Unit 1

THE INDIAN PARTNERSHIP ACT- 1932

Section 4 of the Indian Partnership Act, 1932, defines partnership as the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all. Persons who have entered into partnership with one another are called individually partners and collectively a firm, and the name under which their business is carried on is called the firm name. So, partnership is the contractual agreement between two or more competent individuals for the purpose of carrying on business and sharing of profits on the basis of mutual agency.

When we discuss about the forms a business organisation can take, one of the most prominent ones is a partnership. In India mainly it is a very popular entity to carry out business. Let us take a look at some important elements of a partnership and also some types of partners.

Concept of Partnership

In India, we have a definite law that covers all factors and functioning of a partnership, The Indian Partnership Act 1932. The act also defines a partnership as “the relation between two or more persons who have agreed to share the profits from a business carried on by either all of them or any of them on behalf of/acting for all”

So in such a case two or more (maximum numbers will differ according to the business being carried) persons come together as a unit to achieve some common objective. And the profits earned in pursuit of this objective will be shared amongst themselves.

The entity is collectively called a “Partnership Firm” and all the person members are the “Partners”. So let us look at some important features.

FEATURES OF A PARTNERSHIP

1] Formation/Contract

A partnership firm is now not a separate legal entity. But according to the act, a firm must be fashioned via a legal agreement between all the partners. So a contract must be entered into to form a partnership firm.

Its business activity must be lawful, and the motive has to be one of profit. So two people forming an alliance to carry out charity and/or social work will not constitute a partnership. Similarly, a partnership contract to lift out illegal work, such as smuggling, is void as well.

2] Unlimited Liability

In a unique feature, all partners have unlimited liability in the business. The partners are all individually and jointly liable for the firm and the payment of all debts. This means that even personal assets of a partner can be liquidated to meet the debts of the firm.

If the money is recovered from a single partner, he can, in turn, sue the other partners for their share of the debt as per the contract of the partnership.

3] Continuity

A partnership cannot carry out in perpetuity. The death or retirement or bankruptcy or insolvency or insanity of a partner will dissolve the partnership. The remaining partners may continue the partnership if they so choose, but a new contract must be drawn up. Also, the partnership of a father cannot be inherited by his son. If all the other partners agree, he can be added on as a new partner.

4] Number of Members

As we know that there should be a minimum of two individuals for a partnership. However, the maximum number will vary according to a few conditions. The Partnership Act itself is silent on this issue, but the Companies Act, 2013 provides clarity.

For a banking business, the number of partners must now not exceed ten. For a business of any other nature, the maximum number is twenty. If the number of partners increases it will become an illegal entity or association.

5] Mutual Agency

In a partnership, the business must be carried out by all the partners together. Or alternatively, it can be carried out by any of the partners (one or several) acting for all of them or on behalf of all of them. So this means every partner is an agent as properly as the principal of the partnership.

He represents the other partners in some cases so he is their agent. But in different circumstances, he is bound by the actions of any of the other partners aking him the principal as well.

Some of the major distinction between partnership and a company are as follows:

1. Regulating Act:

A company is regulated by Companies Act, 1956, while a partnership firm is governed by the Indian Partnership Act, 1932.

2. Registration:

A company cannot come into existence unless it is registered, whereas for a partnership firm registration is not compulsory.

3. Number:

The minimum number in a public company is seven and in case of a private companies two. In case of partnership the minimum number of partners is two. The maximum limit of members in case of a private company is fifty but in case of public company there is no maximum limit. In partnership the number should not exceed twenty, while in case of banking business, it should not exceed ten.

4. Liability:

In case of joint stock company the liability of shareholders is limited (except in case of unlimited companies) to the extent of face value of shares or to the extent of guarantee, whereas, in case of partnership the liability of partners is unlimited.

5. Management:

The affairs of a company are managed by its directors. Its members have no right to take part in the day to day management. On the other hand every partner of a firm has a right to participate in the management of the business unless the partnership deed provides otherwise.

