Unit – 1

Introduction

Meaning:-

The terms Macro is derived from the Greek terms ‘Makros’ meaning large. Macroeconomics studies the behaviour of the economy as whole. Thus, Macroeconomics study of aggregates covering the whole economy such as national income, employment, aggregates Demand and Supply, Total investment & General Price level.

Definition:-

1) According to Boulding, “Macroeconomics deals not with individual quantities but with aggregate if these quantities not with individual incomes but with national income not with individual prices but with price levels, not with individual outputs but with the national output.”

2) Gardener Ackley, “It looks at the total size and shape and functioning of the elephant if economic experiences, rather the working or articulation or dimensions of the individual parts. It studies the character of the forest, independent of the trees which compose it”.

3) According Prof. Marshall, “Macroeconomics views the forest as a whole independent of the individual trees composing it.”

Scope and Subject Matter of Macro Economics:-

1) Theory of Income and Employment: Macro Economic analysis explains what determines the level of national income and employment and what causes the fluctuations in the level of national income for a long period of time. So, Macroeconomics is known as “Income Theory”. He showed how the equilibrium level of national income and employment was determined by the aggregate demand and aggregate supply. Aggregate demand constitutes consumption demand and investment demand. Both consumption function and investment functions interact to determine income, employment interest and general price level.

2) Theory of General Price–Level and inflation: Macroeconomics also explains how the general prices level is determined. Keynes has explained that it is not always that increase in supply of money that brings rise in price. But also explained that just as unemployment and depression were caused due to deficiency of aggregate demand, inflation was due to excessive aggregate demand. The problem of fluctuation is a serious problem faced these days, both by the developed and underdeveloped countries of the world. Theory of price level, studies cause and effect of inflation and depression and suggests policies to tackle these problems.

3) Theory of Economic Growth and Development: The problem of growth is along run problem. It was Harrod and Domar who extended the Keynesian analysis to the long-run problem of growth with stability. If growth with stability is to be achieved, income or demand must be increase at a rate sufficient enough to ensure full utilization of increase capacity. General growth theory applies to both the developed and underdeveloped economies. Special theories have been developed, which explain the causes of under development and poverty in underdeveloped countries and also suggests strategies for initiating and accelerating growth in them.

4) Macro Theory of Distribution: The Macroeconomic theory also explains the factors determining the relative shares of various social classes, workers and capitalist in the form of total rent, total wages, income, total interest and total profit in the total national income.

Key Points:- Income & Employment, Inflation, Growth and development, Distribution of National Income. |

Importance of Macroeconomics:-

1) Function of the Economic: The study of individual items will not help in understanding the working of an economic system. Only an aggregative approach can make it possible to understand the functioning of complex system.

2) Formulation of Economic policies: Study of macroeconomic is an essential requirement for farming economic policies. Modern government depends upon reliable statistics of aggregate variable as the basis for the formulation of government policies. For e.g. – The data collected on national income, general price level, wage rate, saving, investment, interest rate is very useful in farming sound economic policies.

3) Dynamic science: Macroeconomics studies and suggests solution to the issue and problems from the dynamic view point. It gives importance to the changes in the economy.

4) Understanding of National income: Macroeconomics studies the computation, use and application of National income data. The national income data enable us to understand & evaluate the performance of economy.

5) International comparison: Macroeconomics facilitate international comparison by providing information about aggregate demand, national income, consumption and saving for different countries.

6) For understanding Micro-theory: Since macroeconomics deals with the group behaviour its study is important in understanding the behavior of individual units.

Circular flow

The Circular Flow of National Income and expenditure refers to the process, whereby the national income and expenditure of an economy flow in a circular manner continuously through time.

Circular flow in a simple economy:-

We begin with a simple hypothetical economy, where there are only two sectors, the household and business.

- Households are the owner of factors of production and consumers of goods and services.

- Business sector produce goods and services and sell them to the household sector.

- The household sector receives income by selling the services of these factors to the business sector.

- The business sector consists of producers who produce goods and services and sell them to the household sector of consumers.

- Thus, the household sector buys the goods and services from the business sector.

- Thus, one man’s income is another man’s expenditure.

The circular flow can be understood with the help of diagram –

HOUSEHOLD FIRM

The outer circle of diagram shows the real flow i.e. flow of factor services from household sector to business sector and corresponding flow of goods and services, from business sector to household sector.

The inner circle shows the money flow, that is, flow of factor payments from business sector to household sector and corresponding flow of consumption expenditure from household sector to business sector.

It must be noted that entire amount of money which is paid by business sector as factor payments, is paid back by the factor owners to the business sector. So here is a circular and continuous flow of money income. In the circular flow of income, production generates factor income, which is converted into expenditure. This flow of income continues as production is a continuous activity due to never ending human wants. It makes the flow of income circular.

a) Gross National Product (GNP)

b) Net National Product (NNP)

c) Income at Factor cost or National Income at Factor Prices

d) Per Capita Income

e) Personal Income (PI)

f) Disposable Income (DI)

Different Concept of National Income:-

National income refers to the monetary value of goods and services produced in a country during a year. The following are the various concepts associated with national income:

GDP, NDP, GNP and NNP are measured at market price as well as factor cost. Market price is the price paid by the consumers i.e. it is monetary value of goods and services. Factor cost refers to the prices of products and services as received by producer i.e. market price minus taxes plus subsidies. Factor cost can also be referred as the payment received by or made to the factors of production in the form of rent, wages, interest, profit, etc. Basically, the amount that is received by producers is paid to the factors of production (including the producer himself who is the entrepreneur in this case).

1) Gross National Product (GNP): GNP is the gross market value of all final goods and services produced in a country during a year. It includes net income from abroad and depreciation.

GNP = C+ I + G+ (X – M) + (R – P)

2) GNP at Market price (GNPMP): GNPMP is the gross market value of final goods and services produced in the country during a year. The Market value refers to the prices prevailing in the market GNP is the basic social accounting measure for total output.

GNPMP = C+ G+ (X – M) + (R – P)

3) GNP at Factor cost (GNPFC): GNPFC is the money value of the income produced and accruing to the factors of production who were involved in producing goods and services during a year. The money received from consumers is distributed among factors of production and therefore GNPMP should be equal to GNPFC. However, government intervention in the form of indirect taxes and subsidies leads to a difference in GNPMP and GNPMP and. The effect of indirect taxes and subsidies has to be adjusted from GNPMP to arrive at GNPFC.

GNPFC = GNPMP - indirect taxes + Subsidies

4) Gross Domestic Product at Market Price (GDPMP): GDPMP is the gross market value of final goods and services produced in the country during a year. Since, it is gross “domestic” product, the net income from abroad is not considered in its calculation.

GDPMP = C+ I + G+ (X – M) OR

GDPMP = GNPMP – Net income from abroad

5) Gross Domestic Product at Factor cost (GDPFC): GDPFC is the gross market value of final goods and service produced in the country during a year. The value of indirect taxes and subsidies is adjusted from GDPMP to arrive at GDPFC

GDPFC =C+ I + G+ (X – M) – Indirect Taxes + Subsidies OR GDPFC =GDPMP – Indirect taxes + Subsidies

6) Net Domestic Product at Market Price (NDPMP): NDPMP is the net market value of goods and services produced in the country during a year. Since, it is net “domestic” product, the net income from abroad is not considered in its calculation. Further, since it is a “net” market value of goods and services, depreciation is not included while calculating NDPMP.

NDPMP = GDPMP – Depreciation

7) Net Domestic Product at Factor Cost (NDPFC): NDPFC is the net market value of goods and services produced in the country during a year. It is also known as “domestic income” or “domestic factor income”. The value of indirect taxes and subsidies is adjusted for GDPMP to arrive at NDPFC. Further, since it is a “net” market value of goods and service, depreciation is not included while calculating NDPFC.

NDPFC = GDPMP – Depreciation – Indirect Taxes + Subsidies OR

NDPFC = NDPMP – Indirect Taxes + Subsidies.

8) Net National Product at Market Price (NNPMP): NNPMP is the net market value of goods and services produced by the residents of a country during a year. Since it is a “net” market value of goods and services, depreciation is not included while calculating NNPMP. NNPMP can be calculated by deducting depreciation from GNPMP. NNPMP = GNPMP – Depreciation.

9) Net National Product at Factor Cost (NNPFC): NNPFC is the net market value of goods and services produced by the resident of a country during a year. It includes income earned by factors of production. NNPFC = NNPMP – Indirect Taxes + Subsidies

10) National Income at Factor cost (NIFC): NIFC refers to sum of all income earned by resources suppliers for their contribution of land, labour, capital and entrepreneurial ability which are utilized in the production of the year. In short, it is the sum total of all income received and accrued to the factors of production. NIFC = NNPMP – Indirect Taxes + subsidies OR NI FC = NNPFC

11) Personal Income: Personal income is the sum of all incomes actually received by and accrued to all individuals or households from all the sources during a given year. Accrued income means the income which is earned but not received.

12) Personal Disposable income: Personal disposable income is the personal income which is left after the payment of direct taxes like personal income tax, property tax, etc.

GNP isn't a satisfactory measure of economic welfare because the estimates of national income don't include certain services and production activities which affect welfare. We discuss below some of the factors which affect human welfare but aren't included in the GNP estimates.

Leisure:

One of the important things that affect the welfare of a society is leisure. But it's not included in GNP. For instance , longer working hours may make people unhappy because their leisure is reduced. On the contrary, shorter working hours per week may increase leisure and make people happy. More or less leisure enjoyed by the community as such may affect the total output of the economy. But the value of leisure is excluded from the national income estimates.

Quality of Life:

GNP estimates don't include the quality of life which reflects the community’s welfare. Life in overcrowded cities is full of tensions. Roads are overcrowded. There’s loss in time. Accidents occur daily which cripple or kill people.

Environment becomes polluted. There are the problems of water, power, housing, transportation, etc. Crimes spread. Life becomes complex and the quality of life deteriorates. Consequently, social welfare is reduced. But all these stresses and strains of city life aren't included in the national income estimates. Strangely, the efforts made by governments to remedy the ills of the city life are included in the GNP because they involve public expenditure.

On the opposite hand, in places where there's no congestion, people enjoy fresh air and the beauty of nature, the quality of life tends to increase. But this is often not reflected in GNP.

Non-market Transactions:

Some of the non-market transactions increase welfare but they're not included in national income estimates. The services of housewives within the home and community activities like religious functions, affect the welfare of the people but they're excluded from the estimates of GNP because no market transaction is involved in providing these services.

Externalities:

Similarly, there are externalities which tend to increase or decrease welfare but they're not included in GNP estimates. “An externality is a cost or benefit conferred upon second or third parties as results of acts of individual production and consumption.” But the cost or advantage of an externality can't be measured in money terms because it's not included in market activities.

An example of an external benefit is the pleasure one man derives from his neighbour’s fine garden. An example of an external cost is environmental pollution caused by industrial plants. The former tends to extend welfare and therefore the latter tends to reduce it. Since externalities are “untraded interdependences”, they're excluded from national income estimates.

Nature of Production:

GNP estimates don't reflect the capacity of different goods to provide different levels of satisfaction to the community. The same amount of money spent on a nuclear bomb or on building a dam across a river adds equally to the value . But they provide different levels of satisfaction to the community. A bomb doesn't increase welfare while a dam increases welfare.

Standard of Living:

National income also doesn't reflect standard of living of the community which determines its welfare. If more national expenditure is incurred on the assembly of arms and ammunitions and on capital goods and fewer on producing consumption goods, this difference isn't reflected in GNP estimates. But the reduction within the production of consumption goods tends to decrease the welfare of the people, while the rise within the expenditure on armaments and capital goods doesn't increase welfare.

Keeping the above limitations in view, GNP can't be used as a measure of welfare. However, a few economists have tried to broaden the definition of GNP soon make it a measure of economic welfare. A pioneering attempt toward this direction has been made by Professors Nordhaus and Tobin in 1972. They have constructed a ‘Measure of Economic Welfare’ which they call MEW. Professor Samuelson calls it ‘Net Economic Welfare’, or NEW.

According to Nordhaus and Tobin, in MEW they have tried to measure all consumption that results in human welfare. To estimate the value of MEW, they deduct from consumption certain items which don't contribute to welfare and add other items that contribute to welfare but are excluded from GNP estimates.

The deductions which they make are of three types:

(1) Those public and private expenditures that don't yield utility directly. They call them “regrettable necessities”, like government expenditures on national defence, police, road maintenance, and sanitation services, and expenses by consumers on commuting (i.e., travelling regularly by train, scooter, car or bus between one’s residence and place of work).

(2) All consumer expenditures on durable household goods like washing machines, cars, TV sets, etc. which yield utility over their lifetime. (3) Estimated costs arising from “negative externalities” which are disamenities arising from urbanisation, congestion and pollution. AH these reduce human welfare.

Having made these deductions, Nordhaus and Tobin add three items to consumption.

They are:

(1) The worth of non-market activities;

(2) The estimates of the worth of the services of durable consumer goods actually consumed by the owners, both households and government; and

(3) The estimates of the worth of leisure.

A trade cycle refers to fluctuations in economic activities especially in employment, output and income, prices, profits etc. it's been defined differently by different economists. Consistent with Mitchell, “Business cycles are of fluctuations within the economic activities of organized communities. The adjective ‘business’ restricts the concept of fluctuations in activities which are systematically conducted on commercial basis.

The noun ‘cycle’ bars out fluctuations which don't occur with a measure of regularity”. Consistent with Keynes, “A trade cycle consists of periods of excellent trade characterised by inflation/ rise in prices and low unemployment percentages altering with periods of bad trade characterised by falling prices and high unemployment percentages”.

Features of a Trade Cycle:

1. A trade cycle is synchronic. When cyclical fluctuations start in one sector it spreads to other sectors.

2. During a trade cycle, a period of prosperity is followed by a period of depression. Hence trade cycle may be a wave like movement.

3. Trade cycle is recurrent and rhythmic; prosperity is followed by depression and the other way around.

4. A trade cycle is cumulative and self-reinforcing. Each phase feeds on itself and creates further movement within the same direction.

5. A trade cycle is asymmetrical. The prosperity phase is slow and gradual and therefore the phase of depression is rapid.

6. The trade cycle isn't periodical. Some trade cycles last for 3 or four years, while others last for 6 or eight or maybe more years.

7. The impact of a trade cycle is differential. It affects different industries in numerous ways.

8. A trade cycle is international in character. Through international trade, booms and depressions in one country are passed to other countries.

Phases of Trade Cycle

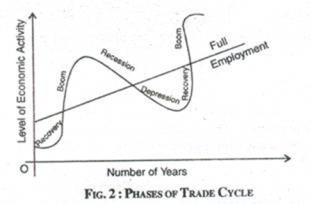

The four important features of trade cycle are (i) Recovery, (ii) Boom, (iii) Recession, and (iv) Depression.

The trades cycle or trade cycle are cyclical fluctuations of an economy. A full trade cycle possesses four phases: (i) Recovery, (ii) Boom, (iii) Recession, and (iv) depression. The upward phase of a business cycle or prosperity is split into two stages—recovery and boom, and therefore the downward phase of a trade cycle is additionally divided into two stages—recession and depression.

Phases of Trade Cycle:

The phases of trade cycle are explained with a diagram:

(1) Recovery:

In the early period of recovery, entrepreneurs increase the extent of investment which successively increases employment and income. Employment increases purchasing power and this results in a rise in demand for commodity.

As a result, demand for goods will press upon their supply and it shall, thereby, cause an increase in prices. The demand for consumer’s goods shall encourage the demand for producer’s goods.

The rise in prices shall rely upon the gestation of investment. The longer the period of investment, the upper shall be the price rise. The increase of prices shall cause a change within the distribution of income. Rent, wages, interest don't rise within the same proportion as prices.

Consequently, the margin of profit improves. The wholesale prices rise quite retail prices. The prices of raw materials rise over the prices of semi-finished goods and therefore the prices of semi-finished goods use over the prices of finished goods.

(2) Boom:

The rate of investment increases still further. Because of the spread of a wave of optimism in business, the amount of production increases and therefore the boom gathers momentum. More investment is feasible only through credit creation. During a period of boom, the economy surpasses the extent of full employment and enters a stage of over full employment.

(3) Recession:

The orders for raw materials are reduced on the onset of a recession. The rate of investment in producers’ goods industries and housing construction declines. Liquidity preference rises in society and due to a contraction of money supply, the prices falls. A wave of pessimism spreads in business and those markets which were sometime before sellers markets become buyer’s markets now.

(4) Depression:

The main feature of a depression may be a general fall in economic activity. Production, employment and income decline. The prices fall and therefore the main factor accountable for it is, a fall in the purchasing power.

The distribution of national income changes, because the costs are rigid in nature, the margin of profit declines. Machines aren't accustomed their full capacity in factories, because effective demand is far less. The prices of finished goods fall but the prices of raw materials.

The classical theory assumes over the long period the existence of full employment without inflation.

Given wage-price flexibility, there are automatic competitive forces within the economic system that tend to keep up full employment, and make the economy produce output at that level within the end of the day .

Thus, full employment is considered a standard situation and any deviation from this level are a few things abnormal since competition automatically pushes the economy toward full employment.

The classical theory of income, output and employment relies on the subsequent assumptions:

1. There's a standard situation of full employment without inflation.

2. There's a laissez faire capitalist economy without foreign trade.

3. There's perfect competition in labour, money and goods markets.

4. Labour is homogeneous.

5. Total output of the economy is splited between consumption and investment expenditures.

6. The amount of money is given. Money is just a medium of exchange.

7. Wages and prices are flexible.

8. Money wages and real wages are directly related and this relationship is proportional.

9. Capital stock and technological knowledge are given within the short run.

Now we study the three pillars of classical theory.

Say’s Law of Markets:

Say’s Law of Markets is that the core of the classical theory of employment. Jean Baptiste Say, an early 19th century French Economist gave the proposition that “supply creates its own demand.” this is often referred to as Say’s Law. In Say’s own words, “It is production which creates markets for goods. A product is not any sooner created than it, from that instant, affords a marketplace for other products to the full extent of its own value. Nothing is more favourable to the demand of 1 product, than the supply of another.”

In its original form, the law was applicable to a barter economy where goods are ultimately sold for goods. Every good delivered to the market creates a demand for a few other goods. Say argued that since work is unpleasant, nobody will work to create a product unless he wants to exchange it for a few other product which he desires.

Therefore, the very act of supplying goods by a huge number of small producers implies a demand for them from producers of other goods. In each a situation there can't be general over-production because supply of goods won't exceed demand as an entire .

Classical conceded that specific good could also be overproduced because the producer incorrectly estimates the number of the product which others want. But this is"> this is often a temporary phenomenon for the surplus production of particular product can be corrected in time by reducing its production.

Even after 100 years, James Mill supported Say’s Law in these words, “Consumption is coextensive with production and production is that the cause, and therefore the sole explanation for demand. It never furnishes supply without furnishing demand, both at the same time and both to an equal extent…. Regardless of the amount of annual produce; it can never exceed the amount of annual demand.”

Thus supply creates its own demand and there can't be general overproduction and hence general unemployment.

The classical logic was that existence of money doesn't alter the working of the fundamental law. “Say’s law, during a very broad way, is,” as Professor Hansen has said, “a description of a free-exchange economy. So conceived, it illuminates the reality that the major source of demand is that the flow of factor income generated from the method of production itself. When producers obtain the varied inputs (land, labour and capital) to be utilized in the assembly process, they generate the required income accruing to the factor owners in the type of rent, wages and interest.

This, in turn, causes adequate demand for the goods produced. During this way, supply creates its own demand. This reasoning relies on the assumption that all income earned by the factor-owners is automatically spent in buying commodities which they assist to produce.

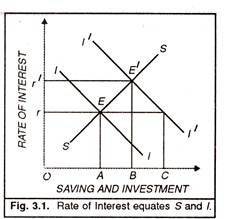

Classical further maintained that what's not consumed is saved which all saving out of income is automatically invested through the capital market. Thus, during a state of equilibrium saving must equal investment. If there's any divergence between the 2, the equality is maintained through the mechanism of the rate of interest. To the classicists, interest is a reward for saving.

The higher is that the rate of interest, the upper the savings, and the other way around. On the contrary, the lower the rate of interest, the higher the demand for investment funds, and the other way around. If at any given time, investment exceeds saving, the rate of interest would rise.

Saving would increase and investment would decline till the 2 are equal at the complete employment level. This is often because saving is considered an increasing function of the rate of interest and investment a decreasing function of the speed of interest. This helps establish the equilibrium condition of saving-investment equality.

The process of generation of the equality between saving and investment is shown in Figure 3.1 where SS is that the saving curve and II is that the investment curve. The 2 curves intersect at E where the rate of interest gets determined at the extent of Or and both saving and investment are adequate to OA. If there's a rise in investment, the investment curve shifts to the proper and is shown as it curve.

At the rate of interest Or, investment is greater than saving. Consistent with the classical economists, the saving curve SS remains at its original level when there's any increase in investment. To take care of the equality between saving and investment, the rate of interest will rise.

This is shown within the figure to rise from Oe to Or’. At this rate of interest, the saving curve SS intersects the investment curve IT at E’. Consequently, both saving and investment equal the quantity shown as OB. Thus whatever is saved gets invested through rate of interest flexibility.

Say’s Law:

Say’s law of markets is the core of the classical theory of employment. An early 19th century French Economist, J.B. Say, enunciated the proposition that “supply creates its own demand.” Therefore, there can't be general overproduction and the problem of unemployment in the economy.

Propositions and Implications of the Law:

Say’s propositions and its implications present truth picture of the market law.

These are given below:

1. Full employment in the Economy:

The law is predicated on the proposition that there's full employment in the economy. Increase in production means more employment to the factors of production. Production continues to increase until the level of full employment is reached. Under such a situation, the extent of production will be maximum.

