UNIT II

Operational Aspect of Commercial Banks in India

Commercial banks form an important part of the country's financial institution system. Commercial banks are institutions that accept deposits from the general public and generate profits that give money (loans) to individuals such as homes, entrepreneurs, and business people. The main purpose of these banks is to make a profit in the form of interest, fees and so on. Of all these commercial banks, it is regulated by the Reserve Bank of India, India's central bank and premier financial institution.

The main source of income for commercial banks is the difference between these two rates, which bill the borrower and pay the depositor. Examples – ICICI Bank, State Bank of India, Axis Bank, and HDFC Bank, Punjab National Bank, Central Bank of India.

Commercial Bank Functions:

Main functions of commercial banks:

Accepting deposits:

Commercial banks, short-term credit dealers, accept national savings in the form of the following deposits:

Lending Money: The second major function is to provide loans and prepayments, thereby earning interest. This feature is the bank's main source of income.

Overdraft Facility: Gives the current A / c holder more permission than what was deposited in his / her account.

Loans & Advances: A type of secured and unsecured loan for certain types of collateral. Bills of Exchange Discounts: If you want money right away, you can show your B / E to each commercial bank to get a discount.

Cash credit:

This is a function for withdrawing a certain amount of money for a specific security.

Secondary functions of commercial banks:

Agency Function: The bank, as an agency, pays on behalf of the customer and receives fees for the agency function, such as:

Forex Trading:

General utility services: locker facilities

Credit Creation: This is one of the most important features of a commercial bank. Banks create credits based on their primary deposits. In addition, we lend money to ordinary borrowers / companies / investors. This landed money is deposited by those who have extra money and want to earn a fixed return on their money. Commercial banks charge more interest from their customers (borrowers) than they are given to money depositors.

Relationship b / w Banker and customers.

In order to maintain healthy relationship between a banker and a customer depends on the sort of transaction

In this banker-customer relationship, both parties have some obligations and rights.

The relationship between a banker and a customer isn't limited to the connection between a debtor and a creditor.

However, we also share other relationships.

Banker:

The term bank defines the acceptance of deposits from the general public for the aim of lending or investing an investment during a cheque or order withdrawal of that cash which will be repaid on demand or otherwise. It may be.

Bank characteristics:

The banking definition describes the subsequent features of banking:

Banking companies got to perform both important functions.

Acceptance of deposit.

Lending or investing the same: The phrase depositing money from the overall public is vital. Bankers accept deposits of cash, not others. People round the world mean that bankers accept deposits from those that provide his / her money for such purposes.

The definition also means the time and time taken to withdraw a deposit. Deposits must be repaid to the depositor upon request by letter or in accordance with an agreement agreed between the parties.

Customer

A person who features a Chequeing account in his name and therefore the banker promises to supply the power as a banker is taken into account a customer.

To configure your customers, you would like to satisfy the subsequent requirements:

Bank accounts are often savings, and current or fixed deposits must be manipulated in his name by making the required money deposits.

Transactions between bankers and customers must be of the character of banking. General relationship between bankers and customers:

Types of banker-customer relationships

There are three categories of banker-customer relationships.

Other special relationships with customers, banker obligations

Relationship as debtor and creditor

When opening an account, the banker takes on the position of debtor. The depositor remains the creditor of his banker as long as there's a credit balance in his account.

Customer relationships are booked as soon because the customer account is debited.

The banker becomes the creditor of the customer who borrowed the loan from the banker and continues his ability until the loan is repaid.

Banker as a trustee:

A banker is typically the debtor of a customer in reporting deposits by letter, but in certain circumstances he also acts as a fiduciary.

A fiduciary hold holds money or assets and performs certain functions for the advantage of others, called beneficiaries.

For example;

If the customer deposits securities or other value with a banker for secure storage, the letter acts because the customer's trustee.

Banker as an agent

Bankers act on behalf of their clients and perform many agency functions for his or her convenience.

For example, he buys and sells securities on behalf of a customer, collects Cheques / Cheques on his behalf, and pays various membership fees for the customer.

Special customer relationships / banker obligations:

Since the most relationship between the banker and its customers is that the debtor-creditor relationship and the other way around, the special function of this relationship as a note above obliges the banker to: i will be able to impose.

