UNIT 4

Recent Trends in Auditing

Nature and significance of cost audit

Cost Audit is mainly a preventive measure, a guide for management policy and decisions, in addition to being the barometer of performance.

Cost Audit is an audit of efficiency of minute details of expenditure while the work in progress and not a post mortem examination.

Cost audit can be defined as verification of correctness of cost accounts and a check on adherence to the cost accounting principles, plans and procedures.

According to Institute of Cost Accountants of India cost audit is “ a system of audit introduced by the government of India for the review, examination and appraisal of the cost accounting records and attendant information, required to be maintained by specified industries.”

According to (CIMA) Chartered Institute of Managemnt Accountanta, London, “Cost audit is verification of the correctness of cost accounts and cost accounting plans.”

Objectives-

Advantages of cost audit

Advantages to management-

Advantages to the shareholders-

Advantages to society-

Advantages to the customers-

Advantages to the government-

Disadvantages of cost audit-

Tax Audit-

Now-a-days tax audit has become very important to ascertain the accuracy of tax related documents. Tax audit mostly covers income returns, invoices, debt and credit notes and various current and fixed assets. Tax audit is an innovation of 21st century. It has added one more chapter to the procedure of auditing. Tax audit ensures the validity and credibility of tax related documents.

The financial statements are certified by the auditor for truth and fairness of operating results and financial position of the business. These are meant for general purpose being used by the owners, creditors, banks and other interested parties. Sometimes a specific information my required by certain people which may not be available in these statements

Under Income Tax Act, profits shown by profit and loss A/c have to be adjusted as per the provisions of the Act. In this way profits for accounting and profits for taxation are not the same. These profits differ due to various reasons. Profits for accounting are ascertained As per accounting policies and standards but profits for the tax purpose are computes as per the provisions and rules of Income Tax Act.

The Income Tax Department cannot verify each and every detail of provisions compiled by the assessee. In this regard expertise of auditors is utilized, who certify the compliance of the provisions of Income Tax Act.

- The tax auditor shall be guided by the auditing standards and guidance notes as issued from time to time by Institute of Chartered Accountants of India.

- Obtaining books of accounts, financial statements and other statements of particulars duly authenticated.

- Evaluation of internal control system on the basis of which extent of vouching and verification can be determined.

- While conducting tax audit the provisions and objectives of sec, 44 AB shall be kept in mind.

- The auditor shall have thorough knowledge of taxation provisions and judicial pronouncements.

- The Central Government has notified the following ‘accounting Standards’ in respect of audit of financial statements under section 44 AB.

Compulsory Tax Audit

Following are provisions relating to compulsory audit under Section 44(AB) of income Tax Act.

I. Tax audit is compulsory for a business if its total sales, turnover or gross receipts in a previous year exceed Rs 1 crore.

II. In case of a profession, Tax audit is compulsory if gross receipt exceed Rs. 25 lakhs.

III. If the profits of a business are determined on presumptive basis, the audit of accounts shall be on compulsory basis if he assessee claims that their profits are less then profits computed under the following sections.

A. Sec 44 (AD) Profit from any business (whether it is retail trading or civil construction or any other business).

Provisions are as follows

The following persons are not eligible

a. Person carrying on profession under [section 44 (AA) (1)]

b. The person earning commission or brokerage or carrying on agency business or plying, hiring or leasing goods carriage.

c. Turnover/gross receipt in the previous year should not exceed 1 crore

B. Profit from the business of carriage of goods [section 44 (AE)]

This sec is applicable to only those persons who are engaged in plying, hiring or leasing goods carriages and own not more than 10 such goods carriages.

C. Profit and gains of a non resident from shipping business [sec. 44 (B)]

A sum equal to 7.5% of the aggregate receipts in India shall be deemed to be the profit

If the assessee does not opt for the above scheme he will have to get accounts audited.

D. Profit and gain of business of Oil exploration of non-resident assessee [sec. 44 (BB)]

A sum equal to 10% of amount payable in India or outside India to assessee shall be deemed to the profit

If the assessee does not opt for the above scheme he will have to get accounts audited.

E. Profit and gains of business of operation of Aircraft by Non- resident[ sec. 44 (BBA)]

A sum equal to 5% of amount payable in India or outside India to assessee shall be deemed to the profit

If the assessee does not opt for the above scheme he will have to get accounts audited.

F. Profit Of Foreign Company Engaged in Business of civil Construction or Erection of plant and machinery or/and Commission thereof[ sec. 44 (BBB)]

A sum equal to 10% of amount payable in India or outside India to assessee shall be deemed to the profit . If the assessee does not opt for the above scheme he will have to get accounts audited. If Gross receipts or sales or turn over exceed a specified amount in a business only then audit is required.

G. Persons covered under section 44 (AB)

a. The persons who are not covered by Income Tax Act need to get their accounts audited for the purpose of this section like a person having agricultural income exceeding 40 lakhs.

b. The persons who are covered by this section but their income is exempted shall get their accounts audited as in case of charitable Trust, co-operative societies etc.

c. Persons, who are covered under this section, having income below the taxable limit, they have to get their accounts audited if the specified limit under section 44 AB has exceeded.

d. In case of non-resident assessee, if his global or receipts exceed the specified limit, then h has to get Indian operations accounts audited.

H. Persons not covered under section 44 AB

a. A non-resident assessee carrying business of operation of ship U/S 44 B.

b. A Non-Resident assessee having income from operation of aircraft u/s 44 BBA

I. Specified date

The audit of accounts must be conducted and audit report must be submitted by the assessee by October 31.

J. Penalty sec. 271 B

If any person fails to get his accounts audited as required u/s 44 AB, the

assessing officer may direct such person shall pay a penalty equal to or .5% total sales, turnover or gross receipts in business or gross receipts in profession or Rs. 100000, whichever is less.

Management Audit-

Management audit is attempt made to evaluate various management functions and process. A detailed and critical review of all the objectives, policies, procedures and functions of management is made with a view to bring about an overall improvement in managerial efficiency.

According to Leslie R. Howard, “ An investigation of a business from the highest level downward in order to ascertain whether sound management prevails throughout, thus facilitating the most effective relationship with outside world and the most efficient organization and smooth running of internal organization.”

According to W.P. Leonard, “A comprehensive and constructive examination of an organization structure of a company, institution or a branch of government or of any component thereof such as division or department, and its plans and objectives, its means of operations, and its uses of human and physical facilities.”

Thus it can be simply stated that management audit, on the basis of established standards, examines, reviews and appraises the various policies and actions of management.

Objectives/Aims of management Audit-

1. To ensure that sound objectives are set by the management.

2. To reveal any irregularity or defect in the process of management and to suggest improvements to obtain the best results.

3. To ensure that the management objectives are achieved.

4. To help various levels of management in the effective discharge of their duties.

5. To assist management in achieving coordination among various departments.

6. To help to achieve the efficiency of management.

7. To assist management in establishing good relations with the employees and to elaborate duties, rights and liabilities of entire staff.

8. To evaluate the performance by comparing inputs with outputs (human and physical both).

9. To ensure most effective relationship with the outsiders and the most efficient internal organization.

10. To recommend changes in the policies and procedure for a better future.

Advantages of Management Audit-

1. It helps management in preparation of plans, objectives and policies and their efficient achievement.

2. It helps management in taking vital decisions for maximization of profits.

3. It helps the management in strengthening its communication systems within and outside the business.

4. It helps in evaluating the performance of management in various areas and measures to improve it.

5. It can help management in preparation of budgets and resource management.

6. It can help management in training of personnel and marketing policies.

Need/importance of Management Audit:

The statutory auditor is not required to examine the policies of management and their implementation or whether any improvement in the efficiency of management can be made. In these days a report on all these matters is very important to the business. The management auditors are appointed to advise the management on various matters related to management. These persons examine the various aspects of management and evaluate the actual performance by comparing it with predetermined standards. Such auditors may or may not be from the field of accountancy. They advise management on the matters relating to performance of various departments as well as of the organization as a whole.

The management may conduct management audit periodically to review the efficiency of managers. The results may be used to provide incentives to staff.

The management audit reveals irregularities and defects in the working of management and suggests the ways to improve the efficiency of management. It concentrates on the results and does not examine whether procedures have been followed or not.

The government may ask for management audit of sick industrial units with a view to examine the efficiency of management. It may be conducted to find whether the sickness is due to functioning of management or the circumstances beyond the control of management. On the basis of report of management auditor, the government may decide to take over to sick units.

It can be said that management audit is a guide which helps in improving the efficiency of management

Appointment of Management Auditor-

A team of experts should be appointed to conducted management audit. It can’t be expected that an individual can possess expertise in all management’s fields; therefore, an expert in each field of management should be included in the team of management auditors. Such team should have full cooperation from the top level management to enable it to conduct the audit smoothly.

The members of management audit team should have a proper training and expert knowledge of science of management. A wide experience of actual work situations will be added to the advantage. The audit of the management involves an appraisal of activities of organization; the auditor must study the organization and its plan in detail.

The internal auditors may be regarded as suitable persons for conduct of management audit because they are familiar with the internal workings of management. Sometimes it is desirable to have O & M experts as management auditors. All will depend on the scope of management audit which the management has to decide.

Qualities of a Management Auditor

The area of activities of management audit is wide; no specific qualities can be narrated for management auditor. He must possess enough qualities to fulfill his professional obligations. Some of the qualities of the management auditor can be described as follows.

1. He should have a good knowledge of managerial functions.

2. He should be familiar with the various principles of management, planning, control, management by objectives, and management by exception.

3. He should have a good understanding of financial statements and their preparations.

4. He should understand the working of organization and its problems.

5. He should be able to understand the objectives of organization.

6. He should be able to assess and critically examine the internal control systems.

7. He should be able to understand the nature of the product and its production process.

8. He should understand plans, budgets, rules and the procedures applied in the organization.

9. He should have a good knowledge of financial statement analysis techniques like standard costing, budgetary control, ratio analysis, fund flow statements etc.

10. He should be familiar with the human resources accounting, social accounting, etc.

11. He should have a good knowledge of economics, business laws, etc.

Management Auditor’s Report

In the end, the management auditor prepares a report. On the basis of findings and definite information, the auditor prepares a report making suggestions for improvement in the working of the management. His report should give a correct assessment of the working of organization. He should not hesitate in criticizing the management. His recommendations should be constructive and not merely condemning in nature. His report may include the following matters:

1. Whether the management; and the staff relations are healthy.

2. Whether the return to shareholders is adequate.

3. Whether the methods of production are out-dated.

4. Comparison of operating efficiency of the organization with other concerns.

5. Rate of the return on investment.

Conduct of Management Audit

Following points need careful attention before he commences his work.

6. The information obtained with the help of above questions should be counter checked from the various records and statements available in the organization.

7. To arrive at definite conclusions, the management audit has to correlate the information collected through various means

Computerized Audit-

Information Technology (IT) is integral to modern accounting and management information systems. It is, therefore, essential that auditors should be aware of the impact of IT on the audit of a client’s financial statements. Information Technology auditing (IT auditing) began as Electronic Data Process (EDP) auditing and developed largely as a result of the rise in technology in accounting systems. The last few years have been an exciting time in the world of IT, auditing as a result of the accounting scandals and increased regulations. Regardless of the computer systems used, the audit objectives and approach will remain largely unchanged from that if the audit was being carried out in a non-computer environment. Information Technology (IT) is integral to modern accounting and management information systems. It is, therefore, essential that auditors should be aware of the impact of IT on the audit of a client’s financial statements. Information Technology auditing (IT auditing) began as Electronic Data Process (EDP) auditing and developed largely as a result of the rise in technology in accounting systems. The last few years have been an exciting time in the world of IT, auditing as a result of the accounting scandals and increased regulations.

Regardless of the computer systems used, the audit objectives and approach will remain largely unchanged from that if the audit was being carried out in a non-computer environment. Audit Approach in Computeriszed Environment Assuming that an enterprise that has acquired a computerised information system during the current period. To carry out the audit, the auditor will usually consider the following features and risks of the CIS at the planning stage.

Information Technology (IT) is integral to modern accounting and management information systems. It is, therefore, essential that auditors should be aware of the impact of IT on the audit of a client’s financial statements. Information Technology auditing (IT auditing) began as Electronic Data Process (EDP) auditing and developed largely as a result of the rise in technology in accounting systems. The last few years have been an exciting time in the world of IT, auditing as a result of the accounting scandals and increased regulations. Regardless of the computer systems used, the audit objectives and approach will remain largely unchanged from that if the audit was being carried out in a non-computer environment.

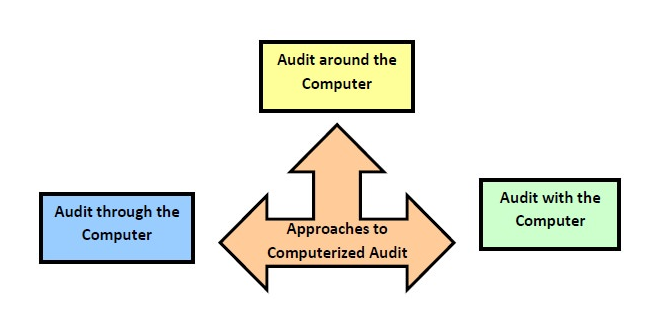

Audit Approach in Computeriszed Environment

1. Auditing Around the Computer: It is the type of auditing done in a traditional method. The auditor summarises the input data and ignores the computer’s processing but ensures the correctness of the output data generated by the computer, this approach is generally referred to as “auditing around the computer”. This methodology was primarily focused on ensuring that source documentation was correctly processed and this was verified by checking the output documentation to the source documentation

2. Auditing Through the Computer: Due to the “real time” computer environments, there may only be a limited amount of source documentation or paperwork hence the auditor may employ an approach known as “auditing through the computer”. In this approach, the reliability and accuracy of the results are analysed through the computer. This involves the auditor to perform tests on the information technology controls to evaluate their effectiveness like Compliance test, Test Packs, Reprocessing.

3. Auditing with the Computer: The utilization of computer by the auditor for some audit work and he uses some general software for the purpose of calculating depreciation, printing letters, and duplicate checking and files comparison.

The computer is not used for all the audit work and it is done manually.

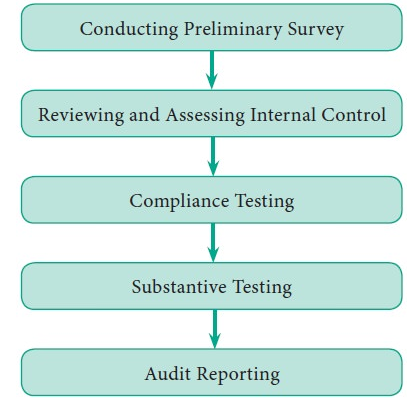

Audit Process for Computerized Accounting System-

The audit process for a computerized accounting system involves the following five majorsteps:

1. Conducting Preliminary Survey: This is a preliminary work to plan how the audit should be conducted. The auditors gather information about the computerized accounting system that is relevant to the audit plan. This includes an understanding of how the computerized accounting functions are organized, identification of the computer software used, understanding accounting application processed by computer and identification applicable controls.

2. Reviewing and Assessing Internal Controls: There are two types of controls namely general controls and application controls.

a) General Controls: General controls are those that cover the organization, management and processing within the computer environment. They should be tested prior to application controls, because if they are found to be ineffective, the auditor will not be able to rely on application controls. General controls include proper segregation of duties, file backup, use of labels, access control, etc.

b) Application Controls: Application controls relate to specific tasks performed by the system. They include input controls, processing controls, and output controls. They should provide reasonable assurance that the initiating, recording, processing and reporting of data are properly performed.

3. Compliance Testing: Compliance testing is performed to determine whether the controls actually exist and function as intended. This can be performed by comparing the results to predetermined results or by processing dummy transactions.

4. Substantive Testing: This is performed to determine whether the data is real. Substantive tests are tests of transactions and balances and analytical procedures designed to substantiate the assertions. Auditors must obtain and evaluate evidence concerning management’s assertions about the financial statements. The auditor must obtain sufficient competent evidential matter to provide a basis for an opinion regarding the financial statements under audit. If sufficient competent evidence cannot be obtained then an opinion cannot be issued.

5. Audit Reporting: The audit report will contain detailed information on various aspects of their findings in the process of audit in a computerized environment.

Key takeaways –

Sources-

1. Gupta, Kamal : Contemporary Auditing, Tata McGraw Hill, New Delhi.

2. Pagare, Dinkar : Principles and Practice of Auditing, Sultan Chand, New Delhi.

3. Sharma, T.R. : Auditing Principles and Problems, Sahitya Bhawan, Agra.

4 Tandon, B.N. : Principles of Auditing, S.Chand & Co., New Delhi.