Unit – III

Public Finance

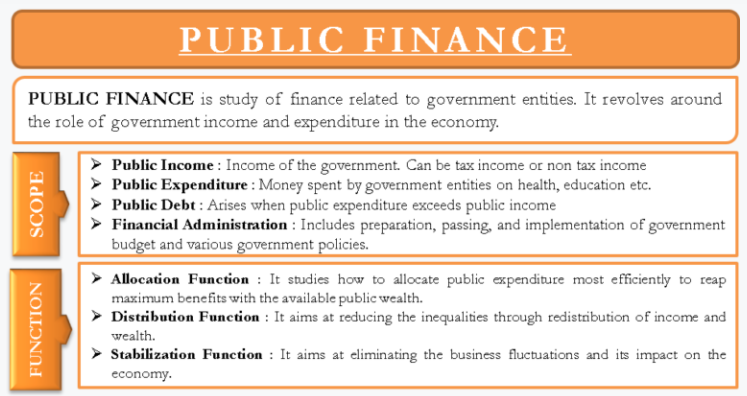

In simple layman terms, public finance is the study of finance related to government entities. It revolves around the role of government income and expenditure in the economy.

Prof. Dalton in his book Principles of Public Finance states that “Public Finance is concerned with income and expenditure of public authorities and with the adjustment of one to the other”

By this definition, we can understand that public finance deals with income and expenditure of government entity at any level be it central, state or local. However in the modern-day context, public finance has a wider scope – it studies the impact of government policies on the economy.

Let’s understand the scope of public finance to understand how public finance impacts the economy.

The scope of Public Finance

Prof. Dalton classifies the scope of public finance into four areas as follows –

Public Income:

As the name suggests, public income refers to the income of the government. The government earns income in two ways – tax income and non-tax income. Tax income is easy to recognize, it’s the tax paid by people of the country in the form of income tax, sales tax, duties, etc. On the other hand non-tax income includes interest income from lending money to other countries, rent & income from government properties, donations from world organizations, etc.

This area studies methods of taxation, revenue classification, methods of increasing government revenue and its impact on the economy as a whole, etc.

Public Expenditure:

Public expenditure is the money spent by government entities. Logically, the government is going to spend money on infrastructure, defense, education, healthcare, etc. for the growth and welfare of the country.

This area studies the objectives and classification of public expenditure, effects of expenditure in different areas, effects of public expenditure on various factors such as employment, production, growth, etc.

Public Debt:

When public expenditure exceeds public income, the gap is filled by borrowing money from the public, or from other countries or world organizations such as The World Bank. These borrowed funds are public debt.

This area of public finance explains the burden of public debt, why it is necessary and its effect on the economy. It also suggests methods to manage public debt.

Financial Administration:

As the name suggests this area of public finance is all about the administration of all public finance i.e. public income, public expenditure, and public debt. Financial administration includes preparation, passing, and implementation of government budget and various government policies. It also studies the policy impact on the social-economic environment, inter-governmental relationships, foreign relationships, etc.

Principle of Maximum Social Advantage:

The fiscal or budgetary operations of the state have manifold effects on the economy. The revenue collected by the state through taxation and the dispersal of public expenditures can have significant influence on the consumption, production and distribution of the national income of the country.

The fiscal operations of the government resolve themselves into a series of transfers of purchasing power from one section of the community to another, along with the variations in the total incomes available in the community. In fact, the fiscal activities of the state affect the allocation of resources, the use of resources from one channel to another, hence, the level of income, output and employment.

Hence, it is desirable that some standard or criterion should be laid down to judge the appropriateness of a particular operation of public finance — the government’s revenue and expenditures. In a modern welfare state, such a criterion can obviously be nothing else but the economic welfare of the people.

It follows, thus, that the particular financial activity of the state which leads to an increase in economic welfare is considered as desirable. It may be considered as undesirable if such an activity does not cause an increase in the welfare or even sometimes, it may be the cause of a reduction in the general economic welfare. The guiding principle of state policy has been technically desirable as the Principle of Maximum Social Advantage by Hugh Dalton.

According to Dalton, the principle of maximum social advantage is the most fundamental principle lying at the root of public finance. Hence, the best system of public finance is that which secures the maximum social advantage from its fiscal operations. Maximum social advantage is the maxim for the states. The optimum financial activities of a state should, therefore, be determined by the principle of maximum social advantage.

It is obvious that taxation by itself is a loss of utility to the people, while public expenditure by itself is a gain of utility to the community. When the state imposes taxes, some disutility or dissatisfaction is experienced in the society. This disutility is in the form of sacrifice involved in the payment of taxes — in parting with the purchasing power.

Similarly, when the state spends money, some utility is created in the society. Some satisfaction is experienced by a group of people in the society on whom, or for whom, the public expenditure is incurred by the state. This is the social benefit of welfare of the public expenditure.

As such, the maximum social advantage is achieved when the state in its financial activities maximise the surplus of social gain or utility (resulting from public expenditure) over the social sacrifice or disutility (involved in payment of taxes.) The principle of public finance, thus, requires the state to compare the sacrifice and benefits of the society in its fiscal operations.

The principle of maximum social advantage implies that public expenditure is subject to diminishing marginal social benefits and taxes are subject to increasing marginal social costs. Thus, an equilibrium is reached when social advantage is maximised, i.e., when the size of the budget is such that marginal social benefits of public expenditures are equal to the marginal social sacrifice of taxation.

