UNIT III

Branch accounts and Departmental accounts

Meaning of Hire Purchase System

If you purchase a TV for cash, you pay, say, Rs. 15,000. But if you wish to make the payment by instalments of say, Rs. 3,000 each, every year, you may be required to pay four instalments, that is Rs. 20,000 in all. The extra amount of Rs. 3,000 is for interest. If you choose the latter mode of the payment, you should debit Rs. 5,000 to interest and treat the TV as valued at Rs. 15,000 (and not at Rs. 20,000). In case payment is to be made by instalments, there may be two kinds of arrangements. Each instalment may be treated as a ‘hire’ the purchaser becoming the owner only if he pays all the instalments. In other words, property does not pass to him even if one instalment remains unpaid. The seller will have the right to take away the goods in case of default in respect of any instalment. This is known as ‘Hire Purchase’ system.

The other arrangement may be that property passes immediately on the signing of the contract. The seller will not have the right to repossess the goods in case an instalment is not paid. His right will be to sue the purchaser for the money due. This is known as the Instalment System.

Interest

Interest: In either case (hire purchase or instalment) interest must be separated from the principal sum due. Since payments continue over two or more financial year’s interest must be calculated for each year separately. Usually information is available regarding cash price and the rate of interest. Calculation of interest then becomes easy. Just prepare the account of one of the parties on ordinary lines and charge interest on the balance due. Suppose on 1st January, 2000 A purchases from B machinery whose cash price is Rs. 15,000; Rs. 5,000 is to be paid down, that is on signing of the contract, and Rs.4,000 is to be paid at the end of each year for 3 years. Rate of interest is 10% p.a. If we prepare B’s account (on a memorandum basis) in A’s books, we shall know the interest for each year.

A’s Books

Dr. |

|

| B’s Account |

| Cr. |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Cash | 5,000 | Jan.1 | By Machinery A/c | 15,000 |

Dec.31 | To Cash | 4,000 | Dec.31 | By Interest A/c | 1,000 |

’’ | To balance c/d | 7,000 |

| (10% on Rs. 10,000) |

|

|

| 16,000 |

|

| 16,000 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 7,000 |

| To Balance c/d | 3,700 | Dec.31 | By Interest A/c |

|

|

|

|

| (10% on Rs. 7,000) | 700 |

|

| 7,700 |

|

| 7,700 |

2002 |

|

| 2002 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 3,700 |

|

|

| Dec.31 | By Interest A/c* | 300 |

|

| 4,000 |

|

| 4,000 |

* As it is the last year of installment, interest amount will be the difference between the Outstanding balance and the actual amount of installment. [Students should note that if you calculate interest for the last year as per the given percentage on the O/S amount (3700 x 10%=370), total amount payable becomes (3700+370=4070) which is greater than the installment paid. So there will be again Rs. 70 payable even after the last installment being paid.]

If the rate of interest is not given, the interest for each year will be in proportion to amount outstanding in each year. In the example given above, the total sum payable is Rs. 17,000 out of which Rs. 5,000 is paid immediately. This leaves Rs. 12,000 as outstanding throughout the first year at the end of which Rs. 4,000 is paid. In the second year Rs. 8,000 is outstanding and in the third year Rs. 4,000 is due. The total interest is Rs. 2,000. i.e., Rs. 17,000. minus Rs. 15,000. The interest should be apportioned over the 3 years in the ratio of amounts outstanding, that Rs. 12,000; Rs. 8,000 and Rs. 4,000 or in the ratio of 3 : 2 :1. The interest for the first year is Rs.1,000 : for the second year it is Rs.670 and for the third year it is Rs.333. Note that the amount cannot be the same as worked out when the rate of interest is given.

To ascertain Cash Price, rate of interest and instalments being given. Sometimes the cash price is not given. Since the asset cannot be debited with more than the cash price, it must be ascertained. The process is to take the last year first and separate interest from principal out of the total sum due. In the example given above, Rs. 4,000 is due at the end of 2002. The rate of interest is 10%. If in the beginning of 2001 Rs.100 was due, Rs.10 would be added making Rs.110 as due at the end of 2002. Thus, out of the sum due at the end of the year, one-eleventh is interest; rest is principal. We can proceed year by year like this.

Thus: —

| Rs. |

Amount due on 31-12-2001 | 4,000 |

Interest @ 1/11 | 364 |

Amount due on 1-1-2002 or 31-12-2001 | 3,636 |

Paid on 31-12-2001 | 4,000 |

Total amount due on 31-12-2001 | 7,636 |

Interest @ 1/11 | 694 |

Amount due on 1-1-96 or 31-12-2000 | 6,942 |

Paid on 31-12-2000 | 4,000 |

Total amount due on 31-12-2000 | 10,942 |

Interest @ 1/11 | 995 |

Amount due on 1-1-2000 | 9,947 |

Paid Cash down on 1-1-2000 | 5,000 |

Cash Price | 14,947 |

The interest for three years is Rs.995, Rs.694 and Rs.364 respectively. | |

Entries in Book: Actual Cash Price Paid Method

This method follows a technical approach and does not treat the hire purchaser as owner until he makes the payment of last instalment. Under this method, the asset is recorded at the cash price actually paid.

* In the last year, the interest is equal to the difference between the amount due and the opening balance. It is not calculated in the usual way.

Journal Entries Under Actual Cash Price Paid Method

The various accounting entries in the books of the hire purchaser and hire vendor are shown below-

Journal Entries Under Actual Cash Price Paid Method

| Case | In the Books of Hire Purchaser |

| In the Books of Hire Vendor | Amount with which debited or credited | |

| ||||||

A. | On making down payment due | Asset A/c To Hire Vendor’s A/c | Dr. | Hire Purchaser’s A/c Dr. To Hire Purchase Sales A/c |

| (With the amount of down payment) |

B. | On making Down Payment | Hire Vendor’s A/c To Bank A/c | Dr. | Bank A/c To Hire Purchaser’s A/c | Dr. | (With the amount of down payment) |

C. | On making principal part of the instalment due | Asset A/c To Hire Vendor’s A/c | Dr. | Hire Purchaser’s A/c To Hire Purchase Sales A/c | Dr. | (With the amount of principal part of the instalment) |

D. | On making interest due on unpaid balance | Interest A/c To Hire Vendor’s A/c | Dr. | Hire Purchaser’s A/c To Interest A/c | Dr. | (With the interest due on unpaid balance) |

E. | On making payment of instalment | To Hire Vendor’s A/c To Bank A/c | Dr. | Bank A/c To Hire Purchaser’s A/c | Dr. | (With the amount of instalment) |

F. | On providing Depreciation | Depreciation A/c To Asset A/c | Dr. | No Entry |

| (With the amount of (depreciation) |

G. | On closure of Depreciation A/c | Profit & Loss A/c To Depreciation A/c | Dr. | No entry |

| (With the amount of depreciation) |

H. | On closure of Interest A/c | Profit & Loss A/c To Interest A/c | Dr. | Interest A/c To Profit & Loss A/c | Dr. | (With the amount of interests) |

Note: Depreciation is charged on full cash price of the asset and Interest is calculated on total outstanding balance.

Disclosure in Balance Sheet Under Actual Cash Price Paid Method

At the end each accounting period, the relevant accounts appear in the Balance Sheet as shown below:

Disclosure In Balance Sheet Under Actual Cash Price Paid Method

Balance Sheet of Hire Purchaser |

| Balance Sheet of Hire Vendor | |||

Liabilities | Rs. Assets | Rs. | Liabilities | Rs. Assets | Rs. |

| Fixed Assets : |

|

|

| |

| Asset (at actual cash) |

|

| No disclosure is | |

| price paid) | xxx |

| required |

|

| Less : Depreciation till date | xxx |

|

|

|

|

| xxx |

|

|

|

|

|

|

|

|

|

Hire Purchase: Books of the Vendor

Books of the Vendor: The vendor follows no special method for recording sales on hire purchase, especially in case of sale of large items. He debits the purchaser with the cash price and credits him with the amount received. Every year the interest due is debited. We illustrate this below.

Illustration-1

Based on particulars given below calculate Interest under the hire purchase system

cash price—Rs. 74,500.

Installments Rs. 20,000 on signing of the agreement. Rest in three instalments of Rs. 20,000 each. Rate of Interest—5%. Depreciation 10% on the diminishing Balance.

2. All particulars as above except that the rate of interest is not given.

3. All particulars as in (1.) above except that the cash price is not given.

Solution :

| ||

|

| Rs. |

Jan.1, 1999 | Cash Price | 74,500 |

| Less-Cash down | 20,000 |

| Balance Due | 54,500 |

| Interest @ 5% for 1999 | 2,725 |

Dec.31, 1999 | Total | 57,225 |

| Amount paid | 20,000 |

Jan.1, 2000 | Balance Due | 37,225 |

| Interest for 2000 @ 5% | 1,861 |

Dec.31, 2000 | Total | 39,086 |

| Amount paid | 20,000 |

Jan.1,2001 | Balance due 2001 | 19,086 |

| Interest for (balancing figure) 2001 | 914 |

Jan.1,2002 | Amount paid | 20,000 |

2. Calculation of interest when the rate of interest is not given :

Hire Purchase Price | 80,000 | ||||

Cash Price | 74,500 | ||||

Total interest | 5,500 | ||||

|

|

|

|

|

|

Year | Amount Outstanding | Ratio | Interest | Rs. | |

1 | 60,000 |

| 3 | 3/6 x 5,500 | 2,750 |

2 | 40,000 |

| 2 | 2/6 x 5,500 | 1,833 |

3 | 20,000 |

| 1 | 1/6 x 5,500 | 917 |

3. Calculation of cash price, rate of interest being given:

Instalment | Amount due at the end of the year (after payment of Installment) | Instalment paid | Total amount due at the end of the Year (before payment of instalment) | Interest @ 1/21 | Principal due in the beginning | |

| Rs. | Rs. |

| Rs. | Rs. | Rs. |

3 | Nil | 20,000 |

| 20,000 | 952 | 19,408 |

2 | 19,048 | 20,000 |

| 39,048 | 1,859 | 37,189 |

1 | 37,189 | 20,000 |

| 57,189 | 2,723 | 54,466 |

|

|

|

|

| 5,534 |

|

Cash Price: 54,466 + cash down, Rs. 20,000 or Rs. 74,466.

Illustration-2

Y & Co. sold machinery whose cash price is Rs. 74,500. to X and Co., on hire purchase basis on 1st January, 2000. Payment was to be made as Rs. 20,000 down and Rs. 20,000 every year for three years. Rate of interest was 5% & Co. charged depreciation @ 10% p.a. on the diminishing balance. Give ledger accounts in the books of Y & Co.

