UNIT V

Working Capital financing

Financing of working capital is carried out through various modes, such as trade credit, cash credit/bank overdraft, working capital loan, bill purchase/bill discount, bank guarantee, credit letter, factoring, business paper, inter-corporate deposits, etc.

The arrangement of financing for working capital forms a major part of the day-to-day activities of a finance manager. It is a very crucial activity and requires continuous attention because the money that keeps day-to-day business operations smooth is working capital. A company may get into trouble without adequate and sufficient financing for working capital. Insufficient working capital can lead to non-payment on time of certain dues. Inappropriate financing would result in a loss of interest that directly affects the company's profits.

An important external source of financing for working capital is trade credit. It is a short-term credit extended, in the normal course of business, by suppliers of goods and services to a buyer in order to increase sales. Trade credit arises when, at a later date, a supplier of goods or services allows clients to pay for goods and services. Cash is not paid immediately, and payment deferral is a source of finance.

Trade Credit features:

The trade credit characteristics are given below:

- No formal legal instruments/debt acknowledgements exist.

- The buyer and seller are an internal arrangement.

- It represents a spontaneous source of funding.

- When payment is not made within the discount period, it is an expensive source of finance.

Characteristics of trade credit:

1. It is an automatic and easy source of short-term finance.

2. It reduces the requirement for capital.

3. It helps the company concentrate on core operations.

4. Any negotiation or formal agreement is not needed.

Bank loans are the simplest source of financing available. A bank loan is a credit extension to a customer or business by a bank; it must be paid along with interest.

Features of loans from banks:

Bank credits have the following features:

1. It is a source of finance for the short term.

2. Depending on the circumstances, a bank loan may be either secured or unsecured.

3. The interest on such a loan charged by the bank may be either fixed or variable.

4. The borrower must pay a number of fees if mortgage loans are to be obtained, such as title search fees, application fees, inspection fees, etc.

Key Takeaways:

- Trade credit is an important external source of financing for working capital. It is a short-term credit extended, in the normal course of business, by suppliers of goods and services to a buyer in order to increase sales.

- Trade credit arises when, at a later date, a supplier of goods or services enables clients to pay for goods and services. Cash is not paid immediately, and payment deferral is a source of finance.

- Bank loans are the easiest source of funding available. A bank loan is an extension of a bank's credit to a client or company; it must be paid along with interest.

Commercial paper is a commonly used form of corporate issued unsecured, short-term debt instrument, typically used for payroll financing, payable accounts and inventories, and meeting other short-term liabilities. Maturities typically last several days on commercial paper, and rarely last longer than 270 days. Commercial paper is typically issued at a face value discount and reflects prevailing market interest rates.

Commercial paper is a commonly used form of corporate issued unsecured, short-term debt instrument, typically used for payroll financing, payable accounts and inventories, and meeting other short-term liabilities. Maturities typically last several days on commercial paper, and rarely last longer than 270 days. Commercial paper is typically issued at a face value discount and reflects prevailing market interest rates.

Commercial paper is generally not supported by any type of collateral, which makes it a form of unsecured debt. It differs from Asset-Backed Commercial Paper (ABCP), which is a class of debt instrument supported by the issuer's selected assets. In either case, only firms with high-quality debt ratings issue commercial paper. Only these types of companies will be able to find buyers easily without having to offer a significant discount (higher cost) for the debt issue.

The denominations of the commercial paper offerings are substantial, usually $100,000 or more, because commercial paper is issued by large institutions. Buyers of commercial paper are generally other corporations, financial institutions, wealthy people, and money market funds.

Advantages of Commercial Paper

A major advantage of commercial paper is that it does not have to be registered with the Securities and Exchange Commission (SEC) as long as it matures for a period of nine months or 270 days, making it a very cost-effective financing option. Although maturities may go as long as 270 days before they fall within the scope of the SEC, commercial paper maturities average approximately 30 days, rarely reaching that threshold. The proceeds from this type of financing may be used only on current assets or inventories and may not be used without SEC involvement on fixed assets, such as a new plant.

Commercial Paper during the Financial Crisis

In the financial crisis that started in 2007, the market for commercial paper played a major role. The market for commercial paper froze as investors began to doubt the financial health and liquidity of companies such as Lehman Brothers, and firms were no longer able to access easy and affordable funding. Another effect of the freezing of the commercial paper market was "breaking the buck." by some money market funds - significant investors in commercial paper. This meant that the affected funds had net asset values below $1, reflecting the decreasing value of their outstanding business paper issued by suspected financial health companies.

Subsequently, on October 27, 2008, the Commercial Paper Funding Facility (CPFF) was established by the Federal Reserve Bank of New York as a result of the credit crunch faced by financial intermediaries in the market for commercial paper. The CPFF was closed in February 2010 by the Federal Reserve Bank of New York after it no longer became necessary as the financial sector and the wider economy recovered.

An example of commercial paper is when a retail company seeks short-term funding for an upcoming holiday season to finance some new inventory. The company needs $10 million and, according to prevailing interest rates, offers investors $10.1 million in face value of commercial paper in exchange for $10 million in cash. In effect, in exchange for the $10 million in cash, there would be a $0.1 million interest payment upon maturity of the commercial paper, equivalent to an interest rate of 1 percent . Depending on the number of days the commercial paper is outstanding, this interest rate can be adjusted for a period of time.

Key Takeaways:

- Commercial paper is a commonly used form of corporate issued unsecured, short-term debt instrument, typically used for payroll financing, payable accounts and inventories, and meeting other short-term liabilities.

- Commercial paper is generally not supported by any form of collateral, which makes it a form of unsecured debt. It differs from Asset-Backed Commercial Paper (ABCP), which is a class of debt instrument supported by the issuer's selected assets.

- A major advantage of commercial paper is that it does not need to be registered with the Securities and Exchange Commission (SEC) until nine months or 270 days have elapsed, which makes it a very cost-effective means of financing.

- Although maturities can go as long as 270 days before they come under the SEC's authority, commercial paper maturities average around 30 days, rarely reaching that threshold.

A certificate of deposit (CD) is a product offered by banks and credit unions which, in return for the customer agreeing to leave a lump-sum deposit untouched for a predetermined period of time, provides an interest rate premium. Although it's up to each bank what CD terms it wants to offer, almost all consumer financial institutions offer them, how much higher the rate will be compared to the savings and money market products of the bank, and what penalties it applies for early withdrawal.

To find the best CD rates, shopping around is crucial because a surprisingly wide range is offered by various financial institutions. For example, your brick-and-mortar bank could pay a pittance on even long-term CDs, while an online bank or local credit union could pay 3 to 5 times the national average. Some of the best rates, meanwhile, come from special promotions, sometimes with unusual durations such as 13 or 21 months, rather than more common terms based on increments of 3, 6, or 18 months or full-year.

The opening of a CD is very similar to any standard bank deposit account opening. The distinction is what you agree with when you sign on the dotted line (even if that signature is now digital). After you've shopped around and identified which CD(s) you're going to open, you're locked into four things by completing the process.

- Interest rate: Locked rates are positive in that they provide your deposit with a clear and predictable return over a specific period of time. The bank cannot change the rate later, thus reducing your earnings. On the flip side, if rates increase significantly later and you have lost your chance to take advantage of higher-paying CDs, a fixed return may hurt you.

- The term: This is the length of time you agree to leave your deposited funds in order to avoid any penalty (e.g. 6-month CD, 1-year CD, 18-month CD, etc.) The term ends on the "maturity date," when your CD is fully matured and you can withdraw your penalty-free funds.

- The principal: With the exception of some specialty CDs, when you open the CD, this is the amount you agree to deposit.

- Institution: If you open your CD, the bank or credit union will determine aspects of the agreement, such as early withdrawal penalties (EWPs) and whether your CD will be automatically reinvested if at the time of maturity you do not provide other instructions.

Anyone who has been following interest rates or business news in general knows that the rate-setting actions of the Federal Reserve Board loom large in terms of what savers can earn on their deposits.2 That's because the decisions of the Fed can have a direct impact on the costs of a bank. Here's how things work.

The Federal Open Market Committee (FOMC) of the Federal Open Market Committee decides every six to eight weeks whether to raise, lower or leave the federal funds rate alone.3 This rate represents the interest that banks pay through the Fed to borrow money.4 When Fed money is cheap (i.e. the federal funds rate is low), banks have less incentive for consumer court deposits. But banks can do better by paying consumers a competitive rate for their deposits when the federal funds rate is moderate or high.

As a stimulus to lift the U.S. economy out of the Great Recession, the Fed reduced its rate to the lowest possible level of essentially zero in December 2008. Even worse for savers was that for a full seven years it left rates anchored there. 2 During that time, all kinds of deposit rates tanked: savings, money market, and CDs.

However, the Fed began to gradually increase the federal funds rate starting in December 2015 in light of metrics showing growth and strength in the U.S. economy. As a result, interest banks paid on deposits increased, with the highest CD rates being an attractive option for certain cash investments. In the later half of 2019, the federal funds rate began to fall, then dropped to between 0 percent and .25 percent in March 2020 in an emergency measure to stifle the economic impact of the pandemic of the corona virus.