2. Proper Utilization of Resources:

If there's full employment in the economy, idle resources will be properly utilized which can further help to produce more and also generate more income.

3. Perfect Competition:

Say’s law of market is based on the proposition of perfect competition in labour and product markets.

Other conditions of perfect competition are given below:

(a) Size of the Market:

According to Say’s law, the size of the market is large enough to make demand for goods. Moreover, the size of the market is also influenced by the forces of demand and supply of various inputs.

(b) Automatic Adjustment Mechanism:

The law is based on this proposition that there's automatic and self-adjusting mechanism in different markets. Disequilibrium in any market is a temporary situation. For instance , in capital market, the equality between saving and investment is maintained by the rate of interest while in the labour market the adjustment between demand and supply of labour is maintained by the wage rate.

(c) Role of money as Neutral:

The law relies on the proposition of a barter system where goods are exchanged for goods. But it's also assumed that the role of cash is neutral. Money doesn't affect the production process.

4. Laissez-faire Policy:

The law assumes a closed capitalist economy which follows the policy of laissez-faire. The policy of laissez-faire is crucial for an automatic and self-adjusting process of full employment equilibrium.

5. Saving as a Social Virtue:

All factor income is spent in buying goods which they assist to produce. Whatever is saved is automatically invested for further production. In other words, saving could be a social virtue.

Criticisms of Say’s Law:

J.M. Keynes in his General Theory made a frontal attack on the classical postulates and Say’s law of markets.

He criticised Say’s law of markets on the subsequent grounds:

1. Supply doesn't create its Demand:

Say’s law assumes that production creates market (demand) for goods. Therefore, supply creates its own demand. But this proposition isn't applicable to modern economies where demand doesn't increase as much as production increases. It's also not possible to consume only those goods which are produced within the economy.

2. Self-adjustment not Possible:

According to Say’s law, full-employment is maintained by an automatic and self-adjustment mechanism in the long run. But Keynes had no patience to wait for the long period for he believed that “In the long-run we are all dead.” it's not the automated adjustment process which removes unemployment. But unemployment is often removed by increase in the rate of investment.

3. Money isn't Neutral:

Say’s law of markets is based on a barter system and ignores the role of money in the system. Say believes that money doesn't affect the economic activities of the markets. On the opposite hand, Keynes has given due importance to money. He regards money as a medium of exchange. Money is held for income and business motives. Individuals hold money for unforeseen contingencies while businessmen keep cash in reserve for future activities.

4. Over Production is Possible:

Say’s law is based on the proposition that supply creates its own demand and there can't be general over-production. But Keynes doesn't agree with this proposition. According to him, all income accruing to factors of production isn't spent but some fraction out of its saved which isn't automatically invested. Therefore, saving and investment are always not equal and it becomes the problem of overproduction and unemployment.

5. Underemployment Situation:

Keynes regards full employment as a special case because there's underemployment in capitalist economies. This is often because the capitalist economies don't function according to Say’s law and supply always exceeds its demand. For example, millions of workers are prepared to work at the current wage rate, and even below it, but they do not find work.

6. State Intervention:

Say’s law relies on the existence of laissez-faire policy. But Keynes has highlighted the need for state intervention in the case of general overproduction and mass unemployment. Laissez-faire, in-fact, led to the great Depression.

Had the capitalist system been automatic and self-adjusting. This would not have occurred. Keynes, therefore, advocated state intervention for adjusting supply and demand within the economy through fiscal and monetary measures.

7. Equality through Income:

Keynes doesn't agree with the classical view that the equality between saving and investment is brought about through the mechanism of rate of interest. But actually, it's changes in income rather than the rate of interest which bring the two to equality.

8. Wage-cut no Solution:

Pigou favoured the policy of wage-cut to solve the matter of unemployment. But Keynes opposed such a policy both from the theoretical and practical points of view. Theoretically, a wage-cut policy increases unemployment instead of removing it. Practically, workers aren't prepared to simply accept a cut in money wage. Keynes, therefore, favoured a versatile monetary policy to a flexible wage policy to boost the level of employment in the economy.

9. Demand creates its own supply:

Say’s law of market is predicated on the proposition that “supply creates its own demand”. Therefore, there cannot be general overproduction and mass unemployment. Keynes has criticized this proposition and propounded the other view that demand creates its own supply. Unemployment results from the deficiency of effective demand because people don't spend the whole of their income on consumption.