Ledger of Y & Co. | |||||

Dr. |

|

| X & Co. |

| Cr. |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Sales | 74,500 | Jan.1 | By Cash | 20,000 |

Dec.31 | To Interest A/c |

| Dec.31 | By Cash | 20,000 |

| (5% on Rs. 54,500) | 2,725 |

| By Balance c/d | 37,225 |

|

| 77,225 |

|

| 77,225 |

2001 |

|

| 2001 |

|

|

Jan.1 | To Balance b/d | 37,225 | Dec.31 | By Cash | 20,000 |

Dec.31 | To Interest A/c | 1,861 |

| By Balance c/d | 19,086 |

|

| 39,086 |

|

| 39,086 |

2002 |

|

| 2002 |

|

|

Jan.1 | To Balance b/d | 19,086 | Dec.31 | By Cash | 20,000 |

Dec.31 | To Interest A/c | 914 |

|

|

|

|

| 20,000 |

|

| 20,000 |

Dr. | Sales Account | Cr. | ||

|

| 2000 |

|

|

|

| Jan. 1 | By X & Co. | Rs. 15,000. |

Interest Account | ||||

Dr. |

|

|

| Cr. |

2000 |

| 2000 |

|

|

Dec.31 to P & L A/c | 2,725 | Dec.31 | By X & Co. | 2,725 |

2001 |

| 2001 |

|

|

Dec.31 to P & L A/c | 1,861 | Dec.31 | By X & Co. | 1,861 |

2002 |

| 2002 |

|

|

Dec.31 to P & L A/c | 914 | Dec.31 | By X & Co. | 914 |

Hire Purchase: Books of Purchaser

Books of Purchaser—First Method. The purchaser can also follow the system adopted by the vendor and make entries like ordinary purchase of an asset. Only, he should credit the vendor with interest due every year and debit him with cash as and when paid. The above given example can be worked out in the following way (ledger accounts.) :—

Dr. |

| Machinery account |

| Cr. | |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Y & Co. | 74,500 | Dec.31 | By Depreciation A/c | 7,450 |

|

|

|

| By Balance c/d | 67,050 |

|

| 74,500 |

|

| 74,500 |

2001 |

|

| 2001 |

|

|

Jan.1 | To Balance b/d | 67,050 | Dec.31 | By Depreciation A/c | 6,705 |

|

|

|

| By Balance c/d | 60,345 |

|

| 67,050 |

|

| 67,050 |

2002 |

|

| 2002 |

|

|

Jan.1 | To Balance b/d | 60,345 | Dec.31 | By Depreciation A/c | 6,035 |

|

|

|

| By Balance c/d | 54,310 |

|

| 60,345 |

|

| 60,345 |

2003 |

|

|

|

|

|

Jan.1 | To Balance b/d | 54,310 |

|

|

|

Y & Co. A/c | |||||

2000 |

| Rs. |

2000 |

| Rs. |

Jan.31 | To bank A/c | 20,000 | Jan.1 | By Machinery A/c | 74,500 |

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Interest A/c | 2,725 |

’’ | To Balance c/d | 37,225 |

|

|

|

|

| 77,225 |

|

| 77,225 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Bank A/c | 20,000 | Jan.1 | By Balance b/d | 37,225 |

’’ | To balance c/d | 19,086 | Dec.31 | By Interest A/c | 1,861 |

|

| 39,086 |

|

| 39,086 |

2002 Dec.31 |

To Bank A/c |

20,000 | 2002 Jan.1 |

By Balance b/d |

19,086 |

|

|

| Dec.31 | By Interest A/c | 914 |

|

| 20,000 |

|

| 20,000 |

The student should prepare accounts relating to Interest and Depreciation.

Second Method. Under the second method, entries are passed only when payment is due or made. At this time, the vendor is credited with the amount due. Interest for the period is debited to interest Account and the balance (principal) is debited to the Asset Account. On payment, of course, the vendor is debited and Cash (or Bank) credited. The two entries are:

Depreciation has to be charged according to the cash price of the asset

We give below the journal entries and ledger accounts in the books of X & Co., the purchaser, in the example given above.

Journal of X & Co.

|

|

| Debit (Rs) | Credit (Rs) |

2000 |

|

|

|

|

Jan.1 | Machinery Account | Dr. | 20,000 | |

| To Y & Co. |

| 20,000 | |

| (Amount due to Y & Co. as down payment for purchase of machinery on hire purchase basis.) |

|

| |

|

|

|

| |

Jan.1 | Y & Co. | Dr. | 20,000 | |

| To Bank Account |

| 20,000 | |

| (Payment made to Y & Co. down) |

|

| |

|

|

|

| |

Dec.31 | Machinery Account | Dr. | 17,275 | |

| Interest Account | Dr. | 2,725 | |

| To Y & Co. |

| 20,000 | |

| (The amount due to Y & Co. under the hire purchase Contract for interest (and debited as such) and the balance treated as payment for machinery) |

|

| |

| ||||

Dec.31 | Y & Co. | Dr. | 20,000 | |

| To Bank A/c |

| 20,000 | |

| (Payment made to Y & Co.) |

|

| |

|

|

|

| |

Dec.31 | Depreciation Account | Dr. | 7,450 | |

| To Machinery Account |

| 7,450 | |

| (Depreciation for 1st year-10% on Rs.74,500) |

|

| |

|

|

|

| |

Dec 31 | Profit & Loss Account | Dr. | 10,175 | |

| To Interest Account |

| 2,725 | |

| To Depreciation Account |

| 7,450 | |

| (Being interest and depreciation transferred to P/L A/c) |

|

| |

2001 | ||||

Dec.31 | Machinery Account | Dr. | 18,139 | |

| Interest Account | Dr. | 1,861 | |

| To Y & Co. |

| 20,000 | |

| (Amount due to Y & Co. for interest the balance charged to Machinery A/c.) |

|

| |

| ||||

Dec.31 | Y & Co. | Dr. | 20,000 | |

| To Bank Account |

| 20,000 | |

| (Payment made to Y & Co.) |

|

| |

|

|

|

| |

Dec. 31 | Depreciation | Dr. | 6,705 | |

| To Machinery Account |

| 6,705 | |

| (Depreciation for the second year 10% on Rs. 67,050; i.e. Rs. 74,500 - Rs. 7,450). |

|

| |

|

|

|

| |

Dec 31 | Profit & Loss Account | Dr. | 8,566 | |

| To Interest Account |

| 1,861 | |

| To Depreciation Account |

| 6,705 | |

| (Being interest and depreciation transferred to P/L A/c) |

|

| |

2002 | ||||

Dec.31 | Machinery Account | Dr. | 19,086 | |

| Interest Account | Dr. | 914 | |

| To Y & Co. |

| 20,000 | |

| (Amount due to Y & Co. in respect of interest and the principal sum.) |

|

| |

| ||||

Dec.31 | Y & Co. | Dr. | 20,000 | |

| To Bank Account |

| 20,000 | |

| (Payment made to Y & Co.) |

|

| |

|

|

|

| |

Dec.31 | Depreciation Account | Dr. | 6,035 | |

| To Machinery Account |

| 6,035 | |

| (Depreciation @ 10% of the diminishing balance charged for the third years). |

|

| |

|

|

|

| |

Dec 31 | Profit & Loss Account | Dr. | 6,949 | |

| To Interest Account |

| 914 | |

| To Depreciation Account |

| 6,035 | |

| (Being interest and depreciation transferred to P/L A/c) |

|

| |

Ledger Accounts | |||||

Dr. |

| Machinery Account |

| Cr. | |

2000 |

| Rs. | 2000 |

| Rs. |

Jan.1 | To Y & Co. | 20,000 | Dec.31 | By Depreciation | 7,450 |

Dec.31 | To Y & Co. |

| Dec.31 | By Balance c/d | 29,825 |

| (20,000—2,725) | 17,275 |

|

|

|

|

| 37,275 |

|

| 37,275 |

2001 |

|

| 2001 |

|

|

Jan.1 | To balance b/d | 29,825 | Dec.31 | By Depreciation A/c | 6,705 |

Dec.31 | To Y & Co. |

| Dec.31 | By Balance c/d | 41,259 |

| (20,000—1,861) | 18,139 |

|

|

|

|

| 47,964 |

|

| 47,964 |

2002 |

|

| 2002 |

|

|

Jan.1 | To Balance b/d | 41,259 | Dec.31 | By Depreciation A/c | 6,035 |

Dec.31 | To Y & Co. | 19,086 | Dec.31 | By Balance c/d | 54,310 |

|

| 60,345 |

|

| 60,345 |

2003 |

|

|

|

|

|

Jan.1 | To Balance b/d | 54,310 |

|

|

|

Dr. |

| Interest Account | Cr. | ||

2000 |

| Rs. | 2000 |

| Rs. |

Dec.31 | To Y & Co. | 2,725 | Dec.31 | By P & L A/c | 2,725 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Y & Co. | 1,861 | Dec.31 | By P & L A/c | 1,861 |

2002 |

|

| 2002 |

|

|

Dec.31 | To Y & Co. | 914 | Dec.31 | By P & L A/c | 914 |

Dr. |

|

| Y & Co. |

|

| Cr. |

2000 |

| Rs. |

| 2000 |

| Rs. |

Jan.1 | To Bank A/c | 20,000 | Jan.1 | By Machinery A/c | 20,000 | |

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Sundries— |

|

|

|

|

|

| Machinery | 17,275 |

|

|

|

|

| Interest | 2,725 | 20,000 |

|

| 40,000 |

|

| 40,000 | |

2001 |

|

| 2001 |

|

|

|

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Machinery A/c | 18,139 | |

|

|

|

| By Interest A/c | 1,861 | |

|

| 20,000 |

|

| 20,000 | |

2002 |

|

| 2002 |

|

| |

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Machinery A/c | 19,086 | |

|

|

|

| By Interest A/c | 914 | |

|

| 20,000 |

|

| 20,000 | |

Depreciation Account

2000 |

| Rs. | 2000 |

| Rs. |

Dec.31 | To Machinery A/c | 7,450 | Dec.31 | By P & L A/c | 7,450 |

2001 |

| 2001 |

|

| |

Dec.31 | To machinery A/c | 6,705 | Dec.31 | By P & L A/c | 6,705 |

2002 |

| 2002 |

|

| |

Dec.31 | To Machinery A/c | 6,035 | Dec.31 | By P & L A/c | 6,035 |

Summary

Hire Purchase: Property does not pass to him even if one instalment remains unpaid. The seller will have the right to take away the goods in case of default in respect of any instalment. This is known as ‘Hire Purchase’ system. The other arrangement may be that property passes immediately on the signing of the contract. The seller will not have the right to repossess the goods in case an instalment is not paid. His right will be to sue the purchaser for the money due. This is known as the Instalment System.

To ascertain Cash Price, rate of interest and instalments being given. Sometimes the cash price is not given. Since the asset cannot be debited with more than the cash price, it must be ascertained. The process is to take the last year first and separate interest from principal out of the total sum due.

Entries In Books : Actual Cash Price Paid Method : This method follows a technical approach and does not treat the hire purchaser as owner until he makes the payment of last instalment. Under this method, the asset is recorded at the cash price actually paid.

Books of the Vendor. The vendor follows no special method for recording sales on hire purchase, specially in case of sale of large items. He debits the purchaser with the cash price and credits him with the amount received. Every year the interest due is debited.

Books of Purchaser

-First Method. The purchaser can also follow the system adopted by the vendor and make entries like ordinary purchase of an asset. Only, he should credit the vendor with interest due every year and debit him with cash as and when paid. The above given example can be worked out in the following way (ledger accounts.) :—

-Second Method. Under the second method, entries are passed only when payment is due or made. At this time, the vendor is credited with the amount due. Interest for the period is debited to interest Account and the balance (principal) is debited to the Asset Account. On payment, of course, the vendor is debited and Cash (or Bank) credited.

Key takeaways:

SOLVED EXAMPLES

Q.1. (Cash Price, Rate of Interest and Amount of Installments are given)

Om Ltd. purchased a machine on hire purchase basis from Kumar Machinery Co. Ltd. on

the following terms:

You are required to calculate the total interest and interest included in cash instalment.

Solution:

Calculation of interest

| Total (Rs.) | Interest in each instalment (1) | Cash price in each instalment (2) |

Cash Price Less: Down Payment Balance due after down payment Interest/Cash Price of 1st instalment

Less: Cash price of 1st instalment Balance due after 1st instalment Interest/cash price of 2nd instalment

Less: Cash price of 2nd instalment Balance due after 2nd instalment Interest/Cash price of 3rd instalment

Less: Cash price of 3rd instalment Balance due after 3rd instalment Interest/Cash price of 4th instalment

Less: Cash price of 4th instalment Balance due after 4th instalment Interest/Cash price of 5th instalment

Less: Cash price of 5th instalment Total | 80,000 (21,622) 58,378 -

(9,562) 48,816 -

(10,518) 38,298 -

(11,570) 26,728

-

(12,728) 14,000 -

(14,000) Nil |

Nil

Rs. 58,378 x10/100 = Rs. 5,838

Rs. 48,816 x 10/100 = Rs. 4,882

Rs. 38,298x10/100 = Rs. 3,830

Rs. 26,728 x10/100 = Rs. 2,672

Rs. 14,000 x10/100 =Rs. 1,400

Rs. 18,622 |

Rs. 21,622

Rs. 15,400 – Rs. 5,838 = Rs. 9,562

Rs. 15,400 - Rs. 4,882 = Rs. 10,518

Rs. 15,400 - Rs. 3,830 = Rs. 11,570

Rs. 15,400 - Rs. 2,672 = Rs. 12,728

Rs. 15400 – Rs. 1,400 = 14,000

Rs. 80,000 |

Total interest can also be calculated as follow:

(Down payment + instalments) – Cash Price = Rs. [21,622+(15400 x 5)] – Rs. 80,000 = Rs. 18,622

Q.2. (Cash Price and Amount of Installments are given; Rate of Interest is not given)

Happy Valley Florists Ltd. acquired a delivery van on hire purchase on 01.04.2011 from Ganesh Enterprises. The terms were as follows:

Particulars | Amount (Rs.) |

Hire Purchase Price | 180,000 |

Down Payment | 30,000 |

1st installment payable after 1 year | 50,000 |

2nd installment after 2 years | 50,000 |

3rd installment after 3 years | 30,000 |

4th installment after 4 years | 20,000 |

Cash price of van Rs. 1,50,000. You are required to calculate Total Interest and Interest included in each instalment.

Solution: Calculation of total Interest and Interest included in each installment Hire Purchase Price (HPP) = Down Payment + instalments = 30,000 + 50,000 + 50,000 + 30,000 + 20,000 = 1,80,000

Total Interest = 1,80,000 – 1,50,000 = 30,000

Computation of IRR (considering two guessed rates of 6% and 12%)

Year | Cash Flow | DF @6% | PV | DF @12% | PV |

0 | 30,000 | 1.00 | 30,000 | 1.00 | 30,000 |

1 | 50,000 | 0.94 | 47,000 | 0.89 | 44,500 |

2 | 50,000 | 0.89 | 44,500 | 0.80 | 40,000 |

3 | 30,000 | 0.84 | 25,200 | 0.71 | 21,300 |

4 | 20,000 | 0.79 | 15,800 | 0.64 | 12,800 |

|

| NPV | 1,62,500 | NPV | 1,48,600 |

Interest rate implicit on lease is computed below by interpolation:

Interest rate implicit on lease= 6% + 1,62,500-1,50,000 x (12-6) = 11.39%

1,62,500-1,48,600

Thus, repayment schedule and interest would be as under:

Installment no. | Principal at beginning | Interest included in each installment | Gross amount | Installment | Principal at end |

Cash down | 1,50,000 |

| 1,50,000 | 30,000 | 1,20,000 |

1 | 1,20,000 | 13,668 | 1,33,668 | 50,000 | 83,668 |

2 | 83,668 | 9,530 | 93,198 | 50,000 | 43,198 |

3 | 43,198 | 4,920 | 48,118 | 30,000 | 18,118 |

4 | 18,118 | 2,064 | 20,182 | 20,000 | 182* |

|

| 30,182* |

|

|

|

* the difference is on account of approximations. | |||||

On January 1, 2011 HP M/s acquired a Pick-up Van on hire purchase from FM M/s. The terms of the contract were as follows:

You are required to:

Solution:

Journal Entries in the books of HP M/s

Date | Particulars | Dr. | Cr. | |

2011 |

| Rs. | Rs. | |

Jan. 31 | Pick-up Van A/c To FM M/S A/c (Being the purchase of a pick-up van on hire purchase from FM M/s) | Dr. | 1,00,000 |

|

|

|

| 1,00,000 | |

“ | FM M/S A/c To Bank A/c (Being the amount paid on signing the H.P. contract) | Dr. | 40,000 |

|

|

|

| 40,000 | |

Dec. 31 | Interest A/c To FM M/s A/c (Being the interest payable @ 6% on Rs. 60,000) | Dr. | 3,600 |

|

|

|

| 3,600 | |

“ | FM M/s A/c (Rs. 20,000+Rs. 3,600) To Bank A/c (Being the payment of 1st instalment along with interest) | Dr. | 23,600 |

|

|

|

| 23,600 | |

“ | Depreciation A/c To Pick-up Van A/c (Being the depreciation charged @ 10% p.a. on Rs. 1,00,000) | Dr. | 10,000 |

|

|

|

| 10,000 | |

“ | Profit & Loss A/c To Depreciation A/c To Interest A/c (Being the depreciation and interest transferred to Profit and Loss Account) | Dr. | 13,600 |

|

|

|

| 10,000 3,600 | |

2012 Dec. 31 | Interest A/c To FM M/s A/c (Being the interest payable @ 6% on Rs. 40,000) | Dr. | 2,400 |

2,400 |

“ | FM M/s A/c (Rs. 20,000 + Rs. 2,400) To Bank A/c (Being the payment of 2nd instalment along with interest) | Dr. | 22,400 |

|

|

|

| 22,400 | |

“ | Depreciation A/c To Pick-up Van A/c (Being the depreciation charged @ 10% p.a.) | Dr. | 10,000 |

|

|

|

| 10,000 | |

“ | Profit & Loss A/c To Depreciation A/c To Interest A/c (Being the depreciation and interest charged to Profit and Loss Account) | Dr. | 12,400 |

|

|

|

| 10,000 2,400 | |

2013 Dec. 31 | Interest A/c To FM M/s A/c (Being the interest payable @ 6% on Rs. 20,000) | Dr. | 1,200 |

1,200 |

“ | FM M/s A/c (Rs. 20,000 + Rs. 1,200) To Bank A/c (Being the payment of final instalment along with interest) | Dr. | 21,200 |

|

|

|

| 21,200 | |

“ | Depreciation A/c To Pick-up Van A/c (Being the depreciation charged @ 10% p.a. on Rs. 1,00,000) | Dr. | 10,000 |

|

|

|

| 10,000 | |

“ | Profit & Loss A/c To Depreciation A/c To Interest A/c (Being the interest and depreciation charged to Profit and Loss Account) | Dr. | 11,200 |

|

|

|

| 10,000 1,200 |

Ledgers in the books of HP M/s

Pick-up Van Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

1.1.2011 | To FM M/s A/c | 1,00,000 | 31.12.2011 | By Depreciation A/c | 10,000 |

|

|

| 31.12.2011 | By Balance c/d | 90,000 |

|

| 1,00,000 |

|

| 1,00,000 |

1.1.2012 | To Balance b/d | 90,000 | 31.12.2012 | By Depreciation A/c | 10,000 |

|

|

| 31.12.2012 | By Balance c/d | 80,000 |

|

| 90,000 |

|

| 90,000 |

1.1.2013 | To Balance b/d | 80,000 | 31.12.2013 | By Depreciation A/c | 10,000 |

|

|

| 31.12.2013 | By Balance c/d | 70,000 |

|

| 80,000 |

|

| 80,000 |

FM M/s Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

1.1.2011 | To Bank A/c | 40,000 | 1.1.2011 | By Pick-up Van A/c | 1,00,000 |

31.12.2011 | To Bank A/c | 23,600 | 31.12.2011 | By Interest c/d | 3,600 |

31.12.2011 | To Balance c/d | 40,000 |

|

|

|

|

| 1,03,600 |

|

| 1,03,600 |

31.12.2012 | To Bank A/c | 22,400 | 1.1.2012 | By Balance b/d | 40,000 |

31.12.2012 | To Balance c/d | 20,000 | 31.12.2012 | By Interest A/c | 2,400 |

|

| 42,400 |

|

| 42,400 |

31.12.2013 | To Bank A/c | 21,200 | 1.1.2013 | By Balance b/d | 20,000 |

|

|

| 31.12.2013 | By Interest A/c | 1,200 |

|

| 21,200 |

|

| 21,200 |

Depreciation Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

31.12.2011 | To Pick-up Van A/c | 10,000 | 31.12.2011 | By Profit & Loss A/c | 10,000 |

31.12.2012 | To Pick-up Van A/c | 10,000 | 31.12.2012 | By Profit & Loss A/c | 10,000 |

31.12.2013 | To Pick-up Van A/c | 10,000 | 31.12.2013 | By Profit & Loss A/c | 10,000 |

Interest Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

31.12.2011 | To FM M/s A/c | 3,600 | 31.12.2011 | By Profit & Loss A/c | 3,600 |

31.12.2012 | To FM M/s A/c | 2,400 | 31.12.2012 | By Profit & Loss A/c | 2,400 |

31.12.2013 | To FM M/s A/c | 1,200 | 31.12.2013 | By Profit & Loss A/c | 1,200 |

Balance Sheet of HP M/s as at 31st December, 2011

Liabilities | Rs. | Assets | Rs. |

FM M/s | 40,000 | Pick-up Van | 90,000 |

Balance Sheet of HP M/s as at 31st December, 2012

Liabilities | Rs. | Assets | Rs. |

FM M/s | 20,000 | Pick-up Van | 80,000 |

Balance Sheet of HP M/s as at 31st December, 2013

Liabilities | Rs. | Assets | Rs. |

|

| Pick-up Van | 70,000 |

Q.3. 1st January, 2000 Mr. A purchases from Mr. B machinery whose cash price is Rs. 15,000; Rs. 5,000 is to be paid down, that is on signing of the contract, and Rs. 4,000 is to be paid at the end of each year for 3 years. Rate of interest is 10% p.a. Prepare B’s account in the books of Mr. A

Solution:

A’s Books

Dr. |

|

| B’s Account |

| Cr. |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Cash | 5,000 | Jan.1 | By Machinery A/c | 15,000 |

Dec.31 | To Cash | 4,000 | Dec.31 | By Interest A/c | 1,000 |

’’ | To balance c/d | 7,000 |

| (10% on Rs. 10,000) |

|

|

| 16,000 |

|

| 16,000 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 7,000 |

| To Balance c/d | 3,700 | Dec.31 | By Interest A/c |

|

|

|

|

| (10% on Rs. 7,000) | 700 |

|

| 7,700 |

|

| 7,700 |

2002 |

|

| 2002 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 3,700 |

|

|

| Dec.31 | By Interest A/c* | 300 |

|

| 4,000 |

|

| 4,000 |

Q.4. Based on particulars given below calculate Interest under the hire purchase system

X & Co.—purchaser Y & Co.-Seller Date of purchase—Jan. 1, 1999, Cash price—Rs. 74,500.

Installments Rs. 20,000 on signing of the agreement. Rest in three instalments of Rs. 20,000 each. Rate of Interest—5%. Depreciation 10% on the diminishing Balance.

Solution:

Calculation of Interest | ||

|

| Rs. |

Jan.1, 1999 | Cash Price | 74,500 |

| Less-Cash down | 20,000 |

| Balance Due | 54,500 |

| Interest @ 5% for 1999 | 2,725 |

Dec.31, 1999 | Total | 57,225 |

| Amount paid | 20,000 |

Jan.1, 2000 | Balance Due | 37,225 |

| Interest for 2000 @ 5% | 1,861 |

Dec.31, 2000 | Total | 39,086 |

| Amount paid | 20,000 |

Jan.1,2001 | Balance due 2001 | 19,086 |

| Interest for (balancing figure) 2001 | 914 |

Jan.1,2002 | Amount paid | 20,000 |

Q.5. Based on particulars given below calculate Interest under the hire purchase system

X & Co.—purchaser Y & Co.-Seller Date of purchase—Jan. 1, 1999, Cash price—Rs. 74,500.

Installments Rs. 20,000 on signing of the agreement. Rest in three instalments of Rs. 20,000 each. Depreciation 10% on the diminishing Balance.

Solution:

Calculation of interest when the rate of interest is not given:

Hire Purchase Price | 80,000 | ||||

Cash Price | 74,500 | ||||

Total interest | 5,500 | ||||

|

|

|

|

|

|

Year | Amount Outstanding | Ratio | Interest | Rs. | |

1 | 60,000 |

| 3 | 3/6 x 5,500 | 2,750 |

2 | 40,000 |

| 2 | 2/6 x 5,500 | 1,833 |

3 | 20,000 |

| 1 | 1/6 x 5,500 | 917 |

Q.6. Based on particulars given below calculate Interest under the hire purchase system

X & Co.—purchaser Y & Co.-Seller Date of purchase—Jan. 1, 1999, Installments Rs. 20,000 on signing of the agreement. Rest in three instalments of Rs. 20,000 each. Rate of Interest—5%. Depreciation 10% on the diminishing Balance.

Solution:

Calculation of cash price, rate of interest being given:

Instalment | Amount due at the end of the year (after payment of Installment) | Instalment paid | Total amount due at the end of the Year (before payment of instalment) | Interest @ 1/21 | Principal due in the beginning | |

| Rs. | Rs. |

| Rs. | Rs. | Rs. |

3 | Nil | 20,000 |

| 20,000 | 952 | 19,408 |

2 | 19,048 | 20,000 |

| 39,048 | 1,859 | 37,189 |

1 | 37,189 | 20,000 |

| 57,189 | 2,723 | 54,466 |

|

|

|

|

| 5,534 |

|

Cash Price: 54,466 + cash down, Rs. 20,000 or Rs. 74,466.

Q.7. Y & Co. sold machinery whose cash price is Rs. 74,500. to X and Co., on hire purchase basis on 1st January, 2000. Payment was to be made as Rs. 20,000 down and Rs. 20,000 every year for three years. Rate of interest was 5% & Co. charged depreciation @ 10% p.a. on the diminishing balance. Give ledger accounts in the books of Y & Co.

Solution:

Ledger of Y & Co. | |||||

Dr. |

|

| X & Co. |

| Cr. |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Sales | 74,500 | Jan.1 | By Cash | 20,000 |

Dec.31 | To Interest A/c |

| Dec.31 | By Cash | 20,000 |

| (5% on Rs. 54,500) | 2,725 |

| By Balance c/d | 37,225 |

|

| 77,225 |

|

| 77,225 |

2001 |

|

| 2001 |

|

|

Jan.1 | To Balance b/d | 37,225 | Dec.31 | By Cash | 20,000 |

Dec.31 | To Interest A/c | 1,861 |

| By Balance c/d | 19,086 |

|

| 39,086 |

|

| 39,086 |

2002 |

|

| 2002 |

|

|

Jan.1 | To Balance b/d | 19,086 | Dec.31 | By Cash | 20,000 |

Dec.31 | To Interest A/c | 914 |

|

|

|

|

| 20,000 |

|

| 20,000 |

Dr. | Sales Account | Cr. | ||

|

| 2000 |

|

|

|

| Jan. 1 | By X & Co. | Rs. 15,000. |

Interest Account | ||||

Dr. |

|

|

| Cr. |

2000 |

| 2000 |

|

|

Dec.31 to P & L A/c | 2,725 | Dec.31 | By X & Co. | 2,725 |

2001 |

| 2001 |

|

|

Dec.31 to P & L A/c | 1,861 | Dec.31 | By X & Co. | 1,861 |

2002 |

| 2002 |

|

|

Dec.31 to P & L A/c | 914 | Dec.31 | By X & Co. | 914 |

Q.8. Y & Co. sold machinery whose cash price is Rs. 74,500. to X and Co., on hire purchase basis on 1st January, 2000. Payment was to be made as Rs. 20,000 down and Rs. 20,000 every year for three years. Rate of interest was 5% & Co. charged depreciation @ 10% p.a. on the diminishing balance. Give Journal Entries & ledger accounts in the books of X & Co.

Solution:

Journal of X & Co.

|

|

| Debit (Rs) | Credit (Rs) | ||||||

2000 |

|

|

|

| ||||||

Jan.1 | Machinery Account | Dr. | 20,000 | |||||||

| To Y & Co. |

| 20,000 | |||||||

| (Amount due to Y & Co. as down payment for purchase of machinery on hire purchase basis.) |

|

| |||||||

|

|

|

| |||||||

Jan.1 | Y & Co. | Dr. | 20,000 | |||||||

| To Bank Account |

| 20,000 | |||||||

| (Payment made to Y & Co. down) |

|

| |||||||

|

|

|

| |||||||

Dec.31 | Machinery Account | Dr. | 17,275 | |||||||

| Interest Account | Dr. | 2,725 | |||||||

| To Y & Co. |

| 20,000 | |||||||

| (The amount due to Y & Co. under the hire purchase Contract for interest (and debited as such) and the balance treated as payment for machinery) |

|

| |||||||

| ||||||||||

Dec.31 | Y & Co. | Dr. | 20,000 | |||||||

| To Bank A/c |

| 20,000 | |||||||

| (Payment made to Y & Co.) |

|

| |||||||

|

|

|

| |||||||

Dec.31 | Depreciation Account | Dr. | 7,450 | |||||||

| To Machinery Account |

| 7,450 | |||||||

| (Depreciation for 1st year-10% on Rs. 74,500) |

|

| |||||||

|

|

|

| |||||||

Dec 31 | Profit & Loss Account | Dr. | 10,175 | |||||||

| To Interest Account |

| 2,725 | |||||||

| To Depreciation Account |

| 7,450 | |||||||

| (Being interest and depreciation transferred to P/L A/c) |

|

| |||||||

2001 | ||||||||||

Dec.31 | Machinery Account | Dr. | 18,139 | |||||||

| Interest Account | Dr. | 1,861 | |||||||

| To Y & Co. |

| 20,000 | |||||||

| (Amount due to Y & Co. for interest the balance charged to Machinery A/c.) |

|

| |||||||

| ||||||||||

Dec.31 | Y & Co. | Dr. | 20,000 | |||||||

| To Bank Account |

| 20,000 | |||||||

| (Payment made to Y & Co.) |

|

| |||||||

|

|

|

| |||||||

Dec. 31 | Depreciation | Dr. | 6,705 | |||||||

| To Machinery Account |

| 6,705 | |||||||

| (Depreciation for the second year 10% on Rs. 67,050; i.e. Rs. 74,500 - Rs. 7,450). |

|

| |||||||

|

|

|

| |||||||

Dec 31 | Profit & Loss Account | Dr. | 8,566 | |||||||

| To Interest Account |

| 1,861 | |||||||

| To Depreciation Account |

| 6,705 | |||||||

| (Being interest and depreciation transferred to P/L A/c) |

|

| |||||||

2002 | ||||||||||

Dec.31 | Machinery Account | Dr. | 19,086 | |||||||

| Interest Account | Dr. | 914 | |||||||

| To Y & Co. |

| 20,000 | |||||||

| (Amount due to Y & Co. in respect of interest and the principal sum.) |

|

| |||||||

| ||||||||||

Dec.31 | Y & Co. | Dr. | 20,000 | |||||||

| To Bank Account |

| 20,000 | |||||||

| (Payment made to Y & Co.) |

|

| |||||||

|

|

|

| |||||||

Dec.31 | Depreciation Account | Dr. | 6,035 | |||||||

| To Machinery Account |

| 6,035 | |||||||

| (Depreciation @ 10% of the diminishing balance charged for the third years). |

|

| |||||||

|

|

|

| |||||||

Dec 31 | Profit & Loss Account | Dr. | 6,949 | |||||||

| To Interest Account |

| 914 | |||||||

| To Depreciation Account |

| 6,035 | |||||||

| (Being interest and depreciation transferred to P/L A/c) |

|

| |||||||

Ledger Accounts | ||||||||||

Dr. |

| Machinery Account |

| Cr. | ||||||

2000 |

| Rs. | 2000 |

| Rs. | |||||

Jan.1 | To Y & Co. | 20,000 | Dec.31 | By Depreciation | 7,450 | |||||

Dec.31 | To Y & Co. |

| Dec.31 | By Balance c/d | 29,825 | |||||

| (20,000—2,725) | 17,275 |

|

|

| |||||

|

| 37,275 |

|

| 37,275 | |||||

2001 |

|

| 2001 |

|

| |||||

Jan.1 | To balance b/d | 29,825 | Dec.31 | By Depreciation A/c | 6,705 | |||||

Dec.31 | To Y & Co. |

| Dec.31 | By Balance c/d | 41,259 | |||||

| (20,000—1,861) | 18,139 |

|

|

| |||||

|

| 47,964 |

|

| 47,964 | |||||

2002 |

|

| 2002 |

|

| |||||

Jan.1 | To Balance b/d | 41,259 | Dec.31 | By Depreciation A/c | 6,035 | |||||

Dec.31 | To Y & Co. | 19,086 | Dec.31 | By Balance c/d | 54,310 | |||||

|

| 60,345 |

|

| 60,345 | |||||

2003 |

|

|

|

|

| |||||

Jan.1 | To Balance b/d | 54,310 |

|

|

| |||||

Dr. |

| Interest Account | Cr. | ||

2000 |

| Rs. | 2000 |

| Rs. |

Dec.31 | To Y & Co. | 2,725 | Dec.31 | By P & L A/c | 2,725 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Y & Co. | 1,861 | Dec.31 | By P & L A/c | 1,861 |