Cheque / Obligation to respect cheque

The deposit that the banker accepts is his debt which will be repaid on demand or otherwise. Therefore, the banker features a legal obligation to respect the customer's Cheque / sign up the regular course.

According to Section 31 of Negotiable Goods. Law 1881 Bankers are obliged to respect customer Cheques / Cheques provided by meeting the subsequent conditions:

The availability of sufficient funds for the customer.

Whether you're a housewife, a college student, a business owner, an entrepreneur, a retired professional, or an Indian living abroad, it's unimaginable that you don't have a bank account. is. Banks offer a bouquet of bank accounts to choose from, based on purpose, frequency of transactions, and location of the account holder. This is a list of Indian bank account types.

1. Current Account:

A chequing account is a deposit account for traders, business owners, and entrepreneurs who need to pay and receive payments more often than others. These accounts have an unlimited number of transactions per day and hold more liquid deposits. The overdraft allows the overdraft function. That is, withdraw more than is currently available in your chequing account. Also, unlike savings accounts that earn some interest, these are interest-free accounts. To be able to manage your chequing account, you need to maintain a minimum balance.

2. Savings Account:

A savings account is a regular deposit account and earns the lowest interest rate. Here, there is a limit to the number of transactions that can be executed each month. Banks offer a variety of savings accounts based on depositor type, product characteristics, account age and purpose, and more. There are regular savings accounts, savings accounts for children, the elderly or women, institutional savings accounts, family savings accounts, and so many.

You have the option to choose from a variety of savings products. There are zero-balanced savings accounts and advanced accounts with features such as automatic sweeps, debit cards, bill payments, and product-to-product benefits. The benefit between products is if your bank has a savings account and you can take advantage of special offers when opening a second account, such as a demat account.

3. Payroll Account:

Of the various types of bank accounts, your payroll account was opened in accordance with the partnership between your employer and your bank. This is the account where the salaries of all employees are credited at the beginning of the payroll cycle. Employees can choose the type of payroll account based on the features they need. Banks that have payroll accounts also have refund accounts. This is where your allowances and refunds are credited.

4. Fixed Deposit Account:

There are different types of accounts like deposits and time deposits to park your funds and earn decent interest rates on them.

With a Fixed Deposit (FD) account, you can earn a fixed interest rate to keep a certain amount fixed for a certain period of time, that is, until the FD expires. FD is from 7 days to 10 years of maturity. The interest rate earned on the FD depends on the holding period of the FD. In general, you cannot withdraw money from an FD before it has matured. Some banks offer premature withdrawal capabilities. But in that case, the interest rates you earn will be lower.

5. Time Deposit Account:

The holding period of time deposits (RD) is fixed. To earn interest, you need to invest a certain amount on a regular basis (monthly or quarterly). Unlike FDs, which require you to make a lump sum deposit, you need to invest less and more often here. You cannot change the holding period of RD and the amount invested monthly or quarterly. Even in the case of RD, premature withdrawals are penalized in the form of low interest rates. The maturity of RD can range from 6 months to 10 years.

6. NRI Account:

There are different types of bank accounts for Indians or Indian immigrants living abroad. These accounts are called overseas accounts. This includes two types of savings accounts and fixed deposits. NRO or non-resident regular account and NRE or non-resident external account. Banks also offer non-resident deposit accounts in foreign currencies. Let's take a quick look at the different types of NRI bank accounts-

a) Non-Resident Ordinary (NRO) Savings Account or Savings Account:

The NRO account is a Rupee account. When NRI deposits money in these accounts, usually in foreign currencies, it is converted to Indian Rupees at prevailing exchange rates. NRI can deposit money earned in India or abroad into an NRO bank account. Payments for rent, maturity, pensions, etc. can be sent overseas via your NRO account. Income earned from these deposit accounts is taxable.

b) Non-resident external (NRE) Savings Account or Deposit Account:

NRE deposit accounts are similar to NRO accounts and the funds in these accounts are maintained in Indian Rupees. Money deposited in these accounts will be converted to Indian Rupees at prevailing exchange rates. However, these accounts are only for parking revenue from abroad. Both principal and interest funds are transferable. However, interest earned on these deposit accounts is not taxable in India.

C) Non-Resident Foreign Currency (FCNR) Account:

As the name implies, unlike the other two types of bank accounts, FCNR accounts are maintained in foreign currencies. Principal and interest from these accounts are transferable, but the interest earned is not taxable in India.

