UNIT IV

Lease and Hire Purchase Financing

Meaning

A "lease" shall be defined as a contract between the lessor and the lessee for the lease of a particular asset for a specific period of time for the payment of a specific lease.

According to the law, the maximum lease duration is 99 years. Land or real estate, mines and quarries were previously taken up on lease. But now the plant and equipment, civil modem aircraft and ships are taken away for a day.

(i) Lessor:

The party which is the owner of the equipment which allows the other party to use the equipment upon payment of the periodic amount.

(ii) Lessee:

The party who acquires the right to use the equipment that he periodically pays for.

Lease Rentals:

This refers to the consideration received in relation to a transaction by the lessor and includes:

(i) Interest in the investment of the lessor;

(ii) Fees incurred by the lessor. Such as maintenance, repairs, insurance, etc.

(iii) Amortization:

(iv) Servicing fees.

Types of Leases:

The different types of leases are discussed below:

1. Financial Lease:

This long-term type of lease provides for the use of the asset during the primary lease period, which devotes nearly the entire life of the asset. The lessor assumes the role of a financier and therefore he does not provide services for repairs, maintenance, etc. A lessor who has no option to terminate the lease agreement retains the legal title.

During the desired playback period, the principal and interest of the lessor is recouped by him in the form of lease rentals. The finance lease is also referred to as a disguised loan for capital leases. Thus, the lessor is typically a financial institution and does not perform specialized asset-related services.

2. Operating Lease:

This is where, during the non-cancellable period of the lease, the asset is not fully amortized, if any, and where the lessor does not rely on the rental profit in the non-cancellable period. In this type of lease, during the initial lease period, the lessor who bears the cost of insurance, machinery, maintenance, repair costs, etc., is unable to realize the full cost of equipment and other incidental charges.

For a specified time, the lessee utilizes the asset. The risk of obsolescence and incidental risks is borne by the lessor. After providing due notice of the same, either party to the lease may terminate the lease since the asset may be leased out to other willing leases.

3. Sale and Lease Back Leasing:

A company can sell an asset that belongs to the lessor with which the ownership vests from there on to raise funds. Subsequently, the lessor leases the same asset to the business that uses it (the lessee). Thus, with the change in title to the lessor, the asset remains with the lessee, allowing the company to obtain the much needed finance.

4. Sales Aid Lease:

Under this arrangement, the lessor agrees, through its leasing operations, with the manufacturer to market its product, in exchange for which the manufacturer agrees to pay him a commission.

5. Specialized Service Lease:

In this type of agreement, in addition to providing its use, the lessor provides specialized personal services.

6. Small Ticket and Big Ticket Leases:

Smaller value asset leases are generally referred to as small ticket leases and larger value assets are referred to as large ticket leases.

7. Cross Border Lease:

Cross broker leasing is called leasing across national borders. Recent developments in economic liberalization have increased the importance of cross-border leasing in areas such as aviation, shipping and other expensive assets that are likely to become absolute due to technological changes.

Key Takeaways:

- A "lease" shall be defined as a contract between the lessor and the lessee for the lease of a particular asset for a specified period of time for the payment of a specified lease.

- The finance lease is also referred to as a capital lease, a disguised loan. Thus, the lessor is typically a financial institution and does not perform specialized asset-related services.

3. Cross-broker leasing is known as leasing across national borders. Recent developments in economic liberalization have made cross-border leasing more important in areas such as aviation, shipping, etc.

Rationale:

Businesses planning to acquire certain assets have financing options that, depending on their goal and financial situation, can bring them significant benefits or disadvantages. Determining the purpose of the asset for the company and analyzing the effect of the purchase on the cash flow of the company and net profit is important. Ultimately, the goal of every businessman is to conserve capital, so the concept of spreading the cost over a long period is extremely important. Hire Purchase and Financial Lease provide entrepreneurs and businesses alike with this flexibility and convenience.

What is a Hire Purchase?

Hire purchase is a funding option in which, under an agreement with the hire vendor, the possession of the asset is transferred to the hire purchaser. Over a specified period, the hirer pays the total amount of the asset in installments. The principal amount of the asset and interests are included in the installment. After the fulfillment of the last installment, transfer of ownership to the rental buyer is possible. Conversely, at any time before the transfer of ownership, the hire purchaser has the option to terminate the agreement.

What is a Financial Lease?

Financial leasing is an agreement that allows the lessee to use the lessor's assets in return for periodic payments called lease rentals. During the whole leasing period, the lessor retains legal ownership of the asset. The lessee, however, enjoys the advantages and takes control of the asset and assumes the risk involved in the asset's economic ownership.

Hire Purchase vs. Financial Lease

Relationship in Agreement

The relationship between the parties will be that of the owner/seller and hirer in the hire purchase agreement, while in the finance lease it will be between the lessor and the lessee.

Ownership Transfer

In hire purchase agreements, after the final installment of the asset has been completed, the ownership is transferred to the purchase hirer, while in financial lease, there is only a possibility of ownership when the lease period ends. By paying a diminutive amount, the lessee may be given the option to own the asset. The ownership may or may not eventually be transferred.

Depreciation Benefit

The lessor derives the depreciation benefit in finance leasing, while in hire purchase, it is the hire buyer who receives the income tax depreciation benefit.

Duration

The duration of the lease of finance is generally longer than the purchase of hire. Land, buildings and properties are common assets used by finance leasing, while cars, equipment, trucks and lorries are usually purchased by hire.

Payments

In a lease purchase, a down payment is mandatory. The remainder of the price is then paid on the basis of the payment, which includes the principal amount and interest. There is no down payment required for the financial lease to be made by the lessee and the cost of using the asset only has to be paid.

Payment Defaults

Defaults in payments allow the owner to seize the hirer's ownership of the asset. The asset can be sold at a specific value to the lessee upon termination of the financial lease agreement.

Maintenance and Repairs. Repairs and maintenance lie with the hirer in the hire purchase. The responsibility for financing leases lies with the lessee.

Mechanics:

- Assets are defined as anything that is owned by a firm or an individual of monetary value. Tangible items such as inventories, equipment and real estate, as well as intangible items such as property rights or goodwill can be included in the assets listed on the balance sheet of a firm.

- In that the lessee does not have ownership rights to the asset, leases differ from term lending. The lessee typically has a choice of extending the lease, returning the asset, or introducing a buyer for the asset at the end of the lease agreement. When they introduce a purchaser, some leasers are entitled to a refund of 95 percent of the sale proceeds. The amount of the refund depends on the agreement between the initial leaser and the lessee.

- HP is a financing solution suitable for companies wishing to purchase assets without immediately paying the full value. An initial deposit is paid by the customer, with the rest of the balance and interest being paid over a period of time. Ownership of the asset is transferred to the customer on completion.

- It is important to note that according to the type of lease it is, the accounting and tax treatment of leases varies. For example, the tax treatment follows the legal form of the transaction, which is the hiring of an asset, because a financial lease is accounted for as a loan financing the asset. More specifically, the treatment of capital allowances differs, and when deciding how to finance the purchase of an asset, tax treatment should be taken into consideration.

In industries where expensive machinery is needed, such as construction, manufacturing, plant hire, printing, road freight, transportation, engineering and professional services, the use of HP or leasing is especially common.

It is also used to finance a business's other capital requirements, such as:

Smaller Items

· Cars

·photocopiers.

This type of linked finance is usually dictated by the asset provider.

Costs

There are two main costs that need to be taken into account:

• rate of interest charged for funding. Rates are favorable to higher-resale value assets (ie machinery, agricultural equipment, vehicles etc). Less favorable rates will be given to assets that are considered 'soft' because of their low resale value (i.e. printers, vending machines, office furniture etc).

Fees charged by the financing company for processing loans and conditions for administrative work meetings. For instance, at regular intervals and from a pre-approved workshop, a car purchased on HP may need servicing.

Depending on the size and complexity of the deal, an HP or leasing facility can normally take up to a week to complete.

Advantages

- HP or leasing allows businesses to control and deploy assets without a major drain on working capital.

- Fixed-rate financing makes it easy to budget as the lessee has a clear view of future spending.

- There is flexibility in repayment structuring to enable seasonal business (e.g. one repayment per year) and to reduce monthly outlay by factoring in a 'balloon' payment at the end of the term.

- Leasing avoids the risk of quickly depreciating the value of an asset and provides flexibility to enter into a new contract at the end of the fixed term of the original lease.

Because lease payments are booked as expenses, funding asset purchases can be more tax-efficient than standard-term loans. While asset depreciation also provides tax advantages, the asset's usable lifetime will vary depending on the asset and local regulations.

High funding accessibility for companies due to the financing secured with the leased asset and the asset owned by the financing company

Maintenance is included within the terms of the agreement in certain situations.

Disadvantages

The total sum of HP or lease capital payments will be greater than the full payment on the purchase of the asset.

If any agreements are applied to the arrangement, administrative complexity and costs will be greater - for instance, updates on changing equipment locations.

If the company changes its strategy, resulting in the leased asset no longer being useful, early termination fees or sublease restrictions may occur.

Operating Leases:

This is where, during the non-cancellable period of the lease, the asset is not fully amortized, if any, and where the lessor does not rely on the rental profit in the non-cancellable period. In this type of lease, during the initial lease period, the lessor who bears the cost of insurance, machinery, maintenance, repair costs, etc., is unable to realize the full cost of equipment and other incidental charges.

For a specified time, the lessee utilizes the asset. The risk of obsolescence and incidental risks is borne by the lessor. After providing due notice of the same, either party to the lease may terminate the lease since the asset may be leased out to other willing leases.

Leasing as Financing Decisions

Leasing is a decision to finance, in the following ways;

Leasing can be an especially efficient way for a business to manage its financial statements rather than buying, in the sense that it gets immediate access to the assets but pays them back on a monthly basis, thereby easing and maintaining its cash flows.

Similarly, leasing has different tax advantages. Businesses can deduct from their taxable income leasing costs and claim back VAT on lease payments.

In addition, in the scenario in which a company secures a loan to finance its lease, the company is opened up to a variety of other tax benefits, which also explains why even the largest companies in the world, such as Apple, with significantly strong cash reserves, still choose to deploy leverage and borrow to finance their spending.

Leasing can also give a business a greater degree of flexibility and eliminate the burden of technology, machinery and vehicle depreciation.Instead of selling at residual value and re-buying assets every few years, a leasing agreement company can easily renew its agreement and thus receive the latest fleet of vans or data storage facilities at little extra cost to their business needs.

Key Takeaways:

- The lessor bears the risk of incidental risks and obsolescence. Since the asset may be leased out to other willing leases, either party to the lease may terminate the lease after giving due notice of the same.

- Leasing can be an especially efficient way for a business to manage its financial statements rather than buying, in the sense that it gets immediate access to the assets but pays them back on a monthly basis, thereby easing and maintaining its cash flows.

Calculation of Cash flows of a finance lease:

Lessee’s Point of View:

Once a company has assessed an asset's economic viability as an investment and has accepted/selected the proposal, alternative methods of financing the investment must be considered. Nevertheless, in making an investment, the firm does not need to own the property. It is essentially interested in obtaining the use of the property.

The company may therefore consider leasing the asset rather than buying it. The cost of leasing the asset should be compared with the cost of financing the asset through normal sources of funding, i.e. debt and equity, when comparing leasing with purchasing.

Because lease rental payments are similar to borrowing interest payments and lease financing is equivalent to debt financing, financial analysts argue that comparing the cost of leasing with that of borrowing costs is the only appropriate comparison. Lease financing decisions concerning leasing or purchasing options therefore mainly involve a comparison between debt financing costs and lease financing.

The evaluation of lease financing decisions from the point of view of the lessee involves the following steps:

I To calculate the present value of the purchase option's net cash flow, called NPV (B).

(ii) Calculate the present value of the leasing option's net cash flow, called NPV (L)

(iii) Decide whether or not to purchase or lease the asset or entirely reject the proposal by applying the following criterion:

(a) Purchase the asset if NPV (B) is positive and greater than NPV (L).

(b) Lease the asset if the NPV (L) is positive and greater than the NPV (B).

(c) If both the NPV (B) and the NPV (L) are negative, reject the proposal entirely.

Because many financial analysts argue that lease financing decisions arise only after the company has made an investment accept-reject decision; it is merely a comparison of lease cost and borrowing options.

The following steps are involved in such an analysis:

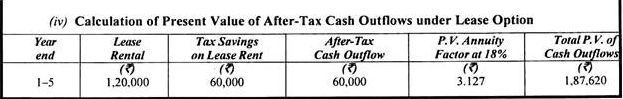

I Determine the present value under the leasing option of after-tax cash outflows.

(ii) Determine the present value of the cash outflows after tax under the purchase or borrowing option.

(iii) Compare the present value of the lease option cash outflows with that of the purchase/borrowing option.

(iv) Select the lower present value option for after-tax cash outflows.

In the following illustrations we have illustrated the above analysis.

Illustration 1:

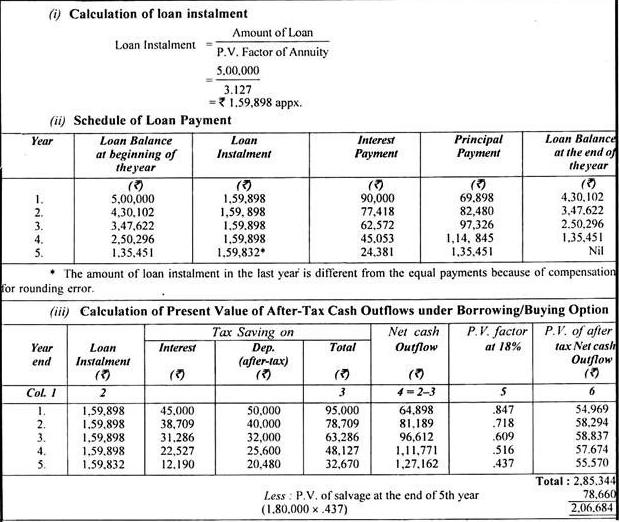

A limited company is interested in acquiring the use of an asset costing Rs. 5, 00,000. It has two options:

I To borrow an amount equal to 18% p.a. Reimbursable in 5 equal or equal instalments

(ii) To lease the asset for a period of five years at year-end leases of Rs. 1, 20,000.

The corporate tax is 50 percent and 20 percent depreciation is allowed on w.d.v. At the end of the 5th year, the asset will have a salvo of Rs. 1, 80,000.

You are required to advise the business on the decision to lease or purchase. If the firm is permitted to claim an investment allowance of 25%, will the decision change?

Note:

(1) The value of the present value of Re. The discount factor of 1 at 18% is:

1st year, .8477

2nd year, with .7188

3rd year with .6099

Fourth year, .516

5th year, .437

(2) The present value of Re's annuity. 1 at p.a. 18 percent. That's Rs. 3.127.

Solution:

|

|

(v) Evaluation:

Since the present value of the after-tax cash outflows under the leasing option is lower than the present value of the purchasing option's after-tax cash outflows, it is advisable to lease the asset.

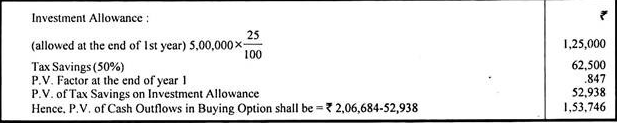

(vi) Decision if Investment Allowance is allowed:

If an investment allowance is granted for the purchase of an asset, the total present value of the net cash outflows will be reduced by the present value of the investment allowance tax savings, as follows:

|

The P.V., in that case. The cash outflows under the purchase option are lower than the P.V. Under the leasing option, cash outflows and the company should purchase the asset.

Financial Evaluation of Leasing: Way # 2.

Lessor’s Point of View:

With the aid of two time-adjusted methods of capital budgeting, the financial viability of leasing out an asset from the lessor's point of view can be assessed:

A) Present Method of Value

(b) Internal return rate Method.

(a) Present Value Method:

This method involves the following steps:

I Determine cash outflows by deducting an asset-owning tax advantage, such as an investment allowance, if any.

(ii) Determine after-tax cash inflows as below:

|

(ii) Determine the present value of cash outflows and cash inflows after tax by discounting the weighted average cost of the lessor's capital.

(iv) Decide in favour of an asset lease, if P.V. Inflows of cash exceed the P.V. Cash outflows, i.e. if the NPV is +ve; otherwise, the lessor would lose on leasing the asset if N.P.V. is -ve.

With the aid of the following example, the above technique has been explained.

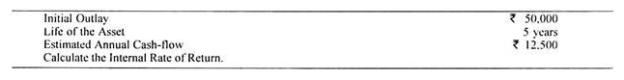

Illustration 2:

|

Solution:

|

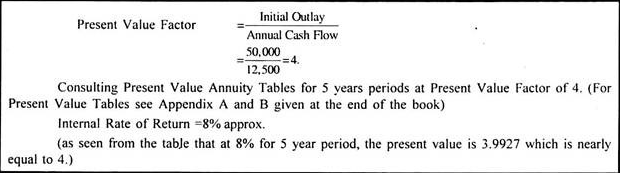

(b) When the annual cash flows are unequal over the life of the asset:

In the event that annual cash flows are unequal over the life of the asset, the internal rate of return cannot be determined by reference to the above-mentioned technique. The internal rate of return is calculated by hit and trial in such cases, and that is why this method is also known as the method of hit and trial yield.

By consulting present value tables, we can start with any assumed discount rate and find out the total present value of all cash flows.

The total present value of the cash inflows calculated in this way is compared to the present value of the cash outflows, which is equal to the cost of the initial investment where the initial total investment is to be made.The internal rate of return is the rate at which the total present value of all cash inflows equals the initial outlay. Until the appropriate rate is found, multiple discount rates may have to be tried. The process of calculation may be summarized as follows.

I Using an arbitrary assumed discount rate to discount the net cash flow to the present value, prepare the cash flow table.

(ii) Determine the Net Present Value by deducting the total cash flows calculated in I above the initial investment cost from the present value.

(iii) If the Net Present Value (NPV) is positive, a higher discount rate applies.

(iv) If there is still a positive net present value of the higher discount rate, increase the discount rate further until the NPV becomes negative.

(v) If, at this higher rate, the NPV is negative, the internal rate of return must be between these two rates:

(3) If the internal rate of return is higher than or equal to the minimum rate of return required, i.e. the cost of capital or the cut-off rate, accept the proposal.

(4) In the case of alternative proposals, if the rates are higher than the cost of capital or the cut-off rate, select the proposal with the highest rate of return.

Key Takeaways:

- Once a company has assessed the economic viability of an asset as an investment and has accepted/selected the proposal, alternative methods of financing the investment must be considered.

- Nevertheless, in making an investment, the firm does not need to own the property. It is essentially interested in obtaining the use of the property.

- Lease rental payments are similar to borrowing interest payments and lease financing is equivalent to debt financing. Financial analysts argue that the only appropriate comparison is to compare lease costs with borrowing costs.

●Hence, lease financing decisions relating to leasing or buying options primarily involve comparison between the cost of debt-financing and lease financing.

