UNIT 4

Foreign Exchange Determination Systems

Basic Concepts Relating to Foreign Exchange

The term market has been interpreted in Economics as the place where both the buyers as well as the sellers meet and they buy and or sell goods.

The foreign exchange market is a place where the transactions in foreign exchange are conducted. In practical world the external transaction requires the use of foreign purchasing power i.e. foreign currency. The foreign exchange market facilitates such transactions by performing number of functions.

Definitions of Foreign Exchange Market:

According to Paul Einzig, "The foreign exchange market is the system in which the conversion of one national currency in to another takes place with transferring money from one country to another."

According to Kindleberger, "It is place where foreign moneys are bought and sold."

Instruments of Foreign Exchange Market

The instruments, with the help of which the international payments are effected. They are,

1. Cheques and Bank Drafts: Persons dealing with foreign exchanges can use bank cheques as well as bank drafts in order to make payments. The cheque is drawn on particular bank instead of a person.

2. Bills of Exchange: It is also called as foreign bill of exchange which is an unconditional order in writing addressed by one person to another. It mentions the person to whom a certain sum is to be paid either on demand or on specific date.

3. Mail Transfer (MT): Under this, funds are transferred from one account of a destination to another destination in the nation by mail. For international payments air-mail is used.

4. Telegraphic Transfers (TT): By this method a sum can be transferred from one place to another place in the world by cable or telex. This is the quickest method of transferring fund from one place to another.

Functions

Various types of Exchange Rate Regimes - Floating Rate Regimes, Managed Fixed Rate Regime

Broadly there are two systems of exchange rate determination. They are known as fixed and flexible or floating exchange rate systems.

Under the fixed exchange rate system, the foreign exchange rate is fixed by the government. The fixed exchange rate was established in the year 1944 under an agreement reached at Bretton Woods in New Hampshire, USA. Under this system, at the fixed exchange rate, if there is disequilibrium in the balance of payments giving rise to either excess demand or supply of foreign exchange, the Central Bank of the country must buy and sell the required quantities of foreign exchange to eliminate the excess demand or supply. The system of exchange rate in which the exchange value of a currency is determined by the market forces of demand and supply of foreign exchange is known as flexible or floating exchange rate system.

The flexible exchange rate system came into existence after the fall of the fixed exchange rate system in 1977. The changes in the exchange value of a currency in the foreign exchange market are known by the terms appreciation and depreciation. For instance, if the rupee – dollar exchange rate becomes Rs.65.05 in a few days hence, the rupee would be said to have depreciated against the dollar. Conversely, if the rupee – dollar exchange rate becomes Rs.60.05 then the rupee would be said to have appreciated against the dollar. The changes in the exchange rate are determined by the market forces in a flexible exchange rate system. In the case of fixed exchange rate system, the central bank must buy or sell foreign exchange so that the exchange rate is maintained at the pegged or fixed level. However, the fixed exchange rate could be changed through devaluation or revaluation only with permission from the IMF in case of fundamental disequilibrium in the balance of payments. Thus, if a country was running large and persistent deficit in her balance of payments, it could devalue its currency to improve the balance of payment position. Conversely, if a country was running large and persistent surpluses in the balance of payments, it could revalue its currency so that correction is made.

Fixed Exchange Rate | Floating Exchange Rate |

Under this system, there is complete government intervention in the foreign exchange markets. | Under this system, the market is allowed to determine the value of exchange rate freely. |

The government or central bank determines the official exchange rate by linking exchange rate to the price of gold or major currencies like US dollar. | The exchange rate is determined by the forces of demand and supply. |

If due to any reason, the exchange rate fluctuates, government intervenes and make sure that equilibrium pre-determined level is maintained. | If due to any reason exchange rate fluctuates, the government never intervenes and allows the market to function and determine the true value of exchange rate. |

The only merit of fixed exchange rate system is that it assures the stability of exchange rate. It prevents both currency appreciation and depreciation. | The only demerit of floating exchange rate system is that exchange rate fluctuates a lot on day to day basis. |

The many disadvantages of such a system are: It puts a heavy burden on governments to maintain exchange rate. This especially happens during the time of deficits, as the governments need to infuse a lot of money to maintain exchange rate. The foreign investors avoid investing in such countries as they fear to lose their investments because they believe that exchange rate does not reflect the true value of the economy. | The advantages of such a system are: the exchange rate is determined in well-functioning foreign exchange markets with no government interference. The exchange rate reflects the true value of the domestic currency which helps in establishing the trust among foreign investor. A country can easily access funds/ loans from IMF and other international institutions if the exchange rate is market determined. |

Manage Floating exchange rate lies in between of the two extremes of fixed and floating exchange rate. Under such a system, the exchange is allowed to move freely and determined by the forces of the market (Demand and Supply). But when a difficult situation arises, the central banks of the country can intervene to stabilise the exchange rate.

There are mainly three sub categories under managed floating exchange rate:

2. Crawling Peg System: In this system, a country keeps on adjusting its exchange rate to new demand and supply conditions. The system requires that instead of devaluing currency at the time of crisis, a country should follow regular checks at the exchange rate and when require must undertake small devaluations.

3. Clean Floating: In the clean float system, the exchange rate is determined by market forces of demand and supply. The exchange rate appreciates or depreciates as per market forces and with no government intervention. It is identical to floating exchange rate.

4. Dirty Floating: In the dirty float system, the exchange rate is to a very large extent is determined by the market forces of demand and supply (so far identical to clean floating), but occasionally the central banks of the countries intervene in foreign exchange markets to smoothen or remove excessive fluctuations from the foreign exchange markets.

Purchasing Power Parity Theory

The purchasing power parity theory of exchange rate determination was put forward by Professor Gustav Cassel of Sweden in the year 1920. There are two versions of the PPP theory known as the absolute and the relative versions. According to the absolute version, the exchange rate between two currencies should be equal to the ratio of the price indexes in the two countries. The formula for the absolute versions of the theory is as follows:

RAB = PA/PB

Here, RAB is the exchange rate between two countries A and B and ‘P’ refers to the price index. The absolute version is not used because it ignores transportation costs and other factors which hinder trade, non-traded goods, capital flows and real purchasing power.

The relative version which is widely used by Economists can be illustrated as follows. Let us assume that India and the United States are on inconvertible paper standard and the domestic purchasing power of $1 in the US is equal to Rs.45 in India. The exchange rate would therefore be $1 = Rs.45. Assuming the price levels in both the countries to be constant, if the exchange rate moves to $1 = Rs.40, it would mean that less rupees are required to buy the same bundle of goods in India as compared to $1 in the US. It means that the US dollar is overvalued and the Indian Rupee is undervalued. Appreciation of the rupee will discourage exports and encourage imports in India. Thus, the demand for USD will increase and that of INR will fall till the PPP exchange rate is restored at $1 = Rs.45. Conversely, if the exchange rate moves to $1 = Rs.50, the INR is overvalued and the USD is undervalued. This will encourage exports and discourage imports till once again the PPP exchange rate is restored.

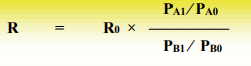

According to the PPP theory, the exchange rate between two countries is determined at a point of equality between the respective purchasing powers of the two currencies. The PPP exchange rate is a moving par which changes with the changes in the price level. To calculate the equilibrium exchange rate under the relative version of the theory, the following formula is used:

Where 0 = base period,

1 = period one,

A&B = Countries A and B.

P = Price Index.

R0 = Exchange rate in the base period.

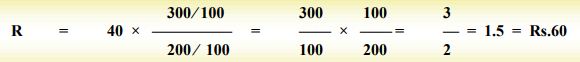

Assuming the price index of Country ‘A’ (India) to be 100 in the base period and 300 in period one and that of United States to be 100 and 200 in the two periods respectively and the Original exchange rate to be Rs.40, the new PPP exchange rate would be as follows:

Thus Rs.60/- or $1 = INR 60 will be the new PPP exchange rate. However, in reality, the PPP exchange rate will be modified by the cost of transporting goods including duties, insurance, banking and other charges. These costs are the limits within which the exchange rate can fluctuate given the demand supply situation. These limits are the ‘upper limit’ or the commodity export point and the ‘lower limit’ or the commodity import point.

Thus Rs.60/- or $1 = INR 60 will be the new PPP exchange rate. However, in reality, the PPP exchange rate will be modified by the cost of transporting goods including duties, insurance, banking and other charges. These costs are the limits within which the exchange rate can fluctuate given the demand supply situation. These limits are the ‘upper limit’ or the commodity export point and the ‘lower limit’ or the commodity import point.

Critical Assessment of the PPP Exchange Rate Theory:

The PPP theory is criticized on the following grounds:

1. Price Indices of Two Countries are not comparable - The base year of indices in two countries may be different. The consumption basket may also be different. The PPP rate may not therefore give an accurate exchange rate based on the relative purchasing powers of any two currencies.

2. Base Year is Indeterminate - The theory assumes that the balance of payments is in equilibrium in the base year. It is difficult to find the base year in which the balance of payment was in equilibrium.

3. Capital Mobility Influences the Price Level -The theory assumes that there is no capital mobility. The general price level does not affect items such as insurance, shipping, banking transactions etc. However, these items influence the exchange rate.

4. Changes in the Exchange Rate affects the General Price Level- When the exchange rate depreciates, the domestic price level is influenced by the rise in import prices. Demand for exports increases, thereby raising the price of export goods. Conversely, when the exchange rate appreciates, exports are affected and imports become cheaper, thus bringing about a fall in the price level.

5. Laissez Faire does not exist - The theory is based on the policy of laissez-faire. However, laissez faire does not exist. International trade is greatly influenced by restrictive and protective trade policies. Non-market forces therefore influence the exchange rate

Factors Affecting Exchange Rates

Changes in market inflation cause changes in currency exchange rates. A country with a lower inflation rate than another's will see an appreciation in the value of its currency. The prices of goods and services increase at a slower rate where the inflation is low. A country with a consistently lower inflation rate exhibits a rising currency value while a country with higher inflation typically sees depreciation in its currency and is usually accompanied by higher interest rates

2. Interest Rates

Changes in interest rate affect currency value and dollar exchange rate. Forex rates, interest rates, and inflation are all correlated. Increases in interest rates cause a country's currency to appreciate because higher interest rates provide higher rates to lenders, thereby attracting more foreign capital, which causes a rise in exchange rates

3. Country’s Current Account / Balance of Payments

A country’s current account reflects balance of trade and earnings on foreign investment. It consists of total number of transactions including its exports, imports, debt, etc. A deficit in current account due to spending more of its currency on importing products than it is earning through sale of exports causes depreciation. Balance of payments fluctuates exchange rate of its domestic currency.

4. Government Debt

Government debt is public debt or national debt owned by the central government. A country with government debt is less likely to acquire foreign capital, leading to inflation. Foreign investors will sell their bonds in the open market if the market predicts government debt within a certain country. As a result, a decrease in the value of its exchange rate will follow.

5. Terms of Trade

Related to current accounts and balance of payments, the terms of trade is the ratio of export prices to import prices. A country's terms of trade improves if its exports prices rise at a greater rate than its imports prices. This results in higher revenue, which causes a higher demand for the country's currency and an increase in its currency's value. This results in an appreciation of exchange rate.

6. Political Stability & Performance

A country's political state and economic performance can affect its currency strength. A country with less risk for political turmoil is more attractive to foreign investors, as a result, drawing investment away from other countries with more political and economic stability. Increase in foreign capital, in turn, leads to an appreciation in the value of its domestic currency. A country with sound financial and trade policy does not give any room for uncertainty in value of its currency. But, a country prone to political confusions may see a depreciation in exchange rates.

7. Recession

When a country experiences a recession, its interest rates are likely to fall, decreasing its chances to acquire foreign capital. As a result, its currency weakens in comparison to that of other countries, therefore lowering the exchange rate.

8. Speculation

If a country's currency value is expected to rise, investors will demand more of that currency in order to make a profit in the near future. As a result, the value of the currency will rise due to the increase in demand. With this increase in currency value comes a rise in the exchange rate as well.

Brief History of Indian Rupees Exchange Rates.

Rupees are used in a number of countries including India and Pakistan. The Indian currency is issued by the Reserve Bank of India (RBI). The Indian rupee exchange rate is measured against six currency trade weighted indices. These currencies belong to countries that have a strong trade relationship with India.

The exchange rate of the Indian rupee (or INR) is determined by market conditions. However, in order to maintain effective exchange rates, the RBI actively trades in the USD/INR currency market. The rupee currency is not pegged to any particular foreign currency at a specific exchange rate. The RBI intervenes in the currency markets to maintain low volatility in exchange rates and remove excess liquidity from the economy.

History of the Rupee:

Historically, the Indian rupee was a silver-based currency, while the major economies of the world were following the gold standard. The value of the rupee was severely impacted when large quantities of silver was discovered in the US and Europe. After independence, India started following a pegged exchange rate system. The country was forced to go through several rounds of devaluation from the 1960s to the early 1990s due to war and balance of payments problems. The rupee was made convertible on the current account in 1993. The Indian currency is set to be made fully convertible in phases over the five years ending 2010-2011.

In June 2008, the rupee appreciated to a ten-year high of US$39.29. The stability of the Indian economy attracted substantial foreign direct investment, while high interest rates in the country led to companies borrowing funds from abroad.

The global financial crisis exerted pressure on crude oil prices, which gradually plummeted to below $50 a barrel. Due to this, dollar inflow declined, with oil companies and investors purchasing more and more dollars. Persistent outflow of foreign funds increased the pressure on the rupee, causing it to decline. On March 5, 2009, the Indian currency depreciated to a record low of US$52.06. The US dollar's gains against other major currencies also weighed on the rupee.

At March end, the rupee stood at:

I USD = 50.6402 INR

1 Euro = 67.392 INR

1 Pound Sterling = 72.4022 INR

100 Japanese Yen = 51.3776 INR

International Business Negotiations:

An international business negotiation is defined as the deliberate interaction of two or more social units (at least one of them a business entity), originating from different nations, that are attempting to define or redefine their interdependence in a business matter. This includes company-company, company-government, and solely interpersonal interactions over business matters such as sales, licensing, joint ventures, and acquisitions

Generally, the process of negotiation consists of three different negotiation stages including the pre-, actual negotiation, and post- stages (Ghauri 1996:7). The effective flow of the negotiation process can determine the success of a negotiation.

The pre-negotiation stage, which involves the preparation and planning, is the most important step in negotiation. It sets the foundation for the process negotiating . It consists of interactions, such as building trust and relationships, and the task-related behaviors which focus on the preferences related to various alternatives . In brief, the first stage of negotiation emphasizes getting to know each other, identifying the issues, and preparing for the negotiation process.

The negotiation stage involves a face-to-face interaction, methods of persuasion, and the use of tactics. At this stage negotiators explore the differences in preferences and expectations related to developing an agreement.

The post-negotiation stage relates to concessions, compromises, evaluating the agreement, and following-up.

These stages are often done concurrently. The negotiation process is a dynamic process, involving a variety of factors related to potential negotiation outcomes.

International business negotiations are typically more complicated and difficult to assess than the negotiations taking place between negotiators from the same culture. This is because the values of the negotiators are different. Negotiators have unique perspectives on negotiations leading to different styles. Other external influences such as international law, exchange rates, and economic growth also increase the complexity of negotiations. International business negotiators need to understand each other’s values so that they can adapt their negotiating approaches to emerging situations.

Future Trends in International Business:

Growing Emerging Markets:

Developing countries will see the highest economic growth as they come closer to the standards of living of the developed world. If you want your business to grow rapidly, consider selling into one of these emerging markets. Language, financial stability, economic system and local cultural factors can influence which markets you should favor.

Population and Demographic Shifts:

The population of the industrialized world is aging while many developing countries still have very youthful populations. Businesses catering to well-off pensioners can profit from a focus on developed countries, while those targeting young families, mothers and children can look in Latin America, Africa and the Far East for growth.

Speed of Innovation:

The pace of innovation is increasing as many new companies develop new products and improved versions of traditional items. Western companies no longer can expect to be automatically at the forefront of technical development, and this trend will intensify as more businesses in developing countries acquire the expertise to innovate successfully.

More Informed Buyers:

More intense and more rapid communications allow customers everywhere to purchase products made anywhere around the globe and to access information about what to buy. As pricing and quality information become available across all markets, businesses will lose pricing power, especially the power to set different prices in different markets.

Increased Business Competition:

As more businesses enter international markets, Western companies will see increased competition. Because companies based in developing markets often have lower labor costs, the challenge for Western firms is to keep ahead with faster and more effective innovation as well as a high degree of automation.

Slower Economic Growth:

The motor of rapid growth has been the Western economies and the largest of the emerging markets, such as China and Brazil. Western economies are stagnating, and emerging market growth has slowed, so economic growth over the next several years will be slower. International businesses must plan for profitability in the face of more slowly growing demand.

Emergence of Clean Technology:

Environmental factors are already a major influence in the West and will become more so worldwide. Businesses must take into account the environmental impact of their normal operations. They can try to market environmentally friendly technologies internationally. The advantage of this market is that it is expected to grow more rapidly than the overall economy.

Key takeaways –

Sources-

1) Jaiswal Bimal - International Business (Himalaya Publication).

2) Hill C.W. - International Business (TMH, 5th Ed).

3) Cherunilam F - International Trade and Export Management (Himalaya, 2007).

4) Varshney R.L, Bhattacharya B - International Marketing Management (Sultan Chand & Sons, 9th Ed).