UNIT 5

LIQUIDATION OF COMPANIES

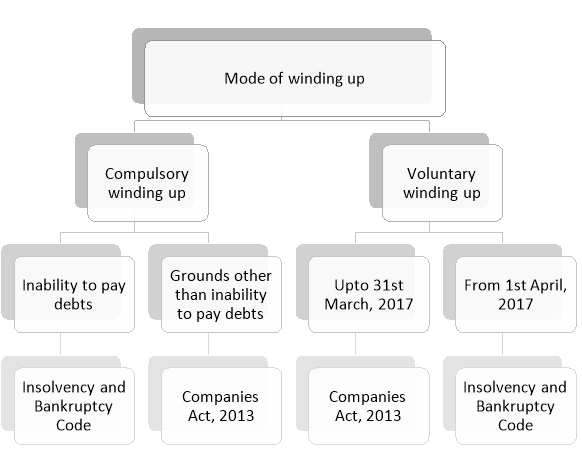

Winding up is a means to dissolve a company and realize and use its assets in the payments of debt. After satisfaction of the debts, the remaining balance, if any, is paid back to the members in proportion to the contribution made by them to capital of the company. The winding up of a company is the process whereby its life is ended, and its property is administered for the benefit of its creditors and members. An administrator, called a liquidator, is appointed and he takes control of the company, collects its assets, pays its debts and finally distributes any surplus among the members in accordance with their rights.

As per SECTION 2(94A) of the Companies Act, 2013, “winding up” means winding up under this Act or liquidation under the Insolvency and Bankruptcy Code, 2016.

Thus, winding up ultimately leads to the dissolution of the company. In between winding up and dissolution, the legal entity of the company remains, and it can be sued in Tribunal of Law.

Winding up V. Liquidation:

Commonly, the expression “winding up” and “liquidation” are used interchangeably; however, there exist a line of difference between the two expressions. Winding up is a process of ending all the business affairs of the company and liquidation refers to selling off the assets of the company.

Petition by Company:

In case of winding up by Tribunal, Section 272(5) of the Companies Act, 2013 provides that a petition presented by the company for winding up before the Tribunal shall be admitted only if accompanied by a statement of affairs in such form and in such manner as may be prescribed.

Petition by Others:

In accordance with Section 274(1), where a petition for winding up is filed before the Tribunal by any person other than the company, the Tribunal shall, if satisfied that a prima facie case for winding up of the company is made out, by an order direct the company to file its objections along with the statement of its affairs within thirty days of the order in such form and in such manner as may be prescribed. The Tribunal may allow a further period of thirty days in a situation of contingency or special circumstances.

Procedure/Contents:

The broad lines on which the Statement of Affairs is prepared are the following:

- Include assets on which there is no fixed charge at the value they are expected to realize.

- Include assets on which there is fixed charge. The amount expected to be realized would be compared with the amount due to creditor concerned. Any Surplus is to be extended to the other column. A Deficit is to be added to unsecured creditors.

- The total of assets in point (a) and any surplus from assets mentioned in point (b) is available for all the creditors (except secured creditors already covered by specifically mortgaged assets).

- From the total assets available, the following should be deducted one by one:

- Preferential creditors,

- Debentures having a floating charge, and

- Unsecured Creditors.

If a minus balance emerges, there would be deficiency as regards creditors, otherwise there would be surplus.

e. The amount of total paid-up capital should be added, and the figure emerging will be deficiency as regards members.

Lists:

Statement of Affairs should accompany eight lists:

- Assets:

- List A: Full particulars of every description of property not specifically pledged and included in any other list are to be set forth in this list.

- List B: Assets specifically pledged, and creditors fully or partly secured.

b. Liabilities:

- List C: Preferential creditors for rated, taxes, salaries, wages and otherwise.

- List D: List of debenture holders secured by a floating charge.

- List E: Unsecured creditors.

c. Share Capital:

- List F: List of Preference shareholders.

- List G: List of Equity shareholders.

d. Deficiency/ Surplus:

- List H: Deficiency or surplus account.

The official liquidator will specify a date for period beginning with the date on which information is supplied for preparation of an account to explain the deficiency or surplus. On that date either assets would exceed capital plus liabilities, that is, there would be a reserve or there would be a deficit or debit balance in the Profit and Loss Account. The deficiency account is divided into two parts:

- The first part starts with the deficit and contains every item that increases deficiency.

- The second part starts with the surplus on the given date and include all profits.

If the total of the first exceeds that of the second, there would be a deficiency to the extent of the difference, and if the total of the second part exceeds that of the first, there would be a surplus.

- Receipts:

While preparing the liquidators statement of account, receipts are shown in the following order:

- Amount realized from assets.

- In case of assets specifically pledged in favor of creditors, only the surplus from it, if any, is entered as ‘surplus from securities.

- In case of partly paid up shares, the equity shareholders should be called up to pay necessary amount if creditors’ claims/claims of preference shareholders can’t be satisfied with the available amount. Preference shareholders would be called upon to contribute for paying off creditors.

- Amounts received from calls to contributories made at the time of winding up are shown on receipts side.

- Net results as per Trading Account are also included on the receipts side.

- Payments made to redeem securities and cost of execution and payments per trading account are deducted from total receipts.

2. Payments:

Payments are made and shown in the following order:

- Legal charges

- Liquidator’s remuneration

- Liquidator’s expenses

- Debenture holders

- Creditors:

- Preferential;

- Unsecured Creditors;

f. Preferential shareholders; and

g. Equity shareholders.

3. Partly paid shares:

In case of partly paid shares, it should be seen whether any amount is to be called up on shares. Firstly, the equity shareholders should be called up to pay necessary amount if creditors claim/claims of preference shareholders cannot be satisfied with the amount. Preference shareholders would be called upon to contribute for paying off creditors.

4. Loss of Shareholders:

The loss is suffered by each class of shareholders, i.e. the amount that cannot be repaid, should be proportionate to the nominal value of the share. The shares have nominal value of Rs. 80 per share and other set has paid Rs. 60 per share. Suitable adjustment will have to be made in cash in such a case; the latter set must contribute Rs. 20 first; or the first set must be paid Rs. 20 first.

Liquidators Final Statement of Accounts

Receipts | Amount (in Rs.) | Payment | Amount (in Rs.) |

To Assets Realized: | Xx | By Legal Charges | Xx |

- Land & Building | Xx | By Liquidation expenses | Xx |

- Plant & Machinery | Xx | By Liquidator’s Remuneration | Xx |

- Furniture | Xx | By Preferential creditors (unsecured) | Xx |

- Debtors | Xx | By Debenture holders (having a floating charge on assets of the Co.): |

|

- Stock | Xx | - Principle | Xx |

- Investment | Xx | - Outstanding Interest | Xx |

- Cash in Hand | Xx | By unsecured Creditors | Xx |

- Cash at Bank | Xx | By Preference Shareholder’s |

|

To Surplus from assets held by secured creditors | Xx | - Principle | Xx |

To Proceeds on call made on: |

| - Dividend in arrears | Xx |

- Equity Shares | Xx | By Equity Shareholder’s | Xx |

- Preference shares | Xx |

|

|

|

|

|

|

| Xxx |

| Xxx |

|

|

|

|