Dalton states, “Public expenditure in every direction should be carried just so far, that the advantages to the community of a further small increase in any direction is just counter-balanced by the disadvantage of a corresponding small increase in taxation or in receipts from any other sources of public expenditure and public income.”

Thus, a rational state seeks to maximise the net social advantage of its fiscal operations. The social net advantage is maximum when the aggregate social benefits resulting from public expenditure is maximum and the aggregate social sacrifice involved in raising the public revenue is minimum. According to the principle of maximum social advantage, the public expenditure should be carried on up to the marginal social sacrifice of the last unit of rupee taxed.

Diagrammatic Representation:

In technical jargon, the maximum social net advantage is achieved when the marginal social sacrifice (disutility) of taxation and the marginal social benefit (utility) of public expenditure are equated. Thus, the point of equality between the marginal social benefit and the marginal social sacrifice is referred to as the point of aggregate maximum social advantage or least aggregate social sacrifice.

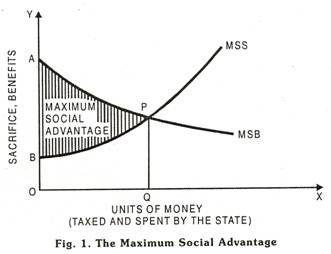

The equilibrium point of maximum social advantage may as well be illustrated by means of a diagram, as in Fig. 1.

The Maximum Social Advantage-

In Fig. 1, MSS is the marginal social sacrifice curve. It is an upward sloping curve implying that the social sacrifice per unit of taxation goes on increasing with every additional unit of money raised. MSB is the marginal social benefit curve. It is a downward sloping curve implying that the social benefits per unit diminishes as the public expenditure increases.

The curves MSS and MSB intersect at point P. This equality (P) of MSS and MSB curves is regarded as the optimum limit of the state’s financial activity. It is easy to see that so long as the MSB curve lies above the MSS curve, each additional unit of revenue raised and spent by the state leads to an increase in the net social advantage.

This beneficial process would then be continued till marginal social sacrifice (MSS) becomes just equal to the marginal social benefit (MSB). Beyond this point, a further increase in the state’s financial activity means the marginal social sacrifice exceeding the marginal social benefit, hence the net social loss.

Thus, only under the condition of MSS = MSB, the maximum social advantage is achieved. Diagrammatically, the shaded area APB (the area between MSS and MSB curves, till both intersect each other) represents the quantum of maximum social advantage. OQ is the optimum amount of financial activities of the state.

Further, the ideal of maximum social advantage is attained by the state, if the following principles of financial operation are followed in the budget.

1. Taxes should be distributed in such a way that the marginal utility of money sacrificed by all the tax-payers is the same.

2. Public spending is done, such that benefits derived from the last unit of money spent on each item becomes equal.

3. Marginal benefits and sacrifices must be equated.

To sum up, all fiscal operations, both as regards revenue and expenditure, should be treated as a series of transfers of purchasing power that must ultimately increase the economic welfare of the people. In this context, Dalton enunciated the principle of maximum social advantage and asserted that financial operations of the government must be in accordance with this principle in a welfare state.

Key Takeaways

To run a nation judiciously, the government needs to collect tax from the eligible citizens; paying taxes to the local government is an integral part of everyone’s life, no matter where we live in the world. Now, taxes can be collected in any form such as state taxes, central government taxes, direct taxes, indirect taxes, and much more. For your ease, let’s divide the types of taxation in India into two categories, viz. direct taxes and indirect taxes. This segregation is based on how the tax is being paid to the government.

What are tax and its types?

A tax is a mandatory fee or financial charge levied by any government on an individual or an organization to collect revenue for public works providing the best facilities and infrastructure. The collected fund is then used to fund different public expenditure programs. If one fails to pay the taxes or refuse to contribute towards it will invite serious implications under the pre-defined law.

Types of Taxes:

Be it an individual or any business/organization, all have to pay the respective taxes in various forms. These taxes are further subcategorized into direct and indirect taxes depending on the manner in which they are paid to the taxation authorities. Let us delve deeper into both types of tax in detail:

Direct Tax:

The definition of direct tax is hidden in its name which implies that this tax is paid directly to the government by the taxpayer.

The general examples of this type of tax in India are Income Tax and Wealth Tax.

From the government’s perspective, estimating tax earnings from direct taxes is relatively easy as it bears a direct correlation to the income or wealth of the registered taxpayers.

Indirect Tax:

Indirect taxes are slightly different from direct taxes and the collection method is also a bit different. These taxes are consumption-based that are applied to goods or services when they are bought and sold.

The indirect tax payment is received by the government from the seller of goods/services.

The seller, in turn, passes the tax on to the end-user i.e. buyer of the good/service.

Thus the name indirect tax as the end-user of the good/service does not pay the tax directly to the government.

Some general examples of indirect tax include sales tax, Goods and Services Tax (GST), Value Added Tax (VAT), etc.

Recent Reforms in Taxes:

In the year 2017, the government introduced Goods and Services Tax (GST) which is considered as the most revolutionary tax reform in independent India to date. Earlier also, governments levied various state and central taxes for availing various services or buying different goods. The problem with the earlier reforms was the taxation process was complex and the contradicting rules enabled some people to evade taxes through loopholes in the system. After the introduction of GST, a higher percentage of assessees was brought under the taxation umbrella and it took a toll on evaders as escaping from paying taxes became tougher.

