UNIT 3

Accounting for managerial Decisions

Absorption Costing

Under this method, the cost of the product is determined after considering the total cost i.e., both fixed and variable costs. Thus this technique is also called traditional or total costing. The variable costs are directly charged to the products where as the fixed costs are apportioned over different products on a suitable basis, manufactured during a period. Thus under absorption costing, all costs are identified with the manufactured products.

Limitations of Absorption Costing:

1. Being dependent on levels of output which vary from period to period, costs are vitiated due to the existence of fixed overhead. This renders them useless for purposes of comparison and control. (If, however, overhead recovery rate is based on normal capacity, this situation will not arise).

2. Carryover of a portion of fixed costs, i.e., period costs to subsequent accounting periods as part of the cost of inventory is a unsound practice because costs pertaining to a period should not be allowed to be vitiated by the inclusion of costs pertaining to the previous period.

3. Profits and losses in the accounts are related not only to sales but also to production, including the product which is unsold. This is contrary to the principle that profits are made not at the stage when products are manufactured but only when they are sold.

4. There is no uniformity in the methods of application of overhead in absorption costing. These problems have, no doubt, to be faced in the case of marginal costing also but to a less extent of fixed overhead will not arise in the case of marginal costing.

5. Absorption costing is not always suitable for decision making solution to various types of problems of management decision making, where the absorption cost method would be practically ineffective, such as selection of production volume and optimum capacity utilization, selection of production mix, whether to buy or manufacture, choice of alternatives and evaluation of performance can be had with the help of marginal cost analysis. Sometimes, the conclusion drawn from absorption cost data in this regard may be misleading and lead to losses.

Marginal Costing

Marginal costing is ―the ascertainment of marginal costs and of the effect on profit of changes in volume or type of output by differentiating between fixed costs and variable costs.‖ Several other terms in use like direct costing, contributory costing, variable costing, comparative costing, differential costing and incremental costing are used more or less synonymously with marginal costing.

It is a process whereby costs are classified into fixed and variable and with such a division so many managerial decisions are taken. The essential feature of marginal costing is division of total costs into fixed and variable, without which this could not have existed. Variable costs vary with volume of production or output, whereas fixed costs remains unchanged irrespective of changes in the volume of output. It is to be understood that unit variable cost remains same at different levels of output and total variable cost changes in direct proportion with the number of units. On the other hand, total fixed cost remains same disregard of changes in units, while there is inverse relationship between the fixed cost per unit and the number of units.

Features of Marginal Costing:

The main features of Marginal Costing may be summed up as follows:

Applications of Marginal Costing:

1. Marginal costing system is simple to operate than absorption costing because they do not involve the problems of overhead apportionment and recovery.

2. Marginal costing avoids, the difficulties of having to explain the purpose and basis of overhead absorption to management that accompany absorption costing. Fluctuations in profit are easier to explain because they result from cost volume interactions and not from changes in inventory valuation.

3. It is easier to make decisions on the basis of marginal cost presentations, e.g., marginal costing shows which products are making a contribution and which are failing to cover their avoidable (i.e., variable) costs. Under absorption costing the relevant information is difficult to gather, and there is the added danger that management may be misled by reliance on unit costs that contain an element of fixed cost.

4. Marginal costing is essentially useful to management as a technique in cost analysis and cost presentation. It enables the presentation of data in a manner useful to different levels of management for the purpose of controlling costs. Therefore, it is an important technique in cost control.

5. Future profit planning of the business enterprises can well be carried out by marginal costing. The contribution ratio and marginal cost ratios are very useful to ascertain the changes in selling price, variable cost etc. Thus, marginal costing is greatly helpful in profit planning.

6. When a business concern consists of several units and produces several products and evaluation of performance of such components can well be made with the help of marginal costing.

7. It is helpful in forecasting.

8. When there are different products, the determination of number of units of each product, called Optimum Product Mix, is made with the help of marginal costing.

9. Similarly, optimum sales mix i.e., sales of each and every product to get maximum profit can also be determined with the help of marginal costing. 10. Apart from the above, numerous managerial decisions can be taken with the help of marginal costing, some of which, may be as follows:-

a) Make or buy decisions,

b) Exploring foreign markets,

c) Accept an order or not,

d) Determination of selling price in different conditions,

e) Replace one product with some other product,

f) Optimum utilisation of labour or machine hours,

g) Evaluation of alternative choices,

h) Subcontract some of the production processes or not,

i) Expand the business or not,

j) Diversification,

k) Shutdown or continue,

Area 1. Cost Control:

The two types of costs—variable and fixed—are controllable and non-controllable respectively. The variable cost is controlled by production department and the fixed cost is controlled by the management.

Area 2. Fixation of Selling Price:

Product pricing is a very important function of management. One of the purposes of cost accounting is the ascertainment of cost for fixation of selling price. Marginal cost of a product represents the minimum price for that product and any sale below the marginal cost would entail a loss of cash. There are cyclic periods in business—boom, depression, recession etc.

During normal circumstances, price is based on full cost. The theory is that only those products should be produced or sold which make the largest contribution towards the recovery of fixed costs. The selling price fixation is also done under different circumstances.

Some important circumstances are as follows:

(i) Fixing Selling Price.

(ii) Reducing Selling Price.

(iii) Selling at or Below Marginal Cost – When we sell a commodity at marginal cost, only variable cost is recovered. Generally, the price of a product is fixed to cover variable cost as well as fixed cost, in addition to a desired profit. Fixing the selling price below the marginal cost, invites loss of some of variable cost.

The products may be sold below the marginal cost in the following cases, when:

a. A competitor is to be driven out of market.

b. To popularise the product.

c. Labour engaged cannot be retrenched.

d. The goods are of perishable nature.

e. To keep the plant in running condition.

f. There is a cut throat competition.

g. To use the materials, which is about to perish.

h. The product is used as a loss leader for the sale of another product.

i. Not to close down the firm.

j. Fear of market which may go out of hand.

k. To prevent the loss of future orders.

l. To capture the foreign market.

Area 3. Closure of a Department or Discontinuing a Product:

Marginal costing technique shows the contribution of each product to fixed costs and profit. If a department or a product contributes the least amount, then the department can be closed or its production can be discontinued.

It means the product which gives a higher amount of contribution may be chosen and the rest should be discontinued.

Area # 4. Selection of a Profitable Product Mix:

In a multiproduct concern, a problem is faced by the management as to which product mix or sales mix will give the maximum profit. The product mix which gives the maximum profit must be selected. Product mix is the ratio in which various products are produced and sold.

The marginal costing technique helps the management in taking decisions regarding changing the ratio of product mix which gives maximum contribution or in dropping unprofitable product line. The product which has comparatively less contribution may be reduced or discontinued.

Area 5. Profit Planning:

Profit planning is a plan for future operation or planning budget to attain the given objective or to attain the maximum profit.

Area 6. Decision to make or buy:

A firm may make some products, parts or tools or sometimes it may buy the same thing from outside. The management must decide which is more profitable to the firm. If the marginal cost of the product is lower than the price of buying from outside, then the firm can make the product.

Area 7. Decision to Accept a Bulk Order or Foreign Market Order:

Large scale purchasers may demand products at less than the market price. A decision has to be taken now whether to accept the order or to reject it. By reducing the normal price, the volume of output and the sales can be increased. If the price is below the total cost, rejection of the order is aimed at.

In marginal costing, the offer may be accepted, if the quoted price is above marginal cost, because of the reason that existing business contribution can recover the fixed costs and the margin of profits.

In such cases, the contribution made by foreign market or bulk orders will be an addition to the profit. But the price should not be less than the marginal cost. However, it should not affect the normal market price.

Area 8. Introduction of a New Product:

A producing firm may add additional products with the available facility. The new product is sold in the market at a reasonable price, in order to sell it in large quantities. It may become popular. If favourable, the sales can be increased; thus the total cost comes down and contributes some amount towards fixed costs and profits.

Area 9. Choice of Technique:

Every management wishes to manufacture the products at the most economical way. For this, the managerial costing is a good guide as to the products at different stages of production, that is to say whether the management has to adopt hand operated system or semi-automatic system or complete automatic system.

When operations are done by hand, fixed cost will be lower than the fixed cost incurred by machines and in complete automatic system fixed costs are more than variable cost.

Area 10. Evaluation of Performance:

Marginal costing helps the management in measuring the performance efficiencies of a department or a product line or sales division. The department or the product or division which gives the highest P/V ratio will be the most profitable one or that is having the highest performance efficiency.

Area 11. Decision Making:

Price must not be less than total cost under normal conditions. Marginal costing acts as a price fixer and a high margin will contribute to the fixed cost and profit. But this principle cannot be followed at all times. Prices should be equal to marginal cost plus a reasonable amount, which depends upon demand and supply, competition, policy of pricing etc.

If the price is equal to marginal cost, then there is a loss equal to fixed costs. Sometimes, the businessman has to face loss when, –

(a) there is cut-throat competition,

(b) there is the fear of future market,

(c) the goods are of perishable nature,

(d) the employees cannot be removed,

(e) a new product is introduced in the market,

(f) competitors cannot be driven out etc.

