UNIT 4

Theory of distribution

Concept of rent

Rent refers only to make payments for factors of production which are in imperfectly elastic supply. For instance, it is the price paid for the use of land.

Definition of Rent:

The concept of rent has been defined as follows:

“Rent is that portion of the produce of earth which is paid to landlord for the use of original and indestructible powers of the soil.” -Ricardo

“Rent is the income derived from the ownership of land and other free gifts of Nature.” He further called it ‘Quasi Rent’ which arises on the manmade equipment’s and machines in the short period and tend to disappear in the long run. – Marshall

“Rent is the price paid for the use of land.” –Prof. Carver

Types of rent

1. Economic Rent:

Economic rent refers to the payment made for the use of land alone. But in economics the term rent is used in the sense of economic rent. In the words of Ricardo and other classical economists, economic rent refers to the payment for the use of land alone It is also called Economic Surplus because it emerges without any effort on the part of landlord. Prof. Boulding termed it “Economic Surplus”.

2. Gross Rent:

Gross rent is the rent which is paid for the services of land and the capital invested on it.

Gross rent consists of:

(1) Economic rent. It refers to payment made for the use of land.

(2) Interest on capital invested for improvement of land.

(3) Reward for risk taken by landlord in investing his capital.

3. Scarcity Rent:

Scarcity rent refers to the price paid for the use of the homogeneous land when its supply is limited in relation to demand. If all land is homogeneous but demand for land exceeds its supply, the entire land will earn economic rent by virtue of its scarcity. In this way, rent will arise when supply of land is inelastic.

4. Differential Rent:

Differential rent refers to the rent which arises due to the differences in the fertility of land. In every country, there exists a variety of land. Some lands are more fertile and some are less fertile. When the farmer’s are compelled to cultivate less fertile land the owners of more fertile land get relatively more production. This surplus which arises due to difference in fertility of land is called the differential rent. This type of rent arises under extensive cultivation.

5. Contract Rent:

Contract rent refers to that rent which is agreed upon between the landowner and the user of the land. On the basis of some contract, which may be verbal or written, contract rent may be more or less than the economic rent.

Wages

Wage is defined as the price paid for the services rendered by the labourer in the production process. If wages are paid according to the amount or quantum of work done, it is called piece-wage. E.g. wage for weeding in one acre of paddy field. If wages are paid to a labourer who works for a fixed period of time, it is known as time wage. E.g. wage for weeding per labourer per day.

When payment is made in terms of cash or money, it is known as money wage or nominal wage. Real wage refers to the income of a worker in terms of real benefit. It refers to the amount of necessaries, comforts, and luxuries that a labourer can obtain in return for his services. Real wage refers to the purchasing power of money earned by the labourer or wages paid in terms of quantity of commodities. The standard of living of a labourer depends on his real wage.

Types of wages

a) Minimum Wages

According to Fair Wages Committee, “Minimum Wages should provide not only for the bare necessities of a worker. It should also provide for the maintenance of efficiency of the worker. From this point of view, minimum wages must be sufficient to provide for all requirements of education, health and other essential amenities”. Minimum Wages means the minimum payment to worker so that he may be able in providing for basic needs for himself and his family members and to maintain his working efficiency only.

b) Money Wages

Nominal or money wages are the payments done to workers in money form and do not take account of inflation rates and any other market conditions. Money wages do not take into consideration the purchasing power and the employee receives the amount that is promised to him when he/she is hired. For example, if a worker receives Rs15 per hour from their organization in exchange of the services or labor provided, then that is the nominal wage. The basic determinants of the nominal wages would be the government regulations and the organization’s compensation policy within its capacity.

c) Real Wages

Real wages are the type of wages that take inflation rates into consideration. These wages determine the purchasing power the individual has and the amount of goods or services the individual can purchase given the current market conditions. In other words, it can also be defined as the actual amount of goods and services the employee can purchase with the payments given after inflation has been considered. Real wages indirectly affect nominal wages as the real wage rises employees can easily demand for more money wages.

d) Subsistence Wages

Wages tend to remain at the subsistence level. Wages paid to workers is just sufficient to fulfill their basic needs. Workers don’t have surplus income. If wages rises above this level, this leads to an increase in the population because the increased prosperity of workers will encourage the workers to marry sooner and increase population. This will increase labor supply. The increased competition among workers for employment causes wages to fall again to the subsistence level.

e) Fair Wages

Prof. Pigou, “Fair wages is the wages which is paid at the rate which is being paid to the workers of same status in the enterprises of the same type and of near-by areas”. Fair wages is more than minimum wages. Fair wage is determined after considering several factors such as the wages paid for similar work in other trades, etc. fair wage is determined between the lower and the upper limits. The lower limit of wage is the minimum wage and the upper limit is the capacity of the industry to pay.

Interest and profit

The reward for capital is known as interest. The owner of the capital receives interest for lending his/her capital to others. Capital can be classified into two types – fixed capital and variable capital. In fact, when we say capital, it includes both fixed and variable capital. However, interest is the income earned only on the variable capital. Interest is earned only on that portion of capital which is given by the owner to the borrower. In other words, it is the price paid by the borrower to the lender who parted with his money. Why do people get paid for lending their money? Money in the form of cash provides the holder with benefit because it enables him to buy anything that he desires. However, if an individual lends it to another person, then he will have to wait until he gets back his money and only then he can utilize it.

Basic Concepts

Gross interest: When the borrower pays an amount to the lender for borrowing the lender's money, the amount so paid by the borrower is known as 'interest'. Therefore, when people refer to interest, they generally refer to 'gross interest'. Gross interest is the total amount paid by the borrower to the lender of the money.

Net interest: Net interest is the amount paid to 'capitalists' only for the use of 'capital'. It is the reward paid to the capitalists exclusively for the use of capital. Net interest is the compensation for lending capital to others under conditions where there is no risk or inconvenience due to investment (investments made with no savings motive) and the lender is not required to perform any work other than lending his money. Therefore, net interest is a part of the gross interest. Gross interest consists of some charges along with the net interest.

Gross Interest = Price of the Capital (Net Interest) + Reward for taking risk of money lending + Reward for management of loan + Others (such as the reward for accepting the inconveniences involved in money lending).

Gross interest thus includes compensation for loan of capital, compensation to cover risk of loss (either business risk or personal risk), compensation for inconvenience of investment, compensation for work and apprehension related to monitoring investment.

Saving and investment: According to the theory, savings and investment are not interdependent. It is known that the income level changes along with the changes in investments. The changes in investment levels invariably have an impact on the savings of individuals. Therefore, it is not correct to say that saving and investment are independent of each other.

Profit

Just like rent is the reward for land, wages for labor and interest for capital, profit is the reward for entrepreneurship. While the rewards for other factors of production are paid by the entrepreneur, profit is the reward received by entrepreneur himself. Simply put, profit is the income of an entrepreneur for utilizing his entrepreneurial abilities and running a business. Profit is nothing but the surplus amount left with the entrepreneur after paying all the factors of production. If the income earned by him is in excess of the costs incurred on the factors of production, then the income can be called as profit. Therefore, profit can also be defined as the difference between the total value of output (total revenues received by the businessman) and the total value of inputs (total costs incurred by the businessman) of a business. Profit =Value of Outputs - Value of Inputs

Profit is also viewed as a reward earned by the entrepreneur for performing the entrepreneurial function in a business. There are other economists who believe that profit is the reward for making innovations in business.

Basic concepts

Profit consists of two major components - gross profit and net profit .

Gross profit : Generally, people consider profit as the residual income left with the entrepreneur after making all the payments to other factors of production. However, it should be noted that this is gross profit. The gross profit is arrived at after excluding all the explicit costs from the revenues received by the business. It does not exclude implicit costs such as rent forgone by entrepreneur for utilizing his own land for business purposes, interest forgone on his own capital, etc.

Gross Profit =Total Revenues - Total Explicit Costs Gross profit thus includes those costs which go unrecorded in the books of accounts, but which are nevertheless important to determine the profit made by the business.

Net profit: The net profit can be arrived at by subtracting the implicit costs from gross profits. This is also sometimes referred to as 'pure profit'. Net profit is the surplus leftover after deducting explicit and implicit costs from the sales receipts of a business.

Net Profit =Gross Profit - Implicit Costs

Thus, it can be observed that net profit is a portion of the gross profit. When a business gets zero net profit, it means that the profit attained is just enough to meet the explicit costs of the business. In other words, the entrepreneur's revenues could not payoff his efforts (or implicit costs) such as utilizing his own resources, undertaking risk and uncertainty of business, etc.

Normal profit : It is the minimum return that an entrepreneur receives for performing entrepreneurial functions such as bearing risk and uncertainty, managing other factors of production, etc. Abnormal or super profit: The income remaining with the entrepreneur after subtracting all costs (both implicit and explicit) from the revenues received from the business. It is an excess over the normal profit.

Theory of rent

Economists like Alfred Marshall, Joan Robinson criticized Ricardian theory of Rent and put forward a new approach. They believed that rent does not arise due to fertility of the land rather it arises due to Scarcity of a factor. Although land is free gift of nature but it is not free for a firm or enterprise. They have to pay for its usage and the price is decided by the scarcity i.e. more scare the factor more price for it. So the availability of the factor affects its price. Here the concept of opportunity cost comes in play. Opportunity cost is the value of next best available alternative .A Factor needs to be paid minimum amount equal to its opportunity cost. Remember it is the minimum amount i.e. the lowest limit, actual amount may be much higher.

The actual amount to be paid depends on the scarcity and availability of that factor. If the factor is scare i.e. less available then the buyer has to pay more amount (Price) for that factor than its opportunity cost. This extra payment is nothing but Rent which depends on scarcity of a factor. Similarly for less scare factor buyer may pay an amount equal or slightly higher than its opportunity cost.

So rent is the extra payment over the opportunity cost (Minimum cost which has to be incurred). The scare factor attracts more rent as the difference in the opportunity cost and actual rent paid is more. Ricardo in his theory assumed that rent arises only on land but the advocates of Modern theory of rent believed that rent can arise on any factor of production.

Suppose an IT professional is working in firm A for a monthly package of Rs.one lakh. With the growing IT sector, the demand for IT professionals will increase. Now firm B offers him a monthly package of Rs. two lakh and he accepts the same.

Opportunity cost in above example = 1,00,000

Actual earning of factor = 2,00,000

Rent= Actual earning- Opportunity cost i.e. 200000-100000=100000

The rent of one lakh is result of scarcity of IT professionals i.e. demand of IT professionals are more than its supply as a result their price increases.

The scarcity of factor can be shown with the help of its Supply curve. If the factor is highly scare its supply curve will be vertical to the X axis or perfectly inelastic showing zero opportunity cost and whole amount as rent. On the other hand if the factor is not scare at all supply curve will be horizontal to the X axis or perfectly elastic one showing that the opportunity cost is equal to actual amount and hence Zero rent. So the shape of supply curve is the indicator of scarcity of the factor.

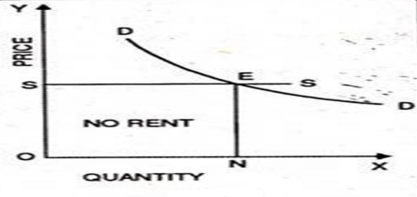

The above diagram shows the situation of no Rent. As you can see the supply cure is perfectly elastic indicating that the factor is not scare at all. Here the opportunity cost is same as the actual amount spent i.e. the minimum amount of opportunity cost is equal to the actual earning of the factor.

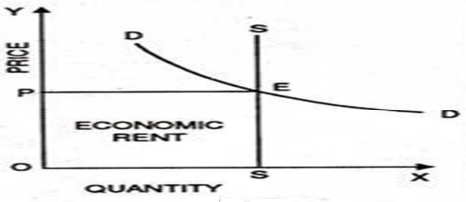

The above diagram shows the case of completely scare factor in which the whole earning is the amount of rent. Here the opportunity cost is zero and supply curve is perfectly inelastic. So whatever the demand for the factor determine its price and the whole amount represents the rent which is OPSE in the above diagram.

Key takeaways –

Marginal Productivity theory

The oldest and most significant theory of factor pricing is the marginal productivity theory. It is also known as Micro Theory of Factor Pricing.

It was propounded by the German economist T.H. Von Thunen. But later on many economists like Karl Mcnger, Walras, Wickstcad, Edgeworth and Clark etc. contributed for the development of this theory.

“The distribution of income of society is controlled by a natural law, if it worked without friction, would give to every agent of production the amount of wealth which that agent creates.” -J.B. Clark

“The marginal productivity theory contends that in equilibrium each productive agent will be rewarded in accordance with its marginal productivity.” -Mark Blaug

Assumptions of the Theory:

The main assumptions of the theory are as under:

Perfect Competition:

The marginal productivity theory rests upon the fundamental assumption of perfect competition. This is because it cannot take into account unequal bargaining power between the buyers and the sellers.

Homogeneous Factors: This theory assumes that units of a factor of production are homogeneous. This implies that different units of factor of production have the same efficiency. Thus, the productivity of all workers offering the particular type of labour is the same.

Rational Behaviour: The theory assumes that every producer desires to reap maximum profits. This is because the organizer is a rational person and he so combines the different factors of production in such a way that marginal productivity from a unit of money is the same in the case of every factor of production.

Perfect Substitutability: The theory is also based upon the assumption of perfect substitution not only between the different units of the same factor but also between the different units of various factors of production.

Perfect Mobility: The theory assumes that both labour and capital are perfectly mobile between industries and localities. In the absence of this assumption the factor rewards could never tend to be equal as between different regions or employments.

Interchangeability:

It implies that all units of a factor are equally efficient and interchangeable. This is because different units of a factor of production are homogeneous, since they are of the same efficiency, they can be employed inter-changeable, and e.g., whether we employ the fourth man or the fifth man, his productivity shall be the same.

Perfect Adaptability: The theory takes for granted that various factors of production are perfectly adaptable as between different occupations.

Knowledge about Marginal Productivity: Both producers and owners of factors of production have means of knowing the value of factor’s marginal product.

Full Employment: It is assumed that various factors of production are fully employed with the exception of those who seek a wage above the value of their marginal product.

Law of Variable Proportions: The law of variable proportions is applicable in the economy.

The Amount of Factors of Production should be Capable of being Varied:

It is assumed that the quantity of factors of production can be varied i.e. their units can either be increased or decreased. Then the remuneration of a factor becomes equal to its marginal productivity.

The Law of Diminishing Marginal Returns: It means that as units of a factor of production are increased the marginal productivity goes on diminishing.

Long-Run Analysis:

Marginal productivity theory of distribution seeks to explain determination of a factor’s remuneration only in the long period.

Modern Theory of wages

Modern theory of wages regards wages as a price of labour. A labour sells his services, which is utilized as a factor in the process of production. As we know, prices of all commodities are determined by their usual supply and demand in the market. According to this approach also wages are determined by the interaction of market forces of demand and supply of labour. To further understand this theory we need to explain the Demand and Supply of labour and the nature of their curves.

Demand for Labour:

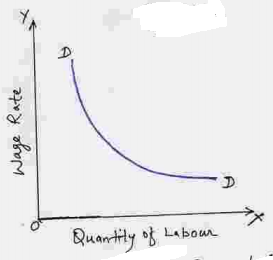

The demand for labour comes from the entrepreneurs as it is used for the production of goods and services. Thus, the demand for labour depends upon the productivity of labour i.e., higher the productivity of labour, the greater will be its demand from employers. Thus, demand for labour depends upon the marginal productivity of labour; since the marginal productivity curve of labour slopes downwards after a stage, the demand curve of labour will also slope downward. This can be shown with the help of below figure

In the above fig number of labour has been measured on OX-axis and the wage rate on Y-axis. DD is the industry’s demand curve. It slopes downward from left to right indicating that when wages are low, demand for labour increases and when the wage rate tends to increase, demand for labour decreases. Thus, there is inverse relationship between wage rate and demand for labour.

Following are the factors that determine the demand for labour:

(a) Derived Demand: The demand for labour is a derived demand. It is derived from the demand for the commodities it helps to produce. Greater the consumer demand for the product, greater the producer demand for labour required to produce that commodity. It may be observed that it is expected demand and not existing demand for the product that determines demand for labour. Hence, the expected increase in the demand for a product will increase the demand for labour.

(b) Elasticity of Demand for Labour: The elasticity of demand for labour depends on the elasticity of demand for commodity. According to this theory, the demand for labour will generally be inelastic if their wages form only a small proportion of the total wages. The demand, on the other hand, will be elastic if the demand for product is also elastic or if cheaper substitutes are available.

(c) Prices & Quantities of Co-Operating Factors: The demand for labour also depends on the prices and the quantities of the co-operating factors. If the machines are costly, the demand for labour will be increased. The greater the demand for the co-operating factors the greater will be the demand for labour, and vice versa.

(d) Technical Progress: Another factor that influences the demand for labour is technical progress. In some cases labour and machineries are used in definite proportions.

Supply of labour

Supply of labour tells us that number of Labourers who are ready to sell their labour at the various wage rates. A labour would sell his services for at least that much of wage in which he can maintain himself and his family. Supply of labour in an economy depends upon both economic as well as non-economic factors. Economic factors influencing the supply of labour comprises of existing employment, desire to increase monetary income, bargaining power of the Labourers, size of population, income distribution etc. while the non-economic factors consist of family affection, social conditions, domestic environment etc.

Psychological factors also affect the supply of labour. It is only due to the psychological factors that a worker decides how much time he should devote to work and how much to leisure. Moreover, the supply of labour also depends on the elasticity.

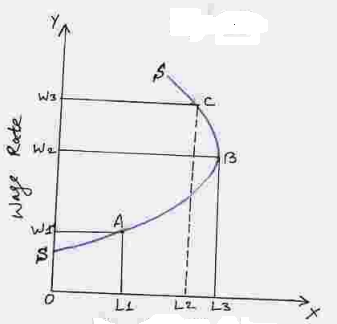

The supply of labour for a firm is perfectly elastic, so, the firm at current wages can employ as many workers as it wishes. On the contrary the nature of supply of labour for an industry is not infinitely elastic. Thus, it cannot employ more and more Labourers at the current wage rate. The industry can do so by attracting labourers from other industries by offering them higher wages. Following diagram clears this point more vividly

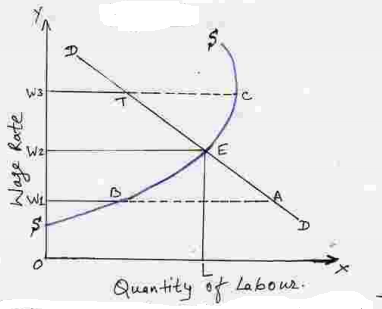

In the above fig, Quantity of Labour selling their services (in hours supplied to an industry) has been taken on X-axis and Wage Rate on Y-axis. SS is the backward bending supply curve. OW1 relates to the initial wage rate. When the wage rate is OW1, the labour supplied or hours of labour supplied are OL1. The maximum supply of labour or working labour hours is OL3 at wage rate OW2. Now suppose the wage rate increases to OW3, in that case quantity of labour supplied or hours of labour services supplied will decrease to OL2. Thus, we may conclude that like other factors of production, supply curve of labour is also upward sloping from left to right.