Key takeaways:

A negotiable note is a document that guarantees that the holder of such a document will receive the amount specified in the document upon request or within the prescribed time stated in the document.

A Cheque is a document issued by an individual to a bank that tells the person named in the document to pay the amount specified for the document to be valid. It is important that the person issuing the Cheque has it. The bank account. The issuer of the Cheque is called the drawer, and it is the drawer that is issued.

Cheque type

The purpose of negotiable bills is to ensure that monetary transactions are carried out smoothly and to the required specifications. For example, cash is the most preferred mode for making instant payments. People accept Cheques for payments that can be received at a later date. Recently, there are credit and debit cards for direct account-to-account transactions. Each type of payment is accompanied by a specific negotiable bill. For Cheques, there are different types of Cheques to use in different situations.

Here are some of the most common types of Cheques.

Bearer Cheque:

The first type of Cheque is an bearer Cheque. This Cheque is paid to the owner of the Cheque, or the owner of the name listed in the column where the Cheque represents the addressee's name. Ideally, this Cheque would have "or bearer" printed at the end of the dotted line. This means that the addressee's name is listed. This Cheque can be presented at the addressee's bank and must be paid to the presenter. This is a transferable instrument, so you can simply deliver it to another instrument. You do not need to approve this type of Cheque.

Order confirmation:

This Cheque cancels the printed word "bearer" and pays only to the person whose name is written on behalf of the addressee. When the "owner" is canceled on a Cheque, it is automatically understood that it is an order Cheque and the bank only completes the transaction if it identifies the owner of the Cheque until it is convinced that it is the same person. can do. It was named in it.

Cross Cheque:

For crossed Cheques, the drawer draws two parallel horizontal lines in the upper left corner of the Cheque, regardless of whether or not it says "a / c recipient". This ensures that no matter who withdraws the Cheque and presents it to the bank, the transaction will only take place in the account of the person specified in the Cheque. The advantage of cross-Chequeing is that this type of Cheque can only be monetized by the addressee's bank, reducing the risk of money being passed on to unauthorized persons.

Open Cheque:

Also known as a non-intersecting Cheque. Cheques that do not intersect fall into the open Cheque category. This Cheque can be presented to the withdrawal bank and must be paid to the presenter. The addressee of this Cheque can also be transferred to another person by writing the name on the Cheque and making it the addressee. To open a Cheque, do not erase the word OPEN. The person issuing the Cheque must ensure that both the front and back of the Cheque are signed. Otherwise, the recipient may be denied payment by the bank. The recipient is also expected to sign the back of the Cheque while receiving the amount.

Cheque after date:

Cheques dated later than the date they were actually issued are called Cheques at a later date. This Cheque may be presented to the addressee bank at any time after issuance, but will not be transferred from the payer's account until the date stated on the Cheque. The recipient may also present the Cheque after the date on the Cheque. It will continue to be valid and the money will be transferred to the recipient's account.

Old Cheque:

As the name implies, an old Cheque is a Cheque that has expired and can no longer be monetized. The time period was six months from the date of issue. Currently, this period has been reduced to 3 months.

Traveller’s Cheque:

These can be equivalent to widely accepted currencies. Traveler's Cheques are available almost everywhere and come in many varieties. This is a means issued by the bank itself to make payments from one place to another. Traveller's Cheques do not expire, so you can use them on your next trip. Alternatively, you can cash your Cheque back in India.

Self-Cheque:

Withdrawals usually issue a self-Cheque to themselves. "Self" is written in the name field of the addressee. A self-Cheque is drawn when the withdrawal wants to withdraw money from the bank in cash for his use. This Cheque can only be cashed at the account holder or withdrawal bank. This Cheque should be used with caution as it can easily be cashed if someone else goes to the withdrawal bank if it is lost.

Bank Cheque:

Bank Cheque, self-described here is a Cheque issued by a bank on behalf of the account holder to pay another person in the same city the specified amount for each order. It is valid only for three months from the date of issue, but can be revalidated after fulfilling certain legal obligations, if necessary.

Endorsement:

The act of the owner of a transferable note signing his or her name on the back of the note, thereby transferring his or her ownership or ownership, is an authorization. Approval may be in favor of another individual or legal entity. Approval provides the transfer of assets to another individual or legal entity. The person whose instrument is approved is called the approver. The person who endorses is the endorser. Now let's take a closer look at instrument approval.

Endorsement type-

Blank endorsement – When the endorser signs only his name and it becomes paid to the owner.

Special endorsement – A place where the endorser puts a signature and writes the name of the person receiving the payment.

Restrictive Approval – This limit further negotiations.

Partial endorsement – Only a portion of the amount paid by the device can be transferred to the endorsement.

Conditional Approval – If you need to meet some conditions.

1. Blank endorsement or general endorsement:

The endorsement is blank or common, allowing the endorser to sign only his name and be paid to the owner. Therefore, if the bill is paid to "ram or order" and he writes "ram" on the back, it is a blank approval by ram and the bill's property can be passed by mere presentation.

You can convert a blank endorsement to a complete endorsement. To do this, fill in the instructions to pay the instrument to another person or his order on the signature of the approver.

2. Special or Full Approval:

A "complete" endorsement or special endorsement is one in which the endorser signs the instrument and writes the name of the person ordering the payment.

Bills that are made to be paid for rams or orders and approved to "pay for Siam's orders" are specifically approved, and Siam further approves them. You can turn a blank endorsement into a special endorsement by adding an order to pay the invoice to the transferee.

3. Restrictive endorsement:

The endorsement is restrictive, which limits further negotiations on the goods.

Examples of restrictive approval: "Pay only to Mrs. Geeta" or "Pay to Mrs. Geeta for my use" or "Pay to Mrs. Geeta for Reeta" or "Pay to Mrs. Geeta or order for collection".

4. Partial endorsement:

An endorsement partial allows you to transfer only part of the amount paid for an item to an endorsement. This does not act as a device negotiation.

Example: Mr. Mohan has a rupee invoice. At 5,000, "Pay to Sohan or order Rs. 2500 inches. Approval is partial and invalid.

5. Conditional or Qualified Approval:

If the approver puts a signature under such a document and the transfer of the title meets some conditions of the occurrence of some events, it is a conditional approval.

If an approver negotiates a product and becomes its owner again, we know it as a negotiation with that approver. After the negotiations return, no intermediate supporter will be liable to him.

Therefore, Lamb was demoted to his original position by the second approval, and he cannot sue Rose, Kara, or Lara. If the approver so excludes his liability and then becomes the owner of the goods, all interim approvers will be liable to him.

You can see the points in the illustration. Ram is the recipient of negotiable bills. He favours the instrument "sans recourse" to roses, roses to kara, kara to Lara, and Lara to ram again.

In this case, Ram not only reverts to his previous rights, but also has the rights of supporters to Rose, Kara, and Lara. For example, Lamb, the owner of the bill, favours it in roses, roses in Kara, and Kara. Approve it again to Lara and then to Lamb. Lamb is the ultimate owner of the bill with a second approval by Lara and can recover that amount from Rose, Kara, or Lara, and the former party himself is responsible for all of them.

Negotiation of lost instruments or instruments acquired by illegal means

If the negotiable bill is lost or obtained from a manufacturer, acceptor, or owner by fraud, or due to illegal activity, the owner or approver pays from such manufacturer, acceptor, or owner. You do not have the right to receive the amount to be paid. From any party in front of such an owner.

He cannot do so unless such an owner or supporter, or someone he claims, is eventually the owner.

A bill of exchange is a written, negotiable note that contains an unconditional order, instructing a particular person to pay only for a particular person or owner's order, or a particular amount. A withdrawal is a person who withdraws an invoice and presents it to the recipient for approval. Of all negotiable bills, only the exchange invoice requires presentation for acceptance.

Summary of presentation for acceptance

The addressee will not be liable for any invoices addressed to him for acceptance or payment until he accepts the invoices. To complete the approval, you must write the word "approved" on your invoice and sign your name below.

By accepting the invoice given by the addressee, you agree to the order of withdrawals. Therefore, the main responsibility of the bill lies with the acceptor. Acceptance is either general or eligible. As a general rule, acceptance should be general. General acceptance is absolute. Eligible approval is subject to some condition or qualification.

Therefore, it changes the effect of the bill. Bill’s owners can refuse to receive qualified approval. In this case, he may treat the bill as disgraceful by disapproval and sue for withdrawal.

Acceptance of honor

Those who are not yet responsible for the bill, with the consent of the owner, in honor of the parties by writing in the bill when the bill is disapproved or written for better security or protested. Can accept the bill.

This person is a recipient of honor. He is obliged to pay only after properly presenting the maturity bill to the addressee for payment, he refuses to pay and the bill is recorded or protested for non-payment.

All types of bills of exchange do not need to be presented for acceptance. Invoices paid on demand or on fixed days do not require this. However, the following bills require presentation for approval in the absence of it or if the parties are not liable.

An invoice that will be paid later to correct the maturity of the invoice.

A bill consisting of a clear provision that a presentation for acceptance is required before a presentation for payment.

In accordance with Article 15, if the addressee dies to a legal representative and goes bankrupt to the official recipient or assignee of the holder, the offer of acceptance will be made to the addressee or its officially authorized agent. It shall be done against.

The bill will be presented to:

Recipient of honor.

Presentations for acceptance shall be made at the place of business or residence of the withdrawal destination before maturity, within reasonable hours after withdrawal, and during business hours on business days.

Dishonour-

You may have heard Cheques bounce due to lack of funds. Similar to the above, there may be disputes regarding the acceptance of negotiable bills. Resolution of such cases includes procedures required by law. In fact, the first step in such a procedure requires the owner or responsible person to notify the disgrace.

Recall that a negotiable note is a document that guarantees payment of the amount, usually stated in the document, with the payer on request or at a set time.

Negotiable Merchandise Act has been enacted to regulate and resolve disputes related to negotiable merchandise in use. Appropriately, acceptable negotiable products include promissory notes, bills of exchange or Cheques, drafts, and certificates of deposit.

Disgrace of a negotiable note means a loss of honor on the part of the manufacturer, addressee, or acceptor, which makes the note unsuitable for payment.

Please note that the disgrace of negotiable bills may be made by the manufacturer, addressee, or acceptor, as the case may be.

In addition, Section 64 sets out general rules for the presentation of negotiable bills for payment. All banknotes, invoices, and Cheques must be presented for payment by or on behalf of the owner during normal business hours and if the bank clerk is in the bank's business hours. It is stated that there is. To point out, in case of disgrace, the offer of payment is exempt.

Case of disgrace

The above means that there may be some cases that lead to the disgrace of negotiable bills, some of which are:

If a maker, drawer, or acceptor actively does something that intentionally interferes with the presentation of the instrument, for example, it robs the owner of the instrument and retains it after maturity.

Disgrace due to non-payment

A promissory note, invoice, or Cheque is disgraced if the Cheque creator, addressee, or recipient defaults on payment when requested to do the same.

In addition, the owner of a promissory note or invoice may call it a disgrace if the creator or recipient explicitly exempts the offer of payment when the payment is overdue.

In the case of bill disgrace, it is important that all approvers and authors of the bill recognize that the owner of the bill is responsible, subject to issuing a notice of disgrace of the bill.

In addition, please note that the addressee is only liable to the owner in case of disgrace due to non-payment.

Disgrace due to disapproval:

Disgrace due to non-acceptance is a situation in which you refuse to accept negotiable bills. In addition, we generally observe the disgrace of non-acceptance in the case of bills of exchange.

This is because it is the only kind of negotiable means that requires a presentation for acceptance or non-acceptance.

Also, in the case of disgrace due to disapproval, only the creator and approver are responsible to the owner of the invoice, provided that the owner issues a notice of disgrace. Some situations that can lead to disgrace of the bill due to disapproval are:

Notice of disgrace-

Rights and liabilities of Paying and collecting Banker

Obligations and Responsibilities to Collect Bankers:

Act as an agent: The banker acts as an agent for the customer while collecting goods for depositing into the customer's account or for himself. As an agent, he generally takes such measures and precautions to protect his interests or his customers, as a person of normal prudence would take to protect his own interests.

Instrument scrutiny: Owner's name, branch name, date, amount of world and figures, unsigned cuts, material changes that need to be Chequeed carefully.

Collection of Banker Protection:

Under Section 131 of the Negotiable Goods Act, if a Cheque or banker's Cheque is generally or specially given to oneself and collected for the customer, the ownership of the goods is found to be flawed. If you do, the collecting banker will not be liable to the true owner of the Cheque or bank Cheque. Sincere and without negligence.

The above statutory protection is only available if the collecting bank meets the following conditions:

No protection:

Pay the banker's obligations and responsibilities.

The banker from whom the Cheque is drawn must pay the Cheque when it is presented for payment. It is his duty according to Section 31 of NI Law. Bankers are obliged to respect the customer's Cheque within the available funds and to respect the lack of legal restrictions for payment. Bankers making payments should take reasonable care and attention to paying Cheques to refrain from actions that could damage the customer's credibility.

When making payments, he needs to observe the following very carefully:

- The Cheque owner's title is valid.

- A / c is not hibernating.

- A / c holders are not bankrupt, dead or crazy.

- A / c is not subject to the clearing procedure.

- No. "Guernsey Order" is issued for each count.

- Properly approved.

4. Cheques are not drawn beyond the limits fixed by the drawer. Respect for quantity.

Key takeaways:

Define Time Value of Money

There is no reason to delay a reasonable person taking the amount to pay him or her. Beyond financial principles, this is a basic instinct. The money you currently have is worth more than the same amount you "may get" in the future. One of the reasons for this is inflation and the other is the potential for profitability. The basic financial code argues that given that money can generate interest, the sooner you receive it, the more valuable a certain amount will be. This is why it is called present value. Basically, the time value of money proves that it is more beneficial to have cash now than later. If you invest rupees, tell me. Today 100 – earnings are higher compared to the same investment made two months later. In addition, there is always the risk that the borrower will be further delayed in the future or will not pay at all.

An example TVM

The relevance of TVM depends on how much profit you can make from the available capital. Money has immeasurable growth potential, and the more you delay the adoption of this potential, the less chance you have of making money. For example, if a friend or lender gives you two options, take Rs. Today is 10,000 rupees and next year is 10,500 rupees. Now, even if this promise is from someone or entity that you implicitly trust, the second option is likely to be a raw transaction. ELS Set in more and more schemes, from low risk to high risk – tax-saving FD. – This total is likely to earn at least 7%, or Rs. 10,700. However, if the interest rate offered is less than 5%, consider receiving money next year. Therefore, it depends on possible returns according to RBI guidelines or the market.

Present value and future value

The present value is the same as the time value explained above. Equivalent to a one-time payment or multiple partial payments in the future is the money you currently have and will be discounted at the appropriate interest rate. Future value is the sum of the amounts that a compound interest savings scheme will be built up to a predetermined future date. This applies not only to lump sum payments, but also to regular investments such as SIP.

PV = FV / (1 + i)^n

FV = PV (1+i)n

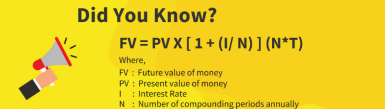

Basic TVM formula

The TVM formula may change to some extent based on your financial situation at that time. For example, for annuity (income) or permanent (until death) annuity payments, the general formula can include more elements. TVM formula is as shown in the image.

FV = PV x [1 + (I / N)] (N * T) where FV is the value of future money, PV is the value of current money, I is the interest rate, and N is the number of compound interest periods per year. , T is the number of years in office. For example, when investing Rs. 1 rack for 5 years with 10% interest, the future value of this 1 rack will be Rs. According to the formula 161,051. This formula helps you analyze different investments over different time periods and allows you to make optimal, informed financial decisions.

TVM and Compound Interest Period

The frequency with which the compound of the investment amount also has a great influence on the future value. See how increasing the frequency of compound interest in the above example affects your bottom line. Monthly: Rupee 164530.89 Quarterly: Rs. 163,861.64 Semi-annual: Rs. 162889. 46 years: Rs. 161,051 The power of compound interest works here. This proves that TVM depends on interest rates, holding periods, and the number of compound interest calculation periods per fiscal year. Now that you understand the concepts of time value and future value, we hope you understand why it is important to start investing. When investing in Clear tax Invest, you have a selection of funds from the top fund houses presented before you choose. They have been well studied and have historically produced good returns. Invest now.

TVM components

The main components are:

1. Interest / Discount Rate (i) – The rate of discount or compound interest applied to the amount to calculate the current or future value.

2. Period (n) – Refers to the integer of the period for which you want to calculate the current or future value of the total. These periods can be yearly, semi-annual, quarterly, monthly, weekly, and so on.

3. Present Value (PV) – The amount obtained by applying a discount rate to the future value of cash flows.

4. Future Value (FV) – The amount obtained by applying compound interest to the present value of cash flows.

5. Instalments (PMT) – Instalments represent payments that are paid on a regular basis or received during each period. The value is positive when the payment is received and negative when the payment is made.

Application of time value of money

The concept of time value of money pertains to any situation in which a party receives or pays an amount to a third party.

That said, let's talk about two everyday situations where you may have to apply the concept of time value of money.

Loan EMI:

EMI stands for Equated Monthly Instalments and constitutes the primary method for repayment of a loan.

When calculating EMI values, we need the concept of time values. Let's go back to the example we talked about earlier.

As in the example, you went to buy a bicycle worth rupee. 3,00,000 and the dealer will give you a choice.

Pay Rs 3,00,000 now or

For the next three years, choose an installment payment of Rs 1,00,000 at the end of each year.

Let's evaluate each option one by one.

The first one is pretty simple, isn't it? You can just pay off the rupees. At this moment, it's 3,000,000, which can have a huge impact on your savings, depending on your income and financial position.

Well, the second is to pay Rs. At the end of each year for three years, reaching 100,000 can have a huge impact on savings. This is because, as we have learned, the value of money continues to grow over time.

Therefore, even three instalments are obvious. With 1,00,000 each, the effective value of these instalments could be even higher in the future.

This is because instalments are not present value, while Rs are not present value. 3,000,000 is the present value of the purchase.

To make the right investment decision, you should always make sure that you are comparing two future values or two present values.

Therefore, to make the right decision, you need to evaluate the present value of all instalments, sum them up, and then compare that value to the present value of the product to see the interest you are paying on the product.

The present value is known as the present value of the amount of money you will receive in the future.

He said that the purchasing power of money will decrease over time. The PV formula illustrates this reduction by applying a discount rate to the amount you will receive in the future.

The process of calculating the present value of an amount because it uses a discount rate is also known as a discount on the amount.

You can use the amount of PV to determine the present value of your projected cash flow if you need to receive money from a bond, annuity, a loan, or a third party in the future. To know exactly how much that money is worth today.

It is given by the following formula –

PV = FV / (1 + i) ^ n

Here, we need three things to calculate the present value –

What is the total value we will receive in the future? (F V);

What is the discount rate that reduces the purchasing power of money? (I); and

How many years later will we receive the relevant amount? (N).

Future value (FV):

As the name implies, FV indicates the value of the amount at a certain date in the future.

This calculation is useful for investors and companies who want to know the future value of their potential investment in order to make the right investment decisions.

The formula for FV is given by:

FV = PV (1 + i) n

This formula only needs three things to give us future value –

How much money do you have now? (PV);

What is the expected interest rate for it to grow? (I); and

How many years will you need money? (N)

Loan Amortization:

Loan amortization is the process by which the amortized principal balance of a loan is repaid through regular payments over the entire term of the loan. A depreciable loan is a loan in which regular repayments include both principal repayment and interest components.

There are several types of loans, some that require regular interest payments and some that require a lump sum payment of principal at the end of the loan. Others do not require a lump sum repayment of principal, instead the principal balance is paid with interest through regular payments. Bonds are a classic example of bullet payment loans, while capital leases, mortgages and car loans are amortized loans.

A loan repayment schedule is a table that lists each recurring payment that occurs on a loan that branches into an amount for interest and an amount that represents the repayment of principal. The principal balance of the amortized loan decreases over time and the associated interest expense also decreases.

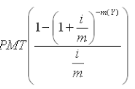

Formula:

The recurring payments required to fully amortize a depreciated loan over that period can be calculated using the regular annuity present value formula.

Where PV represents the outstanding principal balance, i represents the annual rate of return, n represents the number of years of the loan, and m represents the number of compound interest periods per year.

Interest expense for each period is calculated by applying the fixed interest rate to the principal balance of the opening loan.

Interest Expense:

Outstanding Loan Principal x i

____

m

The principal repayment amount for each period is equal to the sum of the loan's recurring payments for a particular period minus the interest accrued on the loan.

Principal Repayment:

PMT Interest - Expense

You can use the Excel PMT, IPMT, and PPMT functions to calculate the sum of the recurring payment, interest component, and principal repayment component, respectively.

Key takeaways-

References: