UNIT II

Mergers and Acquisitions

Mergers and acquisitions (M&A) are defined as business consolidation. Mergers is the combination of two companies to form one, differentiating the two terms, while Acquisitions is one company that the other takes over. One of the main aspects of the world of corporate finance is M&A. The reasoning behind M&A generally given is that, compared to being on an individual stand, two separate companies together create more value. Companies continue to assess various opportunities through the route of merger or acquisition with the goal of wealth maximization.

Horizontal mergers occur when a company merges or acquires another company that provides the final consumers with the same or similar product lines and services, which means that it is in the same industry and at the same production stage. Companies, in this situation, are usually direct rivals.

For example, if a cell phone producing company merges with another cell phone producing company in the industry, this would be called a horizontal merger. The advantage of this type of merger is that it eliminates competition, which allows the business to boost its market share, revenues and profits.In addition, because of the increase in size, it also offers economies of scale as an average cost drop due to higher production volume. As redundant and wasteful activities are removed from operations, i.e. different administrative departments or departments such as advertising, purchasing and marketing, these types of mergers also promote cost efficiency.

Vertical Mergers

A vertical merger is carried out with the objective of combining two companies that produce the same goods and services in the same value chain, but the only difference is the stage of production at which they operate. For example, if a textile factory were taken over by a clothing store, this would be called a vertical merger, because the industry is the same, i.e. clothing, but the stage of production is different: one company operates in the territorial sector, the other in the secondary sector.These types of merger are usually undertaken to secure the supply of essential goods and to avoid disruption of supply, as, in the case of our example, the clothing store would be assured that the textile factory would supply clothing. It is also done to limit supply to rivals, resulting in a greater share of the market, revenues and profits. Vertical mergers also offer cost savings and a greater profit margin, since the share of the manufacturer is eliminated.

Concentric mergers take place between firms that, in a particular industry, serve the same customers but do not offer the same products and services. Their products may be supplements, products that go together, but not the same products, technically. For example, if a company that produces DVDs merges with a company that produces DVD players, this would be called a concentrated merger, as DVD players and DVDs are complementary products that are usually bought together. Usually these are undertaken in order to make it easier for consumers, as it would be easier to sell these products together. This would also help the business diversify, hence higher profits.The sale of one of the products will also encourage the sale of the other, thereby increasing the company's revenue if it is able to increase the sale of one of its products. This would allow businesses to offer one-stop shopping and, therefore, customer convenience. In this case, the two businesses are associated in some way or the other. They typically have the manufacturing process, business markets or basic technology in common. The extension of certain product lines is also included. These types of mergers offer companies the opportunity to venture into other areas of the industry to reduce risk and provide access to previously unavailable resources and markets.

Conglomerate Merger

A merger between both companies is known as a conglomerate merger if two companies operate in completely different industries, regardless of the stage of production. Usually, this is done to diversify into other sectors, which helps reduce risks.

Key Takeaways:

- Mergers and acquisitions (M&A) are defined as business consolidation. Mergers is the combination of two companies to form one, differentiating the two terms, while Acquisitions is one company that the other takes over.

- M&A is one of the major components of global corporate finance.

- Horizontal mergers occur when a business merges or takes over another business that provides the final customers with the same or similar product lines and services, which means that it is in the same industry and at the same production stage.A vertical merger is carried out with the objective of combining two companies that produce the same goods and services in the same value chain, but the only difference is the stage of production at which they operate.

- Synergy is the idea that two companies' combined value and performance will be greater than the sum of the separate parts. Synergy is a term that is used most frequently in mergers and acquisitions (M&A). Synergy, or the potential financial benefit gained by combining businesses, is often the driving force behind a merger.

- Comprehension of Synergy

- Mergers and acquisitions (M&A) are made with the objective of improving the shareholders' financial performance of the company.

Two companies can merge to form one company that is able to generate more revenue than either could have been able to independently, or to create one company that can eliminate or streamline redundant processes, resulting in a significant reduction in costs. Because of this principle, during the M&A process, the potential synergy is examined. If two businesses can merge to create more efficiency or scale, what is sometimes referred to as a synergy merge is the result.If the post-merger share price of a company rises because of the synergistic effect of the deal, shareholders will benefit. Various factors can be attributed to the expected synergy achieved through the merger, such as increased revenues, combined talent and technology, and cost reduction.

Let's say, for example, that Company A and Company B choose to go for synergy. Since we're talking about synergy, we're talking about mergers and acquisitions; let's say that Company A and Company B merge with each other because they think they can reduce costs and increase profits by choosing to combine The reason they choose to merge with each other is that Company B manufactures the raw materials used by Company A to prepare the finished products sold by Company A. Company A doesn't need to look for a vendor if they merge, and it would be seamless to source raw materials.

On the other hand, Company B doesn't need to worry about sales and marketing as a result of the merger. All they need to do is to improve their procedures in order for Company A to produce better raw materials.The sum of Company A and Company B is better in this case than individual Company A and Company B., and that is why we can call this a mergers and acquisitions synergy.

Key Takeaways:

- Synergy is the notion that two companies' combined value and performance will be greater than the sum of the separate parts.

- Synergy is the most widely used term in the context of mergers and acquisitions (M&A).

- Synergy, or the potential financial advantage achieved by merging businesses, is often the driving force behind a merger.

- Two companies can merge to form one company that is able to generate more revenue than either could have been able to independently, or to create one company capable of eliminating or streamlining redundant processes, resulting in a significant reduction in costs.

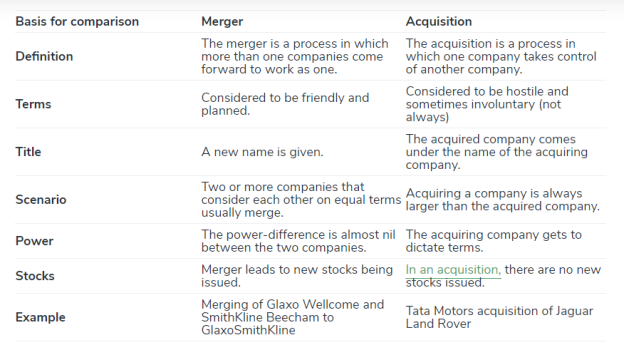

- A merger is a method by which two or more businesses make a strategic decision to come together and merge with a new name as one business. Merger helps the business share information, technology, resources, etc., thus increasing the company's overall strengths. The merger also helps to reduce the weakness of the market and gain a competitive edge. Merger always occurs on friendly terms as the data is already passed on to the managers, staff, etc. Proper planning on the structuring of the new business is carried out.

- Acquisition is the method by which another business is acquired by one business. In order to take over another business, the financially strong business acquires more than 50 percent of the shares. The purchase does not always take place on friendly terms. For different reasons, such as gaining new markets or gaining new customers or reducing competition, etc., it can be a forced move by a company to acquire another company. But acquisition can also occur when one business decides to be acquired without any hostility by another business. The transition is not always smooth in an acquisition, as the company that took over will impose all the decisions on employees, structure, resources, etc. and thus create an air of discomfort for the company that was acquired and its employees.

- One of the main differences is that the merger is the process in which two or more companies agree to come together and form a new company; acquisition is the process by which a financially strong company acquires more than 50 percent of its shares from a less financially strong company.

- After careful discussion and planning between the businesses that will be merged, merging is a strategic decision. Thus, after merging, there are fewer chances of a chaotic atmosphere. The acquisition is also a strategic decision, but the decision is not mutual in most instances. Hence, after an acquisition has been made, there is a lot of hostility and chaos.

- Companies that are merged generally consider each other to be of equal stature and therefore assist each other to create synergies. In the case of an acquisition, the acquiring company imposes its will on the acquired company and deprives the acquired company of its freedom and decision-making power. The difference in power between the acquired and acquiring companies is enormous.

- Since the merger requires the formation of a whole new company, it needs to be followed by many legal formalities and procedures. Compared to the merger, the acquisition does not have many legal formalities and documents to be filled out.

|

Key Takeaways:

- A merger is a method by which two or more businesses make a strategic decision to come together and merge with a new name as one business. Merger helps the business share information, technology, resources, etc., thus increasing the company's overall strengths.

- One of the main differences is that the merger is the process in which two or more companies agree to come together and create a new company; acquisition is the process by which a financially strong company acquires a less financially powerful company by acquiring more than 50% of its shares.

- The transition is not always smooth in an acquisition, as the company that took over will impose all decisions on staffing, structure, resources, etc. and thus create an air of unease for the acquired company and its employees.

• The acquiring company imposes its will on the acquired company in the case of an acquisition, and the acquired company is deprived of its freedom and decision-making. The difference in power between the acquired and acquiring companies is enormous.

The advantages of growing your company through an acquisition or merger are many. They include:

- Obtaining quality employees or additional skills, industry or sector knowledge and other business intelligence. A company with good management and process systems, for example, will be helpful to a buyer who wants to improve their own. The company you choose should ideally have systems that complement your own and that adapt to running a larger company.

- Accessing new development funds or valuable assets. Better facilities for production or distribution are often less costly to purchase than to build. Look for target companies with large unused capacity that are only marginally profitable.

- Underperforming your business. If you are struggling with regional or national growth, for example, buying an existing business may well be less costly than expanding internally.

- Accessing a broader client base and increasing your share of the market. For your own offers, your target company may have distribution channels and systems that you can use.

- Diversification of your enterprise's products, services and long-term prospects. A target company may be able to offer you products or services that you can sell through your own channels of distribution.

Reducing your costs and overheads, increased buying power and lower costs through shared marketing budgets.

• Reduce competition. It may be cheaper to buy new intellectual property, products or services than to develop them yourself.

Organic growth, i.e. the existing growth business plan, needs to be speeded up. In the same industry or location, businesses can combine resources to reduce costs, remove duplicate facilities or departments and increase revenue.

Key Takeaways:

- Obtaining quality employees or additional skills, industry or sector knowledge, and other business intelligence

- Accessing new development funds or valuable assets. It is often less expensive to purchase better production or distribution facilities than to build

- Reducing your costs and overheads, increased buying power and lower costs through shared marketing budgets.

- Reduce competition. It may be cheaper to buy new intellectual property, products or services than to develop them yourself.

- The most common reason for companies to enter into a merger and acquisition is to merge their power over the markets and control them.

- Another advantage is Synergy, the magic power that enables the new entities increased value efficiencies and takes the form of enrichment of returns and cost savings.

- Economies of scale are created by sharing resources and services (Richard et al, 2007). The Union of 2 company’s leads to a competitive advantage in overall cost reduction, which is feasible as a result of increased purchasing power and longer production runs.

• Risk reduction using innovative financial risk management methods.

•Companies must be forced to be at the peak of technological developments

And their applications in order to become competitive. A large company will retain or develop a competitive edge through the M&A of a small businesswith unique technologies.

Tax benefits are the largest advantage. Mergers may be instigated by financial benefits, and companies will make full use of tax shields, increase monetary leverage and use alternative tax benefits (Hayn, 1989).

Key Takeaways:

- The most common reason for companies to enter into a merger and acquisition is to merge their power over the markets and control them.

- Another advantage is Synergy, the magic power that enables the new entity's increased value efficiencies and takes the form of enrichment of returns and cost savings.

- A large company will retain or develop a competitive edge through the M&A of a small business with unique technologies.

For a host of reasons, companies merge with or acquire other companies, including:

1. Synergies: Overall performance efficiency tends to increase by combining business activities and overall costs tend to decrease, due to the fact that each business leverages the strengths of the other company.

2. Growth: Mergers can give an opportunity for the acquiring company to grow market share without significant heavy lifting. Instead, in what is usually referred to as a horizontal merger, acquirers simply purchase the business of a competitor for a certain price. A beer company, for example, may opt to purchase a smaller competing brewery, allowing the smaller outfit to produce more beer and increase its sales to brand-loyal customers.

3. Increase Supply-Chain Pricing Power: A company can eliminate a whole tier of costs by buying out one of its suppliers or distributors. In particular, buying a supplier, known as a vertical merger, allows a company to save on the margins previously added to its costs by the supplier. A business often gains the ability to ship products at a lower cost by purchasing a distributor.

4. Competition Elimination: Many M&A deals allow the acquirer to eliminate future competition and gain a greater market share. On the downside, a large premium is usually required to persuade shareholders of the target company to accept the offer. In response to the firm paying too much for the target company, it is not uncommon for the acquiring company's shareholders to sell their shares and push the price lower.

Key Takeaways:

- Overall performance efficiency tends to increase by combining business activities and overall cost tends to decrease, due to the fact that each business leverages the strengths of the other company.

- Increase Supply-Chain Pricing Power a company can eliminate an entire level of costs by buying out one of its suppliers or distributors.

- Many M&A deals make it possible for the acquirer to eliminate future competition and gain greater market share. On the downside, a large premium is usually required to persuade shareholders of the target company to accept the offer.

Here are six common reasons for failing M&A deals:

Inaccurate errors in data and valuation

In a deal's demise, overly idealistic valuations and lofty projections are frequent culprits. Granted, to make it happen, the parties to a prospective deal want to do everything they can. Unfortunately, this often implies that financial issues are calculated and analyzed rather "creatively" in order to make them as attractive as possible. While it is understandable that parties want to present the numbers assuming the best case scenario, it could prove fatal when it becomes obvious that reality is well below what was presented.

• Insufficient involvement of owners

It is quite common for seasoned professionals to oversee most of the key issues during the negotiations. Some leaders may remain involved in the process, but the company is so busy running and thus allowing the experts to manage most of the job. The problem with this is that once those experts are out of the equation and it is time to move forward for the newly formed entity, the leadership may not have adequate insight into current circumstances and expectations.

Integration Barriers

Merging entities on paper is often much simpler than merging them in terms of operation, culture, and staff. If there is no concrete integration plan in place and/or there is inadequate communication from the higher ups to the middle management, things can get particularly dicey. The confusion of a merger or acquisition often erodes morale, which can easily disrupt efficiency and productivity. These kinds of barriers to integration have to be assessed in advance and delicately dealt with.

Limitations on Resources

For a newly formed entity to overcome the challenges of integrating the two separate companies and cultures, there must be sufficient resources available, both human and financial capital. There is likely to be a need for new employees, updated policies and procedures, extra space for real estate, and so much more, the addition of which will undoubtedly require quite a bit of time and money to be invested. Hopefully, this is something considered and planned well in advance, but that's not always the case, unfortunately.

Unanticipated Economic Factors

If the economy experiences sudden, drastic changes that impact stock prices and interest rates, even the best laid plans can go awry. There is no doubt that a negative economic climate will interfere with the success of mergers and acquisitions, irrespective of how well they are expected to perform.

Lack of Strategy and Planning

For the most part, with proper planning and the creation and execution of a coherent strategy, the aforementioned issues that are often responsible for the failure of a deal can be avoided, at least in part. The main focus is on getting the deal closed for many M&A deals, but not enough attention is paid to preparing for the aftermath. This lack of foresight makes it far more probable that even the smallest of problems will get in the way of the true potential of the deal.

Key Takeaways:

- In a deal's demise, overly idealistic valuations and lofty projections are frequent culprits. Of course, the parties to a prospective deal want to do all they can to make it happen.