Hire Purchase is defined as an agreement in which the owner of the property allows the hirer to hire them for periodic payments paid by the hirer. Once all the agreed payments have been made, the hirer has the option to acquire and own the asset. These periodic payments also include, apart from the price of the asset, the interest component paid towards the use of the asset.

In other countries, the term 'Hire-Purchase' is a UK term and is synonymous with 'rent-to-own' or 'installment plan'. Owning goods through hiring and buying allows businesses to enhance their earnings performanceThis scheme is also the most efficient and safe form of credit sales for the current owner of the asset, not just beneficial to the hirer.

Hire purchasing is a method of purchasing or financing capital goods whereby the goods are almost instantaneously accessible for use, but over an agreed period the payment is made in smaller parts. Only after payment of all installments is the ownership transferred.Technically speaking, it is an agreement between the asset buyer (or user) and the financing company by which the financing company buys the asset on behalf of the buyer and the buyer used it for business purposes and pays back in small installments called hire charges to the financing company.

In other words, it is possible to define hire purchase as an option to finance or acquire an asset for use by allowing the financing company to lease the goods to the buyer against small installments called hire charges, and the buyer is entitled to use the asset with an option to buy the asset by paying all such installments over a period of time.Whether it is a personal car, commercial vehicle, etc., hire purchase was very prominent for vehicle financing, but now equipment, machinery, etc. are also funded by the hire purchase method.

Need and Importance:

Hire buying is a typical transaction in which the assets are allowed to be hired and an option is given to the hirer to purchase the same assets later.

The following are the characteristics of a regular purchase transaction for hire:

● Rental payments are paid in installments over the contract period.

Each rental payment is regarded as an asset hiring charge. This implies that the seller has all the rights to take back the assets when the hirer defaults on any payment.

● All the required terms and conditions are documented in a contract called the Hire-Purchase Agreement between the two parties involved.

● ●As per the terms of the agreement, the frequency of the installments may be annual, half-yearly, quarterly, monthly, etc.

● Once the contract is signed, assets are immediately delivered to the hirer.

● If the hirer uses the purchase option, after the last installment is paid, the assets are passed to him.

● If the hirer does not want to own the asset, the assets can be returned at any time and any payment that falls due after the return is not required.

●

● Once the hirer returns the assets, however, he can not claim back any payments already paid, as they are the fees for hiring and using the assets.

● The hirer, as he is not the owner of the assets until the last payment is made, can not pledge, sell or mortgage the assets.

● Usually, the hirer pays a certain amount as an initial deposit / down payment while the agreement is signed.

● Generally, any time before the ownership rights pass to him, the hirer can terminate the hire purchase agreement.

● Immediate use of assets without the whole amount being paid.

● It is possible to use costly assets as the payment is spread over a period of time.

● As all the expenditures are known in advance, fixed rental payments make budgeting easier.

● Easy accessibility, as the financing is secured.

● As there is no obligation to buy the asset, there is no need to worry about the asset depreciating quickly in value.

Calculation of Hire Purchase instalments:

Hire purchase issues require periodic interest calculation in any of the following cases:

(1) Where there is a cash price, interest rate and installment:

Illustration: illustrations

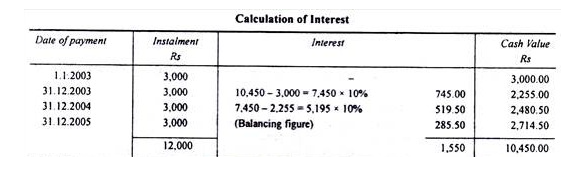

On January 1, 2003, under the Hire Purchase System, A bought a television from a seller, the cash price of which was Rs 10,450 as per the following terms:

(a) Rs 3,000 to be paid upon the agreement being signed.

(b) Balance to be paid at the end of each year in three equal installments of Rs 3,000,

(c) The interest rate charged by the seller is 10 per cent annually.

