Unit 3

Contemporary Issues

Profit maximisation was viewed as the sole business objective; putting this view no more holds good. Business Managers have begun to understand that they owe responsibility to society as they owe to business enterprises.

Some of views of experts on the social responsibility and industry are:

i. Social responsibility is an organisation’s obligation to profit society in ways in which transcend the primary business objective of maximising profit.

Ii. Social responsibility refers to obligation of an organisation to hunt actions that protect and improve the welfare of society alongside its owners.

Iii. Social responsibility is implies, enforced or felt obligation of managers, acting in their official capacities to serve or protect the interest of groups aside from themselves.

Iv. Corporate Social Responsibility (CSR) is that the continuing commitment by the business to behave ethically and contribute to economic development, while improving the standard of life of the workforce and their families also as of the area people and society at large.

v. CSR is about capacity building for sustainable livelihoods. It respects cultural differences and finds the business opportunities in building the talents of employees, the community and therefore the Government. CSR is about business giving back to society.

Vi. Companies should make all efforts to market CSR throughout the value-creation chain that they're a part of. They ought to take responsibility for the social, economic and ecological consequences of their actions and also engage in dialogues with all those that are involved in these dimensions.

Vii. Developing and advocating socially responsible business practices, which benefit not only the company social responsibility (SRO) and its employees, but also the greater community, the economy and therefore the world environment. SRO seek to reshape the way business is done in both for profit and not for profit arena.

Social Responsibility of Business

Introduction:

As we are member of family, we are also part of society. Society and family do several things for our benefit and also expect certain obligations from us. As a student, as an individual, you have certain responsibilities such as completing your assignment in time, taking care of your parents, eating healthy food and keep yourself fit and keeping promises.

It is true for business also business operates within a society. It uses resources of society. It depends on various factors of society for its function. Land, water and others resources i.e. factors of production required by business units are owned by society. Requirements of capital and financial needs are supported by investors who are members of society. Without employees and customers, business unit cannot function.

So all the activities of business should be performed in such a manner that they will not harm any part of society rather they will protect and contribute to the interest of society. Social responsibility refers to all such duties, obligations of business towards welfare of society. Profit making is not the sole function.

Definition:

The international seminar on the social responsibility of business held on New Delhi in 1965 defined – “Social responsibility of business has responsibility to the customers, workers, shareholders and the community.”

In ancient literature, we found a concept of helping poor and disadvantaged through profits made by the traders and emperors. So it was philanthropic concept. It was developed as the business was growing. We found charitable foundations, education and health care institutions and trust of community. Activities of charity such as developing gardens, parks, motivation of research, sponsoring games and sports at national and international level are examples of social responsibility. Modern concept has wider idea, it includes ethical, legal and economic aspects.

Philanthropic (Welfare of people)

Philanthropic (Welfare of people)

Traditional

Help i.e. poor people disadvantaged section of society

Philanthropic – supporting community to educate people

Philanthropic – supporting community to educate people

Ethical - avoid questionable practices

Modern Concept

Legal - obeying all laws – consumers/environment law

Economic - minimizing cost and maximize sales revenue

Observe recent trends of business, we find globalization and pressing ecological issues. That is why role of business is redefined. Corporate social responsibility (CSR) is the newest management strategy where we try to create a positive impact on society while doing business.

International organization for standardization (ISO) has developed an international standard to provide guidelines for adopting and disseminating social responsibilities ISO 26000 for social responsibility. It was published in 2010. These standards are encouraging voluntary commitment for social responsibility and also its methods of evaluation. The standards describes itself as a guide of dialogue for business.

Recent Trends (CSR):

- Improved relations with investors and community

- Better access to capital

- Stronger financial performance

- Profitability through operational efficiency

- Enhance employment relation

- Innovation and Productivity

Needs for social Responsibilities:-

(1) Expectation of society: Business should change as per the market conditions, if it wants to survive and grow. The expectation of the public (society) too has changed. They now expect business to fulfil responsibilities their social obligations. Business now must adopt the motto of ‘profit through service’.

(2) Creating Favourable Public Image: Society now expects business to contribute towards social welfare. Hence if a company fulfils its social obligations, people regard such businesses favourably. It thus builds the company’s public image.

(3) Long term Self Interest: By fulfilling its social obligations, the business is indirectly serving its own long term self-interest. By providing quality goods at fair prices, paying fair wages etc. The company is ensuring not only its immediate survival but also is ensuring its future its growth as it gets the support of its shareholders, consumers etc.

(4) Minimizing Government Control: Government interferes through various regulations and control over such businesses which do not function as per the laws. Hence to avoid too much government control, businesses should not only follow all rules and laws but also fulfil their social duties.

(5) Pressure of Trade Unions: Trade Unions protect and promote the interest of the workers. These days they have a major role in maintaining industrial peace and stability. Hence businesses should conduct activities in such a manner that is fair to the employees.

(6) Pressure of Consumer Movement: Consumers to become more aware of their rights and now expect the businessman to be just and fair with them. It is due to the consumer movement that businessmen consider consumer satisfaction as one of their main goals next to profit making.

(7) Maximum utilization of Resources: Resources are scarce. It is said that only business has the ability to ensure that these scarce resources are used in a manner that will ensure maximum satisfaction of wants. Business should use resources in such a manner that will benefit the entire society.

(8) Protection of Environment: Business use natural resources for undertaking their commercial activities. In doing so, they may misuse these resources. Either they may waste the resources or may wrong use the resources, which directly or indirectly affects the environment. They are the ones who cause all kinds of pollution in the environment. Hence these days, business is supposed to take necessary steps to protect the environment.

(9) Principle of Trusteeship: Mahatma Gandhi said that businessmen should consider themselves as trustee of the society. The profits that they earn are not entirely their own. A part of it belongs to the society. Hence by fulfilling their social obligations they are giving back something to the society.