What is Income Tax?

The most common type of tax that eligible citizens have to pay to the government. A part of your income is paid to the government every year and the government uses this money to fund support the growth and development activities across the country.

Income Tax Assessee

Any individual who is liable to file taxes and fall in the payable income tax slab is an income tax assessee. An individual who is having a regular income is exempted from paying tax if his/her include annual income is below the threshold level determined by the government from time to time or income from exempted sources such as agriculture.

Income Tax Slabs

As mentioned earlier, not all individuals shall pay the same amount of tax; the general rule is – the higher your income, the higher amount of tax you will have to pay. In order to ensure that tax rates and rules are fair rather than uniform, the government uses income tax slabs to determine the rate at which each individual tax assessee is liable to pay income tax.

Income Tax Deductions

Citizens having taxable income in excess of Rs. ₹ 2.5 lakhs are liable to pay income tax as per their applicable slab. However, there are a few tax savings options such as ELSS, Mutual Funds, PPF, EPF, tax saver fixed deposits, and others that can be used to reduce the income tax payable by the individual. A majority of these tax saving schemes are available under sections 80C and 80D of the Income Tax Act, 1961.

Tax Deducted at Source

TDS, short for Tax Deducted at Source is considered as one of the most common ways of deducting tax by the government from any salaried individual. Other cases of TDS can be seen in the case of interest provided on fixed deposits. However, in this case, also, the tax assessee can get a refund after filing the Income Tax Return (ITR).

Tax Evasion Laws and Implications

Various acts related to taxation have been framed by the Government of India and every citizen is liable to comply with these rules, failing which strict actions may be taken against them. Some of the sections of the taxation laws and penalties imposed for non-compliance are:

Section 140A (1): If an assessee fails to pay the taxes, be it partially or wholly on principle amount of interest, he will be considered as a defaulter. The assessing officer can levy a fine equal to the arrear as per section 221 (1)

Section 271 (C): In case an assessee doesn’t reveal the actual income or earning, a fine of 100% to 300% can be imposed on the defaulter in this section.

Section 142 (1) and 143 (2): Under these sections, an income tax notice is sent to the defaulter and if he/she does not respond to it, the assessing officer can ask the assessee to file the return or furnish all details of assets and liabilities in writing.

Some of the most important principles or canons of a good tax system are as follows: 1. Principle or Canon of Equality 2. Canon of Certainty 3. Canon of Convenience 4. Canon of Economy.

A good tax system must fulfill certain principles if it is to raise adequate revenue and fulfill certain social objectives. Adam Smith had explained four canons of taxation which he thought a good tax must fulfill.

These four canons are of:

(1) Equality,

(2) Certainty,

(3) Convenience, and

(4) Economy.

These are still regarded as characteristics of a good tax system. However, there have been significant developments in economic theory and policy since Adam Smith wrote his book “The Wealth of Nations “. Activities and functions of Government have enormously increased.

Now, the Governments are expected to maintain economic stability at full employment level, they are to reduce inequalities in the income distribution, and they are also to perform the functions of a Welfare State.

Above all, they are to promote economic growth and development, especially in the developing countries, net only through encouraging private enterprise but to undertake the task of production in some strategic industries. Thus, in order to devise a good tax system, these objectives and functions of Government’s economic policy must be kept in view.

It may be noted that Adam Smith was basically concerned with how the wealth of nations or, in other words, production capacity of the economy can be increased and he thought that private enterprise working on the basis of free market mechanism would ensure efficient use of resources and, if left unfettered would bring about rapid economic growth.

His ideas about public finance were influenced by his economic philosophy of virtues of free private enterprise. In proposing the above mentioned canons of taxation, he was guided only by the sole objective that Government should be able to raise sufficient revenue to discharge its limited functions of providing for defence, maintaining law and order, and, public utility services.

Both the objectives and functions of modern Governments have increased necessitating large resources. Therefore, the modern economists have added other principles or characteristics which the taxation system of a country must satisfy if the objectives of modern Governments are to be achieved. In what follows we shall spell out in detail the principles and characteristics of a good tax system starting with the explanation of Smithian canons of taxation.

1. Principle or Canon of Equality:

The first canon or principle of a good tax system emphasised by Adam Smith is of equality. According to the canon of equality, every person should pay to the Government according to his ability to pay, that is in proportion of the income or revenue he et jove onder the protection of the State.

Thus under the tax system based on equality principle the richer persons in the society will pay more than the poor. On the basis of this canon of equality or ability to pay Adam Smith argued that taxes should be proportional to income, that is, everybody should pay the same rate or percentage of his income as tax.

However, modem economists interpret equality or ability to pay differently from Adam Smith. Based on the assumption of diminishing marginal utility of money income, they argue that ability to pay principle calls for progressive income tax, that is, the rate of tax increases as income rises. Now, in most of the countries, progressive system of income and other direct taxes have been adopted to ensure equality in the tax system.

It may, however, be mentioned here that there are two aspects of ability to pay principle. First is the concept of horizontal equity. According to the concept of horizontal equity, those who are equal, that is, similarly situated persons ought to be treated equally.

This implies that those who have same income should pay the same amount of tax and there should be no discrimination between them. Second is the concept of vertical equity. The concept of vertical equity is concerned with how people with different abilities to pay should be treated for the purposes of division of tax burden. In other words, what various tax rates should be levied on people with different levels of income, A good tax system must be such as will ensure the horizontal as well as vertical equity.

2. Canon of Certainty:

Another important principle of a good tax system on which Adam Smith laid a good deal of stress is the canon of certainty. To quote Adam Smith, ‘The tax which each individual is bound to pay ought to be certain and not arbitrary.

The time of payment, the manner of payment, the quantity to be paid ought all to be clear and plain to the contributor and to every other person. A successful function of an economy requires that the people, especially business class, must be certain about the sum of tax that they have to pay on their income from work or investment.

The tax system should be such that sum of tax should not be arbitrarily fixed by the income tax authorities. While taking a decision about the amount of work effort that a person should put in or how much investment should he undertake under risky circumstances, he must know with certainty the definite amount of the tax payable by him on his income. If the sum of tax payable by him is subject to much discretion and arbitrariness of the tax assessment authority, this will weaken his incentive to work and invest more.

Moreover, lack of certainty in the tax system, as pointed out by Smith, encourages corruption in the tax administration. Therefore in a good tax system, “individuals should be secure against unpredictable taxes levied on their wages or other incomes. The law should be clear and specific; tax collectors should have little discretion about how much to assess tax payers, for this is a very great power and subject to abuse.”

In the opinion of the present author the Indian tax system violates this canon of certainty as under the Indian income tax law a lot of discretionary powers have been given to the income tax officers, which have been abused with impunity. As a result, there is a lot of harassment of the tax payers and corruption is rampant in the income tax department.

3. Canon of Convenience:

According to the third canon of Adam Smith, the sum, time and/manner of payment of a tax should not only be certain but the time and manner of its payment should also be convenient to the contributor. If land revenue is collected at the time of harvest, it will be convenient since at this time farmers reap their crop and obtain income.

In recent years efforts have been made to make the Indian income tax convenient to the taxpayers by providing for its payments in installments as advance payments at various times during the year. Further, income tax in India is levied on the basis of income received rather than income accrued during a year. This also makes the income tax system convenient. However, there is a lot of harassment of the tax payers as they are asked to come to the income tax office several times during a year for clarifications of their income tax returns.

4. Canon of Economy:

The Government has to spend money on collecting taxes levied by it- Since collection costs of taxes add nothing to the national product, they should be minimized as far as possible. If the collection costs of a tax are more than the total revenue yielded by it, it is not worthwhile to levy it.

More complicated a tax system, more elaborate administrative machinery will be employed to collect it and consequently collection costs will be relatively larger. Therefore, even for achieving economy in the tax collection, the taxes should be as simple as possible and tax laws should not be subject to different interpretations.

Key Takeaways

The Benefits Received Rule, or benefits received principle, may take one of two related definitions: one as a tax theory; and one as a tax provision. The two definitions are:

The Benefits Received Principle, which is a theory of income tax fairness that says people should pay taxes based on the benefits they receive from the government.

A tax provision that says a donor who receives a tangible benefit from making a charitable contribution must subtract the value of that benefit from the amount claimed as an income tax deduction.

● The benefits received rule argues that those who receive the greatest benefit from the government, either directly or indirectly, should pay the most taxes, in principle of fairness.

● Rather than applying such a rule in the U.S., taxes are largely paid based on a progressive income tax system.

● As a tax regulation, the benefits received rule discourages double-counting charitable donations.

Understanding the Benefits Received Rule-

The Benefits Received Rule is thought to be appealing for its apparent fairness in that those who benefit from a service should be the ones who pay for it. However, this is not how the tax system works in the United States. The U.S. tax system is a "progressive" or "ability-to-pay" system, meaning that those who make more money tend to pay taxes at a higher rate and those who make less money tend to pay taxes at a lower rate or even receive taxpayer-funded benefits while paying no taxes at all.

An alternative taxation system is a flat tax system in which everyone pays the same tax irrespective of income, which again, is not how the US tax system works, as the US system is income-based, meaning not everyone pays the same amount of taxes.

Examples of the Benefits Received Rule

Under the first definition of the Benefits Received Principle, supporters believe that taxpayers that use certain services in disproportionate amounts should pay higher taxes on those goods or services than taxpayers who do not utilize them. For example, taxpayers who own or drive cars should pay more taxes that go towards road maintenance than taxpayers who do not own or use cars. However, it is difficult to separate what goods and services are for the good and maintenance of the entire nation and not just an individual.

Under the second definition of the benefits received rule, an individual must subtract his or her contribution towards a tax deduction in order to reflect the true value of the contribution. So, for example, if Jane bought a $500 ticket to a nonprofit fundraising gala and received a dinner worth $100, she could only claim $400 as a tax deduction. This rule, in theory, might help curb attempts to avoid paying taxes by donating money for tax deduction purposes.

The ability-to-pay approach

What is the ability to pay?

Ability to pay is an economic principle that states that the amount of tax an individual pays should be dependent on the level of burden the tax will create relative to the wealth of the individual. The ability to pay principle suggests that the real amount of tax paid is not the only factor that has to be considered and that other issues such as the ability to pay should also be factored into a tax system.

Understanding Ability to Pay

The application of this principle gives rise to the progressive tax system, a system of taxation in which individuals with higher incomes are asked to pay more tax than individuals with lower incomes. The ideology behind this principle is that individuals and business entities that earn higher income can afford to pay more in taxes than lower-income earners. Ability to pay is not the same as straight income brackets. Rather, it extends beyond brackets in determining whether an individual taxpayer can pay his or her entire tax burden or not.

For instance, individuals should not be taxed on transactions in which they don’t receive any cash. Using stock options as an example, these securities have value for the employee who receives them and are, thus, subject to taxation. However, since the employee does not receive any cash, s/he would not pay tax on the options until s/he cashes them in.

Advocates of ability-to-pay taxation argue that it allows those with the most resources the ability to pool together the fund required to provide services needed by many. Critics of this system believe that the practice discourages economic success since it burdens wealthier individuals with a disproportionate amount of taxation. Classical economists like Adam Smith believed any elements of socialism, such as a progressive tax, would destroy the initiative of the population within a free market economy. However, many countries have blended capitalism and socialism with a great degree of success.

In banking, ability to pay is called “capacity.” It is used by lending institutions to determine a borrower’s ability to make his interest and principal repayments on a loan, using his or her disposable income or cash flow. Some bankers judge a borrower’s capacity using the standard Five C’s of Credit – credit history, capital base, capacity to generate cash flow, collateral, and current conditions in the economy. For municipal debt issuers, ability to pay refers to the issuer’s or lender’s present and future ability to create sufficient tax revenue to fulfill its contractual obligations.

Incidence and effect of taxation

What Is a Tax Incidence?

Tax incidence (or incidence of tax) is an economic term for understanding the division of a tax burden between stakeholders, such as buyers and sellers or producers and consumers. Tax incidence can also be related to the price elasticity of supply and demand. When supply is more elastic than demand, the tax burden falls on the buyers. If demand is more elastic than supply, producers will bear the cost of the tax.

How Tax Incidence Works?

The tax incidence depicts the distribution of the tax obligations, which must be covered by the buyer and seller. The level at which each party participates in covering the obligation shifts based on the associated price elasticity of the product or service in question as well as how the product or service is currently affected by the principles of supply and demand.

Tax incidence reveals which group—consumers or producers—will pay the price of a new tax. For example, the demand for prescription drugs is relatively inelastic. Despite changes in cost, its market will remain relatively constant.

Levying New Taxes on Inelastic and Elastic Goods-

Another example is that the demand for cigarettes is mostly inelastic. When governments impose a cigarette tax, producers increase the sale price by the full amount of the tax, transferring the tax burden to consumers. Through analysis, it is found the demand for cigarettes is unaffected by price. Of course, there are limits to this theory. If a pack of cigarettes suddenly increased from $5 to $1,000, consumer demand would fall.

If the levying of new taxes on an elastic good, such as fine jewelry, occurs, most of the burden would likely shift to the producer as an increase in price may have a significant impact on the demand for the associated goods. Elastic goods are goods with close substitutes or that are nonessential.

Price Elasticity and Tax Incidence

Price elasticity is a representation of how buyer activity changes in response to movements in the price of a good or service. In situations where the buyer is likely to continue purchasing a good or service regardless of a price change, the demand is said to be inelastic. When the price of the good or service profoundly impacts the level of demand, the demand is considered highly elastic.

Examples of inelastic goods or services can include gasoline and prescription medicines. The level of consumption across the economy remains steady with price changes. Elastic products are those whose demand is significantly affected by price. This group of products includes luxury goods, houses, and clothing.

The formula for determining the consumer's tax burden with "E" representing elasticity is as follows:

E (supply) / (E (demand)) + E (supply)

The formula for determining the producer or supplier's tax burden with "E" representing elasticity is as follows:

E (demand) / (E (demand) + E (supply))

Effects of Taxes:

The most important objective of taxation is to raise required revenues to meet expenditure. Apart from raising revenue, taxes are considered as instruments of control and regulation with the aim of influencing the pattern of consumption, production and distribution. Taxes thus affect an economy in various ways, although the effects of taxes may not necessarily be good. There are the same bad effects of taxes too.

Economic effects of taxation can be studied under the following headings:

1. Effects of Taxation on Production:

Taxation can influence production and growth. Such effects on production are analysed under three heads:

(i) effects on the ability to work, save and invest

(ii) effects on the will to work, save and invest

iii) effects on the allocation of resources.

2. Effects on the Ability to Work Save:

Imposition of taxes results in the reduction of disposable income of the taxpayers. This will reduce their expenditure on necessaries which are required to be consumed for the sake of improving efficiency. As efficiency suffers, ability to work declines. This ultimately adversely affects savings and investment. However, this happens in the case of poor persons.

Taxation on rich persons has the least effect on the efficiency and ability to work. Not all taxes, however, have adverse effects on the ability to work. There are some harmful goods, such as cigarettes, whose consumption has to be reduced to increase ability to work. That is why high rates of taxes are often imposed on such harmful goods to curb their consumption.

But all taxes adversely affect the ability to save. Since rich people save more than the poor, progressive rate of taxation reduces savings potentiality. This means a low level of investment. Lower rate of investment has a dampening effect on economic growth of a country.