Currently, these lower rates make CDs a less attractive choice for investors in cash.

However, beyond the action of the Fed, each financial institution's situation is an additional determinant of how much interest it is willing to pay on particular CDs. For example, if the lending business of a bank is booming and an increasing amount of deposits is required to finance those loans, the bank may be more aggressive in attempting to attract deposit customers. An exceptionally large bank with more than adequate deposit reserves, on the other hand, may be less interested in expanding its CD portfolio and thus offering low certificate rates.

Features of Deposit Certificates

- A bank can issue a Deposit Certificate to individuals, corporations, businesses and funds.

- A bank will not be able to buy its CD before maturity.

- Banks can only issue dematerialized CDs. If investors want to, they can request a physical form from the bank as well.

- If a CD is in physical form, it can be transferred easily.

- CDs Short and Long-Term

Usually, short-term CDs are for up to a year and do not have coupons or interest payments. Depositors get the principal amount and the interest due at the end of the maturity.The bank pays coupons (or interest) at regular intervals in the case of a long-term CD, such as every quarter or six months. Also, compared to a short-term CD, a long-term CD gets a higher return. This is because, as the holder holds the certificate for a longer period, the risk is greater in the long term, resulting in more uncertainty.

Benefits of Deposit Certificates

- It is a risk-free tool that ensures that banks' funds are safe. Since the Federal Deposit Insurance Corporation (FDIC) insures the Deposit Certificate, it acts as a guarantee that the principal amount will not be lost.

- CDs receive a higher interest rate than either the savings account or the interest-bearing account.

- Because banks compete for funds from depositors, some banks offer better rates than others. This implies that to get the highest interest rate, you can try different banks.

- A Certificate of Deposit's biggest limitation is that your money gets stuck until maturity. While it can always be withdrawn early, you also have to bear a small penalty. Nowadays, in terms of the amount you can withdraw without any penalty, some banks offer flexibility. So, ask your bank if any such facility is offered by it.

- You may lose some profitable investment opportunities since your money gets stuck. For instance, if the rate of interest increases on the other instruments during the CD period, you will lose the interest you would have earned. You can go for a no-penalty CD or something similar to avoid this, which allows you to easily withdraw the amount.

- Although CDs pay more interest rates than the savings account, they do not sometimes offer enough to offset the inflation rate. In the event that the inflation rate is greater than the CD interest rate, you will lose in real terms.How to select a CD?

Below are the few useful guidelines that could help you to choose the best Certificate of Deposit;

- The longer investors are prepared to leave their funds with the bank, the greater the interest rate they will receive.

- If you expect the interest rate to rise in the near future, you should select the short-term CD first. After that, you can re-invest it at a higher interest rate after it matures.

- If you expect the interest rate to fall in the future, choose a longer period of time for the CD. This will ensure you get a higher interest rate even if the rate drops.

Tax Treatment of Interest Earned on CDs

If you have a CD, at regular intervals, like every quarter or after six months, the bank will regularly credit the interest amount. The same will appear in your account as interest income when a bank credits the interest. Therefore, you should also report this as part of your revenue when you file a tax return, similar to other interest income. However, most individuals feel that since they can't actually withdraw the interest on the CD when they are credited by the bank, they should only be taxed at maturity. As interest becomes taxable as soon as the bank adds it to your account, this is incorrect.

Key Takeaways:

- A certificate of deposit (CD) is a product offered by banks and credit unions which, in exchange for the customer agreeing to leave a lump-sum deposit untouched for a predetermined period, provides an interest rate premium.

- Opening a CD is very similar to opening any standard account for bank deposits. The distinction is what you agree with when you sign on the dotted line (even if that signature is now digital). After you shop around and identify which CD(s) you're going to open,

- Although CDs pay more interest rates than the savings account, they sometimes do not provide enough to offset the inflation rate

Unlike other short-term money market instruments, CDs are not sold at a discount, but pay interest on the money deposited. For CD maturities of less than 1 year, interest is paid at maturity. For term CDs — those with a term of 1 year or longer — interest is paid semiannually

Market yields on CDs are determined by the usual factors that affect rates for fixed-income securities: the credit rating of the issuer, the term of the CD, and market interest rates. Like bonds, the price of negotiable CDs varies inversely with market interest rates: when market interest rates decline, CD prices increase, and vice versa. A major determinant of CD yields is the bank's demand for money for loans and the cost of alternative sources of funding, such as commercial paper. The greater the demand or the higher the cost of alternative funding sources, the greater the yields paid on CDs.

Example 1. What is the actual cost to a bank with a 5% Federal Reserve requirement of a 1-year Rs. 100,000 CD paying 6% interest?

Because the bank must keep 5%, or Rs. 5,000, of the money in a Federal Reserve account that pays no interest, the Rs. 6,000 interest that the bank is paying is on Rs. 95,000, yielding an actual interest rate of 6,000/95,000 ≈ 6.32%. A simpler way to calculate the bank's cost is to multiply the interest rate on the CD by 1 plus the Federal Reserve requirement percentage.

Actual Cost to Bank = CD Interest Rate × (1 + Federal Reserve Requirement Percentage)

In this case, the equation would be:

6% × 1.05 = 6.3%

Adding a typical 8 basis points (0.08%) to the interest rate for FDIC insurance increases the bank's actual cost to 6.4%.

Example 2. If a CD (Day-Count Convention: Year = 360 days) pays 5% and has a face value of Rs. 100 and a term of 90 days, then the amount received at maturity is equal to: Rs. 100 × (1 + .05 × 90/360) = Rs. 101.26, of which Rs. 1.26 is interest.

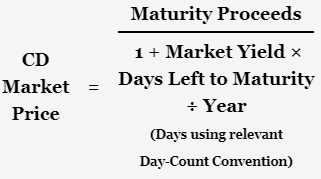

If the CD sold is sold before maturity, then the market price will depend on the market yield, which is what other interest paying instruments with similar characteristics and credit quality are paying, so the market price will be equal to:

|

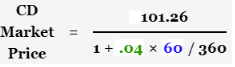

So, if the above CD is offered for sale after 30 days, with 60 days remaining to the CD term, and the market yield is now 4%, then the market price would be:

|

= Rs. 100.56

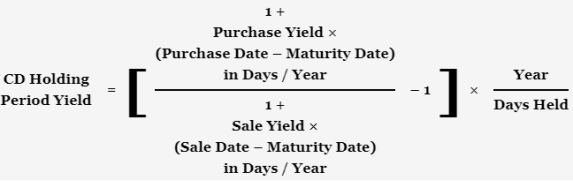

If the CD is sold before maturity, then the investment return for the holding period on the CD is equal to:

|

Example 3. Joe invested Rs.5,000 in CD with the bank at a fixed interest rate of 5% and maturity in 5 years. The Returns and maturity value of CD is calculated as below:

Certificate of Deposit

Year Amount Interest

0 5000 0

1 5250 250

2 5513 263

3 5788 276

4 6078 289

5 6381 304

So the principal amount is Rs.5,000, and the maturity proceeds are Rs.6,381. The return on CD for the period of 5 years is Rs.1,381.

Example 4. Tom invested Rs.10,000 in CD with the bank at a fixed interest rate of 5% and maturity in 5 years. He decides to withdraw the money before maturity at the end of year 3. The early withdrawal penalty is 6 months’ interest.

Certificate of Deposit

Year Amount Interest Early Withdrawl Penalty

0 10000 0

1 10500 500

2 11025 525

3 11576 551 276

In this case, the principal invested is Rs.10,000 and the maturity proceeds at the end of year 3 are Rs.11,576. The total returns for the period are Rs.1,576. Since Tom withdraws money before the maturity period, he needs to pay an early withdrawal penalty of Rs.276 (6 months interest).

Example 5. Rs. 20,000 are invested in CD at fixed rate of 10% for 6 years and to be withdraw at the end of 4 years. The penalty is of 1 year interest. What is the total gain?

Certificate of Deposit

Year Amount Interest

1 20,000 2000

2 24,200 2200

3 26620 2420

4 29282 2662

In this case, return are 29282 – 20000= 9282 but penalty is of 1 year therefore 9282-2662= 6620

So total gain is Rs 6620.

Example 6. Joseph invested Rs. 15000 in CD at fixed rate of 15% for 3 years and he decided to withdraw at the end of 2 years. The penalty is of 6 months interest. What is the total gain?

Certificate of Deposit

Year Amount Interest

1 17250 2250

2 19837.5 2587

In this case, return are 19837-15000= 4837.5 but penalty is 6 months interest so, 4837.5-1293.5=3544

Total gain is Rs. 3544

Example 7. Isha invested Rs. 20000 in CD at variable interest rate for 3 years such as 5%, 10% 15% from first year to third year resp.

Certificate of Deposit

Year Amount Interest Interest Rate

1 20000 1000 5%

2 21000 2100 10%

3 23100 3465 15%

Total gain is 26565-20000= Rs. 3544

Reference Books:

1) Fundamentals of Financial Management by Vyuptakesh Sharma, Pearson Education, New Delhi

2)Financial Management by Khan & Jain