Unit 4

SYBAF

4.1 PUBLIC REVENUE

the income of the authorities via all sources is called public earnings or public revenue.

According to Dalton, however, the time period “Public Income” has two senses — extensive and narrow. In its wider sense it includes all the incomes or receipts which a public authority may additionally secure throughout any duration of time. In its narrow sense, however, it includes solely these sources of income of the public authority which are in most cases acknowledged as “revenue resources.” To keep away from ambiguity, thus, the former is termed “public receipts” and the latter “public revenue.”

As such, receipts from public borrowings (or public debt) and from the sale of public belongings are mostly excluded from public revenue. For instance, the finances of the Government of India are categorized into “revenue” and “capital.” “Heads of Revenue” consist of the heads of income underneath the capital price range are termed as “receipts.” Thus, the term “receipts” consists of sources of public earnings which are excluded from “revenue.”

In a modern-day welfare state, public revenue is of two types, tax income and non-tax revenue.

Tax Revenue:

A fund raised thru the various taxes is referred to as tax revenue. Taxes are obligatory contributions imposed through the authorities on its residents to meet its normal fees incurred for the common good, besides any corresponding advantages to the tax payer.

As Taussig places it, “the essence of a tax, as exotic from other expenses by government, is the absence of a direct quid seasoned quo between the tax payer and the public authority.”

Seligman defines a tax thus: “A tax is a compulsory contribution from a man or woman to the authorities to defray the charges incurred in the frequent interest of all, barring reference to specific advantages conferred.

Tax Revenue

The main characteristic points of a tax are as follows:

1. A tax is a compulsory fee to be paid by means of the citizens who are liable to pay it. Hence, refusal to pay a tax is a punishable offence.

2. There is no direct, quid pro quo between the tax-payers and the public authority. In other words, the tax payer can't declare reciprocal benefits towards the taxes paid. However, as Seligman factors out, the country has to do something for the neighborhood as a whole for what the tax payers have contributed in the form of taxes.

“But this reciprocal responsibility on the part of the government is not towards the man or woman as such, however towards the person as part of a greater whole.”

3. A tax is levied to meet public spending incurred by the authorities in the popular interest of the nation. It is a payment for an oblique carrier to be made via the government to the neighborhood as a whole.

4. A tax is payable in many instances and periodically as determined via the taxing authority.

Taxes represent a good sized phase of public income in modern public finance. Taxes have macro-economic effects. Taxation can affect the size and mode of consumption, pattern of production and distribution of profits and wealth.

Progressive taxes can help in lowering inequalities of earnings and wealth through reducing the excessive income group’s disposable income. By disposable income is meant the profits left in the fingers of the tax payer for disbursement after tax payment. Taxes mean a pressured saving in a creating economy. Thus, taxes constitute an important supply of improvement finance.

Non-Tax Revenue:

Public earnings obtained thru administration, industrial enterprises, items and grants are the source of non-tax revenues of the government.

Thus, nontax revenue includes:

(i) Administrative revenue

(ii) Profit from nation enterprises

(iii) Gifts and grants

Administrative Revenues:

Under public administration, public authorities can increase some funds in the structure of fees, fines and penalties, and distinctive assessments.

Fees:

Fees are charged with the aid of the authorities or public authorities for rendering a service to the beneficiaries. To quote Seligman, “A rate is a fee to defray the fee of every habitual service undertaken by means of the government, especially in the public interest, but conferring a measurable advantage to the payer.”

Court fees, passport fees, etc., fall under this category. Similarly, license expenses are charged to confer a permission for something by means of the controlling authority, e.g., riding license fee, import license fee, liquor permit fee, etc. Fees are to be paid by means of those who receive some specific advantages. Generally the quantity of the rate depends upon the cost of offerings rendered.

Fees are a bye- product of the administrative things to do of the authorities and no longer a charge for a business. Thus, charges are distinct from prices.

However prices are obligatory contributions, though both are made for distinctive services. Sometimes a charge incorporates an aspect of tax when it is charged high in order to convey income to the exchequer e.g., a license fee.

Fines and Penalties:

Fines and penalties are levied and amassed from offenders of legal guidelines as punishment. Here the primary object of these levies is no longer so a good deal to earn earnings as to forestall the fee of offences and infringement of laws of the country. Fines and penalties are arbitrarily decided and have no relation to the fee of administration or things to do of the government. Hence, collections from such levies are insignificant as a source of public revenue.

Special Assessments:

“A distinct assessment,” as Seligman points out, “is a compulsory contribution levied in share to the social advantages derived to defray the cost of a precise enchantment to property undertaken in the public interest.” That is to say, on occasion when the authorities undertakes positive sorts of public upgrades such as building of roads, provision of drainage, street lighting fixtures etc., it may confer a exceptional gain to these possessing properties nearby.

As a result, values of rents of these homes might also rise. The government, therefore, may additionally impose some different levy to recover a part of the costs so incurred.

Such different assessment is levied generally in percentage to the increase in the cost of the properties involved. In this respect, it differs from a tax.

In India, these one-of-a-kind assessments are referred to as “betterment levy.” Betterment levy is imposed on land when its cost is stronger via the construction of social overhead capital such as roads, drainage, street- lighting, etc. with the aid of the public authority in an area.

Profits of State Enterprise:

Profits of state undertakings additionally are an essential supply of income these days, owing to the growth of the public sector. For instance, the central government runs railways. Surplus from railway earnings can be normally contributed to the income price range of the central budget.

Likewise, income from the state transport company and other public undertakings can be important sources of income for the budgets of state governments. Similarly, other business undertakings in the public quarter such as Hindustan Machine Tools, Bokaro Steel Plant, State Trading Corporation etc. can make earnings to support the central budget.

Earnings from state companies rely upon the expenditures charged by means of them for their goods and offerings and the surplus derived therefrom.

Thus, the pricing policy of country undertakings must be self-supporting and fairly profit-oriented. Again, expenditures are charged with a factor of quid pro quo i.e., directly in proportion to the benefits conferred by way of the services rendered.

A charge is a form of income derived through the government with the aid of promoting goods and offerings of public enterprises.

Thus, rate is the income received from enterprise exercise undertaken with the aid of the public authorities. Many public companies like postal offerings run on cost-to-cost basis. The fees are charged simply to cowl the value of rendering such services.

However, in certain cases, when the nation has an absolute monopoly, expenses having an excessive income component are charged. Such monopoly incomes of a country business enterprise are in the nature of a tax. The distinction between charge and charge is this: the former normally can in no way be less than the fee of production or service, while the latter may also not always cover the fee of service.

Gifts and Grants:

These shape normally a very small section of public revenue. Quite often, patriotic humans or establishments may additionally make items to the state. These are basically voluntary contributions. Gifts have some significance, particularly at some stage in hostilities time or an emergency.

In present day times, however, provides from one authority to any other have a larger importance. Local governments get hold of delivers from nation governments and nation governments from the center. The central government offers grants- in-aid to kingdom governments in order to enable them to rise out their functions.

When promises are made by means of one country’s government to any other country’s authorities it is known as foreign aid.

Usually bad nations receive such resource from developed countries, which may also be in the form of navy aid, financial aid, food aid, technological aid, and so on.

Objectives of Taxation:

The predominant cause of taxation is to elevate income to meet huge public expenditure. Most governmental activities need to be financed via taxation. But it is not the only goal. In other words, taxation policy has some non-revenue objectives.