(10) Help to government: Government alone cannot tackle all the social, economic and political problems existing in a country. This is because it does not have enough resources or skills to handle all the problems. Hence the business community is supposed to help the government in solving the various problems faced by the society. It may either undertake social projects of its own or sponsor some government projects.

SOCIAL RESPONSIBILITIES TOWARDS DIFFERENT SOCIAL GROUPS:

A) Social Responsibilities towards Employees: Without the help and cooperation of the employees, no business can survive. Hence to keep their employees happy, business should fulfil the following duties towards employees.

(1) Job security: The Company should provide job security to its employees. The workers should not be kept temporarily for a long time. They must be given permanent jobs.

(2)Monetary factors: Workers should be paid proper wages and other incentives like bonus, medical allowance, etc. Prompt payment often results in higher motivation to the workforce. There should be increment and revision in wages.

(3) Working conditions: The workers should be provided with good working conditions. There should be adequate lighting and ventilations. Noise, dirt and dust pollution should be avoided. There should be proper working hours with rest pauses.

(4) Health and safety measures: The company should take proper measures to protect health of the employees. They should be provided with canteen facilities, and medical facilities. Proper maintenance of machines and building must be done to prevent accidents.

(5) Proper personnel policies: There must be proper personnel policies in respect of transfers, promotions, recruitment, training, etc. There should be no partiality in promotions and transfers of employees.

(6) Workers participation in management: The workers must been courage to take part in management. There are different ways of workers participation in management, such as quality circles, Works committee, suggestion schemes, profit sharing and so on.

(7) Grievance Procedure: There should be a proper grievance procedure to handle employee’s complaints. Any complaint of the employee must be immediately sorted by suitable grievance procedure.

(8) Recognition of workers union: To maintain industrial peace is the responsibility of management. Therefore, the management should recognition the rightful trade union, representing majority of the workers.

B) Social Responsibilities towards Shareholders (Owners): The main motive of a business is to earn profit and this profit is utilized for growth and prosperity of the owners. If the business fails to satisfy its responsibility towards owners, it may not too able to performs its responsibility towards any other social group. Following are the responsibilities of business towards its owners.

1.] Opportunities: In business usually an organization which innovates and starts something new has a big advantage over than organizations. It is important that they keep looking for opportunities and exploit it as soon as it is available. This leads to success of the business.

2.] Wastage of reduced: Organization need to work efficiently any kinds of wastage. No financial loss should be allowed. If an organization Is not working in an efficient manner, it may require more funds than necessary.

3.] Need to keep updated: Business should keep its owners’ updates about its financial position and performance. Owners should be always know how well is a company performing. This information can be given by way of annual reports, newspapers, internet etc.

4.] Efficiency and Effectiveness: Business should be efficient as well as effective. This will help in increasing sales as well as profits if company. Efficiency is to do the things in right manner so that cost can reduce. Effectiveness means to do right things and thereby increase sales.

5.] Return: Business should generate sufficient returns. Reasonable returns shall keep the owners / shareholders interested in the business. Further, shareholder’s funds must be utilized in the best possible manner.

6.] Standard practice on stock exchange: The price of the share of the company in the stock exchange is an indicating of the performance of the company for a shareholder. Therefore, business should follow standard and fair practice related to stock exchange. It should declare all material information and not provide any wrong information to stock exchange.

7.] Goodwill: A company cans great goodwill by manufacturing world class products, following standards practices, giving sufficient returns, performing its social responsibility etc. It helps to create a respectable stand in market. Owners feel proud to be associated with such companies.

8.] Growth: Business should undertake various plans which result in expansion of company. They should keep innovating which will help them to stay ahead of their competitors. Business must also concentrate on research and development. As results, it will lead to the growth of the business and higher returns to shareholders.

9.] Safety of Capital: Business should use the capital carefully. The management should take calculated risks. It should analyse the risk factor in every decision. Shareholders prefer safety of their funds over a high return.

C] What are the responsibilities of business towards its investors?

Investors are basically those who provide fiancé to the company. They are ones who provide capital for the functioning of business. Following are the duties of business towards investors:

1.] Image: A company can crate goodwill by manufacturing world class products, following standard practice, giving sufficient returns, performing its social responsibility etc. It helps to create a respectable stand in market. Investors feel proud to be associated with such companies.

2.] Need to maintain transparency: Investors are the true owners of a business. They invest their money with a possibility of losing the amount of invested. Since, an organization runs on the funds received from other people, it should maintain transparency in their operations. The organization should not hide any information from the investors.

3.] Effective procedure to handle grievances: At time, investors have queries or complaints there should be proper procedure to handle such complaints. Investors grievance should be resolved at the earliest. Investors are satisfied if an organization listens to their problems and provides a quick solution.

4.] Safety of Capital: Safety of capital and return on investment are the two most important objectives of investors. Safety of capital also includes no reduction in value of amount invested. Business should be ensure that the funds of investor are invested properly and efficiently.

5.] Trust: Business should develop trust among its investors. This can be done by disclosing information completely, timely and correctly. The information can be disclosed by way of statement, reports, circulars etc.

6.] Organize periodic meetings: Meetings with the investors should be conducted at periodic intervals. Investors should be sent notice as well as agenda for the meeting in advance. They should be informed about the usage of funds the future plans, profits, important decision etc.

7.] Return: Investors invest in a business with an objective of earning satisfactory returns. Business should generate sufficient returns in form of interest/ dividends. Reasonable returns, appreciation of the amount invested and safety of the amount invested shall keep the investors interested in the business.

D) Social Responsibilities of business towards Customers: No business can survive if can’t satisfy its customers. Besides good quality products, customers have various other expectations from business. Following are the Social Responsibilities towards customers.

(1)Quality: The Company should produce quality goods. The company should always giving importance to improve its quality. At no time quality can be 100%, and as such there is always a room for improvement.

(2)Fair price: The consumers will not like if they are being cheated. After all, the company will not be able to fool the consumers all the time.

