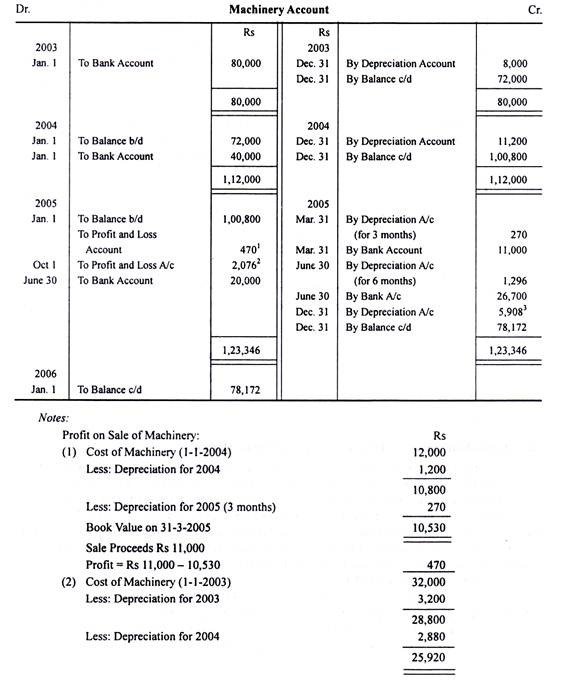

Q28. The 32,000-rupee plant purchased on January 1, 2003 has an estimated lifespan of 8 years.

Further purchases of plants are:

1. As of March 31, 2003, the value of the plant is 15,000 rupees and therefore the estimated life is 10 years.

2. On September 30, 2004, the factory cost is 12,000 rupees and therefore the estimated life is 6 years.

3. On April 30, 2005, the factory cost is 20,000 rupees and therefore the estimated life is 8 years.

Of the first plant acquired on January 1, 2003, one machine of Rs 5,000 was sold for Rs 4,700 on June 30, 2005.

The residual value of every asset is 10% of the first cost.

Prepare a plant account for the primary three years.

A28:

Q29. The balance of the plant and machinery accounts on New Year's Eve , 2003 was Rs 19,515 after depreciation for the year. (The total cost of the plant was 35,800 rupees and eight ,900 rupees including the plant purchased in 1995.)

In January 2004, a substitute factory was purchased at a price of Rs 2,950, and in 1980 a machine costing Rs 550 was sold as scrap of Rs 35.

In January 2005, there was an addition of 1,800 rupees, and in 2001 a 700-rupee machine was sold for 350 rupees.

You need to make machine accounts for 2004 and 2005. All calculations are displayed.

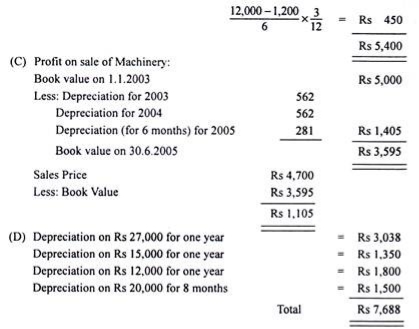

On January 1, 2003, the machine was purchased for Rs 80,000. On January 1, 2004, a machine of 40,000 rupees was added. On March 31, 2005, a machine of Rs 12,000 purchased on January 1, 2004 was sold for Rs 11,000 and 32,000 purchased on June 30, 2005 on January 1, 2003. The rupee machine was sold for 26,700 rupees. On October 1, 2005, an amount of Rs 20,000 was added. Depreciation was provided at an annual rate of 10%. About the reduction balance method.

Shows machine accounts for the three years from 2003 to New Year's Eve, 2005.

A29 :

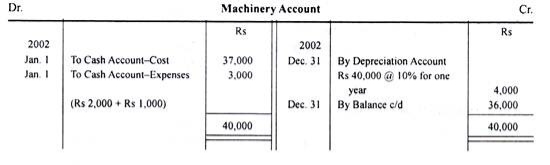

Q30. A company bought a second hand machine for Rs 37,000 on January 1, 2002 and immediately spent Rs 2,000 for repairs and Rs 1,000 for construction. I bought another machine for Rs 10.000 on Dominion Day, 2003 and sold the primary machine I bought in 2002 on Dominion Day, 2004 for Rs 28,000. On an equivalent day, I bought the machine for 25,000 rupees. The second machine, which was purchased for 10,000 rupees, was also sold for 2,000 rupees on Dominion Day, 2005.

Depreciation was provided to the machine on December 31st annually at a rate of 10% of the first cost. However, in 2003, we changed the depreciation method and adopted a depreciation method with a rate of depreciation of 15%.

We will offer you a machine account for 4 years from January 1, 2002.

Key takeaways:

References:

4. https://www.accountingnotes.net/cost-accounting/depreciation-cost-accounting/depreciation-concept-definition-and-causes/8099

5. https://www.dummies.com/business/accounting/straight-line-depreciation-practice-questions/

6. https://www.freshbooks.com/hub/accounting/straight-line-depreciation

7. https://www.investopedia.com/terms/i/inventory-management.asp

8. https://www.caclub.in/list-of-accounting-standards-of-icai-as/