UNIT III

Redemption of Debentures

|

Repayment of debt securities

The Companies Act of 1956 does not lay down strict guidelines or conditions for the repayment of bonds. Regardless of this, this debt instrument is redeemable without exception and the process is normally carried out in accordance with the conditions specified in a prospectus formulated during the issuance.

As a rule, such conditions must be in accordance with the issuing company. Nevertheless, in order to successfully execute it, investors need to obtain more information and should not limit it to the repayment of bonds.

It follows an in-depth look into this concept that can help shed light on how debt securities are redeemed.

What is the repayment of bonds?

Typically, it can be described as the process of repaying bonds issued by an entity to its debtors. In other words, it is the process of repaying the principal amount to debtors.

It is a remarkable transaction for most companies as the amount required for repayment is quite substantial.

As soon as bonds are redeemed, the issuing company unloads its share of liability and takes it off the balance sheet. As a result, companies build up a robust provision from their profits and accumulate capital for the recovery of bonds.

As a rule, the repayment terms are specified in the promissory note certificate. In particular, the approach behind the repayment of bonds can be understood by looking at these following notes –

- Bonds can be redeemed at either premium or par.

- Repayment means- repayment of the number of bonds to debtors.

- All Redemption conditions are listed in the prospectus of a company that initiates an invitation to issue bonds.

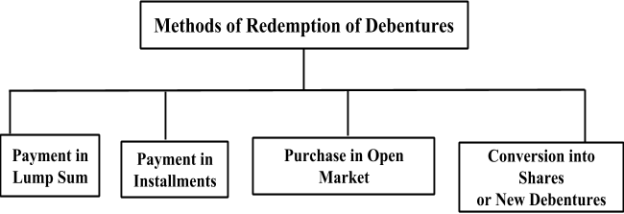

Methods of repayment of debt securities

Different companies may choose different methods of repayment of bonds. These following are some popular ways to do this:

- Lump sum payment to a preceding date

This unique method is considered one of the simplest redemption options. According to this method, debtors receive the promised sum on the preceding date.

If the bonds are not redeemed with a discount or premium, the lump sum, calculated by the sum of the net present value of all bonds, will be paid on the pre-specified or maturity date specified in the bond agreement. The issuing company may decide to pay off the amount of the bond before its due date. Since companies know in advance when to pay for the bond, they are better positioned to streamline it.

The accounting treatment of the repayment of debt securities in this method is specified below

S.N. | Particulars | Amount (Rs.) | Amount (Rs.) |

1. | Bank A / C (Dr) To Repay The Investment A / C (investment sold) | xxx | xxx |

2. | Use of profit And loss a / C (Dr) To For Debt Repayment A / C (The amount of the transferred profit) | xxx | xxx |

Debt Redemption Fund A / C (Dr) To The General Reserve A / C To The Capital Reserve A / C (Profit from the sale of investments) | xxx | xxx |

2. Payment in annual rate

This method is considered to be similar to the redemption process of a temporary loan. According to this method, companies pay a portion of the capital of a bond to the holders each year until their due date. Total liability is divided by the number of investment years and the result is paid out each year.

3. Debenture redemption reserve

This is also called a sinking fund. Essentially, it is a reserve that is built up by accumulating at least 25% of the face value of the bond each year until maturity. The main objective of this reserve is to protect the interests of debtors. Under the Indian Companies Act of 1956, companies issuing bonds are required to form this reserve before the maturity date of a particular bond.

4. Call and put option

Some companies issue bonds with both calls and put options for repayment. Typically, the call option allows companies to purchase their bonds either before or on the maturity date at a predetermined price. The put option, on the other hand, allows debtors to claim the right to sell the bond back to the company either before or on the due date at an agreed price.

5. Conversion into shares

This particular method is directed against convertible bonds. Such bonds include a clause allowing holders to convert their shares into common shares of the company. It is at this point of conversion that the entire liability of debt securities is discharged.

6. You buy from the open market

Companies can also buy bonds from an open market if their shares are traded on a regulated exchange. It saves you the effort of being subject to administrative documents. In addition, bonds are often traded at a discount on the market. In turn, it allows individuals to lower the payout and helps retain more revenue.

Regardless of this, investors and issuers must weigh the advantages and disadvantages of their repayment in the prevailing market condition before repaying bonds. In addition, one should be clear about their purpose of repayment of these debt securities and research in detail about their prospects.

a) When buying a premium

S.N. | Particulars | Amount (Rs.) | Amount (Rs.) |

1. | Bond A/c Dr Loss on repayment A/c Dr To Bank A/c | xxx

| xxx |

2. | Profit & Loss A / C (Dr) To Loss on redemption A / C | xxx | xxx |

b) When buying with a discount

S.N. | Particulars | Amount (Rs.) | Amount (Rs.) |

1. | Debenture A / C (Dr) To benefit from repayment A / C (Dr)) To Bank A / C | xxx | xxx |

2. | Profit on redemption A / C (Dr) To the capital reserve a / c | xxx | xxx |

Key takeaways:

|

|

Meaning

Debenture is the most important instrument and method for increasing the company's loan capital. A bond is such as a loan certificate or loan bond that demonstrates the fact that the company has to pay a certain amount with interest and although the money raised from the bonds becomes part of the company's capital structure, it does not become share capital.

Section 2 (30) of the businesses Act, 2013 defines inclusive debenture as "debenture" includes debentures, bonds or other instruments of a corporation that establish a debt, whether or not it is a burden on the company's assets.

The authority to issue bonds may be exercised on behalf of the company as a Board Meeting pursuant to Section 179 (3) of the Companies Act 2013. Further, Section 71 of the Companies Act, 2013 deals with the provisions relating to the issue of bonds, together with the penalties for non-compliance with them, which may be summarized as follows:

- A company may issue bonds with the option to convert all or part of these bonds into shares at the time of redemption. Provided that the issue of bonds with the option to convert these bonds into shares is approved by a special resolution of the shareholders at a duly convened annual general meeting of the company.

- Companies may issue secured and unsecured bonds. Secured bonds may be issued by an entity under the prescribed conditions. The company cannot issue bonds that do not protect voting rights.

- The company creates a debenture repayment reserve account from the profits of the company available for the payment of the dividend, and the amount credited to this account is not used by the company with the exception of the repayment of debentures.

- The company may not issue a prospectus or make an offer or invitation to the public or its members for more than five hundred to subscribe for its bonds unless it has appointed one or more bond trustees prior to such issue or offer.

- A debt trustee shall take measures to protect the interests of debtors and remedy their complaints in accordance with the rules that may be prescribed.

- Any provision contained in a trust deed to secure the issuance of bonds, or in a contract with debtors secured by a trust deed, shall be void to the extent that it would result in a trustee being exempted from it, or exempting him from liability for breaches of trust, unless he demonstrates the degree of care and duty of care required of him as a trustee, taking into account the provisions of the trust deed that confer upon him power, authority or discretion; Provided that the liability of the debtor trustee is subject to the exceptions that may be agreed upon by the majority of debtors holding at least three-quarters of the total debt securities in a meeting held for this purpose.

- A company pays interest and redeems the bonds in accordance with the terms of its issue.

- If, at any time, the debt trustee concludes that the company's assets are insufficient or likely not to be sufficient to pay the principal when it becomes due, the debt trustee may file an application with the court, and the court, after hearing the company and any other person interested in the matter, May, by order, impose such restrictions on the formation of further liabilities of the company that the court deems necessary in the interest of the debtors.

- If a company does not redeem the bonds on the due date or does not pay the interest on the bonds on the due date, the court May, at the request of one or all debtors or debt trustees and after hearing the parties concerned, request the company to redeem the bonds immediately against payment of the capital and interest due thereon.

- If a default is made in accordance with the order of the court under this Section, any officer of the company who is in default will be punished with a custodial sentence for a term that may extend up to three years or with a fine not less than two lakh rupees, but which may extend up to five lakh rupees, or with both.

- A contract with the company to receive and pay bonds of the company may be enforced by a decree for certain services.

- And finally, the central government may prescribe the procedure for securing the issuance of bonds, the form of the promissory note, the procedure for debtor holders to examine the trust deed and obtain copies of it, the necessary reserves for the repayment of bonds and such other matters.

(Share Capital and Debentures) Rules, 2014 ("2014 Rules"), which prescribes certain conditions to be met by a corporation for issuing secured bonds, provides " rule 18 of the businesses "

The company may not issue secured bonds unless it meets the following conditions, namely:-

- Secured bonds may be issued provided that the date of their repayment does not exceed ten years from the date of issue. Provided that a company setting up infrastructure projects can issue secured bonds for a period of more than ten but not more than thirty years;

- Such issuance of debt securities is secured by the creation of a levy on the company's real estate or assets with a value sufficient for the repayment of the amount of the debt securities and interest due;

- the Company shall appoint a debt trustee prior to the issue of the prospectus or the letter of offer to subscribe to its bonds and shall issue a debt deed to protect the interests of the debtors no later than sixty days after the bonds have been allotted; and

- the security for the Bonds by a levy or mortgage will be paid to the debtor trustee on-

- any specific movable property of the company (not in the nature of pledge); or

- any specific property, wherever situate, or have an interest in it.

PROCEDURE FOR ISSUING BONDS UNDER THE COMPANIES ACT, 2013

[Applicable provisions: articles 56, 72 of the businesses Act, 2013 pursuant to rules 18 and 19 of the businesses Rules (share capital and bonds), 2014]:

- Call and hold a board meeting and decide which types of bond are issued by the company.

- If the company decides to issue secured bonds, the company must comply with the conditions set out in Rule 18 of the companies (Share Capital & Debentures) Rules, 2014.

- In the case of the appointment of a debt trustee, approval is obtained from a Sebi-registered debt trustee, who is proposed to be appointed. If bonds to be issued are collateralized bonds, a bond certificate in form no. SH-12 or as close as possible shall be executed by the company for the benefit of Debenture Trustees within sixty days of the allocation of Debentures.

- Resolutions adopted at the board meeting for

a) approval of the offer letter for the private placement in form no. PAS-4 and application forms (in the case of private placement of bonds)

b) Debenture Trustee Agreement and appointment of a Debenture Trustee (in the case of secured bonds only) should be approved ;

c) appointment of an expert for valuation (in the case of private placement of bonds);

d) to approve the increase in lending powers, if necessary;

e) to approve the preparation of fees for the assets of the company;

f) to approve the promissory note agreement;

g) to set the date, date and time for the Extraordinary General Meeting of shareholders.

5. Draft of the following should be prepared

- Agreement of Debenture Subscription;

- the private placement should provide the offer letter in form PAS-4 and application forms;

- records of a private placement offer in form PAS-5;

- Debenture Trustee Agreement;

- mortgage agreement to prepare fees for the company's assets.

6. Issue notices of the extraordinary general meeting together with the statement of reasons.

7. Hold an extraordinary general meeting and adopt a special resolution to issue convertible bonds and to increase the company's borrowing and to authorize the executive board to incur a charge on the company's assets.

8. File Form No. PAS-4 and PAS-5 in the form not. Transmit GNL – 2 with the Registrar of Companies.

9. File offer letter in form no. MGT-14 with the Registrar of companies.

Key takeaways:

|

|

Issue of debt securities [under Section 71 & company rules rule 18 (share capital & debt securities), 2014]

The bonds issued by an entity are a confirmation that the entity has borrowed an amount of money from the public that it promises to repay at a later date. Debtors are therefore creditors of the company. A bond does not carry voting rights, financing by it does not dilute shareholder control over management. The issue of bonds is appropriate in the situation where sales and earnings are relatively stable.

The majority of the bonds come with a fixed interest rate and these interest must be paid before dividends are paid to shareholders. In the US, most debt securities are unsecured, but elsewhere debt securities are usually secured by the borrower's assets.When we talk about the classification of debt securities in terms of their repayment modes, the same can be divided into two modes:

- Convertible bonds - these can be converted into corporate holdings and this option is in the hands of the holder of the bonds.

- Non-convertible debentures - non-convertible debentures have no option to convert into shares and will be repaid after the specified period(s). They are usually listed on the stock exchanges and any investor with a demat account can invest in them. Furthermore, the NCD can be classified into secured and unsecured.

Now the governing sections and rules prescribed in the Companies Act 2013 must be taken into account when issuing bonds,:

- Section 2 (30)

- Section 71

- Section 179(3)

- Section 180, Paragraph 1, Letter C)

Through these articles we will discuss the detailed process for issuing bonds and the same can be completed as follows:

- Convene and hold a Board meeting and this Board meeting:

Determine the type of bond to be issued after the debt securities have been resolved.The draft offer letter should be accepted to be placed privately in the form no PAS 4 in the debentures subscription agreement

A draft offer for a private placement should also be approved for form no. PAS 5

The appointment of the trustee for the bond should also be resolved if the bond is secured in nature

The executive board should be authorized to invest the burden on the company's assets in the form of CHG-9 in respect of secured bonds.

Open a separate bank account to receive subscription money to continue issuing CCDs.

The Extraordinary General Meeting of shareholders should be dealt with in accordance with Section 180(1) (C) if the borrowing of the board of Directors is increased.Notice of the extraordinary general meeting together with the reasons

Pursuant to Section 42, the board of directors should be authorized to open a separate account for the proposed issue.

2. Call The Extraordinary General Meeting

To examine and approve the increase of the Executive Board mandates with a special resolution. MGT-14 must be submitted within 30 days from the date of adoption of a special decision.Letter of approval to be sent to shareholders

The application format attached to the offer letter should be used by the applicant to request the allocation of securities by paying the application fee.

Decision on the allocation of CCDs

The offer letter should be submitted to ROC by completing Form PAS-4 and PAS-5 as an attachment together with GNL-2.Approval for the submission of form PAS-3

Approval for submission of the form FC-GPR in the case of a foreign subscriber is involved.

3. The Board meeting should be convened, to approve the following ;

Pursuant to Section 42(6), bonds should be issued within 60 days of the date of receipt of the funds. CHG-9 should be filed within 30 days from the date of special settlement (if the company has issued secured debentures)

Return to the allotment for the PAS to be submitted 3 within thirty days from the date of allotment with list of allottees, board resolution for allotment, evaluation report, copy of special resolution passed.

Debenture trust deed draft will be approved at Secured Debentures. (if the company has issued secured bonds).Debenture certificate to be issued.

4. Items of note in the appointment of Debenture Trustee or Trustees (if the company has not issued secured debentures).

Debenture trustees must be appointed before the issue of the letter, but not later than 60 days after the allotment. Debenture trustee should obtain Written consent

5. A trust deed in form no SH. 12 or as close as possible shall be executed by the company issuing bonds in favour of the bond trustees within three months of the closing of the issue or offer (if the company has issued secured bonds).

6. the company must comply with the Debenture Redemption Reserve (DRR) requirements and the investment or deposit of the amount in respect of debt securities maturing during the year ended December 31, 2018.

7. Reserve for debt securities is formed from profits of the company that are available for the distribution of the dividend;

For unlisted companies with the exception of all Indian financial institutions and banking companies, the adequacy of the redemption reserve for debt securities is ten percent of the value of the outstanding debt securities.

NOTE: RULE 18 APPLIES ONLY TO SECURED BONDS

IN SHORT, THE PROVISIONS BELOW MUST BE COMPLIED WITH IN THE EVENT OF ISSUANCE OF BONDS:

- Call for Board meeting

- letter in form of PAS-4 Draft offer (letter for private placement)

- Creation of the PAS-5 form (recording of a private placement)

- the registered valuer prepared the valuation report

Changes to company rules (share capital and debt securities), 2014 22. August 2019

On August 16, 2019, the Ministry of Corporate Affairs ("MCA") notified companies (share capital and debt securities) Amendment Rules, 2019 ("the amended rules") to make certain changes to the Companies (share capital and debt securities) Rules, 2014 ("the existing rules") in respect of shares with different voting rights, issuance of ESOPs by start-up companies and maintenance of Debenture Redemption Reserves ("DRR") by several classes of companies.

The most important highlights of the report [1] are summarised below.

Amendment of Rule 4-shares with different rights:

- The existing rules allow the issue of shares with different rights on condition that the shares with different rights may not exceed 26% of the total equity of the company paid out after the issue at any time. This upper limit will now be changed to 74% of the total voting rights, including voting rights for shares with different rights, at any time.

- In addition, under the amended rules, the requirement of a track record of distributable profits over the past three years for the issue of shares with different rights has been abolished.

Amendment of Rule 5-Certificate of shares (if shares are not in DEMAT form):

Under the existing rules, the directors were allowed to sign a share certificate by various means, such as facsimile signature, etc. However, according to the amended rules, the secretary of the company is also permitted to sign the share certificate in a similar manner.

Change of Rule 12 - issue of Employee Stock Options:

- According to the existing rules, the start-up companies were allowed to issue ESOPs to "employees", as mentioned below, up to the period of "five years" from the date of their establishment or registration:

- An individual belonging to the group of promoter, or A promoter

- A director who directly or indirectly holds more than ten percent of the outstanding shares of the company, either himself or through his relative or through a corporation.

- Under the revised rules, start-up companies may issue ESOPs to such employees for a period of "ten years" from the date of their establishment or registration.

The definition of start-up companies has also been expanded to include the following:

- A company that is a private company or registered partnership company or registered Limited Partnership Company for a period of up to ten years from its formation / registration; and

- With a turnover of up to INR 100 crores for each of the financial years since the establishment / registration ; and

- Company works towards innovation, development or improvement of products or processes or services or when it is a scalable business model with a high potential to create jobs or wealth.

- Provided that a company formed by splitting or reconstructing an existing company is not considered a "start-up".

Amendment to rule 18-debt securities:

According to the amended rules, the requirement to create DRR by certain business classes has been abolished. The summary of the changes in the DRR provisions and the comparison of the changed rules with the existing rules are given in the table under:

- Sr. Nr.

- Class of companies

- According to the existing rules

- According to the amended rules

- All Indian financial institutions regulated by the Reserve Bank of India (RBI) and banking companies

- Public Issue:

- No disaster preparedness required

- Private Problem:

- No disaster preparedness required

- DRR provisions as provided in the existing rules

2. Other Financial Institutions According To § 2 (72) Companies Act, 2013

- DRR provisions apply to NBFCs registered with the RBI

- DRR provisions as provided in the existing rules

3. For listed companies (with the exception of all Indian financial institutions and banking companies, as stated in serial number 1 Above)

a) All listed NBFCs and listed HFCs

- Public Issue:DRR amounted to 25% of the value of the outstanding bonds issued by public issue

- Private Problem:No disaster preparedness required

- Public Issue:No disaster preparedness required

b) Other listed companies

- Public Issue:DRR amounted to 25% of the value of the outstanding bonds

- Private Problem:DRR amounted to 25% of the value of the outstanding bonds

- Public Issue:No disaster preparedness required

- Private Problem:No disaster preparedness required

4. For unlisted companies (excluding all Indian financial institutions and banking companies as per serial number 1 Above))

a) All listed NBFCs and Unlisted HFCs

- Public issue [according to Sebi (issuance and listing of debt securities) Regulations, 2008]:

- DRR amounted to 25% of the value of the outstanding bonds

b) Other unlisted companies

- Public issue [according to Sebi (issuance and listing of debt securities) Regulations, 2008]:

- DRR amounted to 25% of the value of the outstanding bonds

- Private Problem:

- DRR amounted to 25% of the value of the outstanding bonds

- DRR is 10% of the value of the outstanding bonds

In addition, each company required to establish a DRR had to invest or deposit, in accordance with applicable rules, at least 15% of the amount of its debt securities maturing during the year ending March 31 of the following year in a separate fund recognised as a Debenture Reserve Fund ("DRF") on or before April 30 of each year.

However, under the revised rules, only certain types of companies need to invest or deposit this amount. The list of such companies that need to invest in DRF is as follows:

- All listed NBFCs registered with the Reserve Bank of India;

- All listed HFCs registered with the National Housing Board;

- All other listed companies (except all Indian financial institutions, banking companies and other financial institutions) and

- All unlisted companies that are not NBFCs and HFCs

BDO comments:

The amended rules have provided the necessary clarity on the limitation of voting

rights up to which a company can issue shares with different voting rights.

In addition, the change has expanded not only the types of companies that now

qualify for the start-ups category, but also a relaxation for such start-ups by

increasing the sales limit and the period of years up to which they can be considered as start-ups.

The amendment also abolished the requirement to create DRR for listed companies

and also lowered the DRR threshold for unlisted companies. On the other hand, the

amended rules make it mandatory for listed companies to invest in DRF, although

DRR is not applicable to them. In addition, it would have been helpful if clarity had

been provided regarding the DRR requirements for unlisted NBFCs and unlisted

HFCs in the case of public debt issuance.

The amendments contained in the application shall enter into force from 16 June

2018.

Key takeaways:

changed rules with the existing rules. |

Meaning of depreciation discount

The loss or discount on the issuance of debt securities is usually a capital loss or a notional asset and must therefore be written off during the term of the debt securities. The amount of the loss or discount on the issuance of debt securities shall not be written off in the year of issue, as the benefit of the debt securities would accumulate with the company until they are repaid or repaid.

The loss or discount, therefore considered as a capital loss. The discount can either be charged to Securities Premium A/c or written off over three to five years through the income statement in accordance with guidelines published by ICAI (the Institute of Chartered Accountants of India).

If there are no capital gains or if the capital gains are not sufficient, the amount of such a loss or discount can be written off each year by passing on the magazine entry below to the revenue gain :

- Income statement Dr.

- Discount / loss on issuance of bonds a / c

- (Discount / losses on issuance of debt securities written off)

Some of the methods used to treat the discount in the issuance of debentures are the following:

The discount on the bond issue is a capital loss. It will appear on the asset side of the balance sheet until it is written off. It is desirable that it be cancelled as soon as possible. Discount in issuance of debentures, as it is a loss of capital nature, it can be amortized in two ways.

First method:

In this case, the total amount of discount on obligations is distributed equally over the life of the obligations. Assume that the bonds are issued at a discount to be redeemed after five years. The amount of the discount will be divided by five and the amount thus obtained will be charged to the profit and loss account for five years. This method is followed when the bonds are redeemed at the end of a specified period.

Second method:

In this method, the discount is cancelled each year in proportion to the amount of debentures used each year. This method is followed when the bonds are exchanged each year by notification and lottery.

The accounting entry to cancel the discount is as follows:

Profit and Loss a/c Dr.

TO discount on debenture a/c

Journal entry example:

Problem 1:

X Co. Ltd. issues Rs. 1, 00,000 debentures on January 1, 2012, with a 10 percent discount. Calculate the amount of discount that will be cancelled each year in each of the following cases:

- Obligations will be repaid after four years.

- The company redeems Rs. 25,000 debentures each year by drawing starting on December 31, 2012.

Solution:

1. The company will reimburse obligations after 4 years. Therefore, the discount amount to be cancelled each year will be Rs. 10,000 / 4 or Rs. 2,500.

2. The company redeems debentures worth Rs. 25,000 every year. Therefore, the discount will be amortized proportionally.

It is calculated as follows:

Year | Amount of debenture used (RS) | Ratio | Discount to be written |

1 2 3 4 | 1,00,000 75,000 50,000 25,000 | 4 3 2 1 | 10,000 ×4/10 = 4,000 10,000 × 3/10 = 3,000 10,000 × 2/10 = 2,000 10,000 × 1/10 = 1,000 |

10 | 10,000 |

Problem 2:

One company issued bonds for the face value of Rs. 1, 00,000 with a discount of 6%. The obligations were repaid by annual drafts of Rs. 20,000. How would you calculate the discount on debentures? Show the discount account in the company's general ledger for the duration of the obligations.

Solution:

The discount of obligations can be amortized in two ways:

(a) Likewise during the life of the obligations. Since the obligations are for five years, each year one fifth of the discount can be taken to the profit and loss account.

(b) In proportion to the amount used. Since in this case the redemption plan is given, it is possible to cancel the discount in the proportion of the amount used.

If done then it will be cancelled as in:

Years | Debenture Outstanding | Ratio | Discount written off |

1st year 2nd year 3rd year | 1,00,000 80,000 60,000 | 5 4 3 | 5/15 × Rs 6,000 = 2,000 4/15× Rs 6,000= 1,600 3/15× Rs 6,000 = 1,200 |

Years | Debenture Outstanding | Ratio | Discount written off |

4th year 5thyear | 40,000 20,000 | 2 1 | 2/15 × Rs 6,000 = 800 1/15 × Rs 6,000 = 400 |

|

| 15 | 6,000 |

The debenture discount in the second case will appear as under:

Debenture Discount

Date | Particular | Rs | Date | Particular | Rs |

1st year Jan. 1 | To debenture | 6,000 | 1st Dec.31 | By Profit and Loss By closing balance | 2,000 4,000 |

6,000 | |||||

6,000 | |||||

| |||||

2nd year Jan. 1 | To Opening balance | 4,000 | 2nd Dec. 3 | By Profit and Loss By closing balance | 1,600 2,400 |

4,000 | |||||

4,000 | |||||

3rd year Jan. 1 | To Opening Balance | 2,400 | 3rd year Dec. 31 | By Profit and Loss By closing balance | 1,200 1,200 |

2,400 | |||||

2,400 | |||||

4th year Jan. 1 | To Opening Balance | 1,200 | 4th year Dec. 31 | By Profit and Loss By closing balance | 800 400 |

1,200 | |||||

1,200 | |||||

5th year Jan. 1 | To Opening Balance | 400 | 5th year Dec. 31 | By Profit and Loss | 400 |

4,00 | |||||

400 |

Problem 3

AB Ltd. bought assets worth Rs. 6, 80,000 and assumed liabilities of Rs. 80,000. It was accepted to pay the purchase price of Rs. 6.40,000 through the issuance of debentures valued at Rs. 4.40,000 of Rs. 100 each with a 10% premium and cash balance. Record the transaction in the books of the buying company.

Solution:

Sundry Assets Account) Dr. Goodwill (Bal, figure) Dr. To Liabilities Account To Vendor Account (Being purchase of business for a consideration of Rs. 6,40,000) |

| Rs 6,80,000 40,000 | Rs

80,000 6,40,000 |

Vendor Account ) Dr. To Debenture Account To Premium on Issue of Debenture Account To Bank Account (Being the purchase consideration) |

| 6,40,000 |

4,00,000

40,000 2,00,000 |

NB: No of Debentures = Rs 4,40,000 / Rs, 100 + Rs. 10 = 4,000 Debentures

Therefore, premium = 4,000 x Rs. 100 x 10% = Rs. 40,000

Problem 4:

You must approve the journal entries for the issuance of the following obligations:

(a) 120 10% Rs. 1,000 bonds are issued at a 5% discount and are repayable at par.

(b) Others 150 7% Rs. 1,000 bonds are issued with a 5% discount and refundable with a 10% premium.

(c) Plus 80 9% Rs. 1,000 bonds are issued with a 5% premium.

(d) In addition, another 400 8% Rs. 100 bonds are issued as collateral against a loan of Rs. 40,000. (ICWA Inter)

Solution:

Journal Entries Dr. Cr.

(a) |

Bank Account Dr. Discount on issue of Debentures Account ) Dr. To 10% Debentures Account (Being the receipt of money on issue of 120 10% Debentures at a discount of 5%) |

| Rs 1,14,000 6,000 | Rs

1,20,000 |

(b) | Bank Account Dr. Loss on Issue of Debentures Account Dr. Top 7% Debentures Account TO Premium on Redemption of Debentures Account (Being the receipt of money on issue of 150 7% Debentures at 5% discount and repayable at a premium of 10%) |

| 1,42,500 22,500 |

1,50,000

15,000 |

(c) | Bank Account Dr. To 9% Debentures Account To Premium on Issue of Debentures Account (Being the receipt of money on issue of 80 9% Debentures) |

| 84,000 |

80,000 4,000 |

(d) | Debentures Suspense Account Dr. To 8% Debentures Account (Being issue of 400 8% Debentures as collateral security against a loan of Rs. 40,000) |

| 40,000 |

40,000 |

Problem 5:

B.K. Ltd. issued at Rs 1, 00,000 10% to 95% bond. Subscriptions are paid up to Rs 20,000 on application and balance on assignment. The cost of the issue is 500 rupees.

Show the journal entries and the Company Balance Sheet.

Solution:

Journal Entries Dr. Cr.

|

Bank Account Dr. To 10% Debenture Application Account (Being issue of debentures and receipt of application money) |

| Rs 20,000 | Rs

20,000 |

| 10% Debentures Application Account Dr. To 10% Debenture Account (Being application money transferred to Debenture Account on allotment) |

| 20,000 |

200,000 |

| 10% Debenture Allotment Account Dr. Discount on Issue of Debentures Account Dr. To 10% Debenture Account (Being allotment money due to debentures) |

| 75.,000 5,000 |

80,000 |

| Bank Account Dr. To 10% Debenture Allotment Account (Being money received on allotment) |

| 75,000 |

75,000 |

| Expenses on Subscription Account Dr. To Bank Account (being expenses paid on issue of debentures) |

| 500 |

500 |

Balance Sheet of B.K. Ltd.

Liabilities | Rs | Assets | Rs |

Secured Loans: 10% Debentures |

1,00,000

| Current Assets: Bank Misc. Expenses: Expenses on Subscription 500 Discount on Debentures 5,000 |

94,500

5,500 |

1,00,000 | 1,00,000 |

Problem 6:

On a company's balance sheet, the discount on obligations shows a debit balance of 15,000 rupees. Every year 5,000 rupees is charged to the profit and loss account. How will the discount on the liability account appear at the end of the first year and the second year on the company's balance sheet?

Solution:

Balance Sheet (First Year)

Asset Side | Rs | Rs |

Misc. Expenditure: Discount on Debentures Less: Charged to Profit and Loss Account |

15,000 5,000 |

10,000 |

Balance Sheet (Second Year) | ||

Asset Side | Rs | Rs |

Misc. Expenditure: Discount on Debentures Less: Charged to Profit and Loss |

10,000 5,000 |

5,000 |

Problem 7:

One Company issued Rs 2.00,000 Bonds at 10% of Rs 100 each at par, repayable at the end of 5 years with a 5% premium. Regarding the deed of trust, a sinking fund would be created in order to accumulate sufficient funds for this purpose. Investments were made with a 5% interest received at the end of each year. All investments, including reinvestments of interest received, were made at the end of the year. All investments were sold in the fifth year for Rs 1, 63,805.

You must show journal entries and general ledger accounts for 5 years.

Note:

Rs 2, 71462 invested at the end of each year at 5% compounded interest will amount to Rs 15 at the end of 5 years.

The calculation can be done to the nearest rupee.

Solution:

Amount required for the redemption of debentures:

(a) Nominal value of debentures = Rs 2,00,000

(b) Premium on redemption at5% = Rs 10,000

= Rs 2,10,000

When the amount required id Rs 15, annual instalment= Rs 2.71462

When the amount required is Rs 2,10,000, annual instalment

= 2,10,000 × 2.71462/15 = Rs. 38,005 (approximate)

(Without Narration)

1st year Jan. 1 |

Bank Account Dr Loss on Issue of Debenture Account Dr To 10% Debenture Account To Premium on Redemption Account |

| Rs 2,00,000 10,000 | Rs

2,00,000 10,000 |

Dec 31 | Profit and Loss Appropriation A/c Dr To Sinking Find Account Sinking Fund Investment Account Dr To Bank Account |

| 38,005

38,005 |

38,005

38,005 |

|

| 2nd year | 3rd year | 4th year | 5th year | ||||

Dec 31. | Bank Account To Interest on S.F.I Account | Rs 1,900 | Rs 1,900 | Rs 3,896 | Rs 3,896 | Rs 5,991 | Rs 5,991 | Rs 8,190 | Rs 8,190 |

| Interest on S.F.I A/c To Sinking Fund | 19,000 | 1900 | 3,896 | 3,896 | 5,991 | 5,991 | 8,190 | 8,190 |

| P & L Appropriation Account To Sinking fund A/c | 38,005 | 38,005 | 38,005 | 38,005 | 38,005 | 38,005 | 38,005 | 38,005 |

| S.F.I. Account To Bank A/c | 39,905 | 39,905 | 41,901 | 41,901 | 43,996 | 43,996 |

| Nil |

Dr. Cr

V Year Dec.31 | Bank Account To Sinking Fund Investment Account Dr |

| Rs 1,63,805 | Rs 1,63,805 |

“ | Sinking Fund Account Dr To Sinking Fund Investment A/c |

| 2 | 2 |

“ | 10% Debenture Account Dr Premium on Redemption Account Dr To Debenture-holder’s Account |

| 2,00,000 10,000 | 2,10,000 |

Dec.31 | Debenture holder’s Account Dr To Bank Account |

| 2,10,000 | 2,10,000 |

“ | Sinking Fund Account Dr To General Reserve Account |

| 2,00,000 | 2,00,000 |

Problem 8:

On January 1, 1993, a company issued 10,000 bonds at 6% of Rs 100 each, repayable at par after 15 years. The terms of the issue, however, established that the debentures could be exchanged with 6 months' notice at any time after 5 years with a premium of 4%, either through payment in cash or through the allocation of preferred shares and / or other obligations in accordance with the option of the bondholders.

On April 1, 2004, the company informed the bondholders to repay the bonds on October 1, 2004, either by cash payment or by allocating 8% of preferred shares of Rs 100 each to Rs 130 per share or 7% of second bonds from Rs 100 each to Rs 96 per bond.

Holders of 4,000 debentures accepted the offer of 8% preferred shares, holders of 4,800 debentures accepted the offer of 7% of 2nd Debenture and the remainder demanded cash. Provide journal entries that record the previous redemption.

Solution

Journal Entries Dr. Cr.

2004 Oct. 1 |

6% Debentures Account Dr. Premium on Redemption Account Dr. To Debentures-holders Account (Being amount payable on redemption of debentures including premium 4%) |

| Rs 10,00,000 40,000 | Rs

10,40,000 |

Oct. 1 | Debenture holder’s Account (4,000 x Rs 104) Dr. To 8% Preference Share Capital Account (4,16,000 x 100/130) To Share Premium Account (4,16,000 x 30/ 130) (Being Debenture holders are satisfied by allotment or preference shares of Rs. 100 each at a premium of Rs 30 per share) |

| 4,16,000 |

3,20,000 96,000 |

Oct. 1 | Debenture holder’s Accoutn (4,800 x Rs 104) Dr. Discount on Issue of Debentures Account . (4,99,200 x 4/96) Dr. To 7% Second Debentures Account (Being Debentures holders are satisfied by allotment of debentures of Rs 100 each at a discount of 4% |

| 4,99,200

20,800

|

5,20,000 |

Oct. 1 | Debenture holder’s Account Dr. To Bank Account (Being amount due to Debenture holders paid off) |

| 1,24,800 |

1,24,800 |

Oct. 1 | Share Premium Account (40,000 + 20,800) Dr. To Premium on Redemption Account To Discount o Issue of Debenture Account (Being Premium on Redemption and Discount on Issue of debentures are written off against Share Premium Account) |

| 60,800 |

40,000 20,800 |

Dr. | Debentureholder’s Account | Cr. | |||

2004 Ocr. 1 |

8% Preference Share Capital Account To Share Premium A/c To 7% Second Debenture Account (5,20,000 – 20,800) To Bank Account | Rs

3,20,000 96,000

4,99,200 1,24,800 | 2004 Oct. 1

“ “ |

By 6% Debentureholder’s Account By Premium on Redemption A/c | Rs

10,00,000 40,00,000

|

10,40,000 |

|

| 10,40,000 | ||

Terms of issue of debentures

Meaning:

The debentures are issued in the same way as the shares are issued. The company issues a prospectus that invites applications along with a sum of money called application money. After the scrutiny, the Board of Directors makes the assignment of obligations.

If the full sum of money has not been requested along with the applications, another requested sum of money, the allocation money, may be requested. Later there may even be some calls. But above all, the full amount is received by application or by application and award.

The transactions for the issuance of debentures are same to those approved for the issuance of shares, only the names of the accounts are changed. There is an Obligation Requests Account, a Obligation Assignment Account (or a Request Account and an Obligation Assignment), a First Call Obligation Account, a Second Call Obligation Account, a Third and Last Call Account obligations, etc.

Instead of crediting the capital account, the obligation account is credited.

The amount on application which are rejected will be refunded. The entry, therefore, is:

Debenture Application Account Dr. application money on rejected

To Bank applications

Likes share, surplus application money on partially accepted application will be transferred to Debentures Allotments. Thus –

Debentur Applications Account Dr. surplus application money on

To Debentures Allotment Account partially accepted applications

The amount due to allotment of debentures is journalised as:

Debentures Allotment Account Dr. gross amount due to allotment.

To Debentures

On receipt of allotment money, bank will be debited and the Debentures Allotment Account credited.

Upon receipt of the assignment money, the bank will be debited and the Obligation Assignment Account will be credited.

It is customary to put “Obligations” before the interest rate. Thus, if the interest rate is 14 percent, the name given will be "Obligations at 14%."

The premium in the issuance of the bond account and the discount in the issue of the bond account take place in the securities premium account and the discount in the issue of the share account, respectively.

Like stocks, bonds can be issued at par, at a premium, or at a discount. But the law does not establish any maximum discount limit in the issuance of obligations. Nor is the approval of the Company Law Board necessary.

Obligations are invariably redeemable. They can be exchanged at par or with a premium. The exchange of debentures with a premium means that the company pays the holders of debentures, at the time of exchange, a sum greater than the face value of the debentures they hold.

If a company issues debentures on the condition that it repays them with a premium, this additional liability must be recorded in a separate account called "Debt Reimbursement Premium Account" and shown together with the liability "Debentures" on the balance sheet.

Since the debentures can be issued at par, at a premium, or at a discount and can be redeemed at par or at a premium, there are several possible cases of entries that must be approved at the time of issuance of the debentures.

Summary entries for typical cases are given below:

(a) Journal Entries (Debentures Issued at Par)

On recepipt pplication money | Bank Account Dr To Debenture Application A/c |

On allotment of debentures

| Debentures Application A/c Dr. To Debenture Account |

On making allotment or calls

| Debentures Allotment/ Call A/c Dr. To Debentures Account |

On receipt of money | Bank Account To Debenture Allotment / Call A/c Dr. |

(b) Journal Entries (Debentures issued at Premium)

When issue price of debentures is more than the face value of debentures they ar said to be issued at premium.

Generally, premium money is collected alongwith allotment money. As already said, procedure for issue of debentures is the same as tht for issue of shres. Therefore, only the journal entry relating to premium is given below:

Allotment money along with premium is due | Debenture Allotment A/c Dr To Debenture Account To Debenture Premium A/c |

When cash received | Bank Accoutn Dr. To Debenture Allotment/Call A/c |

(c) Journal Entries (Debentures issued at Discount)

Only the journal entries relating to disount is given below:

Allotment money is due and discount allowed | Debenture Allotment A/c Dr. Discount on Issue of Debentures A/c Dr. TO Debenture Account |

When cash received | Bank Account Dr. Debenture Allotment A/c |

The name Issue Premium has been changed to Securities Premium. Obligations are also securities. Therefore, the premium in the issuance of debentures, logically, can be credited to the Securities Premium Account. Then, the restrictions on the use of the premium in the issuance of shares will also apply to the use of the premium in the issuance of debentures.

The Bonds Redemption Premium must be distinguished from the Share Issue Premium; The first is a liability that is shown together with the Obligations in the Long-term Loans item, while the second is a capital gain that is shown in Reserves and Surpluses.

Alternatively, the discount allowed in the issuance of debentures, as well as the amount of the premium payable in the reimbursement, can be charged to the Loss Account in the Issuance of Debentures, in which case the journal entry will be as follows:

2. Expenses of issuance of the bond account:

The discount in the issuance of the debenture account and the loss in the issuance of the debenture account can be transferred to the cost account of issuance of debentures through the following journal entry:

Cost of issuing the debt account Dr

To the costs of issuing the bond account

To a discount on the issuance of an obligation account

To Loss due to issuance of bond account

The cost of issuing the bond account, the cost of issuing the bond account, the discount on the bond account issue and the loss on the bond account issue represent capital losses and their balances are shown as a deduction from reserves and balance sheet surplus.

In accordance with the provisions of the Public Limited Companies Law, it is not necessary to amortize the amount of said loss. But sound accounting principles require that the loss be gradually and appropriately amortized over the useful life of the obligations in respect of which the loss has been incurred. Alternatively, the loss can be transferred in whole or in part to the Securities Premium Account.

The premium on issuance of the bond account represents a capital gain and must be transferred to Capital Reserve. The Premium account in exchange of obligations is a personal account. At the time of the redemption of obligations, the premium of the account of redemption of obligations is transferred to the account of holders of various obligations.

Problem 9:

White Ltd. issues 10,000 secured bonds at 12% Rs. 100 each. Indicate journal entries if the Notes can be exchanged at par and are issued (i) at par, (ii) with a 2 percent discount and (iii) with a 3 percent premium. Also indicate the entries that will be made if the Notes are redeemable with a premium of 5 percent and are issued (i) at par and (ii) with a discount of 2 percent. Also indicate in each case how the figures will appear on the balance sheet.

Solution:

Journal Entries Dr. Cr.

|

Debenture redeemable at par (i) Issued at par:- Bank Dr. To 12% Debentures Issue of 10,000 12% Debentures of Rs 100 each at a par |

| Rs

10,00,000 | Rs

10,00,000 |

| (ii) Issued at a discount:- Bank Dr. Discount on Issue of Debentures Account Dr, TO 12% Debentures Issue of 10,000 12% Debentures of Rs100 each at a discount 12% |

| 9,80,000 20,000 |

10,00,000 |

| (iii) Issued at a premium :- Bank Dr. To 12% Debentures TO Premium on Issue of Debentures Account / Securities Premium Account Issue 10,000 12% Debentures of Rs 100 each at a premium 3%. |

| 10,30,000 |

10,00,000 30,000 |

| (i ) Debentures issued at apar but redeemable at a premium of 50% Bank Dr. Loss on Issue of Debentures Account Dr. To 12% Debentures TO premium on Redemption of Debenture Account at par but redeemable at a premium of 5%

|

| 10,00,000 50,000 |

10,00,000 50,000 |

| (ii ) Debentures issued at a discount of 12% but redeemable at a premium of 5%:- Bank Dr. Loss on Issue of Debenture Account Dr. TO 12% Debentures TO Premium on Redemption of Debentures Account Issue of 10,000 12% Debentures issued at a discount of 2% but redeemable at a premium of 5% |

|

9,80,000 70,000 |

10,00,000 50,000 |

Balance Sheet

(i) Debentures issued at par and redeemable at per

Particulars | Note No | Rs |

Non-current liabilities Long-term borrowings |

1 |

10,00,000 |

II. Assets Current Assets Cash and Cash equivalence |

2 |

10,00,000 |

Notes: RS

- Long term Borrowings

12% Debentures 10,00,000

2. Cash and Cash equivalence

Balance with Bank 10,00,000

(ii) Debenture issued at a discount and redeemable at per

Particulars | Note No | Rs |

Shareholder’s Funds Reserve and surplus Non-current liabilities Long-term borrowings |

1

2 |

(20,000)

10,00,000 |

9,80,000 | ||

II. Assets Current Assets Cash and Cash equivalence |

3 |

9,80,000 |

Notes:

- Reserve and Surplus

Discount on Issue of Debentures (20,000)

2. Long term Borrowings

12% Debentures 10,000

3. Cash and Cash Equivalents

Balance with Bank 9,80,000

(iii) Debentures issued as premium and redeemable at par

Particulars | Note No | Rs |

Shareholder’s Funds Reserve and surplus Non-current liabilities Long-term borrowings |

1

2 |

(30,000)

|

10,00,000 | ||

10,30,000 | ||

II. Assets Current Assets Cash and Cash equivalence |

3 |

10,30,000 |

Notes:

- Reserve and Surplus

Securities Premium Account (30,000)

2. Long term Borrowings

12% Debentures 10,00,000

3. Cash and Cash Equivalents

Balance with Bank 10,30,000

(iv) Debentures issued at par and redeemable at a premium of 5%

Particulars | Note No | Rs |

Shareholder’s Funds Reserve and surplus Non-current liabilities Long-term borrowings |

1

2 |

(50,000)

|

10,50,000 | ||

10,00,000 | ||

II. Assets Current Assets Cash and Cash equivalence |

3 |

10,00,000 |

Notes:

- Reserve and Surplus

Loss on Issue of Debentures (30,000)

2. Long term Borrowings

12% Debentures 10,00,000

Premium on Redemption of Debentures 50,000

10,50,000

3. Cash and Cash Equivalents

Balance with Bank 10,00,000

(v) Debentures issued at a discount and redeemable at a premium

Particulars | Note No | Rs |

Shareholder’s Funds Reserve and surplus Non-current liabilities Long-term borrowings |

1

2 |

(70,000)

|

10,50,000 | ||

9,80,000 | ||

II. Assets Current Assets Cash and Cash equivalence |

3 |

980,000 |

Notes:

- Reserve and Surplus

Loss on Issue of Debentures (70,000)

2. Long term Borrowings

12% Debentures 10,00,000

Premium on Redemption of Debentures 50,000

10,50,000

3. Cash and Cash Equivalents

Balance with Bank 9,80,000

The bonds can be issued in exchange for a consideration other than cash. This issue can be done at par, with a premium or with a discount. When a company takes over a running business, it very often discharges part of the consideration in the form of obligations.

Problem 10:

Pee Co. Limited took over certain fixed assets for Rs. 3.15,000 from the liquidator of Tee Limited that was being liquidated and assigned 3,000 obligations of 13% with a premium of 5% to the liquidator to satisfy the consideration.

The company then issued a prospectus inviting the public to subscribe 10,000 12% Dentures of Rs100 each at a discount of 12%, payable as follows:- Rs

With application 35

On allotment 23

On first and final call 40

Applications were received for 9,000 debentures only. All the application were accepts. In course of time the call was also made. All the money’s were duly received.

Prepare the Cash Book and the Journal.

Solution:

Dr. Cash Book (Bank Columns Only) Cr.

To 12% Debentures Applications and Allotment Account (Application money on 9,000 12% Debentures @ Rs 35 each) | Rs

3,15,000 |

|

By Balance c/d | Rs 8,82,000 |

To 12% Debentures Applications and Allotment Account (Allotment money on 9,000 12% Debentures@ Rs 23 each) |

2,07,000 |

|

|

|

To 12% First and Final Call Account (Final and final call @ Rs 40 each)

To Balance b/d |

3,60,000 |

|

|

|

8,82,000 | 8,82,000 | |||

8,82,000 |

|

Journal Dr. Cr.

Fixed Assets Dr. To Liquidator of Tee Ltd Purchase of fixed Assets for an agreed value of Rs 3,15,000 |

| Rs 3,15,000 | Rs

3,15,000 |

Liquidator of Tee Ltd. Dr. To 13% Debentures To Premium on Issue of Debentures / Securities Premium Issue of 3,000 13% Debentures of Rs 100 each at a premium of 5% in discharge of consideration.

12% Debenture Application and Allotment Account Dr. |

| 3,15,000

5,22,000 |

3,00,000 15,000 |

3. Reserve for the exchange of obligations:

In accordance with SEBI guidelines, in the event of issuance of debentures with a maturity of more than 18 months, a debenture redemption reserve must be created.

The following points are also worth noting:

(i) A moratorium may be established until the date of commercial production for the creation of the reserve for the reimbursement of obligations with respect to the obligations obtained for the financing of projects.

(ii) The reserve for the exchange of obligations can be created in equal instalments for the remaining period or with higher amounts if the earnings allow it.

(iii) In the case of partially convertible bonds, the bond reimbursement reserve must be created with respect to the non-convertible part of the bond issue on the same lines that apply for the issue of fully non-convertible bonds.

With respect to the non-convertible issues of new companies, the creation of the reserve for the reimbursement of obligations must begin from the year in which the company obtains benefits for the remaining life of the obligations.

(iv) The company must create a disaster risk reduction equivalent to 50% of the amount of the debenture issue before the debenture swap begins. Withdrawal of RRD is allowed only after the company has redeemed 10% of the liability.

(v) The reserve for the exchange of obligations will be treated as part of the General Reserve for the consideration of bond issuance proposals.

The entry for creating the debenture exchange reservation will be as follows:

Profit and loss appropriation account Dr. with the amount of the fee

To reserve for the exchange of obligations

Problem 11:

On April 1, 2008, a company issued 1,000 debentures at 14% of 1,000 rupees each at 950 rupees. The issuance conditions stipulated that as of April 2010, 50,000 rupees of bonds should be exchanged, either by drawing at par or by buying in the market year. Expenses for the issue amounted to Rs 8,000 which was cancelled in 2008-09.

The company cancelled Rs 10,000 of the bond issue discount each year. In 2010-11, the obligations to be exchanged were reimbursed at the end of the year by lottery. In 2011-2012, the company purchased 50 bonds for cancellation at the prevailing price of Rs 980 on March 31, 2012, with expenses being Rs 500.

Interest is paid annually. Each year, an appropriate amount was also credited to the Reserve for the exchange of obligations. Ignore the income tax.

Provide the journal entries and balance sheet (as it relates to obligations) as of March 31, 2012.

Solution:

Journal Dr. Cr

2008 April 1 |

Bank Dr. Discount on Issue of Debentures Account Dr. To 14%, Debentures The issue of 1,000 14% debentures of Rs 1,000 each at Rs 950 |

| Rs 9,50,000 50,000 | Rs

10,00,00 |

“ “ | Debenture Issue Expense Account Dr. To Bank The Expense of Rs 8,000 incurred on issue of the debentures. |

| 8,000 |

8,000 |

2009 Mar.31 |

Interest on Debentures Account Dr. To Bank Payment of interest for the year on debentures |

| 1,40,000 |

1,40,000 |

“ “ | Profit and Loss Account To Interest on Debentures Account To Debenture Issue Expenses Account To Discount on Issue of Debentures Account Transfer of Interest on Debentures Account and Debentures Issue Expense Account to Profit and Loss Account and writing off Rs 10,000 of discount on Issue of Debentures |

| 1,58,000 |

1,40,000 8,000 10,000 |

“ “ | Profit and Loss Appropriation Account Dr. TO Debentures Redemption Reserve Creation of Debentures Redemption Reserve for redemption of debentures |

| 2,50,000 |

2,50,000 |

2010 Mar.31

|

Interest on Debentures Account Dr. TO Bank Payment of interest for the year on debentures |

| 1,40,000 |

1,40,000 |

“ “ | Profit and Loss Account Dr TO Interest on Debentures Account TO Discount on Issue of Debentures Account Transfer of Interest on Debentures Account to Profit and Loss account and writing off Rs 10,000 of Discount of Issue of Debentures. |

| 1,50,000 |

3,40,000 10,000 |

2010 May. 31 |

Profit and Loss Appropriation Account Dr. To Debentures Redemption Reserve Bringing up Debentures Redemption Reserve equal to 50% of the amount of Debentures to facilitate part redemption of debentures to |

| 2,50,000 |

2,50,000 |

2011 Mar.31 |

Interest on debentures Account Dr. 14% Debentures Dr. To Bank Payment of yearly interest on debentures and redemption of debentures of the paid up value of Rs50,000 at par by draw of lots. |

| Rs 1,40,000 50,000 | Rs

1,90,000 |

“ “ | Profit and Loss Account Dr. To Interest on Debentures Account To Discount on Issue of Debentures Account Transfer of Interest on Debentures Account to Profit And Loss Account and writing off Rs 10,00 of Discount on Issue of Debentures |

| 1,50,000 |

1,40,000 10,000 |

“ “ | Profit and Loss application Account Dr. To Debentures Redemption Reserve Increase made in Debenture Redemption Reserve to General Reserve |

| 2,50,000 |

2,50,000 |

“ “ | Debenture Redemption Reserve Dr. To General Reserve Transfer of the par value of debentures redeemed this year from Debenture Redemption Reserve to General Reserve |

| 50,000 |

50,000 |

2012 Mar. 31 |

Interest on Debentures Account Dr. To Bank Payment of yearly interest on debentures for Rs 9,50,000 |

| 1,33,000 |

1,33,000 |

“ “ | 14% Debentures Dr. To Bank To Profit on Redemption of Debentures Purchase of 50 Debentures in the Debentures market for cancellation @ Rs 980 plus expense Rs 500 |

| 50,000 |

49,500 500 |

“ “ | Profit on Redemption of Dr. To Discount on Issue of Debentures Account Use of Profit on redemption of debentures to partly write off discount o issue of debentures. |

| 500 |

500 |

“ “ | Profit and Loss Account Dr. To Interest on Debentures Account To Discount on Issue of Debentures Account Transfer of Interest on Debentures Account to Profit and Loss Account and writing off Rs9,500 of discount on Issue of Debentures, making total write off for the year equal to Rs 10,000 |

| 1,42,500 |

1,33,500 9,500 |

“ “ | Profit and Loss Appropriation Account Dr. To Debenture Redemption Reserve |

| 2,50,000 |

2,50,000 |

“ “ | Debenture Redemption Reserve Dr. Transfer from Debenture Redemption Reserve to General Reserve, the face value of debentures redeemed during the year. |

| 50,000 |

50,000 |

Balance Sheet as on March 31, 2012

(Items relating to debentures only)

Reserve and Surplus Long term borrowings | Note No. 1 2 | Rs 9,90,000 9,00,000 |

Notes:

- Reserve and Surplus

Debentures Redemption Reserve 9,00,000

General Reserve 1,00,000

Discount on issue of Debentures (10,000)

9,90,000

2. Long term borrowings

900 14% Debentures @ Rs 7,000 each 9,00,000

4. Issuance of obligations as collateral guarantee:

A company can issue obligations in favour of a money lender as collateral (subsidiary or secondary) of a loan obtained by it. The obligations remain dormant with the lender unless and until the company defaults on the loan for which the obligations have been issued. It is not necessary to approve any entry for the issuance of such bonds.

However, if an input is desired, the following input can be passed:

Debentures Suspense Account Dr

To the obligation account

Nominal value of the bonds issued as guarantee.

On the balance sheet, both the Obligation Account and the Obligation Suspension Account will appear on the P side

Balance Sheet

Debentures

Less: debentures Suspense Account

When the loan is repaid, the above entry is reversed as follows:

Debentures Suspense Account Dr

To Debentures Account

Problem 12:

Kalpana Ltd. obtained a bank loan of 2.50,000 rupees and issued 250 bonds of 14% of 1,000 rupees as collateral. In addition, the company issued to the public 8,000 12% bonds of Rs 100 each with a 2% discount payable on Rs 50 on application and balance on award.

The issue was subscribed by M / s Ajanta Underwriters for a commission of 1% of the nominal value of the subscribed obligations. The entire issue was subscribed to by members of the public. The company paid the underwriting fee in the form of 12% bonds of Rs 100 each issued at par. Pass journal entries for the above-mentioned transactions and draw the balance sheet of Kalpana Ltd.

|

Bank Dr. To Bank Loan Amount of bank loan raised |

| Rs 2,50,000 | Rs 2,50,000 |

| 14% Debentures Suspense Account Dr. To 14% Debentures Account Issue of 14% Debentures in favour of bank by way of a collateral security |

| 2,50,000 |

2,50,000 |

| Bank To 12% Debentures Application Account Receipt of application money on 8,000 12% Debentures @ Rs 50 per debenture. |

| 4,00,000 |

4,00,000 |

| 12% Debentures Application Account Dr. 12% Debentures Allotment Account Dr. Discount on Issue of Debentures Account Dr. To 12% Debentures Account Allotment of 8,000 12% Debenture of Rs 100 each at a discount of Rs 2 per debentures. |

| 4,00,000 3,84,000 16,000 |

8,00,000 |

| Underwriting Commission on Issue of Debentures Account Dr. To M/c Ajanta Underwriters Underwriting commissions payable to M/s Ajanta Underwriters @ 1% on Rs 8,00,000, the nominal value of debentures underwritten |

| 8,000 |

8,000 |

| M/s Ajanta Underwriters Dr. To 12% Debentures Account Allotment of 80 12% Debentures of Rs 100 each at par to M/c Ajanta Underwriters by way of payment of underwriting commission due to them |

| 8,000 |

8,000 |

| Bank Dr. To 12% Debenture Allotment Account Receipt of allotment money on 8,000 12% Debentures @ Rs 48 per debenture. |

| 3,84,000 |

3,84,000 |

Balance Sheet of Kalpan Ltd. as on …. |

|

|

| Note No | Rs |

Shareholder’s fund’s Reserve and surplus

Non-Current liabilities Long-term borrowings |

1

2 |

(24,000)

10,58,000 |

10,34,000 | ||

2. Assets Current assets Cash and cash equivalents |

3 |

10,34,000 |

Notes: Rs Rs

|

Underwriting Commission on (16,000) |

Issue of Debentures (8,000) |

(24,000) |

2. Long-term Borrowings |

14% Debentures 2,50,000 |

Less: 14% Debentures |

Suspense Account 2,50,000 Nil |

12% Debentures 8,08,000 |

Bank Loan 2,50,000 |

10,58,000 |

3. Cash and Cash Equivalents |

Balance with Bank 10,34,000 |

Working Notes:-

Dr. Cash Book (Bank Column Only) Cr.

To Bank Loan To 12% Debentures Application Account To 12% Debenture Allotment Account

To Balance b/d | Rs 2,50,000

4,00,000 3,84,00 10,34,000 10,34,000 |

|

By Balance c/d | Rs 10,34,000 |

Dr. 12% Debenture Account Cr.

To Balance c/d | Rs 8,08,000

|

|

By 12% Debenture Application Account By 12% Debenture Allotment Account By Discount on issue of Debenture Account By M/s Ajanta Underwriters

By Balance b/d | Rs 4,00,000 3,84,000 16,000

8,000 |

8,08,000 | ||||

8,08,000 |

| 8,08,000 |

5. Cancellation of discounts, etc. in the issuance of obligations:

A company is not legally obliged to cancel discounts or losses or expenses in the issuance of debentures (cost of issuing debentures). But prudence requires that such amounts be gradually written off by transfer to the Profit and Loss Account on a reasonable basis.

If the debentures are exchangeable at the end of a specified period, say ten years, it will be reasonable to pay off one-tenth of the cost of issuing the debentures each year.

If the obligations must be repaid in instalments, the amount to be paid each year must be proportional to the amount pending payment of the obligations, since it represents the benefit that the company obtains from the issuance of obligations.

Suppose company issues debentures of Rs 10, 00,000 and redeems at the end of each year debentures of Rs 1, 00,000. Then, the total cost of issuing the debentures must be amortized over ten years in a ratio of 10: 9: 8: 7: 6: 5: 4: 3: 2: 1. If the debentures remain outstanding for only part of a year, the amount to be paid at the end of that year must be reduced proportionally.

Problem 13:

Vaishali Co. Limited closes its books of accounts every year on March 31st. On May 1, 1999, it issues 8% bonds for a nominal value of Rs 5,000,000 with a 3% discount. The issuance costs amount to Rs 3,000. Calculate the amounts of the cost of Issuance of Obligations to be derecognized in different accounting years in each of the following cases:

(a) All obligations will be repaid after 10 years on May 1, 2009.

(b) Obligations of a face value of Rs 1.00,000 shall be repaid each year; the first repayment took place on May 1, 2000.

(c) Obligations will be repaid in five equal annual instalments of Rs 100,000 each, the first instalment being payable on May 1, 2003.

Solution:

Discount allowed on issuance of debentures = 3/100 x Rs 5, 00,000 = Rs 15,000

Bond issue expenses = Rs 3,000

Total cost of issuing bonds to be cancelled = 15,000 rupees + 3,000 rupees = 18,000 rupees

(a) Since the debentures will be redeemed after 10 years, one-tenth of the total cost of issuing the debentures must be amortized for each full year.

But in the 1999-2000 accounting year, the bonds remain outstanding for only 11 months (that is, from May 1, 1999 to March 31, 2000). Therefore, the amount to be written off in accounting year 1999-2000 = Rs 18,000 x 1/10 x 11/12 = Rs 1,650 The amount to be written off in each of the next nine accounting years = Rs 18,000 x 1/10 = 1,800 rupees

In the 2009-10 accounting year, the debentures remain outstanding for only 1 month (that is, from April 1, 2009 to May 1, 2009). Therefore, the amount to be written off in accounting year 2009-10 = Rs 18,000 x 1/10 x 1/12 = Rs 150.

(b) Obligations of Rs 1, 00,000 are repaid after each full year. Therefore, during the years 1999-2000,2000-01,2001-02,2002-03 and 2003-04, debentures of the face value of Rs 5 lakh, Rs 4 lakh, Rs 3 lakh, Rs 2 lakh and Rs 1 lakh respectively. Remain pending.

The cost of issuing the debentures must be amortized in a ratio of 5: 4: 3: 2: 1. Total of the proportions = 5 + 4 + 3 + 2 + 1 = 15. Cost of issuing the debentures to be amortized in the period between May 1, 1999 and May 1, 2000 = Rs 18,000 x 5/15 = Rs 6,000.

But in accounting year 1999-2000, the obligations of Rs 5 lakh remain in circulation for only 11 months (i.e. from May 1, 1999 to March 31, 2000). Therefore, the amount to write off in 1999-2000 = 18,000 rupees x 5/15 x 11/12 = 5,500 rupees.

In accounting year 2000-01, obligations of Rs 5,000,000 remain outstanding for 1 month and those of Rs 4, 00,000 remain outstanding for 11 months.

Therefore, the amount to be written off in accounting year 2000-01 = Rs (18,000 x 5/15 x 1/12) + Rs (18,000 x 4/15 x 11/12) = Rs 500 + Rs 4,400 = Rs 4,900

Key takeaways:

|

What is the redemption of obligations?

The exchange of debentures refers to the payment of the amount of debentures by the company. When the debentures are recovered, the liability is discharged on account of the debentures. To put it in other words, the amount of capital required for the repayment of obligations is large, and therefore economic enterprises make an adequate provision of profits and accumulate capital to claim obligations.

Meaning of the exchange of obligations

It means the reimbursement of the number of debentures to the holders of debentures.

- The bonds can be redeemed at par or at a premium.

- The terms and conditions of redemption are generally given in the prospectus that invites applications for the issuance of obligations.

There are 4 ways to claim the obligations. Namely:

- Lump sum payment

- Instalment payment

- Buy on the open market

- By conversion into shares or new obligations

|

- Lump sum payment: The Company claims the obligations by paying the fund in a lump sum (round sum) to the bondholders during their maturity according to the terms and conditions of issue.

- Payment in instalments: under this method, the exchange of debentures is generally paid in instalments on the particular date during the time the obligations are located. The total amount of the liability is divided by the total number of years. This should be noted that the authentic recoverable debentures are recognized by the sources of extraction of the required number of lots of the outstanding debentures for payment.

- Buying in the open market: when a company buys its own obligations in order to cancel them, such act of buying and cancelling the obligations includes the exchange of the obligations through the purchase in the open market.

- Conversion into shares or new obligations: a company can reclaim its obligations by transforming them into a new class of obligations or shares. If bondholders find the offer useful, they can exercise their right to transform their debentures into a new class of debentures or shares. These new shares or obligations can circulate at a premium, at a discount or at par. It should be noted that this method is applicable only to convertible bonds.

- Refund of obligations in lump sum upon maturity:

In this case, the obligations are exchanged in a single payment at the end of the stipulated period.

The basic accounting entries for the reimbursement of obligations are:

To debentures holder a/c | Dr. |

2. Debenture holder a/c To bank | Dr. |

The bonds can be exchanged at par, with a premium or with a discount. When the bonds are exchanged at par, the two previous entries are passed. When the bonds are exchanged with a premium, the following accounting entries are passed.

Debentures a/c Dr. (with face value of debentures to be redeemed)

Premium on redemption of debenture a/c Dr.(with premium payable on redemption)

To debenture holders a/c

It should be noted here that the "premium in the exchange of a / c debentures" may have been opened and paid at the time of issuance of debentures. If so, the premium payable on the debenture exchange should only be transferred to the account of the debenture holders based on the first entry. If it has not been opened before, it will be loaded now and then closed by transferring it to the a/ c securities premium or profit and loss account.

Bonds can be redeemed at a discount, although this is an unrealistic situation and is not found in practice.

However, in such a case the following inputs are passed:

Debentures a/c Dr. (with the face value of debentures redeemed)

To debenture holders (with the amount payable)

To profit on redemption of debentures (with discount on redemption)

The benefit of the bond redemption is a capital benefit. It is used to cancel the discount on the issuance of debentures / shares; otherwise, it will be transferred to the capital reserve. The bonds can be exchanged with capital or with earnings. Prudent companies arrange for the swap of bonds early on. They separate a certain sum of money from earnings each year and invest an equivalent amount in first-class securities so that the necessary funds are available for the debt swap at the appropriate time.

To invest funds out of business, the business can use either of the following two methods:

(a) Sinking fund method / Obligation sinking fund method

(b) Insurance policy method

(a) Sinking fund method / Obligation sinking fund method:

According to this method, each year, the company reserves a certain part of the earnings and credits the same to the bond redemption fund. To raise the necessary funds at the time of repayment, invest them in first-class securities. Interest earned on investments is also reversed when the obligations are due for repayment; the investments are sold and the proceeds of the sale are used to redeem the bonds.

Following transactions are:

To debenture redemption fund a/c It may be noted that amount to be credited to DR Fund a/c is ascertained from sinking fund tables. 2. Debenture redemption fund investment a/c Dr. To bank a/c (Being the amount invested in securities) |

The above two entries are passed in the first yea. At the end of second year and subsquent tears, the following entries will be passed:

To Interest on D.R.F investment (Being interest received on D>R.F investment a/c) |

2. Interest on DRF investment a/c Dr. To DRF account (Being interest credited to DRF a/c) |

3. Profit and Loss appropriation a/c Dr. To DRF a/c (Being appropriation of profit to DRF a/c) |

4. DRF investmetn a/c To bank a/c (Being amount of annual appropraition of profit plus interest received invested in securities) |

Accounting for last year are as follows:

To interest on DRF investment a/c (Being the amount of interest received o investment) |

2. Interest on DRF investment a/c Dr. To DRF a/c (Being the interest credited to DRF a/c) |

3. Profit and loss appropriation a/c To DRF a/c (Being the amount of Profit transferred to DRF) |

4. Last year's entry for the purchase of investments will not be approved as investments will not be purchased.

Instead, the entry for the sale of investments and the repayment of obligations will be approved, which are the following:

For the loss on the sale of investments, the reverse entry will be passed. In the exchange of obligations, the following entries will be approved.

Bank a/c Dr. To DRF investment a/c (Being the sale of investment) DRF investment a/c Dr. To DRF a/c Dr. (Being the profit on sale of investment transferred to DRF a/c) |

The credit balance in DRF a / c will be transferred to the general reserve account. It should be noted here that the proceeds from investment sales that were previously transferred to the DRF account will be transferred to the DRF capital reserve, these events are recorded using the following accounting entry.

Debenture Redemption Funds A/c Dr. To general reserve a/c To capital reserve a/c (Profit on sale of investment) |

(b) Insurance policy method:

Under this method, instead of buying investments, the company takes out an insurance policy for an amount that would be adequate for the exchange of debentures.

The accounting entries, under these methods, are the following:

First year and beyond (including last year)

To bank a/c (Being the payment of premium on DRF policy) |

2. Profit and loss appropriation a/c Dr. To debentures redemption fund a/c (Being the appropriation of profit to DR Fund a/c) |

In the last year, when the amount of the policy is made and the obligations are exchanged, the following accounting entries are passed.

To DRF policy a/c (Being the amount of policy relaised) |

2. Debentures a/ Dr. To debentures holders a/c (Being payment made to debenture holders |

3. Debenture holders a/c Dr. To bank (Being payment made to debenture holder) |

4. DRF policy a/c Dr. To DRF a/c (Being the profit on insurance policy transferred to DRF a/c) |