Truly speaking, in the current world, taxation is used as an instrument of financial policy. It impacts the total quantity of production, consumption, investment, preference of industrial area and techniques, balance of payments, distribution of income, etc.

Here we will talk about the goals of taxation in modern-day public finance:

1. Economic Development

2. Full Employment

3. Price Stability

4. Control of Cyclical Fluctuations

5. Reduction of BOP Difficulties

6. Non-Revenue Objective

1. Economic Development:

One of the vital goals of taxation is monetary development. Economic improvement of any user is generally conditioned via the increase of capital formation. It is said that capital formation is the kingpin of economic development. But LDCs generally go through from the scarcity of capital.

To overcome the shortage of capital, governments of these nations mobilize sources so that a speedy capital accumulation takes place.

To step up both public and personal investment, government faucets tax revenues. Through suitable tax planning, the ratio of savings to national earnings can be raised.

By elevating the present fee of taxes or by means of imposing new taxes, the procedure of capital formation can be made smooth.

One of the essential elements of economic development is the raising of savings- earnings ratio which can be efficiently raised through taxation policy.

However, perfect care has to be taken, regarding investment.

If monetary sources or investments are channelized in the un-productive sectors of the economy the financial development may additionally be jeopardized, even if savings and investment rates are increased. Thus, the tax coverage has to be employed in such a way that investment occurs in the productive sectors of the economy, consisting of the infrastructural sectors.

2. Full Employment:

Second objective is the full employment. Since the stage of employment depends on fantastic demand, a united states of america desirous of reaching the intention of full employment have to reduce down the fee of taxes. Consequently, disposable profits will upward jab and, hence, demand for items and services will rise. Increased demand will stimulate investment main to a upward shove in profits and employment via the multiplier mechanism.

3. Price Stability:

Thirdly, taxation can be used to make certain charge stability—a short run objective of taxation. Taxes are viewed as a fantastic capability of controlling inflation.

By raising the rate of direct taxes, non-public spending can be controlled. Naturally, the pressure on the commodity market is reduced.

But indirect taxes imposed on commodities gasoline inflationary tendencies. High commodity prices, on the one hand, discourage consumption and, on the different hand, motivate saving. Opposite effect will take place when taxes are diminished down during deflation.

4. Control of Cyclical Fluctuations:

Fourthly, manipulate of cyclical fluctuations—periods of increase and depression—is regarded to be any other goal of taxation. During depression, taxes are lowered down whilst at some point of increase taxes are improved so that cyclical fluctuations are tamed.

5. Reduction of BOP Difficulties:

Fifthly, taxes like custom responsibilities are additionally used to control imports of sure goods with the objective of lowering the intensity of stability of payments difficulties and encouraging domestic production of import substitutes.

6. Non-Revenue Objective:

Finally, some other extra-revenue or non-revenue objective of taxation is the discount of inequalities in income and wealth. This can be finished by taxing the prosperous at higher charge than the bad or via introducing a system of revolutionary taxation.

Canons of Taxation:

Canons of taxation refer to the administrative factors of a tax. They relate to the rate, amount, and method of levy and collection of a tax.

In other words, the characteristics or qualities which a appropriate tax need to possess are described as canons of taxation. It must be noted that canons refer to the characteristics of a remote tax and no longer to the tax device as a whole. A good tax device must have a desirable mixture of all sorts of taxes having distinctive canons.

According to Adam Smith, there are four canons or maxims of taxation on the administrative side of public finance which are still known as classic.

To him a correct tax is one which contains:

1. Canon of equality or equity.

2. Canon of certainty.

3. Canon of economy.

4. Canon of convenience.

5. Canon of elasticity.

6. Canon of productivity.

7. Canon of simplicity.

8. Canon of diversity.

9. Canon of expediency

Canon of Equality:

Every fiscal economist, along with Adam Smith, stresses that taxation have to make certain justice. The canon of equality or equity implies that the burden of taxation ought to be allotted equally or equitably in relation to the ability of the tax payers.

Equity or social justice demands that the prosperous people bear a heavier burden of tax and the bad a lesser burden. Hence, a tax gadget need to include revolutionary tax costs based totally on the tax-payer’s ability to pay and sacrifice.

Canon of Certainty:

Taxation should have an issue of certainty. According to Adam Smith, “the tax which every man or woman is certain to pay ought to be sure and now not arbitrary. The time of payment, the manner of payment, the amount to be paid ought to be clear and simple to the contributor and to every different person.”

The sure bet aspects of taxation are:

1. Certainty of wonderful incidence i.e., who shall bear the tax burden.

2. Certainty of legal responsibility as to how lots shall be the tax quantity payable in a precise period. This the tax payers as well as the exchequer should unambiguously know.

3. Certainty of income i.e., the government should be sure about the estimated collection of income from a given tax levied.

Canon of Economy:

This precept suggests that the price of collecting a tax have to not be exorbitant however be the minimum. Extravagant tax series equipment is no longer justified. According to Adam Smith, “Every tax has to be contrived as both to take and preserve out of the pockets of the human beings as little as viable over and above what it brings into the public treasury of the state.”

Owing to the complex and ever-changing nature of taxation laws in India, authorities has to maintain elaborate tax series equipment with a large staff of fantastically trained personnel involving high administrative prices and inordinate delay in assessment and collection of tax.

Canon of Convenience:

According to this canon, tax must be accrued in a handy manner from the tax payers. Adam Smith stresses: “Every tax ought to be levied at the time or in the manner in which it is most possibly to be convenient for the contributor to pay it.” For example, it is handy to pay a tax when it is deducted at source from the salaried training at the time of paying salaries.

Canon of Elasticity:

Taxation ought to be elastic in nature in the experience that greater income is automatically fetched when earnings of the humans rises. This means that taxation have to have built-in flexibility.

Canon of Productivity:

This implies that a tax ought to yield ample revenue and no longer adversely affect production in the economy.

Canon of Simplicity:

This norm suggests that tax rates and tax structures ought to be easy and understandable and not to be complex and beyond the appreciation of the layman. This is what is hardly ever observed in the Indian tax structure.

Canon of Diversity:

Canon of diversity implies that there ought to be a a couple of tax system of numerous nature rather than having a single tax system. In the former case, the tax payer will not be harassed with a high incidence of tax in the aggregate.

Canon of Expediency:

This suggests that a tax ought to be decided on the ground of its economic, social and political expediency. For instance, a tax on agricultural profits lacks social, political or administrative expediency in India and that is why the authorities of India had to discontinue it.

Different Types of Taxes

Prevalence of number sorts of taxes is found in India. Taxes in India can be either direct or indirect. However, the kinds of taxes even depend on whether a precise tax is being levied by the central or the kingdom authorities or any other municipalities. Following are some of the predominant Indian taxes:

Direct Taxes

It is names so because it is directly paid to the Union Government of India. As per a survey, the Republic of India has witnessed a steady upward jab in the collection of such taxes over a period of previous years. The seen growth in these tax collections as well as the rate of taxes displays a healthful within your budget boom of India. Besides that, it even portrays the compliance of high tax alongside with higher administration of taxation. To title a few of the direct taxes, which are imposed with the aid of the Indian Government are:

• Banking Cash Transaction Tax

• Corporate Tax

• Capital Gains Tax

• Double Tax Avoidance Treaty

• Fringe Benefit Tax

• Securities Transaction Tax

• Personal Income Tax

• Tax Incentives

Indirect Taxes

As hostile to the direct taxes, such a tax in the nation is normally levied on some specific services or some unique goods. An indirect tax is no longer levied on any specific organization or an individual. Almost all the activities, which fall within the periphery of the indirect taxation, are protected in the range beginning from manufacturing items and transport of offerings to those that are supposed for consumption.