(3)Consumer welfare: The firm should assist government and consumer associations in promoting consumer welfare.

(4) Market Research: The firm should conduct proper market research so that it produces the right kind of goods required by the consumers.

(5)Honest Advertising: The consumers expect true facts of the product, its uses, merits, side-effects and so on. The company should also alert from vulgar and unethical advertisements.

(6)After-sale-service: The consumers expect efficient and effective after-sale-service, especially in the case of consumer durables.

(7)Availability of goods: The consumers should be made available the goods regularly as and when they need it. The company should not create artificial shortage and hoard the goods in cooperation with unethical dealers.

(8) Redressal of complaints: The complaints of the consumers must be immediately solved by the Company. Valid suggestions of the consumers must be taken into consideration.

(9)Consumer safety: The consumers expect the company to produce goods which are customer-health oriented and environment friendly products. Unsafe products must not be marketed by the company. Consumers should be warned of any such unsafe goods.

E) Social Responsibilities of business towards Society: Business taken all factors of production from the society. Business survives only because of the society in which it operates. Hence Business should satisfy the need of the society to ensure its existence. Following are the Social Responsibilities towards society.

(1) Protection of Environment: The organization should take all possible measures to prevent air and water pollution. Business firms should not misuse or over-exploit natural resources.

(2) Optimum use of resources: The business firms make use of scarce natural resources such as raw material of iron, steel, fuel, and so on. The business firm should not make wrong use of scarce resources in the interest of the society.

(3) Upliftment of Backward regions: The society expects that the companies should start industries in backward areas. This will generate employment facilities and increase in purchasing power of the rural public.

(4) Help to weaker sections of the society: The business Organization should also uplift the weaker sections of the society. Certain jobs may be reserved for economically weaker sections of the society.

(5) Financial Assistance: The society also expects donations and financial assistance to various social causes, such as eradication of poverty, illiteracy, etc. They expect the company to take part in anti- drug campaigns, anti-noise campaigns, and so on.

(6) Prevent congestion in cities: The companies should also work to avoid congestion in cities by spending their industries in different places or locations.

(7) Least participation in anti-social activities: The society expects that the companies should not take part in anti-social activities. They should not support and provide financial assistance to anti-social elements.

(8) Expansion: The society expects expansion and diversification of industries so as to generate employment opportunities and at the same time to enhance standard of living of the society.

(9)Employment Generation: Business firms should make all possible efforts to generate employment. Such efforts will help to solve problems caused to unemployment in the society.

F) Social Responsibilities of business towards Government: Government is the authority, which governs the working of all business enterprises. Having a cordial relationship with government helps a business to function smoothly. Following are the Social Responsibilities towards government.

(1) Assistance in implementing socio-economic policies: The government expect cooperation and Assistance from the business sector to assist it in implementing socio-economic programmes.

(2) Payment Taxes: The government expects the corporate sector to pay taxes and duties regularly. If the corporate sector does not pay taxes and duties on time, then it would be difficult for the government to undertake its plans.

(3) Observance of Government rules and regulations: The government expects strict observance of its rules and regulations on the part of the corporate sector. If the corporate has any valid suggestions to modify the rules and regulations, then it should do so in the interest of the society.

(4) Political stability: The corporate sector should work towards the political stability of the country. A stable government often brings more returns and peace in a democratic society. Therefore, corporate sector should not support those elements who are inducing in political instability.

(5) No seeking of unfair favours: The companies should not seek unfair favours from government officials by bribing or influencing them.

(6) Earning of Foreign Exchange: Companies, especially the large ones should enter in export trade to earn valuable foreign exchange for the country. This foreign exchange is necessary to pay for vital imports.

(7) Advising the Government: Corporate sector should provide timely advice to the government in respect of framing various policies, such export-import policy, licensing policy, industrial policy, and so on.

(8) Contribution to Government Treasury: The corporate sector should contribute funds during the times of emergencies or natural calamities, such as floods, earthquakes, etc.

G) Social Responsibilities of business towards Debenture holder: The debenture holders are the creditors of the company. They provide medium term or long term funds by subscribing to the debentures issued by the company. The company has certain social obligations towards the debenture holders:

1) Proper Disclosure of information: A company must provide proper financial information at the time of issue of debentures. The financial performance of the company must be provided correctly so that the prospective investors can take the right decision whether to invest in the debentures or not.

2) Payment of interest: A company should make regular payment of interest to the debenture holders. As far as possible, delay in payment of interest to be avoided.

3) Handling Grievances: A company should handle the grievances of the debenture holders effectively. Also, all queries of the debenture holders must be effectively answered.

4) Redemption of Debentures: A company must redeem the debentures as stated in the debenture certificate. If, due to certain reasons, the company cannot redeem the debentures on the due date, then proper explanation must be given to the debenture holders.

5) Conversion of Debentures: A company may issue convertible debentures. It must convert the debentures into equity shares, and send proper notice to that effect to the debenture holders.

6) Meetings: A company may call meetings of debenture holders affecting their rights and interests. Proper notice of meetings must be sent to debenture holders.

Corporate governance is also defined as follows:

Corporate governance refers to the accountability of the Board of Directors to all stakeholders of the corporation i.e. shareholders, employees, suppliers, customers and society in general; towards giving the corporation a good, efficient and transparent administration.

Following are cited some popular definitions of corporate governance:

(1) “Corporate governance means company managers its business in a manner that's accountable and responsible to the shareholders. In a wider interpretation, corporate governance includes company’s accountability to shareholders and other stakeholders like employees, suppliers, customers and native community.” – Catherwood.

(2) “Corporate governance is that the system by which companies are directed and controlled.” – The Cadbury Committee (U.K.)

Certain useful comments on the concept of corporate governance are given below:

(i) Corporate governance is more than company administration. It refers to a good , efficient and transparent functioning of the company management system.

(ii)Corporate governance refers to a code of conduct; the Board of Directors must abide by; while running the company enterprise.