Each year, you are required to calculate the interest paid by the buyer to the vendor.

Solution:

|

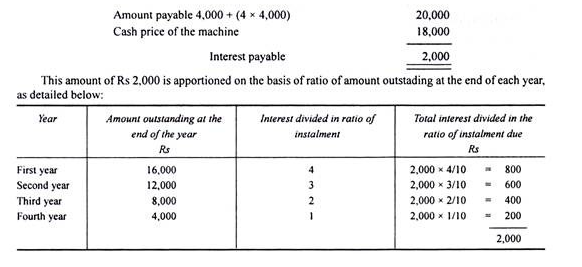

(2) Where Cash Price and Installments are given but Rate of Interest is omitted:

If the interest rate is not given and only the cash price and the total payments under hire purchase installments are given, then the difference between the asset's cash price and the total amount paid under the agreement is the total interest paid. This amount of interest is allocated to the ratio of the amount outstanding at the end of each period.

Illustration:

Mr. A bought a machine under a lease purchase agreement, Rs 18,000 being the cash price of the machine. As per the terms, on signing the agreement, the buyer has to pay Rs 4,000 and the balance in four installments of Rs 4,000 each, payable at the end of each year. Calculate the payable interest at the end of each year.

|

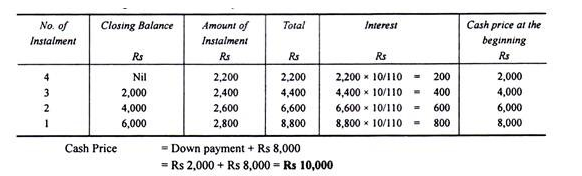

(3) Where installments and Rate of Interest are given but Cash Value of the Asset is omitted:

The cash price is not given for certain issues. First, we need to find out the cash price and interest included in the instalments. It is necessary to debit the asset account with the actual price of the asset. In such circumstances, i.e. in the absence of cash prices, interest is calculated on the basis of the last year.

It may be noted that from 3rd year to 2nd year, 2nd year to 1st year, the amount of interest continues to increase. We can find out the cash price because the interest is included in the installments and by knowing the rate of interest.

Therefore:

Let the outstanding cash price be: Rs 100,

Interest @ 10 percent for a year on Rs 100: Rs 10 10

Payment payable at the end of the year 110

Interest on the price of the payment = 10/110 or 1/11 as a ratio.

Illustration:

I'm buying a TV with the Hire Purchase System.

The terms of payment are as follows:

Rs 2,000 to be paid upon the agreement being signed;

At the end of the first year, Rs 2,800;

At the end of the second year, Rs 2,600;

At the end of the third year, Rs 2,400;

|

At the conclusion of the fourth year, Rs 2,200.

What was the cash value of the television if interest was charged at a rate of 10 percent p.a.?

Solution:

A reference to the annuity table in which the present value of the annuity is given at a certain interest rate for a number of years is sometimes referred to in the problem. In these cases, the cash price is calculated by multiplying the installment amount and adding the product to the initial payment.

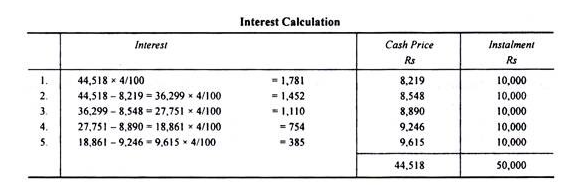

Illustration:

Under the Hire Purchase System, A agrees to purchase a machine from a seller for an annual installment of Rs 10,000 over a period of 5 years. At 4 percent p.a., the seller charges interest. On an annual balance.

N.B.—N.B. The present value of the p.a. of Re 1 4 percent for five years is Rs 4.4518. Find out the machine's cash price.

Solution:

Installment Re 1 Value present = Rs 4.45188

Installment = Rs 10,000 Value present = Rs 4.4518 x 10,000 = Rs 44,518

|

Key Takeaways:

- Hire Purchase is defined as an agreement in which the owner of the assets lets them on hire for regular installments paid by the hirer. The hirer has the option to purchase and own the asset once all the agreed payments have been made.

- These periodic payments also include, apart from the price of the asset, the interest component paid towards the use of the asset.

- Each rental payment is regarded as an asset hiring charge. This implies that the seller has all the rights to take back the assets when the hirer defaults on any payment.

All the required terms and conditions are documented in a contract called the Hire-Purchase Agreement between the two parties involved.

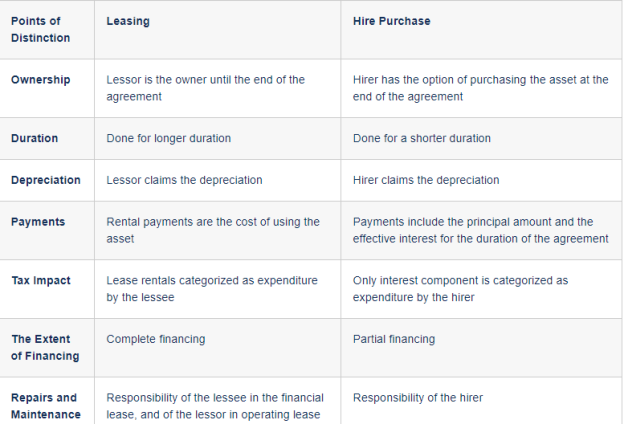

Choice between Leasing and Hire Purchase:

Property of the Asset

Ownership lies with the lessor in a lease. The lessee is entitled to use the equipment and does not have the option of buying it. Whereas the hirer has the option to buy in the hire purchase. Immediately after the last instalment is paid, the hirer becomes the owner of the asset/equipment.

Depreciation From

The depreciation is claimed in lease finance as an expense in the lessor's books. On the other hand, in the case of a lease purchase transaction, the depreciation claim is permitted to the hirer.

Payments for Rental

The rentals for the lease cover the cost of using an asset. It is normally derived from the cost of an asset over the life of the asset. The installment is inclusive of the principal amount in the case of hire purchase and the interest is used for the time period of the asset.

The Duration

Lease agreements are generally carried out for longer durations and for larger assets such as land, property, etc. Hire purchase agreements are mostly for shorter periods and cheaper assets, such as car hire, machinery, etc.

Impact Tax

The total lease rentals are shown in the lease agreement as expenditure by the lessee. The hirer claims the asset depreciation as an expense in the hire purchase.

Reparations and Maintenance

Repair and maintenance of the asset in the financial lease is the responsibility of the lessee, but it is the responsibility of the lessor in the operating lease. The responsibility lies with the hirer for the hire purchase.

The scope of finance

The complete financing option in which no down payments are required can be called lease financing, but in the case of hire purchase, the hirer usually needs to pay an amount of margin money in advance. We therefore refer to it as partial finance, such as loans, etc.

Businessmen may choose lease finance or hire purchase options, but they should be properly analyzed as to how the options suit the requirements and circumstances of the business.

|

Key Takeaways:

- Ownership lies with the lessor in a lease. The lessee is entitled to use the equipment and does not have the option of buying it.

- Whereas the hirer has the option to buy in the hire purchase. Immediately after the last instalment is paid, the hirer becomes the owner of the asset/equipment.

- Hire purchase contracts are mostly made for shorter periods and cheaper assets such as car hire, machinery, etc.

4. The total lease rentals are shown by the lessee as expenditure in the leasing agreement. The hirer claims the depreciation of the asset in hire purchases as an expense.

Reference Books:

1) Fundamentals of Financial Management by Vyuptakesh Sharma, Pearson Education, New Delhi

2) Fundamentals of Financial Management by J.C. Van Horne, Prentice Hall of India, New Delhi

3) Financial Management: Text and Problems by M.Y. Khan and P.K. Jain, Tata McGraw Hill, New Delhi