Apart from these, the different things to do and services, which are associated to import, buying and selling etc. are even covered inside this range. This large range results in the involvement as well as implementation of some or other oblique tax in all lines of business.

Usually, the oblique taxation in the Indian Republic is a complicated process that involves legal guidelines and regulations, which are interconnected to every other.

These taxation guidelines even consist of some laws that are specific to some of the states of the country. The regime of indirect taxation encompasses distinctive sorts of taxes. The groups provide offerings in all or most of the associated fields, some of which are as follows:

• Anti-Dumping Duty

• Custom Duty

• Excise Duty

• Sales Tax

• Service Tax

• Value Added Tax or V. A. T.

Taxation Types: Proportional, Progressive, Regressive and Digressive Taxes!

Considering the relation between the tax rate and the tax base (income), there can be 4 types of taxation, viz.:

(i) Proportional taxes,

(ii) Progressive taxes,

(iii) Regressive taxes and

(iv) Digressive taxes.

Proportional Taxes:

Taxes in which the price of tax stays constant, even though the tax base changes, are called proportional taxes.

Here, the tax base may also be income, cash cost of property, wealth, or items etc. Income is, however, viewed as the fundamental tax base, because it is the determinant of taxable capability of a person.

In a proportional tax system, thus, taxes fluctuate in direct share to the change in income. If earnings is doubled, the tax quantity is additionally doubled.

Thus, a proportional tax extracts a regular share of rising income.

Progressive Taxes:

Taxes in which the price of tax increases are known as innovative taxes. Thus, in an innovative tax, the quantity of tax paid will increase at a greater price than the amplify in tax base or income, for the taxation quantity is the product of multiplying the base through the charge and both these expand in a revolutionary tax.

Regressive Taxes:

When the charge of tax decreases as the tax base increases, the taxes are known as regressive taxes.

It must be referred to that in regressive taxation, although the whole quantity of tax increases on greater earnings in the absolute sense, in the relative sense, the tax rate declines on a greater income. As such, highly a heavier burden (sacrifice involved) falls upon the negative than on the rich. Generally, taxes on necessaries are regressive as they take away a higher percentage of lower incomes as compared to greater incomes.

Thus, regressive taxation is unjust and inequitable. It does no longer comply with the canon of equity. It tends to accentuate inequalities of earnings in the community.

Digressive Taxes:

Taxes which are mildly progressive, consequently now not very steep, so that excessive earnings earners do not make a due sacrifice on the foundation of equity, are known as digressive.

In digressive taxation, thus, the tax payable increases solely at a diminishing rate.

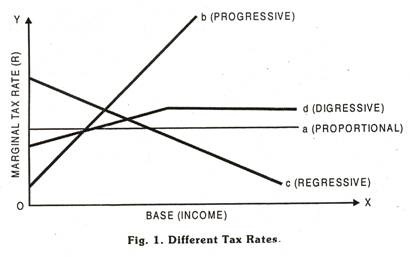

Diagrammatically, differences in progressive, proportional, regressive and digressive taxation are shown in Fig. 1.

Fig. 1 depicts the percentage of profits taken away in taxation under special tax rates. Tax line a represents a revolutionary tax rate, tax line b represents a proportional tax rate, tax line с suggests a regressive tax rate and tax line d denotes a digressive tax rate.

The proportional tax charge has a regular slope, graphically, whilst the revolutionary tax rate has a rising fine slope.

The steeper the slope of the tax line, the modern the tax regime. The regressive tax charge line has a declining negative slope. The steeper the negative slope of the tax line, the more regressive the taxation. The digressive tax price line has a rising slope initially, but it turns into constant after a point.

4.2 SHIFTING OF TAX BURDEN

The incidence of a tax rests on the person(s) whose real internet earnings are decreased by the tax. It is vital that the real burden of taxation does not always rest upon the individual who is legally accountable for charge of the tax. General sales taxes are paid through business firms, however most of the price of the tax is really surpassed on to those who purchase the items that are being taxed.

In different words, the tax is shifted from the enterprise to the consumer. Taxes may additionally be shifted in countless directions. Forward transferring takes area if the burden falls entirely on the user, as a substitute than the supplier, of the commodity or service in question—e.g., an excise tax on luxuries that will increase their rate to the purchaser. Backward transferring happens when the price of the article taxed remains the same however the price of the tax is borne by way of those engaged in producing it—e.g., thru lower wages and salaries, decrease fees for uncooked materials, or a decrease return on borrowed capital. Finally, a tax may additionally now not be shifted at all—e.g., a tax on enterprise earnings might also decrease the internet earnings of the enterprise owner.

Impact and Incidence of Taxation:

Definition of Incidence of Tax:

One of the very vital difficulty of taxation is the problem of incidence of a tax. By incidence of taxation is intended ultimate money burden of a tax or ultimate resting vicinity of a tax. It is the desire of each and every authorities that it must tightly closed justice in taxation, but if it does now not comprehend as to who sooner or later bears cash burden of a tax or out of whose packet money is received, it cannot acquire equality in taxation. If authorities is aware of who pays tax, it can evolve an equitable tax system.

It can effortlessly faucet vital sources of taxation and accordingly can collect giant quantity of money besides adversely affecting economic and social lifestyles of the citizens of the country.

Definition of Impact of Tax

Impact of a tax is on character from whom government collects cash in first instance while incidence of a tax is on man or woman who finally bears burden of a tax.

Explanation:

To make it extra clear, we take an example. Suppose authorities levies a tax on electric powered goods in USA.

Tax will be paid to Government in first instance through producers of electric goods. Impact of tax is, therefore, on them. If producers of electric goods industries add tax to rate and be triumphant in promoting items at higher prices of electric items to consumers, burden of tax is for this reason shifted on to consumers.

Incidence is Different From Shifting:

Incidence is closing resting location of a tax while transferring is procedure of transferring money burden of tax to any individual else. Shifting subsequently ends in incidence. When a character on whom tax is levied tries to shift tax on to the other, he might also be triumphant in shifting tax completely, partly, or may also no longer succeed at all. Shifting of tax can take area in two directions, ahead and backward. If tax is shifted, from vendor to consumer, it is a case of forwarding shifting.

Backward shifting takes area when consumers do no longer purchase commodities at accelerated prices.

Sellers are then compelled to reduce down prices and undergo burden of tax themselves. Backward transferring is consequently carried out by means of buyers.

Incidence and Effect of a Tax:

Before we proceed similarly it appears critical that we distinguish the thinking of incidence from effect. As referred to beforehand incidence is direct cash burden of a tax. Effect of taxation is repercussions or consequences of imposition of a tax on persons and on community in general.

The most important objective of taxation is to elevate required revenues to meet expenditures.

Apart from raising revenue, taxes are considered as contraptions of control and legislation with the purpose of influencing the sample of consumption, manufacturing and distribution.

Taxes accordingly affect an economic system in more than a few ways, though the effects of taxes may additionally now not necessarily be good. There are equal horrific outcomes of taxes too.

Economic outcomes of taxation can be studied below the following headings:

1. Effects of Taxation on Production:

Taxation can have an effect on production and growth. Such effects on production are analyzed underneath three heads:

(i) outcomes on the capacity to work, keep and invest

(ii) effects on the will to work, store and invest

(iii) consequences on the allocation of resources.