Area 12. Maintaining a Desired Level of Profit:

An industry has to cut prices of its products from time to time on account of competition, government regulations and other compelling reasons. The contribution per unit on account of such cutting is reduced while the industry is interested in maintaining a minimum level of its profits.Marginal costing technique can ascertain how many units have to be sold to maintain the same level of profits.

Charles points out “when desired profits are agreed upon, their attainability may be quickly appraised by computing the number of units that must be sold to secure the wanted profits. The computation is easily made by dividing the fixed costs plus desired profits by the contribution margin per unit”.

Area 13. Level of Activity Planning:

Where different levels of production and/or selling activities are being considered and the management has to decide the optimum level of activity, the marginal costing technique helps the management. What level of activity is optimum for a business to adopt is an important problem faced by businesses.

Area 14. Alternative Methods of Production:

Marginal costing techniques are also used in comparing the alternative methods of manufacture i.e. machine work or hand work, whether one machine is to be employed instead of another etc.

Many a time, management has to choose a course of action from among so many alternatives, the changes in the marginal contribution under each of the proposed methods are worked out and the method which gives the greatest contribution is obviously adopted keeping in view the limiting factor if any.

Area 15. Introduction of New Product or Product Line:

The technique to assess the profitability of line extension products is the incremental contribution estimates. The same technique of contribution analysis would be followed in assessing the profitability of a new product line. Sales forecast would result from a market survey and market research.

Tools and techniques of marginal costing

Contribution margin of a product is the difference between the selling price and its variable cost. It is obtained by subtracting marginal cost from sales revenue of a given activity. The difference between sales revenue and variable cost is called contribution since it contributes towards fixed expenses and profit of the entire business. It is also known as ‘unit contribution margin’ or ‘marginal contribution per unit’.

In normal circumstances, selling prices contain an element of profit but there may be circumstances, when products may have to be sold at cost or even at loss. Therefore, the character of contributions will have the following composition under different circumstances:

Selling price containing profit: Contribution = Fixed cost + Profit

Selling price at Cost: Contribution = Fixed Cost

Selling price at loss: Contribution = Fixed Cost – Loss

2. Profit volume ratio

The P/V Ratio shows percentage of contribution to the sales value i.e. margin as percentage of sales out of it the fixed cost is met and there is a profit.

Contribution = Sales Value × P/V Ratio

P/V ratio is a relative ratio. It cannot be adopted independently. If it is studied in an isolated way, it will not give much information. As fixed costs are not relevant in the calculation of P/V ratio, erroneous conclusions may be arrived.

The Profit Volume Ratio can be calculated as follows:

PV Ratio = (Contribution/ Sales) x 100

PV Ratio = (Changes in Profit/ Changes in Sales) x 100

PV Ratio = 100 – Variable Cost Ratio

3. Breakeven point

Break-even point is a point where the total sales or revenue are equal to total costs. In breakeven point, there is no profit or loss in the volume of sales. In other words, it is a point at which no profit no loss situation prevails in the operating activity of a business firm. This indicates that the break-even point is the minimum level of production at which total cost is recovered and no profit or no loss is sustained.

Break-even Point = Fixed Cost/ P/V ratio

Break-even Point (in units) = Fixed cost / Contribution per unit

4. Margin of safety

Margin of safety is the difference between the actual sales and sales at break-even point. Sales beyond break-even volume bring in profits. Such sales represent a margin of safety. Margin of safety is calculated as follows:

Margin of safety = Total sales – Break even sales

Margin of safety can also be calculated with the help of P/V ratio i.e.

Margin of safety = Profit/ P/V Ratio

Margin of safety can also be expressed as percentage of sales:

(Margin of safety/ Total sales)* 100

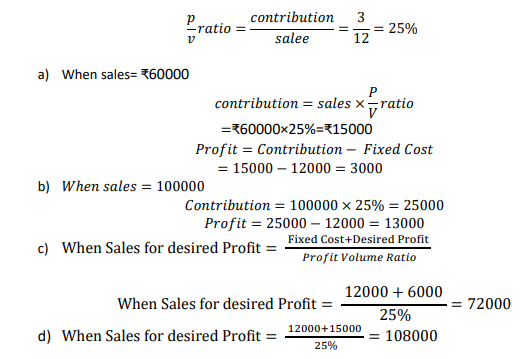

Example 1

1The following data is given:

Fixed cost =rs12000

Selling price =rs12 per unit

Variable cost= rs 9 per unit

i) What will be the profit when sales are a)rs 60000 b) rs100000?

ii) What will be the amount of sales at desired to earn a profit of c) 6000; d) 15000?

Solution

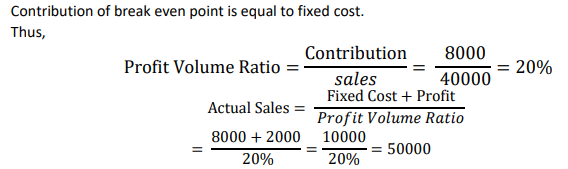

Example 2

Given:

Fixed cost rs 8000

Profit earned rs2000

Break even sales rs40000

What is the actual sales?

Solution

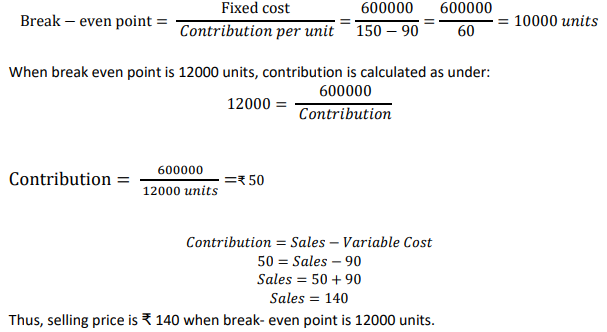

Example 3

Selling price Rs 150 per unit; variable cost Rs 90 per unit; fixed cost Rs 600000 (total).

What is the break-even point?

What is the selling price per unit if break-even point is 12000 units?

Solution

Example 4

A company producing 500 units its variable cost $200 per unit and sale price 250 per unit, fixed expenses are $12,000 per month.

Required

Calculate BEP in units and sales and show profit at 90% capacity.

Answer

(i). BEP (units) = Fixed Expenses / C

= ($5,42,000 + $2,52,000) / 6

= 7,92,000 / 6 = 1,32,000 units

BEP (Sales) = 1,32,000 x 20 = $26,40,000

(ii) Sales for examining profit $60,000

BEP (units) = (Fixed Exp. + Desired Profit) / C

= (7,92,000 + 60,000) / 6

= 8,52,000 / 6

= 1,42,000 units

BEP Sales = 1,42,000 x 20 = $28,40,000

Standard costing

Meaning of Standard Costing:

It is a method of costing by which standard costs are employed. According to ICMA, London, Standard Costing is ―the preparation and use of standard costs, their comparison with actual cost and the analysis of variances to their causes and points of incidence‖.

According to Wheldon, it is a method of ascertaining the costs whereby statistics are prepared to show:

(i) The standard cost;

(ii) The actual cost;

(iii) The difference between these costs which is termed the variance.

W. Bigg expresses:

Standard Costing discloses the cost of deviations from standards and clarifies these as to their causes, so that management is immediately informed of the sphere of operations in which remedial action is necessary.

Thus, from the above, it becomes clear that Standard Costing involves:

(i) Ascertainment and use of Standard Costs;

(ii) Recording the actual costs;

(iii) Comparison of actual costs with standard costs in order to find out the variance;

(iv) Analysis of variance; and

(v) After analysing the variance, appropriate action may be taken where necessary

Features of standard costing

Advantages of Standard Costing:

The following advantages may be derived from Standard Costing:

(i) Standard Costing serves as a guide to the management in several management functions while formulating prices and production policies etc.

(ii) More effective cost control is possible under standard costing if the same is reviewed and analysed at regular intervals for improvements and immediate action can be taken if deviations from standards are found out which, ultimately, leads to cost reduction.

(iii) Analysis of variance and its measurement helps to detect inefficiencies and mistakes which enable the management to investigate the reasons.

(iv) Since standard costs are predetermined costs they are very useful for planning and budgeting. It also helps to estimate the effect of changes in Cost-Price-Volume relationship which also helps the management for decision-making in future.

(v) As standard is fixed for each product, its components, materials, process operation etc. it improves the overall production efficiency which also ultimately reduces cost and thereby increases profit.

(vi) Once the Standard Costing System is implemented it will lead to saving cost since most of the costing work can be eliminated.

(vii) Delegation of authority and responsibility becomes effective by setting up standards for each cost centre as the supervisors or executives of each cost centre will know the standard which they have to maintain.

(viii) This system also helps to prepare Profit and Loss Account promptly for short period in order to know the trend of the business which helps the management to take decisions promptly.

(ix) Standard costing also is used for inventory valuation purposes. Stock can be valued at standard cost which can reduce the fluctuation of profit for different methods of valuation for the same.

(x) Efficiency of labour is promoted.

(xi) This system creates cost-consciousness among all employees, executives and top management which increase efficiency and productivity as well.

Key takeaways-

Sources-