Unit 5

Introduction to IFRS

International Financial Reporting Standards (IFRS) are a bunch of global accounting standards expressing how specific sorts of exchanges and different occasions ought to be accounted for in budget summaries. IFRS are given by the International Accounting Standards Board (IASB), and they indicate precisely how bookkeepers should keep up and report their records. IFRS were set up to have a typical bookkeeping language, so business and records can be perceived from organization to organization and country to country.

Objectives OF IFRS

- To create, in the public premium, a solitary arrangement of high caliber, justifiable and enforceable worldwide bookkeeping guidelines that require high caliber, straightforward and practically identical data in fiscal summaries and other monetary answering to help members on the planets capital business sectors and different clients settle on financial choices;

- To advance the utilization and thorough use of those guidelines;

- In satisfying the goals related with (1) and (2), to assess, as fitting, the exceptional requirements of little and medium-sized elements and arising economies.

- To achieve intermingling of public bookkeeping norms and International Accounting principles and IFRS to top notch arrangements.

Accounting standards

Accounting standards are legitimate guidelines for monetary detailing and are the essential wellspring of proper accounting rules (GAAP).Accounting principles indicate how exchanges and different occasions are to be perceived, estimated, introduced and uncovered in fiscal summaries. Their goal is to give monetary data to financial specialists, banks, loan bosses, givers, and others that is helpful in settling on choices about giving assets to the substance.

Objective of Accounting Standards characterized by ICAI

THE PRIMARY OBJECTIVE OF ACCOUNTING STANDARDS ARE:

- To give a norm to the different bookkeeping strategies and standards.

- To stop the non-likeness of fiscal reports.

- To build the unwavering quality of the fiscal reports.

- To give norms which are straightforward to clients.

- To characterize the norms which are tantamount over all periods introduced.

- To give a reasonable beginning stage to bookkeeping.

- It contains great data to produce the monetary reports. This should be possible at an expense that doesn't surpass the advantages.

- For the annihilation the tremendous measure of variety in the treatment of bookkeeping norms.

- To encourage simplicity of both between firm and intra-firm examination.

The essential goal of accounting standards is to orchestrate the diverse bookkeeping strategies. The strategies are utilized in the planning of monetary reports. These reports could be set up by various undertakings. This would achieve a specific level of disarray at the hour of examination.

This is the place where the accounting guidelines come in. The goal of bookkeeping guidelines is to carry a norm to the strategies. This will encourage simple correlation as for between firm and intra-firm announcing.

The ICAI perceives the requirement for a worldwide norm in these worldwide occasions. Accordingly, the Government of India alongside ICAI chose not to embrace the IFRS the manner in which they are. All things being equal, it presented the Indian AS, famously referred to as Ind AS. Allow us to investigate conclusion view at Indian AS; its set of experiences and a couple of its principle ideas.

Indian AS

The Institute of the Chartered Accountants of India (ICAI) is the body that sets up the Accounting Standards in India. In 2006, ICAI started the way toward moving towards the International Financial Reporting Standards (IFRS). Global Accounting Standards Board (IASB) issues the IFRS. The reason for the ICAI to move towards the IFRS is to expand the agreeableness and straightforwardness of the fiscal reports of the Indian corporates on the worldwide stage.

The public authority and ICAI originally investigated the prerequisites of IFRS in detail. They at that point chose to meet it. Bookkeeping Standards Board (ASB) has defined the Ind AS. It has made an honest effort to keep them in accordance with the IFRS. Just significant changes were made.

The Central Government of India gave Indian Accounting Standards in counsel with the National Advisory Committee on Accounting Standards (NACAS). It did this under the oversight and control of the Accounting Standards Board (ASB) of ICAI.

Indian AS (Ind AS) are IFRS merged guidelines. They are named and numbered similarly as their comparing IFRS. Public Advisory Committee on Accounting Standards (NACAS) prescribed these norms to the Ministry of Corporate Affairs. Service of Corporate Affairs (MCA) makes Ind AS pertinent on the organizations in India. So far 40 Indian AS have been given.

The meaning of Indian Accounting Standards

Ind AS depends on They encourage the cross-line stream of cash, worldwide posting and worldwide equivalence of the fiscal reports. This, thusly, encourages worldwide speculation and advantage to capital market partners. It improves the financial specialist's capacity to analyze the ventures on a worldwide premise. This, thusly, lessens the danger of misconceptions. It additionally dispenses with the expensive necessities of reestablishment of fiscal reports.

Relevance of Indian Accounting Standards

The Initial date of usage of Indian AS was 2011 yet because of specific issues, Ministry of Corporate Affairs delayed its execution date. In July 2014, the Finance Minister declared to apply Ind AS desperately. In February 2015, the Ministry of Corporate Affairs had given the Companies (Indian Accounting Standards) Rules. It, along these lines, modified the guide of execution of Ind AS for organizations and avoided the Banking organizations, Insurance organizations, and NBFC'S from it

According to the warning, from first April 2015, Ind AS will be actualized on a deliberate premise and will be required from first April 2016. Later on, it gave the guide for execution on NBFC's, Banking organizations, and Insurance organizations.

International Accounting Standards (IAS)

International Accounting Standards (IAS) are more established bookkeeping guidelines gave by the International Accounting Standards Board (IASB), an autonomous global standard-setting body situated in London. The IAS were supplanted in 2001 by International Financial Reporting Standards (IFRS).

Global bookkeeping is a subset of bookkeeping that considers worldwide bookkeeping principles when adjusting books.

Understanding International Accounting Standards (IAS)

Worldwide Accounting Standards (IAS) were the main global bookkeeping principles that were given by the International Accounting Standards Committee (IASC), framed in 1973. The objective at that point, as it remains today, was to make it simpler to look at organizations around the planet, increment straightforwardness and trust in monetary announcing, and encourage worldwide exchange and speculation.

Worldwide tantamount bookkeeping guidelines advance straightforwardness, responsibility, and proficiency in monetary business sectors around the globe. This empowers speculators and other market members to settle on educated monetary choices about venture openings and chances and improves capital portion. Widespread guidelines additionally fundamentally diminish revealing and administrative expenses, particularly for organizations with worldwide tasks and auxiliaries in various nations.

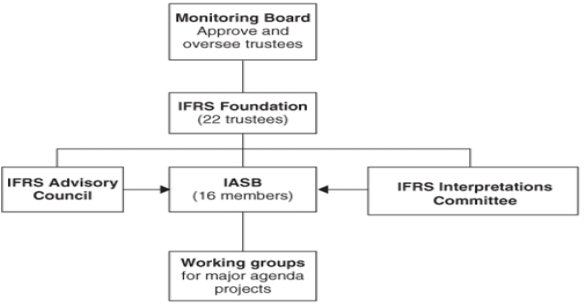

The IASB is the free standard-setting body of the IFRS Foundation answerable for the turn of events and distribution of IFRSs and for affirming Interpretations of IFRSs as evolved by the IFRS Interpretations Committee.

The Board is a free gathering of specialists with a fitting blend of ongoing down to earth insight in setting bookkeeping guidelines, in getting ready, evaluating, or utilizing monetary reports, and in bookkeeping schooling. Expansive topographical variety is likewise required. The IFRS Foundation Constitution diagrams the full rules for the structure of the Board, and the topographical portion can be seen on the individual profiles. Board individuals are answerable for the turn of events and distribution of IFRS Standards, including the IFRS for SMEs Standard. The Board is likewise liable for endorsing Interpretations of IFRS Standards as evolved by the IFRS Interpretations Committee (once IFRIC). Individuals are named by the Trustees of the IFRS Foundation through an open and thorough cycle that incorporates promoting opportunities and counseling applicable associations.

The IASB initially had 13 full-time Board individuals, each with one vote. They are chosen as a gathering of specialists with a blend of involvement of standard-setting, getting ready and utilizing records, and scholarly work. At their January 2009 gathering, the Trustees of the Foundation finished up the initial segment of the subsequent Constitution Review, declaring the formation of a Monitoring Board and the extension of the IASB to 16 individuals and giving more thought to the topographical structure of the IASB. The IFRS Interpretations Committee has 15 individuals. Its brief is to give opportune direction on issues that emerge practically speaking. A consistent vote isn't essential all together for the distribution of a Standard, openness draft, or last "IFRIC" Interpretation. The Board's 2008 Due Process manual expressed that endorsement by nine of the individuals is required.

IASB's Role

Under the IFRS Foundation Constitution, the IASB has total obligation regarding all specialized issues of the IFRS Foundation including:

- Full caution in creating and seeking after its specialized plan, subject to certain conference necessities with the Trustees and people in general

- The readiness and giving of IFRSs (other than Interpretations) and openness drafts, following the fair treatment specified in the Constitution

- The endorsement and giving of Interpretations created by the IFRS Interpretations Committee.

IASB - Background and Structure

The IASB was recently known as the International Accounting Standards Committee (IASC) until April 2001, when it turned into the IASB. The IASC was initially set up in 1973 and was the sole body to have both duty and position to give worldwide bookkeeping guidelines. In 2001, when the IASB took over duty regarding global monetary announcing, it took on the entirety of the IASC's principles (which were completely prefixed with 'IAS' – for example IAS 2 Inventories, IAS 10 Events After the Reporting Period). The IASB revised a significant number of the principles, yet then started to give its own guidelines, which were known as International Financial Reporting Standards (IFRS). This is the reason you see principles prefixed with IAS (IASC guidelines) and IFRS (IASB norms). The term 'IFRS' has become a to some degree nonexclusive term that alludes to all the guidelines (the two IAS and IFRS). The arrangement of the IASB is as per the following:

|

Standard Setting Process

According to IASB a thorough, transparent and participatory due process is followed when issuing an IFRS Standard or an IFRIC Interpretation that helps companies better implement their Standards. Standard-setting entails:

- Public Board meetings broadcast live from their London office;

- Agenda papers that inform the Board's deliberations;

- Discussion and decision summaries that are made available after meetings; and

- Comment letters received on their consultation documents.

IASB Conceptual Framework

While the International Accounting Standards Board (IASB) is not a country it does have a sort of constitution, in the form of the Conceptual Framework for Financial Reporting (the Framework), that proves the definitive reference document for the development of accounting standards. The Framework can also be described as a theoretical base, a statement of principles, a philosophy and a map. By setting out the very basic theory of accounting the Framework points the way for the development of new accounting standards. It should be noted that the Framework is not an accounting standard, and where there is perceived to be a conflict between the Framework and the specific provisions of an accounting standard then the accounting standard prevails. The IASB Framework:

- Seeks to ensure that accounting standards have a consistent approach to problem solving and do not represent a series of ad hoc responses that address accounting problems on a piece meal basis

- Assists the IASB in the development of coherent and consistent accounting standards

- Is not a standard, but rather acts as a guide to the preparer of financial statements to enable them to resolve accounting issues that are not addressed directly in a standard

- Is an important and influential document that helps users understand the purpose of, and limitations of, financial reporting

- Used to be called the Framework for the Preparation and Presentation of Financial Statements

- Is a current issue as it is being revised as a joint project with the IASB's American counterparts the Financial Accounting Standards Board.

|

|

KEY TAKEAWAYS

- Global Financial Reporting Standards (IFRS) were set up to carry consistency to bookkeeping principles and practices, paying little mind to the organization or the country.

- They are given by the Accounting Standards Board (IASB) and address record keeping, account revealing and different parts of monetary detailing.

- IFRS advantage organizations and people the same in encouraging more prominent corporate straightforwardness.

- The disadvantage of IFRS are that they are not general, with the United States utilizing GAAP bookkeeping, and various different nations utilizing different strategies.

References

1. Financial Accounting by B.B Dam

2. Financial Accounting by K.R Das