2. Effects on the Ability to Work Save:

Imposition of taxes results in the discount of disposable income of the taxpayers. This will reduce their expenditure on necessaries which are required to be consumed for the sake of enhancing efficiency. As affectivity suffers ability to work declines this in the end adversely influences savings and investment. However, this occurs in the case of terrible persons.

Taxation on wealthy people has the least impact on the efficiency and potential to work. Not all taxes, however, have unfavorable outcomes on the ability to work. There are some detrimental goods, such as cigarettes, whose consumption has to be reduced to enlarge potential to work. That is why high price of taxes are often imposed on such detrimental goods to curb their consumption.

But all taxes adversely affect ability to save. Since wealthy people save extra than the poor, modern charge of taxation reduces financial savings potentiality. This capability low level of investment Lower price of investment has a dampening impact on financial increase of a country.

Thus, on the whole, taxes have the disincentive impact on the potential to work, store and invest.

3. Effects on the will to Work, Save and Invest:

The outcomes of taxation on the willingness to work, shop and make investments are partly the result of money burden of tax and partly the result of psychological burden of tax.

Taxes which are quickly imposed to meet any emergency (e.g., Kargil Tax imposed for 12 months or so) or taxes imposed on windfall acquire (e.g., lottery income) do now not produce destructive outcomes on the desire to work, shop and invest. But if taxes are predicted to proceed in future, it will limit the willingness to work and shop of the taxpayers.

Taxpayers have a feeling that every tax is a burden. This psychological state of thought of the taxpayers has a disincentive impact on the willingness to work. They sense that it is not well worth taking more responsibility or inserting in greater hours due to the fact so a good deal of their extra earnings would be taken away via the authorities in the form of taxes.

However, if taxpayers are desirous of preserving their present standard of dwelling in the midst of payment of large taxes, they may put in greater efforts to make up for the earnings misplaced in tax.

It is advised that outcomes of taxes upon the willingness to work, retailer and invest depends on the income elasticity of demand. Income elasticity of demand varies from man or woman to individual.

If the earnings demand of a character taxpayer is inelastic, a reduce in income consequent upon the imposition of taxes will result in him to work extra and to save greater so that the lost profits is at least in part recovered. On the other hand, the desire to work and retailer of those people whose demand for earnings is elastic will be affected adversely.

Thus, we have conflicting views on the incentives to work. It would seem logical that there must be a disincentive impact of taxes at some point however it is now not clear at what stage of taxation that fundamental point would be reached.

4. Effects on the Allocation of Resources:

By diverting assets to the preferred directions, taxation can influence the volume or the measurement of production as nicely as the sample of production in the economy. It may, in the closing analysis, produce some beneficial results on production. High taxation on dangerous tablets and commodities will decrease their consumption.

This will discourage production of these commodities and the scarce sources will now be diverted from their production to the different products which are useful for financial growth. Similarly, tax concessions on some merchandise are given in a locality which is considered as backward. Thus, taxation might also promote regional balanced improvement via allocating resources in the backward regions.

However, no longer always such recommended effect will usually be reaped. There are some taxes which might also produce some damaging consequences on production. Taxes imposed on positive useful merchandise may also divert sources from one region to another. Such unhealthy diversion may cause discount of consumption and manufacturing of these products.

5. Effects of Taxation on Income Distribution:

Taxation has each favorable and negative consequences on the distribution of income and wealth. Whether taxes decrease or increase profits inequality relies upon on the nature of taxes. A steeply modern taxation gadget tends to decrease earnings inequality due to the fact that the burden of such taxes falls heavily on the richer persons.

But a regressive tax system increases the inequality of income. Further, taxes imposed heavily on luxuries and nonessential items tend to have a beneficial influence on income distribution. But taxes imposed on necessary articles may additionally have regressive effect on profits distribution.

However, we regularly discover some conflicting role of taxes on output and distribution. A modern machine of taxation has beneficial effect on profits distribution however it has disincentive effects on output.

A excessive dose of earnings tax will limit inequalities but such will produce some detrimental outcomes on the capacity to work, save, funding and, finally, output. Both the goals—the equitable profits distribution and larger output—cannot be attained simultaneously.

6. Other Effects of Taxation:

If taxes produce favorable outcomes on the ability and the wish to work, retailer and invest, there will be a favorable effect on the employment scenario of a country. Further, if resources accrued by means of taxes are utilized for improvement projects, it will amplify employment in the economy. If taxes affect the volume of financial savings and funding badly then recession and unemployment hassle will be aggravated.

Again, effect of taxes on the rate stage can also be beneficial and unfavourable. Sometimes, taxes are imposed to curb inflation. Again, as an imposition of commodity taxes lead to rising prices of production, taxes aggravate the problem of inflation.

Thus, taxation creates both beneficial and unfavorable results on various parameters. Unfavorable results of taxes can be wiped out by way of the judicious use of revolutionary taxation.

4.4 REDISTRIBUTION AND ANTI-INFLATIONARY NATURE OF TAXATIONS

The authority regularly makes deliberate adjustments in revenues and charges for the reason of acquiring greater monetary stability. Such changes go by using the identify ‘fiscal policy’. Since fiscal policy operates in general via the budget, it is also acknowledged as the budgetary policy.

The typically regularly occurring intention of fiscal policy is financial balance which implies each full employment and the rate stage stability. Economic stability requires related fees of increase in aggregate demand and productive capacity. If aggregate demand outruns the fee of expand in output, inflation will result.

Anti-inflationary fiscal coverage involves changes in authorities’ expenditures, taxation and borrowing and debt management policies.

Borrowing and debt administration policies are related to the central bank’s economic coverage.

Aims:

If fiscal policy is to manipulate inflation, there is want to curtail the volume of spending in such a manner that prices of production are no longer increased.

In different words, for fiscal policy to manage inflation there is need for a maximum reduction in government bills and expand in taxes so as to achieve a stability between mixture expenditure and output.

Since immoderate aggregate spending is the root motive of inflation, a reduction in authorities spending, which is one main elements of total spending, is probable to reduce inflationary pressures.

During inflation it is crucial to eliminate wasteful public expenditure or these public works programmes which might also be justifiable in intervals of low employment, however are not warranted in full employment.

Secondly, inflationary pressures can be decreased by means of suspending public construction of a variety of types, such as the constructing of new put up offices, bridges, or highways.

One kind of authorities’ expenditure, namely, government subsidies, if used judiciously, may useful resource in checking inflationary pressures. Prima facie, if an essential object like metal is in brief supply, subsidies to marginal producers may additionally help elevate output and for this reason take away particular inflationary (cost + push) pressures because steel is used as enter by using many industries.

Secondly, subsidies might also be supplied to producers of critical gadgets of consumption to offset cost increases, so that these companies will no longer have to elevate expenditures and therefore amplify the price of dwelling and set off established wage increases.

However, subsidy payments themselves are inflationary, considering that they result in multiplied buying energy in the hands of the public.

But if they convey about tremendous will increase in output of very scarce goods, the increased supply will more than offset net extra demand pressure.

In fact, the most effective kind of subsidy from the inflationary point of view is one utilized to imports. Such a subsidy increases the domestic provide of subsidised commodities besides including to home purchasing power.

However, the features may also partly be lost due to the potential of other international locations to purchase our products.

Taxes appear to have the best anti-inflationary effects. However, the effectiveness of taxes depends not solely on the person taxes however additionally on the universal tax structure.

A tax on non-public profits reduces inflationary pressures via lowering people’s disposable income. It does have a minimal effect on business cost, barring to the extent that rate reductions in disposable income lead alternate unions to demand wage increases.

On the contrary, it does now not area a burden on folks who do now not fall underneath the tax net or who are able to stay away from taxes or who spend massive sums from gathered wealth. Moreover, a major component of the tax can also be absorbed from savings and accordingly it might also supply no direct incentive to curtail spending. Thus, its anti-inflationary impact will be less per rupee than that of a tax on spending.

Expenses incurred by means of the public authorities—central, country and local self- governments are known as public expenditure. Such fees are made for the protection of the governments as nicely as for the advantage of the society as whole.

There was once a misbelief in the tutorial circles in the nineteenth century that public expenses had been wasteful. Public expenditures ought to be kept low as far as practicable. This conservative questioning died down in the twentieth century, especially after the Second World War.

As a cutting-edge kingdom is termed a ‘welfare state’, the horizon of things to do of the government has improved in length and breadth.

Now we can factor out the motives for extensive expand in public expenditure in the course of the world even in the capitalist international locations where laissez-faire principle operates. These are the following.

Causes of Increase in Public Expenditure:

(a) Size of the Country and Population:

We see an enlargement of geographical place of almost all countries. Even in no-man’s land one finds the activities of the current government.

Assuming a fixed measurement of a country, growing world has seen an big extend in population growth. Consequently, the growth in administrative things to do of the government (like defense, police, and judiciary) has resulted in a increase of public fees in these areas.

(b) Defense Expenditure:

The top notch boom of public expenditure can be attributed to threats of war. No gorgeous conflict has been performed in the second half of the twentieth century. But the threats of hostilities have not vanished; alternatively it looms large. Thus, mere sovereignty, demands a larger allocation of financial sources for defense preparedness.

(c) Welfare State:

The 19th century nation was once a ‘police state’ while, in twentieth and twenty first centuries modern-day nation is a ‘welfare state’. Even in a capitalist framework, socialistic ideas are not altogether discarded.

Since socialistic concepts are revered here, cutting-edge governments have come out overtly for socio-economic uplift of the masses.

Various socio-economic programmes are undertaken to promote people’s welfare. Modern governments spend huge cash for the reason of monetary development. It performs an energetic position in the production of items and services. Such funding is financed by way of the government.

Besides development activities, welfare things have grown. It spends money for providing more than a few social security benefits. Social sectors like health, education, etc.

Get hold of an extraordinary remedy below the government patronage. It builds up not only social infrastructure but also financial infrastructure in the form of transport, electricity, etc.

Provision of all these require big finance. Since a hefty sum is required for financing these activities, modern-day governments are the only carriers of money. However, more than a few welfare things to do of the authorities are largely shaped and influenced by way of the political leaders (Ministers, MPs, and MLAs to have a political mileage, as well as with the aid of the bureaucrats (MPLAD)).

(d) Economic Development:

Modern authorities has a gorgeous function to play in shaping an economy. Private capitalists are fully incapable of financing monetary improvement of a country. This incapacity of the non-public sector has brought on modern governments to invest in a variety of sectors so that financial improvement occurs.

Economic improvement is generally conditioned with the aid of the availability of economic infrastructure. Only with the aid of building up monetary infrastructure, road, transport, electricity, etc., the shape of a financial system can be made to improve. Obviously, for financing these activities, authorities spends money.

4.6 CANONS OF PUBLIC EXPENDITURE:

The most important ideas or canons of public expenditure are as follows:

(i) The Principle of Maximum Social Advantage: The government expenditure be incurred in such a way that it ought to give gain to the neighborhood as a whole. The goal of the public expenditure is the provision of maximum social advantage. If one part of the society or one specific group receives advantage of the public expenditure at the price of the society as a whole, then that expenditure cannot be justified in any way, due to the fact it does no longer end result in the best suitable to the public in general. So we can say that the public, expenditure should impenetrable the most social advantage.

(ii) The Principle of Economy: The principle of economic system requires that authorities should spend money in such a manner that all wasteful expenditure is avoided. Economy does no longer suggest miserliness or niggardliness. By financial system we mean that public expenditure should be elevated besides any extravagance and duplication. If the hard-earned money of the people, gathered through taxes, is thoughtlessly spent, the public expenditure will no longer verify to the cannon of economy.

(iii) The Principle of Sanction: According to the principle, all public expenditure need to be incurred by means of getting prior sanction from the capable authority. The sanction is necessary due to the fact it helps in warding off waste, extravagance, and overlapping of public money. Moreover, prior approval of the public expenditure makes it easy for the audit department to scrutinize the extraordinary gadgets of expenditure and see whether the money has now not been overspent or misappropriated.

(iv) The Principle of balanced Budgets: Every government have to strive to preserve its budgets nicely balanced. There should be neither ever habitual surpluses nor deficits in the budgets. Ever habitual surpluses are now not favored because it shows that people are unnecessarily heavily taxed. If expenditure exceeds revenue each and every year, then that too is now not a healthful signal due to the fact this is considered to be the sign of financial weak point of the country. The government, therefore, must attempt to stay inside its very own means.

(v) The Principle of Elasticity: The principle of elasticity requires that public expenditure no longer in any way be rigidly fixed for all times. It ought to be rather pretty elastic. The public authorities should be in a function to range the expenditure as the situation demands. During the length of depression, it be possible for the government to amplify the expenditure so that financial system is lifted from low level of employment.

During growth period, the country must be in a role to curtail the expenditure besides inflicting any misery to the people.

(vi) No unhealthy impact on Production and Distribution:

The public expenditure must be arranged in such a way that it should not have unfavorable impact on production or distribution of wealth in the country.

Public expenditure should aim at stimulating manufacturing and reducing inequalities of wealth distribution. If due to unwise public spending, wealth gets targeted in a few hands, then its reason is now not served. The cash surely goes waste then.

Rules or ideas that govern the expenditure coverage of the authorities are called canons of public expenditure.

Fundamental standards of public spending determine the effectivity and propriety of the expenditure itself. While making its spending programme, government need to follow these principles. These principles, in short, are called canons of public expenditure.

Findlay Shirras has laid down the following 4 canons of public expenditure:

(i) Canon of benefit

(ii) Canon of economy

(iii) Canon of sanction

(iv) Canon of surplus

(i) Canon of Benefit:

According to this canon, public spending has to be made in such a way that it confers biggest social benefits. In different words, public expenditure should not be geared in such a way that it provides advantages to a particular crew of the community. Thus, public expenditure is to be made in these directions where commonplace benefits rather than specific benefits float in.

However, frequently public expenditure is incurred for the benefit of a precise group (say, dalits, tribals). This type of public expenditure does not violate canon of benefit. Any public expenditure for the improvement of a backward place does promote social interest.

(ii) Canon of Economy:

Economy does not suggest miserliness. It refers to the avoidance of wasteful and extravagant expenditure. Public expenditure have to be made in such a way that it turns into productive and efficient. Efficiency in public expenditure requires economic system of expenditures. To enjoy the maximum aggregate gain from any public spending programme, it is necessary that the canon of economy is observed.

An uneconomic growth in public expenditure will end result in shortage of funds, the much-needed boom of the productive sectors will be hampered. This ability lower social benefit. It is for that reason apparent that the canon of financial system is now not unbiased of the canon of benefit.

(iii) Canon of Sanction:

The canon of section, as counseled by Shirras, requires that public spending must now not be made besides any concurrence or sanction of an suitable authority. Arbitrariness in public spending can be avoided solely if spending is approved. Further, economy in public spending can by no means be ensured if it is not sanctioned.

(iv) Canon of Surplus:

This canon suggests the avoidance of deficit in public spending. Like individuals, saving is a advantage for the government. So the government should prepare its price range in such a way that authority’s income exceeds government expenditure so as to create a surplus. It should now not run deficit to cowl its expenditure.

However, cutting-edge economists do now not like to connect any significance to Shirras’ fourth canon— the canon of surplus. To them, deficit financing is the most high quality potential of financing monetary programmes of the government.

Types of Public Expenditure:

Public expenditure may additionally be categorized into developmental and non-developmental expenditures. Former consists of the expenditure incurred on social and community services, monetary services, etc. Non-developmental expenditure consists of charges made for administrative service, defence service, debt servicing, subsidies, etc.

Public expenditure is categorized into income expenditure and capital expenditure. Revenue expenditure consists of civil expenditure (e.g., regularly occurring services, social and neighborhood services and financial services), defense expenditure, etc. On the different hand, capital expenditure contains bills incurred on social and community development, economic development, defense, familiar services, etc.

By incurring such expenditure,

The government creates a healthy conditions or surroundings for economic activities. Due to financial growth,

The government may also be in a position to generate income in shape of obligations and taxes.

Productive and Unproductive Expenditure

This classification used to be made by means of Classical economists on the basis of introduction of productive capacity.

Productive Expenditure:-

Expenditure on infrastructure development, public companies or development of agriculture extends productive capacity in the economy and bring income to the government. Thus they are labeled as productive expenditure.

Unproductive Expenditure:-

Expenditures in the nature of consumption such as defence, pastime payments, expenditure on regulation and order, public administration, do now not create any productive asset which can deliver income or returns to the government. Such expenses are labeled as unproductive expenditures.

4 Development and Non-Development Expenditure

Modern economists have modified this classification into big difference between improvement and non-development expenditures.

Development Expenditure:-

All expenditures that promote economic boom and improvement are termed as development expenditure. These are the same as productive expenditure.

Non-Development Expenditure:-

Unproductive costs are termed as non-development expenditures.

5. Grants and Purchase Price

this classification has been cautioned by way of economist Hugh Dalton.

Grants:-

Grants are those payments made by a public authority for which there may no longer be any quid-pro-quo, i.e., there will be no receipt of items or services. For example, old age pension, unemployment benefits, subsidies, social insurance, etc. Grants are switch expenditures.

Purchase costs:

Purchase expenditures are bills for which the government receives goods and services in return for example, salaries and wages to authorities employees and purchase of consumption and capital goods.

6. Classification According to Benefits

Public expenditure can be classified on the foundation of advantages they confer on special companies of people.

Common advantages to all: Expenditures that confer common advantages on all the people. For example, expenditure on education, public health, transport, defense, law and order, usual administration

Special benefits to all: Expenditures that confer different advantages on all. For example, administration of justice, social safety measures, community welfare.

Special advantages to some:

Expenditures that confer direct distinctive advantages on sure people and additionally add to prevalent welfare. For example, historical age pension, subsidies to weaker section, unemployment benefits.

7. Hugh Dalton's Classification of Public Expenditure

Hugh Dalton has labeled public expenditure as follows:-

Expenditures on political executives : i.e. upkeep of ceremonial heads of state, like the president.

Administrative expenditure: to keep the commonplace administration of the country, like authorities departments and offices.

Security expenditure: to preserve armed forces and the police forces.

Expenditure on administration of justice: include protection of courts, judges, public prosecutors.

Developmental bills: to promote growth and improvement of the economy, like expenditure on infrastructure, irrigation, etc.

Social expenses: on public health, neighborhood welfare, social security, etc.

Public debt costs: consist of price of interest and compensation of precept amount.

Effects of Public Expenditure On Economy

1. Effects on Production

The impact of public expenditure on production can be examined with reference to its consequences on capability & willingness to work, store & make investments and on diversion of resources.

Ability to work, store and make investments: Socially proper public expenditure increases community's productive capacity. Expenditure on education, health, communication, will increase people's productivity at work and therefore their incomes. With upward jostle in earnings savings additionally extend and this in flip has a really useful impact on investment and capital formation.

Willingness to work, retailer and invest: Public expenditure, sometimes, brings negative results on people's willingness to work and save. Government expenditure on social security amenities may additionally bring such destructive effects. For e.g. Government spends a giant portion of its income closer to provision of social protection benefits such as unemployment allowances old age pension, insurance plan benefits, sickness benefit, scientific benefit, etc. Such benefits limit the desire to work. In different phrases they act as disincentive to work.

Effect on allocation of resources among unique industries & trade:

Many an instances the government expenditure proves to be an effective instrument to inspire investment on a particular industry. For e.g. If authorities decides to promote exports, it presents benefits like subsidies, tax advantages to appeal to investment in the direction of such industry. Similarly authorities can additionally promote a specific vicinity by offering a variety of incentives for those who make funding in that region.

Effects on Distribution

The foremost purpose of the government is to maximise social advantage via public expenditure. The goal of most social welfare can be performed solely when the inequality of profits is removed or minimised. Government expenditure is very useful to fulfill this goal.

Government collects excess income of the rich thru earnings tax and income tax on luxuries. The cash as a result mobilised are directed towards welfare programmes to promote the trendy of terrible and weaker section. Thus public expenditure helps to achieve the objective of equal distribution of income.

Expenditure on social protection & subsidies to negative are aimed at increasing their real profits & buying power. Public expenditure on education, communication, health has a effective effect on productiveness of the weaker area of society, thereby growing their income earning capacity.

Effects on Consumption

Public expenditure allows redistribution of income in favour of poor. It improves the capability of the bad to consume.

Thus public expenditure promotes consumption and thereby other economic activities. The authorities expenditure on welfare programmes like free education, health care and housing in reality improves the trendy of the bad people. It also promotes their capacity to consume and save.

Effects on Economic Stability

Economic instability takes the structure of depression, recession and inflation. Public expenditure is used as a mechanism to manipulate instability. The current economist Keynes recommended public expenditure as a better machine to increase high quality demand & to get out of depression. Public expenditure is also beneficial in controlling inflation & deflation. Expansion of Public expenditure at some stage in deflation & reduction of public expenditure at some point of inflation control money supply & bring fee stability.

Effects on Economic Growth

The goals of planning are successfully realised only thru government expenditure. The government allocates funds for the growth of a number of sectors like agriculture, industry, transport, communications, education, energy, health, exports, imports, with a view to obtain astonishing growth.

Government expenditure has been very helpful in preserving balanced economic growth. Government takes eager interest to allocate greater resources for improvement of backward regions. Such efforts reduces regional inequality and promotes balanced financial growth.

Effects of Public Expenditure on Distribution

Public expenditure can have a very wholesome affect on the distribution of wealth in the community.

It can decrease inequalities of incomes. It is an admitted fact that the benefit to the poor from State things to do is a long way higher than to the rich. A prosperous man can guard himself.

He can make preparations for the schooling and medical relief of himself and his family.

But a bad man is helpless. It is, therefore, the terrible man who advantages the most from the State activity. To this extent, the State expenditure seeks to bridge the gulf between the rich and the poor.

There is a positive expenditure which benefits the terrible completely and primarily, e.g. Terrible relief, old-age pensions and unemployment and illness benefits. The advantages derived from such social services by way of the poor might also be considered as a internet addition to their incomes. And when we take into account that the revenue is obtained with the aid of taxing the rich, the conclusion is inescapable that inequalities of wealth distribution have been reduced to some extent.