6. Capital:

The share capital of a company can be increased or decreased only in accordance with the provisions of the Companies Act, whereas partners can alter the amount of their capital by mutual agreement.

7. Legal Status:

A company has a separate legal status distinct from its shareholders, while a partnership firm has no legal existence distinct from its partners.

8. Transfer of Interest:

Shares in a public company are freely transferable from one person to another person. In private company the right to transfer shares is restricted, while a partner cannot transfer his interest to others without the consent of other partners.

9. Insolvency/Death:

Insolvency or death of a shareholder does not affect the existence of a company. On the other hand a partnership ceases to exist if any partner retires, dies or is declared insolvent.

10. Winding up:

A company comes to an end only when it is wound up according to the provisions of the Companies Act. A firm is dissolved by an agreement or by the order of court. It is also automatically dissolved on the insolvency of a partner.

11. Books:

The provisions of Companies Act, 1956 have their bearing on the preparation of accounts books of a company but in case of firm there is no specific legal direction to this effect.

12. Audit:

Audit of accounts of a company is compulsory whereas it is generally, discretionary in case of a firm.

13. Authority of Members:

A shareholder is not an agent of a company and has no power to bind the company by his acts. A partner is an agent of a firm. He can enter into contracts with outsiders and incur liabilities so long as he acts in the ordinary course of firm’s business.

14. Commencement of Business:

A company has to comply with various legal formalities and has to file various documents with the Registrar of Companies before the commencement of business while a firm is not required to fulfil legal formalities.

The true test of a partnership is a way for us to determine whether a group or association of persons is a partnership firm or not. It also helps us recognize the partners of the firm and separate them from the third parties.

The idea behind such a true test is to examine the relevant facts and determine the real relations between parties and conclude about the presence of a partnership.

Let us take a look at the three important aspects of a real test of a partnership, namely agreement, profit sharing and mutual agency.

1] Agreement/Contract between Parties

For there to be a partnership between two or more people there has to be an agreement of partnership between them. The partnership cannot arise family status or any operation of law. There has to be a specific agreement between the partners.

So if family members of a HUF are running a business together this is not a partnership. Because, there is no agreement of partnership between them the members of HUF are born into the HUF, so they cannot be partners.

2] Profit Sharing

Sharing of profits is an aspect of the true test of a partnership. However, profit sharing is only a prima facie evidence of a partnership. The Act does not consider profit sharing as a conclusive evidence of a partnership. This is because there are cases of profit sharing that are still contradictory to a partnership. Let us see some such cases

Sharing of profits/ gross receipts from a property that two or more persons own together or have a joint interest in is not a partnership

A share of profits given to an agent or servant does not make him a partner

If a share of the profit is given to a widow or child of a deceased partner does not make them partners

Part of the profits shared with the preceding owner as a part of goodwill or as a form of consideration will not make him a partner.

Now ascertaining this rationale becomes difficult if there is no express agreement between the concerned parties. In such a case we will consider the cumulative effect of all relevant facts. This will help us to determine the true relationship between the parties.

3] Mutual Agency

True Test of Partnership: Mutual Agency

This is the truest test of a partnership, it I the cardinal principle of a partnership. So if a partner is both the principle as well as an agent of the firm we can say that mutual agency exists. This means that the actions of any partner/s will bind all the other partners as well.

So whenever there is confusion about the existence of a partnership between people we check for the presence of a mutual agency. If such an agency exists between the parties who run a business together and share profits it will be deemed that a partnership exists.

Various types of partnerships exist, including limited partnership, limited liability partnership, joint liability, limited liability, and joint ventures. The most important thing to understand is that partnerships are agreements between two or more parties to achieve a particular business goal. General partnerships are:

Equal agreements

Various responsibilities can be delegated among members

Partnerships force all parties to share sure risks and rewards during business endeavors

For instance, a partner can handle the investment angle by pouring capital in the business, while another can act in a management capacity. In addition, a single partner can bind group partners into a single legal obligation. Under partnerships, each party takes responsibility for individual obligations or debts.

