UNIT V

Working Capital Management

Definition of working capital management

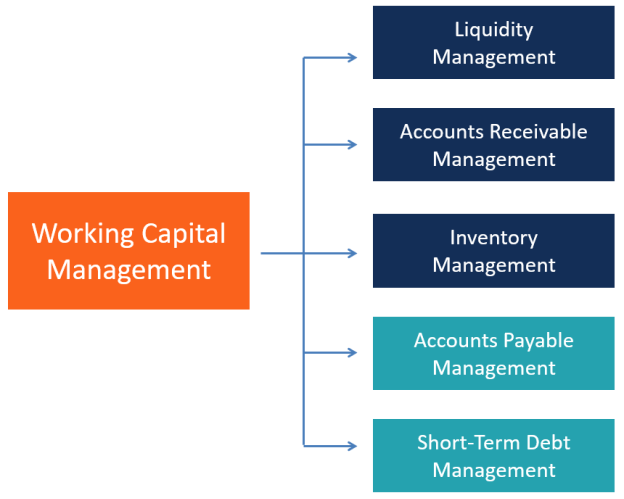

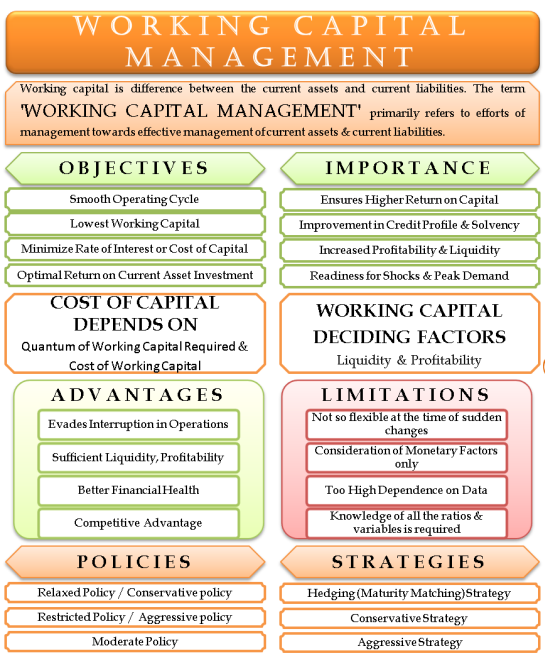

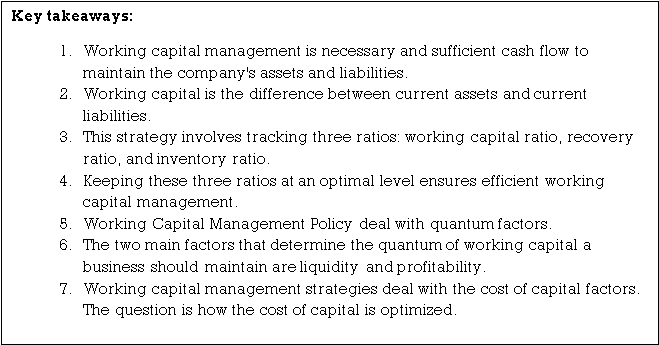

The term "working capital management" mainly refers to management's efforts towards effective management of current assets and current liabilities .Working capital is the difference between current assets and current liabilities. In other words, efficient working capital management means ensuring sufficient liquidity to meet short-term expenses and debts.

In a broader view, "working capital management" includes working capital financing apart from liquid assets and debt management. It arranges working capital at the lowest possible cost and adds a commitment for making cost-effective use of capital.

Purpose of working capital management

The main objectives of working capital management are:

- Smooth operation cycle: an important objective of working capital management is to ensure a smooth operation cycle.

- Lowest working capital: in order to achieve a smooth operating cycle, it is also important to keep working capital requirements at the lowest. This can be achieved by good credit conditions with accounts payable and accounts receivable, faster production cycles, effective inventory management, etc.

- Minimize interest rate or capital costs: it is important to understand that the interest cost of capital is one of the main costs in any enterprise. The management of the company should negotiate well with the financial institution, choose the appropriate financial mode and maintain the optimal capital structure.

- Optimal returns on current asset investments: in many companies, liquidity decreases at one point and excess liquidity at another. This happens mainly in the seasonal industry. In times of excess liquidity, management should have good short-term investment instruments to benefit from idle funds.

The importance of effective working capital management

The importance of working capital is indisputable in any type of business. Working capital management is a daily activity, unlike the determination of capital budgets. The most important thing is that the inefficiencies of management at all levels affect working capital and its management. Here are the main points that show why it is important to take seriously the management of working capital:

- We guarantee a higher return on capital

- Improved credit profile and solvency

- Increase profitability

- Better liquidity

- Business value appreciation

- Most suitable financing terms

- Production free of interruption

- Responding to shocks and peak demand

Advantage over competitors ' decisions in capital management

If someone explains the benefits of Working Capital Management in terms of money, it will most likely be the cost of capital that the business pays on investment in working capital. The amount of this cost depends on two things namely: Quantum of working capital required and the cost of working capital. The quantum of working capital is determined by the company's working capital policy, whereas the optimization of capital costs is working in working capital management strategies.

Determinants of working capital-the level and mode of financing

The two main factors that determine the quantum of working capital a business should maintain are liquidity and profitability. Let's understand in detail the impact of both of these factors.

No one denies the importance of liquidity, but most have the question of what proportion that liquidity should be. What is the proper level of liquidity? A business cannot sit on unlimited or too high liquidity, because high liquidity leads to higher investment in working capital. And higher investment in working capital means higher capital costs and interest costs if financed by bank finance. Therefore, higher liquidity has a direct impact on profitability as capital costs rise. In essence, the relationship between liquidity and profitability is the opposite. On the one hand, higher and fairly adequate liquidity is the main goal of working capital management. On the other hand, profitability as an objective is aligned with the overall goal of organization i.e. wealth maximization.

With that, it is clear that the policies that organizations follow fall between these pillars. There are policies that are leaning toward liquidity, and other policies may be heading toward profitability. It's a management decision where they want to set a policy in their organization.

Working capital management policy

Does Working Capital Management Policy deal with quantum factors, i.e. how many liquid assets should be maintained? These policies are, in essence, different levels of trade-off between liquidity and profitability. Whereas in theory it can be N policies depending on where the trade-off between liquidity and profitability is, the following three types of policies are available:

- Relaxed policy/conservative policy–this policy features a high level of quick assets maintained to respect current liabilities. Here, liquidity is very high, and the direct impact on profitability is also high.

- Limited policy/aggressive policy–this policy has a low level of liquid assets. Here, the liquidity level is very low, so the direct impact on profitability is also low.

- Moderate policy-it's between conservative and aggressive policies.

Working capital management strategy

Working capital management strategies deal with the cost of capital factors. The question is how the cost of capital is optimized. A business has a choice to choose between short-term versus long-term sources of capital. Usually, short-term funds are cheap but risky in the long run. Short-term funds are risky in terms of the risk of refinancing and the risk of rising interest rates. Once it matures, it may not be refinanced in the same financial institution, and the interest rate may be reviewed every time it is renewed.

Let's divide a company's capital investment into two types: investment in fixed assets and investment in working capital. Let's safely assume that long-term funds fund fixed assets. What remains now is working capital. Let's further divide the working capital into permanent working capital and temporary working capital. The nature of permanent capital is analogous to fixed assets i.e. the level of investment in working is always present and the rest continues to fluctuate

- Hedging (maturity matching) strategy–this strategy follows the principal of long-term funds, that is, to finance long-term assets, and vice versa. In this strategy, the maturity of the current is consistent with the maturity of its financing instrument. It has no cushion or flexibility in case of delay in the realization of liquid assets. It is a very ideal strategy, but includes a high risk of bankruptcy.

- Conservative-it’s safer strategy, apart from the entire financing of permanent working capital, it also funds a portion of temporary working capital.

- Aggressive-it is a risky strategy apart from the entire financing of temporary working capital; it also funds part of permanent working capital.

Benefits of working capital management

- Working capital management ensures sufficient liquidity if necessary.

- It avoids interruption of operation.

- Profitability was maximized.

- Achieve better financial health.

- Develop a competitive advantage due to streamlined operation.

Disadvantages of working capital management

- It considers only monetary factors. It has non-monetary factors to ignore like customer and employee satisfaction, government policies, market trends, etc.

- It is difficult to respond to sudden economic changes.

- Too much reliance on data is another drawback. A small organization has such data.

- Too many parameters to keep in mind say current ratio, fast ratio, collection period, etc.

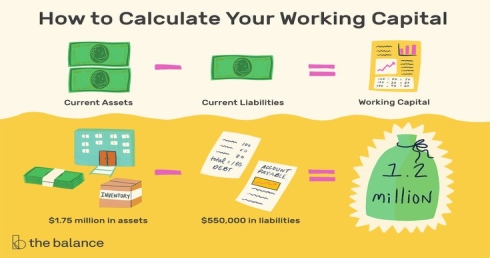

Fig 1

Meaning:

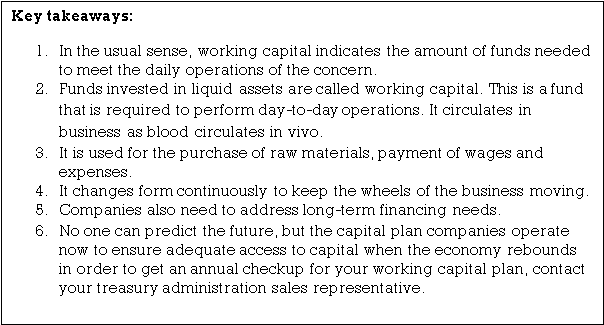

In the usual sense, working capital indicates the amount of funds needed to meet the daily operations of the concern.

It is related to short-term assets and short-term funding sources. Thus, it deals with both assets and liabilities—in the sense of managing working capital, it is an excess of current assets relative to current liabilities. In this article, we will talk about different aspects of working capital.

Working capital concept:

Funds invested in liquid assets are called working capital. This is a fund that is required to perform day-to-day operations. It circulates in business as blood circulates in vivo. In general, working capital refers to the current assets of a company that have been changed from one form to another in the normal business process: from cash to inventory, from inventory to ongoing work in process (WIP), from WIP to finished product, from finished product to receivables, and from receivables to cash.

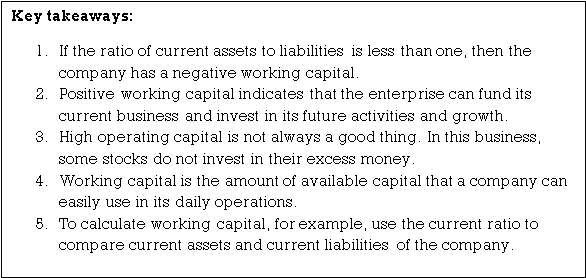

There are two concepts about working capital.

- Total working capital and

- Net working capital.

Total working capital:

The sum of all current assets of a business concern is called Total working capital. So

Total working capital=shares+debtors+receivables+cash.

Net working capital:

The difference between current assets and current liabilities for business concerns is called net working capital.

Therefore,

Net working capital=shares+debtorsdebt.

Nature of working capital:

The nature of working capital is as follows:

- It is used for the purchase of raw materials, payment of wages and expenses.

- It changes form continuously to keep the wheels of the business moving.

- It generates elements of costs, namely: materials, wages and expenses.

- It allows enterprises to take advantage of cash discount facilities offered by suppliers.

- This improvement shows the highest rise in moral business executives and their efficiency.

- This will facilitate the expansion program of the enterprise and help maintain the operational efficiency of fixed assets

Planning of Working Capital

- Assess future funding requirements for running a business.

Start by evaluating the company's short-term funding needs (for example, payroll meeting and paying suppliers, utilities, rent and taxes). These due dates may not correspond to your cash flow, so you must have a strong understanding of your cash requirements to meet your company's obligations.

Companies also need to address long-term financing needs. For example, buying a building or factory and upgrading a manufacturing facility usually requires capital to be financed. Experts in the Ministry of finance need to secure the necessary funds before the company finalizes plans to run large-scale capital projects.

2. Calculate the required working capital given the different growth scenarios.

We will conduct a “scenario analysis “to determine whether the current working capital strategy supports various growth rates.

First, a business should consider economic, industry and market competition to establish realistic expectations of the growth opportunities available. For example, what would happen to your balance sheet if your unpaid trade debt increased by 5%? Can you still make a salary?

Then, run the shock analysis by running the numbers at a growth rate that is far above or below the expected rate of the scenario analysis. This is useful for emergency response planning.

In addition to revenue growth, we assess margins and overhead at different growth levels.

3. Assess your current access to working capital and consider diversification.

Companies need to check their current access to various sources of funds, such as working capital lines, cash and investment accounts, accounts receivable and inventory. However, it’s SEO enough to meet strategic goals.

As a best practice, mid-market and large organizations (those with annual earnings of more than$100 million) suggest that this diverse approach to holding cash and investments in at least two separate institutions will tighten booming lending and make it easier for companies to access credit.

4. We review the debt and receivables processes and strive to maximize working capital.

There are several strategies and processes that companies can adopt to maximize working capital.

On the accounts receivable side, direct debits can be provided to customers via the automatic clearing house (ACH) network, so payments are automatically made on a given schedule this approach is useful for companies that sell services that regularly ask for scheduled payments, such as utilities and real estate companies. Electronic invoice payment is an application that allows you to send invoices via the internet, an agent, or an interactive voice response while maintaining control over when the payment is made.

In addition, the lockbox service applies cheque payments at least a day earlier than companies can if they process the payment on their own.

On the accounts payable side, companies can use controlled accounts payable to learn early every morning that the checks they issue will hit their accounts that day, and also, using an integrated payables solution or ACH Network, the preferred method without worrying about how fast the Postal Service will deliver the checks.

5. As you grow, use borrowing and credit facilities instead of running out of cash.

Cash-rich companies should not automatically tap their cash when it's time to grow. One of the reasons for this is that a positive cash position improves the company's access to capital. In addition, being in a position of good liquidity reduces the cost of capital of the company. So as the economy improves and investment returns are good, it is likely that it will be cheaper for companies to borrow at existing interest rates rather than dip into corporate cash.

6. Test and update working capital plans.

Formal working capital plans should be updated annually and supplemented by quarterly or monthly closing reviews to see if adjustments are needed.

Plan now for tomorrow.

No one can predict the future, but the capital plan companies operate now to ensure adequate access to capital when the economy rebounds in order to get an annual checkup for your working capital plan, contact your treasury administration sales representative.

- Estimation / Projection of Working Capital Requirement in case of Trading and Manufacturing Organization

Estimate of working capital in case of trading and manufacturing

Two components of capital are current assets and current liabilities. Estimation of the amount of current and current liabilities to maintain a certain level of operation is not an easy task.

The lack of working capital disrupts the smooth production process, and excess working capital increases costs.

Here we describe the estimation of working capital in case of trading and manufacturing concerns.

Manufacturing concerns:

The following procedure should be employed to estimate working capital for manufacturing concerns:

(a) Expected production per week or per month.

(b) Determination of costs for each element, namely material, labor and overhead, as well as profit per unit;

(c) Calculation of the amount blocked for each week/month for each element of cost and profit;

(d) Determination of the operating cycle by estimating the raw material retention period. Processing time, storage period of finished products, debt collection period. The period of payment of creditor it takes time lag in pay and overhead payments.

(e) Determining the net block period. This is the period during which each element of the cost remains blocked. For example, if the raw material remains in the store for 2 weeks after purchase, the processing time is 2 weeks, the finished product remains in stock, 3 weeks if the credit period extended to the debtor is extended for 4 weeks, and the payment for the material is made for 2 weeks after purchase, the net block period is as follows::

[(2+ 2 + 3 + 4) – (2)] = 9 a few weeks.

(f) Obtain the working capital requirements for each element of the cost by multiplying the net block period calculated in step (e) and the amount blocked for each element of the cost according to step (c).

(g) Get the total amount of working capital, if any, by summing up the costs and all the amounts calculated for each element of the desired cash

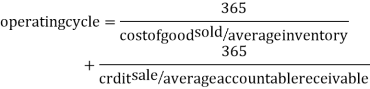

The operating cycle (OC) refers to the amount of days a business must receive inventory, sell inventory, and collect cash from the sale of inventory. This cycle of role decisions is more efficient.

Formula

The OC expression is:

Operating cycle=inventory period+accounts receivable period

Where:

The inventory period is that the time that the inventory is kept until it's sold.

The assets period is that the time it takes to recover cash from the sale of inventory.

Using the operation cycle formula

Using the above behaviour cycle formula:

The inventory period is calculated as follows:

Inventory Period=click 365/inventory turnover

The formula for inventory turnover is:

Inventory turnover=cost of products sold/average inventory

The assets period is calculated as follows:

Accounts receivable Period=click 365 / assets sales

The formula for calculating the turnover of assets is as follows:

Accounts receivable sales = average assets sales of credit assets average assets sales of credit assets

So the detailed expression for OC is:

Problem:

When you want to understand the capital by way of Inc. X operating cycle: Estimated sales of 20,000 units@ $ 5P.U. Similar will be the Production and sales the year.

Production cost: M-2.5 p.U. Labour, 1.00 p.U.Overhead$17.500.

60 days credit is given to Customers and 50 days from suppliers on credit. 40 days’ supply of raw materials and 15 days’ supply of finished products are kept future

The production cycle is 20 days. All materials are issued at the start of every production cycle. SA mean of 1/3 of the capital is held as a cash balance for contingencies’).

Solution:

(a). Total Op. Exp. For the year. | $ |

R.M. 20,000 x 250 | 50,000 |

Labor 20,000 x 1 | 20,000 |

Overheads | 17,500 |

| 87,500 |

|

|

(b). Period of Production cycle | Days |

Material storage days (Pds) | 40 |

Finished goods storage Pds. | 15 |

Production cycle storage Pds. | 20 |

Av. Collection pd. | 60 |

| 135 |

Less: average payment (crs) | 50 |

| 85 |

(c) No... Annual operating cycle: 365/85=4.3

(d). Working capital=87,500/4.3=$20,349

Added: Reserve 1/3 for contingencies=6,789/27,132

References:

- Https://efinancemanagement.com/working-capital-financing/working-capital-management

- Https://taulia.com/glossary/what-is-working-capital-management/

- Https://corporatefinanceinstitute.com/resources/knowledge/finance/working-capital-management/

- Https://efinancemanagement.com/working-capital-financing/working-capital-management

- Https://link.springer.com/chapter/10.1007/978-94-009-4964-5_10

- Http://erepository.uonbi.ac.ke/bitstream/handle/11295/103537/Chirchir_Financial%20Planning%20%26%20Working%20Capital%20Management%20%28SEMIs%29.pdf?sequence=1&isAllowed=y