UNIT I

Indian financial System

Developing Countries – India is the world's fifth largest economy in terms of nominal GDP. India's financial system refers to all institutions, structures, and services that provide financial facilities to the public.

It enables the trading and transfer of funds in a secure way. Democratic India has an independent pillar of the financial system, especially in the areas of banking, capital markets, equity markets, insurance, liability, claims, trading and investment.

It is important for the creation of wealth and the economic development of the country.

Characteristics, importance, and function of the Indian financial system

There are five main components:

1. Financial institution:

There are two main types of financial institutions.

a. Banking or deposit handling institution

b. Non-banking or non-depositing institution

These have three additional categories:

2. Financial assets:

These objectives are to provide convenient trading of securities in the commercial and financial markets, based on the requirements of credit seekers.

These are goods or products sold in the financial markets. Financial assets include:

3. Financial services:

Financial services are also included in them:

Banking Services: The functions that banks perform, such as providing loans, accepting debits, distributing credit or debit cards, opening accounts, and granting checks, are some of these services.

Insurance Services: These include services such as providing insurance, selling insurance, and brokerage transactions.

Investment Services: These services include oversight and management of investments, assets and deposits,

Forex Services: These include foreign currency exchange, foreign exchange, and foreign money transfers.

4. Financial market:

These are the markets where bonds, stocks, money, investments and assets are traded and exchanged between buyers.

There are four main types of financial markets:

a. Capital market

b. Financial market

It has two main types:

a) organized money market

b) Unorganized money market

c. Forex market

d. Credit Market

5. Money:

This is an important exchange that can be used to purchase goods and services. It also can act as a store useful. It is evenly accepted everywhere.

Conclusion

The above article on Indian financial system raises awareness about Indian financial system. It helps you prepare for a competitive exam.

Banking System in India

Banks are institutions that accept deposits from the general public. Anyone who has an account in a bank can withdraw money. Banks also lend money.

Indigenous Banks:

The exact date of existence of the indigenous banks is unknown. But it's true that the old banking system has worked for centuries. Some people date the existence of indigenous banks to the Vedic period from 2000 to 1400 BC. It has successfully met the needs of the country in the past.

However, with the arrival of England, its decline began. However, despite the rapid growth of modern commercial banks, indigenous banks continue to maintain their outstanding position in India's money markets. This includes Schlov, Seth, Mahajan, Chetis and more. Indigenous bankers lend money. Act as a money changer and fund India's internal trade through Hundi or internal bills of exchange.

Defect:

The main drawbacks of indigenous banking are:

(i) It is unorganized and has no contact with other sections of the banking industry.

(ii) The combination of banking, trading and commissioning creates trade risks in banking.

(iii) There is no distinction between short-term and long-term financing and the purpose of financing.

(iv) They follow common methods for maintaining an account. They do not issue receipts in most cases, and the interest they charge is not proportional to the interest rates charged by other banking institutions in the country.

Suggestions for improvement:

(i) You need to upgrade your banking business.

(ii) Encourage them to use certain facilities of the banking system, including RBI.

(iii) These banks should be linked to commercial banks based on a certain understanding of the interest charged by the borrower, its verification by the commercial bank, and the transfer of concessions to the preferred sector.

(iv) These banks should be encouraged to become legal entities rather than survive as family-owned businesses.

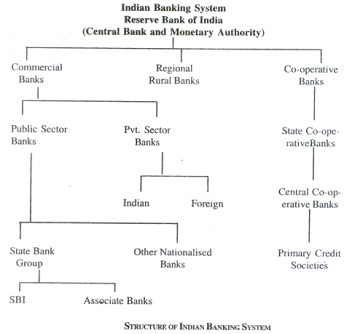

Structure of the organized Indian banking system:

Reserve Bank of India (RBI):

Prior to the establishment of the RBI, the country did not have a central bank. RBI is India's premier financial and banking authority and controls India's banking system. It is called a reserve bank because it holds the reserves of all commercial banks.

Commercial Banks: Commercial banks mobilize civilian savings and make them available to large and small industrial and trade sectors, primarily due to working capital requirements.

Indian commercial banks are primarily India's public and private sectors, with several foreign banks. Public sector banks account for more than 92% of India's total banking business and dominate commercial banks. The State Bank of India and its seven affiliated banks, as well as 19 other banks, are public sector banks.

Scheduled and unscheduled banks:

The planned banks are those stipulated in the second schedule of the RBI Act of 1934. These banks have paid-in capital and a total reserve of Rs or greater. Rs 50,000, hey, we have to satisfy the RBI that their business is carried out for the benefit of their depositors.

All commercial banks (India and foreign), regional banks, and state co-operative banks are planned banks. Unscheduled banks are those that are not included in the second schedule of the 1934 RBI Act. Currently, there are only three of these banks in the country.

Local regional banks: The latest form of banking, regional banks (RRBs), developed the local economy in the mid-1970s (sponsored by individual state-owned commercial banks) by providing credit and deposit facilities such as agriculture. Was born for the purpose of. All kinds of production activities in rural areas.

The emphasis is on providing such facilities to small and marginal farmers, agricultural workers, rural artisans, and other small entrepreneurs in rural areas.

Other special features of these banks are:

(I) Their areas of activity are limited to specific areas, including one or more districts in any state. (ii) Their lending rates cannot be higher than the general lending rates of co-operative credit associations in a particular state. (iii) The paid-up capital of each regional bank is Rs 2,50,000 ,50% of them are from the central government, 15% are from the state government, and 35% are from public sector commercial banks, which are also responsible for the actual establishment of the RRB.

These banks are backed by higher level institutions. The sponsor bank lends funds and advises and trains senior staff. NABARD (National Agricultural and Rural Development Bank) offers short-term and medium-term loans. RBI maintains this. Their CRR (cash reserve requirement) is 3% and SLR (statutory liquidity requirement) is 25%. For other commercial banks, the minimum ratio required has changed over time.

Cooperative Banking:

Co-operative banks are so-called because they're organized under the provisions of the State Co-operative Credit Association Act. the most beneficiaries of co-operatives are the agricultural sector and therefore the general rural sector especially.

There are two main sorts of cooperative credit institutions operating in Japan: agricultural (dominant) and non-agricultural. There are two separate co-operative agencies for providing agricultural credit. One is for short-term and medium-term credit, and therefore the other is for long-term credit. the previous features a three-tiered federal structure.

At the highest is that the State Cooperative Bank (SCB) (cooperation is that the subject of the Indian state), at the intermediate (district) level is that the Central Cooperative Bank (CCB), and at the village level is that the Primary Agricultural Credit Association (PAC)

Long-term agricultural credit is provided by the exploitation Bank. RBI funding for the agricultural sector actually goes through SCB and CCB. Originally based in rural areas, the co-operative credit movement has now spread to urban areas, with many urban co-operative banks under the SCB.

Financial sector reforms in India

The financial sector is part of an economy consisting of companies and institutions responsible for providing financial services to customers in the commercial and retail segments. The financial sector includes commercial banks, non-bank financial companies, investment funds, money markets, insurance and pension companies, real estate and more. The financial sector is seen as an essential economic foundation for financial mobilization and distribution. resource.

Financial sector reform refers to measures to reform the banking system, capital markets, government bond markets, foreign exchange markets, and so on. To mobilize household savings and make good use of them in the production sector, we need an efficient financial sector. Prior to 1991, India's financial sector suffered from several flaws and deficiencies that reduced the quality and efficiency of its operations. Therefore, reform of the financial sector was indispensable at that time.

Reasons for India's financial sector reform

Strategies adopted by India for financial sector reform

India's financial sector reform

Narasimhan Commission Report, 1991

Banking sector reform:

Private Bank Permits: After financial reform, we were given life and HDFC Bank, ICICI Bank, IDBI Bank, Corporation Bank, etc. were established in India. This has created a lot of necessary competition in the Indian money market, which was essential to improving its efficiency. Foreign banks are also allowed to open branches in India, and banks such as Bank of America, Citibank and American Express have opened many new branches in India. Foreign banks have been allowed to operate in India using the following three channels:

Government Bond Market Reform

Regulatory Role

Forex Market Reform

Other important financial sector reforms

Key takeaways:

RBI is the governing body of India's monetary policy. They control the flow of money to the market through various means of monetary policy. This helps the RBI manage inflation and liquidity in the economy. Let's take a look at the monetary policy tools used by the RBI.

Reserve Bank of India

RBI is the Central Bank of India. It was founded in 1935 under the special law of Parliament. The RBI is a major authority on national monetary policy. The main function of the RBI is to maintain economic stability and the required level of liquidity.

RBI also controls and regulates the monetary system of our economy. This is the only banknote issuer in India. RBI is the central bank that manages all other commercial banks, financial institutions, financial companies and more. The RBI oversees the country's entire financial sector.

Monetary policy means

Monetary policy is the way the RBI manages the money supply in the economy. Therefore, these credit policies help control inflation and thus help the country's economic growth and development. Let's take a look at the various monetary policy tools that RBI has at its disposal.