Limited Partnerships (LPs)

A limited partnership allows each partner to avoid personal liability to the amount of his or her business investment. Such an arrangement requires one individual to take the role of general status, opening his or herself up to potential personal liabilities, while the limited partner takes less of a risk. However, the accepted partner retains control of the business, and the limited partner is generally not involved in management operations.

Limited Liability Partnerships (LLP)

LLPs come with tax advantages in the same manner as general partnerships combined with liability protections. For example, individuals are not responsible for any debts or liabilities arising from the business. LLPs are usually found among law or accounting partnerships. Where taxation is concerned, the IRS recognizes such businesses as partnerships and approves members to file taxes individually on personal returns. GPs, LLPs, and LPs are taxed in the same manner, however partnerships do not pay taxes.

LLPs permit members to work together while retaining a measure of independence when it comes to liability. With that, not all parties are held equally responsible, and other members are not held liable for the actions of others. Before engaging in any type of partnership, know the terms before agreeing or signing any document.

Limited Liability Protection

If you are concerned about limited liability protection, remember that general partnerships do not afford you any protective measures. In a general capacity, partners can be held responsible for movements or decisions of other partners. General partnerships pose the highest risk to general partners, but they are the easiest to create. LLCs have become a popular alternative to general partnerships. LLCs are ideal for those who wish to invest in a business, but do not want face exposure to any legal ramifications.

Joint Ventures as Partnerships

According to the Small Business Administration, a joint venture is another form of partnership. Joint ventures occur when a range of entities converge in pursuit of a set goal. For example, businesses may forge a partnership to construct a building.

Qualified joint ventures are a special partnership that allows spouses to co-own a business but to file separate returns to avoid partnership returns.

Joint Liabilities

A joint liability partnership holds all partners equally liable for any financial and legal issues. Joint liability partnerships bind all parties into equal liability. Moreover, each party can be held responsible in pending lawsuits or other legal consequences. Joint liabilities are different than several liability principles in the respect that partnerships are held on equal footing at all times.

Several liabilities, on the other hand, is the agreement to settle any legal disputes and is based on a partner’s standing or contribution to a partnership.

Limited Liability Company

A limited liability company (LLC) offers each the most benefits and the most protection for a business owner.

A limited liability company allows members to forge a single entity while taking benefits of liability protection. LLCs provide the same tax havens as partnerships, but with the brought liability benefits of a corporation. Corporate law dictates that corporations are held liable for startup investments only. For example, a $10 million business does not give others the right to sue you for over $2 million if you started that business for only $2 million.

The LLC provides for the same tax protection as a partnership, but also gives the liability protection of a corporation. Under corporate law, a corporation is only liable for the total startup investment in the company. Also, certain states allow members to create what is recognized as a Professional LLC, which gives certain professionals such as doctors or lawyers more limitations than regular businesses.

Partnership is an agreement between persons to carry on a business. The agreement entered into between partners may be either oral or written. But, it is always suitable to have a written agreement so as to avoid misunderstandings and unnecessary litigations in future. When the agreement is in written form, it is known as ‘Partnership Deed.’ It must be duly signed by the partners, stamped and registered. Any alteration in partnership deed can be made with the mutual consent of all the partners.

Although it is left to the choice of the partners of the firm to decide themselves as to what should be mentioned in their partnership deed, yet a partnership deed usually contains the following:

1. Name of the firm.

2. Nature of the business.

3. Names of partners.

4. Place of the business.

5. Amount of capital to be contributed by each partner

6. Profit sharing ratio between the partners.

7. Loans and advances from the partners and the price of interest thereon.

8. Drawings allowed to the partners and the rate of interest thereon.

9. Amount of salary and commission, if any, payable to the partners.

10. Duties, powers and obligations of partners.

11. Maintenance of accounts and arrangement for their audit.

12. Mode of valuation of goodwill in the event of admission, retirement and demise of a partner.

13. Settlement of accounts in the case of dissolution of the firm.

PROCEDURE OF REGISTRATION OF A FIRM

Registration of a firm means getting the firm registered with the government. Section 56-71 of the Act deal with the registration of firms. The process of registering a firm is extremely simple. The registration of a firm may be filed at any time by submitting an application comprising of a statement in a prescribed form along with the prescribed fees to the registrar.

The application for registration must have the following:-

- The name of the firm

- The place or principal place of business of the firm;

- The name of any other place where the firm carries on business;

- The date on which each partner joined the firm;

- The duration of the firm;

- The full names and addresses of the partners;

- The statement shall be signed by all the partners or by their agent on their behalf.

Once the registrar is satisfied that the due procedure has been complied with, he shall record an entry of the statement in the register of firms and issue a certificate of registration.

EFFECTS OF NON-REGISTRATION

Registration of a firm is not compulsory in India. While the Act does not impose any penalty for non-registration, there are certain legal disabilities arising from non-registration which are so great that generally the partners of a firm would want to have their firm registered.

Section 69 of the Indian Partnership Act is designed to exert pressure on partners to get the firm registered.

If the firm is not registered there are the following consequences or effects:-

- No suit by a partner

Under Section 69(1), a partner or any person on his behalf cannot file a suit against the firm or any person alleged to be a partner of the firm to enforce a right arising from a partnership contract or under the Partnership Act unless the firm is a registered one and the person has his name filed as a partner in the register of firms as held in the case of Jagat Mittar Saigal v. Kailash Chander Saigal. Thus, if a firm is unregistered or the name of a partner isn’t lodged in the register of firms, that partner cannot sue the firm or another partner of the firm if any of his rights are violated.

2. No suit by the firm

Under Section 69(2), a firm or any other person on its behalf cannot file a suit against a third party for enforcing any contractual rights unless that firm is a registered one as held in the case of Beacon Industries v. Anupam Ghosh and Bharat Sarvodaya Mills Co. Ltd v. M/s Mohatta Brothers. This can be overcome only by registration of the firm before filing a suit. No such disability has been imposed upon a third party. Any person can bring a suit even against an unregistered firm or any of its partners.

3. No claim of set-off or other proceedings to enforce a right arising from a contract

Under Section 69(3), a claim of set-off or any other proceeding to enforce a right arising from a contract cannot be filed unless the firm is a registered firm. A set-off is an equitable defence to the whole or to a portion of a plaintiff’s claim. It is the right of a debtor to balance mutual debts with a creditor. Other proceedings include arbitration proceedings. So, if in a dispute, one of the partners referred the matter to arbitration as per the agreement clause but the other partner did not agree, the suit to enforce the arbitration agreement would fail as the firm wasn’t a registered firm as held by the Supreme Court in the case of Jagdish Chandra Gupta v. Kajaria Traders (India) Ltd.

There are a few exceptions to the above mentioned situations:-

- Suit for dissolution of firm and accounts

Section 69(3)(a) permits a suit for the dissolution of firms and accounts thereof. A partner can sue another partner after the dissolution of the unregistered firm for settlement of accounts as held in the case of K.L. Verma and Anr.v Shri V.K. Sharma and Anr.

B. Suit for realisation of the property of an insolvent partner

An official assignee receiver or Court under the Insolvency Act, 1920, may bring an action to realize the property of an insolvent partner.

C. Suit by a firm whose place of business is out of India or where the Act is not operative

If a place of business of the firm is somewhere where the Act does not extend, no disability due to non-registration applies.

D. Suit in which value does not exceed Rs. 100

In case of a small claim upto Rs. 100, the disability to due to non-registration does not apply.

E. Suit for non-contractual rights and statutory rights

Section 69 does not apply to non-contractual and statutory rights. So, an action is maintainable in torts or crime or for the enforcement of a statutory right even in the firm is unregistered as held in the case of Raptokas Brett Co. Ltd vs. Ganesh Property.

Non- registration of partnership firm

In India, it is not compulsory to register the partnership and no penalty is being imposed for non-registration but if we talk about English law it is compulsory to register partnership firm and if it is not registered then the penalty is imposed. Non-registration leads to a certain disability in accordance with Section 69 of the Act.

Effect of non-registration (Section 69)

- No suit can be initiated in civil court by the firm or other co-partners against the third party

- In case of breach of contract by the third party; the suit cannot be brought in any civil suit. The suit must be filed by the one whose name is registered as a partner in a register of the firm.

- No partners can claim a relief of set-off.

- Any action which is brought out by the third party against the firm having a value of Rs 100 cannot be set off by the firm or any of its partners.

- An aggrieved person cannot sue against firms or other partners

Generally, no action can be brought against the firm or the partners but there is an exception to it. In a case when the firm is dissolved it can bring a suit for the realization of his share in the firm’s property.

Non-registrations do not affect the following rights

- A third party can bring a suit against the firm

- Right of the partners or firm to claim a relief of set off the claim for the value which does not exceed Rs 100

- Power of official liquidator, official assignees to release the property of insolvent partners and brings a legal action

- Partner right to claim for the realization of his share in case of dissolution of the firm

Broadly, the provisions of the Act regarding rights, responsibilities and powers of partners are as under:

(a) Every partner has a right to take part in the habits and management of business.

(b) Every partner has a right to be consulted and heard in all matters affecting the business of the partnership.

(c) Every partner has a right of free access to all records, books and accounts of the business, and additionally to examine and copy them.

(d) Every partner is entitled to share the profits equally.

(e) A partner who has contributed more than the agreed share of capital is entitled to interest at the rate of 6 per cent per annum. But no interest can be claimed on capital.

(f) A associate is entitled to be indemnified by the firm for all acts done by him in the direction of the partnership business, for all payments made by him in respect of partnership debts or liabilities and for expenses and disbursements made in an emergency for protecting the firm from loss provided he acted as a person of regular prudence would have acted in similar circumstances for his own personal business.

(g) Every partner is, as a rule, joint owner of the partnership property. He is entitled to have the partnership property used exclusively for the purposes of the partnership.

(h) A partner has power to act in an emergency for protecting the firm from loss, but he must act reasonably.

(i) Every partner is entitled to prevent the introduction of a new partner into the firm without his consent.

(J) Every partner has a right to retire according to the Deed or with the consent of the other partners. If the partnership is at will, he can retire by giving note to other partners.

(k) Every partner has a right to continue in the partnership.

(l) A retiring partner or the heirs of a deceased partner are entitled to have a share in the profits earned with the aid of the proportion of assets belonging to such outgoing partner or interest at six per cent per annum at the option of the outgoing partner (or his representative) until the accounts are finally settled.

(a) Every partner is bound to diligently raise on the business of the firm to the greatest common advantage. Unless the agreement provides, there is no salary.

(b) Every partner must be just and faithful to the other partners.

(c) A partner is bound to keep and render true, proper, and correct accounts of the partnership and must permit other partners to check out and copy such accounts.

(d) Every partner is bound to indemnify the firm for any loss prompted by his willful neglect or fraud in the conduct of the business.

(e) A partner ought to not carry on competing business, nor use the property of the firm for his private purposes. In each cases, he must hand over to the firm any profit or gain made by him but he must himself suffer any loss that might have occurred.

(f) Every partner is bound to share the losses equally with the others.

(g) A partner is bound to act within the scope of his authority.

(h) No partner can assign or transfer his partnership interest to any other person so as to make him a partner in the business.

A new partner may be admitted into partnership firm only with the consent of all the partners. A new partner admitted will not be liable for any acts of other partners or firms before his admission.

What are the rights and liabilities of a new partner?

The liabilities of new partner commences from the date when he is admitted as a partner in a partnership firm.

After the admission of a new partner, the new firm is liable for the debts of the old firm and the creditor has to discharge the old firm and accept a new firm as its debtor. It can be called as a novation. It can be done only when the creditor gives the consent to it.

RETIREMENT OF PARTNER (SECTION 32)

Section 32 of Act talks about the retirement of partners when the partner withdraws from the partnership by dissolving it then it is dissolution but not a retirement.

Any partner may retire:

- When there is a partnership at will, by serving a notice to all the existing partners

- When there is an express agreement among the partners

- When the consent of all the partners is given

LIABILITIES OF RETIRED PARTNER

A retired partner continues to be liable for the acts of firms and other partners till he or any other partners give public notice about his retirement. When the third party does not know that he was a partner and deals with the firm; then in such case a retired partner is not liable. If it is a partnership at will then there is no requirement to give public notice about his retirement.

The outgoing partner may enter into an agreement to not carry similar business or activities within a specified period of time.

EXPULSION OF PARTNER (SECTION 33)

A partner can be expelled only when below three conditions are satisfied:

- Expulsion of the partner is necessary for the interest of the partnership

- Notice is served to the expelled partner

- An opportunity of being heard is given to the expelled partner

If the above three conditions are not fulfilled then such expulsion will be considered as null and void.

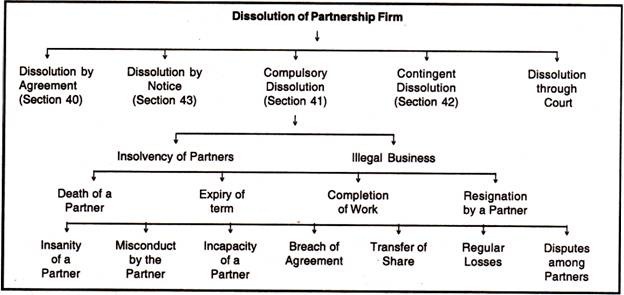

When the partnership between all the partners of a firm is dissolved, then it is called dissolution of a firm. It is important to word that the relationship between all partners should be dissolved for the firm to be dissolved. Let us look at the legal provisions for the dissolution of a firm.

The dissolution of a firm means discontinuance of its activities. When the working of a firm is stopped and the assets are realised to pay a range of liabilities it amounts to dissolution of the firm. The dissolution of a firm should not be confused with the dissolution of partnership. When a partner agrees to continue the firm underneath the same name, even after the retirement or death of a partner, it amounts to dissolution of partnership and not of firm.

The remaining partners may purchase the share of the outgoing or deceased partner and proceed the business under the same name; it involves solely the dissolution of partnership. The dissolution of firm includes the dissolution of partnership too. The partners have a contractual relationship among themselves. When this relationship is terminated it is an end of the firm.

A firm may be dissolved under the following circumstances:

(a) Dissolution by Agreement (Section 40):

A partnership firm can be dissolved by an agreement among all the partners. Section 40 of Indian Partnership Act, 1932 approves the dissolution of a partnership firm if all the partners agree to dissolve it. Partnership concern is created by settlement and similarly it can be dissolved by agreement. This type of dissolution is known as voluntary dissolution.

(b) Dissolution by way of Notice (Section 43):

If a partnership is at will, it can be dissolved by any partner giving a notice to other partners. The notice for dissolution must be in writing. The dissolution will be effective from the date of the notice, in case no date is mentioned in the notice, and then it will be dissolved from the date of receipt of notice. A notice as soon as given cannot be withdrawn without the consent of all the partners.

(c) Compulsory Dissolution (Section 41):

A firm may be compulsorily dissolved beneath the following situations:

(i) Insolvency of Partners:

When all the partners of a firm are declared insolvent or all but one partner are insolvent, then the firm is compulsorily dissolved.

(ii) Illegal Business:

The activities of the firm may end up illegal under the changed circumstances. If government enforces prohibition policy, then all the firms dealing in liquor will have to close down their business because it will be an unlawful undertaking under the new law. Similarly, a firm may be trading with the businessmen of any other country. The trading will be lawful under present conditions.

After some time a war erupts between the two countries, it will become a trading with an alien enemy and further trading with the same events will be illegal. Under new circumstances the firm will have to be dissolved. In case a firm carries on more than one type of business, then illegality of one work will not amount to dissolution of the firm. The firm can continue with the activities which are lawful.

(d) Contingent Dissolution (Section 42):

In case there is no agreement among partners related to certain contingencies, partnership firm will be dissolved on the happening of any of the situations:

(i) Death of a Partner:

A partnership firm is dissolved on the demise of any of the partner.

(ii) Expiry of the Term:

A partnership firm may be for a fixed period. On the expiry of that period, the firm will be dissolved.

(iii) Completion of Work:

A partnership concern may be formed to carry out a specified work. On the completion of that work the company will be automatically dissolved. If a firm is formed to construct a road, then the second the road is completed the firm will be dissolved.

(iv) Resignation by Partner:

If a partner does not want to continue in the firm, his resignation from the concern will dissolve the partnership.

(e) Dissolution via Court (Section 44):

A partner can apply to the court for dissolution of the firm on any of these grounds:

(i) Insanity of a Partner:

If a partner goes insane, the partnership firm can be dissolved on the petition of different partners. The firm is not automatically dissolved on the insanity of a partner. The court will act only on the petition of a partner who himself is not insane.

(ii) Misconduct by the Partner:

When a partner is guilty of misconduct, the other partners can move the court for dissolution of the firm. The misconduct of a partner brings bad name to the firm and it adversely affects the reputation of the concern. The misconduct can be in business or otherwise. If a partner is jailed for committing a theft, it will also affect the good name of the firm though it has nothing to do with the business.

(iii) Incapacity of a Partner:

If a partner other than the suing partner becomes incapable of performing his duties, then partnership can be dissolved.

(iv) Breach of Agreement:

When a partner wilfully commits breach of agreement relating to business, it will become a ground for getting the firm dissolved. Under such a situation it becomes hard to carry on the business smoothly.

(v) Transfer of Share:

If a partner sells his share to a third party or transfers his share to another person permanently, other partners can pass the court for dissolving the firm.

(vi) Regular Losses:

When the firm cannot be carried on profitably, then the firm can be dissolved. Though there may also be losses in every type of business but if the firm is incurring losses continuously and it is not possible to run it profitably, then the court can order the dissolution of the firm.

(vii) Disputes amongst Partners:

Partnership firm is based on mutual faith. If partners do not have faith each other, then it will not be possible to run the business. When the partners quarrel with every other, then the very basis of partnership is lost and it will be better to dissolve it.

Following are the ways in which dissolution of a partnership firm takes place:

1. Dissolution by Agreement

A firm may be dissolved if all the partners agree to the dissolution. Also, if there exists a contract between the partners regarding the dissolution, the dissolution may take place in accordance with it.

2. Compulsory Dissolution

In the following cases the dissolution of a company takes place compulsorily:

• Insolvency of all the partners or all but one partner as this makes them incompetent to enter into a contract.

• When the business of the firm becomes illegal due to some reason.

• When due to some event it turns into unlawful for the partnership firm to carry its business. For example, a partnership firm has a companion who is of another country and India declares war against that country, then he becomes an enemy. Thus, the business becomes unlawful.

3. When certain contingencies happen

The dissolution of the association takes place subject to a contract among the partners, if:

• The firm is formed for a fixed term, on the expiry of that term.

• The firm is formed to carry out specific venture, on the completion of that venture.

• A partner dies.

• A partner becomes insolvent.

4. Dissolution by Notice

When the partnership is at will, the dissolution of a firm may take place if any one of the partners gives a word in writing to the other partners stating his intention to dissolve the firm.

5. Dissolution by Court

When a partner files a suit in the court, the court may order the dissolution of the company on the basis of the following grounds:

• In the case where a partner becomes insane

• In the case the place a partner becomes permanently incapable of performing his duties.

• When a partner will become guilty of misconduct and it affects the firm’s business adversely.

• When a partner continually commits a breach of the partnership agreement.

• In a case where a partner transfers the whole of his interest in the partnership company to a third party.

• In a case where the business cannot be carried on barring at a loss

• When the court regards the dissolution of the firm to be just and equitable on any ground.