2002 |

|

| 2002 |

|

|

Dec.31 | To Y & Co. | 914 | Dec.31 | By P & L A/c | 914 |

Dr. |

|

| Y & Co. |

|

| Cr. |

2000 |

| Rs. |

| 2000 |

| Rs. |

Jan.1 | To Bank A/c | 20,000 | Jan.1 | By Machinery A/c | 20,000 | |

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Sundries— |

|

|

|

|

|

| Machinery | 17,275 |

|

|

|

|

| Interest | 2,725 | 20,000 |

|

| 40,000 |

|

| 40,000 | |

2001 |

|

| 2001 |

|

|

|

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Machinery A/c | 18,139 | |

|

|

|

| By Interest A/c | 1,861 | |

|

| 20,000 |

|

| 20,000 | |

2002 |

|

| 2002 |

|

| |

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Machinery A/c | 19,086 | |

|

|

|

| By Interest A/c | 914 | |

|

| 20,000 |

|

| 20,000 | |

Depreciation Account

2000 |

| Rs. | 2000 |

| Rs. |

Dec.31 | To Machinery A/c | 7,450 | Dec.31 | By P & L A/c | 7,450 |

2001 |

| 2001 |

|

| |

Dec.31 | To machinery A/c | 6,705 | Dec.31 | By P & L A/c | 6,705 |

2002 |

| 2002 |

|

| |

Dec.31 | To Machinery A/c | 6,035 | Dec.31 | By P & L A/c | 6,035 |

INTRODUCTION: -

A branch may be defined as section of an enterprise, geographically separated from the rest of the business, controlled by head office, and generally carrying on the same activities as of the enterprise. As a business grow, it may open up branches in different towns and cities in order to market its product/services over a large territory and thus increase its profit.

For example, Bata shoe Co. Ltd has branches in various cities all over the country. The same example holds good for a commercial bank also.

As per the provision of Companies Act, branch office in relation to a company means-

It should be mentioned that a branch is not a separate legal entity it is simply a segment of a business. From an accounting standpoint, a branch is a clearly identifiable profit centre. In order to exercise greater control over the branches it is necessary to ascertain profit or loss made by such branches separately. Apart from this, specialised accounting techni9have to be adopted for controlling various branches activities and for their smooth running both at the branch level and at the head office level. The system of accounting varies between different enterprises in accordance with their type of activities, methods of operation and the preference of their managements.

NEED FOR BRANCH ACCOUNTING

a) Ascertain the profitability of each branch separately for particular accounting period.

b) Ascertain the financial position of each branch separately at the end of that accounting period.

c) Assess the progress and performance of each branch

d) Incorporate the profit or loss made by the branch and its assets and liabilities in the firm's final accounts

e) Ascertain the requirements of cash and stock for each branch,

f) Ascertain whether the branch should expended or closed

TYPES OF BRANCHES

From accounting point of view, the branches can be divided into the following main cases:

1) HOME BRANCHES: -

2) FOREIGN BRANCHES: -

They almost invariably trade independently and record their transaction in foreign currency.

Dependent Branches

When the policies and administration of a branch are totally controlled by the head office, who also maintains its accounts, the branch is called as dependent branch.

Independent Branches

Independent Branches are those which make purchases from outside, get goods from Head Office, supply goods to Head Office and fix the selling price by itself Thus an independent Branch enjoys a good amount of freedom like an American Son.

ACCOUNTING SYSTEM OF BRANCHES

The accounting arrangement of a branch depends upon its size, the type of activities, the methods of operation and the degree of control to be exercised by the head office. There are three main system of accounting for branches transaction, viz.

This system of accounting is suitable for the small- size branches. Under this, a Branch Account is opened for each branch in the head office ledger. All the transaction relating to that branch is recorded in this account. The branch account is prepared in such a way that it discloses the profit or loss of the branch.

Head office may send goods to branch either at "cost price" or "selling price".

Cost price method: - under this method at the beginning of the year the branch Account is debited with the opening balances of asset such as stock, petty cash, furniture, prepaid expenses, etc. lying with the branch. Similarly, it is credited with the opening balance of liabilities of the branch such as, creditors, ots salary, rent, etc.

The branch is then debited with the amount of goods sent to the branch and other amounts remitted to meet various expenses such as, salaries, rent, rates, taxes, etc. Likewise, the branch account is credited with the return of goods by the branch and receipts from branches. At the year end, Branch Account is debited with the closing values of liabilities and credited with the closing values of assets. The difference between the two sides represents profit or loss for the branch for a particular period.

DEBTORS METHOD

Journal entries

1) For goods sent to branch

Branch A/c _______Dr.

To Goods Sent to Branch A/c

(Being goods sent to branch)

2) For goods returned by the branch

Goods Sent to Branch A/c _______Dr.

To Branch A/c

(Being goods returned by the branch)

3) For amount sent to branch for expenses

Branch A/c _______ Dr.

To Bank A/c

(Being cheque sent to branch for expenses)

4) For amount received from branch

Bank A/c _______ Dr.

To Branch A/c

(Being cash or cheque received from branch)

5) For closing goods sent to branch account

Goods Sent to Branch Alc Dr.

To Purchase A/c

(Being balance transferred to Trading Account)

6) For closing balances of assets at the branch

Branch Assets A/c ________ Dr. (Individually)

To Branch A/c

(Being closing balances of assets brought into account)

7) For closing balances of Liabilities at the branch

Branch A/c ________Dr.

To Branch Liabilities A/c (Individually)

(Being closing balances of liabilities brought into account)

8) For transferring Profit or Loss to General Profit and Loss Account

Branch A/c _______ Dr.

To General Profit and Loss A/c

(Being branch profit transferred to General P & L A/c)

General Profit and Loss A/c ________ Dr.

To Branch A/c

(Being branch loss transferred to General P & L A/c)

The closing balances of branch assets and liabilities are shown in the Balance Sheet

of the head office. At the beginning of the next year, the entire numbers 6 and 7 are

reversed so as to show opening balances in the Branch Account.

STOCK AND DEBTORS METHOD:

Under this method accounts relating to branch are maintained in a more comprehensive and detailed manner as compared to Debtors method. This method keeps a better control stock. Under this method separate accounts are prepared for various accounting function

This accounting procedure under this method depends upon the policy of head office with regard to pricing of goods send to branch. Head office may adopt one of the following methods for invoicing goods to branch.

When goods have been invoiced to branch at cost price.

In this case following accounts are prepared.

a) Branch Stock Account .

b) Goods sent to Branch Account.

c) Branch Debtors Account .

d) Branch Expenses Account.

e) Branch Profit & Loss Account .

f) Branch Cash Account .

I) When goods are sent to the branch (at invoice price)

Branch Stock A/c _____ Dr.

To Goods Sent to Branch A/c

2) When goods are returned by the branch to the H.O. (at invoice price)

Goods Sent to Branch A/c _______ Dr.

To Branch Stock A/c

3) When sales are made by the branch

Cash A/c _______ Dr.

To Branch Stock A/c

Branch Debtors A/c _______ Dr.

To Branch Stock A/c

4) When Cash is Received from Debtors

Cash A/c ______ Dr.

To Branch Debtors A/c

5) For Sales Returns

Branch Stock A/c ________ Dr.

To Branch Debtors A/c

6) For discount allowed, bad debts, etc.

Branch Expenses A/c ________ Dr.

To Branch Debtors A/c

7) For Shortage of Stock

Branch Adjustment A/c ________ Dr.(with amount of loading)

Branch P & L A/c ________ Dr. (with cost of shortage)

To Branch Stock A/c

For surplus at branch, the reverse entry will be passed.

8) For Branch Expenses paid in Cash

Branch Expenses A/c ______ Dr.

To Cash A/c

9) For Closing Branch Expenses Account

Branch P&L A/c ______ Dr.

To Branch Expenses A/c

10) For Adjustment of Loading on the Opening Stock

Stock Reserve A/c ______ Dr.

To Branch Adjustment A/c

11) For Adjustment of Loading on the Closing Stock

Branch Adjustment A/c ______ Dr.

To Stock Reserve A/c

12) For Adjustment Loading Goods sent to Branch

Goods Sent to Branch A/c ________ Dr.

To Branch Adjustment A/c

13) For Transfer of Gross Profit

Branch Adjustment A/c _______ Dr.

To Branch P & L A/c

Examples

Q.1 (AT COST)

Suri is having his Head office at Mumbai and Branch Office at Nasik. Prepare the branch Account in the books of the Head Office from the following transaction with the branch:

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

Opening Balance at Branch: |

| Amounts remitted to the Branch for : |

|

- Petty Cash | 1,000 | - Petty Cash Expenses | 4,000 |

- Stock | 39,500 | - Salary | 12,000 |

- Debtors | 21,000 | - Rent and Taxes | 3,500 |

Goods Supplied to Branch during the year | 3,10,000 | Closing balances ay Branch: |

|

Amounts remitted by the branch |

| - Petty | 950 |

- Cash Sales | 1,13,200 | - Debtors | 53,000 |

- Realisation from Debtors | 2,30,300 | - Stock | 26,500 |

SOLUTION: -

IN THE BOOKS OF H.O.

Dr. NASIK BRANCH ACCOUNT. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d |

| By Bank (Remittance): |

|

Branch petty cash | 1,000 | - Petty Cash Expenses | 4,000 |

Branch Stock | 39,500 | - Salary | 12,000 |

Branch Debtors | 21,000 | - Rent and Taxes | 3,500 |

To Goods sent to Branch | 3,10,000 | Closing balance at Branch |

|

To cash remitted for: |

| - Petty Cash | 950 |

Petty Cash Expenses | 4,000 | - Debtors | 53,000 |

Salary | 12,000 | - Stock | 26,500 |

Rent | 3,500 |

|

|

To General P&L (Bal Fig) | 32,950 |

|

|

TOTAL | 4,23,950 | TOTAL | 4,23,950 |

Q.2 (INVOICE PRICE)

D of Delhi have a branch at Madras. Goods are sent by the Head Office at Invoice Price which is at the Profit of 25% on Cost Price. All the Expenses of the branch are paid by the Head Office. From the following particulars, prepare Branch Account in Head Office Books

BALANCES | OPENING | CLOSING |

Stock at invoice | 11,000 | 13,000 |

Debtors | 1,700 | 2,000 |

Petty Cash | 100 | 25 |

TOTAL | 12,800 | 15,025 |

Goods sent to branch at invoice price Rs. 20,000.

Expenses made by head office: -Rent Rs.600, Wages Rs.200, Salaries Rs.900

Remittance made to Head Office: - Cash Sales Rs. 2,650, Cash collected from debtors Rs. 21,000

Goods Returned by Branch at Invoice Price Rs.400

SOLUTION: -

IN THE BOOKS OF HEAD OFFICE

Dr. MADRAS BRANCH A/c. Cr.

