UNIT I

MEANING AND DEFINITIONS OF ECONOMICS

Economics is a study of ‘Choices’ or ‘Choice making’. Choice making is relevant for every individuals, families, societies, institution, area, state and nations and for the whole world. It also analyses how a society allocate the limited resources to achieve growth. The word’ Economics’ originates from a Greek word ‘Oikonomikos’. This Greek word has 2 parts – ‘Oikos’ means ‘Home’ and ‘Nomos’ means Management. Hence Economics means Home management.

Economics has emerged as high level of application due to its basic principle of ‘Choice making for optimization with the given resources of scarcity and surplus’.

Evolution in the definition of Economics

Wealth definition

Adam Smith is called as father of economics. He was the first one to put economics in systematic way.

He defined economics as “a science which inquires into the nature and cause of wealth of nations”

Characteristic

Criticism

Welfare definition

In 1890, Alfred Marshall stated that “'a study of mankind in the ordinary business of life; it examines that part of individual and social action which is most closely connected with the attainment and with the use of material requisites of well being”

Characteristics

Criticism

Scarcity definition

According to Lionel Robbins: “Economics is the science which studies human behavior as a relationship between ends and scarce means which have alternative uses.”

He emphasizes on ‘choice under scarcity’. In other words “Economics is concerned with that aspect of behavior which arises from the scarcity of means to achieve given ends”

Characteristics

Criticism

Growth definition

According to Prof. Paul A Samuelson, “Economics is the study of how men and society choose, with or without the use of money, to employ scarce productive resources which could have alternative uses, to produce various commodities over time and distribute them for consumption now and in the future amongst various people and groups of society”

Characteristic

Criticism

Modern definition of economics

Prof. A.C.Dhas defines economics as "The study of choice making by individuals, institutions, societies, nations and globe under conditions of scarcity and surplus towards maximizing benefits and satisfying the unlimited present and future needs.”

In short, the subject Economics is defined as the “Study of choices by all in maximizing production and consumption benefits with the given resources of scarce and surplus, for present and future needs.”

Characteristics

Key takeaways –

The deductive method is also called as analytical, abstract or prior method. It consists of certain assumptions and formal data used to draw conclusion. It involves deriving conclusion from fundamental facts. For ex, it is assumed business man aims at maximizing profit. Thus the businessman buys material at cheapest cost and sells it to the market. This is also known as hypothetical method as actual facts may not be available but very near facts are used to draw conclusion.

Steps of deductive method

2. Formulating assumption – hypothesis is based on assumption. Thus the next step is to formulate assumptions. The assumption should be in terms of which a hypothesis can be formulated.

3. Formulating hypothesis: The third step is to formulate hypothesis from the assumptions taken in deriving generalizations.

4. Testing of hypothesis: the next step is to test and verify the hypothesis through statistical and econometric methods. Hypothesis can be verified by direct observations of events in the rear world.

Advantages of deductive method

2. Simple - This method is simple because it is analytical. It involves dividing the complex problem into component parts to make the problem very simple and then inferences are drawn.

3. Powerful – this is a powerful method as it derives conclusions by analyzing certain facts. When conducted under proper check, this method is most powerful instrument of discovery.

4. Exact - The use of statistical and mathematical techniques leads to exactness and clarity in economic analysis. The use of mathematical -deductive method helps in deriving inferences in a short time.

5. Universal - based on general principles, such as the law of diminishing returns, the deductive method helps in drawing inferences which are of universal validity

6. This method is less time consuming and less expensive

Demerits of deductive method

2. Incorrect verification – the laws or theories are based on observation. The observation is based on correct data or facts. In case hypothesis derived from inadequate data then the theory will be proved wrong.

3. Abstract method – this method is abstract and requires great skill in drawing conclusion from various premises. Sometimes its very difficult to apply this method, due to the complexity of certain economic problems

4. Static method – this method is based on assumption that the condition should remain same. But in actual, the economic condition changes continuously. Thus correct analysis cannot be made from static method.