Factors Affecting Supply:

2. Efficiency of Labour: The supply of labour does not merely depend upon the size of population. It also depends upon the efficiency of labour. Efficiency depends upon several factors like hours of working, service and working conditions, wage rates, economic incentives and other conditions that have a bearing upon the working ability of labour.

3. Mobility of Labour: The supply of labour also depends upon the mobility of labour. If the labour is less mobile either because the means of transport are not developed or there is conservatism among the laborers, or because there are climatic, language or traditional hindrances, then it follows that supply of labour shall be highly limited.

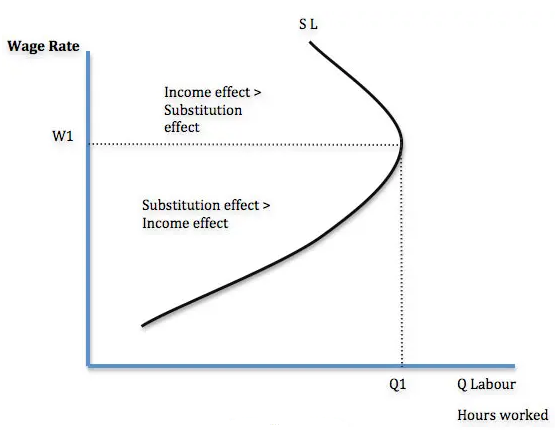

4. Work Leisure Ratio: Supply of labour is influenced very much by this element. A change in supply of labour produces two types of effects: a) Substitution effect: At first when the wages increases then labour instead of taking leisure wants to work more. This is known as substitution effect. b) Income effect: The second impact of increase in wages is increase in their income but after a point instead of working more for earning more they prefer to take leisure. This is known as income effect.

Intersection of the Demand and Supply curve and Wage determination:

In any industry wage is determined at that point where the demand curve for labour cuts the supply curve of labour. At this point demand for labour is equal to supply of labour as shown in the figure below:

In the figure at OW2 wage rate supply and demand of labour are equal where the supply and demand curve of labour intersect each other at point E, so the wage is determined at this point. However, when the wage rate decreases to OW1 then the demand of labour W1A is less than the supply of labour W1B. This will lead to labour shortage which will force wage rate to increase.

On the other hand when the wage rate increases to OW3 then supply of labour W3C is greater than demand of labour W3T. This will lead to surplus availability of labour which will force the wage rate to decrease. Hence, it is only the OW2 wage rate which is the equilibrium wage rate prevalent in the wage market. In the equilibrium state, wage rate always tends to be equal to the marginal productivity of labour, though, in practical life it may be more or less than the marginal productivity.

Backward Bending Supply Curve of Labour

A typical supply curve shows an increase in supply as wages rise. It slopes from left to right.

However, in labour markets, we can often witness a backward bending supply curve. This means after a certain point, higher wages can lead to a decline in labour supply. This occurs when higher wages encourage workers to work less and enjoy more leisure time.

There are two effects related to determining supply of labour.

Key takeaways –

Interest meaning

Interest is a payment made by a borrower to the lender for the money borrowed and is expressed as a rate percent per year. Interest implies the return to capital as a factor of production. But for all practical purposes, “interest is the price of capital.” Capital as a factor of production, in real terms, refers to the stock of capital goods (machinery, raw-materials, factory plant etc.).

As Prof. Marshall has said – “The payment made by borrower for the use of a loan is called interest”.

Classical theory

This theory was expounded by eminent economists like Prof. Pigou, Prof. Marshall, Walras, Knight etc. According to this theory, Interest is the reward for the productive use of the capital which is equal to the marginal productivity of physical capital.

Therefore, those economists who hold classical view have said that “the rate of Interest is determined by the supply and demand of capital. The supply of capital is governed by the time preference and the demand for capital by the expected productivity of capital. Both time preference and productivity of capital depend upon waiting or saving. The theory is, therefore, also known as the supply and demand theory of waiting or saving.”

Demand for capital

Demand for capital implies the demand for savings. Investors agree to pay interest on these savings because the capital projects which will be undertaken with the use of these funds, will be so productive that the returns on investment realised will be in excess of the cost of borrowing, i.e., Interest.

In short, capital is demanded because it is productive, i.e., it has the power to yield an income even after covering its cost, i.e., Interest. The marginal productivity curve of capital thus determines the demand curve for capital. This curve after a point is a downward sloping curve. While deciding about an investment, the entrepreneur, however, compares the marginal productivity of capital with the prevailing market rate of Interest.

Marginal Productivity of Capital = the marginal physical product of capital x the price of the product.

When, the rate of Interest falls, the entrepreneur will be induced to invest more till marginal productivity of capital is equal to the rate of Interest. Thus, the investment demand expands when the Interest rate falls and it contracts when the Interest rate rises. As such, investment demand is regarded as the inverse function of the rate of Interest.

Supply of Capital:

Supply of capital depends basically on the availability of savings in the economy. Savings emerge out of the people‟s desire and capacity to save. To some classical economists like Senior, abstinence from consumption is essential for the act of saving while economists like Fisher. Stress that time preference is the basic consideration of the people who save.

In both the views the rate of Interest plays an important role in the determination of savings. The chemical economists commonly hold that the rate of saving is the direct function of the rate of Interest. That is, savings expand with the rise in the rate of Interest and when the rate of Interest falls, savings contract. It must be noted that the saving-function or the supply of savings curve is an upward sloping curve.

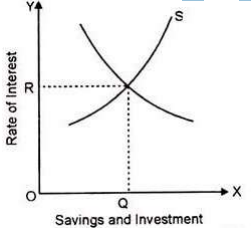

Equilibrium Rate of Interest:

The equilibrium rate of Interest is determined at that point at which both demand for and supply of capital are equal. In other words, at the point at which investment equals savings, the equilibrium rate of Interest is determined. This has been shown by the diagram given below:

In the figure given here OR is the equilibrium rate of Interest which is determined at the point at which the supply of savings curve intersects the investment demand curve, so that OQ amount of savings is supplied as well as invested. This implies that the demand for capital OQ is equal to the supply of capital OQ at the equilibrium rate of Interest OR.

Indeed, the demand for capital is influenced by the productivity of capital and the supply of capital. In turn savings are conditioned by the thrift habits of the community. Thus, the classical theory of Interest implies that the real factor, thrift and productivity in the economy are the fundamental determinants of the rate of Interest.

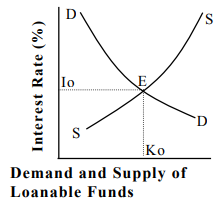

Loanable fund theory of interest

According to this theory, rate of interest is determined by demand and supply of loanable funds. The supply of loanable funds consists of (i) savings of people out of their disposable income, (ii) dishoarding by people from past savings, (iii) disinvestments and (iv) bank credit. The supply of loanable fund is positively related to the rate of interest and hence, the supply curve of loanable funds is upward sloping. In other words, larger amount of loanable funds will be available at higher rates of interest and vice-versa.

Loanable funds are demanded for the following three purposes:

The demand for loanable funds is inversely related to rate of interest. So the demand curve of loanable funds is inversely period of time in the case of long-term loan. So he expects higher interest rate for such loans. The equilibrium interest rate gets determined at the point (E) where supply of loanable funds equals demand for loanable funds, i.e., at equilibrium point the demand and supply curves cut each other. Thus, this theory states that savings of people depend upon the interest rate. But Keynes has shown that savings of people depend upon money income and their preference to keep liquid cash.

Liquidity preference theory

The ‘real’ factors of the supply of saving and the demand for investment are the determinants of the equilibrium interest rate in the classical model. Whereas in the Keynesian analysis, determinants of the interest rate are the ‘monetary’ factors alone.

As the determinants of interest rate, Keynes’ analysis concentrates on the demand for and supply of money. According to Keynes, the rate of interest is purely “a monetary phenomenon.” The price paid for borrowed funds is the interest. The rate of interest in the Keynesian theory is determined by the demand for money and supply of money.

Demand for money

The desire for demand for money arises because of three motives:

Transaction Demand for Money: for day to day transaction money is needed. Money is demanded as there is gap between the receipt of income and spending. Income is earned at the end of week or month but individuals income are spent to meet day to day transaction. Throughout the period spending are made but income are received after a period of time. To finance the transaction individual needs active balance in the form of cash. This is known as transaction demand for money. To meet day to day transaction people with higher income keep more liquid money. Transaction demand for money is an increasing function of money income.

Tdm= f (Y)

Where,

Pdm = f (Y)

2. Speculative Demand for Money: The speculative motive refers to the desire to hold one’s assets in liquid form to take advantages of market movements regarding the uncertainty and expectation of future changes in the rate of interest.

Sdm = f (r) Where, Y is the rate of interest.

3. Total demand for money - The total demand for money (DM) is the sum of all three types of demand for money.

That is, Dm = Tdm + Pdm + Sdm.

The demand for money has a negative slope because of the inverse relationship between the speculative demand for money and the rate of interest.

Key takeaways –

Meaning

Profit is the reward to an entrepreneur for the functions he renders in productive activity. Out of the income earned by the farm, land owner is paid rent, labourer is paid wage and capitalist is paid interest. Whatever is left over goes to the entrepreneur as profit. Hence, profit is also called a residual income

Risk and Uncertainty Theory of Profit

Risk Bearing Theory of Profit

According to Professor Hawley, profits are the rewards for risk taking, which is an important function of an entrepreneur. Production is carried on in anticipation of demand. However, the risks due to theft, accidental damages, price changes (which may again be due to change in fashion, tastes, preferences, etc), labour strike and so on may cause losses. Hence, the entrepreneur has to reduce these risks wherever it is possible. The risk taking is an unpleasant work, though an essential job, for which the entrepreneur has to be suitably rewarded. That reward is called profit. However, there are certain risks for which the consequences are not known well in advance and such risks cannot be insured against. The remuneration for known risks is not profit. Profit arises on account of assumption of unknown risks and it is explained by the uncertainty theory. 3.

Uncertainty-Bearing Theory of Profit

This theory was propounded by F.H. Knight. Knight divided risks into (i) foreseeable risk-a risk that can be foreseen by the entrepreneur and (ii) unforeseeable risk-a risk, which cannot be foreseen by the entrepreneur. Knight calls this unforeseeable risk as uncertainty. According to Knight, profit does not arise on account of foreseeable risk, since such risks can be insured. Hence, risk taking is not the function of the entrepreneur, but of the insurance companies. Profit, according to Professor knight, is due to non-insurable risk (or, unforeseeable risk). A loss due to fire accident in a factory is an insurable risk. A few cases of non-insurable risks are: (i) Loss due to labour strike, (ii) loss due to heavy competition from rival companies, (iii) Loss due to changes in tastes and preferences of the consumer which in turn would result in low demand for the product. It is the primary function of the entrepreneur to anticipate and provide alternative arrangements to tackle non-insurable risks or uncertainties. Thus, profit is paid to the entrepreneur for his ability to bear uncertainty and not for risk-taking.

Innovation Theory of Profit

The innovation theory of profit is developed by Schumpeter. The creation of new products or new process of production is called invention, while innovation is the commercial utilization of invention. Thus the innovator derives profit by utilizing commercially the newly invented products. An entrepreneur is said to be an innovator when he brings a new product for commercial purpose and can earn super normal profit. However, this super normal profit can be obtained only in the short run. This short run super normal profit induces others to introduce similar kind of products or similar process of productions and in the long run this additional profit will be reduced.

Key takeaways –

References