Corresponding to the precept of minimal sacrifice in taxation, there is the principle of most benefit in public expenditure. Public expenditure should be so arranged as to confer a most benefit on the neighborhood as a whole. This is the guiding principle. Judged in this light, we can see that expenditure on debt services is regressive, due to the fact it gives greater earnings to the already rich. Granting of old-age pensions and advantages of social insurance plan are progressive. If a authorities subsidizes the production of commodities mostly consumed with the aid of the poor, it is revolutionary otherwise regressive.

We have also to think about the response of public expenditure on character income. If a authorities supply reduces the individual’s want to work and save, it may additionally lead to discount of incomes of the beneficiaries. In this case, the inequalities of wealth distribution are now not reduced. On the whole, public expenditure in modern-day times tends to make the distribution of wealth in the communes more equitable.

Growth of Public Expenditure:

Public expenditure has phenomenally accelerated all the world over. A pertinent query is what the causes of this out of the ordinary growth are in public expenditure. It will be beneficial to talk about this with reference to India. This is because the elements responsible for a large amplify in public expenditure over time in India are generally applicable to different nations too. It will be interesting to point out here two legal guidelines about the growth of public expenditure.

4.8 WAGNER’S LAW OF INCREASING STATE ACTIVITY:

First, there is Wagner’s Law of Increasing State Activity. According to Wagner, a German economist, there are inherent dispositions for the things to do of the Government to expand both extensively and intensively. In different words, according to this law as an financial system develops over time, the activities or functions of the Government increase.

With the improvement of the economy, new functions and things to do are undertaken by the Government and historic functions are carried out more thoroughly. The enlargement in the Government features and things to do leads to the increase in public expenditure. Though Wanger primarily based his regulation on the historical evidence drawn from financial boom of Germany, this applies equally to different countries, each developed and developing ones.

4.9 WISEMAN-PEACOCK HYPOTHESIS:

The 2nd hypothesis about the increase of public expenditure has been put ahead via Wiseman and Peacock in their find out about of public expenditure of U.K. According to this Wiseman-Peacock hypothesis, Government expenditure does no longer enlarge at a constant price always however in jerks and step-like manner.

However, in the view of the existing author, each these factors, one making for a non-stop make bigger in Government pastime and as a result public expenditure as emphasised by using Wagner and others like struggle and depression causing the public expenditure to upward shove via jerks as emphasized by way of Wiseman and Peacock have been responsible for the extensive make bigger in public expenditure. In what follows, we shall give an explanation for

the elements accountable for growth in public expenditure

1. Defense:

An vital component responsible for public expenditure is the mounting defence expenditure incurred through countries all the world over. It is now not only during proper wars that defense expenditure has been rising but even at some point of peace time, the international locations have to stay in the state of navy preparedness disturbing massive defence expenditure.

There is palms race going on between countries. A terrible united states like India has to guard its difficult earned freedom and this includes a lot of expenditure on constructing up efficient and enough armed forces. India is wedged in between two enemies, namely, expansionist China and aggressive Pakistan, which have been strengthening their armed forces.

India had to battle three wars on the grounds that independence. India has as a result to remain in a nation of army preparedness. Internally also in view of conflict of linguistic, territorial and political interests, lot of expenditure has to be incurred on retaining interior security.

2. Population Growth and Urbanization:

Another element responsible for the enlarge in public expenditure is the increase in populace and urbanization of the economies. Population has been growing in almost all international locations of the world, even though at various rates.

In India the populace has been growing at an alarming rate when you consider that independence. The population of India which was once 36 crores in 1951 has now long gone upto about 100 crores in 2001. The scale of authorities things to do such as presenting education, public health, roads and transport amenities has to expand in concord with the boom of population. Further, when population increases, more has to be spent on administrative offerings (police, jails, judiciary etc.) to preserve law and order in the country.

With the development of the economy and the increase of population, the extent of urbanization increases. In India, the percentage of city population to the complete population has raised from 11.3 per cent in 1921 to 25.5 per cent in 1991 and to 27.8 per cent in 2001.

As an end result of the increasing urbanization, the current cities increase and the new ones come up. Urbanization calls for greater per capita expenditure on social and administrative services. Therefore, the increase in urbanization in India has tended to enlarge the government expenditure.

3. Activities of a Welfare State:

The Government things to do and functions have been increasing due to the exchange in the nature of State. The contemporary States are no longer Police States involved mainly with the upkeep of regulation and order. They have now end up Welfare States.

A Welfare State is one which presents for social insurance of its citizens towards historic age, sickness, unemployment etc. The modern-day Governments have therefore to incur a lot of expenditure on social safety measures such as old age pensions, unemployment allowances, illness benefits.

4. Maintaining Economic Stability:

As pointed out by way of Wagner, state functions extend with the development and growth of the economy. In the nineteenth and early twentieth century, the Government observed laissez-fair policy. Now, need for energetic intervention of the Government has been more and more felt.

Thanks to J.M. Keynes whose macroeconomic concept clearly introduced out that the working of free-market mechanism does not ensure monetary balance at full employment level. According to his theory, lapses from full employment or depressions are brought about by way of deficiency of aggregate demand due to the slackened non-public funding activity.

In order to compensate for this shortfall in non-public investment, the Government has to step up its expenditure on public works. The expand in Government expenditure raises aggregate demand manifold thru the working of what Keynes has called earnings multiplier.

This helps to push the economic system out of depression and to elevate stages of income and employment. Now, this compensatory fiscal coverage is being observed through all the world over, on the grounds that fulfillment of full employment and preservation of economic balance has turn out to be a necessary goal of the Government.

It is in line with the goal of employment that in India, the Government has taken over various private ailing mills and incurs a lot of expenditure on them so that employees employed in them are no longer rendered unemployed.

Further, the Indian Government, each Central and States, incur a lot of expenditure on alleviation public works in rural areas when drought and different natural calamities occurs. Besides, a lot of public expenditure is being incurred on one of a kind employment schemes to promote employment in the economy.

5. Economic Growth and Development:

The most important factor in developing international locations such as ours that has led to a out of the ordinary amplify in public expenditure is the growth in developmental activities of the Government. In nations like India which have socialistic tendencies the public region plays a vital position in promotion economic increase and development.

Not only public utility services such as water supply, electricity, post and petroleum and transport services have been undertaken by means of the public sector, however also the Government has invested a huge sum of resources in industrial and agricultural improvement of the economy.

Several steel plants, multipurpose irrigation projects, fertilizer factories, coal mining, exploration and production of oil and petroleum, distinct sorts of machine-making industries and chemical vegetation have been commenced and are being operated in the public sector.

On these a big quantity of expenditure is being incurred with the aid of the Government in India. Owing to these developmental activities of the Government in India, the percentage of developmental expenditure to the total Government expenditure has extensively increased. In 2003-04, Central Government’s graph expenditure, which is primarily developmental expenditure, was 122.3 thousand crores which rose to 137.4 thousand crores in 2004-05.

6. Mounting Debt Service Charges:

The Governments in all creating nations (including India) has been borrowing closely in current years to finance their growing activities. Not only the debt cash has to be paid back when it matures, activity repayments have additionally to be made annually to the creditors.

These debt provider costs have resulted in extensive expand in public expenditure. It be mentioned that the Government in India has not solely been borrowing from within the us of a but additionally from abroad thru foreign aid or commercial loans from private capital markets to finance her improvement plans. It has been estimated that for the year 1998-99, Rs. 75 thousand crores had been spent on the activity payments which went up to Rs. 125.9 crores in 2004-05 via the Central Government.

7. Mounting Expenditure on Subsidies:

Governments, both in the developed and developing countries, incur a lot of expenditure on subsidies to the more than a few sections of population. In India, the Government has been offering subsidies on food, fertilizers, exports and education, and expenditure on them has been growing at a speedy rate which is the predominant reason of large fiscal deficit in India.

For example whilst in 2002-2003, the Central, Government expenditure on subsidies used to be of the order of Rs. 44.6 thousand crores and for the yr 2004-2005 it was estimated to go up to Rs. 46.5 thousand crores.

The expenditure of Central Government’s expenditure on subsidies on food, fertilizers, exports now account for about 7 per cent of price range expenditure. While the aim of giving food subsidy is to assist the humans under the poverty line, the goal of fertilizer subsidy is to promote the increase of agriculture and assist small farmers.

8. Anti-Poverty Schemes:

Another important cause of increasing public expenditure in India is large expenditure which he Government is incurring on employment producing anti- poverty schemes. It has now been realized that financial increase alone will now not eradicate poverty, at least in the brief run. Therefore, a number of employment schemes have been started through the Government for the humans dwelling under the poverty line.

Prominent amongst these anti-poverty schemes in India are Jawahar Rozgar Yojna, Prime Minister’s Employment Scheme and Integrated Rural Development Scheme (IRDP). Expenditure on these schemes has significantly risen in current years.

4.10 SIGNIFICANCE OF PUBLIC EXPENDITURE:

An old fashioned dictum says that “The very great of all plans of finance is to spend little, and the satisfactory of all taxes is that which is least in amount.” No one nowadays believes this philosophy. In the 1930s, J. M. Keynes emphasized the importance of public expenditure.

The current state is described as the ‘welfare state’. As a result, the things to do of the current government have widened enormously. Modern governments are venture more than a few social and economic activities, especially in less developed nations (LDCs).

i. Economic Development:

Without government aid and backing, a negative us of a cannot make big investments to deliver about a beneficial trade in the monetary base of a country. That is why massive investments are made through the government in the development of basic and key industries, agriculture, consumable goods, etc.

Public expenditure has the expansionary effect on the boom of country wide income, employment opportunities, etc. Economic improvement additionally requires improvement of monetary infrastructures. A developing country like India should undertake quite a number projects, like road-bridge-dam construction, power plants, transport and communications, etc.

These social overhead capital or monetary infrastructures are of integral significance for accelerating the pace of financial development. It is to be remembered here that personal investors are incapable of making such large investments on the quite a number infrastructural projects. It is necessary that the government undertakes such projects. Greater the public expenditure, greater is the level of monetary development.

ii. Fiscal Policy Instrument:

Public expenditure is considered as an vital tool of fiscal policy. Public expenditure creates and will increase the scope of employment opportunities during depression. Thus, public expenditure can prevent periodic cyclical fluctuations. During depression, it is recommended that there must be greater and greater governmental expenditures on the floor that it creates jobs and incomes.

On the contrary, a cut-back in government’s expenditure is critical when the economic system faces the hassle of inflation. That is why it is stated that via manipulating public expenditure, cyclical fluctuations can be lessened greatly. In different words, version of public expenditure is a phase of the anti- cyclical fiscal policy.

It is to be kept in idea that it is now not just the quantity of public expenditure that is incurred which is of importance to the economy. What is equally, if not more, necessary is the purpose of such expenditure or the high-quality of expenditure. The best of expenditure determines the adequacy and effectiveness of such expenditure. Excessive expenses may additionally purpose inflation.

Moreover, if the government has to impose taxes at high costs there will be loss of incentives. So, it is fundamental to keep away from unnecessary expenditure as far as practicable, in any other case benefits of higher financial improvement might also no longer be reaped. As a fiscal coverage instrument, it may also be counter-productive.

iii. Redistribution of Income:

Public expenditure is used as an effective fiscal instrument to carry about an equitable distribution of income and wealth. There are right a lot public expenditure that benefit bad earnings groups. By supplying subsidies, free training and fitness care facilities to the bad people, authorities can enhance the financial position of these people.

iv. Balanced Regional Growth:

Public expenditure can correct regional disparities. By diverting sources in backward regions, authorities can bring about all-round improvement there so as to compete with the advanced regions of the country.

This is what is required to keep integration and team spirit amongst human beings of all the regions. Unbalanced regional boom encourages disintegrating forces to rise. Public expenditure is an antidote for these reactionary elements.

Thus, public expenditure has each monetary and social objectives. It is vital to make sure that the government’s expenditure is made fully in the public activity and does now not serve any individual’s interest or that of any political party or a crew of persons.

4.11 SOCIAL SECURITY CONTRIBUTIONS

Social security is "any authorities system that offers monetary assistance to human beings with an inadequate or no income"

Introduction to India’s Social Security System

India’s social security system is composed of a number of schemes and applications spread in the course of a range of legal guidelines and regulations. Keep in mind, however, that the government-controlled social protection system in India applies to only a small portion of the population.

Furthermore, the social protection device in India includes not simply an insurance plan fee of premiums into authorities funds (like in China), but also lump sum organization obligations.

Generally, India’s social safety schemes cover the following sorts of social insurances:

Pension

Health Insurance and Medical Benefit

Disability Benefit

Maternity Benefit

Gratuity

While a top notch deal of the Indian population is in the unorganized zone and may additionally no longer have an opportunity to participate in every of these schemes, Indian residents in the organized sector (which consist of those employed via foreign investors) and their employers are entitled to insurance underneath the above schemes.

ESI Benefits in India: The Scheme and Provisions

the applicability of obligatory contributions to social insurances is varied. Some of the social insurances require business enterprise contributions from all companies, some from groups with a minimal of ten or more employees, and some from organizations with twenty or greater employees.

In this article, we’ll discuss every of these social insurances, alongside with their coverage, contribution rates, and the laws and regulations behind them.

Pension or Employees’ Provident Fund

The Employees’ Provident Fund Organization, below the Ministry of Labor and Employment, ensures superannuation pension and family pension in case of loss of life in the course of service. Presently, only about 35 million out of a labor pressure of 400 million have access to formal social security in the shape of old-age income protection in India. Out of these 35 million, 26 million people are individuals of the Employees’ Provident Fund Organization, which involves private region workers, civil servants, navy personnel, and employees of State Public Sector Undertakings (PSUs).

The schemes below the Employees’ Provident Fund Organization apply to agencies with at least 20 employees. Contributions to the Employees’ Provident Fund Scheme are obligatory for each the business enterprise and the worker when the employee is incomes up to Rs 15,000 (US$220) per month, and voluntary, when the worker earns more than this amount. If the pay of any employee exceeds this amount, the contribution payable through the organisation will be restricted to the amount payable on the first Rs 15,000 (US$220) only.

The Employees’ Provident Fund Organization includes three schemes:

The Employees’ Provident Fund Scheme, 1952;

The Employees’ Pension Scheme, 1995; and,

The Employees’ Deposit Linked Insurance Scheme, 1976.

The Employees’ Provident Fund (EPF) Scheme is contributed to by using the company (1.67-3.67 percent) and the worker (10-12 percent).

The Employee Pension Scheme (EPS) is contributed to with the aid of the business enterprise (8.33 percent) and the authorities (1.16 percent), however no longer the employee.