PARTICULARS | AMOUNT | AMOUNT | PARTICULARS | AMOUNT | AMOUNT |

To Balance b/d |

|

| By Stock Reserve A/c b/d(Load on OP. Stock 11,000 X 25/125) |

| 2,200 |

Stock (IP) |

| 11,000 | By Bank |

|

|

Debtors |

| 1,700 | Cash Sales | 2,650 |

|

Petty Cash |

| 100 | Cash collected from Debtors | 21,000 | 23,650 |

To Goods sent to Branch (IP) |

| 20,000 | By Goods sent to branch (Returns at IP) |

| 400 |

To Bank (Expenses): |

|

| By Goods sent to branch (19,600 X 25/125; net Loading) |

| 3,920 |

Rent | 600 |

| By Balance c/d |

|

|

Wages | 200 |

| Stock (IP) | 13,000 |

|

Salaries | 900 | 1,700 | Debtors | 2,000 |

|

To Stock Reserve A/c c/d(Load on Cl. Stock 13,000 X 25/125) |

| 2,600 | Petty Cash | 25 | 15,025 |

To Net Profit tfd to general P&L (Bal Fig) |

| 8,095 |

|

|

|

TOTAL |

| 45,195 | TOTAL |

| 45,195 |

Note: Goods are sent by Head Office at @ 25% on Cost Price.

So, Cost + Profit = Invoice Price

100 + 25 = 125

Profit charged by Head Office is 1/5 or 20% of Invoice Price.

Q.3 (INVOICE PRICE)

One M.P. Head Office has a branch at Berhampur to which goods are invoiced at cost plus 20% .from the following particulars prepare the Branch Account in the Head Office Books :

PARTICULARS | AMOUNT |

Goods sent to Branch at invoice Price | 2,11,872 |

Total Sales | 2,06,400 |

Cash Sales | 1,10,400 |

Cash received from Branch Debtors | 88,000 |

Branch Debtors at commencement | 24,000 |

Branch Stock at commencement at Invoice price | 7,680 |

Branch Stock at Close of the period at Invoice Price | 13,440 |

SOLUTION: -

IN THE BOOKS OF M.P. HEAD OFFICE

Dr. BERHAMPUR BRANCH ACCOUNT. Cr.

PARTICULARS | AMOUNT | AMOUNT | PARTICULARS | AMOUNT | AMOUNT |

To Balance b/d |

|

| By Stock Reserve A/c b/d(Load on OP. Stock) |

| 1,280 |

Stock (IP) |

| 7,680 | By Bank |

|

|

Debtors |

| 24,000 | Cash Sales | 1,10,400 |

|

To Goods sent to Branch (IP) |

| 2,11,872 | Cash collected from Debtors | 88,000 | 1,98,400 |

To Stock Reserve A/c c/d(Load on Cl. Stock) |

| 2,240 | By Goods sent to branch (2,11,872 X 20/120; net Loading) |

| 35,312 |

To Net Profit tfd to general P&L (Bal Fig) |

| 34,640 | By Balance c/d |

|

|

|

|

| Stock (IP) | 13,440 |

|

|

|

| Debtors | 32,000 | 45,440 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

| 2,80,432 | TOTAL |

| 2,80,432 |

Working Note:

Dr. BERHAMPUR BRANCH DEBTORS ACCOUNT. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 24,000 | By Cash | 88,000 |

To Credit Sales | 96,000 | By balance c/d (balancing figure) | 32,000 |

TOTAL | 1,20,000 | TOTAL | 1,20,000 |

(2)

Total Sales =2,06,400

Less: - Cash Sales =1,10,400

Credit Sales =96,000

(3)

Goods are sent by Head Office at @ 20% on Cost Price.

So, Cost + Profit = Invoice Price

100 + 20 = 120

Profit charged by Head Office is 1/6 of Invoice Price.

Q.4 (AT COST)

The Canada commercial company invoiced goods to its Jaipur Branch at cost. The head office paid all the branch expenses from its bank except petty cash expenses which were Paid by the branch. From the following details relating to the branch, prepare

(1): Branch Stock A/c

(2)Branch Debtors A/c

(3)Branch Expenses A/c

(4)Branch P&L A/c

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

Stock (Opening) | 21,000 | Discount to Customer | 4,200 |

Debtors (Opening) | 37,800 | Bad Debts | 1,800 |

Petty Cash(Opening) | 600 | Goods returned by customers to branch | 1,500 |

Goods sent to H.O. | 78,000 | Salaries | 18,600 |

Goods returned to H.O. | 3,000 | Rent | 3,600 |

Cash Sales | 52,500 | Debtors(Closing) | 29,400 |

Advertisement | 2,400 | Petty Cash (Closing) | 300 |

Cash received from debtors | 85,500 | Credit Sales | 85,200 |

Stock(Closing) | 19,500 |

|

|

Allowances to Customer | 600 |

|

|

|

|

|

|

SOLUTION: -

Dr. BRANCH STOCK A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 21,000 | By Branch Cash | 52,500 |

To Goods sent to sent Branch | 78,000 | By Goods sent to Branch | 3,000 |

To Branch Debtors | 1,500 | By Branch Debtors | 85,200 |

To Branch P&L (Transfer) | 59,700 | By Balance c/d | 19,500 |

TOTAL | 1,60,200 | TOTAL | 1,60,200 |

Dr. BRANCH DEBTORS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 37,800 | By Branch Cash | 85,500 |

To Branch Stock (Credit Sales) | 85,200 | By Branch expenses Bad Debts 1,800 Allowances 600 Discount 4,200

| 6,600 |

|

| By Branch Stock (Returns) | 1,500 |

|

| By Balance c/d | 29,400 |

TOTAL | 1,23,000 | TOTAL | 1,23,000 |

Dr. BRANCH EXPENSES A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Debtors | 6,600 | By Branch P&L | 31,500 |

To Bank Advertisement 2,400 Salaries 18,600 Rent 3,600 | 24,600 |

|

|

To Petty Expenses (600-300) | 300 |

|

|

|

|

|

|

TOTAL | 31,500 | TOTAL | 31,500 |

Dr. BRANCH PROFIT & LOSS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Expenses | 31,500 | By Branch Stock | 59,700 |

To General P&L (Bal Fig) | 28,200 |

|

|

TOTAL | 59,700 | TOTAL | 59,700 |

Q.5 (AT COST)

The following are the details of ‘Indore Branch’ for the year 2018

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

Opening stock | 6,000 | Salaries | 2,000 |

Opening Petty Cash | 500 | Rent | 1,500 |

Opening Debtors | 8,000 | Closing Stock | 8,000 |

Goods sent to Branch | 24,000 | Cash sent to Branch | 2,200 |

Goods returned by Branch | 800 | Discount Allowed | 100 |

Remittance from Branch | 33,500 | Bad Debts | 150 |

Returns from Debtors | 2,000 | Commission Paid | 750 |

Collection from Debtors | 34,000 | Closing Petty Cash | 450 |

Cash Sales | 1,500 | Closing Debtors | 9,000 |

Prepare: (1) Branch Stock A/c (2) Branch Debtors A/c (3) Branch Expenses A/c

(4) Branch P&L A/c (5) Branch Cash (6) Goods sent to Branch A/c

SOLUTION: -

Dr. BRANCH STOCK A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 6,000 | By Branch Cash (Cash Sales) | 1,500 |

To Goods sent to sent Branch | 24,000 | By Goods sent to Branch | 800 |

To Branch Debtors(Return Inwards) | 2,000 | By Branch Debtors(Credit Sales) | 37,250 |

To Branch P&L (Transfer) | 15,550 | By Balance c/d | 8,000 |

TOTAL | 47,550 | TOTAL | 47,550 |

Dr. BRANCH DEBTORS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 8,000 | By Branch Cash (Received from Debtors) | 34,000 |

To Branch Stock (Credit Sales) (Bal Fig) | 37,250 | Branch expenses Bad Debts 150 Discount 100 | 250 |

|

| By Branch Stock (Returns) | 2,000 |

|

| By Balance c/d | 9,000 |

TOTAL | 45,250 | TOTAL | 45,250 |

Dr. BRANCH CASH A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance (Petty Cash) | 500 | By Branch Expenses Salaries 2,000 Rent 1,500 Commission 750 | 4,250 |

To Bank (Remittance) | 2,200 | By Bank (Remittance from Branch) | 33,500 |

To Branch stock (Cash Sales) | 1,500 | By Balance (Petty Cash) | 450 |

To Branch Debtors (Received) | 34,000 |

|

|

|

|

|

|

TOTAL | 38,200 | TOTAL | 38,200 |

Dr. BRANCH EXPENSES A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Debtors | 6,600 | By Branch P&L | 31,500 |

To Bank Advertisement 2,400 Salaries 18,600 Rent 3,600

| 24,600 |

|

|

To Petty Expenses (600-300) | 300 |

|

|

|

|

|

|

TOTAL | 31,500 | TOTAL | 31,500 |

Dr. BRANCH EXPENSES A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Debtors | 250 | By Branch P&L (Balance Transferred) | 4,500 |

To Branch Cash | 4,250 |

|

|

|

|

|

|

|

|

|

|

TOTAL | 4,500 | TOTAL | 4,500 |

Dr. GOODS SENT TO BRANCH A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Stock | 800 | By Branch Stock | 24,000 |

To Purchase | 23,200 |

|

|

|

|

|

|

|

|

|

|

TOTAL | 24,000 | TOTAL | 24,000 |

Dr. BRANCH PROFIT & LOSS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Expenses | 4,500 | By Branch Stock (Gross Profit) | 15,550 |

To General P&L (Bal Fig) | 11,050 |

|

|

TOTAL | 15,550 | TOTAL | 15,550 |

Q.6 Mumbai Textile Mills Ltd. Has branch at Agra. Goods are invoiced to branch at cost plus 50%. Branch remits all cash received to the head office and all expenses are met by head office. From the following particulars, prepare the necessary accounts under the Stock and Debtors system to Show the Profit Earned at the Branch:

PARTICULARS | AMOUNT |

Stock on the 1st April,2013 (Invoice Price) | 93,000 |

Debtors on 1st April,2013 | 68,000 |

Goods Invoiced to Branch (Cost) | 3,40,000 |

Sales at Branch: |

|

Cash | 2,50,100 |

Credit | 3,10,000 |

Cash Collected from Debtors | 3,04,000 |

Goods Returned by Debtors | 12,000 |

Goods Returned by Branch to head office | 1,500 |

Shortage of Stock | 4,500 |

Discount Allowed to Customer | 2,000 |

Expenses at Branch | 54,000 |

SOLUTION: -

Dr. BRANCH STOCK A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 93,000 | By Branch Cash (Cash Sales) | 2,50,100 |

To Goods sent to sent Branch (3,40,000 X 150%) | 5,10,000 | By Branch Debtors(Credit Sales) | 3,10,000 |

To Branch Debtors | 12,000 | By Goods sent to Branch | 1,500 |

|

| By Branch Adjustment (Shortage) | 4,500 |

|

| By Balance c/d | 48,900 |

TOTAL | 6,15,000 | TOTAL | 6,15,000 |

Dr. BRANCH ADJUSTMENT A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Stock(Shortage) | 4,500 | By Stock Reserve(Loading on Opening Stock) | 31,000 |

To Goods Sent to Branch | 500 | By Goods Sent to Branch | 1,70,000 |

To Gross Profit c/d | 1,79,700 |

|

|

To Stock Reserve(Loading on Closing Stock) | 16,300 |

|

|

TOTAL | 2,01,000 | TOTAL | 2,01,000 |

Dr. BRANCH PROFIT & LOSS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Expenses | 54,000 | By Branch Stock (Gross Profit) | 1,79,700 |

To Discount | 2,000 |

|

|

To General P&L (Bal Fig) | 1,23,700 |

|

|

TOTAL | 1,79,700 | TOTAL | 1,79,700 |

Dr. GOODS SENT TO BRANCH A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Stock | 1,500 | By Branch Stock | 5,10,000 |

To Branch Adjustment | 1,70,000 | By Branch Adjustment | 500 |

To Trading A/c(Bal Fig) | 3,39,000 |

|

|

|

|

|

|

TOTAL | 5,10,500 | TOTAL | 5,10,500 |

Dr. BRANCH DEBTORS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 68,000 | By Branch Cash (Received from Debtors) | 3,04,000 |

|

| By Branch expenses (Discount) | 2,000 |

To Branch Stock (Credit Sales) | 3,10,000 | By Branch Stock (Returns) | 12,000 |

|

| By Balance c/d | 60,000 |

TOTAL | 3,78,000 | TOTAL | 3,78,000 |

Dr. BRANCH CASH A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Sales | 2,50,100 | By Head Office Cash | 5,54,100 |

To Debtors | 3,04,000 | (Sent to HO) |

|

TOTAL | 5,54,100 | TOTAL | 5,54,100 |

Q.7. A Ltd. has a branch in Calcutta. Goods are invoiced at cost plus 25%. | |

Opening Balance | 2002 |

Stock | 3,200 |

Debtors | 1,300 |

Goods sent to Branch (Invoice price) | 75,000 |

Sales at Calcutta |

|

Cash Sales | 32,000 |

Credit Sales | 38,000 |

Cash collected from Debtors | 33,400 |

Discount allowed | 400 |

Bad Debts written off | 250 |

Cash sent to Branch for expenses | 5,500 |

Stock at end | 7,900 |

SOLUTION: -

BRANCH STOCK A/C | |||

To Balance b/d | 3,200 | To Cash Sales | 32,000 |

To Goods Sent to Branch A/c |

| By Branch Debtors | 38,000 |

| 75,000 | By Branch Adjustment A/c | 300 |

|

| By Balance c/d | 7,900 |

| 78,200 |

| 78,200 |

GOODS SENT TO BRANCH A/C | |||

To br. Adjustment A/c (loading) | 15,000 | By Br. Stock A/c | 75,000 |

To Trading A/c (Transfer) | 60,000 |

|

|

| 75,000 |

| 75,000 |

BRANCH STOCK RESERVE A/C

To Br. Adjustment A/c | 640 | By Balance b/d | 640 | |||

To balance c/d | 1,580 | By Branch Adj. A/c | 1,580 | |||

| 2,220 |

| 2,220 | |||

BRANCH DEBTORS A/C | ||||||

To Balance b/d | 1,300 | By Cash | 33,400 | |||

To Branch Stock (Cr. Sales) | 38,000 | By Branch Exp. A/c |

| |||

|

| Discount | 400 |

| ||

|

| Bad Debts | 250 | 650 | ||

|

| By Bal. c/d | 5,250 | |||

| 39,300 |

| 39,300 | |||

BRANCH ADJUSTMENT A/C | ||||||

To Branch Stock Reserve |

|

| ||||

(closing stock) A/c | 1,580 | By Stock Reserve (opening stock) | 640 | |||

To br. Stock A/c (shortage) | 300 |

|

| |||

To Br. Exp. A/c | 7,150 | By Goods sent to br. A/c | 15,000 | |||

To P & L A/c | 6,610 |

|

| |||

| 15,640 |

| 15,640 | |||

BRANCH EXPENSES A/C | ||||||

To Cash | 6,500 | By Branch Adjustment A/c | 7,150 | |||

To branch Dr. s A/c |

|

|

| |||

| Discount | 400 |

|

|

| |

| Bad Debts | 250 | 650 |

|

| |

| 7,150 |

| 7,150 | |||

Independent branches: concept-accounting treatment: important adjustment entries and preparation of consolidated profit and loss account and balance sheet.

Steps to maintain an independent branch account

The independent branch, like the headquarters, keeps all records individually and independently in the double-entry bookkeeping system. Dependents have little power, rely on headquarters for supplies and expenses, and are like a minor son.

An independent branch is a branch that purchases from outside, receives goods from the head office, supplies the goods to the head office, and fixes the selling price on its own. Therefore, an independent branch enjoys considerable freedom like an American son.

Features of independent branches:

1. The Independent Branch holds a complete set of books. Such branches receive goods from headquarters and external parties. I have my own bank account. Therefore, the branch maintains an accounting frill system.

2. Create your own trial balance, transaction and income statement and balance sheet. A copy of these statements is sent to headquarters for inclusion in the headquarters books.

3. The books contain accounts called "head office accounts" or "head office checking accounts". This account will be credited with everything received from headquarters and debited with everything sent to headquarters. That is, all transactions related to headquarters are recorded in this account. Therefore, the checking account at the head office is the account of the sole proprietor (that is, the capital account).

Despite their independence, branches cannot function without resources, and resources are provided by headquarters, especially in the early stages. Therefore, the investment by the headquarters from the perspective of the headquarters account is essentially a personal account.

Similarly, the head office opens a "branch checking" account on the books. It is also the executive account between the branch and the headquarters, which includes all transactions between the branch and the headquarters.

The feature is that the head office current balance of the branch books and the branch current balance of the head office books are mutually maintained.

The balance of these accounts on any date is equal to the difference between the assets and liabilities of the branch on that day. The branch recurring balance of the head office book and the head office recurring balance of the branch book show the same but opposite balances on a particular date.

4. There may be inter-branch transactions. That is, goods are transferred from one branch to another at the same headquarters. We'll talk about such entries later.

5. When the head office receives the account and statement, the head office checks the balance. The balance is displayed in the head office accounts in the branch books and in the branch accounts in the head office books. The difference will be adjusted. This is treated individually.

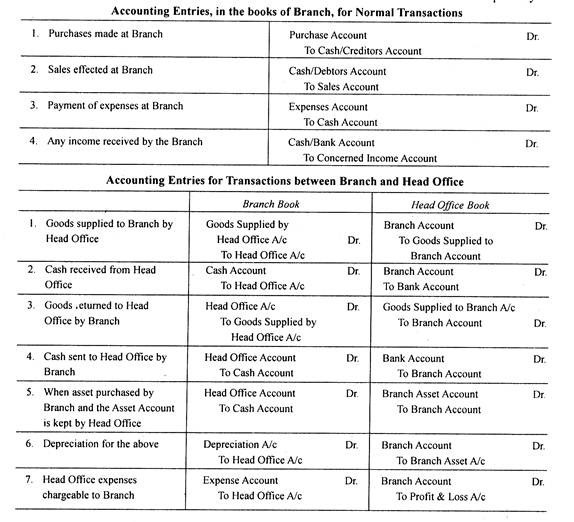

Accounting journals for regular transactions

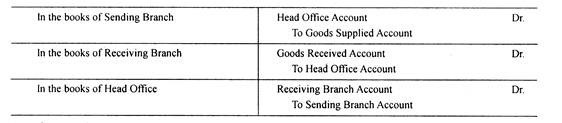

Inter-branch transactions:

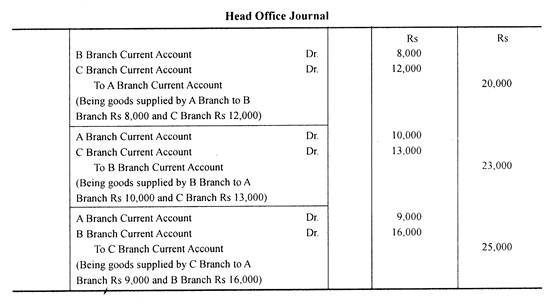

If the head office has multiple branches, transactions may take place between them, and such transactions are called inter-branch transactions. A branch does not need to have an account at another branch. Inter-branch transactions are treated as transactions with the head office.

The entries are:

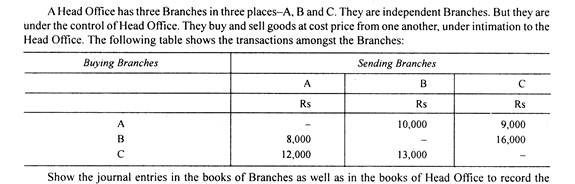

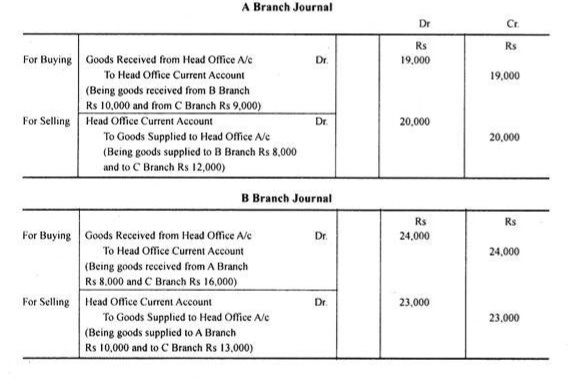

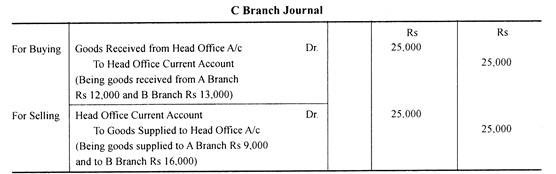

Example

Solution:

Items in transit:

Generally, the balance of the branch's checking in the head office's books is the same as the balance of the head's checking in the branch's books. The balances of these current accounts must be the same, but on the opposite side of both books.

The difference occurs in the following situations:

1. If the branch sends goods or cash to the head office, the branch will enter it in the head office account. However, the same is recorded in the headquarters books only upon receipt of goods or cash. For example, goods or cash sent by a branch just before the end of a fiscal year may not reach headquarters in the same fiscal year.

Therefore, the branch accounts are not credited in the head office books, but the head office accounts are debited in the branch books at the same time. Therefore, there is a difference between the two books.

2. Similarly, the head office may send cash or goods to the branch office. When you submit them, the branch checking account will be debited to the headquarters books. If the item is not received by the branch book, the corresponding entry will not be passed to the branch book.

In this way, goods or cash sent from the head office to the branch office or from the branch office to the head office and not received by the recipient are called in transit.

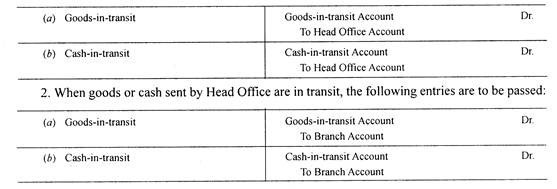

1. If the goods or cash sent by the branch is in transit, the following entry will be passed.

Goods or cash sent from the branch are in transit

The above entries will remain on the books for a short period of time or until the cash or goods in transit arrive. If the recipient receives the goods or cash in transit, the shipping account will be closed because you need to cancel the entry.

