UNIT 1

UNDERWRITING OF SHARES & DEBENTURES

‘Underwriting’ refers to the functions of an under-writer. An under-writer may be an individual, firm or a joint stock company, performing the under-writing function. Under-writing may be defined as a contract entered into by the company with persons or institutions, called under-writers, who undertake to take up the whole or a portion of such of the offered shares or debentures as may not be subscribed for by the public. Such agreements are called ‘Under-writing agreement’.

A newly formed company enters into an agreement with an under-writer to the effect that he will take up shares or Debentures offered by it to the public but not subscribed for in fully by the public. Such an agreement may become necessary when a company issues shares or debentures for the first time to the public, or subsequently when it is in need of working capital.

When the company does not receive 90 per cent of issued amount from public subscription, within 120 days from the date of opening the issue, the company cannot proceed with allotment. In such a case, the company must refund the amount of subscription. In the case of a new company, it cannot obtain a certificate to commence function.

A company is not sure whether the shares or debentures offered for subscription may be taken up by the public. There arises a risk to ensure the success of issue. Therefore, companies resort to underwriting in order to ensure that sufficient number of shares or debentures would subscribed for. Thus, risk-bearing or uncertainty bearing is an important function of an underwriter.

Thus, an underwriter is a person who undertakes to take up the whole or a portion of the shares or debentures offered by a company to the public for subscription as may not be subscribed for by the public, prior to making such an offer. The company has to pay a commission to such an underwriter. It is known as underwriting commission. It is, of course, a type of insurance against under-subscription.

Broker is a person who helps in subscribing the shares. A broker is one who finds buyers for the shares or debentures of the company and gets the brokerage on the number of shares or debentures subscribed by the public through him. Underwriter is different from a broker. An underwriter is a person who agrees to take a specified number of shares or debentures, in case, not subscribed by the public.

That is, an underwriter is liable to take up shares in case the public fails to subscribe whereas a broker is not liable. Underwriter gets underwriting commission and a broker gets brokerage. Underwriter gives a guarantee whereas a broker does the service of placing the shares.

Thus, the function of an underwriter is of great economic significance since he himself assumes the risk of uncertainty on behalf of the company making public issue of shares or debentures. A broker, on the other hand, does not assume any such risk. Underwriting acts as a sort of insurance or guarantee against the danger of not receiving minimum subscription.

An underwriter may himself enter into a sub-agreement with other persons, called sub- underwriters, whereby he transfers a part of his underwriting risk. Just like re-insurance, sub- underwriting helps in spreading the risk. An underwriter may appoint several underwriters to work under him. However, the sub-underwriters have no privacy of contract with the company. They get their commission from the underwriter and are also responsible to him.

It is lawful for a company to pay commission to an underwriter, subject to the following restrictions, according to provisions of the Companies Act of 2013.

(1) The payment of commission is authorised by the Article.

(2) The commission paid or agreed to be paid does not exceed in the case of shares, 5% of the price at which the shares are issued or the amount or rate authorised by the Article, whichever is less.

(3) The commission paid or agreed to be paid does not exceed in case of debentures, 2.5% of the price at which the debentures are issued or the amount or rate authorised by the Article, whichever is less.

(4) The rate of commission and the number of shares which persons have agreed to subscribe absolutely or conditionally are disclosed in the prospectus. However, brokerage can be paid in addition to the payment of commission.

(5) Commission should not be given on those shares which are not issued to the public.

The Balance sheet of a company, prepared according to the prescribed form, should also disclose, under the head ‘Miscellaneous Expenditure’ all sums payable by way of commission, brokerage etc.

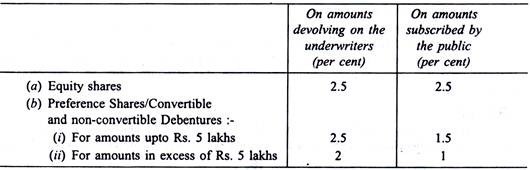

Pursuant to the guidelines issued by the Stock Exchange Division of the Department of Economic Affairs, Ministry of Finance vide their letter of 7th May 1985; the following rates for payment of under-writing commission, brokerage and managing broker’s remuneration are in force:

Notes:

(i) The rates of under-writing commission given above are the maximum. The company is free to negotiate such rates with the under-writers, subject to the ceiling.

(ii) Under-writing commission will not be payable on amounts taken up by the promoters group, employees, directors, their friends and business associates.

1. Underwriting acts as a sort of insurance or guarantee against the danger of not receiving minimum subscription, in the absence of underwriting agreement, there is always uncertainty regarding subscription of shares of debentures by the public. The guarantee of the underwriters removes the uncertainty.

2. When shares or debentures are sold through underwriters, there arise more confidence amongst the public. This is because underwriters undertake shares or debentures of only those companies which are sound concerns and whose future is bright.

3. Underwriting creates an impression regarding sound status of a company. It increases the goodwill of the company.

An agreement to undertake the shares or debentures of a company are of the following types:

(a) Complete Underwriting:

In case, the entire issue of shares or debentures of a company is undertaken, it is said to be full or complete underwriting. Such an underwriting may be done by one underwriter or by a number of underwriters. If the full issue is underwritten by one underwriter, then his liability will be equal to the number of shares or debentures underwritten minus shares applied for.

Even if the issue is fully as subscribed or over-subscribed, the underwriter is eligible to get the agreed commission on the issue of shares. In case less number of shares or debentures are subscribed by the public, the underwriter is required to meet the deficiency in whole. In case, the public response is good, the underwriter is at an advantage to get the underwriting commission, without subscribing even a single share of debenture.

At the same time, if there are more than one underwriter, then allocation of unsubscribed shares or debentures amongst themselves is made pro-rata, that is, in the ratio in which the number of shares or debentures underwritten bear to the total number of shares or debentures offered for subscription.

(b) Partial Underwriting:

If a part of the issue of shares or debenture of a company is underwritten, it is said to be partial underwriting. Such an underwriting may be done by one underwriter or by a number of underwriters. In case of partial underwriting, the company is treated as ‘underwriter’ for the remaining part of the issue. For instance, a company issued 1,000 shares and 40% thereof is underwritten by Nikhil. Out of 800 applications received, the marked applications are 350.

The liability of Nikhil is calculated as under:

Gross liability of Nikhil = 40% of 1,000 shares = 400

Less: Marked Applications = 350

Net liability of Nikhil = 50

It is to be noted that in case of partial underwriting, the underwriter does not get credit against the unmarked applications.

(c) Firm Underwriting:

It is an underwriting agreement where the underwriter or underwriters agree to buy a certain number of shares or debentures irrespective of the number of shares or debentures subscribed by the public. Thus, in firm underwriting, the underwriters agree that a certain number of shares be allotted to them, whether or not the issue is over subscribed.

An underwriting agreement may be open or firm. An agreement to take up shares or debentures only when the issue is not subscribed in full is called open underwriting.

For instance, if an underwriter guarantees the issue of 1,00,000 shares and the public applied for 70,000 shares, then the underwriter has to purchase the balance of 30,000 shares which are unsubscribed; in case, the public applied for 80,000 shares, then the underwriter has to purchase the balance of 20,000 unsubscribed shares; in case the public applied for 90,000 shares, then the underwriter has to purchase the balance i.e., 10,000 shares and in case the public applied for 1,00,000 or more shares, the underwriter has no liability against the shares. Again, in case of under-subscription, the underwriter is asked to purchase the deficiency of agreed shares, under open underwriting.

When an underwriter, enters into an agreement with the Company, to purchase certain number of shares or debentures, irrespective of the public subscription, in addition to the open writing, is known as firm underwriting. Thus, under firm underwriting, the underwriter agrees to take a specified number of shares or debentures, in addition to the unsubscribed shares or debentures. An underwriter through such an agreement with the Company gets priority over the public in relation to the allotment, in case of over-subscription.

Firm applications are generally treated as direct applications from the public and are included therein. If, however, the agreement specifically provides, personal relief is given for firm applications also along-with the marked applications. Firm applications are added to the net liability to find out the ultimate liability of an underwriter.

Generally, shares or debentures issued by a Company are usually underwritten by a number of underwriters, in an agreed ratio of the whole issue. Each of the underwriter tries to sell the shares or debentures at the maximum in order to reduce the risk of liability. Therefore, a method of marking the application form with the stamp of the underwriters is adopted.

This facilitates to distinguish the forms of one underwriter from that of others and becomes clear to the Company to know the exact number of applications received through a particular underwriter. Such applications with stamp of an underwriter are called marked applications.

In some cases, public get the application form directly from the Company and such forms do not bear the stamp of underwriters. Such applications, which do not possess the stamp of underwriters, are called unmarked or direct applications.

The liability of the underwriter or underwriters will be determined in the following ways. They are:-

1. Complete Underwriting

2. Partial Underwriting

3. Firm Underwriting.

1. Complete Underwriting:

(a) When the whole issue of shares or debentures is underwritten by a single underwriter:

When the full issue is underwritten by one underwriter, then his liability will be equal to the number of shares or debentures underwritten minus shares or debentures applied for. If the issue is fully subscribed or oversubscribed, there will be no liability for the underwriter to take up any share or debenture.

(b) When the whole issue of shares or debentures is underwritten by two or more underwriters:

In such a case, the liability of the respective underwriters can be determined in either of the following two ways:

(i) The gross liability of each underwriter according to the agreed ratio should be reduced first by the marked applications and then credit should be given in respect of the unmarked applications sent directly to the company by way of deduction from the balance left in the ratio of gross liability.

The liability of each underwriter in such a case will be as follows:

Gross liability ………..

Less: Marked Applications ………..

Balance left ………..

Less: Unmarked Applications ……….. (in the ratio of gross)

NET LIABILITY ………..

(ii) The gross liability of each underwriter according to the agreed ratio should be reduced first by the marked applications and then credit should be given in respect of the unmarked applications sent directly to the company by way of deduction from the balance left in the ratio of gross liability as reduced by the marked applications

The liability of each underwriter in such a case will be as follows:

Gross liability ……….

Less: Marked Applications

Balance left

Less: Unmarked Applications ………………..

(in the ratio of balance —————– ‘

Left, i.e. gross liability as reduced by marked applications) Net Liability

Note:

Liability of the underwriters varies under the above two methods. It is, therefore, desirable that the particular method to be followed should be clearly mentioned in the underwriting agreement.

2. Partial Underwriting:

(a) When a part of the issue of shares or debentures is underwritten by one person only. In such a case, only a part of the whole issue is underwritten only by one underwriter and the balance amount is deemed to have been underwritten by the company itself. In such a situation the unmarked applications are treated as marked application from the point of view of the company.

The liability is determined as follows:

Net Liability = Gross Liability – Marked Applications

3. Firm Underwriting:

It is an underwriting agreement where the underwriter or underwriters agree to buy a certain number of shares or debentures irrespective of the number of shares or debentures subscribed by the public. It is a case of firm underwriting.

Thus in firm underwriting, the underwriters agree that a certain number of shares be allotted to them, whether or not the issue is over-subscribed. The liability of the underwriters in such a case will be the unsubscribed shares or debentures plus the shares or debentures under firm underwriting.

Total liability= Net liability for unsubscribed on the basis of agreement

Add: Liability under Firm Underwriting

In the calculation of net liability, the shares under firm underwriting may be treated as marked or unmarked application. The liability of underwriters differs under the two methods. The steps involved under both the methods are given followed by an illustration worked out under both the methods.

The following entries are to be made in the books of the company:

(a) For Commission or Brokerage due:

Commission/Brokerage on Issue of Shares/Debentures A/c Dr.

To Underwriter’s/Broker’s A/c

(b) For Commission/or Brokerage paid:

Underwriter’s/Broker’s A/c Dr.

To Cash/Bank/Shares/Debentures A/c

(c) For acquiring any liability in case of under-subscription:

Underwriter’s A/c Dr.

To Share Capital/Debentures A/c

(d) For receiving payment:

Bank A/c Dr.

To Underwriter’s A/c

(e) For making payment:

Underwriter’s A/c Dr.

To Bank A/c