1] Open market operations:

Open market operations are the direct involvement of the RBI in buying and selling short-term securities in the open market. This is a direct and effective way to increase or decrease the money supply in the market. It also has a direct impact on the market's ongoing interest rates.

Let's say the market is in equilibrium. The RBI then decides to sell the short-term securities in the market. The money supply in the market will decrease. And after that, the demand for credit lines will increase. Therefore, interest rates will rise accordingly.

On the other hand, if RBI buys securities from the open market, it has the opposite effect. The money supply to the market will increase. As a result, the demand for credits declines and interest rates fall.

2] Bank interest rates:

One of the most effective means of monetary policy is bank interest rates. Bank interest rates are basically the interest rates at which RBI lends funds to commercial banks with or without collateral. This is also the standard rate at which RBI purchases or discounts bills of exchange and other such products.

Therefore, if RBI raises bank interest rates, commercial banks also need to raise lending rates. And this helps manage the money supply in the market. And vice versa will obviously increase the money supply in the market.

3] Variable reserve requirements:

This monetary policy instrument has two components: the cash reserve ratio (CLR) and the statutory liquidity ratio (SLR). Let's understand both.

The Cash Reserve Rate (CRR) is part of a commercial bank deposit that must be deposited with the RBI. Therefore, CRR is the percentage of deposits that a commercial bank must hold in RBI. The RBI adjusts the above percentages to control the money supply available at the bank. Therefore, the loans offered by banks will be cheaper or more expensive. CRR is a great tool for controlling inflation.

The statutory liquidity ratio (SLR) is the percentage of total deposits that a commercial bank must hold in the form of cash reserves or gold. Therefore, increasing SLR means that banks provide less money as loans and control the money supply in the economy and vice versa.

4] Liquidity adjustment facility:

The Liquidity Adjustment Facility (LAF) is an indirect means of managing currencies. Control the flow of funds through repo rates and reverse repo rates. Repo rates are actually the rates at which commercial banks and other institutions obtain short-term loans from central banks.

Reverse repo rate is the rate at which RBI deposits funds in a commercial bank in a short period of time. Therefore, RBI constantly changes these rates to control the flow of funds in the market according to economic conditions.

5] Moral appeal:

This is an informal method of money management. The RBI is the central bank of the country and therefore enjoys a supervisory position in the banking system. If necessary, banks can be encouraged to exercise credit control from time to time in order to maintain a balance of funds in the market. This method is actually very effective, as banks tend to follow the policies set by the RBI.

The role of the RBI is broadly divided into two parts, namely traditional functions and development functions.

Traditional Functions:

Check out the functions that are common to any or all central banks within the world. the normal functions of the financial organisation embrace the following:

(a) Issuing bank: Has the exclusive right to issue banknotes (currency) in all countries of the world. In the early years of banking, all banks enjoyed the right to issue promissory notes. However, this led to a number of problems, such as excessive banknote issuance and disorganization of the monetary system. Therefore, the governments of different countries authorized the central banks to issue banknotes. The issuance of notes by a bank has resulted in uniformity in the circulation of notes and the equilibrium of the money supply.

(b)Banker, agent and consultant to the govt: It implies that a financial organization performs totally different functions for the government. As a banker, the financial organization performs banking functions for the govt even as industrial banks do for the general public by acceptive government deposits and creating loans to the govt. As agent, the financial organization manages the general public debt, assumes the payment of the interest on this debt and provides all different debt-related services. As associate consultant, the financial organization advises the govt on matters of policy, securities industry, capital markets, and government loans. except for this, the financial organization formulates and implements business enterprise and financial policies to {control} the money provides within the market and control inflation.

(c) Steward of the money reserves of economic banks: Government banker, agent and consultant: It implies that a financial organization performs totally different functions for the government. As a banker, the finance organization performs banking functions for the government, just as industrial banks do for the general public, by accepting deposits from the government and creating loans for the government. As an agent, the financial institution manages the general public debt, assumes the payment of interest on this debt and provides all the different services related to the debt. As an associate consultant, the finance organization advises the government on policy, securities industry, capital markets, and government loans. Except for this, the finance organization formulates and implements business and financial policies to {control} the money provided within the market and to control inflation.

