UNIT III

Negotiable Instruments

A negotiable product is a written contract that allows the transfer of profits from the original holder to the new holder. In other words, a negotiable item is a document that promises payment to the transferee (the person to whom it is assigned / given) or the designated person. These documents are transferable, signed documents and promise to pay the owner / owner when requested or at any time in the future. As mentioned above, these instruments are transferable. The final owner can receive the funds and use them according to his requirements. That is, when an instrument is transferred, the owner of such an instrument takes full legal ownership of such an instrument.

Negotiable product features

The term "negotiable" in negotiable bills refers to the fact that they are transferable to different parties. If it is transferred, the new owner will take full legal ownership of it.

Non-negotiable bills, on the other hand, are stoned and cannot be changed in any way.

Negotiable goods allow their holders to receive funds in cash or send money to others. The exact amount that the payer promises to pay is shown on the negotiable bill and must be paid on request or on a specified date. As with contracts, negotiable merchandise is signed by the publisher of the document.

Types of products that can be negotiated

Certificate of Deposit (CD)

Certificates of Deposit (CD) are products offered by financial institutions and banks that allow you to deposit a certain number of deposits for a certain period of time and leave them as they are, in return for the benefits of very high interest rates. I can do it.

Interest rates usually rise steadily over the length of the term. Certificates of deposit will be retained until maturity when principal and interest can be withdrawn. As a result, fees are often charged as a penalty for early withdrawal.

Most financial institutions, including banks and credit unions, offer CDs, but interest rates, term limits, and penalties vary widely. Most people are looking for the best interest rate before committing to a CD, as the interest rate charged on a CD is significantly higher than the interest rate on a savings account (about 3-5 times).

CDs are attractive to customers because of their safe and conservative nature, not only because they have high interest rates, but also because they are fixed throughout the period.

Promissory note

A promissory note is a written promise to its owner that a company or individual will pay a certain amount by a predetermined date. In other words, a promissory note indicates how much someone should pay you, or what you should pay someone, along with the interest rate and payment date. For example, A buys from B the equivalent of 10,000 Indian rupees. If A cannot or does not want to pay the purchase price in cash, he can give B a promissory note. It is A's promise to pay B on either the specified date or on demand. Another possibility is that A has a promissory note issued by C. He can approve this bill and give it to B to settle the membership fee in this way. However, the seller is not obliged to accept the promissory note. The buyer's reputation is very important to the seller in deciding whether to accept the promissory note.

Bill of exchange

A bill of exchange is a legally binding written document that directs a party to pay a given amount to a second (other) party. Some bills state that money should be paid on a specified date in the future, while others state that payments should be paid on demand. Bills of exchange are used in transactions related to goods and services. It is signed by the party borrowing the money (called the payer) and given to the party eligible to receive the money (called the payee or seller) and can be used to fulfil the payment contract. However, the seller can also approve the bill of exchange and pass it to someone else, so that such payment can be passed to another party. Note that when a bill of exchange is issued by a financial institution, it is usually called a bank check. Also, when issued by an individual, it is usually referred to as a trade draft. Bills of exchange primarily serve as promissory notes for international trade. The exporter or seller corresponds to the bill of exchange to the importer or buyer in the transaction. Third parties, usually banks, are parties to some bills of exchange that act as guarantees for these payments. This helps mitigate the risk of being part of a transaction.

Check

A check is a written document that contains an unconditional order, is addressed to a banker, and is signed by the person who deposited the money with the banker. For this order, the bank clerk must pay a certain amount on request only to the check owner (the person holding the check) or someone else who is paid specially according to the instructions. Checks can be a good way to pay different types of invoices. Although check usage is declining year by year due to online banking, individuals still use it to pay for checks loans, college tuition, car EMI, and more. Checks are also a good way to track all transactions on paper. Checks, on the other hand, are a relatively slow payment method and can take a long time to process.

Negotiable Commodity (Modified) Bill, 2017

The 2017 Negotiable Commodity (Amendment) Bill was introduced on January 2, 2018 in Lok Sabha earlier this year. The bill calls for amendments to existing legislation. The bill defines promissory notes, bills of exchange, and checks. The bill also provides penalties for check disgrace and various other violations related to negotiable goods. According to recent circulations, up to 10,000 Indian rupees, along with interest rates of 6% to 9%, must be paid by the individual for a check that has been checked. The bill also inserts clauses for allowing the court to order provisional compensation for those whose checks have been returned for disgraceful parties (individuals / groups with negligence). Such provisional compensation does not exceed 20 percent of the total check amount.

Meaning of Bills of Exchange

According to the Bill of Exchange Act of 1881, a bill of exchange is "a written product that contains an unconditional order, is signed by the manufacturer, and directs a particular person to pay a particular amount, or only to that order." Is defined as. To a specific person or the owner of the instrument. "

Features of the bill

Types of Bills-

Documentary Invoices-In this case, exchange invoices are supported by related documents that verify the authenticity of the sale or transaction made between the seller and the buyer.

Request Invoice-This invoice must be paid when requested. The bill does not have a fixed payment date, so the bill must be settled each time it is presented.

Usage Bill-This is a time-limited bill, which means that you must pay within the specified time period and time.

Inland Bill-Inland bills are paid in only one country, not in other countries. This bill is the opposite of the foreign bill.

Clean Bill-This bill has relatively higher interest rates than other bills because there is no documentary evidence.

Foreign Bills-Bills that can be paid outside India are called foreign bills. Two examples of foreign bills are export bills and import bills.

Accommodation-A bill that is sponsored, withdrawn, and unconditionally accepted is called accommodation.

Trade Bills-This kind of bill is specifically relevant only to trade.

Supply Bills-Bills drawn from the government sector by suppliers or contractors are called supply bills.

Benefits of Bills

Legal Document-This is a legal document that makes it easier for withdrawals to legally collect the amount if the addressee fails to pay.

Discount Features-If your withdrawal needs money right away, your invoice can be converted to cash by discounting from the bank by paying a small fee.

Approvable-This bill of exchange can be exchanged from one individual to another for debt adjustment.

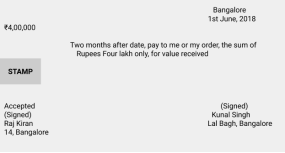

Bill format

Parties to the Bill of Exchange

The bill of exchange has three parties.

(1) Drawer:

Withdrawals are the makers of bills of exchange.

The bill is signed by a withdrawal.

Creditors who are eligible to receive payment from the debtor can draw a bill of exchange.

(2) Address:

The addressee is the person from whom the bill of exchange is withdrawn.

A withdrawal is a debtor who has to pay for the withdrawal.

He is also known as the "acceptor".

(3) Recipient:

The recipient is the person who needs to pay.

The recipient may be the withdrawal itself or a third party.

Due Date of a Bill

a) If the billing period is specified on a monthly basis

In this case, the maturity date is calculated according to the calendar month.

Ignore the number of days in a month.

Three days of grace period will be added.

Example: – If an invoice dated May 4, 2017 is paid 3 months after the date: -

= In that case, the maturity date will be August 4, 2017 + 3 days grace = August 7, 2017.

(B) When the billing period is specified in days

The maturity date is calculated in days.

This does not include the transaction date, but it does include the payment date.

Again, a three-day grace period will be added.

Example: -If an invoice dated June 5, 2017 is paid after 65 days, the maturity date will be: ---

= June 25 + July 31 + August 9 + Grace 3 days = 1 August 2, 2017

(C) When the maturity date falls on a holiday

If the invoice is due on a holiday

In that case, the maturity date of the invoice will be the previous business day.

Example: -If the invoice is due on January 26th (Republic Day), it will be due on January 25th.

If the due date is August 15th (Independence Day), the due date will be August 14th.

(D) When the maturity date is declared as an emergency holiday

If the invoice is due as an emergency holiday,

In that case, the invoice will be due one day after the maturity date.

Example: -If the invoice is due on July 25th and is declared as an emergency holiday, the due date will be July 26th.

a) Maturity date for "Bill at Sight" or "Instrument Payable on Demand".

Appearance invoices will expire as soon as they are presented for payment.

For "devices that pay on demand", the payment time is not listed.

Such bills are not eligible for Days of Grace.

(E) The maturity date in the case of "the day after billing".

In the case of "after billing", the payment time is stated.

Such a bill allows a three-day grace period.

(F) Maturity date for "Bill After Sight".

In the case of "Bill after Sight, pay for a certain period of" after sight "".

The period begins on the day the invoice is received.

Such a bill allows a three-day grace period.

What is a promissory note?

Promissory notes include unconditional promises signed by the manufacturer and are defined as written means (not banknotes or banknotes) to pay a particular person, only to a particular person's order, or a particular amount. The owner of the instrument.

Importance of promissory notes in bills of exchange

According to the Negotiable Commodity Act of 1881, a promissory note means a written product (not a banknote or a banknote), including an unconditional promise signed by the manufacturer, and paying only a certain amount to: However, according to the Indian Reserve Bank Act, promissory notes paid to bearers are illegal. Therefore, paying promissory notes to bearers is not possible.

Promissory note party

The Promissory Note has two parties.

(1) Manufacturer: A manufacturer or withdrawal is an individual or group that creates or draws a promissory note, promising to pay a certain amount specified in the promissory note. Maker is also known as promisor.

(2) Recipient: The recipient is the person from whom the promissory note was withdrawn.

Key takeaways:

A transferable note is a promissory note, bill of exchange, or check paid for either an order or bearer. It is a piece of paper that has a certain value and can be transferred from one person to another by mere delivery or by approval and delivery. This section describes the parties' liability for negotiable legal liability.

Party Responsibilities-Check-

The provisions regarding the liability of parties to negotiable goods are based on Sections 30-32 and 35-42 of the Negotiable Goods Act of 1881.

The responsibilities of the parties are as follows:

1. Withdrawal Responsibility (Section 30)

Withdrawal means a person who signs a check or bill of exchange and orders the bank to pay the amount to the payee.

In the case of a check or bill of exchange disgrace by the addressee or recipient, the withdrawal of such a check or bill of exchange must indemnify the owner for such amount. However, withdrawals must receive a legitimate notice of disgrace.

Therefore, the nature of withdrawal liability for invoicing is as follows:

(i) Regarding legitimate presentation: -It should be accepted and paid accordingly.

(ii) In case of disgrace: -The withdrawal must indemnify the owner for the amount only if the addressee receives a notice of disgrace.

2. Responsibility of the addressee of the stamp (Section 31)

A person who draws a check, that is, a withdrawal with sufficient funds in hand to properly apply for payment of such a check, must pay the check when legitimately requested, or such payment. In case of non-compliance, he shall compensate the withdrawal. Loss or damage caused by such defaults.

The addressee of the check will always be the banker. The banker is obliged to withdraw, or pay the customer's check, because the check is a bill of exchange withdrawn to the bank clerk designated by the withdrawal. The following conditions must be met.

(i) The banker must have sufficient funds to deposit into the customer's account.

(ii) Such funds need to be properly applied to the payment of such checks. For example, the funds do not belong to any kind of lien.

(iii) Checks must be paid legitimately during bank business hours and after the date of payment.

If the banker unreasonably refuses to respect the customer's check, the banker shall be liable for damages.

3. Responsibilities of Bill Recipients and Notetakers (Section 32)

In accordance with Article 32 of the Bill of Exchange Act, in the absence of a counter-contract, the promissory note creator and the pre-maturity acceptor of the promissory note are obliged to pay the amount at maturity.

They each have to pay the amount according to the apparent period of note or acceptance. The recipient of the bill of exchange at or after maturity is obliged to pay the amount to the holder upon request.

The liability of the recipient of the bill or the creator of the note is absolute and unconditional, but is subject to the opposite contract and may be excluded or modified by the collateral contract.

4. Approver's Responsibilities (Section 35)

An approver is a person who approves and provides a negotiable note before maturity. All supporters are responsible for the parties following him.

Also, in the case of an instrument disgrace by the addressee, recipient, or manufacturer, he subsequently succeeds in compensating such owner for any loss or damage caused to him by such disgrace. Be bound by all owners. However, he will only be compensated if the following conditions are met:

(i) There is no opposite contract

(ii) The approver has not explicitly excluded, restricted or conditional on his liability.

(iii) And such approver shall receive a legitimate notice of disgrace.

5. The former responsibility (Section 36)

All previous parties to the negotiable security will eventually be liable to the owner until the security is justified. Pre-parties include manufacturers or withdrawals, acceptors, and all intervening approvers. In time, the responsibility to the owner becomes a collective responsibility. In the case of disgrace, the owner may eventually declare some or all of the parties before being liable for the amount.

6. Mutual responsibility:

All responsible parties have different positions or positions regarding the nature of their responsibilities.

7. Responsibilities of the acceptor if the endorsement is forged (Section 41)

Recipients of bills of exchange that have already approved the bill will not be released from liability if such approval is forged. This is true even if he knew or had reason to believe that the endorsement was forged when he accepted the bill.

8. Recipient's liability if the invoice is drawn with a fictitious name:

The recipient of the bill of exchange, which draws the bill with a fictitious name paid for the withdrawal order, is obliged to pay the owner in due course. He or she will not be released from such liability for any reason such names are fictitious.

Bills Discounting and Purchasing

What is an invoice discount?

An invoice or invoice discount is a trading activity in which the seller obtains the amount in advance from the lender at a discount rate. This allows buyers to contribute in the form of interest expense and monthly fees, in the form of interest rates to increase the profits of financial institutions, banks, or NBFCs.

Example: Selling goods to Mr. X, who provided a letter of credit from a bank for 30 days. If you want to receive money from the bank before 30 days, the bank will charge you some interest. This is called the seller's discount. Let's say the amount you were supposed to get was rupees. 10,000 rupees after 30 days, with bank discounts or Rs interest rates. I won 50,000 rupees. 95,000 in return from the bank. The buyer will deposit Rs anyway. 10,000 rupees for each bank only on the 30th day.

This transaction or financial process is called an invoice discount or invoice discount.

The bills that are eligible for the bill discount are called "bill of exchange". You can use the invoice discount feature to take out a loan of up to about 90% of the invoices you have incurred. The credit period depends mainly on the creditworthiness of the purchaser. Once the bank is satisfied, it will offer you a discount on the amount you have to pay at the end of the credit period.

Invoice Discount Interest Rate:

Interest rates offered by financial institutions for invoice discounts depend on factors such as business stability, financial history, volume, duration, applicant's credit score, or financial status as well as creditworthiness.

Invoice Discount Process:

Invoice discount eligibility-

The eligibility criteria for bill discounts vary from lender to lender and are defined by each financial institution that provides the loan.

Factors Affecting Eligibility

Features and benefits of invoice discounts:

Credit evaluation:

Before approving invoices and invoice discounts, banks do not want to be at risk if the buyer repays the amount by default, so past repayment history, financial stability, and buyer's creditworthiness. Checking ensures that the seller's reputation is taken into account.

Instant cache availability:

Businesses and businesses have free access to instant cash to help them improve their momentum. In addition, it gives entrepreneurs the option to do business without funding. It works the same as overdraft, but not because the customer has to pay interest on the amount spent.

Banking partner priority:

Reputable banks are always the first priority before bill discounts are offered to buyers. This ensures the credibility and credibility of the buyer's bank (payment entity). The purpose of the discount requires an agreement between a reputable company or bank.

Invoice usage:

The use of an invoice, also known as the "use period," is the period during which the invoice must be valid within the invoice date and the period the customer allows for its payment. This period varies from 3 weeks to 3 months.

Other benefits-

In the invoice discount process, the interest amount is pre-charged by the buyer by the bank. Since it is an agreement between the buyer and the seller, the bill will be paid at the end of the credit period.

Ancillary Services of the Bankers

What is a bank assistance service?

Auxiliary services are other services that banks provide to men in general, along with the banking services they need. These ancillary services are just a few of the services offered by banks. Some of the supplementary services offered by banks are:

a) Money transfer service: Convenient for sending and receiving money from all over the world.

b) Forex Services: You can buy Forex for any purpose, such as traveling or buying goods, and sell it to your bank when you earn or receive it abroad.

c) Storage service: You can store valuables such as jewellery and documents. In this service, this is commonly known as a locker facility (safe deposit box).

d) Gold Sale: This can only be offered at the bank or some selected branches of the bank.

e) e-Banking: Also known as Internet Banking or Internet Banking, it is the latest and most useful feature of banks. You can get an ID and password to operate your account online: to transfer funds to another account at the same bank or another bank. By using this function, you can deposit surplus funds in a fixed deposit.

Some default remittance limits are given to customers based on their account type. If you would like to increase your daily limit, you can request it in writing from the branch office.

Recipient Maintenance: You can usually maintain the "recipient" who wants to send money. You must provide a "Recipient ID" for each recipient and attach a valid account for each recipient you manage.

Transfer of funds between accounts (real time): You can transfer funds within the "net available balance" (from one of your accounts, the source account) or up to the "daily limit" set by your bank. You will be one of the other accounts, whichever is less.

Third Party Fund Transfer (Real Time): You can transfer funds within the "Net Available Balance" (from one of your accounts, the source account) or up to the "daily limit" set by your bank whichever is less, to one of the beneficiary accounts you manage. All recipient accounts you manage will be available in the picklist and you can choose one of them.

NEFT Online Remittance: You can transfer funds to either the "Net Available Balance" (from one of your accounts, the source account) or the bank's "Daily Limit", whichever is less. I will. With another bank. The funds will be transferred using the NEFT facility provided by RBI and will be processed in the next available payment cycle, depending on the time of the request. The recipient will receive the credit on the same day or the next day, depending on the settlement time.

Time deposit options:

Time Deposit Details: You can view details of the selected time deposit account, such as principal, contract interest rate, maturity value, holding period, maturity date, and lien (if any).

Loan options:

Loan Account Details: You can view the details of the selected loan account and print these details using the Print option. You can also go to the Account Overview, Early and Final Settlement, and Loan Repayment options here.

Loan Account Activity: Allows you to view transaction details for the selected account for a specified period of time. Transaction details can be printed directly using the Print option or downloaded and saved as a file using the Download option.

Automatic transfer (SI) option:

Start automatic transfer: You can create an automatic transfer. There are three types of automatic transfers: between accounts, between loan accounts, and banker's draft (BC) requests. Whenever a BC request is selected, you must also enter the recipient details. For all three types, the automatic transfer will be performed on the start date of the execution date. If your balance is insufficient, no attempts will be made until the next run date.

View SI: You can view the details of automatic transfers made directly at the branch office or through internet banking.

(To remove the automatic transfer, you need to send a request through the branch.)

2. Safe storage and safe deposit:

The safe deposit box locker facility is an auxiliary service provided by the Bank. Bank branches that provide this feature will view / display this information.

We will keep the secret of the safe deposit box locker used by the customer to the maximum extent, and unless it is necessary to disclose it with the explicit consent of the user, we will provide information on the use, operation method, etc. of the locker to a third party. Will not be disclosed to. (S) Or comply with the order of the competent authority with legal authority.

Bank lockers are available to anyone with fraud contracting ability, that is, the ability to conclude a contract. Therefore, lockers can be hired jointly by individuals and / or two or more individuals, as well as companies, limited liability companies, associations, associations, clubs, etc.

Locker assignment

Locker assignments shall be based on the print format provided by the bank and properly (properly) filled out on the prospective recruiter's application form. Lockers are assigned by the branch on a first-come, first-served basis.

Providing a copy of the contract:

The branch will give a copy of the contract to the person using the locker when allocating the locker, if the customer so desires.

Collection of rent from employer

The safe deposit box locker rent is prepaid and the Bank reserves the right to deny access to the locker employer if the locker rent remains unpaid. Locker rent is collected annually. The one-year rental period begins on the day you rent the locker and continues until the day before the day of the following year.

Safe deposit box / locker operation:

The branch will take great care and necessary precautions to protect the lockers provided to you. Hirer / s can operate the safe deposit box locker only on our business days and during our business hours.

Before operating the locker, the employer must sign the attendance record kept at the bank.

Lockers can be handed over by the employer at any time during the contract period through a written application and handing over the keys to bank staff.

The bank can also request the locker to be handed over upon notice.

The main aspects of managing locker services are:

Merchant Banking is known as the Commercial Services Bank in the United Kingdom. A bank that mainly provides financial services for businesses and large investors.

Merchant banking means investment management. Companies raise funds by issuing securities in the market. The merchant banker acts as an intermediary between the issuer of capital and the investors who purchase these securities. Merchant banking is a financial intermediary that matches entities that require capital with those that have capital for investment.

Merchant banker service

Services provided by Merchant Bankers include the management of mutual funds, public issuance, trusts, securities and international funds. This includes advice on dealing with corporate clients and a variety of issues such as mergers, acquisitions and public issues. Merchant banking is a combination of banking and consulting services.

a) Government bonds.

b) Commercial paper issued by large companies.

c) Treasury short-term securities issued by the government.

Key takeaways:

References: