Unit 3

Foreign Trade Policies

Free trade policy of a country does not discriminate against import and export. The economy following free trade policy does not impose any tariff on imported products or exported items. It involves complete absence of tariffs, quotas, exchange restrictions, taxes and subsidies of production among the member countries. Economist Adam Smith argued for free trade policy in his theory Comparative advantage theory of international trade. It created lower trade barrier among the member countries and promotes free movement of factors of production and goods.

It is considered as beneficial because-

Free trade policy is also disadvantageous because-

Protective trade policy refers to impositions of restrictions on import to protect the domestic industries. Such policies are usually implemented with the goal to improve economic activity within a domestic economy but can also be implemented for safety or quality concerns. It consist of the following methods-

Advantages of protective trade policy

Disadvantages of protective trade policy

Difference between free trade and protective trade policy

Basis of difference | Free trade policy | Protective trade policy |

1.objective | Its objective is to encourage trade among the member countries. | Its objective is to protect domestic industries from foreign competition. |

2.Tariff | It involves complete absence of tariffs, quotas, exchange restrictions, taxes and subsidies of production among the member countries. | It involves imposition of tariff, quotas, exchange restrictions, subsidies etc. |

3. choice to consumers | It provides wide choices of products and services to consumers. | It provides limited choices of products and services to consumers. |

4.Movement of factors of production | It allows free movement of factors of production among the member countries. | It restricts free movement of factors of production. |

5.BOP | It may cause deficit in BOP of a country. | It may cause surplus in BOP of a country. |

6. Revenue to government | It does not provide revenue to government. | It provides revenue to government. |

7. Hike in price | It provides goods and services to consumers at competitive price. | It provides goods and services to consumers at higher prices. |

8. Competition. | There is huge competition in the market. | There is no competition in the market. |

Key takeaways

India is a member of World Trade Organisation and is a trading partner with the other member countries of WTO. India singed different bilateral and multilateral trade agreement with different countries of the world to promote trade and investment among them. The Major trading partners of India with export/import share in per cent are highlighted in the table 1 below-

Table 1: Major Import and Export partner

Sl. No. | Name of the country | Import Partner in share (%) | Export partner in share (%) |

1. | China | 14.63 | 5.08 |

2. | United States | 6.30 | 16.02 |

3. | Saudi Arabia | 5.56 | 1.70 |

4. | UAE | 5.20 | 8.85 |

5. | Iraq | 4.60 | 0.57 |

6. | Indonesia | 3.18 | 1.49 |

7. | Japan | 2.46 | 1.47 |

8. | Qatar | 2.07 | 0.52 |

9. | Korea Rep. | 3.18 | 1.49 |

10. | Hong Kong | 3.03 | 4.07 |

11. | Iran | 2.93 | 0.88 |

12. | Switzerland | 3.54 | 0.38 |

13. | Nepal | 0.08 | 2.26 |

14. | Sri Lanka | 0.25 | 1.45 |

15. | Bangladesh | 0.17 | 2.71 |

16. | Germany | 2,74 | 2.78 |

17. | UK | 1.38 | 3.02 |

18. | Malaysia | 2.08 | 2.03 |

19. | Australia | 2.83 | 1.16 |

20. | Singapore | 2.73 | 3.24 |

Source: World Integrated Trade Solution Report, 2018.

Key takeaways

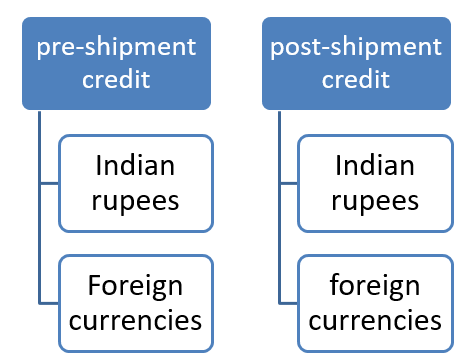

Financing of foreign trade implies facilitating traders engaged in foreign trade in receipt and payment of money in convenient currency. Commercial banks involves in the practice of financing the foreign trade. Reserve Bank of India provides, Export Import Bank provides refinance to the banks for financing foreign trade. Guarantees issued by Export Credit Guarantee Corporation of India facilitate the task of financing the foreign trade. The export credit provided by commercial banks broadly divided into two parts, i.e. pre-shipment credit and post shipment credit. The classification is showed in figure 1-