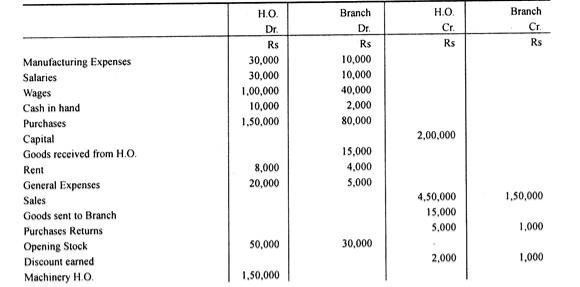

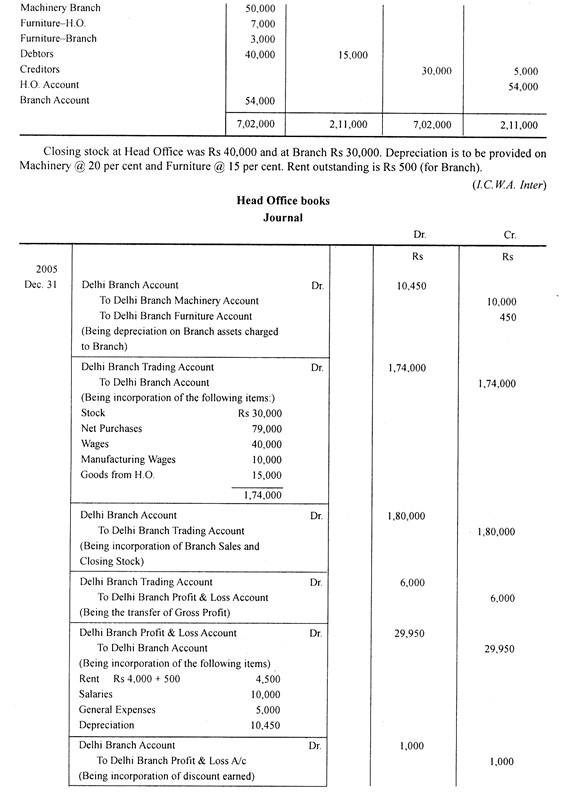

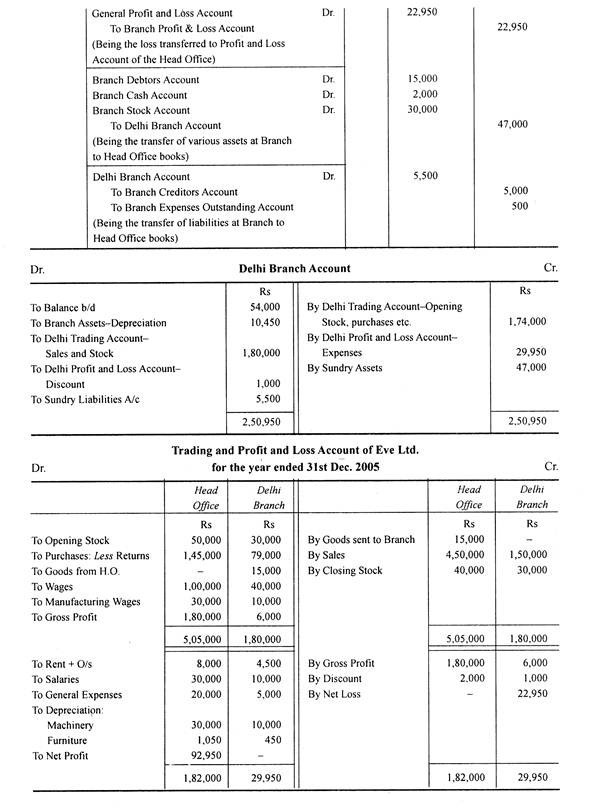

Incorporation of branch trial balances into head office books:

If a branch is dependent, it is relatively easy to incorporate the branch results because the accounting for such a branch is done at the headquarters itself. Profit is transferred from the branch account under the debtor system or the branch adjustment account under the stock debtor system to the general profit and loss account. An independent branch with its own accounting system creates a trial balance and sends a copy to the headquarters.

After receiving the trial balance from the branch, the head office passes a built-in entry to prepare the balance sheet combined with the branch's transactions and income statement. With the help of the branch trial balance, the head office records in a book about the branch. This process is known as the integration of branch trial balances.

There are two ways:

The item is divided into two parts.

After passing the above six journals, Headquarters creates branch transactions and P & L accounts.

Closing entries if head office wants

Items related to the balance sheet

After passing all eight of these entries, the total debit of the branch accounts equals the total of the crediting branch accounts, so the branch accounts in the head office books are automatically balanced. That is, if branch assets and liabilities are included, the branch accounts in the head office books created and incorporated after adjustment do not leave a balance.

If the assets and liabilities of the branch are not included, the branch accounts in the head office books created by the above method will leave a closing balance equal to the net assets (assets minus liabilities) as of the closing date.

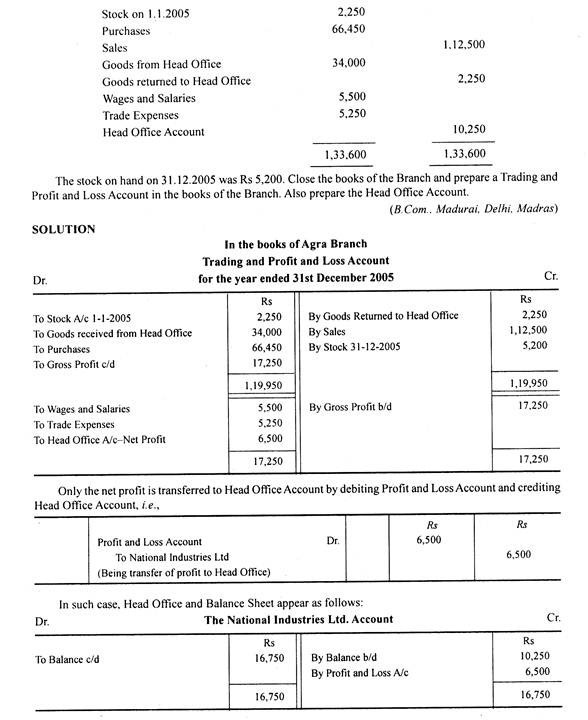

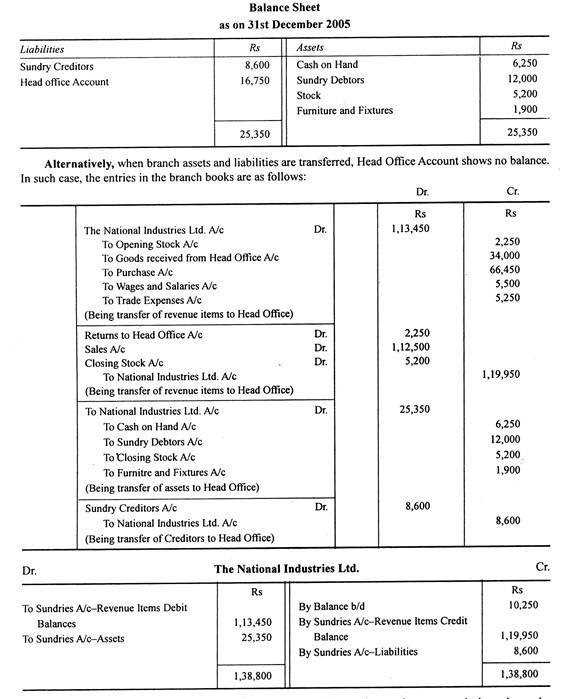

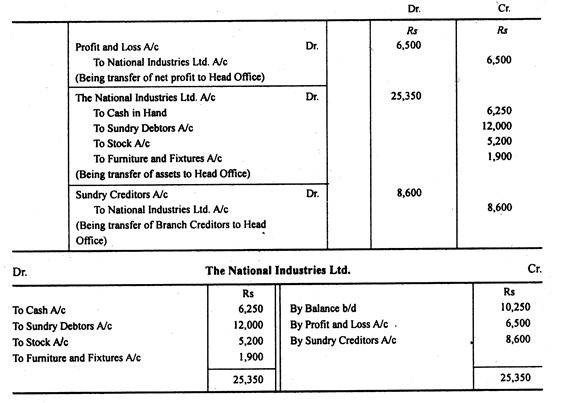

2. Incorporation of branch net income / loss, liabilities and assets:

Instead of transferring all items, the branch can create transactions and profit and loss accounts and transfer only net income or net loss to headquarters with or without assets and liabilities.

If assets and liabilities are transferred, the headquarters will not leave a balance. However, if assets and liabilities are not transferred, the head office account will have a balance equal to net worth. However, at the time the consolidated balance sheet was created, this account was replaced by branch assets and liabilities.

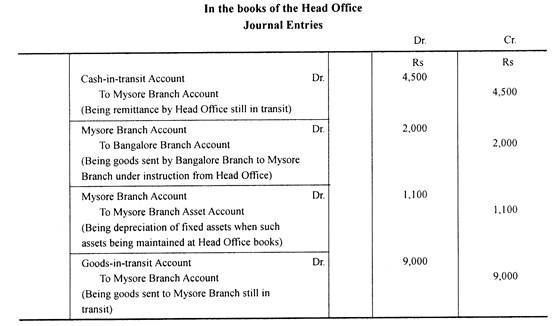

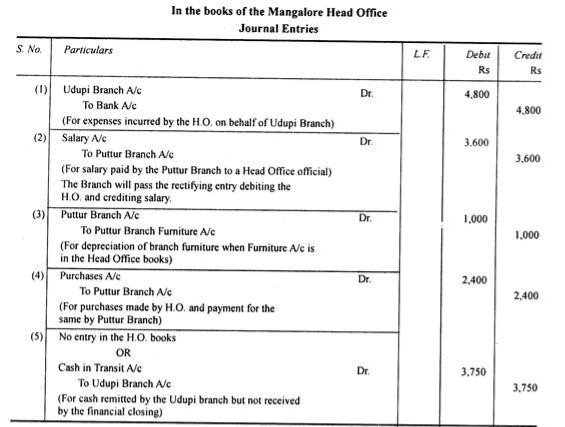

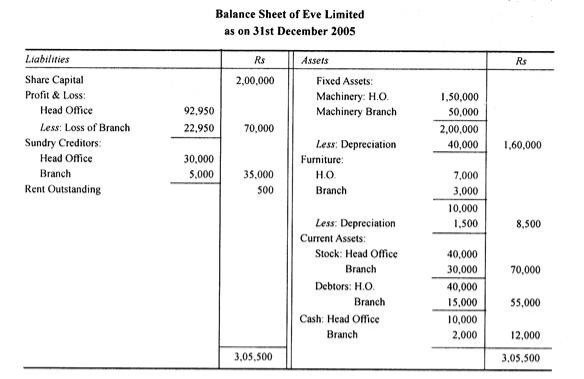

Example:

The Chennai company has two branches in Mysore and Bangalore. Headquarters and branches will close their books on December 31st.