(d) Manager of the money reserves of economic banks: It implicit that the central bank keeps a minimum deposit of international currency. The main objective of this reserve is to meet emergency foreign exchange requirements and overcome adverse deficit requirements in the balance of payments

(e)Rediscount bank: Meet the money wants of people and firms by rediscounting bills of exchange through business banks. this can be associate indirect manner of loaning cash to business banks by the financial organization. Discounting a bill of exchange implies deed the bill by shopping for it for a add but its face price. Rediscount involves discounting a antecedental discounted bill of exchange. once house owners of bills of exchange want money, they approach the banking concern to discount these bills. If the business banks themselves want money, they approach the financial organization to rediscount the bills.

(f) investor of last resort: see the foremost crucial role of the financial organization. The financial organization conjointly lends cash to business banks. rather than rediscounting bills, the financial organization makes loans against treasury bills, government securities, and bills of exchange.

(g)Central clearing, settlement and transfer bank: It implies that the central bank helps to settle the mutual indebtedness between commercial banks. Bank depositors deliver checks and money orders from other banks. In such a case, it is not possible for banks to approach each other for clearing, settlement or transfer of deposits. The central bank facilitates this process by establishing a clearinghouse under its responsibility. The clearinghouse acts as an institution where mutual indebtedness between banks is settled. Representatives of different banks meet at the clearinghouse to settle interbank payments. This helps the central bank to know the liquidity status of commercial banks.

(h) Credit controller: It implies that the central bank has the power to regulate the creation of credit by commercial banks. Credit creation depends on the amount of deposits, cash reserves, and interest rate given by commercial banks. All of these are controlled directly or indirectly by the central bank. For example, the central bank can influence commercial bank deposits by conducting open market operations and making changes to the CRR to control various economic conditions.

(b) Developmental Functions:

Refer to the functions related to the promotion of the banking system and the economic development of the country. These are not mandatory functions of the central bank. These are treated as follows:

(i) Development of specialized financial institutions: See the main functions of the central bank for the economic development of a country. The central bank establishes institutions that serve the credit needs of the agricultural sector and other rural businesses. Some of these financial institutions include the Industrial Development Bank of India (IDBI) and the National Bank for Agriculture and Rural Development (NABARD). They are called specialized institutions because they serve specific sectors of the economy.

(ii) Influence the money market and the capital market: It implies that the central bank helps to control the financial markets. Money market operations in short-term credit and capital market operations in long-term credit. The central bank maintains the economic growth of the country by controlling the activities of these markets.

(iii) Compilation of statistical data: It compiles and analyzes data related to the banking, monetary and exchange position of a country. The data is very useful for researchers, politicians and economists. For example, the Reserve Bank of India publishes a magazine called the Reserve Bank of India Bulletin, whose data is useful for formulating different policies and making decisions at the macro level.

7 Important Promotional Functions of Reserve Bank of India

Reserve Bank of India promotion function

The various promotional features implemented by the Federal Reserve Bank of India are listed below.

1. Promote banking habits:

The Federal Reserve Bank of India helps mobilize people's savings for investment. we've expanded our banking industry nationwide by establishing various institutions like UTI, IDBI, IRCI and NABARD. This promoted people's banking habits.

2. Offering refinancing for export:

The Federal Reserve Bank of India offers refinancing to market exports. credit and Guarantee Corporation (ECGC) and Export Import Bank were originally established by the Federal Reserve Bank of India to fund India's foreign trade. They lend to foreign trade the shape of insurance covers, long-term loans and foreign currency-denominated credit. However, it's currently working individually.

3. Granting credit to agriculture:

The Federal Reserve Bank of India has institutional arrangements for rural or agricultural finance. For instance, banks have found out special agricultural credit cells. It promoted local regional banks with the assistance of economic banks. NABARD is additionally promoted.

4. Providing credit to small industrial units:

Commercial banks lend to the tiny industrial sector in accordance with the occasional directive issued by the Federal Reserve Bank of India. The Federal Reserve Bank of India encourages commercial banks to supply guarantee services to the tiny industry sector also. The Federal Reserve Bank of India considers the progress given to the tiny sector as progress within the priority sector. He also instructed commercial banks to open specialized branches to supply adequate financial and technical assistance to the tiny industrial sector.

5. Providing indirect finance to the co-operative sector:

The RBI has instructed NABARD to lend to the state co-operative banks, which are lending to the co-operative sector. Therefore, the Federal Reserve Bank of India provides indirect financing to the Indian co-operative sector.

6. Exercise control over the national financial and banking industry:

The Federal Reserve Bank of India has enormous and broad authority over the supervision and control of economic banks, co-operative banks, and non-bank institutions that receive deposits. Banking Regulations provide a minimum of a good range of requirements for paid-in capital, reserves, cash reserves and current assets.