The inductive method

Induction “is the process of reasoning from a part to the whole, from particulars to generals or from the individual to the universal.” Bacon described it as “an ascending process” in which facts are collected, arranged and then general conclusions are drawn.

Inductive method are also called empirical method was adopted by the “Historical School of Economists". This method derives generalization or law on the basis of experiment, observation and statistical tools.

The inductive method includes first collect material, draw gereralisations, and verifies the conclusions by applying them to subsequent events. This method uses statistical method to find the conclusion. This method involves the following step

2. Data – the second step involves using appropriate statistical techniques for collection, enumeration, classification and analysis of data.

3. Observation – to make observation data are used about particular facts concerning the problem.

4. Generalization – generalization is derived on the basis of observation which establishes a general truth from particular facts. This process involved generalization on the basis of particular observed facts.

Advantages

The advantages of this method are as follows

2. Future enquiries – this method helps in future enquires. Induction method helps future investigations by discovering and providing general principles. Generalization becomes the starting point of future enquires.

3. Statistical method – the method derives generalization on the basis of statistical tools. In the application of induction method, this statistical method has made significant improvement for analyzing economic problems of wide range.

4. Dynamic- it is a dynamic method. On the basis of experiences, changing economic phenomena can be analysed and conclusions are drawn. Thus appropriate remedial measures can be taken for the changes.

5. Historic – relative – this method involves deriving conclusion fom historical situation. Unless the situations are exactly similar it cannot be applied to all the situations. This method has the advantage of applying generalizations only to related situations.

Demerit

2. Uncertain conclusion - Boulding points out that “statistical information can only give us propositions whose truth is more or less probable it can never give us certainty.”

3. Lacks concreteness – for the same problem definitions, sources and methods used in statistical analysis differ from investigator to investigator. The statistical method lacks concreteness.

4. Costly method – the inductive method is time consuming and costly. It consist of detailed process of collection, classification, analyses and interpretation of data from trained and expert investigators. Thus the entire process of deriving generalization is costly.

5. Difficult to prove hypothesis – the hypothesis cannot be proved with the use of statistics. The hypothesis is not consistent to the known facts.

6. Controlled experimentation is not possible in economics – the scope of controlled experiment is very little in inductive method as economics deals with human behavior which differ from one person to another and from place to place.

Micro vs macro economics

Micro economics

Microeconomics (from Greek prefix mikro- meaning "small") is a branch of economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources. “The interactions among these individuals and firms”

Microeconomics is the study of individuals, households and firm’s behavior in decision making and allocation of resources. It generally applies to markets of goods and services and deals with individual and economic issues.

Definition

Microeconomics is the study of individuals, households and firms' behavior in decision making and allocation of resources. It generally applies to markets of goods and services and deals with individual and economic issues.

Microeconomics is a branch of economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms.

This is considered to be basic economics. Microeconomics may be defined as that branch of economic analysis which studies the economic behavior of the individual unit, maybe a person, a particular household, or a particular firm.

The production of goods and services is based on allocation of scarce resources.

Efficient distribution of goods – this studies the matter relating to (a) Product pricing, (b) Factor pricing, (c) Economic welfare.

Macro economics

The term "macro" was first used in economics by Ragnar Frisch in 1933. However, it originated in the 16th and 17th century mercantilists as a methodological approach to economic problems. They were interested in the entire economic system. In the 18th century,

Physiocrats adopted it in the table economy, demonstrating a "wealth cycle" (i.e., net production) among the three classes represented by the peasant, landowner, and barren classes.

Malthus, Sismondi and Marx in the 19th century dealt with macroeconomic issues. Walras, Wicksell and Fisher contributed modernly to the development of pre-Keynes macroeconomic analysis.

Certain economists such as Kassel, Marshall, Pigovian, Robertson, Hayek, and Hortley developed the Quantity Theory of Money and General Price Theory in the decade following World War I. But Keynes, who eventually developed the general theory of income, output, and employment in the wake of the Great Depression, has credit.

Economics is a science that deals with the production, Exchange and consumption of various goods in the economic system. It is a scarce resource that can lessen the abundance of human welfare. The central focus of Economics lies in the choice between resource scarcity and its alternative uses. The word "economics" is derived from two the Greek words oikos (House) and nemein (to manage) mean to manage the household budget "using the limited funds possible.

Macroeconomics is an important concept that considers the whole country and works for the welfare of the economy.

1. Business cycle analysis

Timing of economic fluctuations helps prevent or prepare for financial crises and long-term negative situations.

2. Formulation of economic policy

The fiscal and monetary policy system relies entirely on the widespread analysis of macroeconomic conditions in the country.

3. Reduce the effects of inflation and deflation

Macroeconomics is primarily aimed at helping governments and financial institutions prepare for economic stability in a country.

4. Promote material welfare

This stream of economics provides a broader perspective on social or national issues. Those who want to contribute to the welfare of society need to study macroeconomics.

5. Regulate the economic system

It continues to guarantee or check the proper functioning and actual position of the country's economy.

6. Solve economic problems

Macroeconomic theory and problem analysis help economists and governments understand the causes and possible solutions to such macro-level problems.

7. Economic development

By utilizing macroeconomic data to respond to various economic conditions, the door to national growth will be opened.

Difference between micro and macro economics

Microeconomics | Macroeconomics |

Meaning | |

Microeconomics is the branch of Economics that is related to the study of individual, household and firm’s behaviour in decision making and allocation of the resources. It comprises markets of goods and services and deals with economic issues. | Macroeconomics is the branch of Economics that deals with the study of the behaviour and performance of the economy in total. The most important factors studied in macroeconomics involve gross domestic product (GDP), unemployment, inflation and growth rate etc. |

Area of study | |

Microeconomics studies the particular market segment of the economy | Macroeconomics studies the whole economy, that covers several market segments |

Deals with | |

Microeconomics deals with various issues like demand, supply, factor pricing, product pricing, economic welfare, production, consumption, etc. | Macroeconomics deals with various issues like national income, distribution, employment, general price level, money, etc. |

Business Application | |

Applicable in studying internal issues

| Applicable in studying environment and external issues

|

Scope | |

Covers several issues like demand, supply, factor pricing, product pricing, economic welfare, production, consumption, etc. | Covers several issues like distribution, national income, employment, money, general price level, etc. |

Significance | |

Useful in regulating the prices of a product alongside the prices of factors of production (labour, land, entrepreneur, capital, etc) within the economy | Perpetuates firmness in the broad price level and solves the major issues of the economy like deflation, inflation, rising prices (reflation), unemployment and poverty as a whole |

Limitations | |

It is based on impractical presuppositions, i.e., in microeconomics, it is presumed that there is full employment in the community, which is not at all feasible | It has been scrutinized that Misconception of Composition’ incorporates, which sometimes fails to prove accurate because it is feasible that what is true for aggregate (comprehensive) may not be true for individuals too |

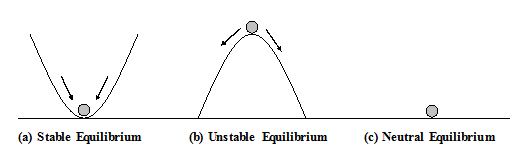

Concept of Equilibrium – Stable, unstable and Neutral Equilibrium

The term equilibrium has often to be used in economic analysis. In fact, Modern Economics is sometimes called equilibrium analysis. Equilibrium means a state of balance. When forces acting in opposite directions are exactly equal, the object on which they are acting is said to be in a state of equilibrium.

Types of Equilibrium

Basically, there are three types of any equilibrium:

(a) Stable Equilibrium: There is stable equilibrium, when the object concerned, after having been disturbed, tends to resume its original position. Thus, in the case of a stable equilibrium, there is a tendency for the object to revert to the old position.

(b) Unstable Equilibrium: On the other hand, the equilibrium is unstable when a slight disturbance evokes further disturbance, so that the original position is never restored. In this case, there is a tendency for the object to assume newer and newer positions once there is departure from the original position.

(c) Neutral Equilibrium: It is neutral equilibrium when the disturbing forces neither bring it back to the original position nor do they drive it further away from it. It rests where it has been moved. Thus, in the case of a neutral equilibrium, the object assumes once for all a new position after the original position is disturbed.

When the word equilibrium is used to qualify the term value, then according to Professor Schumpeter, a stable equilibrium value is an equilibrium value that if changed by a small amount, calls into action forces that will tend to reproduce the old value; a neutral equilibrium value is an equilibrium value that does not know any such forces; and an unstable equilibrium value is an equilibrium value, change in which calls forth forces which tend to move the system farther and farther away from the equilibrium value.

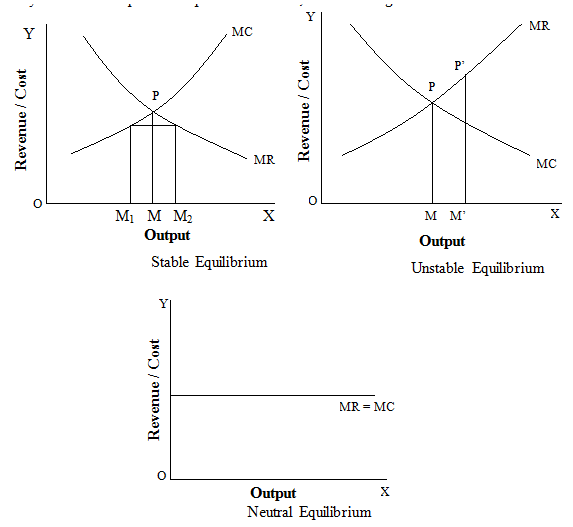

In the below figure, the stable equilibrium is shown. When in equilibrium at point P, the producer produces an output OM and maximises his profits. In case the producer increases his output to OM2 or decreases it to OM1, the size of profits is reduced. This automatically brings in forces that tend to establish equilibrium again at P.

The next figure represents the case of unstable equilibrium. Initially the producer is in equilibrium at point P, where MR = MC and he is maximising his profits. If now he increases his output to OM1, he would be in equilibrium output at point P1, where he will obtain higher profits, because, at this output, marginal revenue is greater than marginal cost. Thus there is no tendency to return to the original position at P.

The third figure represents the situation of neutral equilibrium. In this case, MR = MC at all levels of output so that the producer has no tendency to return to the old position and every time a new equilibrium point is obtained, which is as good as the initial one.

Key takeaways

Cardinal and ordinal approaches to consumer behavior determine the utility of a commodity or services. It varies according to every individual. In other words it implies the satisfying power of the goods and services. This utility is measured and can be expressed quantitatively ie 1, 3,4, 5.

Cardinal utility

Cardinal utility refers to the proposition that economic prosperity can be rightly perceived and provided with value. Individuals can determine the use of certain products consumed. It prompts measuring of the satisfactory levels in utils.

Ordinal utility

The functions that represent utility of a product according to its preference, but does not provide any numerical figure refers to ordinal utility. Ordinal utility believes that the satisfaction level cannot be evaluated; however, it can be leveled.

Difference between cardinal and ordinal utility

| Cardinal utility | Ordinal utility |

Definition | It explains that the satisfaction level after consuming a good or service can be scaled in terms of countable numbers. | It explains that the satisfaction after consuming a good or service cannot be scaled in numbers, however, these things can be arranged in the order of preference. |

Measurement | Utility is measured on the basis of utils | Utility is ranked on the basis of satisfaction |

Realistic | It is less practical. | It is more practical and sensible. |

Used by | This theory was applied by Prof. Marshall | This theory was applied by Prof. J R Hicks |

Approach | Quantitative approach | Qualitative approach |

Examination | Marginal utility analysis | Indifference curve analysis |

Key takeaways –

The simple meaning of ‘utility’ is ‘usefulness’. In economics utility is the capacity of a commodity to satisfy human wants.

Utility is the quality in goods to satisfy human wants. Thus, it is said that “Wants satisfying capacity of goods or services is called Utility.”

Definition

According to Prof. Waugh:

“Utility is the power of commodity to satisfy human wants.”

According to Fraser:

“On the whole in recent years the wider definition is preferred and utility is identified, with desireness rather than with satisfyingness.”

Total Utility (TU):

Total utility refers to the total satisfaction obtained from the consumption of all possible units of a commodity. It measures the total satisfaction obtained from consumption of all the units of that good. For example, if the 1st ice-cream gives you a satisfaction of 20 utils and 2nd one gives 16 utils, then TU from 2 ice-creams is 20 + 16 = 36 utils. If the 3rd ice-cream generates satisfaction of 10 utils, then TU from 3 ice-creams will be 20+ 16 + 10 = 46 utils.

TU can be calculated as:

TUn = U1 + U2 + U3 +……………………. + Un

Where:

TUn = Total utility from n units of a given commodity

U1, U2, U3,……………. Un = Utility from the 1st, 2nd, 3rd nth unit

n = Number of units consumed

Marginal utility

Marginal utility is the utility derived from the last or marginal unit of consumption. It refers to the additional utility derived from an extra unit of the given commodity purchased, acquired or consumed by the consumer.

It is the net addition to total utility made by the utility of the additional or extra units of the commodity in its total stock. It has been said—as the last unit in the given total stock of a commodity.

According to Prof. Boulding—”The marginal utility of any quantity of a commodity is the increase in total utility which results from a unit increase in its consumption.”

Average utility

Average Utility is that utility in which the total unit of consumption of goods is divided by number of Total Units. The Quotient is known as Average Utility. For example—If the Total Utility of 4 bread is 40, then the average utility of 3 bread will be 12 if the Total Utility of 3 bread is 36 i.e., (36 ÷ 3 = 12).

Key takeaways - Utility depends upon the intensity of want. When a want is unsatisfied or more intense, there is a greater urge to demand a particular commodity which satisfies a given want

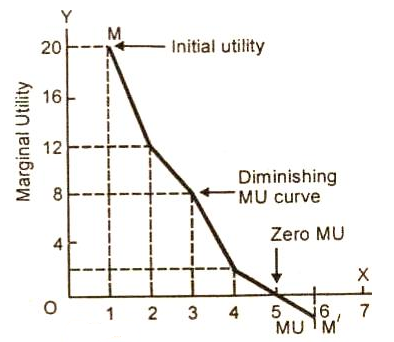

Law of diminishing marginal utility

The law of diminishing marginal utility describes a familiar and fundamental tendency of human behavior. The law of diminishing marginal utility states that:

“As a consumer consumes more and more units of a specific commodity, the utility from the successive units goes on diminishing”.

Mr. H. Gossen, a German economist, was first to explain this law in 1854. Alfred Marshal later on restated this law in the following words:

“The additional benefit which a person derives from an increase of his stock of a thing diminishes with every increase in the stock that already has”.

This law is based upon three facts

The law of diminishing marginal utility is based upon three facts.

Explanation

Suppose a man is very thirsty. He goes to market and buy a glass of sweet water. The glass of water gives him immense pleasure or says first glass of water is great utility for him. If he takes second glass utility is than first one. If he drinks third glass of water, the utility of the third glass will be less than that of second and so on. And if he increases the glass of water will reach at the stage where he feel negative increase or say utility is declined.

Simply we say in a given span of time the more use of product the lesser will be the utility.

Assumption of the law

Assumptions of law of diminishing utility are:

Schedule

Units | Total utility | Marginal utility |

1st glass | 20 | 20 |

2nd glass | 32 | 12 |

3rd glass | 40 | 8 |

4th glass | 42 | 2 |

5th glass | 42 | 0 |

6th glass | 39 | -3 |

From the above table, it is clear that in a given span of time, the first glass of water to a thirsty man gives 20 units of utility. When he takes second glass of water, the marginal utility goes on down to 12 units; When he consumes fifth glass of water, the marginal utility drops down to zero and if the consumption of water is forced further from this point, the utility changes into disutility (-3).

Diagram

In the above figure, X axis we measure units of a commodity consumed and on the Y axis is shown the marginal utility derived from them. The marginal utility of the first glass of water is called initial utility. It is equal to 20 units. The MU of the 5th glass of water is zero. It is called satiety point. The MU of the 6th glass of water is negative (-3). The MU curve here lies below the OX axis. The utility curve MM/ falls left from left down to the right showing that the marginal utility of the success units of glasses of water is falling.

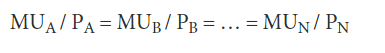

Law of equi marginal utility

The law of equi-marginal utility is simply an extension of law of diminishing marginal utility to two or more than two commodities. The law of equilibrium utility is known, by various names. It is named as the Law of Substitution, the Law of Maximum Satisfaction, the Law of Indifference, the Proportionate Rule and the Gossen’s Second Law.

In cardinal utility analysis, this law is stated by Lipsey in the following words:

“The household maximizing the utility will so allocate the expenditure between commodities that the utility of the last penny spent on each item is equal”.

The law of equi-marginal utility explains the behaviour of a consumer when he consumers more than one commodity. Wants are unlimited but the income which is available to the consumers to satisfy all his wants is limited. This law explains how the consumer spends his limited income on various commodities to get maximum satisfaction.

Definition

In the words of Prof. Marshall, 'If a person has a thing which can be put to several uses, he will distribute it among these uses in such a way that it has the same marginal utility in all'.

The law states that a consumer should spend his limited income on different commodities in such a way that the last rupee spent on each commodity yield him equal marginal utility in order to get maximum satisfaction.

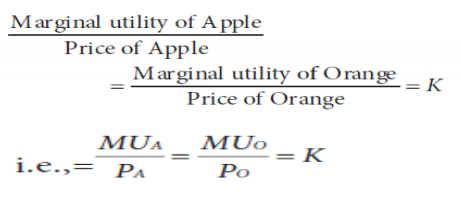

Suppose there are different commodities like A, B, …, N. A consumer will get the maximum satisfaction in the case of equilibrium i.e.,

Where MU’s are the marginal utilities for the commodities and P’s are the prices of the commodities.

Assumption

Explanation

Suppose a consumer wants to spend his limited income on Apple and Orange. He is said to be in equilibrium, only when he gets maximum satisfaction with his limited income. Therefore, he will be in equilibrium at the point where the utility derived from the last rupee spent on

Law of equi marginal utility schedule

Units | Marginal utility of apple | Marginal utility of orange |

1 | 10 | 8 |

2 | 9 | 7 |

3 | 8 | 6 |

4 | 7 | 5 |

5 | 6 | 4 |

6 | 5 | 3 |

7 | 4 | 2 |

8 | 3 | 1 |

Suppose the ma tility of money is constant at Rs 1 = 5 units, th er will buy 6 nits of apple and 5 units of Orange. His total expenditure will be (Rs 5 x 6) + (Rs 4 x 5 ) = Rs 50/- on both commodities. At this point of expenditure his satisfaction is maximised and therefore he will be in equilibrium.

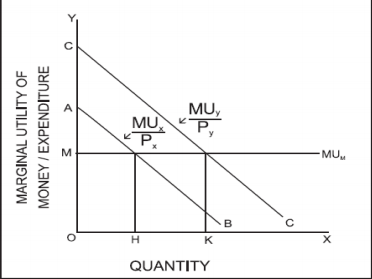

Taking the income of a consumer as given, let his marginal utility of money be constant at OM utils in the above fig. MUX/p X is equal to OM (the marginal utility of money) when OH apple amount of good apple is purchased; MUY/p Y is equal to OM when OK quantity of good orange is purchased. Therefore, the consumer will be in equilibrium when he buys OH of apple and OK of orange.

Limitation

Key takeaways –

References