Thus, on the whole, taxes have the disincentive effect on the ability to work, save and invest.

3. Effects on the will to Work, Save and Invest:

The effects of taxation on the willingness to work, save and invest are partly the result of money burden of tax and partly the result of psychological burden of tax.

Taxes which are temporarily imposed to meet any emergency (e.g., Kargil Tax imposed for a year or so) or taxes imposed on windfall gain (e.g., lottery income) do not produce adverse effects on the desire to work, save and invest. But if taxes are expected to continue in the future, it will reduce the willingness to work and save the taxpayers.

Taxpayers have a feeling that every tax is a burden. This psychological state of mind of the taxpayers has a disincentive effect on the willingness to work. They feel that it is not worth taking extra responsibility or putting in more hours because so much of their extra income would be taken away by the government in the form of taxes.

However, if taxpayers are desirous of maintaining their existing standard of living in the midst of payment of large taxes, they might put in extra efforts to make up for the income lost in tax.

It is suggested that effects of taxes upon the willingness to work, save and invest depends on the income elasticity of demand. Income elasticity of demand varies from individual to individual.

If the income demand of an individual taxpayer is inelastic, a cut in income consequent upon the imposition of taxes will induce him to work more and to save more so that the lost income is at least partially recovered. On the other hand, the desire to work and save of those people whose demand for income is elastic will be adversely affected.

Thus, we have conflicting views on the incentives to work. It would seem logical that there must be a disincentive effect of taxes at some point but it is not clear at what level of taxation that crucial point would be reached.

4. Effects on the Allocation of Resources:

By diverting resources to the desired directions, taxation can influence the volume or the size of production as well as the pattern of production in the economy. It may, in the ultimate analysis, produce some beneficial effects on production. High taxation on harmful drugs and commodities will reduce their consumption.

This will discourage production of these commodities and the scarce resources will now be diverted from their production to the other products which are useful for economic growth. Similarly, tax concessions on some products are given in a locality which is considered as backward. Thus, taxation may promote regional balanced development by allocating resources in the backward regions.

However, not necessarily such beneficial effects will always be reaped. There are some taxes which may produce some unfavourable effects on production. Taxes imposed on certain useful products may divert resources from one region to another. Such unhealthy diversion may cause reduction of consumption and production of these products.

5. Effects of Taxation on Income Distribution:

Taxation has both favourable and unfavourable effects on the distribution of income and wealth. Whether taxes reduce or increase income inequality depends on the nature of taxes. A steeply progressive taxation system tends to reduce income inequality since the burden of such taxes falls heavily on the richer persons.

But a regressive tax system increases the inequality of income. Further, taxes imposed heavily on luxuries and nonessential goods tend to have a favourable impact on income distribution. But taxes imposed on necessary articles may have a regressive effect on income distribution.

However, we often find some conflicting roles of taxes on output and distribution. A progressive system of taxation has a favourable effect on income distribution but it has disincentive effects on output.

A high dose of income tax will reduce inequalities but such will produce some unfavourable effects on the ability to work, save, investment and, finally, output. Both the goals—the equitable income distribution and larger output—cannot be attained simultaneously.

6. Other Effects of Taxation:

If taxes produce favourable effects on the ability and the desire to work, save and invest, there will be a favourable effect on the employment situation of a country. Further, if resources collected via taxes are utilized for development projects, it will increase employment in the economy. If taxes affect the volume of savings and investment badly then recession and unemployment problems will be aggravated.

Again, the effect of taxes on the price level may be favourable and unfavourable. Sometimes, taxes are imposed to curb inflation. Again, as an imposition of commodity taxes lead to rising costs of production, taxes aggravate the problem of inflation.

Thus, taxation creates both favourable and unfavourable effects on various parameters. Unfavourable effects of taxes can be wiped out by the judicious use of progressive taxation.

Key Takeaways:

Just as there are well-known principles or canons of taxation, similarly it is possible to formulate some principles to which prudent public expenditure should conform.

These principles are:

1. Principle of Maximum Social Benefit:

It is necessary that all public expenditure should satisfy one fundamental test, viz., that of Maximum Social Advantage. That is, the government should discover and maintain an optimum level of public expenditure by balancing social benefits and social costs. Every rupee spent by a government must have as its aim the promotion of the maximum welfare of the society as a whole.

Care has to be taken that public funds are not utilized for the benefit of a particular group or a section of society. The aim is the general welfare. Government exists for the benefit of the governed and the justification of the government expenditure is, therefore, to be sought in the benefit of the community as a whole.

2. Canon of Economy:

Although the aim of public expenditure is to maximize the social benefit, yet it does not exempt the government from exercising utmost economy in its expenditure. Economy does not mean niggardliness. It only means that extravagance and waste of all types should be avoided. Public expenditure has great potential for public good but it may also prove injurious and wasteful. Thus, if revenue collected from the taxpayer is heedlessly spent, it would be obviously uneconomical.

To satisfy the canon of economy, it will be necessary to avoid all duplication of expenditure and overlapping of authorities. Further, public expenditure should not adversely affect saving. In case government activity damaged the individual’s will or power to save, it would go against the canon of economy.

3. Canon of Sanction:

Another important principle of public expenditure of public expenditure is that before it is actually incurred it should be sanctioned by a competent authority. Unauthorised spending is bound to lead to extravagance and overspending. It also means that the amount must be spent on the purpose for which it was sanctioned.