Figure 1: Classification of Export Credit

a) Pre-shipment credit: It means any loan or advance or any other credit provided by a bank to an exporter for financing the purchase, processing, manufacturing or packing of goods prior to shipment. It meets working capital needs of an exporter at the pre-shipment stage. Banks provide pre-shipment credit after taking into consideration all factors relevant for granting credit. But the basis of granting such credit is:

(i) A letter of credit opened by the importer in favour of the exporter, or

ii) A confirmed and irrevocable order for the export of goods from India, or any other evidence of such an order.

b) Post-shipment credit: It means any loan or advance granted or any other credit provided by a bank to an exporter of goods from India after the shipment of goods to the realization of the export proceeds. Such credit arises after the exporter has shipped the goods and has secured the shipping documents, such as bill of lading, etc. Now, the concern of the exporter is to realize his dues from the foreign importer. This is invariably done by drawing a bill of exchange on the importer. The bill may be drawn either on Documents against Acceptance (D/A) basis or on Documents against Payment (D/P) basis. Exporter's bank provides post-shipment advance to the exporter in either of the two ways, viz,

(i) By purchasing, discounting or negotiating the export bills,

(ii) By granting advance against bills for collections.

Export Credit in Foreign Currency

Reserve Bank of India has permitted the authorized dealers in foreign exchange to extend export credit in foreign currencies viz, U.S dollars, pound sterling, Japanese Yen, Euro, etc.

a) Pre-shipment export credit in foreign currency: Pre-shipment Credit in foreign currency is granted to exporters for purchasing domestic and imported inputs for goods to be exported. Banks are permitted to extend pre-shipment credit in one convertible currency in respect of an export order while invoice is prepared in another convertible currency. The risk and cost of cross-currency transaction will be borne by the exporter. Banks may grant pre-shipment credit in foreign currency from the funds raised from the following sources:

(i) Foreign Currency Balances: It is available with the banks in different types of accounts, viz. Exchange Earners Foreign Currency Accounts, Resident Foreign Currency Accounts, Foreign Currency (Non-Resident) Accounts, and Exporters Foreign Currency Accounts.

(ii) Foreign Currency lines of Credit: Banks may arrange lines of credit with overseas banks for this purpose, provided the rate of interest on such borrowings does not exceed 0.75% over six months LIBOR/EURO. If it exceeds this limit, approval from Reserve Bank of India is required.

Pre-shipment credit in Foreign Currency is initially granted for a maximum period of 180 days which may be extended further but an additional interest of 2% is charged.

b) Post-shipment Export Credit in Foreign Currency: Banks having discounted the export bills drawn in foreign currencies are allowed to re-discount such bills abroad at rates linked to international interest rates at post-shipment stage. The exporters can also arrange themselves a line of credit with an overseas bank or any other agency for discounting their export bills directly. Bills are to be rediscounted through the bank from whom pre-shipment credit facility has been availed of. The above scheme covers mainly export bills with usance period upto 180 days from the date of shipment including normal transit period and grace period. Sources of funds for post-shipment export credit are the same as are in case of pre-shipment export credit in foreign currency.

Letter of credit in financing foreign trade

A Letter of Credit is defined as a letter issued by the banker of the buyer at request of buyer in favour of the seller (exporter) informing him that the issuing banker undertakes to accept the bills drawn in respect of exports made to the buyer specified therein. The importer at whose request the L/C is issued is called the applicant, the exporter is called the beneficiary and the banker issuing it is called the issuing banker.

The different types of Letters of Credit are described below:

1). Documentary Letter of Credit and Clean Letter of Credit: When the L/C contains a clause that documents of title to goods, such as bill of lading, insurance policy, invoice, consular invoice, certificate of origin, etc, must be attached with the bill of exchange drawn under L/C, it is called a documentary L/C. In the absence of such a clause, it is called a clean letter of credit.

2). Fixed Credit and Revolving Credit: In case of fixed credit, the L/C specifies the amount upto which one or more bills may be drawn by the beneficiary within the specified period of time. But in case of revolving credit, the L/C specifies the total amount upto which bills drawn may remain outstanding at a time. As soon as a bill is paid by the importer, another bill may be drawn by the exporter on the importer under the same L/C.

3). Revocable and Irrevocable Letter of Credit: When the opening banker reserves to itself the right to cancel or modify the credit at any time without prior notice to the beneficiary, it is called revocable L/C. When a L/C cannot be revoked or cancelled as above it is an irrevocable L/C and provides unconditional undertaking to the exporter.

4). Confirmed and Unconfirmed L/C: When the issuing banker requests the advising bank (i.e. the banker in exporter's country), to add its own confirmation, also to an irrevocable credit and the latter does so, it is called irrevocable and Confirmed L/C. After confirmation the advising banker is called confirming banker and takes upon itself the task of negotiating the export bills without recourse to the drawer.

5). With and without Recourse Credits: In case of With Recourse' bills the banker, as the holder of the bill, can recover obligation. The negotiating banker should, therefore, take precautions in case the drawee of the bill fails to honour it. On the other hand, in case of Without Recourse credit the issuing banker will have recourse to the drawee only. If he fails to pay, banker can realize by disposing off the goods.

Key takeaways

EXIM Bank (Export and Import Bank)

Export-Import Bank of India (EXIM BANK) was established by an Act of Parliament on January 1, 1982 with objective to extend financing, facilitating and promoting the foreign trade of India. It is also allowed to finance export of consultancy and related services, assist joint venture in third world countries, and finance export-oriented industries. Besides the finance function, EXIM Bank also renders a diverse range of information, advisory and support services to exporters. The functions of the EXIM bank thus broadly fall in the following three categories:

1) Export Financing: It extend export finance under the lending programmes for the purpose of Indian Exporters, Commercial Banks and Overseas Entities. The export financing activities of commercial banks are

a) Pre-shipment credit is provided to Indian exporters to enable there to buy raw materials and other inputs for export contracts.

b) Foreign Currency Pre-shipment credit is provided in foreign currency to the exporters to enable them to import raw materials and other inputs needed for export production.

c) Export (Supplier's) Credit is extended for periods exceeding six months to exporters to enable them to extend term credit to overseas importers of eligible Indian goods.

d) Finance for consultancy and Technology Services are provided as a special credit facility to Indian exporters of consultancy and technology services, so that they can, in turn, extend term credit to overseas importers. The services covered include providing personnel for rendering technical services, transfer of technology/know-how preparations of project feasibility reports etc.

e) Finance for Project Export Contracts facilitates Indian project exporters to incur rupee expenditure while executing overseas project export contracts. EXIM Bank helps them in meeting these expenses.

2) Services to Exporters: EXIM Bank renders the following important services to the exporters:

a) It enables Indian companies to provide requisite guarantees to facilitate execution of export contracts and import transactions.

b) It acts as a facilitator for the Indian exporter in availing the services of an overseas forfaiting agency.

c) It provides refinance/re-discounting facilities to commercial banks in India such sa-

3) Facilities for Overseas Entities: The EXIM Bank facilitates to overseas buyers and financial institutions-

a) To avail of Buyer's Credit from EXIM Bank to import eligible goods from India on deferred payment terms.

b) It grants credit to Overseas Financial Institutions, Foreign Governments and their Agencies to enable them to lend term loans to finance import of eligible goods from India.

ECGC (Export Credit and Guarantee Corporation)

Export Credit Guarantee Corporation (ECGC), a company wholly owned by the Government of India established with objective to help exporters to obtain finance from commercial banks. This objective is achieved by

a) Issuing insurance policies to the exporters to cover their commercial and political risks in respect of the goods exported by them, and

b) Issuing financial guarantees to banks to cover the risks involved in providing credit to exporters.

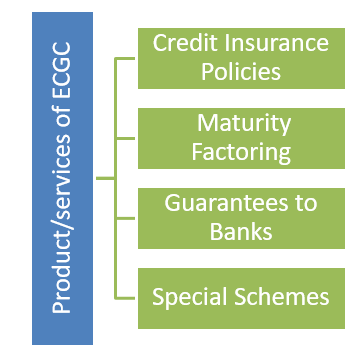

The products and services offered by ECGC are broadly classified as under:

Figure 2: Classification of products and services of ECGC

a) Credit Insurance Policies: Some of the important credit insurance policies are discussed below:

i) Standard Policy: This policy covers the risks in respect of goods exported on short term credit i.e. credit not exceeding 180 days. This policy covers both commercial and political risks from the date of shipment. It is issued to those exporters whose estimated export turnover is more than Rs.50 lakh during the next 12 months.

ii) Small Exporter's Policy: Small exporters are those whose anticipated export turnover during the next 12 months does not exceed Rs.50 lakhs. These policies are issued for a period of 12 months (as against 24 months in case of standard policies). In case of these policies ECGC pays the claims to the extent of 95 per cent in case of commercial risks and upto 100 per cent in case of political risks.

2. Maturity Factoring: This scheme is designed by ECGC has certain unique features and does not exactly fit into the conventional mould of maturity factoring. The changes devised are intended to give the clients the benefits of full factoring services through the Maturity Factoring scheme, thus effectively addressing the needs of exporters to avail of pre-finance (advance) on the receivables, for their working capital requirements.

3. Guarantees to banks: ECGC issues the following types of financial guarantees to the banks:

a) Packing Credit Guarantee: It is issued for a period of 12 months and covers all advances made by the bank to an exporter within an approved limit during the period. ECGC reimburses the bank to the extent of 66.6% of its loss, if the entire amount due from the exporter is not recovered within a period of 4 months from the due date of repayment.

b) Export Production Finance Guarantee: This guarantee is also issued in respect of packing credit granted by banks. It enables the banks to sanction advances to the full extent of cost of production if it exceeds the F.O.B value of the export order.

c) Post-shipment Export Credit Guarantee: Post-shipment finance given to exporters by way of purchase, negotiation or discount of export bills or advances against such bills is eligible for this guarantee. The exporter is required to hold a suitable policy of ECGC to cover the overseas credit risks.

d) Export Finance Guarantee: This guarantee is issued to cover post-shipment advances granted by banks to exporters against export incentives receivable in the form of cash assistance, duty drawbacks, etc. Thus this guarantee is issued when bank provides finance equal to the difference between the export value and the domestic price; such difference is receivable by the exporter from the Government.

e) Export Finance (Overseas Lending) Guarantee: This guarantee is issued if a bank finances an overseas project and provides a foreign currency loan to the contractor. It covers the risk of non-payment by the contractor. The premium rates are similar to those prescribed for the performance guarantee. Premium is payable in Indian rupees and so is the case with the claims.

4. Special Schemes: It provides following benefits-

i) Transfer Guarantee: It is issued to an Indian bank which adds its confirmation to a foreign Letter of Credit in favour of Indian exporter. Such banker, called confirming banker, may suffer loss due to the insolvency or default of the opening banker or due to certain political risks or transfer delays or moratorium on payments.

ii) Overseas Investment Insurance: Under this scheme, protection is granted to investment made abroad by way of equity capital or untied loans for the purpose of setting up or expansion of overseas projects. It covers both investments made in cash or by way of export of capital goods and services from India.

iii) Exchange Fluctuation Risk Cover: This cover is available for payments scheduled over a period of 12 months or more and upto 15 years. Cover can be obtained from the date of bidding and right upto the final instalment. Under this cover, ECGC covers the risks to the exporters on account of fluctuations in the exchange rate.

Key takeaways

The State Trading Corporation of India Ltd. (STC) was set up in 1956 and is a premier International trading company of the Government of India, and, was engaged primarily in exports, and imports operations. The Corporation is registered as an autonomous company under the Companies Act, 1956 and functions under the administrative control of the Ministry of Commerce & Industry, Govt. of India. In the pre-liberalisation era, it acted as an arm of the Government of India not only to regulate foreign trade but also for intervention in the domestic market. The Corporation handled canalized exports and imports of large number of items varying from chemicals and drugs to bulk commodities such as edible oils, cement, sugar, newsprint, wheat, urea, etc. thereby ensuring timely availability and equitable distribution of mass consumption items as well as essential raw materials for the industry. Canalisation also helped the nation to benefit from economies of scale and keeping a close watch on the scarce foreign exchange. It undertook price support operations to ensure remunerative prices to growers for their crops such as raw jute, shellac, tobacco, rubber and vanilla as and when called upon by the Government to do so.

The organisational Structure of STC consist of The Board of Directors of STC that comprises of

The Corporate office of the Corporation at New Delhi and has one branch office in Agra, India.

Key takeaways

Minerals and Metals Trading Corporation (MMTC) was established in 1963 which is one of the two highest foreign exchange earners for India. It is major global player in the minerals trade and is the single largest exporter of minerals from India. It imported non–ferrous metals viz. copper, aluminium, zinc, lead, tin and nickel other minor metals like magnesium, antimony, silicon and mercury, as also industrial raw materials like asbestos and also steel and its products. With its comprehensive infrastructural expertise to handle minerals, the company provides full logistic support from procurement, quality control to guaranteed timely deliveries of minerals from different ports, through a wide network of regional and port offices in India, as well as international subsidiary.

It is the largest importer of gold and silver in the Indian sub–continent also supplies gold on loan and outright basis to exporters, bullion dealers and jewellery manufacturers on all India. MMTC has retail jewellery and its own branded 'Sterling Silverware' (Sanchi) showrooms in all the major metro cities of India. It also supplies branded hallmarked gold and studded jewellery. Besides organizing major jewellery exhibitions in India and abroad, the company also has a medallion manufacturing unit for minting of gold/ silver medallions. MMTC is amongst the leading Indian exporters and importers of agro products. The company's bulk exports include commodities such as rice, wheat, wheat flour, soyameal, pulses, sugar, processed foods and plantation products like tea, coffee, jute, etc. It also undertakes extensive operations in oilseed extraction, from the procurement of seeds to the production of de–oiled cakes for export, as well as the production of edible oil for domestic consumption and imports edible oils. Its comprehensive infrastructure for bulk cargo handling, with well–developed arrangements for rail and road transportation, warehousing, port and shipping, operations, gives MMTC complete control over trade logistics, both for exports and imports.

The company's countrywide domestic network is spread over 75 regional, sub–regional, port and field offices, warehouses and procurement centres. To create synergy between its manufacturing, trading and technology partners and to bring optimum efficiency and expertise to its operations worldwide, MMTC has promoted along with government of Orissa, a million tonnes capacity iron and steel plant and a 0.8 million tonne capacity, coke oven battery with by product recovery plant and a captive power plant of 55 MW capacity. The company operates 13 regional offices located at Kolkata, Bhubaneswar, Mumbai, Goa, Ahmedabad, Delhi, Jhandewalan (Delhi), Jaipur and Bangalore, Bellary, Chennai, Hyderabad, Vizag. MMTC Ltd., Metals and Minerals Trading Corporation of India, is one of the two highest earners of foreign exchange for India and India's largest public sector trading body. MMTC's diverse trade activities cover Third Country Trade, Joint Ventures and Link Deals and all modern forms of international trading. The company has a vast international trade network, spanning almost in all countries in Asia, Europe, Africa, Oceania, and America and also includes a wholly owned international subsidiary in Singapore, MTPL. It is one of the Miniratnas companies.

Key takeaways

SEZ is a Policy announced for the very first time in 2000 in order to overcome the obstacles businesses faced. SEZ is defined as an Act to provide for the establishment, development and management of the Special Economic Zones for the promotion of exports and for matters connected therewith or incidental thereto. The Parliament passed the Special Economic Zones Act in 2005 and came into force along with the SEZ Rules in 2006. It is duty-free and has different business and commercial laws chiefly to encourage investment and create employment. Apart from generating employment opportunities and promoting investment, SEZs are created also to better administer these areas, thereby increasing the ease of doing business. In order to attract huge foreign investments into the country, the government announced the Policy.

The main objectives of the SEZ Act are:

The term special economic zone includes:

The incentives and facilities offered to the units in SEZs for attracting investments into the SEZs including foreign investment are:-

1) Duty free import/domestic procurement of goods for development, operation and maintenance of SEZ units.

2) 100% Income Tax exemption on export income for SEZ units under Section 10AA of the Income Tax Act for first 5 years, 50% for next 5 years thereafter and 50% of the ploughed back export profit for next 5 years. (Sunset Clause for Units will become effective from 01.04.2020)

3) Exemption from Minimum Alternate Tax (MAT) under section 115JB of the Income Tax Act. (withdrawn w.e.f. 1.4.2012)

4) Exemption from Central Sales Tax, Exemption from Service Tax and Exemption from State sales tax. These have now subsumed into GST and supplies to SEZs are zero rated under IGST Act, 2017.

5) Other levies as imposed by the respective State Governments.

6) Single window clearance for Central and State level approvals.

The major incentives and facilities available to SEZ developers include:-

1) Exemption from customs/excise duties for development of SEZs for authorized operations approved by the BOA.

2) Income Tax exemption on income derived from the business of development of the SEZ in a block of 10 years in 15 years under Section 80-IAB of the Income Tax Act. (Sunset Clause for Developers has become effective from 01.04.2017)

3) Exemption from Minimum Alternate Tax (MAT) under Section 115 JB of the Income Tax Act. (withdrawn w.e.f. 1.4.2012)

4) Exemption from Dividend Distribution Tax (DDT) under Section 115O of the Income Tax Act. (withdrawn w.e.f. 1.6.2011)

5) Exemption from Central Sales Tax (CST).

6) Exemption from Service Tax.

Key takeaways

Export processing zones (EPZs) are industrial estates that are fenced in for producing manufactured goods for export. Free Trade Zones (FTZ)/ Export Processing Zones (EPZs) have emerged as an effective instrument to boost export of manufactured products. The basic objectives of EPZs are to enhance foreign exchange earnings, develop export-oriented industries and to generate employment opportunities. The permissible item, cover almost all categories of goods required in connection with the production activity for export & include capital goods, raw materials, components, packing, consumables, spares etc. The government of India converted all the Export Processing Zones in the country to Special Economic Zones according to a new scheme in the EXIM Policy, 2000. EPZs in India are supported by world-class efficient and modern infrastructure, non-fiscal and fiscal concessions, and a business environment that is free from corruption. The first Zone was set up at Kandla (Gujarat) in 1965, followed by SEEPZ, Mumbai in 1972. Thereafter, four more Zones were set up at NOIDA (UP), FALTA (West Bengal), Cochin (Kerala), Chennai (Tamil Nadu) in 1984 and at Vishakapatnam (Andhra Pradesh) in 1989. In 1997, Surat Export Processing Zone came into existence. With the announcement of Special Economic Zone Scheme in year 2000, the four Export Processing Zones / FTZ, namely Kandla, SEEPZ, Cochin and Surat have been converted into Special Economic Zones with effect from 1-11-2000.

Each Zone provides basic infrastructural facilities like

The provisions of EXIM Policy regarding importability of goods, DTA sale, clearance of samples, sub-contracting, inter-unit transfer, repairs, re-conditioning and re-engineering, sale of unutilized material, deboning etc. for EOUs are applicable to EPZ units. The Development Commissioners appointed by the Ministry of Commerce monitor and coordinate the functioning of each Zone. To enable the EPZs to import/procure locally their requirement of raw materials, capital goods and office equipment etc. duty free, a number of Customs and Central Excise notifications have been issued by the Ministry of Finance. The various Features of Export Processing Zones are that they are

The various Export Processing Zones in India are:

Key takeaways

Government of India undertake export promotion schemes Foreign Trade Policy 2015-20 to boost India’s exports with the objective to offset infrastructural inefficiencies and associated costs involved to provide exporters a level playing field. Such measures are as under:

1) Merchandise Exports from India Scheme (MEIS): Under this scheme, exports of notified goods/ products to notified markets as listed in Appendix 3B of Handbook of Procedures are granted freely transferable duty credit scripts on realized freight on board (FOB) value of exports in free foreign exchange at specified rate. Such duty credit scripts can be used for payment of basic custom duties for import of inputs or goods. MEIS has since been withdrawn w.e.f. 1st January, 2021. A new Scheme called Remission of Duties and Taxes on Exported Products (RoDTEP) has been introduced which shall refund the embedded duties suffered in export goods.

2) Service Exports from India Scheme (SEIS): Service providers of notified services as per Appendix 3D are eligible for freely transferable duty credit scrip @ 5% of net foreign exchange earned.

3) Advance Authorization Scheme: Under this scheme, duty free import of inputs are allowed, that are physically incorporated in the export product (after making normal allowance for wastage) with minimum 15% value addition. Advance Authorization (AA) is issued for inputs in relation to resultant products as per SION or on the basis of self-declaration, as per procedures of FTP.

4) Advance Authorization for annual requirement: Exporters having past export performance (in at least preceding two financial years) shall be entitled for Advance Authorization for Annual requirement. This shall only be issued for items having SION.

5) Duty Free Import Authorization (DFIA) Scheme: DFIA is issued to allow duty free import of inputs, with a minimum value addition requirement of 20%. DFIA shall be exempted only from the payment of basic customs duty. DFIA shall be issued on post export basis for products for which SION has been notified.

6) Duty Drawback of Customs: Under this scheme products made out of duty paid inputs are first exported and thereafter refund of duty is claimed in two ways:

a) All Industry Rates: As per Schedule

b) Brand Rate : As per application on the basis of data/documents

7) Interest Equalisation Scheme (IES): The Government announced the Interest Equalisation Scheme @ 3% per annum for Pre and Post Shipment Rupee Export Credit with effect from 1st April, 2015 for 5 years available to all exports under 416 tariff lines and exports made by Micro, Small & Medium Enterprises (MSMEs) across all ITC(HS) codes.

8) Zero duty EPCG scheme: Under this scheme, import of capital goods at zero custom duty is allowed for producing quality goods and services to enhance India’s export competitiveness. Import under EPCG shall be subject to export obligation equivalent to six times of duty saved in six years. Scheme also allows indigenous sourcing of capital goods with 25% less export obligation.

9) Post Export EPCG Duty Credit Scrip Scheme: A Post Export EPCG Duty Credit Scrip Scheme shall be available for exporters who intend to import capital goods on full payment of applicable duty in cash.

10) EOU/EHTP/STP & BTP Schemes: Units undertaking to export their entire production of goods and services may be set up under this scheme for import/ procurement domestically without payment of duties. For details of the scheme and benefits available therein FTP may be required.

11) Towns of Export Excellence (TEE): Selected towns producing goods of Rs. 750 crores or more are notified as TEE on potential for growth in exports and provide financial assistance under MAI Scheme to recognized Associations.

12) Market Access Initiative (MAI) Scheme: Under the Scheme, financial assistance is provided for export promotion activities on focus country, focus product basis to EPCs, Industry & Trade Associations, etc. The activities are like market studies/surveys, setting up showroom/warehouse, participation in international trade fairs, publicity campaigns, brand promotion, reimbursement of registration charges for pharmaceuticals, testing charges for engineering products abroad, etc.

13) Status Holder Scheme: Upon achieving prescribed export performance, status recognition as one star Export House, two Star Export House, three star export houses, four star export houses and five star export houses is accorded to the eligible applicants as per their export performance. Such Status Holders are eligible for various non-fiscal privileges as prescribed in the Foreign Trade Policy.

14) Gold Card Scheme: The Gold Card Scheme was introduced by the RBI in the year 2004. The Scheme provides for a credit limit for three years, automatic renewal of credit limit, additional 20% limit to meet sudden need of exports on account of additional orders, priority in PCFC, lower charge schedule and fee structure in respect of services provided by Banks, relaxed norms for security and collateral etc.

Key takeaways

References