UNIT 4

Analysis and Interpretation of Financial Statements

What are financial statements?

The term financial statement refers to a statement of change in financial condition, statement of retained earnings, balance sheet, income statement, and so on. But in general, financial statements contain only two statements; they are profit and loss accounts and balance sheets. It is observed that the mere presentation of these statements does not serve anyone's purpose anyway. The importance of these statements lies in their analysis and interpretation. Initially, the analysis was carried out only to extend credit, but now it is used as the most important function of management accountants to provide information.

Hampton J.J. "A statement disclosing the status of an investment is known as a balance sheet and a statement indicating the result is known as a profit and loss account, “the statement said.

Some of the schedules are prepared and submitted alongside financial statements for meaningful presentation. Such a schedule is based on the schedule of fixed assets, the schedule of debtors, the schedule of creditors, the schedule of investments.

Meaning of analysis

Analysis means the process of splitting or splitting the content of financial statements into many parts to obtain maximum meaningful information.

Meaning of interpretation

Explaining the meaning and significance of the rearrangement and/or modified data of the financial statements is called Interpretation

F.Wood:Putting the meaning of a press release in simple words for the advantage of a person is called "Interpretation

Procedures for analysis and interpretation

In order to conduct an effective analysis and interpretation of financial statements, it is necessary to complete the following basics:

Purpose of analysis and interpretation

Many stakeholders of financial statements are analysed and interpreted according to their various purposes. Despite the variability of the purposes of analysis and interpretation by different classes of people, there are several common purposes of interpretation, which are given below.

1. To find out the income capacity and efficiency of various business activities with the help of the income statement.

2. Measure management efficiency under different business situations.

3. Estimate the performance ratings of different departments over a period of time.

4. With the help of the balance sheet, measure the short-and long-term solvency position of the business organization.

5. To find out the source of Finance and how to utilize available finance.

6. To determine the future prospects of earnings capacity and business concerns.

7. Identify the role of fixed assets in maintaining revenue capacity for how they are utilized and business concerns.

8. Investigate the future potential of business concerns.

9. Compare the operational efficiency of similar concerns engaged in the same industry.

10. Identify the growth trend of the business organization.

The importance of analysis and interpretation

All quantitative information i.e. financial accounting information is comprehensively analysed and interpreted so that important facts and relationships regarding various aspects of financial life of business concerns are known to everyone. Thus, various factors increase the importance of analysing and interpreting financial statements.

1. Wrong and incomplete decisions are taken by the management team in the absence of analysis and interpretation.

2. Sometimes, decisions are also taken by various responsible executives in haste.

3. Everyone has limited experience in business activities. Therefore, the complexity of business activities can be easily understood through analysis and interpretation.

4. If a decision is made based on intuition or conclusions, then the decision has no meaning, and no one understands the decision. In other words, if the decision is based on scientific analysis and interpretation, then everyone understands the decision very easily.

5. Analysis and interpretation are necessary to verify and consider the correctness and correctness of selections already made on the idea of intuition.

Key takeaways:

Ratio Analysis

Ratio analysis is used to evaluate relationships among financial statement items. It is used to identify trends over time for one company or to compare two or more companies at one point in time. Financial statement ratio analysis focuses on three key aspects of a business: liquidity, profitability, and solvency.

Ratio analysis is concerned with the calculation of relationship to provide indicators of past performance in terms of critical success factors of a business. This is an accounting ratio. The accounting ratio offer quick ways to evaluate a business's financial condition.

According to Accounting Scholar, ratios are the most frequently used accounting formulas in regard to business analysis. Analyzing your finances with these ratios helps you identify trends and other data that inform important business decisions.

Key takeaways –

Different types of accounting ratio

These ratios are used to evaluate the company ability in paying its debts, usually by measuring current liabilities and liquid assets. This determines the ability of the company to pay off short-term debts. These are some common liquidity ratios:

It is also known as working capital ratio. The purpose of this ratio is to measure the company ability to pay off short-term debts by liquidating the assets. Current assets includes stock, debtors, cash and bank balances, bills receivable, etc. current liabilities includes creditors, bank overdrafts, outstanding expenses, etc. The ideal ratio is considered to be 2:1

This ratio is similar to the current ratio above, except that to measure "quick" assets, which includes Cash + Cash Equivalents + Short Term Investments + Accounts Receivables. The ideal ratio is 1:1.

By calculating the net working capital ratio, the company is calculating the liquidity of the assets. An increasing net working capital ratio indicates that the business is investing more in liquid assets than fixed assets.

This ratio tells the ability of business in covering its debts using only cash.

The cash coverage ratio is similar to the cash ratio, but it calculates the business ability to pay interest on its debts.

2. Profitability ratios

This ratio is used by accountant to measure a business's earnings versus its expenses. Profitability is the ability of a business to earn profit over a period of time. The profitability ratios show the combined effects of liquidity, asset management and debt management on operating results. These are some common profitability ratios:

This ratio determines the basic profitability of the firm. The ratio is represented as a percentage of sales. Higher the ratio, the higher is the profit earned on sales

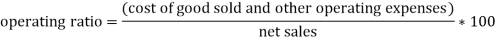

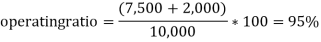

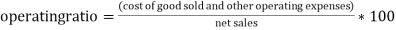

This ratio measures the equation between the cost of operating activities and the net sales, or revenue from operations. This ratio expresses the cost of goods sold as a percentage of the net sales. Lower the ratio, lower the expense related to the sales

This ratio measures the ultimate profitability. Higher the ratio, the more profitable are the sales.

The return on assets ratio indicates how much profit businesses make compared to their assets. Higher the return, the more efficient is the management in utilizing its asset base

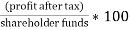

It measures how much the shareholders earned for their investment in the company. Higher percentage indicates better return to investors.

This ratio measures the overall efficiency of the utilization of the firm’s funds. It indicates the productivity of capital employed.

The earnings-per-share ratio is similar to the return-on-equity ratio, except that this ratio indicates the company profitability from the outstanding shares at the end of a given period.

3. Leverage ratios

A leverage ratio is a important indicator of financial strength, it sees how much of the company's capital comes from debt and how the company can meet its financial obligations.

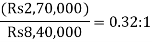

This ratio compares the company’s total debt to its total assets. The higher the debt ratio the more difficult it becomes for the firm to raise debt.

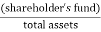

This ratio measures the strength of the financial structure of the company. A high equity ratio reflects a strong financial structure of the company.

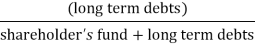

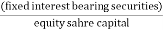

This ratio measures the debt component of a company’s capital structure. A low level of debt and a healthy proportion of equity in a company’s capital structure is an indication of financial strength.

4. Turnover ratios

Turnover ratios are used to measure the company's income against its assets. There are many different types of turnover ratios. Here are some common turnover ratios:

5. Market value ratios

Market value ratios deal entirely with stocks and shares. Many investors use these ratios to determine if your stocks are overpriced or underpriced. These are a couple of common market value ratios:

Key takeaways - Ratio analysis compares line-item data from a company's financial statements to reveal insights regarding profitability, liquidity, operational efficiency, and solvency.

Problem 1:

The company's balance sheet for December 31 is as follows:

Liabilities | Rs | Assets | Rs |

Share capital | 2,00,000 | Land and building | 1.,40,000 |

Profit & loss account | 30,000 | Plant and machinery | 3,50,000 |

General reserve | 40,000 | Stock | 2,00,000 |

12% debenture | 4,20,000 | Sundry debtor | 1,00,000 |

Sundry creditor | 1,00,000 | Bills receivable | 10,000 |

Bills payable | 50,000 | Cash at bank | 40,000 |

| 8,40,000 |

| 8,40,000 |

Calculate :-

Solutions :

=2.33:1

=2.33:1

2. Quick ratio =

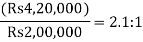

3. Inventory to working capital =

working capital= current assets – current liabilities

Rs 3,50,000 - Rs 1,50,000= Rs 2,00,000

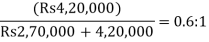

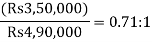

4. Debt to equity ratio=

(or)

5. Proprietary ratio=

6. Capital gearing ratio =

7. Current assets to fixed assets =

Problem 2:

From the following items listed in the trading and profit and loss accounts of the corporation.Working out, business concerns occupancy rate:

Trading account of a account LTD.

For the period ending December 21

Dr. Cr.

Expenses | Rs | Income | Rs |

To opening stock | 1,400 | By net sales | 10,000 |

To purchase | 6,400 | By closing stock. | 600 |

To direct expenses | 300 |

|

|

To gross profit | 2,500 |

|

|

| 10,600 |

| 10,600 |

Profit and loss account of a company LTD.

For the period ending December 31

Dr. Cr.

Expenses | Rs | Income | Rs |

To operating expenses |

| By gross profit | 2,500 |

| 1,600 |

|

|

b. Selling and distribution expenses | 300 |

|

|

To financial expenses | 100 |

|

|

To net profit | 500 |

|

|

| 2,500 |

| 2,500 |

Solution :

cost of good sold | Rs |

Opening stock | 1,400 |

purchases | 6,400 |

Direct expenses | 300 |

| 8,100 |

Less closing stock | 600 |

Cost of good sold | 7,500 |

Operating expenses | Rs |

| 1,600 |

b. Selling and distribution expenses | 300 |

c. Financial expenses | 100 |

Operating expenses | 2,000 |

Problem 3:

Below is a summary profit and loss account of Taj Products Ltd. Published January 31-4:

Profit and loss account

| Rs |

| Rs |

Opening stock of market | 99,500 | Sales | 8,50,0000 |

Purchase of material | 3,20,000 | Stock of material (closing) | 89,000 |

Direct wages | 2,25,000 | Stock of finished goods ( closing ) | 60,0000 |

Manufacturing expenses | 14,250 | Non- operating income interest | 3,0000 |

Selling & distribution |

| Profit on sale of shares | 6,000 |

Expenses | 30,000 |

|

|

Administrative expenses | 1,50,000 |

|

|

Finance charges | 15,000 |

|

|

Non- operating expenses |

|

|

|

Loss on scale of assets | 4,000 |

|

|

Net profit | 1,50,000 |

|

|

| 10,08,000 |

| 10,08,000 |

Work out following ratios:-

Solution

Gross sales (a) |

| 8,50,000 |

Less: cost of good sold: | Rs |

|

Opening stock of material | 99,500 |

|

Add: material purchased | 3,20,000 |

|

| 4,19,500 |

|

Less: stock of material (closing) | 89,000 |

|

Material consumed ; (b) | 3,30,500 |

|

Direct wages | 2,25,000 |

|

Manufacturing expenses | 14,250 |

|

Cost of production | 5,70,000 |

|

Less: closing stock of finished products | 60,000 |

|

Cost of good sold |

|

|

Gross profit (e) |

|

|

Less: administrative expenses | 1,50,000 | 5,10,000 |

selling and distribution | 30,000 | 1,80,000 |

Net operating profit before interest and taxation |

| 1,60,000 |

Add: non- operating income (g) |

|

|

Interest | 3,000 |

|

Profit on sales of shares | 6,000 | 9,000 |

|

| 1,69,000 |

Less: loss on sale of assets | 4,000 |

|

Finance charges | 15,000 | 19,000 |

Income before taxation |

| 1,50,000 |

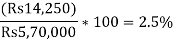

2. Net profit ratio=

3.

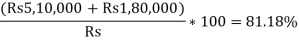

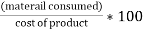

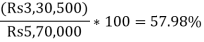

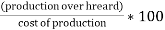

4. i. material consumed ratio=

Problem 4

You need to calculate from the following balance sheet and additional information:

(i)Total Return on resources

(ii)Return on employment capital

(iii) Shareholder fund return

Balance sheet as on 31stdec

| Rs |

| Rs |

Share capital (Rs10) | 8,00,000 | Fixed assets | 10,00,000 |

Reserve | 2,00,000 | Current assets | 3,60,000 |

8% debenture | 2,00,000 |

|

|

Creditors | 1,60,000 |

|

|

| 13,60,000 |

| 13,60,000 |

Net operating profit before tax is Rs 2,80,000. Assume tax rate at 50% . dividend declared amount to Rs 1,20,000

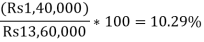

Solution :-

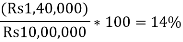

ii. return on capital employed =

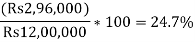

iii. return on shareholder’s fund=

Problem 5:

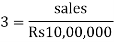

The company has Rs capital. 10, 00,000; its turnover is 3 times the capital, and the margin of turnover is 6%. What is the return on investment?

Solution :-

Capital turnover ratio=

rate of return on investment =

Gross profit =6% of Rs 30,00,000

Rs= 1,80,000

Significance of ratio analysis

Ratios are vey useful tools to analyze the financial performance of the enterprise over a period of time. Against the industry average the efficiency of the enterprise can also be judged. The vertical ratio analysis helps the analyst to determine whether performance of the firm at a point of time is good, questionable or poor.

Likewise, use of ratios in horizontal analysis indicates whether the financial condition of the firm is improving or deteriorating and whether the cost, profitability or efficiency is showing an upward or downward trend.

In the task of planning and forecasting, a study of the trend of strategic ratios will help the management. The investment decisions at times are based on the condition revealed by certain ratios. In this way it serves as handmaid to the management.

2. For planning and forecasting: ratio analysis helps the manager to find a trend and based on that trend, project into foreseeable future what an item of financial statement would most likely be.

3. As a basis of decision making: ratio analysis output can be used as a basis for making investment decision. After calculating some investment ratios an investor would be better equipped to make decision of whether to invest in a project or not to invest.

4. To compare results and performance: an insight of how management are doing can be obtained by calculating ratios.

5. For analysis of strengths and weakness: ratio analysis helps the management to find out department or division that is not relatively doing well and then take some corrective actions to improve the performance.

6. For analyzing change in the form of trend: investors are more interested in analyzing the trend of the company. This trend is found using ratios and ratio analysis.

Key takeaways - Ratios are vey useful tools to analyze the financial performance of the enterprise over a period of time.

Fund Flow Analysis

A fund flow statement is a statement in summary form that indicates changes in terms of financial position between two different balance sheet dates showing clearly the different sources from which funds are obtained and uses to which funds are put.

Definition

Roy A. Fouke defines fund flow statement as “a statement of sources and application of funds is a technical device designed to analyse the changes in the financial condition of a business enterprise between two dates.”

Steps for preparing funds flow statement

General rules for preparing funds flow statement

Format of funds flow statement

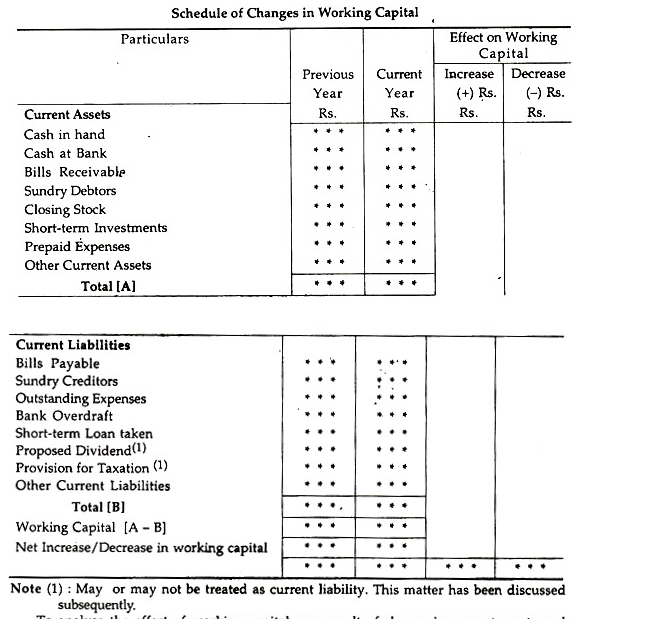

The fund flow analysis involves the preparation of two statement

The Schedule or Statement of changes in working capital is a statement that compares the change in the amount of current assets and current liabilities on two balance sheet dates and highlights its impact on working capital.

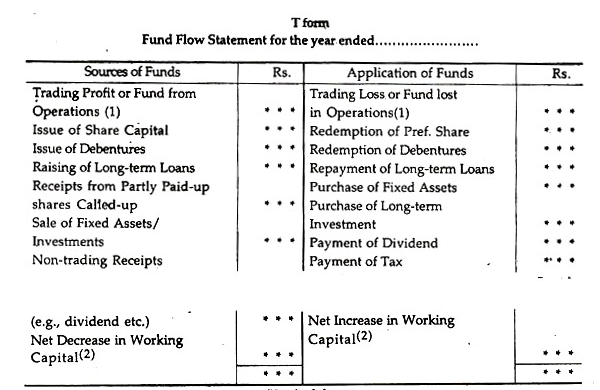

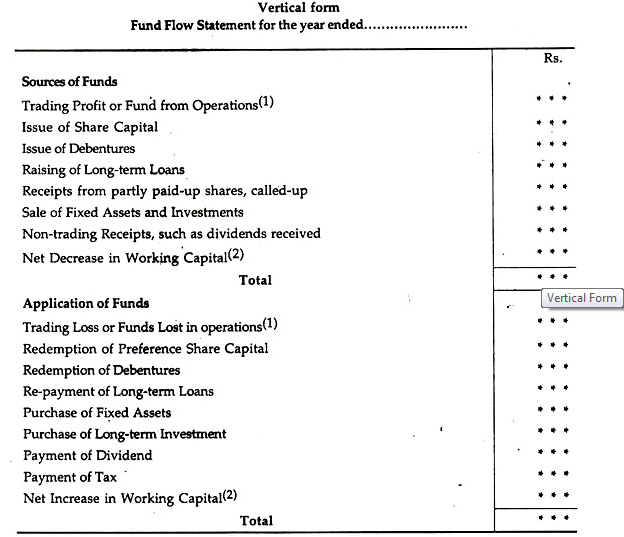

2. Funds flow statement : After preparing the schedule of changes in working capital, the next step is to find out the different sources and applications of funds through preparation of funds flow statement. This statement GIVES emphasis on the changes in the fixed assets and fixed liabilities. The statement may be prepared either in ‘T form’ or in ‘Vertical form’.

Key takeaways - A fund flow statement is a statement in summary form that indicates changes in terms of financial position between two different balance sheet dates

Cash Flow Analysis comparative and common size Statements

Comparative statement

Every business needs to produce basic financial statements that summarize its performance and financial situation for a certain period of time. It includes income statements, balance sheets, and cash flow statements.

Therefore, the purpose of drawing up these statements is to check the profitability and financial health of the business. The detailed information reflected in the table is not enough to reach the meaningful management of the need for execution. Therefore, detailed financial analysis and interpretation of these statements is required using various tools and technologies.

This analysis can be obtained by the relationship of each part in one place, and in each country of the description. So, one of the commonly used tools to do the analysis of financial statements is to create comparative financial statements. Other technologies include、:

What are comparative financial statements?

Creating comparative financial statements is the most commonly used technique for analysing financial statements. This technique determines the profitability and financial status of a business by comparing financial statements for multiple periods. Therefore, this technique is also called horizontal analysis. Typically, the Income Statement and balance sheet are prepared in a comparative form to conduct such analysis.

In addition, there are provisions attached to the comparison of financial data indicated by such statements. This is related to using the same accounting principles to create a comparative statement for each. If you do not follow the same accounting principles to make such statements, the difference must be disclosed in the footnotes below.

Comparative balance sheet

Comparison balance sheet showcase:

What to study while analysing the comparative balance sheet?

The business owner or financial manager should study the following aspects of the comparative balance sheet:

1. Working capital

Working capital refers to the excess of current assets relative to current liabilities. This will let you know about the Financial Accounting Manager or the owner of the business and become a liquidity position.

2. Changes in Long-Term Assets, Liabilities and capital

The next component that a financial manager or business owner needs to analyse is the change in fixed assets, long-term liabilities and capital of the business. This analysis helps each stakeholder understand the long-term financial situation of the business.

3. Profitability

Working capital refers to the excess of current assets relative to current liabilities.This will let you know about the Financial Accounting Manager or the owner of the business and become a liquidity position.

Procedure for creating a comparative balance sheet

1. Step 1 clicks OK.

First, specify the absolute values of assets and liabilities related to the accounting period that will be considered for analysis. These amounts are listed in columns I and II of the comparison balance sheet.

2. Step 2 clicks OK.

Examine the absolute changes in the items listed on the balance sheet. This is done by subtracting the item amount in the previous year from the item amount in the current year. This increase or decrease in absolute amounts can be found in Column III of the comparative balance sheet.

3. Step 3 clicks OK.

At last we need to sum up the rate of change in assets and liabilities for the current year relative to the previous year. Changes in this percentage of assets and liabilities are indicated in column V of the comparative balance sheet.

Rate of change= (absolute increase or decrease) / absolute number of previous year's figures) * 100

Let's understand the comparative balance sheet through examples.

For the illustration,consider the following balance sheets for M/S Kapoor and Co, as in December31th, 2017 and December31th, 2018.M / s Kapoor and Co.Balance sheet of December 31, 2017,as of January 31, 2018.Kapoor Pvt Ltd balance sheet to explain comparative financial statements

Comparison balance sheet of Kapoor Pvt Ltd. one of the comparative financial statements

Particular | December 31, 2017 | December 31, 2018 |

Net sales | 1,70,000 | 1,90,400 |

Less: cost of good sales | 1,05,000 | 1,20,000 |

Gross profit | 65,000 | 70,400 |

Administrative expenses | 13,200 | 14,960 |

Selling expenses |

|

|

Advertisement expenses | 3,000 | 4,000 |

Other selling expenses | 40, 800 | 41,800 |

Total selling expenses | 43,800 | 45,800 |

Operating expenses | 57,000 | 60,760 |

Operating profit (D)=(D=P. A+B) | 8,000 | 9,640 |

Other income E | 6,400 | 9,200 |

Other expenses | 6,800 | 4,800 |

Profit before tax (PBT)(PBT=D+E.F) | 7,600 | 14,040 |

Income tax | 3,800 | 6,200 |

Profit after tax (PAT) (PAT=PBT.T) | 3,800 | 7,840 |

M/s Kapoor and Co.Compare balance sheets of December31, 2017, and December31, 2018 and so on.

particulars | December 31, 2017 | December 31, 2018 | (+/(-) | %(+)(-) |

Net sales | 1,70,000 | 1,90,400 | (+) 20,400 | (+) 12.00 |

Less cost goods sold | 1,05,000 | 1,20,000 | (+) 15,000 | (+) 14.30 |

Gross profit | 65,000 | 70,400 | (+)5,400 | (+) 8.3 |

Administrative expenses | 13,200 | 14,960 | (+)1,760 | (+)13.3 |

Selling expensive |

|

|

|

|

Advertisement expensive | 3,000 | 4,000 | (+)1,000 | (+) 3.3 |

Other selling expenses | 40,800 | 41,800 | (+) 1,000 | (+) 2.5 |

Total selling expense | 43,800 | 45,800 | (+) 2,000 | (+) 4.6 |

Operating expense | 57,000 | 60,760 | (+) 3760 | (+) 6.6 |

Operating profit | 8000 | 9640 | (+)16,40 | (+) 20.5 |

Other income | 6400 | 9200 | (+)2800 | (+) 43.8 |

Other expenses | 6800 | 4,800 | (-) 2,000 | (-) 29.4 |

Profit before tax | 76000 | 14,040 | (+) 6,440 | 84.7 |

Income tax | 3800 | 62000 | (+) 2,400 | (+) 63.2 |

Profit after tax | 3800 | 7,840 | (+) 4,040 | (+) 106.3 |

Analysis

As evidenced by the comparative income statement above, sales of M/s Singhania increased Rs 20,400 during 2018 versus 2017 as well. But the cost of goods sold for the company increased by just 15,000 rupees over the same period. If you look carefully, sales increased by 12% and the cost of goods sold increased by 14.3%. Thus, the gross profit of M/s Singhania did not increase significantly. Now, there are several reasons to lower gross profit during the year:

Increase in the cost of goods sold

First, a higher increase in the cost of the goods sold can be either due to an increase in the volume of sales or a higher input cost. In addition, it is clear that our sales cost has improved due to the increase in sales volume. This is due to the increase in sales for the year.

Now, if the company had made a sale at the previous sale price, the sales value would have increased significantly. But that's not because the sales value did not change to a great extent. This suggests towards the fact that incremental sales are done at a lower price than the selling price.

In addition, this analysis is supported by an increase in advertising spending for the company in 2018. These were up 33 per cent, much higher compared to a mere 12 per cent increase in sales. Thus, the whole scenario showed that it is very difficult to sell goods during 2018

Therefore, we significantly increased the cost of advertising, lowered the sales price and increased the sales volume. Also, this scenario may be the result of the launch of a new product. In such cases, the company spent a huge amount of money on advertising and had to lower the selling price for market penetration.

Increase in other income and decrease in other expenses

In addition, “otherexpenses” have decreased significantly in absolute and relative terms. Therefore, these items of the income statement will lead to an improvement in pre-tax profit for 2018 versus 2017.

Thus, such facts indicate that the company was more focused on earning non-operating profits than on sales. Comparison balance sheet of Kapoor Pvt Ltd. one of the comparative financial statements.

Thus, such facts indicate that the company was more focused on earning non-operating profits than on sales. Comparison balance sheet of Kapoor Pvt Ltd. one of the comparative financial statements.

Key takeaways:

Common size statement

Financial statements are prepared for an organization or company to know about the state of the business at that time or period. For organizations and business owners, the importance of financial statements is defined by their interpretation and analysis.

The importance of financial statements is different for different individuals in the organization. For managers, it is the efficiency of operations, and for shareholders, it is related to the interests and interests of the company.

What is a common size statement?

A statement of general size is a form of analysis and interpretation of financial statements. It is also called vertical analysis. In this method, you analyse the financial statements by taking into account each item as a percentage of the base amount for that particular accounting period.

The general size statement is not any kind of financial ratio, but it is a financial statement that makes it easy to analyse those statements.

A typical size statement is always in the form of a percentage. Therefore, such a statement is also called a 100 percent statement or a constituent percentage statement, since all individual items are taken as a percentage of 100.

Common size statement types

There are two types of common size statements:

This is a kind of general size statement in which the sale is taken as the base for all calculations. Therefore, the calculation of each line item takes into account sales as a base, and each item is represented as a percentage of sales.

General size statement format

The common size statement has the following format:

General size statement limitations

The limitations are:

2. Common size balance sheet:

A general size balance sheet is a statement in which the total table item is calculated as the ratio of each asset to total assets. For liabilities, each debt is calculated as a ratio of the total liabilities.

A balance sheet of a common size can be used to compare companies of different sizes. It was found that such a comparison of numbers for different periods is not so useful, since the total value seems to be influenced by several factors.

This method does not allow you to study the trends in numbers and to establish standard values for various assets, since you cannot get the right result.

Common size Statement use

Key takeaways:

Practical Questions:

Problem 1

From the following income statement,prepare a general size income statement for Jayant Ltd which ended 31st March, 2011.

Particular | Amount |

revenue from operations | 25,38,000 |

(+) other income | 38,000 |

Total income | 25,76,000 |

Expenses |

|

Cost of revenue from operations | 14,00,000 |

Operating expenses | 5, 00,000 |

Total expenses | 19,00,000 |

profit before tax | 6,76,000 |

(-) income tax | 3,38,000 |

profit after tax |

|

Ans

Common size statement of profit and loss

for the year ended 31st March, 2011

Particular | Amt | Amt |

| 25,38,000 | 100.00 |

II. Other income | 38,000 | 1.50 |

III. Total revenue (I+II) | 25, 76, 000 | 101.50 |

IV. Expenses |

|

|

(a). cost of revenue from operations. (b). operations expenses | 14,00,000 5,00,000 | 55.16 19.70 |

Total expenses | 19,00,000 | 74.86 |

V. Profit before tax (III-IV) | 6,76,000 | 26.64 |

VI. Tax | 3,38,000 | 13.32 |

VII. Profit after tax ( V-VI) | 3,38,000 | 13.32 |

Problem 2:

Below is Raj Ltd's income statement for the year ended 31st March, 2011.

Particular | Amount |

Revenue from operations | 2,00,000 |

(+) other income | 15,000 |

Total income | 2,15,000 |

Expenses |

|

Cost of revenue from operations . | 1,10,000 |

Operating expenses | 5,000 |

Total expenses | 1,15000 |

Profit before tax | 1,00,000 |

(-) income tax | 40,000 |

profit after tax | 60,000 |

Preparing a statement of the general size of Raj Ltd's profit and loss for the year ended 31st March, 2011.(Delhi 2012, fix)

Ans

Common size income statement

For the year ended 31st march, 2011

Particular | Amt. | Percentage of sales |

| 2,00,000 | 100.00 |

II. Other income | 15,000 | 7.50 |

III. Total revenue (I+II) | 2,15,000 | 107.50 |

IV. Expenses (a) Cost of revenue from operations (b) Operating expenses |

1,10,000 5,000 |

55.00 2.50 |

Total expenses | 1,15,000 | 57.50 |

V. profit before tax ( III-IV) | 1,00,,000 | 50.00 |

VI. Tax | 40,000 | 20.00 |

VII. Profit after tax (V-VI) | 60,000 | 30.00 |

Problem 3

Create a comparative statement of profit and loss from the following information

Particular | 31st march, 2009 | 31st march 2010 |

Revenue from operations | 40,000 | 50,000 |

Cost of revenue from operations | 30,000 | 35,000 |

Wage paid | 16,000 | 14,000 |

Operating expenses | 2,500 | 3,000 |

Other income | 2,000 | 3,000 |

Income tax | 4,750 | 7,500 |

Ans.

Comparative statement of profit and loss

For the year ended 31stmarch , 2009 and 2010

Particular | 31st march 2009 | 31st march 2010 | Absolute change ( increase or decrease) | Percentage change ( increase or decrease )(%) |

| 40,000 | 50,000 | 10,000 | 25.00 |

II. Other income | 2,000 | 3,000 | 1,000 | 50.00 |

III. Total revenue (I+II) | 42,000 | 53,000 | 11,000 | 26.19 |

IV. Expenses (a) Cost of revenue from operations. (b) Operating expenses Total expenses |

30,000 2,500 32,500 |

35,000 3,000 38,000 |

5,000 500 5,500 |

16.67 20.00 16.92 |

V. Profit before tax ( III-IV) | 9,500 | 15,000 | 5,500 | 57.89 |

VI. Tax | 4,750 | 7,500 | 2,750 | 57.89 |

VII. Profit after tax (V-VI) | 4,750 | 7,500 | 2,750 | 57.89 |

Note the paid wages are part of the direct costs and are included in the cost of goods already sold.

Problem 4

Create a comparative statement of profit and loss from the following information

Particular | 2009 | 2010 |

Revenue from operations | 10,00,000 | 12,50,000 |

Cost of revenue from operations | 5,00,000 | 6,50,000 |

Carriage inwards | 30,000 | 50,000 |

Operating expenses | 50,000 | 60,000 |

Income tax | 50% | 50% |

Ans

Comparative statement of profit and loss

For the year ended 31st march, 2009 and 2010

Particulars | 31st march 2009 | 31st march 2010 | Absolute change(increases or decreases) | Percentage change (increase or decrease) |

| 10,00000 | 12,50,000 | 2,50,000 | 25.0 |

II. Other income | - | - | - | - |

III. Total revenue (I+II) | 10,00000 | 12,50,000 | 2,50,000 | 25.0 |

IV. Expenses (a) Cost of revenue from operations (b) Operating expenses Total expense |

5,00,000 50,000 5,50,0000 |

6,50,000 60,000 7,10,000 |

1,50,000 10,000 1,60,000 |

30.00 20.00 29.09 |

V. Profit before tax ( III-IV) | 4,50,000 | 5,40,000 | 90,000 | 20.00 |

VI. Tax @ 50% | 2,25,000 | 2,70,000 | 45,000 | 20.00 |

VII. Profit and tax (V-VI) | 2,25,000

| 2,70,000 | 45,000 | 20.00 |

Note: inward carriage is part of the direct cost and is included in the cost of goods already sold.

Problem 5:

Use the following information to create a comparative statement of profit and loss.

Particular | 31st march, 2008 | 31st march, 2009 |

Revenue from operations | 2,00,000 | 3,50,000 |

Purchase | 1,00,000 | 2,00,000 |

Cost of revenue | 60% of revenue from operations | 70% of revenue from operations |

Administrative expenses | 5% on gross profit | 7% on gross profit |

Income tax | 45% | 45% |

Ans

Comparative statement of profit and loss

For the year ended 31st march, 2008 and 2009

Particular | 31st march 2008 | 31st march 2009 | Absolute change | Percentage change |

| 2,00,000 | 3,50,000 | 1,50,000 | 75.00 |

II. Other income | - | - | - | - |

III. Total revenue (I+II) | 2,00,000 | 3,50,000 | 1,50,000 | 75.00 |

IV. Expense

|

1,20,000 4,000 1,24,000 |

2,45,000 7,350 2,52,000 |

1,25,000 3,350 1,28,350 |

104.17 83.75 103.51 |

V. Profit before tax (III-IV) | 76,000 | 97,650 | 21,650 | 28.49 |

VI. Tax @45% | 34,200 | 43,943 | 9,743 | 28.49 |

VII. Profit after tax | 41,800 | 53,707 | 11,970 | 28.49 |

Note purchases are not indicated individually, as they are part of the cost of the goods sold.

Working note

| 2008 | 2009 |

Revenue from operational (sales) | 2,00,000 | 3,50,000 |

(-) cost of revenue from operations | 1,20,000 | 2,45,000 |

Gross profit | 80,000 | 1,05,000 |

administrative expenses | 5% on gross profit i.e 4,000 | 7% on gross profit i.e 7,350 |

Problem 6:

Create a comparative income statement for profit and loss from the following information

Particular | 31stmarch , 2008 | 31st , march 2009 |

revenue from operations | 3,00,000 | 4,00,000 |

Sales return | 1,00,000 | 2,00,000 |

Cost of revenue from operations | 60% of revenue operations | 50% of revenue from operations |

Administrative expense | 20% gross profit | 10% on gross profit |

Income tax | 40% | 40% |

Ans

Comparative statement of profit and loss

For the year ended 31st march, 2008 and 2009

Particular | 31st march 2008 | 31st march 2009 | Absolute change (increase or decrease) | Percentage change( increase or decrease) |

| 2,00,000 | 2,00,000 | - | - |

II. Other income | - | - | - | - |

III. Total revenue ( I+II) | 2,00,000 | 2,00,000 | - | - |

IV. Expenses

Total expense |

1,20,000 16,000 1,36,000 |

1,00,000 10,000 1,10,000 |

(20,000) (6,000) (26,000) |

(16.67) (37.50) (19.12) |

V. Profit before tax ( III-IV) | 64,000 | 90,000 | 26,000 | 40.63 |

VI. Tax @40% | 25,600 | 36,000 | 10,400 | 40.63 |

VII. Profit after tax (V-VI) | 38,400 | 54,000 | 15,600 | 40.63 |

Working note

| 2008 | 2009 |

Revenue from operations | 3,00,000 | 4,00,000 |

(-) sales return | 1,00,000 | 2,00,000 |

Revenue from operations | 2,00,000 | 2,00,000 |

(-) cost of revenue from operations | 1,20,000 | 1,00,000 |

Gross profit | 80,000 | 1,00,000 |

Administrative expenses | 20% on gross profit i.e 16,000 | 10% on gross profit i.e 10,000 |

Problem 7:

Create a comparative statement of profit and loss from the following

Particular | 31st march 2008 | 31st march , 2009 |

Revenue from operations | 140% of cost of revenue from operations | 160% of cost of revenue from operations |

Purchases | 2,50,000 | 4,50,000 |

Cost of revenue from operations | 3,00,000 | 5,00,000 |

Administrative expenses | 10% of cost of revenue from operations | 8% of cost of revenue from operations |

Income tax | 40% | 50% |

Ans

Comparative statement of profit and loss

For the year ended 31st march, 2008 and 2009

Particular | 31st march 2008 | 31st march 2009 | Absolute change | Percentage change |

| 4,20,000 | 8,00,000 | 3,80,000 | 90.48 |

II. Other income | - | - | - | - |

III. Total revenue (I+II) | 4,20,000 | 8,00,000 | 3,80,000 | 90.48 |

IV. Expenses

Total expenses |

3,00,000 30,000 3,30,000 |

5,00,000 40,000 5,40,000 |

2,00,000 10,000 2,10,000 |

66.67 33.33 63.64 |

V. Profit before tax ( III-IV) | 90,000 | 2,60,000 | 1,70,000 | 188.89 |

VI. Tax @ 40% and 50% | 36,000 | 1,30,000 | 94,000 | 261.11 |

VII. Profit after tax (V-VI) | 54,000 | 1,30,000 | 76,000 | 140.74 |

Note purchases are not indicated individually, as they are part of the cost of the goods sold.

Problem 8:

Create a comparative statement of profit and loss from the following

Particular | 31st march, 2008 | 31st march, 2009 |

Revenue from operations | 140% of cost of revenue from operations | 150% of cost of revenue from operations |

Purchases | 1,50,000 | 2,50,000 |

Cost of revenue from operations | 2,00,000 | 3,00,000 |

Operating expenses | 10,000 | 15,000 |

Income tax | 40% | 40% |

Ans:

Particular | 31st march 2008 | 31st march 2009 | Absolute change | Percentage change | |

| 2,80,000 | 4,50,000 | 1,70,000 | 60.71 | |

II. Other income | - | - | - | - | |

III. Total revenue (I+II) | 2,80,000 | 4,50,000 | 1,70,000 | 60.71 | |

IV. Expenses c. Cost of revenue from operations d. Administrative expenses Total expenses |

2,00,000 10,000 2,10,000 |

3,00,000 15,000 3,15,000 |

1,00,000 5,000 1,05,000 |

50.00 50.00 50.00 | |

V. Profit before tax ( III-IV) | 70,000 | 1,35,000 | 65,000 | 92.86 | |

VI. Tax @ 40% and 50% | 28,000 | 54,000 | 26,000 | 92.86 | |

VII. Profit after tax (V-VI) | 42,000 | 81,000 | 39,000 | 92.86 |

|

Note the purchase is part of the cost of the goods sold and therefore does not appear separately.

Problem 9:

Prepare a comparison statement for the 2008 and 2009 periods from the following information provided

Particular | 2008 | 2009 |

Revenue from operations | 5,00,000 | 6,00,000 |

Gross profit | 40% on revenue from operations | 50% on revenue from operations |

Administrative expenses | 20% on gross profit | 15% on gross profit |

Income tax | 50% | 50% |

Ans

Comparative statement of profit and loss

For the year ended 31st march, 2008 and 2009

Particular | 31st march 2008 | 31st march 2009 | Absolute change | Percentage change |

VIII. Revenue from operations (sales) | 5,00,000 | 6,00,000 | 1,00,000 | 20.00 |

IX. Other income | - | - | - | - |

X. Total revenue (I+II) | 5,00,000 | 6,00,000 | 1,00,000 | 20.00 |

XI. Expenses e. Cost of revenue from operations f. Administrative expenses Total expenses |

3,00,000 40,000 3, 40,000 |

3,00,000 45,000 3, 45,000 |

- 5,000 5,000 |

- 1250 1.47 |

XII. Profit before tax ( III-IV) | 1, 60,000 | 2,55,000 | 95,000 | 59.38 |

XIII. Tax @ 40% and 50% | 80,000 | 1,27,500 | 47,500 | 59.38 |

XIV. Profit after tax (V-VI) | 80,000 | 1,27,500 | 47,500 | 59.38 |

Working note.

| 2008 | 2009 |

Revenue from operations | 5,00,000 | 6,00,000 |

(-) gross profit | 2,00,000 | 3,00,000 |

Cost of revenue from operations | 3,00,000 | 3,00,000 |

Administrative expenses | 20% on gross profit i.e 40,000 | 15% on gross profit i.e 45,000 |

Problem10:

From the information provided below, prepare a comparative statement of profit and loss for the 2008 and 2009 periods.

Particular | 2008 | 2009 |

Revenue from operations | 8,00,000 | 9,00,000 |

Gross profit | 40% on revenue from operations | 50% on revenue from operations |

Administrative expenses | 20% on gross profit | 15% on gross profit |

Income tax | 50% | 50% |

Ans

Comparative statement of profit and loss

For the year ended 31st march, 2008 and 2009

Particular | 31st march 2008 | 31st march 2009 | Absolute change | Percentage change |

XV. Revenue from operations (sales) | 8,00,000 | 9,00,000 | 1,00,000 | 12.50 |

XVI. Other income | - | - | - | - |

XVII. Total revenue (I+II) | 8,00,000 | 9,00,000 | 1,00,000 | 12.50 |

XVIII. Expenses g. Cost of revenue from operations h. Administrative expenses Total expenses |

4,80,000 64,000 5,44,000 |

4,50,000 67,500 5,17,500 |

(30,000) 3500 (26,500) |

(6.25) 5.47 (4.87) |

XIX. Profit before tax ( III-IV) | 2,56,000 | 3,82,500 | 1,26,500 | 49.41 |

XX. Tax @ 50% | 1,28,000 | 1,91,250 | 63,250 | 49.41 |

XXI. Profit after tax (V-VI) | 1,28,000 | 1,91,250 | 63,250 | 49.41 |

Working note :-

| 2008 | 2009 |

Revenue from operations | 8,00,000 | 9,00,000 |

(-) gross profit | 3,20,000 | 4,50,000 |

Cost of revenue from operations | 4,80,000 | 4,50,000 |

Administrative expenses | 20% on gross profit i.e 64,000 | 15% on gross profit i.e 67,500 |

Problem 11

Create a comparative statement of profit and loss from the following

Particular | 31st march 2007 | 31st march, 2008 |

Revenue from operations | 10,00,000 | 12,50,000 |

Cost of revenue from operations | 6,00,000 | 7,50,000 |

Operating expenses | 40,000 | 50,000 |

Interest on investments Rs 50,000 and tax payable @50%

Ans

Comparative statement of profit and loss

For the year ended 31st march, 2007 and 2008

Particular | 31st march 2007 | 31st march 2008 | Absolute change | Percentage change |

| 10,00,000 | 12,50,000 | 2,50,000 | 25.00 |

II. Other income | 50,000 | - | - | - |

III. Total revenue (I+II) | 10,50,000 | 12,50,000 | 2,50,000 | 23.81 |

IV. Expenses i. Cost of revenue from operations j. Administrative expenses Total expenses |

6,00,000 40,000 6,40,000 |

7,50,000 50,000 8,00,000 |

1,50,000 10,000 1,60,000 |

25.00 25.00 25.00 |

V. Profit before tax ( III-IV) | 4,10,000 | 5,00,000 | 90,000 | 21.95 |

VI. Tax @ 50% | 2,05,000 | 2,50,000 | 45,000 | 21.95 |

VII. Profit after tax (V-VI) | 2,05,000 | 2,50,000 | 45,000 | 21.95 |

Problem 12:

From the following information, we make a comparative statement of profit and loss (Vival Ltd.)

Particular | 2006 | 2007 |

Revenue from operations | 20,00,000 | 24,00,000 |

Cost of revenue from operations | 18,00,000 | 19,00,000 |

Indirect expenses | 50,000 | 80,000 |

Income tax | 40% | 40% |

Ans

Comparative statement of profit and loss

For the year ended 31st march, 2006 and 2007

particular | 31st march 2006 | 31st march 2007 | Absolute change (increase or decrease) | Percentage change |

| 20,00,000 | 24,00,000 | 4,00,000 | 20.00 |

II. Other income | - | - | - | - |

III. Total revenue | 20,00,000 | 24,00,000 | 4,00,000 | 20.00 |

IV. Expenses

Total expenses |

1,80,000 50,000 18,50,000 |

19,00,000 80,000 19,80,000 |

1,00,000 30,000 1,30,000

|

5.56 60.00 7.03 |

V. Profit before tax | 1,50,000 | 4,20,000 | 2,70,000 | 180.00 |

VI. Tax @40% | 60,000 | 1,68,000 | 1,08,000 | 180.00 |

VII. Profit after tax (V-VI) | 90,000 | 2,52,000 | 1,62,000 | 180.00 |

Problem 13

From the following information, we will make a comparative statement of profit and loss Victor Inc.

Particular | 2006 | 2007 |

Revenue from operations | 15,00,000 | 18,00,000 |

Cost of revenue from operations | 11,10,000 | 14,00,000 |

Indirect expenses | 20%on gross profit | 25% of gross profit |

Income tax | 50% | 50% |

Ans

Comporative statement of profit and loss

For the year ended 31st march, 2006 and 2007

particular | 31st march 2006 | 31st march 2007 | Absolute change (increase or decrease) | Percentage change |

VIII. Revenue from operation ( sales) | 15,00,000 | 18,00,000 | 3,00,000 | 20.00 |

IX. Other income | - | - | - | - |

X. Total revenue | 15,00,000 | 18,00,000 | 3,00,000 | 20.00 |

XI. Expenses c. Cost of revenue from operations d. Indirect expenses Total expenses |

11,00,000 80,000 11,80,000 |

14,00,000 1,00,000 15,00,000 |

3,00,000 20,000 3,20,000

|

27.27 25.00 27.12 |

XII. Profit before tax | 3,20,000 | 3,00,000 | (20,000) | (6.25) |

XIII. Tax @50% | 1, 60,000 | 1,50.000 | (10,000) | (6.25) |

XIV. Profit after tax (V-VI) | 1,60,000 | 1,50,,000 | 10,000) | (6.25) |

Working note

| 2006 | 2007 |

Revenue from operation (sales) | 15,00,000 | 18,00,000 |

(-) cost of revenue from operations | 11,00,000 | 14,00,000 |

Gross profit | 4,00,000 | 4,00,000 |

Indirect expenses | 20% on gross profit | 25% on gross profit i.e 1,00,000 |

Problem 14:

Create a comparative income statement from: from the table above, you can make the following inferences: financial table analysis

Particular | 2004 Rs | 2005 Rs |

Sales | 2,00,000 | 2,50,000 |

Cost of good sold | 1,00,000 | 1,30,000 |

| 1,00,000 | 1,20,000 |

Operating expenses | 10,000 | 10,000 |

Net profit | 90,000 | 1,10,000 |

Comparative income statement

Particular | 2004 Rs | 2005Rs | Absolute change Rs | % increase | % decrease |

Sales | 2,00,000 | 2,50,000 | 50,000 | 25 | - |

(-) cost of good sold | 1,00,000 | 1,30,000 | 30,000 | 30 | - |

| 1,00,000 | 1,20,000 | 20,000 | 20 | - |

(-) operating expenses | 10,000 | 10,000 | N.C | - | - |

Net profit | 90,000 | 1,10,000 | 20,000 | 22.22 |

|

Problem 15:

Prepare a comparative income statement from the following information: for this issue, follow the comparative statement analysis for profit and loss accounts for two different years 2001 and 2002.

Particular | 2001Rs | 2002Rs |

Sales | 10,00,000 | 8,00,000 |

Cost of goods sold | 6,00,000 | 4,00,000 |

Administrative expenses | 2,00,000 | 1,40,000 |

Other income | 40,000 | 20,000 |

Income tax | 1,20,000 | 1,40,000 |

Comparative income statement

Particular | 2001 Rs | 2002 Rs | Absolute change Rs | % increase | % decrease |

Sales | 10,00,000 | 8,00,000 | (2,00,000) | - | 20 |

(-) cost of good sold | 6,00,000 | 4,00,000 | (2,00,000) | - | 33.33 |

| 4,00,000 | 4,00,000 |

| - | - |

(-) administrative expenses | 2,00,000 | 1,40,000 | (60,000) | - | 30 |

Operating income | 2,00,000 | 2,60,000 | 60,000 | 30 | - |

(+) other income | 40,000 | 20,000 | (20,000) | - | 50 |

Total net income before tax | 2,40,000 | 2,80,000 | 40,000 | - | 16.66 |

Income tax | 1,20,000 | 1,40,000 | 20,000 | 16.66 | - |

Net income after the tax | 1,20,000 | 1,40,000 | 20,000 | 16.66 | - |

The next important tool in financial table analysis is the general size, which is known as the dominant tool in corporate analysis when studying the share of each component.

The components are converted into proportions for analysis and interpretation. As for the profit and loss account, the turnover is considered as the base for the calculation of the share of each available financial factor.

For the balance sheet, the total amount of assets and liabilities is taken into account for the calculation of the share of each financial factor available under the heading assets and liabilities.

Problem 16:

Prepare general size Statement Analysis for the company ABC ltd

Particular | 1990Rs | 1991Rs | Assets | 1990Rs | 1991Rs |

Share capital | 2,00,000 | 3,00,000 | Fixed assets | 2,25,000 | 4,00,0000 |

Reserve and surpluses | 1,00,000 | 2,00,000 | Stock | 1,29,000 | 2,00,000 |

Bank overdraft | 60,000 | 2,00,000 | Quick assets | 46,000 | 2,00,000 |

Quick liabilities | 40,000 | 1,00,000 |

|

|

|

|

|

|

|

|

|

| 4,00,000 | 8,00,000 |

| 4,00,000 | 8,00,000 |

General size Statement Analysis of the balance sheet of the company ABC Corporation

common size statement analysis of the balance sheet of the firm ABC ltd.

Particular | Amount | % of balance sheet | ||

Assets | 1990Rs | 1991Rs | 1990 | 1991 |

Fixed assets | 2,25,000 | 4,00,000 | 56.25 | 50

|

Stock | 1,29,000 | 2,00,000 | 32.25 | 25 |

Quick assets | 46,000 | 2,00,000 | 11.5 | 25 |

Total | 4,00,000 | 8,00,000 | 100 | 100 |

Liabilities |

|

|

|

|

Share capital | 2,00,000 | 3,00,000 | 50 | 37.5 |

Reserve and surplus | 1,00,000 | 2,00,000 | 25 | 25 |

Bank overdraft | 60,000 | 2,00,000 | 15 | 25 |

Quick liabilities | 40,000 | 1,00,000 | 10 | 12.5 |

| 40,000 | 8,00,000 | 100 | 100 |

The figure above highlights the share of all components of the balance sheet among the total amount of assets and liabilities.

This will certainly facilitate the corporate to simply understand not only the share of all components, but also to make meaningful and relevant information with various time periods.

Prepare a typical size statement analysis from the following table:

| 2000Rs | 2001Rs |

Sales | 20,00,000 | 24,00,000 |

Miscellaneous income | 20,000 | 16,000 |

| 20,20,000 | 24.16,000 |

Material consumed | 11,00,000 | 12,96,000 |

Wages | 3,00,000 | 4,08,000 |

Factory expenses | 2,00,000 | 2,16,000 |

Office expenses | 90,000 | 1,00,000 |

Interest | 1,00,000 | 1,20,000 |

Depreciation | 1,40,000 | 1,50,000 |

Profit | 90,000 | 1,26,000 |

| 20,20,000 | 24.16,000 |

Common size statement profit & loss

Particular | 2000Rs | % percentage | 2001Rs | Percentage % |

Sales | 20,00,000 | 100 | 24,00,000 | 100 |

Miscellaneous income | 20,000 | 9 | 16,000 | 67 |

| 20,20,000 | 100.9 | 24.16,000 | 100.67 |

Material consumed | 11,00,000 | 54.46 | 12.96,000 | 53.64 |

Wages | 3,00,000 | 14.85 | 4,08,000 | 16.82 |

Factory expenses | 2,00,000 | 9.90 | 2,16,000 | 8.92 |

Office expenses | 90,000 | 4.47 | 1,00,000 | 4.95 |

interest | 1,00,000 | 4.95 | 1,20,000 | 4.92 |

Depreciation | 1,40,000 | 6.95 | 1,50,000 | 6.21 |

Profit | 90,000 | 4.47 | 1,26,000 | 5.21 |

| 20,20,000 | 100.9 | 24,16,000 | 100.67 |

Problem 17

From the following information, create a comparative statement of profit and loss for 2009-2010 (additional information)

Particular | 2009 | 2010 |

Revenue from operation i.e | 7,00,000 | 8,50,000 |

Material consumed | 3,30,000 | 4,20,000 |

Manufacturing and office expenses | 2,40,000 | 2,60,000 |

Other income | 30,000 | 30,000 |

(i) Income tax is calculated@50%.

(ii) Production costs are 50% of the total for that category. (All India 2011;fix)

Ans

Comparative statement of profit and loss

For the year ended 31stmarch , 2009 and 2010

Particular | 31st march 2009 | 31st march 2010 | Absolute change | Percentage change |

| 7,00,000 | 1,50,000 | 1,50,000 | 21.43 |

II. Other income | 30,000 | - | - | - |

III. Total revenue (I+II) | 7,30,000 | 1,50,000 | 1,50,000 | 20.55 |

IV. Expenses

Total expenses |

3,30,000 1,20,000

1,20,000 5,70,000 |

4,20,000 1,30,000

1,30,000 6,80,000 |

90,000 10,000

10,000 1,10,000 |

27.27 8.33

8.33 19.30 |

V. Profit before tax ( III-IV) | 1,60,000 | 2,00,000 | 40,000 | 25.00 |

VI. Tax @50% | 80,000 | 1,00,000 | 20,000 | 25.00 |

VII. Profit after tax ( V-VI) | 80,000 | 1,00,000 | 20,000 | 25.00 |

Problem 18

Prepare a comparative statement of profit and loss for 2009 and 2010 from the following information

Particular | 2009 | 2010 |

Revenue from operations | 8,00,000 | 10,00,000 |

Material consumed | 4,00,000 | 4,60,000 |

Manufacturing and office expenses | 2,10,000 | 2,40,000 |

Other income | 30,000 | 30,000 |

Other information

(i) Income tax is calculated@50%.

(ii) Production costs are 50% of the total for that category.

Ans

Comparative statement of profit and loss

For the year ended 31st march, 2009 and 2010

Particular | 31st march 2009 | 31st march 2010 | Absolute change | Percentage change |

VIII. Revenue from operational sale | 8,00,000 | 1,00,000 | 2,00,000 | 25.00 |

IX. Other income | 30,000 | 30,000 | - | - |

X. Total revenue (I+II) | 8,30,000 | 10,30,00 | 2,00,000 | 24.10 |

XI. Expenses d. Material consumed e. Manufacturing expenses f. Other income ( office expenses) Total expenses |

4,00,000 1,05,000

1,05,000 6,10,000 |

4,60,000 1,20,000

1,20,000 7,00,000 |

60,000 15,000

15,000 90,000 |

15.00 14.29

14.29 14.75 |

XII. Profit before tax ( III-IV) | 2,20,000 | 3,30,000 | 1,10,000 | 50.00 |

XIII. Tax @50% | 1,10,00 | 1,65,000 | 55,000 | 50.00 |

XIV. Profit after tax ( V-VI) | 80,000 | 1,65,000 | 55,000 | 50.00 |

Working note :-

Manufacturing expenses=50% of manufacturing and office expenses

Problem 19

Draw up a comparative statement of profit and loss based on the following information extracted from the Income Statement for the years ending 31st March, 2012 and 2013:

Particular | Note no. | 31st march 2013 | 31st march 2012 |

Revenue from operations |

| 30,00,000 | 20,00,000 |

Expenses |

| 21,00,000 | 12,00,000 |

Other income |

| 3,60,000 | 4,00,000 |

Tax rate |

| 50% | 50% |

Particular | Note no. | 2012 -2013 | 2011-12 |

Revenue from operation |

| 8,00,000 | 6,00,000 |

Other income |

| 1,00,000 | 50,000 |

Expenses |

| 5,00,000 | 4,00,000 |

Ans.

Comparative statement of profit and loss

For the year ended 31st march 2013 and 2012

Particular | 31st march 2012 | 31st march 2012 | Absolute change | Percentage change |

| 20,00000 | 30,00,000 | 10,00,000 | 50.00 |

II. Other income | 4,00,000 | 3,60,000 | (40,000) | (10.00) |

III. Total revenue (I+II) | 24,00000 | 33,60,000 | 9,60,000 | 40.00 |

IV. Expenses | 12,00,000 | 21,00,000 | 9,00,0000 | 75.00 |

V. Profit before tax (III-IV) | 12,00,000 | 12,60,000 | 60,000 | 5.00 |

VI. Tax @50% | 6,00,000 | 6,30,000 | 30,000 | 5.00 |

VII. Profit after tax (V-VI) | 6,00,000 | 6,30,000 | 30,000 | 5.00 |

Comparative statement of profit and loss

For the year ended 31stmarch , 2013

Particular | Absolute value | change | ||

2011-12 | 2012-13 | Absolute value | Percentage change | |

| 6,00,000 | 8,00,000 | 2,00,000 | 33.33% |

II. (+) other income | 50,000 | 1,00,000 | 50,000 | 100% |

III. Total revenue (I+II) | 6,50,000 | 9,00,000 | 2,50,000 | 38.46% |

IV. (-) expenses | 4,00,000 | 5,00,000 | 1,00,000 | 25% |

V. Profit before tax (III-IV) (-) tax @40% | 2,50,000 1,00,000

| 4,00,000 1,60,000 | 1,50,000 60,000 | 60% 60% |

VI. Profit after tax | 1,50,000 | 2,40,000 | 90,000 | 60% |

Problem 20

Sun track Corporation's profit and loss statement from the following statements for the year ended 31st March, 2011 and 2012, to produce a "comparative statement of profit and loss".

Particular | Note no. | 2011-12 | 2010-11 |

Revenue from operations |

| 20,00,000 | 12,00,000 |

Other income |

| 12,00,000 | 9,00,000 |

Expenses |

| 13,00,000 | 10,00,000 |

Ans.

Comparative statement of profit and loss

For the year ended 31stmarch , 2013

Particular | Absolute value | change | ||

2010-11 | 2011-12 | Absolute value | Percentage change | |

| 12,00,000 | 20,00,000 | 8,00,000 | 66.67 |

II. (+) other income | 9,00,000 | 12,00,000 | 3,00,000 | 33.33 |

III. Total revenue (I+II) | 21,00,000 | 32,00,000 | 11,00,000 | 52.28 |

IV. (-) expenses | 10,00,000 | 13,00,000 | 3,00,000 | 30.00 |

V. Profit before Tax | 11,00,000 | 19,00,000 | 8,00,000 | 72.72 |

Problem 21

From the following statement of profit and loss of Moon truck Ltd., finished 31 March, 2011 and 2012 years of the year,"prepare a comparative statement of profit and loss."

Particular | Note no. | 2011-12 | 2010-11 |

revenue from operations |

| 40,00,000 | 24,00,000 |

Other income |

| 24,00,000 | 18,00,000 |

Expenses |

| 16,00,000 | 14,00,000 |

Ans

Comparative statement of profit and loss

For the year ended 31st march, 2011 and 2012

Particular | Absolute value | change | ||

2010-11 | 2011-12 | Absolute value | Percentage change | |

| 24,00,000 | 40,00,000 | 16,00,000 | 66.67 |

II. (+) other income | 18,00,000 | 24,00,000 | 6,00,000 | 33.33 |

III. Total revenue (I+II) | 42,00,000 | 64,00,000 | 22,00,000 | 52.38 |

IV. (-) expenses | 14,00,000 | 16,00,000 | 2,00,000 | 14.29 |

V. Profit before Tax | 28,00,000 | 48,00,000 | 20,00,000 | 71.43 |

Problem 22

Make a comparative statement of profit and loss from FenoxLtd's following income statement for the year ending 31stMarch, 2013

Particular | Note no. | 2012-13 | 2011-12 |

Revenue from operations |

| 8,00,000 | 6,00,000 |

Other income |

| 1,00,000 | 50,000 |

Expenses |

| 5,00,000 | 4,00,000 |

Rate of income 40%

Ans

Comparative statement of profit and loss

For the year ended 31st march, 2013

Particular | Absolute value | change | ||

2010-11 | 2011-12 | Absolute value | Percentage change | |

| 6,00,000 | 8,00,000 | 2,00,000 | 33.33% |

II. (+) other income | 50,000 | 1,00,000 | 50,000 | 100% |

III. Total revenue (I+II) | 6,50,000 | 9,00,000 | 2,50,000 | 38.46% |

IV. (-) expenses | 4,00,000 | 5,00,000 | 1,00,000 | 25% |

V. Profit before Tax (III-IV) (-) tax@40% | 2,50,000 1,00,000 | 4,00,000 1,60,000 | 1,50,000 60,000 | 60% 60% |

VI. Profit after tax | 1,50,000 | 2,40,000 | 90,000 | 60% |

Sources