Allied to the canon of sanction, there is another viz., auditing. Not only is previous sanction of public expenditure essential but a post-mortem examination is equally imperative. That is, all the public accounts at the end of the year should be properly audited to see that the amounts have not been misspent or misappropriated.

4. Canon of Elasticity:

Another sane principle of public expenditure is that it should be fairly elastic. It should be possible for public authority to vary the expenditure according to need or circumstances. A rigid level of expenditure may prove a source of trouble and embarrassment in bad times. Alteration in the upward direction is not difficult.

It is easy, rather tempting, to increase the scale of expenditure. But elasticity is needed, tempting to increase the scale of expenditure. But elasticity is needed most in the downward direction. When the economy axe is applied it is a very painful process. Retrenchment of a wide spread character creates serious social discontent.

It is very necessary, therefore, that when the scale of public expenditure had to be increased, it should be increased gradually. A short spell of prosperity should not lead to long-term commitments. A fair degree of elasticity is essential if financial breakdown is to be avoided at a time of shrinking revenue.

5. No Adverse Influence on Production or Distribution:

It is also necessary to ensure that public expenditure should exercise a healthy influence both on production and distribution of wealth in the community. It should stimulate productive activity so that income and employment increase. But this object of raising the living standards of the masses will be served only if wealth is evenly distributed. If newly created wealth goes to enrich the already rich, the purpose is not served. Public expenditure should aim at reducing the inequalities of wealth distribution.

6. Principle of Surplus:

It is considered a sound or orthodox principle of public expenditure that as far as possible public expenditure should be kept well within the revenue of the State so that a surplus is left at the end of the year. In other words, the government should avoid deficit budget, But the modern economists, especially Keynes, do not regard surplus budgeting as a virtue, rather deficit budgeting is more useful in raising the levels of income and employment in the under-developed countries. All the same, budget deficits running over a series of years are considered bad for the financial stability of the country and they cause inflation which is injurious to the health of the economy.

Wagner’s Law-

Wagner's law of state , is known as the law of increasing state spending, is a principle named after the German economist Adolph Wagner (1835–1917).He first observed it for his own country and then for other countries. The theory holds that for any country, that public expenditure rises constantly as income growth expands. The law predicts that the development of an industrial economy will be accompanied by an increased share of public expenditure in gross national product:

The advent of modern industrial society will result in increasing political pressure for social progress and increased allowance for social consideration by industry.

Wagner's law suggests that a welfare state evolves from free market capitalism due to the population voting for ever-increasing social services as general income levels grow across broad spectrums of the economy. In spite of some ambiguity, Wagner's statement in formal terms has been interpreted by Richard Musgrave as follows:

As progressive nations industrialize, the share of the public sector in the national economy grows continually. The increase in State Expenditure is needed because of three main reasons. Wagner himself identified these as (i) social activities of the state, (ii) administrative and protective actions, and (iii) welfare functions. The material below is an apparently much more generous interpretation of Wagner's original premise.

Socio-political, i.e., the state social functions expand over time: retirement insurance, natural disaster aid (either internal or external), environmental protection programs, etc.

Economic: science and technology advance, consequently there is an increase of state assignments into the sciences, technology and various investment projects, etc.

Historical: the state resorts to government loans for covering contingencies, and thus the sum of government debt and interest amount grow; i.e., it is an increase in debt service expenditure.

Wiseman Peacock Hypothesis-

According to Wagner's Law the principal determining force for the rise in public expenditure is the growth of real per capita income or in other words increased public demand for new public services arising out of the growth of real per capita income. There have been some recent attempts at the positive theory of public expenditure stressing the supply side operating through tolerable limits to taxation on the financing of public expenditure as the more important determinant of the growth of public expenditure. Of the supply side theories of public expenditure, the displacement hypothesis of Peacock and Wiseman has received deepest attention.

Peacock and Wiseman's empirical study of the growth of public expenditure in the United Kingdom from 1890 to 1955 is probably one of the best known analyses of the 'time pattern' of public expenditures. They founded their analysis upon a political theory of public expenditure determination, namely that governments like to spend more money but citizens do not like to pay more taxes, and that governments need to pay some attention to the wishes of their citizens. Thus they opened up public expenditure to the influence of the ballot box. Peacock and Wiseman make the following assumptions about the nature of the state:

(i) Decisions about public expenditure are taken politically, and so can be influenced through the ballot box or by whatever media citizens can bring pressure to bear upon the government,

(ii) Political choices about the use of resources differ from choices made through the market system, and (iii) citizen can have ideas about desirable public expenditure which are quite different from and incompatible with their ideas about tolerable burden of taxation. Peacock and Wiseman viewed the voter as an individual who enjoyed the benefits of public goods and sources but who disliked paying taxes. Thus the government when deciding upon the expenditure side of its budget keeps a close watch on the voters' reactions to the implied taxation. They assumed that there is some tolerable level of taxation' which acts as a constraint on government behaviors.

As the economy grows, tax revenue, at constant tax rates, would rise,thereby enabling public expenditure to grow in the line with GNP. In normal times, therefore, public expenditure would show a gradual upward trend, even though within the economy there might be a divergence between what people regarded as being a desirable level of public expenditure and desirable level of taxation.

During the period of social upheaval, however, this gradual upward trend in public expenditure would be disturbed. These periods would coincide with war, famine or some large-scale social disaster which would require a rapid increase in public expenditures. In order to finance the increase in public expenditures the government would be forced to raise taxation levels. This raising of taxation levels would, however, be regarded as acceptable to the electorate during the periods of crisis.

Peacock and Wiseman referred to this as the 'displacement effect'. Public expenditure is displaced upwards and for the period of the crisis displaces private expenditure for public expenditures. The process represents an upward shift in the trend line of public expenditure. Following the period of crisis public expenditure does not, however, fall to its original level. A war is not fully paid for from taxation; no nation has such a large taxable capacity. Countries therefore borrow, and debt charges have to be met after the event. Another effect that they thought might operate was the 'inspection effect'.

This effect arises from the voters' keener awareness of social problems during the period of upheaval. The government therefore expands its scope of services to improve these social conditions, and because the electorates' perception of tolerable level of taxation does not return to its former level the government is able to finance these higher levels of expenditure originating in the expanded scope of government and debt charges.

Alongside the displacement effect, there is another influence, called the 'concentration process' (Peacock and Wiseman, 1967). This concentration effect refers to the apparent tendency for the central government economic activity to grow faster than that of state and local level government. British data are consistent with this hypothesis. Moreover, this aspect of concentration effect is also closely connected with the political set up of the country. Peacock and Wiseman's theory has not gone without criticism. Gupta (1967) argued that the concept of the tolerable burden of taxation would rather suggest a shift in the downward direction depending on the prevailing situation.

During the depressions public expenditure expands, but it becomes difficult for the government to raise the level of taxation. Higher public expenditure is incurred without increasing the burden of taxation. For meeting revenue needs, the government resorts to deficit financing. Therefore, if the concept of the tolerable burden were expanded so as to include not only that of taxes but also that of other methods of financing government expenditure, it would provide a better explanation of the growth of public expenditure.

Effect of Public expenditure on Production and Distribution

The effect of public expenditure on production can be examined with reference to its effects on ability & willingness to work, save & invest and on diversion of resources.

Ability to work, save and invest: Socially desirable public expenditure increases community's productive capacity. Expenditure on education, health, communication, increases people's productivity at work and therefore their incomes. With rise in income savings also increases and this in turn has a beneficial effect on investment and capital formation.

Willingness to work, save and invest: Public expenditure, sometimes, brings adverse effects on people's willingness to work and save. Government expenditure on social security facilities may bring such unfavourable effects. For e.g. Government spends a considerable portion of its income towards provision of social security benefits such as unemployment allowances, old age pension, insurance benefits, sickness benefit, medical benefit, etc. Such benefits reduce the desire to work. In other words they act as disincentives to work.

Effect on allocation of resources among different industries & trade: Many a times the government expenditure proves to be an effective instrument to encourage investment in a particular industry. For e.g. If the government decides to promote exports, it provides benefits like subsidies, tax benefits to attract investment towards such industry. Similarly the government can also promote a particular region by providing various incentives for those who make investment in that region.

Effects on Distribution

The primary aim of the government is to maximise social benefit through public expenditure. The objective of maximum social welfare can be achieved only when the inequality of income is removed or minimised. Government expenditure is very useful to fulfill this goal. Government collects excess income from the rich through income tax and sales tax on luxuries. The funds thus mobilised are directed towards welfare programmes to promote the standard of poor and weaker sections. Thus public expenditure helps to achieve the objective of equal distribution of income.

Expenditure on social security & subsidies to poor are aimed at increasing their real income & purchasing power. Public expenditure on education, communication, and health has a positive impact on productivity of the weaker section of society, thereby increasing their income earning capacity.

Effects on Consumption

Public expenditure enables redistribution of income in favour of the poor. It improves the capacity of the poor to consume. Thus public expenditure promotes consumption and thereby other economic activities. The government expenditure on welfare programmes like free education, health care and housing certainly improves the standard of the poor people. It also promotes their capacity to consume and save.

Effects on Economic Stability

Economic instability takes the form of depression, recession and inflation. Public expenditure is used as a mechanism to control instability. The modern economist Keynes advocated public expenditure as a better device to raise effective demand & to get out of depression. Public expenditure is also useful in controlling inflation & deflation. Expansion of Public expenditure during deflation & reduction of public expenditure during inflation control money supply & bring price stability.

Effects on Economic Growth

The goals of planning are effectively realised only through government expenditure. The government allocates funds for the growth of various sectors like agriculture, industry, transport, communications, education, energy, health, exports, imports, with a view to achieve impressive growth.

Government expenditure has been very helpful in maintaining balanced economic growth. Government takes keen interest to allocate more resources for development of backward regions. Such efforts reduce regional inequality and promote balanced economic growth.

Conclusion

Modern economies have all experienced tremendous growth in public expenditure. So it is absolutely necessary for governments to formulate rational public expenditure policies in order to achieve the desired effects on income, distribution, employment and growth.

Key Takeaways

Reference:

1. Indian Economy (B.Com. - III) Paperback – 1 January 2014 by T R Jain (Author), Mukesh Trehan (Author), Ranju Trehan (Author).

2. Indian Economy Key Concepts (English, Paperback, Karuppiah Sankarganesh).