UNIT V

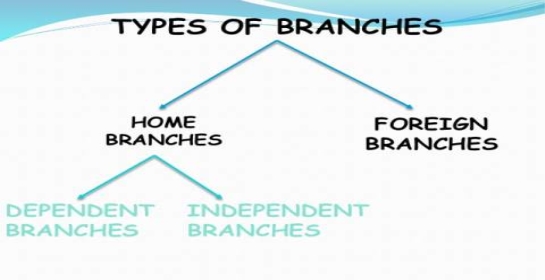

Foreign Branch

|

Introduction:

In modern times, the market for goods is not limited to one country, but extends to other countries. To sell products overseas, you need to open a branch office in that country. Such a branch is known as a foreign branch.

A foreign branch is nothing more than an independent branch in a foreign country. One of the important differences between an independent branch in your own country and an independent branch in a foreign country is that the latter holds accounting books in the foreign currency in which it operates.

The main problem when the head office receives the trial balance is to convert the trial balance into the currency of the head office. This is because it cannot be incorporated into the books of the head office unless the trial balance is converted.

Therefore, the question arises of how to convert when exchange rate fluctuations are apparent in the open market.

Fluctuations can be divided into three categories:

1. A stable currency with almost no exchange rate fluctuations.

2. Moderate fluctuations in exchange rates within a medium range.

3. Wide fluctuations where fluctuations exceed a certain limit.

IN THE BOOKS OF HEAD OFFICE

Trading and Profit and Loss Account

for the year ended 31st Dec. 2005

| H.O | Branch | Total |

| H.O | Bramch | Total |

To Opening Stock TO Purchase To Goods from H.O To Gross Profit

To Sundry Expenses To Depreciation To Net Profit

| Rs 15,000 3,00,000 - 65,000 | Rs 7,000 20,000 30,000 37,000 | Rs 22,000 3,20,000 30,000 1,02,000 |

By Sales By Goods sent to Branch By Closing Stock

By Gross Profit | Rs 3,20,000 30,000 25,000 5,000 | Rs 82,000 - 12,000 - | Rs 4,02,000 30,000 37,000 5,0000 |

3,80,000 | 94,000 | 4,74,000 | 3,80,000 | 94,000 | 4,74,000 | ||

12,000 8,800 44,200 | 9,000 3,000 25,000

| 21,000 11,800 69,200

| 65,000

|

37,000

|

1,02,000

| ||

65,000 | 37,000 | 1,02,000 |

| 65,000 | 37,000 | 1,02,000 |

1. Stable currency with virtually no exchange rate fluctuations:

If the foreign exchange rate between the two countries is fairly stable, the figures included in the trial balance of the foreign branch will be converted at a fixed rate, that is, the official rate. However, (a) remittances from branches will be converted at the actual rate. The remittance is made, and (b) the unconverted, but acquired headquarters account with the number showing the branch account on the date on the headquarters books.

The converted branch trial balance shows a slight difference in the head office books. It is placed on the short side of the account designated as the "exchange difference" that is closed by the transfer to the branch's P & L account.

2. When the exchange rate fluctuates slowly:

You must follow the rules below.

Items | Rate of conversion |

Closing Stock 4. Opening Stock Closing Stock 5. Goods from Head Office Remittance to and from Head Office Account 6. Depreciation 7. Provision of Bad Debts 8. Trading account and Profit and Loss account items | The rate prevailing when purchased. The rate prevailing when incurred. At the rate on the accounting date, called closing rate.

The rates ruling on the respective dates.

Actual rate i.e., actual figures appearing in the respective reciprocal accounts of the head office. The rate applicable to the related fixed assets. The rate applicable to the Debtors. At an average rate. Average is equal to opening rate plus closing rate divided by 2. |

Converting a branch trial balance into your home currency often makes a difference. This is called the "Exchange difference".

It may mean profit or loss. If there is a profit, the same can be carried forward for future losses from the exchange. If there is a loss, it may be adjusted and carried forward with respect to past exchange profits. If not, it may be transferred to the income statement.

3. Wide variability when variability exceeds certain limits:

If the exchange rate fluctuates frequently between the two countries and the market or actual rate differs significantly from the standard or official rate, the exchange rate is said to fluctuate significantly.

For each set of books, you need to enter the actual receipt or payment and convert them at an artificial fixed rate. The difference will be transferred to your foreign exchange reserves account.

Problem 1:

On December 31, 2005, the following balances appeared in the books of the Kolkata branch of a British company headquartered in London.

| Dr. | Cr. |

Stock on 1-1-2005 Purchase and Sales Debtors and Creditors Bills of Exchange Wages and Salaries Rent, Rates and Taxes Sundry Charges Furniture and Fixtures Bank Balance London Office | Rs 12,600 75,000 39,000 10,400 4,800 3,600 1,500 4,910 28,990 - | Rs - 1,12,500 26,000 9,100 - - - - - 33,200 |

1,80,800 | 1,80,800 |

Inventory on December 31, 2005 was Rs 32,500. The Kolkata branch A / c on the books of the London office showed a debit balance of 2,580 on December 31, 2005. Furniture and fixtures were obtained from a £ 350 remittance from London. This accurately covered the cost of such equipment.

You can get the exchange rate at:

Date | Rate |

31-12-2004 31-12-2005 | Rs 14 per £ Rs 13 per £ |

The average price in 2005 is 12 rupees per person.

Prepare transactions and income statements and balance sheets related to the Kolkata branch in a book in London.

Solution:

In London Books

Converted Trail Balance

| Branch Currency | Rate | H.O Currency | ||

Stock on 1.1.2005 Purchase and Sales Debtors and Creditors Bills of Exhange Wages and Salries Sundry Charges Furniture and Fixtures Bank Balance London Office Different in Exchange (loss) | Dr. Rs 12,600 75,000 39,000 10,400 4,800 3,600 1,500 4,910 28,990

- | Cr. Rs - 1,12,500 26,000 9,100 - - - - - 33,200

|

14 12 13 13 12 12 12 Actual 13 actual | Dr £ 900 6,250 3,000 800 400 300 125 350 2,230 - 300 | Cr. £ - 9,375 2,000 700 - - - - - 2,580 - |

1,80,800 | 1,80,800 | 14,655 | 14,655 | ||

Closing Stock | 32,500 | 13 | 2,500 | ||

Kolkata Branch Trading and Profit & Loss Account

for the year ended 31st December, 2005

Dr. Cr.

To Opening Stock To Purchase To Gross Profit c/d

To Wages and Salaries To Rent, Rates and Taxes To Sundry Charges To Difference in Exchange To Net Profit

| £ 900 6,250 4,725 |

By Sales By Closing Stock

By Gross Profit b/d | £ 9,375 2,500

|

11,875 | 11,875 | ||

400 300 125 300 3,600 | 4,725

| ||

4,725 | 4,725 |

Kolkata Branch Balance Sheet

as at 31st December, 2005

Liabilities | £ | Assets | £ |

Head office A/c 2,580 Add: Net Profit 3,600 Creditors Bills Payable |

6,180 2,000 700

| Furniture & Fixtures Closing Stock Sundry Debtors Bills Receivable Bank | 350 2,500 3,000 800 2,230 |

8,880 | 8,880 |

Problem 2:

From the following details, prepare a Branch Trading and Profit & Loss and a Branch A/c in the Head Office books of a business with Head Office in India and Branchin New York.

Trail Balance as on 30-06-2005

Particulars | H.O | Branch | Particulars | H.O | Branch |

H.O. Current A/c Purchase Goods from H.O Goods from Branch Branch A/c (1-7-2004) Opening Stock Debtors Salaries Rent and Taxes Furniture (1-7-2004) Cash on hand | Rs - 1,25,000 - 485 29,100 10,000 15,000 3,000 2,000 3,000 1,015 | $ 5,000 - 7,400 - - 500 1,000 400 300 500 300 | Rs Branch Current A/c Goods to Branch Head Office (1-7-2004) Sales Creditors Capital A/c Goods to H.O.

| $ 24,890 36,300 - 50,000 25,000 52410 -

|

- - 6,000 9,300 - - 100

|

1,88,600 | 15,400 | 1,88,600 | 15,400 |

The following information is provided:

(1) The exchange rate on January 7, 2004 was $ 1 = Rs 4.80 and the exchange rate on March 6, 2005 was $ 14.90. The rate of average was $ 1 = Rs 4.85.

(2) The closing price of the branch is $ 220.

(3) The branching product is H.O. You will be charged more than 10% of the cost to.

(4) Depreciate branch furniture at 10%.

Solution:

In H.O. books

Converted Trial Balance of New York Branch

| Branch Currency | Rate | H.O Currency | ||

H.O. Current A/c Goods from H.O. Opening Stock Debtors Salaries Rent & Taxes Furniture Cash on hand H.O. A/c Sales Goods to H.O. Difference in Exchange (profit)

| Dr. | Cr |

| Dr. | Cr. |

£ 5,000 7,400 500 1,000 400 300 500 300 - - - - | £ - - - - - - - - 6,000 9,300 100 - |

actual actual 4.80 4.90 4.85 4.85 4.85 4.90 actual 4.85 Actual

| Rs 24,890 36,300 2,400 4,900 1,940 1,455 2,425 1,470 - - - - | Rs - - - - -

- - 29,100 45,105 485 1,090 | |

15,400 | 15,400 | 75,780 | 75,780 | ||

Closing Stock | 220 | 4,90 | 1,078 | ||

Note: Branch ‘Furniture’ has been converted at the average rate in the absenc of information regarding the rate of exchange on the date of acquistion of furniture.

New York Branch Trading and Profit & Loss Account

for the year ended 30th June, 2005

Dr. Cr.

To Opening Stock (100/110 × 2.400) To Goods from H.O (100/110 × 36,300) 33,000 Less: Return (100/110 × 485) 441 To Gross Profit c/d

To Salaries To Depreciation on Furniture 10% on Rs. 2,425 To Net Profit | Rs 2,182

32,559 11,344 |

By Sales By Closing Stock (100/110 × 1,078)

By Gross Profit b/d

| Rs 45,105

980

|

46,085 | 46,085 | ||

1,940 1,455

243 7,706 | 11,344

| ||

11,344 | 11,344 |

New York Branch Account

Dr. Cr.

1-7-2004 To Balance b/d 30-6-91 To General P/L A/c Branch net profit To Difference in Exchange A/c Profit on exchange | Rs 29,100

7,706

1,090

| 30-6-2005 By Branch Current A/c transfer By Branch Stock Adjustment A/c transfer By Branch Assets Rs Debtors 4,900 Furniture (2,425 – 243) 2,182 Cash 1,470 Stock 1,078 | Rs 24,890

3,376

9,630 |

37,896 | 37,896 |

Branch Stock Adjustment Account

To Goods from Branch (Loads on goods returned) To Branch A/c – transfer (Balancing figure) To Balance c/d (Load on Closing Stock) | Rs 44

3,376 98

|

By Balance b/d (Load on opening stock) By Goods to Branch (Load on goods sent) | Rs 218

3,300 |

3,518 | 3,518 |

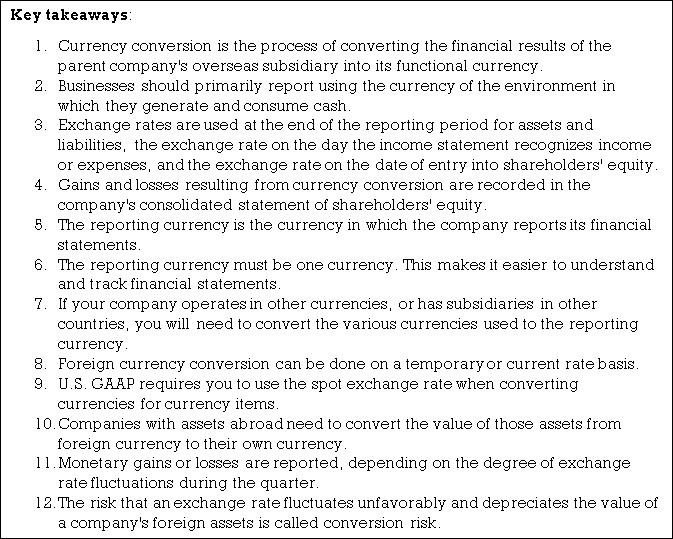

Companies may engage in forex-related transactions in several ways. To include foreign business and foreign currency transactions in the financial statements, the transactions must be expressed and reported in the financial statements in the company's reporting currency.

Applicability of AS11 Impact of fluctuations in foreign exchange rates

This standard deals with key issues regarding accounting for foreign businesses and foreign currency transactions in determining the exchange rate to be used and guidance on recognizing the financial impact of exchange rate fluctuations in financial statements.

This standard does not specify the currency in which the company represents its books. However, companies typically use the currency of their country of residence. If you are using different currencies, the standard must disclose why. The standard also requires disclosure of the reasons for the change in reporting currency.

AS 11 doesn't handle the restatement of business financial statements from the reporting currency to a different currency to facilitate users familiar with such currencies, or for such similar purposes.

This standard does not cover the presentation of cash flow statements resulting from transactions in foreign currencies and conversion of cash flows from overseas businesses.

The standard also does not treat foreign exchange differences resulting from borrowing in foreign currencies until it is considered an adjustment of interest costs.

Foreign currency transactions

A. First recognition

Foreign currency transactions are transactions denominated in foreign currencies or that need to be settled in foreign currencies. Such foreign currency transactions must be recorded by applying the exchange rate between the foreign currency and the reporting currency to the foreign currency amount on the trading day upon initial recognition in the reporting currency.

B. Subsequent balance sheet date report

All Balance Sheet Dates:

(A) All foreign currency items must be reported at the closing price. However, in certain circumstances, the closing rate may not indicate a reasonable and accurate amount in the reporting currency that is expected to be realized.

In such a scenario, the monetary item must be reported in the reporting currency at the value expected to be realized from such monetary item on the balance sheet date or required for payment.

(B) Non-monetary items recorded at acquisition costs denominated in foreign currencies must be reported using the exchange rate on the transaction date. And

(C) Non-monetary items recorded at fair value or similar valuations denominated in foreign currencies must be reported at the prevailing exchange rate at the time such value was determined.

Recognition of exchange differences

The foreign exchange difference that occurs when you report a company's financial items at a different rate than originally recorded must be recognized as revenue or expense.

Case Study

X Ltd. purchased 3,000 racks worth of fixed assets on January 1, 2006 and raised funds through a foreign currency (US $) loan paid in three equal instalments. The exchange rates on January 1, 2006 and December 31, 2006 were Rs 1 = 40.00 Rs and Rs 42.50, respectively. The first instalment was rendered on December 31, 2006. The total foreign exchange difference is capitalized.

Here, these transactions are accounted for as follows:

According to paragraph 13, the exchange rate difference resulting from the reporting of a financial item of a company or the settlement of a financial item at a rate different from that initially recorded during the period or reported in the previous financial statements must be recognized as income or expense for the period in which it occurred.

Calculation of exchange difference:

Currency of Foreign (US dollar) loan = 3,000 lakh ÷ 40 (exchange rate as of January 1, 2006) = USD 75 lakh

Exchange difference = US $ 75 x (42.50 – 40.00) = Rupee 187.50. Therefore, the entire loss incurred due to the exchange difference of Rs 187.50 must be charged to the income statement for each year. AS11 and Ind AS 21

Para 46 and 46A

The general principle is that the income statement must reflect the exchange difference, regardless of the exchange difference that occurs in the revenue or capital accounts. However, the Dominion of India has inserted the above paragraph in AS11 “Effects of Exchange Rate Fluctuations” with reference to the notice issued on March 31, 2009.

Differences in exchanges that occur for amortizable if it occurs in an account for depreciable assets, you do not need to charge the income statement and it may be added or reduced from the cost of such assets. This addition must be depreciated along with the asset over the useful life of such a depreciable asset.

The underlined condition is that such an asset is a depreciable capital asset and must appear in foreign currency on the balance sheet and be designated as a "long-term foreign currency item".

Tax effect due to exchange differences

Gains and losses on foreign exchange differences resulting from the conversion of foreign currency transactions and financial statements of foreign businesses may be subject to tax effects that are accounted for in accordance with AS22 “Corporate Tax Accounting”.

Overseas branch: Headquarters entry

A feature of overseas branches is that the information received from overseas branches is displayed in foreign currency and must be converted into the currency of the country of the head office before it are often used for accounting. For example, if an Indian company has a branch office in Nairobi, the trial balance for the branch office will be shilling. The trial balance must be converted to rupees before it can be incorporated. Before addressing the issue of incorporation, it is a good idea to consider how to handle transactions with branches from an exchange perspective.

Moderate variation:

The rules for recording transactions with branches in the books of the head office can be stated as follows.

(A) Fixed assets:

If you keep the fixed asset accounts acquired at the branch in the books of the head office, the price you paid can be converted to either the transaction date or the payment date rate. The depreciation charged to the branch for such assets must also be converted at the same rate. If exchange rate fluctuations increase or decrease liability for repayment of a loan made to purchase a fixed asset, such an increase will be added to the acquisition cost of the fixed asset and the decrease will be deducted Asset.

(B) Fixed liability:

If you want to keep the accounts related to fixed liabilities in the books of the head office, the conversion for entry into the head office must be done at either the prevailing rate or the prevailing rate on the day the liability was incurred. payment.

(C) Products entrusted to the branch office:

Products entrusted to the branch office are recorded in the books of the head office for a fee. The branch translates the invoice at the prevailing rate on the date of receipt of the goods.

(D) Remittance from branch office:

Remittances from the branch will be converted to the actual amount received at the head office. Similarly, remittances to a branch are converted by the branch for the amount actually received.

(E) Expenses charged to the branch:

The costs charged to the branch are converted by the branch at the average rate. The Institute of Chartered Accountants of India distinguishes between permanent changes and temporary or short-term changes in the value of a currency.

Following the IMF, the practice of allowing member states to change the value of their currency by 2.25% without the permission of the IMF is that the Institute makes such changes temporary or short-term and exceeds this limit is considered to be permanent.

Perhaps the institute doesn't say so, but for permanent changes, the devaluation treatment recommendations will apply. Otherwise, the usual conversion rules apply. These are summarized below.

Trial balance conversion:

The following rules are followed:

(A) The conversion of fixed assets displayed in the trial balance of the branch office must be performed at the prevailing rate on the transaction date or payment date.

(B) Fixed liabilities must be transformed at the prevailing rate, either on the date the liability was incurred or on the date of payment. The same rate will be used later. (As the redemption date approaches, the conversion may take place at the current interest rate.) (The review question may not list multiple interest rates for fixed assets and liabilities. In that case, the initial interest rate. Prefers. You must use the day of the year.)

(C) Current assets and liabilities should be converted at the prevailing rate on the last day of the year. (If the current asset is acquired and held overseas by the head office and is subject to a futures exchange agreement, the asset must be converted at the rate stated in the agreement.)

(D) Revenue items must be converted at the average rate. The average rate should be reached by checking the average of the rates at the beginning and end of the year. However, all types of starting stocks must be converted at the starting rate (since the starting stock was an asset of the previous year, it will be converted at the ending rate).

Similarly, the closing price must be converted at the closing price. Depreciation must be converted at the rate at which the associated fixed asset was converted. It should be noted that in the year the local currency is devalued, even revenue items should be converted at the prevailing rate at the end of the year.

This is due to the recommendation of the Institute of Chartered Accountants of India regarding the devaluation. According to the Association of Certified Accountants of India, under certain special circumstances, the average rate may not be appropriate for converting revenue items in the financial statements of foreign companies.

Here is an example of this situation:

- When income / expenditure is not evenly earned / generated during the accounting period, such as in a seasonal business.

- When the exchange rate fluctuates very much during the accounting period.

- When you receive a profit transfer from a branch, or when you make a loss transfer to a branch at a rate that is significantly different from the average rate.

In such cases, the institute has stated that the weighted average rate may be more appropriate.

(E) Remittances from branches must be converted to the corresponding numbers in the head office books. Suppose the Nairobi branch indicates a remittance Sh. 60,000 at headquarters in India. If the headquarters receives only 63,890 rupees, this must be the number standing in the credit of the account named "Transfer from Branch".

The appearance of Sh. 60,000 is converted with Rs63, 890 instead of calculation. Similarly, the head office accounts and other connected accounts in the branch trial balance must be converted to the numbers in the branch accounts in the head office books. The conversion in this case is not calculated.

(F) The trial balances will not match because various items in the branch trial balance have been converted at different rates. The difference must be stated shortly as the "exchange difference" and reflected in the income statement. However, if the difference is large, it must be carried forward in the currency fluctuation account. However, if the exchange rate fluctuates slowly, it is unlikely that a big difference will occur.

Note: The Institute of Chartered Accountants of India distinguishes between translation and conversion as follows:

Foreign currency conversion:

The process of expressing the amount displayed in foreign currencies as the equivalent amount in rupees using the exchange rate between the two currencies

Foreign currency conversion:

The process of expressing the amount displayed in foreign currency to the equivalent amount in rupees using the exchange rate at which the foreign currency is bought and sold.

Problem 3:

The following is B Ltd in Mumbai as of March 31, 2012. It is a trial balance of the Nairobi branch office.

Land and Buildings Plant and Machinery Furniture and Fittings Stock as on April 1, 2011 Purchase Goods Received from Head Office Wages Carriage Inwards Sales Salaries Rent, Rates and Taxes Insurance Trade Expenses Head Office Account Sundry Creditors Sundry Debtors Cash in Hand and at Bank Bills Payable | Shillings Rs 1,50,00 3,00,000 20,000 56,000 2,40,000 80,000 30,000 5,000

25,000 5,000 4,000 3,000

30,000 10,000

| Shillings Rs

6,16,000

2,40,000 18,000

84,000 |

9,58,000 | 9,58,000 |

The stock at Nariobi on 31st March, 2012 was 30,000 shillings. The followings were the exchange rates:

When fixed assets were acquired Re. 1 = 1.50 shillings

On April 1, 2011 Re. 1 = 0.90 shillings

On March 31, 2012 Re. 1 = 0.92 shillings

Average Re. 1 = 0.91 shillings

Goods from the headquarters were charged to the books of the headquarters for 90,000 rupees. What is the branch account in the books of the head office? It shows the debit balance of 1, 62,000. After converting the trial balance of Nairobi and charging 10% depreciation for plants and machinery, furniture and accessories, prepare the Nairobi transaction and income statement. Also, please enter the account of the Nariobi branch in the books of the head office.

Solution:

Nairobi Trial Balance

Names of Accounts | Dr. Sh. | Cr. Sh. | Rate | Dr. Rs | Cr. Rs |

Land and Buildings Plant and Machinery Furniture and Fittings Stock, April 1, 2011 Purchase Goods Received from Head Office Wages Carriage Inwards Sales Salaries Rent, Rates and Taxes Insurance Trade Expenses Head Office Account Sundry Creditors Sundry Debtors Cash in Hand and at Bank Bills Payable Difference in Exchange (balancing figure) | 1,50,00 3,00,000 20,000 56,000 2,40,000 80,000 30,000 5,000

25,000 5,000 4,000 3,000

30,000 10,000

|

6,16,000

2,40,000 18,000

84,000

| 1.50 1.50 1.50 0.90 0.91

0.91 0.91 0.91 0.91 0.91 0.91 0.91

0.92 0.92 0.92 0.92 | 1,00,000 2,00,000 13,333 62,222 2,63,736 90,000 32,967 5,494

27,473 5,494 4,396 3,297

32,608 10,869

97,899 |

6,76,923

1,62,000 19,565

91,300 |

| 9,58,000 | 9,58,000 |

| 9,49,788 | 9,49,788 |

Value of Stock @ Re. 1 = 0.92 Sh., Rs 32,608.

Dr. Nairobi Trading and Profit and Loss Account for the year ended March 31, 2012 Cr.

To Opening Stock To Purchase To Goods Received from Head Office To Carriage Inwards To Gross Profit c/d

To Salaries To Rent, Rates and Taxes To Insurance To Trade Expenses To Depreciation on: Plant and Machinery @ 10% Furniture and Fittings @ 10% To Difference in Exchange To Net Profit | Rs 62,222 2,63,736 90,000 32,967 5,494 2,55,112 |

By Sales By Closing Stock

By Gross Profit b/d | Rs 6,76,923 32,608

|

7,09,531 | 7,09,531 | ||

27,473 5,494 4,396 3,297

20,000 1,333 97,899 95,220 | 2,55,112

| ||

2,55,112 | 2,55,112 |

2012 Mar. 31 “ “

2012 Apr. 1 |

To Balance b/fd To Profit & Loss Account

To Balance b/d | Rs 1,62,000 95,220 | 2012 Mar. 31 |

By Balance c/d | Rs 2,57,220

|

2,57,220 | 2,57,220 | ||||

2,57,220 |

|

Nairobi Branch Account

Students are encouraged to check if this is correct by comparing the balance of the Nairobi branch with their net worth.

Alternative method of conversion:

Instead of converting all the items and then creating a branch transaction income statement in the head office books, first create a branch transaction income statement in the branch currency and then a simplified trial balance according to the rules. It can be converted.

If you solve the above figure this way, the solution would be:

Nairobi Trading and Profit and Loss Account

Dr. (In Local Currency) Cr.

To Opening Stock To Purchase To Goods Received from Head Office To Wages To Carriage Inwards To Gross Profit c/d

To Salaries To Rent, Rates and Taxes To Insurance To Trade Expenses To Depreciation on: Plant and Machinery, @ 10% Furniture and Fittings @ 10% To Net Profit transferred to H.O. A/c | Sh. 56,000 2,40,000 80,000 30,000 5,000 2,35,000 |

By Sales By Closing Stock

By Gross Profit b/d | Sh. 6,16,000 30,000

|

6,46,000 | 6,46,000 | ||

2,35,000

| |||

25,000 5,000 4,000 3,000

30,000 2,000 1,66,000 | |||

2,35,000 |

| 2,35,000 |

Nairobi Branch Trial Balances as on 31st March, 2012

Land and Buildings Plant and Machinery less Depreciation Furniture and Fittings less Depreciation Head Office Account Sundry Creditors Sundry Debtors Cash in Hand and at Bank Bills Payable Closing Stock (converted @ 0.92) Profit and Loss Account (converted @ 0.91) Difference in Exchange (balancing figure) | Sh. 1,50,000 2,70,000 18,000

30,000 10,000

30,000

- | Sh.

2,40,000 18,000

84,000

1,66,000 - | Rs 1,00,000 1,80,000 12,000

32,608 10,869

32,608

87,197 | Rs

1,62,000 19,565

91,300

1,82,417 - |

5,08,000 | 5,08,000 | 4,55,282 | 4,55,282 |

The Nairobi Branch Account will appear as under:

Nairobi Branch Account

Dr. Cr.

2012 Mar. 31 “ “

2012 Apr. 1 |

To Balance b/fd. To Profit & Loss A/c

To Balance b/d | Rs 1,62,000 1,82,417 | 2012 Mar. 31 Mar. 31 |

By Difference in Exchange By Balance c/d | Rs 87,197 2,57,220 |

3,44,417 | 3,44,417 | ||||

2,57,220 |

|

Students will find that the "difference in exchange" in this way is different from what was revealed in the previous way. This is because the branch transaction / profit and loss account has already been created, including the opening price, depreciation cost, and closing price. Each of these items was converted at a different rate in the previous method. However, since net income is converted at the average rate, the second method also has the effect that the average rate is applied to these items.

| Rs | Rs |

Difference in Exchange in the First Method (Dr.) Add: Items increasing the difference i.e., reducing the debit Side or increasing the credit side in the second method (i) Opening Stock: Second Method @ 0.91 First Method @ 0.90 (ii) Goods Received from H.O. First Method Second Method @ 0.91 (iii) Closing Stock: Second Method @ 0.91 First Method @ 0.92 (increase on the credit side) |

61,538 62,222 | 97,899

684

2,088

359 |

90,000 87,912 | ||

32,967 32,608 | ||

| 1,01,030 | |

Less: Items reducing the difference: Depreciation (Total 32,000 Sh.) Second Method @ 0.91 First Method

Difference in Exchange in the Second Method (Re. 1difference due to rounding up) |

35,165 21,333 |

13,832 |

| 87,198 | |

87,197 |

Problem 4:

C Ltd in Kolkata has a branch in Imagine, which has dollars as currency. In July 2009, we had the following transactions with the head office.

Stores received from Kolkata (Re 1 = $1) Stores purchased locally Stores used on capital (at standard rate) Store used on revenue (at standard rate) Sales (all cash) Wages (capital) Wages (revenue) | Rs 45,000 $ 10,000 $ 16,000 $50,000 $60,000 $ 5,000 $12,000 |

During the month, $ 20,000 was sent to Kolkata at the actual rate of $ 1.25. 1. The standard rate is $ 2 = Re. 1. The average rate is $ 1 = Re. At 1, the rate at the end of the month was $ .80 = Re. 1. Shows how transactions are entered into the branch ledger. It also shows how branch accounts appear in the books at headquarters, and also shows the converted trial balance.

Solution:

Branch Books

Stores Control Account

Dr. Cr.

2009 July

2009 Aug. 1 |

To Head Office (1) To Cash (2)

To Balance b/d | Rate $

2 2 | Nominal $

90,000 20,000

| Real $

45,000 10,000

|

2009 July. 31

July. 31

July. 31

July. 31 |

By Capital Ex-penditure (3) By Revenue Account (4) By Difference in Exchange (balancing figure) By Balance c/d (5) | Rate $

2

2

0.8 | Nominal $

16,000

50,000

44,000 | Real $

8,000

25,000

4,400 17,600 |

1,10,000 | 55,000 | 1,10,000 | 55,000 | ||||||

44,000 |

17,000 |

|

|

Head Office Account

2009 July. ? July. 31

July. 31

July. 31

|

To Cash To Capital Expenditure (transfer) To Stores Control A/c (different in exchange) To Balance c/d | $ 20,000

13,000

4,400 30,600 | 2009 July. ? July. 31

Aug. 1 |

By Stores Control A/c By Trading and Profit and Loss A/c (profit)

By Balance b/d | $ 45,000

23,000

|

68,000 | 68,000 | ||||

| 30,600 |

Capital Expenditure Account

2009 July. ? |

To Stores Control A/c To Cash (wages) | $ 8,000 5,000 | 2009 July. 31 |

By H.O. A/c (transfer) | $ 13,000

|

13,000 | 13,000 |

DR. Trading and Profit and Loss Account Cr.

2009 July. 31 |

To Stores Control A/c (stores used) To Wages To Profit transferred to H.O. A/c | $ 25,000 12,000 23,000 |

|

| $ 60,000

|

60,000 | 60,000 |

Cash Account

2009 July

2009 Aug. 1 |

To Sales

To Balance b/d | $ 60,000

| 2009 July July July

July. 31

|

By Stores Control A/c – Purchase By H.O. A/c (remittance) By Capital Expenditure A/c (wages) By Wages By Balance c/d | $ 10,000 20,000 5,000 12,000 13,000 |

60,000 | 60,000 | ||||

13,000 |

|

Branch Account (in H.O. Books)

2009 July. ?

2009 Aug. 1 |

To Goods Sent to Branch A/c To Profit and Loss A/c ($ 23,000 @ Re. 1 = $1)

To Balance b/d | Rs

45,000

23,000 | 2009 July. ?

July. 31

July. 31 |

By Cash Remittance Received ($ 20,000 @ Re. 1 = $1.25) By Capital Expenditure ($ 13,000 @ Re. 1 = $1 (6) By Balance c/d | Rs

16,000

13,000 39,000 |

68,000 | 68,000 | ||||

39,000 |

|

Branch Trial Balance

Stores Control Account @ $.80 = Re. 1 Cash at Bank @ $.80 = Re. 1 Head Office Account (as per Branch Accoutn in H.O. Ledger) Difference in Exchange | Rs 22,000 16,250

750 | Rs

39,000

| $ 17,600 13,000

| $

30,600

|

39,000 | 39,000 | 30,600 | 30,600 |

Note:

(1) To get the nominal value, convert the value of $ 45,000 at the nominal interest rate, which is twice the actual value of the transaction. The nominal interest rate is $ 2 = Re.1 while 1 = $ 1.

(2) The nominal interest rate is twice the real interest rate. Therefore, the number entered in the Nominal column is twice the actual number of the purchase.

(3) A $ 16,000 store is used to spend at standard rates. The average rate is $ l = Re. 1, half of the nominal interest rate. Therefore, the number entered in the actual column is half the standard number.

(4) Same reason as (3).

(5) The balance in the Nominal column shows the closing price of $ 44,000 at par. The prevailing rate on July 31 is $ 0.80 per rupee. Therefore, the actual value of the closing price is 44,000/2 x 8 or $ 17,600.

(6) Capital expenditures should have been converted at the prevailing rate on the day the construction was completed but because it has not been given and converted at average rate.

Problem 5:

Carlin & Co. Is headquartered in New York (USA) and has a branch office in Mumbai (India). The Mumbai branch will provide a trial balance as of March 31, 2012 and additional information provided thereafter.

| Dr. Rupees in thousands | Cr. Rupees in thousands |

Stock on 1st April, 2011 Purchase and Sales Sundry debtors and creditors Bills of exchange Wages and Salaries Rent, rates and taxes Sundry charges Computers Bank balance New York office a/c | 300 800 400 120 560 360 160 240 420 - | - 1,200 300 240 - - - - - 1,620 |

3,360 | 3,360 |

Additional Information:

(A) The computer was obtained from a US $ 6,000 remittance received from the New York headquarters and paid to the supplier. Depreciate your computer at 60% per year.

(B) As of March 31, 2012, the unsold inventory of the Mumbai branch was worth Rs 420,000.

(C) The exchange rate can be interpreted as follows.

1) January 4, 2011 @ 40 rupees per US dollar

2) March 1, 2012 @ 742 per US $

3) Average annual exchange rate @ 41 rupees per US dollar

4) Conversion with $ must be done with precision up to two decimal places.

Income statement for the year ended March 31, 2012 and Carlin & Co. You will be asked to prepare the balance sheet for the day of the Mumbai branch on the books of the New York headquarters in US dollars. The Mumbai branch account showed a debit balance of US $ 39609 on March 31, 2012 in New York's books and there were no items awaiting adjustment.

Solution:

Trading and Profit and Loss Account of Mumbai branch

for the year ended 31st March, 2012

To Opening Stock TO Purchase To Gross profit c/d

To Wages and Salaries To Depreciation on Computers | $ 7,500.00 19,512.20 12,256.09 |

By Sales By Closing Stock

By Gross profit b/d By Net Loss | $ 29,268.29 10,000.00

|

39,268.29 | 39,268.29 | ||

13,658.54 8,780.49 3,902.44 3,600.00 | 12,256.09 17,658.38

| ||

29,941.47 | 29,941.47 |

Balance Sheet of Mumbai Branch as on 31.3.2012

Liabilities New York Office Account: $ Balance b/fd 39,609.18 Les: Net Loss 17,658.38 | $

21,923.80 | Assets $ Computers 6,000 Less: Depreciation 3,600

| $

2,400.00 |

Sundry Creditors Bills payable | $

7,142.86 5,714.29

|

Closing Stock Sundry Debtors Bills Receivables Bank Balance | $ 10,000.00 9,523.81 2,857.14 10,000.00 |

34,780.95 | 34,780.95 |

Working Notes:

Converted Trial Balance of Mumbai Branch as on 31st March, 2012

Name of Account | Rate per $ Rs | Debit Rs | Credit Rs | Converted debit Rs | Converted credit Rs |

Stock on 1st April, 1998 Purchase and Sales Sundry Debtors and Creditors Bills of Exchange Wages and Salaries Rent, Rates and Taxes Sundry Charges Bank Balance New York Office Account | 40 41 42 42 41 41 41

42 - | 300,000 800,000 400,000 120,000 560,000 360,000 160,000 240,000 420,000 - | - 1200,000 300,000 240,000 - - - - - 1620,000 | 7,500.00 19,512.20 9,523.81 2,857.14 13,658.54 8,780.49 3,902.44 6,000.00 10,000.00 - | - 29268.29 7142.86 5714.29 - - -

- 39,609.18 |

3360,000 | 3360,000 | 81,734.62 | 81,734.62 |

Problem 6:

S & M Ltd. in Mumbai has a branch office in Sydney, Australia. As of the end of March 2012, the following ledger balances have been extracted from the books of the Mumbai and Sydney offices.

| Mumbai (Rs in thousands) | Sydney (Australian dollars in thousands) | ||

| Debit | Credit | Debit | Credit |

Share Capital Reserve and Surplus Land Buildings Depreciation Provision Plant & Machinery (Cost) Plant & Machinery Depreciation Provision Debtors and Creditors Stock (1.4.2011) Branch Stock Reserve Cash & Bank Balances Purchase and Sales Goods Sent to Branch Managing Director’s Salary Wages & Salaries Rent Office Expenses Commission Receipts Branch/H.O. Current Accounts | - - 500 1,000 - 2,500

- 280 100 - 10 240 - 30 75 - 25 - 120 | 2,000 1,000 - - 200 -

600 200 - 4 - 520 100 - - - - 256 - | - - - - - 200

- 60 20 - 10 20 5 - 45 12 18 - - | - - - - - -

130 30 - - - 123 - - - - - 100 7 |

4,880 | 4,880 | 390 | 390 | |

The following information is also available:

(1) Inventory as of March 1, 2012:

Mumbai Rs1, 50,000

Sydney A $ 3,125

(2) The head office always shipped products to branches at a cost of 25%.

(3) The allowance for doubtful accounts is 5%.

(4) Depreciation is provided at 10% of the building and 20% of the depreciation of plants and machinery.

(5) Managing Directors are entitled to a 2% commission on net income.

(6) Income tax is provided at 47.5%.

Things necessary:

(A) To convert the trial balance of a branch to rupees, use the following exchange rates.

Open rate A $ = Rs 20

Closing price A $ = Rs 24

Average rate A $ = Rs 22

For fixed assets A $ = Rs 18

(B) Create trading and profit and loss accounts for the fiscal year ended March 31, 2012, and present head office performance and branch performance as separately as possible. (No balance sheet required.) Ignore the depreciation rates listed in Schedule XIV of the Companies Act. [C.A. (Intel) May Modified in 1995]

(a) S & M Ltd.

Sydney Branch Trial Balance (in Rupee)

As on 31st March, 2012

(Rs. 000)

| Conversion rate per A$ | Dr. | Cr. |

Plant & Machinery (cost) Plant & Machinery Depreciation Provision Debtors and Creditors Stock (1.4.2011) Cash & Bank Balances Purchase and Sales Goods Received from Head Office Wages and Salaries Rent Commission Receipts H.O. Current Account

Exchange Loss, (balancing figure) | Rs 18 Rs 18 Rs 24 Rs 20 Rs 24 Rs 22 - Rs 22 Rs 22 Rs 22 Rs 22 | 36,00

1,440 400 240 440 100 990 264 396

|

2,340 720

2,706

2,200 120 |

7870 216 | 8086

| ||

8086 | 8086 |

(b) Trading and Profit and Loss Account for the year ended 31st March, 2012

Particulars | Rs (000) | Particulars | Rs (000) | ||||

H.O. | Branch | Total | H.O. | Branch | Total | ||

To Opening Stock To Gross Profit c/d | 100 240 -

430 | 400 440 100

1,841 | 500 680 100

2271 | By Sales By Goods Sent to Branch By Closing Stock

| 520 100 150

| 2706 - 75

| 3,226 100 225

|

770 | 2781 | 3551 | 770 | 2,781 | 3,551 | ||

To Wages & Salaries To Rent To Office Expenses To Provision for Doubtful Debts @ 5% To Depreciation [working note (i)] To Balance c/d

To Exchange Loss To Branch Stock Reserve [Working note (ii)] To Managing Director’s Remuneration: Salary 30 Commission 41 [Working note (iii)] To Provision for Income-tax [Working note (iv)] To Balance c/fd | 75 - 25

14

460 112 | 990 264 296

72

252 2067 | 1065 264 421

86

712 2179 | By Gross Profit b/d By Commission Receipts

By Balance b/d | 430 256

| 1841 2200

| 2271 2456

|

686 | 4041 | 4727 | 686 | 4071 | 47,27 | ||

|

| 216

11

71

893 988 |

|

| 2179

| ||

2179 | 2179 | ||||||

Working Notes:

(i) Calculation of Depreciation:

Less: Depreciation Provision

Depreciation @ 10%

B. Plant & Machinery, cost Less: Depreciation Provision

Depreciation @ 20% Total depreciation (A+B)

(ii) Calculation of Branch Stock Reserve: Closing stock Reserve on closing stock ( 75 x 1/5) Less: Branch Stock Reserve (as on 1.4.2011) Additional reserve required

(iii) Calculations of Managing Director’s Commission: Profit before adjustments Add: Provision for Doubtful Debts

Less: Branch Stock Reserve Exchange Loss

(iv) Calculation of Provision for Income tax: Profit u/s 349 as computed above Less: Provision for doubtful debts Less: MD’s remuneration Profit before tax Provision for tax @ 47.5 % |

(Rs ‘000) H.O. 1,000 200 |

Branch - -

3600 2340 |

800 | ||

80

2500 600 | ||

1900 | 1260 | |

380 | 252 | |

460 | 252 | |

11 216

86 71 | (Rs. ‘000) 75 | |

15 4 | ||

11 | ||

(Rs. ‘000) 2179 86 | ||

2265 | ||

227 | ||

2038* | ||

41 (approx.) | ||

157 | ||

1881 | ||

893** (approx.) |

References:

- Financial Accounting by B.B. Dam

- Financial Accounting K.R DAS