(iii)Corporate governance refers to a group of systems, procedures and practices which make sure that the corporate is managed in the best interest of all corporate stakeholders.

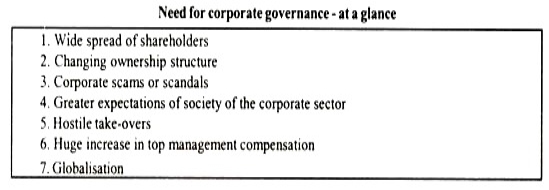

Need for Corporate Governance:

The need for corporate governance is highlighted by the subsequent factors:

(i) Wide Spread of Shareholders:

Today a company features a very large number of shareholders spread everywhere the state and even the world; and a majority of shareholders being unorganised and having an indifferent attitude towards corporate affairs. The thought of shareholders’ democracy remains confined only to the law and therefore the Articles of Association; which needs a practical implementation through a code of conduct of corporate governance.

(ii) Changing Ownership Structure:

The pattern of corporate ownership has changed considerably, in the present-day-times; with institutional investors (foreign also Indian) and mutual funds becoming largest shareholders in large corporate private sector. These investors became the greatest challenge to corporate managements, forcing the latter to abide by some established code of corporate governance to create up its image in society.

(iii) Corporate Scams or Scandals:

Corporate scams (or frauds) within the recent years of the past have shaken public confidence in corporate management. The event of Harshad Mehta scandal, which is probably, one biggest scandal, is within the heart and mind of all, connected with corporate shareholding or otherwise being educated and socially conscious.

The need for corporate governance is, then, imperative for reviving investors’ confidence within the corporate sector towards the economic development of society.

(iv) Greater Expectations of Society of the corporate Sector:

Society of today holds greater expectations of the corporate sector in terms of reasonable price, better quality, pollution control, best utilisation of resources etc. to satisfy social expectations, there's a requirement for a code of corporate governance, for the simplest management of company in economic and social terms.

(v) Hostile Take-Overs:

Hostile take-overs of corporations witnessed in several countries, put a question mark on the efficiency of managements of take-over companies. This factors also points bent the necessity for corporate governance, within the sort of an efficient code of conduct for corporate managements.

(vi) Huge Increase in Top Management Compensation:

It has been observed in both developing and developed economies that there has been a good increase within the monetary payments (compensation) packages of top level corporate executives. There’s no justification for exorbitant payments to top ranking managers, out of corporate funds, which are a property of shareholders and society.

This factor necessitates corporate governance to contain the ill-practices of top managements of companies.

(vii) Globalisation:

Desire of more and more Indian companies to urge listed on international stock exchanges also focuses on a requirement for corporate governance. In fact, corporate governance has become a buzzword within the corporate sector. There's no doubt that international capital market recognises only companies well-managed consistent with standard codes of corporate governance.

Important Objectives of corporate governance:

1. A properly structured board capable of taking independent and objective decisions is in place at the helm of affairs

2. The board is balance as regards the representation of adequate number of non-executive and independent directors who will look out of their interests and well-being of all the stakeholders

3. The board adopts transparent procedures and practices and arrives at decisions on the strength of adequate information

4. The board has an efficient machinery to take care and manage the concerns of stakeholders

5. The board keeps the shareholders informed of relevant developments impacting the corporate

6. The board effectively and frequently monitors the functioning of the management team

7. The board remains in effective control of the affairs of the corporate at all times

The overall endeavour of the board should be to require the organisation forward so on maximize future value and shareholders’ wealth.

Regulatory framework on corporate governance

The Indian statutory framework has, by and large, been in consonance with the international best practices of corporate governance. Broadly, the company governance mechanism for companies in India is enumerated within the following enactments/ regulations/ guidelines/ listing agreement:

1. The companies Act, 2013 inter alia contains provisions concerning board constitution, board meetings, board processes, independent directors, general meetings, audit committees, related party transactions, disclosure requirements in financial statements, etc.

2. Securities and Exchange Board of India (SEBI) Guidelines: SEBI may be a regulatory agency having jurisdiction over listed companies and which issues regulations, rules and guidelines to companies to make sure protection of investors.

3. Standard Listing Agreement of Stock Exchanges: For companies whose shares are listed on the stock exchanges.

4. Accounting Standards issued by the Institute of Chartered Accountants of India (ICAI): ICAI is an autonomous body, which issues accounting standards providing guidelines for disclosures of monetary information. Section 129 of the New Companies Act inter alia provides that the financial statements shall provide a true and fair view of the state of affairs of the corporate or companies, suits the accounting standards notified under s 133 of the New Companies Act. It's further as long as items contained in such financial statements shall be in accordance with the accounting standards.

5. Secretarial Standards issued by the Institute of Company Secretaries of India (ICSI): ICSI is an autonomous body, which issues secretarial standards in terms of the provisions of the New Companies Act. So far, the ICSI has issued Secretarial Standard on "Meetings of the Board of Directors" (SS-1) and Secretarial Standards on "General Meetings" (SS-2). These Secretarial Standards have come into force w.e.f. July 1, 2015. Section 118(10) of the New Companies Act provide that each company (other than one person company) shall observe Secretarial Standards specified intrinsically by the ICSI with reference to general and board meetings.

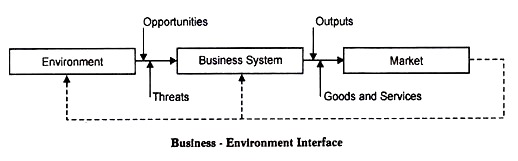

Business and environment interaction takes place within the following ways:

1. Business is stricken by economic conditions of the environment. During recessionary conditions, for instance, firms reduce the production or pile their inventories to sell during normal or boom conditions. Business, on the opposite hand, can create artificial scarcity of products by piling inventories and force the economic conditions to show signs of adversity while it's not actually so. Both business and environment, thus, affect and are affected by one another.

2. When financial institutions increase the lending rates, firms may resort to other sources of funds, like bank loans or internal savings (reserves). This might force the financial institutions to lower the interest rates. The financial environment and therefore the business system, thus, act and interact with one another.

3. The firm’s micro environment consisting of workers, suppliers, shareholders etc. affects the business activities and is, suffering from them. Workers demand high wages; suppliers demand high prices and shareholders demand high dividends.

Firms reconcile the interests of diverse groups and satisfy their demands. If management resolves these demands, it'll be positively suffering from the environmental forces but if it fails to satisfy these demands, it becomes a victim of the environment. Growing firms pay high wages and dividends to their workers and shareholders to take care of harmonious industrial relations and a positive business-environment interface.

4. Business receives useful information from the environment regarding consumers’ tastes and preferences, technological developments, Government policies, competitors’ policies etc. and provides useful information to the environment regarding its goals, policies and financial returns. This information is transmitted to environment through annual reports as a requirement of disclosure practices.

5. The basic function of a commercial enterprise , input-output conversion, is carried through active interaction with the environment. It receives inputs from the environment, converts them into outputs through productive facilities which also are received from the environment and sends them back to the environment. a continuing feedback is received from the environment to enhance its performance.

6. The environment offers threats and opportunities to business systems which they overcome and exploit through their strengths and weaknesses. SWOT analysis helps in integrating external environment with the interior environment.

The business and environment, thus, have much to offer and take from one another . The economy is structured by effective interaction of the business and its environment. The business-environment interaction may be a continuous process. It's sort of a biological organism that keeps environment and management responsive to one another .

This interaction is shown as:

Environment—————— > Management——————- > Environment——————– >

The continuous interaction of environment with business results in new expectations of environment from business (in terms of social responsibilities and business ethics) and business from environment (in terms of normal supply of inputs at reasonable prices). This involves changes in business and environmental policies and results in new level of business-environment interface or business-environment equilibrium.

Interactions of business with environment are often shown as follows:

The concept of carbon credit came into existence as a consequence of growing concern and increasing awareness on the necessity for pollution control so as to ameliorate the environment. It seeks to encourage countries to scale back their greenhouse gas emissions and rewards those countries which meet their targets and supply financial incentives to others to try to so as quickly as possible. Surplus credits collected by overshooting the emission reduction target can be sold within the global market. One credit is like one tonne of CO2 emission reduced or not emitted.

This concept became materialized through a voluntary treaty Kyoto Protocol signed by 141 countries. Indian has also signed the treaty. The United States of America—which accounts for one-third of the entire greenhouse emission emissions—has not signed the treaty. The treaty set penalty for non-compliance.

In the first phase, which is to begin in 2007, the penalty is 40 euros per tonne of CO2 equivalent. .In the second phase, penalty is 100 euros per tonne of CO2 equivalent. Carbon credits are certificates issued to countries that reduce their emission of greenhouse gases which cause heating.

This concept is one of the ways in which countries can meet their obligations under the Kyoto Protocol to mitigate heating . Carbon credits are available for companies engaged in developing renewable energy projects that offset the utilization of fossil fuels. Developed countries need to spend nearly $300-500 for each tonne reduction in CO2, against $10-25 in developing countries.

In countries like India, greenhouse emission is far below the target fixed by Kyoto Protocol and such countries are excluded from reduction of greenhouse emission and allowed to sell surplus credits to developed countries. Foreign companies who cannot fulfil the protocol norms can purchase the surplus credit from companies in other countries through trading.

This allows Credit Emission Reduction (CER) trade to flourish between developing and developed countries. Carbon emissions’ trading involves the trading of permits to emit CO2 and other greenhouse gases, calculated in tonnes of CO2 equivalent (tCO2e).

A country or group of nations caps its carbon emissions at a particular level referred to as “cap and trade” then issues permits to firms and industries that grant the firm the right to emit a stated amount of CO2 over a period of time . Firms are then free to trade these credits in a free market. Firms whose emissions exceed the quantity of credits they possess are going to be heavily penalized. Industrialized countries buy emission credits by investing in clean projects in developing world.

The idea behind carbon trading is that firms which will reduce their emissions at a low cost will do so then sell their credits on to firms that are unable to simply reduce emissions. A shortage of credits will drip up the price of credits and make it more profitable for firms to engage in carbon reduction. The specified carbon reductions are met during this way at the lowest cost possible to society.

India is the largest beneficiary claiming about 31% of the entire world carbon trade through the Clean Development Mechanism (CDM) and is emerging as a significant player in the global carbon credits market. This mechanism is predicted to rate in at least $5-10 billion over a period of time. The quantity of Indian projects in the field of biomass, cogeneration, hydro power and wind generation eligible for getting carbon credits now stands at 225 with a possible of 225 million CERs.

According to the Indian wind power Association (IWPA), the country produces around 1.3 billion units of electricity per annum. The worth of CERs works out to about Rs. 20 crore and in this context, the IWPA proposes to line up a wind generation seller’s consortium “Windcon” to assist its members sell CERs. The prototype carbon fund of the World Bank and other agencies buy CERs from wind farms.

But, these agencies require a minimum project size of 15 MW so as to bundle the projects to the minimum size. With a total installed capacity of over 1,870 MW, the country is that the fifth largest wind generation producer within the world. Further, wind generation capacities are on the rise and this enhances the earning potential from carbon credit trading.

The strategies addressing reduction within the use of fossil fuels and promotion of other renewable energy resources that cause no carbon emissions would make India as a pioneer within the global carbon credits market.

CARBON TRADING & CLIMATE CHANGE

Introduction:

India has been in the forefront of an intense battle to guard the environment by reducing its carbon foot print. To this end, it's invested heavily in low-carbon intensive technologies, successfully switched to renewable energy and stepped up its efforts to guard forests. In the process it earned many millions of carbon credits or emission reduction certificates that also are called CERs. Under the prevailing Kyoto Protocol climate agreement, carbon credits are utilized in market-based system of Carbon Trading. Carbon trading allows countries and firms to sell their carbon credits for money. In December the UN climate change Conference or COP 25 was held in Madrid. COP 25 was to possess finalised rules for a replacement global carbon market under the Paris Agreement. For India, one the goals and focus at the Madrid conference was to win the right to sell its hard-earned carbon credits .But the talks that concluded in Madrid on 15th December ended without agreeing on the rules for future carbon trading

Carbon Trade:

1. Carbon trading is an exchange of credits between nations designed to scale back emissions of CO2.

2. Carbon trading is additionally mentioned as carbon emissions trading. Carbon emissions trading accounts for many emissions trading

Why we have the Carbon Trade?

1. When countries use fossil fuels and produce CO2 , they do not pay for the implications of burning those fossil fuels directly. There are some costs that they incur, just like the price of the fuel itself, but there are other costs not included in the price of the fuel. These are referred to as externalities. In the case of fuel usage, often these externalities are negative externalities, meaning that the consumption of the good has negative effects on third parties.

2. These externalities include health costs, (like the contribution that burning fossil fuels makes to heart disease, cancer, stroke, and lung diseases) and environmental costs, (like environmental degradation, pollution, climate change, and global warming). Interestingly, research has found that, often, the burdens of climate change most directly affect countries with the lowest greenhouse emissions.

3. So, if a country goes to burn fossil fuels, and produces these negative externalities, the thinking is that they ought to buy them.

4. The carbon trade originated with the 1997 Kyoto Protocol, with the target of reducing carbon emissions and mitigating climate change and future global warming. At the time, the measure devised was intended to scale back overall CO2 emissions to roughly 5% below 1990 levels by between 2008 and 2012.

How It Works?

1. Basically, each country features a cap on the amount of carbon they're allowed to release. Carbon emissions trading then allow countries that have higher carbon emissions to purchase the right to release more CO2 into the atmosphere from countries that have lower carbon emissions.

2. The carbon trade also refers to the ability of individual companies to trade polluting rights through a regulatory system referred to as cap and trade. Companies that pollute less can sell their unused pollution rights to companies that pollute more.

3. The goal is to ensure that companies within the aggregate don't exceed a baseline level of pollution and to supply a financial incentive for companies to pollute less.

The Kyoto Protocol is an international agreement linked to the United Nations Framework Convention on climate change (UNFCCC), which commits its Parties by setting internationally binding emission reduction targets.

1. The Kyoto Protocol was adopted in Kyoto, Japan, in December 1997 and entered into force in February 2005.

2. The first commitment period under the Kyoto Protocol was from 2008-2012. The Doha Amendment to the Kyoto Protocol was adopted in Qatar in December 2012. The amendment includes new commitments for parties to the Kyoto Protocol who agreed to take on commitments during a second commitment period from January 2013 to December 2020 and a revised list of greenhouse gases to be reported on by Parties within the second commitment period.

3. Recognizing that developed countries are principally responsible for the current high levels of greenhouse gas (GHGs) within the atmosphere, the Kyoto Protocol places commitments on developed nations to undertake mitigation targets and to supply financial resources and transfer of technology to the developing nations.

4. Developing countries like India haven't any mandatory mitigation obligations or targets under the Kyoto Protocol

Paris Agreement:

The Paris Agreement of 2016 may be a historic international accord that brings almost 200 countries together in setting a common target to reduce global greenhouse emissions in an attempt to fight climate change.

1. The pact seeks to stay global temperature rise to below 2 degrees Celsius from pre-industrial levels, and to undertake and limit the temperature increase even further to 1.5 degrees Celsius.

2. To this end, each country has pledged to implement targeted action plans which will limit their greenhouse emission emissions.

3. The Agreement asks rich and developed countries to provide financial and technological support to the developing world in its quest to fight and adapt to climate change.

Benefits of emissions trading:

1. Emissions trading achieve the environmental objective – reduced emissions – at the lowest cost.

2. Emissions trading incentivize innovation and identify lowest-cost solutions to make businesses more sustainable.

3. Cap and trade has proven to be an efficient policy choice.

4. Emissions trading is better able to answer economic fluctuations than other policy tools.

5. Cap and trade is designed to deliver an environmental outcome – the cap must be met, or there are sanctions like fines. Allowing trading within that cap is the most effective way of minimising the value – which is good for business and good for households.

6. Determining physical actions that companies must take, with no flexibility, isn't guaranteed to achieve the required reductions. Neither is establishing a regulated price, since the price required to drive reductions may take policy-makers several years to determine.

7. By allowing the open market to set the price of carbon allows for better flexibility and avoids price shocks or undue burdens. For instance , as seen in Europe, prices will fall during a recession as industrial output, and thus emissions, fall. A centrally-administered tax doesn't have an equivalent flexibility.

8. The combination of an absolute cap on the level of emissions permitted and therefore the carbon price signal from trading helps firms identify low-cost methods of reducing emissions on site, like investing in energy efficiency – which may lead to an extra reduction in overheads. This helps make business more sustainable for the future. Imposing technology on business doesn't leave creativity and may actually cause higher costs as companies look merely to suits regulations.

9. Cap and trade has proven its effectiveness in the US through the acid rain program, where it quickly and effectively reduced pollution levels at a far lower cost than expected. The EU Emissions Trading System has shown that cap and trade are often extended to carbon, and in doing so creates a price on carbon that drives emissions reductions. Reductions in pollution that industry feared would be excessively costly were achieved at a fraction of the first estimates.

10. Emissions trading can provide a global response to a global challenge. Cap and trade provides a way of building rigour around emissions monitoring, reporting and verification – essential for any climate policy to preserve integrity.

Disadvantages:

1. Creating a market in something with no intrinsic value like CO2 is very difficult. You need to promote scarcity – and you've got to strictly limit the right to emit in order that it can be traded.

2. In the world’s biggest carbon trading scheme, the EU ETS, political interference has created gluts of permits.

3. These have often been given away for free, which has led to a collapse within the price and no effective reductions in emissions. Another problem is that offset permits, gained from paying for pollution reductions in poorer countries, are allowed to be traded also .

4. The importance of those permits in reducing carbon emissions is questionable and therefore the effectiveness of the overall cap and trade scheme is additionally reduced.

Case study

Corporate governance philosophy of Infosys

Corporate Governance

Being ethical and managing the business with accountability

Corporate governance is about maximizing shareholder value legally, ethically and on a sustainable basis. At Infosys, the goal of corporate governance is to ensure fairness for every stakeholder – our customers, investors, vendor-partners, the community, and the governments of the countries in which we operate. We believe that sound corporate governance is critical in enhancing and retaining investor trust. It is a reflection of our culture, our policies, and our relationship with stakeholders and our commitment to values. Accordingly, we always seek to ensure that our performance is driven by integrity.

Our Board exercises its fiduciary responsibilities in the widest sense of the term. Our disclosures seek to attain the best practices in international corporate governance. We also endeavour to enhance long-term shareholder value and respect minority rights in all our business decisions.

We continue to be a pioneer in benchmarking our corporate governance policies with the best in the world. Our efforts are widely recognized by investors in India and abroad. We have been audited for corporate governance by the Investment Information and Credit Rating Agency (ICRA) and have been awarded a rating of Corporate Governance Rating 1 (CGR 1).

We are also in compliance with the recommendations of the Narayana Murthy Committee on Corporate Governance, constituted by the Securities and Exchange Board of India (SEBI).

Corporate governance philosophy

Our corporate governance philosophy is based on the following principles:

• Satisfying the spirit of the law and not just the letter of the law

• Going beyond the law in upholding corporate governance standards

• Maintaining transparency and a high degree of disclosure levels

• Making a clear distinction between personal convenience and corporate resources

• Communicating externally in a truthful manner about how the company is run internally

• Complying with the laws in all the countries in which the company operates

• Having a simple and transparent corporate structure driven solely by business needs

• Embracing a trusteeship model in which the management is the trustee of the shareholders' capital and not the owner

• Driving the business on the basis of the belief, 'when in doubt, disclose'

Board composition

At the core of our corporate governance practice is the Infosys Board, which oversees how the management serves and protects the long-term interests of all our stakeholders. The majority of the board, seven out of 10, are independent members. As active and well informed members of the board, they are fully committed to ensuring the highest standards of corporate governance. In addition, the independent directors make up the audit, compensation, investor grievance, nominations, and risk management committees, bringing their valuable perspective to the board.

As a part of our commitment to follow global best practices, we comply with the Euro shareholders Corporate Governance Guidelines 2000, and the recommendations of the Conference Board Commission on Public Trusts and Private Enterprises in the US. We also adhere to the UN Global Compact Program.

‘Social Audit’ is “a public assembly where all the details of a project are scrutinized”. It's “a way of measuring, understanding, reporting and ultimately improving an organization’s/programme’s social and ethical performance”.

Social Audit (SA):

*Social Audit is a process within which details of the resources, both financial and non-financial, is used by public agencies for development initiatives and is shared with the people often through public platforms.

*It includes in-depth scrutiny and analysis of the working of an entity within which the general public is involved is-à-vis. Its social relevance.

Origin of social audit in India:

*In India, the initiative of conducting social audits was taken by Tata Iron and steel company Limited (TISCO), Jamshedpur within the year 1979.

*Social audit gained significance after the 73rd amendment. The approach paper to the 9th FYP (2002-07) emphasized upon social audit for effective functioning of Panchayat Raj institutions (PRIs) and empowered gram sabhas to conduct SAs additionally to its other functions.

*National Rural Employment Guarantee Act, 2005 provides for normal “Social Audits” so as to ensure transparency and accountability within the scheme.

*The state government shall identify or establish, under the NREGS, an independent organization, Social Audit Unit (SAU), at the state level, to facilitate conduct of social audit by Gram Sabhas.

The main reason for the push for social audit is that the huge disconnect between what people want and what people get. As soon as social audit kicks in, it exercises its control over the policy developers and implementers within the following manner:

- Reduces corruption:SA uncovers irregularities and malpractices within the public sector and maintains oversight on government functioning, thus reducing leakages and corruption.

- Monitoring and feedback: It monitors social and ethical impact of an organisation’s performance and provides feedback on the work.

- Accountability and transparency:SA ensures accountability and transparency in working of government bodies and reduces trust gap between people and native governments.

- Participative and democratic: SA promotes participation of individuals in implementation of programmes and makes people more forthcoming for social development activities.

- Strengthens the Gram Sabha:SA gives voice and influencing power to the Gram Sabha, the lynchpin of rural governance structure.

- Generates demand:Serves because the basis for framing the management’s policies by rising demands during a socially responsible and accountable manner by highlighting the important problems.

- Improves professionalism: SA boosts professionalism in public bodies by forcing Panchayats to maintain proper records and accounts of the spending made against the grants received from the govt. And other sources.

- Collective platform:SA provides a collective platform like a social audit Gram Sabha, for people to precise their common needs, resulting into social cohesion.

- Commercial audit is an official examination of company’s financial statement by certified chartered accountant.

- Social audit is a systematic evaluation of an organization’s social performance

Social audit Vs Other Audits

Social Audit | Other audits (financial etc.) |

Beneficiaries are auditors | Employs external auditors. |

Audit is concerned with matching real outcomes with intended outcomes and ensures social accountability. | Audit focuses on financial records, checks if rules have been adhered to and uses accounting principles and ensures organizational accountability. |

Broad scope i.e. measuring, understanding and improving the social performance of an activity of an organisation. | Limited scope i.e. limited to finance or operations of an organization. |

Includes many stakeholders i.e. people, government officials, civil society and experts. | Includes professional auditors and organization employees only. |

Almost any issue and parameter relating to the programme can be discussed. | Fixed parameters are evaluated and checked in professional audit. |

Issues/challenges with social audits:

Rules not followed: In many states Social Audit Units (SAUs) don’t seek record from Gram Panchayats regarding execution of works and expenditure (CAG report), social audit reports are either not prepared or not made available to gram Sabha in local languages.

Not institutionalized: Government has not mandated institutionalization of SA thus making auditors susceptible to implementing agencies, which face resistance and intimidation and find it difficult to even access primary records for verification.

Apathy of implementing agency:The implementing agency requests for postponement of social audit, fails to supply documents on time, doesn't send independent observers for the Gram Sabha, and fails to require action on the findings of the social audit.

SAUs lack independence:

Some SAUs need to obtain sanction from the project implementation agency before spending funds.

Many states don’t follow the open process laid out in the standards for the appointment of the SAU’s director.

Several SAUs don't have adequate staff to cover all the panchayats even once a year.

Lack of stringent penalty: Flouting of SA principles and norms doesn't attract any penalty or legal proceeding which makes SA a toothless exercise.

Lack of awareness: Lack of awareness among Gram Sabha members and their rights on social audit

Absence of a well-conceived information system: Government agencies believe hazy and incomplete system of pertaining to government accounts and government methods of reporting to trace progress of scheme thanks to which it becomes difficult for auditor to require stock, speed up, slow down or apply corrective measures.

No incentive to participate:Lack of interest in people about the village activities because of their livelihood reasons.

Social Audit process is often made better through:

- Providing more finances to SAUs: In 2012, MORD had recommended 1 per cent of the expenses under MGNREGS for SA, which got reduced to 0.5 per cent later.

- Director and staff selection:The selection of Directors of SAUs should be freed from political control and therefore the selection process should be strictly followed.

- Resource Hub on Social Audit: Aresource hub should be constituted under the National Institute of Rural Development and Panchayati Raj (NIRD&PR) to supply assistance to State Governments and SAUs on parameters like training support, monitoring and evaluation, action research, documentation and certification of trainers etc.

- Support of implementing agencies:Rules must be framed in order that implementation agencies are mandated to play a supportive role within the social audit process and take prompt action on the findings.

- Legally sanctioned outcomes: Outcomes of social audit must have legal sanctionand state governments should enact specific rules for this.

- Increased frequency: Social audits must be conducted in every Gram Panchayat once in every 6 months.

- Using Management information system (MIS): Usage of MIS to trace details of schemes at all levels to streamline the life-cycle of programme planning, implementation and feedback

- Punitive action against non-compliance: state government should promptly fix responsibility also as take action against errant officials in SAUs and other ground level auditors.

- Refurbishing social audit process by:

- Convening the Gram Sabha at a neutral place and not within the village of the head of the panchayat

- Meeting to be chaired by an elderly member who isn't a part of Panchayat

- Putting the resolutions and decisions to voting

- Video recording of the meeting and uploading the Social Audit Reports (SAUs) on government website in local languages

- Monitoring of SA: MoRD should monitor the response (or the shortage of it) by the implementing agency to the social audit findings; a quarterly meeting should be held between SAU, implementing agencies and MoRD officials to watch the action-taken reports

- Displaying Information of Notice Board: Gram Sabha should demand from the Panchayat, display of all the data, on Panchayat notice board from time to time, about the works being carried out or planned in near future

- Knowledge dissemination through regular meetings: Meetings of gram Sabha should be held regularly and members/villagers must be educated about their role in social audit process through these meetings by Programme Officers.

- Civil society participation: People including students from different universities should be encouraged to participate as Village Resource Persons.Example, Jharkhand has instituted a proper mechanism by inviting prominent civil society representatives to be a part of the SA panel.

- Role of media: Media should also take responsibility to reach to the rural areas and spread the awareness through their designed programmes focusing on the problems of the rural concerns especially Gram Sabha’s and their powers of social audit.

Best practices:

Andhra Pradesh:

*Society for Social Audit, Accountability and Transparency, an autonomous body insulated from government interference, was set up in Andhra Pradesh .The state of Andhra Pradesh has become a role model for all the other states as far as implementation of SA is concerned.

*The main aim of the SSAAT is to uphold the concept of eternal vigilance by the people, facilitated by social activists and Government acting in conjunction.

*It aims at empowerment of the agricultural population covered by welfare schemes like MGNREGS and minimization of leakage and wastage of public funds.

*Public vigilance, verification of the varied stages of implementation and ‘Social Audit Forums-Public Hearings’ are important components of the social audit process followed by SSAAT.

Jharkhand

*Public hearings are heard by juries with PRI and CSO members.

*An advisory for action to be taken on specific irregularities has been formulated for the guidance of the jury members.

*Hearings are held at the panchayat, block, district and State levels.

*Special and test audits are done

*A cultural workshop for IEC activities was conducted and songs in eight different languages are prepared.

Chhattisgarh

*Apart from MGNREGS, social audit team also collects complaints regarding other issues and hands it over to the Sarpanch and Sachiv within the Gram Sabha.

*Wall writing of muster rolls, bills and measurement books is administered to make sure active involvement of the community within the social audit process

Items Examined during a Social Audit

The scope of a social audit can vary and be wide-ranging. The assessment can include social and public responsibility but also employee treatment. Some of the rules and topics that comprise a social audit include the following:

• Environmental impact resulting from the company's operations

• Transparency in reporting any issues regarding the effect on the general public or environment.

• Accounting and financial transparency

• Community development and financial contributions

• Charitable giving

• Volunteer activity of employees

• Energy use or impact on footprint

• Work environment including safety, freed from harassment, and civil right

• Worker pay and benefits

• Non-discriminatory practices

• Diversity

There is no standard for the things included in a social audit. Social audits are optional, which suggests that companies can choose whether to release the results publicly or only use them internally.