UNIT IV

WINDING UP

A private limited company is an artificial judicial person and requires various compliances like appointment of Auditor, regular filing of tax return, annual return filing and more. Failing to take care of compliance for a company could end in fines and/or disqualification of the directors from incorporating another Company. Therefore, if a private Ltd. has become inactive and there are not any transactions within the company, then it's best to finish up the company.

Voluntary winding up of a company are often initiated at anytime by the shareholders of the company. just in case there are any secured or unsecured creditors or employees on-roll, the outstanding dues must be settled. Once all the dues are settled, the bank accounts of the company must be closed. Finally, the company must regularise any overdue compliance like tax return or annual filing and surrender the GST registration. Once, all activities are stopped and therefore the registrations are surrendered, the winding up application petition can be filed with the Ministry of Corporate Affairs.

IndiaFilings can help you wind up your Company, quickly and simply. IndiaFilings can assist you initiate the completing process within 10 to 14 business days. the whole process for winding up of a company are often completed within 3 to six months, subject to government processing times. The timeline for winding up of a company could also differ from case to case, based on unique circumstances. to discuss more about winding up a company, get in-tuned with an IndiaFilings Advisor.

MODES OF WINDING UP-

The main modes of winding up may be discussed under the following three heads, namely:-

1. Compulsory winding up by the court.

2. Voluntary winding up without the intervention of the court.

3. Voluntary winding up with the intervention of the court i.e., under the supervision of the court.

Mode # 1. Compulsory Winding Up by the Court:

Winding up of a Company by an order of the court is called the compulsory winding up. Section 433 of the Companies Act lays down the circumstances under which a Company may be compulsorily wound up. They are:

(a) If the Company has by special resolution, resolved that the Company may be wound up by the court.

(b) If default is made in delivering the statutory report to the Registrar or in holding the statutory meeting.

(c) If the Company does not commence its business within a year from its incorporation or suspends it for a whole year.

(d) If the number of members is reduced, in the case of a public Company below seven, and in the case of a private company below two.

(e) If the Company is unable to pay its debts.

(f) If the court is of the opinion that it is just and equitable that the company should be wound up.

Persons Entitled to Apply for Liquidation:

The Petition for winding up of a Company may be presented by any of the following persons (Sec. 439):

(1) The Company.

(2) The creditors which include contingent creditors, prospective creditors, secured creditors, debenture holders, or a trustee for debenture holders.

(3) The contributories – comprise present and past shareholders of a Company (Secs. 426 and 428).

(4) The Registrar.

(5) Any person authorised by the Central Government on the-basis of report of inspectors.

Mode # 2. Voluntary Winding Up:

A voluntary winding up occurs without the intervention of the court. Here the Company and its creditors mutually settle their affairs without going to the court.

This mode of winding up takes place on:

(a) The expiry of the prefixed duration of the Company, or the occurrence of event whereby the Company is to be dissolved, and adoption by the Company in general meeting of an ordinary resolution to wind up voluntarily; or

(b) The passing of a special resolution by the Company to wind up voluntarily.

Mode # 3. Winding Up Subject to Supervision of the Court:

Windings up with the intervention of the court are ordered where the voluntary winding up has already commenced. As a matter of fact, it is the voluntary winding up but under the supervision of the court. A court may approve a resolution passed by the Company for voluntary winding up but the winding up should continue under the supervision of the court.

The court will issue such an order only under the following circumstances:

(a) If the resolution for winding up was obtained by fraud by the company; or

(b) If the rules pertaining to winding up are not being properly adhered to; or

The Court may exercise the same powers as it has in the case of compulsory winding up under the order of the court.

Key Takeaways:

1) Winding up of a Company by an order of the court is called the compulsory winding up.

Corporate Governance: In the wake of Sarbanes-Oxley, organizations have had to develop strategies to meet the Act’s new, evolving regulations. Because Governance should operate like a system by which companies are directed and controlled in order to protect shareholder value, technology has a key role to play. While the link between IT and shareholder value is increasingly understood and quantifiable, financial pressures prompt companies to adopt a cautious approach to IT. The question for business leaders is to know where, when and how they should invest in technology. Solving this dilemma will have a crucial impact on the performance of business.

Executive Compensation and Backdating Options: Unlawful schemes to backdate executive stock options benefit employees at the expense of shareholders. In a simple stock option, a company grants an employee the right to purchase a specified number of shares of the company’s stock at a specific price (exercise price) after a specified period of time (exercise date). In one scenario, employees backdate exercise dates to correspond with low points of the closing price of a company’s stock. This minimizes the gain at exercise that they report as ordinary income on their tax returns, while maximizing the capital gains treatment of any eventual profits by starting the clock ticking early on the holding period for capital gains treatment. At the same time, the reduced gain at the exercise of an option results in a corresponding reduction in the tax deduction for the company. Criminal and civil charges apply.

Gifts and Entertainment: The SEC published a notice requesting comment on rule filings by the National Association of Securities Dealers (NASD) and the New York Stock Exchange (NYSE) relating to business entertainment of customers by member firms, and their associated persons. In conjunction with the announcement that it had settled proceedings against a broker-dealer regarding gifts, travel and entertainment provided to certain personnel of a registered adviser, the NASD issued (a) a report on its examination of over 40 member firms’ gifts and gratuities practices and (b) a Notice to Members (NTM), which provides additional guidance on complying with NASD’s gifts and gratuities rule. In general terms, the rule prohibits any NASD member or its associated persons from giving, or permitting to be given, anything of value in excess of $100 per year to any individual where the gift is in relation to the business of the recipient’s employer. The rule also requires an NASD member to maintain a separate record of all payments or gratuities “in any amount known to the member” and have systems and procedures reasonably designed to achieve compliance with the rule.

Recent Developments in Delaware Corporation Law: The Delaware Supreme Court recently held, in a case of first impression for that court, that creditors of insolvent and nearly-insolvent Delaware corporations may not assert direct claims against directors for breaches of fiduciary duties. In Gatz v. Ponsoldt, the Delaware Supreme Court recognized expanded scope of direct shareholder claims. The Court, en banc, held that public shareholders could bring direct claims, in addition to derivative claims, to challenge a series of transactions orchestrated by a controlling shareholder that transferred voting power and economic value from the public shareholders to a third party, and ultimately benefited the controlling shareholder.

With agriculture being the backbone of the Indian economy, the sector employs more than 50% of India’s total workforce and contributes almost 17-18% to the country’s GDP.

Considering the pressing issues of farmers and agriculturalists (collectively termed “Producers”) in India, like agricultural labour, technological advancements, policy changes, etc., and to bring in better governance and channelize the agricultural activities, the concept of “Producer company” was introduced in 2002. In this blog, we will further know about what producer company means, what are the registration procedures of a producer company, the formation and the benefits of a producer company.

Definition of Producer Company:

Producer Company allows farmers cooperatives to function as a corporate entity under the Ministry of Corporate Act.

According to the Companies Act 1956, the objective of the Producer Company is related to all or any of the following matters:

a) Production,

b) Harvesting,

c) Procurement,

d) Grading,

e) Pooling,

f) Handling,

g) Marketing,

h) Selling ,

i) Import/Export of primary produce.

The Members of the Producer Company can carry these activities by themselves or through other entities:

Formation and Producer Company Registration

A Producer Company must be formed by:

The Producer Company must fulfil its objects as specified in the Act.

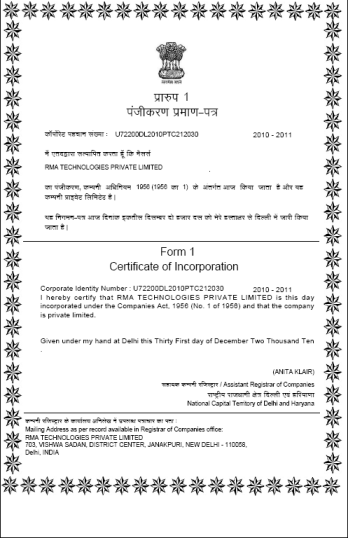

The Registrar after being satisfied with the requirements will issue the Certificate of Incorporation within 30 days of receiving the necessary documents.

Certificate of Incorporation-

If the Registrar is completely satisfied that all requirements have been fulfilled by the company that is being incorporated, then he will register the company and issue a certificate of incorporation. As a result, the incorporation certificate provided by the Registrar is definite proof that all requirements of the Act have been met.

Commencement of Business Certificate is the declaration that the Director of the Company needs to file with Registrar of Companies. Moreover this declaration is filed in Form INC-20A within 180 days of the incorporation of the Company.

Basically, this is a declaration filed before commencing the business and exercising borrowing powers by the Company. Company has to comply with Section 10A(1)(a) of Companies Act 2013 and Companies (Incorporation) Rules, 2014 while filing the Certificate of Commencement of Business.

Provisions related to Commencement of Business Certificate

Section 10A of Companies Act provides that all the Companies incorporated after Companies (Amendment) Ordinance 2018 and having Share capital shall not commence business or not exercise borrowing powers unless it complies with some conditions. Those conditions are:-

Share certificate:

Meaning and definition-

According to section 84- A share certificate is a certificate issued by the company under its common seal specifying the share held by any member. It is an evidence, of the title of the allottee or transferee of shares. Share Certificate: The Share Certificate is a document issued by the company and is prima facie evidence to show that the person named therein is the holder (title) of the specified number of shares stated therein. Share certificate is issued by the company to the (share holder) allottee of shares.

Contents o Share Certificate-

The share certificate form consists of the three parts:-

The share certificate forms are consecutively numbered and invariably bound in a book form.

Every share certificate shall be issued under the common seal of the company to be affixed in the presence of at least two directors and the secretary of the company. Also, all these persons must sign the share certificate.

Share Warrant-

Conditions for the issue of share warrants:--

Share warrants consists of three parts:

Counterfoil, share warrant and dividend coupon.

Contents of share warrants: -

References:

1) ‘Company Law’ by Brenda Hannigan.

2) ‘Elements of Company’ Law by N. D. Kapoor.