- Merging entities on paper is often far easier than combining them in terms of operations, culture, and staff. If there is no concrete integration plan in place and/or there is inadequate communication from the higher ups to the middle management, things can get particularly dicey.

- There is no doubt that a negative economic climate will interfere with the success of mergers and acquisitions, irrespective of how well they are expected to perform.

- The primary focus of many M&A deals is to close the deal, but not enough attention is paid to preparing for the aftermath.

Earnings per share, market price per share, and book value per share are the commonly used foundations for determining the exchange ratio.

- Earnings per share: assume that the earnings per share of the acquiring company are Rs 5.00 and the earnings per share of the destination company are Rs 2.00. The exchange ratio will be 0.4, which is (2/5), based on earnings per share. This means that 2 shares in the acquiring firms will be exchanged for the target firm's 5 shares.

While earnings per share reflect the prime facie power of earnings, there are some issues in an exchange ratio based solely on the merging companies' current earnings per share because it does not take the following into account:

* The difference in the earnings growth rates of the two companies

* Earnings gains arising from mergers

* The differential risks associated with the two companies' earnings

- In addition, the measurement problem of defining the normal level of current earnings is present. Some transient factors, such as a windfall profit, or an abnormal labor problem, or a large tax relief, may influence the current earnings per share. Lastly, how can earnings per share be used when they are negative?

Market price per share: The exchange ratio may be based on the relative market prices of the acquiring firm's and the target company's shares. For example, if the equity share of the acquiring firm sells for Rs 50 and the equity share of the target firm sells for Rs 10, the market price-based exchange ratio is 0.2, i.e. (10/50). This means that 1 of the acquiring firm's shares will be exchanged for the target firm's 5 shares.

Market prices are of considerable merit when the shares of the acquiring firm and the target firm are actively traded in a competitive market. They reflect current earnings, prospects of growth and characteristics of risk.However, when trading is poor market prices, it may not be very reliable. In extreme cases, where the shares are not traded, market prices may not be available. Another issue with market prices is that those who have a vested interest may manipulate them.

Book value per share: For the determination of the exchange rate, the relative book values of the two firms may be used. For example, if the book value per share of the acquiring company is Rs 25 and the target company's book value per share is Rs 15, the exchange ratio based on the book value is 0.6 =(15/25).

Book value proponents contend that it provides a very objective basis. This argument, however, is not persuasive because book values are affected by accounting policies that reflect subjective judgments. Serious objections against the use of the value of the book still exist.

1. The values of books do not reflect changes in cash purchasing power.

2. The values of books often differ greatly from genuine economic values.

Key Takeaways:

- Some transient factors, such as a windfall profit, or an abnormal labor problem, or a large tax relief, may influence the current earnings per share.

- Market prices have considerable merit when the shares of the acquiring firm and the target firm are actively traded in a competitive market. They reflect current earnings, prospects of growth and characteristics of risk.

- Book value proponents contend that it provides a very objective basis. This argument, however, is not persuasive because book values are affected by accounting policies that reflect subjective judgments.

- In terms of a focal agreement or transaction, there are a myriad of ways to approach and measure what success looks like. Regardless of the approach, attempting to 'measure' the performance of M&A involves several constraints:

- What metric captures M&A performance?

- Commonly used measures include the share price of the company; accounting measures such as sales, profits, return on assets, return on investments; or subjective performance assessments by managers. Results differ depending on the metric used. Which metric to rely on? How is it possible to compare results using different metrics against each other?

- Over what time frame is M&A performance to be assessed?

- While short-to-long-term windows ranging from a few days to several years after the deal are used for inventory measures, accounting measures tend to measure performance in the one to three years after the deal. It is evident that outcomes will also differ, depending on the time frame used.

- Whose performance is measured the acquiring or selling side’s performance?

- The two sides enter into the deal with different expectations, possibly incomparable. The desired performance targets influence the two sides differently, depending on the strategic rationale guiding the transaction. The view of the acquirer of "success" does not necessarily match the opinion of the seller.

- How can the acquisition’s performance be captured after the deal?

Once the acquired firm is part of the organization of the purchasing firm, it becomes difficult to isolate its operating performance within the reporting structure of the purchasing firm. How can M&A performance be monitored post-deal then?

Furthermore, there are also caveats with respect to comparing the results of one M&A performance study with the results of another study. This poses the question, "What is M&A?" "The sheer diversity of M&A and the number of ways in which M&A can vary make it difficult to compare deals and studies. Naturally, the results of M&A performance based on the type of deal, such as the focus on mergers, acquisitions, domestic, cross-border, or diversification, or M&A carried out in different countries or sectors, are likely to differ. To what extent are results then comparable across studies and deals?

- The challenges revolve around:

(1) adequately define and measure the performance of M&A: identify the appropriate metrics, time frames and information sources;

(2) comparing results across M&A, when a range of transaction types are covered by M&A. It is against this background that we turn to examine, from the perspective of corporate best practice, the measurement of M&A performance.

2. A geographic merger is essentially a "land grab" that expands the customer base of the buying firm with a new set of customers. Since the goal is to boost sales, one of the main metrics in these deals is increased sales revenue. Increased sales can result in increased profits, depending on the organizational set-up of the purchasing firm. A question to look at in order to set up the right metrics to measure the success of this type of deal is: "is the customer-facing organization running on a revenue or profit basis?" ”

3. One objective of the purchase of a new technology or a new product is to increase sales of the new technology by ensuring its access to the sales channels of the purchasing firm. Sales may ramp up much more slowly in this type of deal than in a geographic merger. This is still a growth-oriented deal, aimed at increasing revenue rapidly. An additional objective of a technology transaction is to combine the technological know-how of both companies, such as joint research and development projects. The speed at which jointly developed products come to market reflects a viable success metric.

4. The logic is in many ways similar to the geographical merger in buying customers, with the difference that, in this case, the customer bases of the companies reside in the same geographical area. Two options are available for this type of deal:

- The customer bases of the procurement and target firms overlap. The purpose is to boost sales. The challenge is to avoid losing clients from both companies and to ensure that the overall client base is properly served. What levels of service and quality of product will be sought? Monitoring revenue and profit as well as product quality, service levels, product returns, and customer complaints is the success metric that fits this type of deal. In terms of meeting sales targets, the latter metrics provide early warning signs.

The merger allows the buying company to enter a new sector. Sales, revenue, and/or profit are success metrics to use. Customer contact numbers can be used to predict future levels of sales. Since the objective of the deal is not only to learn about new markets, but also to start cross-selling products between the current and new markets of the company, it is also possible to track new product development (NPD) or NPD ideas.

5. The objective of the classic overlap merger is to reduce costs as well as to generate revenue. That dual goal makes this type of deal the most difficult of all. The purchasing firm needs to be well aware of the strategy guiding its action in order to ensure success. Regarding metrics:

a. Both companies need to be analyzed from an efficiency perspective to deliver on cost cutting. The goal is to monitor the cost-cutting exercise as minutely as possible afterwards. In addition, the amount of money invested is tracked in the change or efficiency projects themselves. Third, it is necessary to monitor the increase in profit and progress on reaching set P&L targets. It is necessary to avoid the possible double counting of synergy savings.

b. Sales, revenue, profit, and margin increases will be tracked to deliver on the growth side of this merger, as in the above deal types. It is also necessary to track innovation levels, i.e. NPD, potentially leading to a larger product range and thus increased sales.

5. The same metrics as in the other types of deal apply in a reverse takeover. The key issue in this type of deal is management control, as the buying company takes over effectively, but the target is larger in size. This leads to considerations about which side is in control, what modifications will be sought, and how these changes will be made. The measurement of success will depend on the objectives set and on the roles of the parties involved in the transaction.

6. In service sector deals, as the purchase revolves around a service rather than a product company, any of the above deal types can apply. The same metrics as above will be pursued, therefore. Additional progress indicators will, however, be relevant. Indicators such as absenteeism (i.e. early warning signal of high stress levels, poor productivity, or employees looking for alternative jobs) and retention levels will therefore prove useful when buying, e.g. a consultancy firm, in predicting future sales, as any loss in (senior) talent is likely to result in lost contact with customers.

Although the list of six types of deals portrays the diversity of M&A deals, many deals combine several of these 'ideal' types of deals in practice. This explains why it can be a challenging exercise to monitor the performance of an individual transaction or its components.

7. To define achievable metrics. Performance metrics need to be defined in a way that makes them measurable and achievable in order to measure M&A performance and to ultimately report success. The question is, what are measurable and achievable metrics that allow progress to be tracked, depending on the strategic rationale guiding the deal? In addition, to both internal and external company audiences, what metrics can be clearly communicated?

8. Time frame selection. A relevant problem is selecting the appropriate time frame against which progress and performance can be tracked when measuring M&A performance and defining M&A success. The results can be expected sooner or later, depending on the strategic rationale guiding the deal, the degrees of integration sought after the transaction, the size of the companies involved, the speed at which integration is initiated, and the quality of integration management. For instance:

a. Business continues as usual in small-sized deals with little integration; therefore, timing of "success" is not a problem

b. Results can be expected in the months to years after the deal, depending on the set goals and the speed of integration, for medium-to-large sized deals involving significant integration.

- Various internal perspectives on success. Depending on one's position within the buying company, individuals will view the success of a deal through different lenses. If integration has failed, for example, the deal is likely to be deemed unsuccessful. Yet, despite the failure of integration, the agreement may have been successful in achieving the desired goals. In short, the success of M&A depends on the lens adopted; even within the company, stakeholders will hold diverse views on the success of a focal agreement.

- M&A strategies communicated by Intended v. In defining M&A strategies, objectives, and metrics, the strategy communicated externally by the company often does not reflect the strategy it intends to implement. Thus, while the media and external stakeholders could view a transaction through a negative lens, lamenting "poor success" from the perspective of the acquiring company, given its rationale, the transaction could have been very successful as it fitted the goals of the company. Yet, for reasons of confidentiality, it is often impossible to disclose these reasons. We are beginning to understand why it is so difficult to capture M&A results in reality. While M&A performance is at best measured against the strategic rationale that guides the deal, rarely, if ever, is this underlying strategic rationale disclosed to other than the inner executive circle involved in the transaction.

- Internal and external perceptions of success. In view of the attention that more strategically important transactions receive from the media, a potential caveat allows external stakeholders, be they the media, investors, shareholders, or competition, to define the success of the transaction. Share price variation measures the expectations of investors about the future success of the company; it does not measure the success of M&A per say.

- Performance metrics at best represent the strategic rationale and objectives of the company for the transaction. Different types of deals, sectors and companies call for different metrics. Performance metrics need to be measurable and achievable at the same time.

- Depending on the nature of the objectives, firm size, and integration, the expected time frame during which performance is expected to materialize ranges from months to years.

- • Who defines achievement? Outside the acquiring company's inner circle, acquisition rationales are rarely known, hence what is externally communicated and what. Strategies intended rarely coincide. Also, depending on one's position and perspective, opinions will differ within the company. The deal is portrayed as successful according to their judgment.

- External stakeholders hold opinions on the success of deals, including investors and the media. Often, however, this view is not based on relevant knowledge. How much is it possible to trust the views of external parties on the success of deals?

- M&A is being carried out for a variety of strategic reasons. However, this diversity is only reduced to financial performance by the performance debate about M&As.

Reference Books:

1) Financial Management by C. Paramasivan& T. Subramanian

2)Financial Management by IM Pandey

3) Financial Management by Ravi Kishor