Bank operations, management, mergers, reconstructions, liquidations, etc. are thoroughly overseen by Federal Reserve Bank of India staff. All planned banks are required to submit a weekly report back to the Federal Reserve Bank showing key items of India's liabilities and assets.

7. Creating an industrial agreement for industrial finance:

The Federal Reserve Bank of India has institutional arrangements for industrial finance. for instance, several development banks are created to supply long-term finance to industry, like the economic Finance Corporation of India and therefore the Industrial Development Bank of India.

Monetary Policy-

Monetary policy is a policy developed by the Central Bank, the RBI (Reserve Bank of India), and is related to national financial issues. This policy includes measures taken to regulate the money supply, availability, and credit costs in the economy.

This policy also monitors the distribution of credits between users, as well as interest rate borrowing and lending. In developing countries like India, monetary policy is important in promoting economic growth. Various means of monetary policy include bank interest rates, other interest rates, selective credit management, currency supply, reserve requirement fluctuations, and open market fluctuations.

Purpose of monetary policy

Facilitating Savings and Investment: Monetary policy controls domestic interest rates and inflation, which can affect people's savings and investment. Higher interest rates lead to greater opportunities for investment and savings, thereby maintaining healthy cash flow within the economy.

Export-Import Control: Monetary policy helps export-oriented units replace imports and increase exports by helping industries secure loans at low interest rates. This, in turn, helps improve the balance of payments.

Business Cycle Management: The two main stages of the business cycle are boom and bust. Monetary policy is the greatest tool for controlling business cycle booms and busts by managing credit and controlling the money supply. Market inflation can be controlled by reducing the money supply. On the other hand, as the money supply increases, so does the demand of the economy.

Aggregate Demand Regulation: Monetary policy can control the demands of the economy, which financial authorities can use to balance the supply and demand of goods and services. As credit grows and interest rates fall, more people will be able to secure loans to buy goods and services. This leads to increased demand. On the other hand, if authorities want to reduce demand, they can reduce credit and raise interest rates.

Job Creation: Monetary policy can lower interest rates, making it easy for small and medium-sized enterprises (SMEs) to secure loans to expand their business. This can lead to greater employment opportunities.

Supporting Infrastructure Development: Monetary policy allows concessional funding for the development of domestic infrastructure.

Allocation of more credits to priority segments: Under monetary policy, additional funds will be allocated at lower interest rates for the development of priority sectors such as small industries, agriculture and underdeveloped sections of society.

Banking Sector Management and Development: The entire banking industry is managed by the Reserve Bank of India (RBI). The RBI aims to make banking facilities widely available nationwide, but uses monetary policy to instruct other banks to establish local branches whenever necessary for agricultural development. In addition, the government has also set up local regional banks and co-operative banks to give farmers immediate access to the financial assistance they need.

Flexible Inflation Targeting Framework (FITF)

The Flexible Inflation Targeting Framework (FITF) was introduced in India in 2016 after the Reserve Bank of India (RBI) Act was amended in 1934. In accordance with the RBI Act, the Government of India sets an inflation target every five years after consultation. With RBI. The inflation target for the period from August 5, 2016 to March 31, 2021 was determined to be 4% of the consumer price index (CPI), but the central government has capped it at 6%. In the same case, the lower limit can be 2%.

This framework may not be able to meet a fixed inflation target for a period of time. This can happen in the following cases:

Average inflation has been above the central government's pre-determined inflation target for the third consecutive quarter.

Average inflation has been below the central government's preset lower limit of inflation for the third straight quarter.

Monetary policy tool-

Quantitative tools –

Tools applied by policies affecting the money supply of the entire economy, including sectors such as manufacturing, agriculture, automobiles and housing

Reserve Ratio

Banks need to secure a certain percentage of cash reserves or RBI-approved assets. There are two types of reserve rates.

Reserve requirement ratio (CRR) – Banks must secure this portion in cash with the RBI. Banks cannot lend it to anyone or earn interest or profits on CRR.

Legal Liquidity Ratio (SLR) – Banks must reserve this portion in current assets such as gold or RBI-approved securities such as government securities. Banks can earn interest on these securities, but that is very low.

Open Market Operations (OMO):

To manage the money supply, RBI buys and sells government bonds on the open market. These operations performed by the central bank in the open market are called open market operations.

Liquidity is sucked from the market when RBI sells government bonds, and the opposite happens when RBI buys securities. The latter is done to control inflation. The purpose of OMO is to check for temporary market liquidity mismatches due to the flow of foreign capital.

Qualitative tools:

Policy rate:

Bank interest rates – The interest rate at which the RBI lends long-term funds to a bank is called the bank interest rate. However, RBI does not currently have full control over the money supply through bank interest rates. We use the liquidity adjustment facility (LAF), which is a repo, as one of the key tools for establishing the management of the money supply.

Bank rates are used to penalize banks if they do not maintain a prescribed SLR or CRR.

Liquidity Adjustment Facility (LAF) – RBI uses LAF as a means of adjusting liquidity and the money supply. The following types of LAF are:

Repo rate: Repo rate is the rate at which a bank borrows from RBI for a repo contract in the short term. Under this policy, banks are required to provide government securities as collateral and buy them back after a predefined time.

Reverse repo rate: The opposite of repo rate. That is, this is the rate that RBI pays the bank to hold additional funds in RBI. It is linked to the repo rate in the following ways:

Reverse repo rate = repo rate – 1

Marginal Permanent Facility (MSF) Rate: The MSF rate is the penalty rate at which the central bank lends money to the bank and exceeds the rate available in the contact policy. Banks using MSF rates can use up to 1% of SLR securities.

MSF rate = repo rate +1

Communication of monetary policy-

Steps to improve money transfers:

Non-monetary economy in certain rural areas.

Dear monetary policy or contractile monetary policy:

Dear monetary policy is the policy when money becomes more expensive. Rising interest rates. For this reason, the money supply also decreases in the economy, so it is also called contraction monetary policy.

This policy leads to slower business expansion and slower business expansion due to high credit costs. This affects employment because it slows growth. Therefore, rate cuts such as SLR and CRR are preferred by governments and businesses.

Fiscal policy:

The policies set by the Treasury, which deal with matters related to government spending and revenue, are called fiscal policy. Income issues include non-tax issues such as loan procurement, taxation, service fees, and sales. Expenditure issues include salaries, pensions, subsidies, and the funds used to create capital assets such as bridges and roads.

Demand pull inflation:

This is a condition where people have excess money to buy goods in the market. The RBI can lead to a decline in the money supply in the economy, which means lower prices, which makes it easier to manage.

Supply-Side Inflation:

Economic inflation due to restrictions on the supply side of commodities in the market. This is not controlled by RBI as it does not control the price of the item. In this case, government plays an important role through fiscal policy.

Conclusion:

The Reserve Bank of India reduced its repo rate and reverse repo rate to 4.40% and 4.00% on March 27. However, the coronavirus pandemic hit the economy and the central bank lowered its reverse repo rate by another 25 basis points on April 17. The reverse repo rate after reduction is 3.75%.

On March 27, the central bank reduced its Marginal Standing Facility (MSF) rate and bank rate to 4.65%, respectively.

Creating credits (money) :

RBI makes money, Money by creating credits, which are also treated as credit creation. Commercial banks generate credit in the form of secondary deposits.

There are two types of total bank deposits.

(I) Primary deposits (initial cash deposits by the general public) and (ii)Secondary deposits (deposits generated by loans from banks and expected to be re-deposited in banks) Funds generated by commercial banks are (i) primary deposits (initial cash deposits) and (ii) statutory reserves. It is determined by two factors. Ratio (LRR), the minimum ratio of deposits that a commercial bank is legally required to hold as liquid cash. Broadly speaking, when a bank receives a cash deposit from the general public, the bank holds a portion of the deposit as a cash reserve (LRR) and uses the remaining amount for lending. In the process of lending money, banks can generate credit through secondary deposits that are many times larger than the initial deposit (primary deposit).

How? It is explained below.

Money (credit) making process:

A man like X deposits 2,000 rupees in a bank and LRR

Ten%. This means that the bank holds only the minimum required Rs 200 as a cash reserve (LRR). The bank can use the remaining amount Rs 1800 (= 2000 – 200) to lend to someone. (To be on the safe side, the loan will not be offered in cash, but will be re-deposited into the bank as a demand deposit in favor of the borrower.) The bank does not actually lend, only the demand deposit account We will lend 1800 rupees to the opened Y. The name and amount will be credited to his account.

This is the first round of credit creation in the form of secondary deposits (Rs 1800), which is 90% of the primary (initial) deposits. Again, 10% of Y's deposit (ie Rs 180) is kept in the bank as a cash reserve (LRR) and the remaining Rs 1620 (= 1800 – 180) goes to Z, for example. The bank will receive a new demand deposit of Rs. 1620. This is the second round of credit creation, which is 90% of the primary round of increase of 1800 rupees. The third round of credit creation will be 90% of the second round of 1620. This is not the end of the story. The credit creation process continues until the derivative deposit

(Secondary deposit) will be zero. After all, the amount of total credit

Anything created this way will be a multiple of the initial (primary) deposit. The·

The quantitative result is called the money multiplier. If the bank successfully creates total credits, Rs 18000 means that the bank has created 9 primary deposits for Rs 2000. This is the meaning of credit creation.

Money multiplier:

This means a multiple that increases total deposits due to initial deposits

(Primary) deposit. The money multiplier (or credit multiplier) is the reciprocal of the statutory reserve ratio (LRR). If the LRR is 10%, that is, 10/100 or 0.1, then the money multiplier = 1 / 0.1 = 10.

The smaller the LRR, the larger the size of the money multiplier deposited in his account. He is only given a cheque book to draw a cheque when he needs money. Again, 20% of Sohan's deposit, which is considered a safe limit, is held for him by the bank and the remaining Rs 640 (= 80% of 800) is remitted to Mohan, for example. Therefore, the credit creation process goes on and on, and the final volume of the total credits created this way will be a multiple of the first cash deposit. Bank loans only make deposits (or credits) for the borrower, so banks can lend money and claim interest without letting go of cash. If a bank succeeds in creating a credit of, for example, 15,000 rupees, it means that the bank has created 15 times as many credits as a primary deposit of 1,000 rupees. This is the meaning of credit creation. Similarly, banks buy securities and create credits when they pay the seller their own check. Checks are deposited in some banks and deposits (credits) are created for the seller of securities. This is also called credit creation. As a result of credit creation, the money supply in the economy will be higher. Because of this credit creativity of commercial banks (or banking systems), they are called credit factories or money manufacturers.

The limits of the credit creation process are explained as follows:

(A) Cash amount:

Affects the creation of credit by commercial banks. Cash is high Commercial banks in the form of public deposits, more will be credit Created. However, the amount of cash held by commercial banks it is managed by the central bank. Central banks have the potential to increase or decrease cash in commercial banks. Purchase or sale of government securities. In addition, credit Creation ability depends on the rate of increase / decrease in CRR.

(B) CRR:

Refers to the cash reserve rate that needs to be stored in a central bank. According to a commercial bank. The main purpose of maintaining this reserve is meet depositors' trading needs, ensure security, Liquidity of commercial banks. Credit creation when the ratio goes down more and vice versa.

(C) Leakage:

It means the outflow of cash. The credit creation process is Cash leak.

The different types of leaks are described as follows:

(I) Excessive preparation:

It generally happens when the economy is heading into a recession.In such cases, the bank may decide to keep the reserve instead of using it. Funds for lending. Therefore, in such situations, the credits created by Commercial banks will be small, as large amounts of cash are indignant.

(II) Currency outflow:

It means that the public does not deposit all the cash. Customers are possible to hold with them cash that affects the credit creation of banks. Therefore, banks' ability to generate credit is diminished.

(D) Borrower availability:

It affects the credit creation of banks. Credits are created by lending money in the form of a loan to the borrower. No credit creation if there is no borrower.

(E) Availability of securities:

A security that a bank lends. Therefore, the availability of securities is required to grant a loan. Otherwise, credit creation will not occur. According to Clauser, "Banks do not generate money from thin air. It turns other forms of wealth into money."

(F) Business conditions:

Credit creation means being influenced by the cyclical nature of the economy. For example, when the economy enters a recession, credit creation becomes smaller. This is because during the depression stage, businessmen do not like to invest in new projects. On the other hand, during the prosperous period, businessmen ask banks for loans, which leads to credit creation.

Despite that limitation, we create that credit Commercial banks are an important source of income.

The basic conditions for creating a credit are as follows:

Key takeaways-

What is a commercial bank?

A commercial bank is a type of financial institution that does everything from depositing and withdrawing money to the general public and providing loans for investment. These banks are commercial institutions and operate solely for commercial purposes.

The two main characteristics of commercial banks are lending and borrowing. Banks receive deposits and give money to various projects to earn interest (profit). The interest rate that a bank provides to depositors is called the borrowing interest rate, and the interest rate that a bank lends money to is called the lending interest rate.

Commercial bank functions:

The functions of commercial banks fall into two major divisions.

(A) Main functions

Accept Deposits: Banks receive deposits in the form of savings, current and fixed deposits. Surplus balances collected from companies and individuals are lent out as a temporary requirement for commercial transactions.

Providing Loans and Prepaid: Another important function of this bank is to provide entrepreneurs and businessmen with loans and prepayments and collect interest. For all banks, it is a major source of profit. In this process, the bank holds a small number of deposits as reserves and provides (lends) the remaining amount to the borrower at banks such as demand loans, overdrafts, cash credits and short-term loans.

Credit Cash: When a customer is offered a credit or loan, no liquid cash is offered. First, a bank account is opened for the customer and then the money is transferred to that account. This process allows banks to make money

(B) Secondary function

Bill of exchange discount: This is a written agreement approving the amount to be paid for goods purchased at a particular point in the future. You can also settle the amount before the estimated time by using the discount method of the commercial bank.

Overdraft Facility: A prepayment given to a customer by overdrawing the overdraft to a certain limit.

Buying and Selling Securities: Banks provide the ability to sell and buy securities.

Locker Equipment: Banks provide locker equipment to their customers to keep valuables and documents safe. The bank charges a minimum annual fee for this service.

Use various means such as promissory notes, checks, and bills of exchange.

Types of commercial banks:

There are three different types of commercial banks.

Private Bank –: A type of commercial bank in which an individual or company owns a majority of the equity capital. All private banks are recorded as limited liability companies. Banks such as Housing Development Finance Corporation (HDFC) Bank, India Industrial Credit Investment Corporation (ICICI) Bank, Yes Bank, etc.

Public Banks –: A type of nationalized bank in which the government holds important shares. For example, Bank of Baroda, State Bank of India (SBI), Dena Bank, Corporation Bank, Punjab National Bank.

Foreign Banks –: These banks are established abroad and have branches in other countries. For example, banks such as American Express Bank, Hongkong and Shanghai Banking Corporation (HSBC), Standard & Chartered Bank, and Citibank.

Commercial Bank Example

Here are some examples of commercial banks in India:

Regulatory Environment for commercial bank in Indian core banking.

India's financial system is regulated by independent regulators in a variety of areas, including banks, capital markets, insurance, commodity markets and pension funds. However, the Government of India, at least to some extent, plays an important role in influencing the regulatory framework of these institutions.

Primarily in India, banking and financial institution regulations comply with the Banking Regulation Act of 1949. It was passed as the Banking Companies Act of 1949 and came into effect on March 16, 1949. Banking Regulations Act from March 1, 1966.

For those who want to work in a bank, it is appropriate to know about the workings and regulations of Indian financial institutions. From a review perspective, you can ask objective questions about the chair of the regulatory body, the location of the headquarters, the year of establishment, and so on.

In addition, questions about banking regulation laws and related recent developments can be asked in the main and interviews.

Now let's take a brief look at the regulations of banks and financial institutions.

Banking Regulation Act 1949

The following are important points regarding the Banking Regulation Act of 1949.

It regulates all banking institutions in India. Initially applied only to banking companies, it was amended in 1965 to have jurisdiction over co-operative banks. Cooperative banks are established and operated by the state government, but authorization and regulation are under the control of the RBI.

The law authorizes RBI to license banks and regulates shareholding. Regulate bank operations. Oversees the appointment of the board of directors and management. Create an audit instruction. Issue directives for the public good. Manage moratoriums, mergers, liquidations and acquisitions. I will impose penalties.

Reserve Bank of India (RBI)-

Founded under the RBI Act of 1934, RBI is the central bank of India. And it has various responsibilities under the Banking Regulation Act of 1949. Some of its main features are listed below.

Securities and Exchange Commission of India (SEBI)

The Securities and Exchange Commission of India (SEBI), established on April 12, 1992 under SEBI Act 1992, is a statutory body owned by the Government of India. Its main function is to protect the interests of investors on the stock exchange and regulate the securities market. SEBI is headquartered in Mumbai with branch offices in Delhi, Kolkata and Chennai.

India Insurance Regulatory Development Agency (IRDAI)

Established under the Insurance Regulatory Development Authority Act of 1999, IRDAI is a self-governing body responsible for regulating and promoting the Indian insurance and reinsurance industry. Headquartered in Hyderabad, it is a 10-member organization consisting of a president, 5 full-time members, and 4 part-time members appointed by the Government of India.

PFRDA under the Ministry of Finance

PFRDA stands for Pension Fund Regulatory Development Bureau. Established by the Government of India by Executive Order on August 23, 2003, PFRDA is obliged to act as a regulator of pension funds. Headquartered in Delhi, India, it is currently headed by Supratim Bandyopadhyay, chair of PFRDA. The organizational structure consists of a chairman, three full-time members of finance, law and economics, and a chief alert officer.

Candidates are encouraged to investigate in detail the primary objectives of each of these regulators. Keep an eye on recent developments in any of these institutions as they are very important from a testing perspective.

Key takeaway:

References: