Payment of Tax

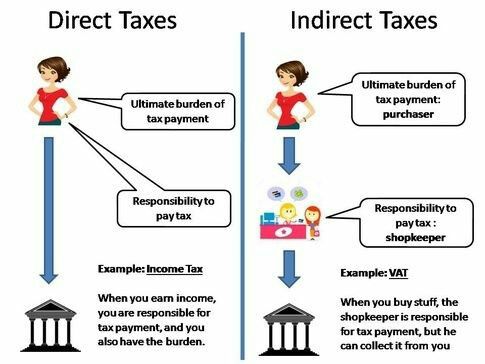

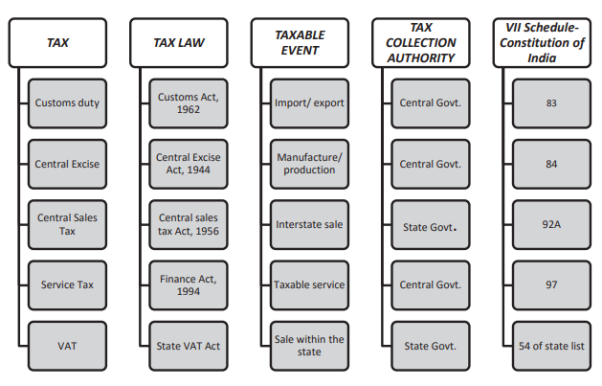

Income Tax in India: Taxes in India can be categorized as direct and indirect taxes. Direct tax is a tax you pay on your income directly to the government. Indirect tax is a tax that somebody else collects on your behalf and pays to the government e.g. restaurants; theatres and e-commerce websites recover taxes from you on goods you purchase or a service you avail. This tax is, in turn, passed down to the government. Direct Taxes are broadly classified as:

- Income Tax – This is taxes an individual or a Hindu Undivided Family or any taxpayer other than companies, pay on the income received. The law prescribes the rate at which such income should be taxed

- Corporate Tax – This is the tax that companies pay on the profits they make from their businesses. Here again, a specific rate of tax for corporates has been prescribed by the income tax laws of India

Indirect taxes take many forms: service tax on restaurant bills and movie tickets, value-added tax or VAT on goods such as clothes and electronics. Goods and services tax, which has recently been introduced is a unified tax that has replaced all the indirect taxes that business owners have to deal with.

|

Fig.1: Direct and Indirect tax

Unlike direct taxes where documents need to be accomplished and filing is required, indirect taxes are paid the moment a consumer buys a product. The tax is collected by the supplier and paid to the government.

Indirect Tax:

An indirect tax is a tax collected by an intermediary (such as a retail store) from the person who bears the ultimate economic burden of the tax (such as the customer). An indirect tax is one that can be shifted by the taxpayer to someone else. An indirect tax may increase the price of a good so that consumers are actually paying the tax by paying more for the products. Some important indirect taxes imposed in India are as under:

Customs Duty:

The Customs Act was formulated in 1962 to prevent illegal imports and exports of goods. Besides, all imports are sought to be subject to a duty with a view to affording protection to indigenous industries as well as to keep the imports to the minimum in the interests of securing the exchange rate of Indian currency. Duties of customs are levied on goods imported or exported from India at the rate specified under the customs Tariff Act, 1975 as amended from time to time or any other law for the time being in force. Under the custom laws, the various types of duties are leviable.

(1) Basic Duty: This duty is levied on imported goods under the Customs Act, 1962. (2) Additional Duty (Countervailing Duty) (CVD): This is levied under section 3 (1) of the Custom Tariff Act and is equal to excise duty levied on a like product manufactured or produced in India. If a like product is not manufactured or produced in India, the excise duty that would be leviable on that product had it been manufactured or produced in India is the duty payable. If the product is leviable at different rates, the highest rate among those rates is the rate applicable. Such duty is leviable on the value of goods plus basic custom duty payable.

(3) Additional Duty to compensate duty on inputs used by Indian manufacturers: This is levied under section 3(3) of the Customs Act.

(4) Anti-dumping Duty: Sometimes, foreign sellers abroad may export into India goods at prices below the amounts charged by them in their domestic markets in order to capture Indian markets to the detriment of Indian industry. This is known as dumping. In order to prevent dumping, the Central Government may levy additional duty equal to the margin of dumping on such articles. There are however certain restrictions on imposing dumping duties in case of countries which are signatories to the GATT or on countries given "Most Favoured Nation Status" under agreement.

(5) Protective Duty: If the Tariff Commission set up by law recommends that in order to protect the interests of Indian industry, the Central Government may levy protective anti-dumping duties at the rate recommended on specified goods.

(6) Duty on 73 Bounty Fed Articles: In case a foreign country subsidises its exporters for exporting goods to India, the Central Government may impose additional import duty equal to the amount of such subsidy or bounty. If the amount of subsidy or bounty cannot be clearly determined immediately, additional duty may be collected on a provisional basis and after final determination; difference may be collected or refunded, as the case may be.

(7) Export Duty: Such duty is levied on export of goods. At present very few articles such as skins and leather are subject to export duty. The main purpose of this duty is to restrict exports of certain goods.

(8) Cess on Export: Under sub-section (1) of section 3 of the Agricultural & Processed Food Products Export Cess Act, 1985 (3 of 1986), 0.5% ad valorem as the rate of duty of customs be levied and collected as cess on export of all scheduled products.

(9) National Calamity Contingent Duty: This duty was imposed under Section 134 of the Finance Act, 2003 on imported petroleum crude oil. This tax was also leviable on motor cars, imported multi-utility vehicles, two wheelers and mobile phones.

(10) Education Cess: Education Cess is leviable @ 2% on the aggregate of duties of Customs (except safeguard duty under Section 8B and 8C, CVD under Section 9 and anti-dumping duty under Section 9A of the Customs Tariff Act, 1985). Items attracting Customs Duty at bound rates under international commitments are exempted from this Cess.

(11) Secondary and Higher Education Cess: Leviable @1% on the aggregate of duties of Customs.

(12) Road Cess: Additional Duty of Customs on Motor Spirit is leviable and Additional Duty of Customs on High-Speed Diesel Oil is leviable by the Finance Act (No.2), 1998. And the Finance Act, 1999 respectively.

(13) Surcharge on Motor Spirit: Special Additional Duty of Customs (Surcharge) on Motor Spirit is leviable by the Finance Act, 2002.

Central Excise Duty:

The Central Government levies excise duty under the Central Excise Act, 1944 and the Central Excise Tariff Act, 1985. Central excise duty is tax which is charged on such excisable goods that are manufactured in India and are meant for domestic consumption. The term "excisable goods" means the goods which are specified in the First Schedule and the Second Schedule to the Central Excise Tariff Act 1985. It is mandatory to pay Central Excise duty payable on the goods manufactured, unless exempted e.g.; duty is not payable on the goods exported out of India. Further various other exemptions are also notified by the Government from the payment of duty by the manufacturers. Various Central Excise are:

(1) Basis Excise Duty: Excise Duty, imposed under section 3 of the ‘Central Excises and Salt Act’ of 1944 on all excisable goods other than salt produced or manufactured in India, at the rates set forth in the schedule to the Central Excise tariff Act, 1985, falls under the category of Basic Excise Duty In India.

(2) Special Excise Duty: According to Section 37 of the Finance Act, 1978, Special Excise Duty is levied on all excisable goods that come under taxation, in line with the Basic Excise Duty under the Central Excises and Salt Act of 1944. Therefore, each year the Finance Act spells out that whether the Special Excise Duty shall or shall not be charged, and eventually collected during the relevant financial year.

(3) Additional Duty of Excise: Section 3 of the ‘Additional Duties of Excise Act’ of 1957 permits the charge and collection of excise duty in respect of the goods as listed in the Schedule of this Act.

(4) Road Cess: (a) Additional Duty of Excise on Motor Spirit: This is leviable by the Finance Act (No.2), 1998. (b) Additional Duty of Excise on High-Speed Diesel Oil: This is leviable by the Finance Act, 1999.

(5) Surcharge: (a) Special Additional Duty of Excise on Motor Spirit: This is leviable by the Finance Act, 2002. (b) Surcharge on Pan Masala and Tobacco Products: This Additional Duty of Excise has been imposed on cigarettes, pan masala and certain specified tobacco products, at specified rates in the Budget 2005-06. Biris are not subjected to this levy.

(6) National Calamity Contingent Duty (NCCD): NCCD was levied on pan masala and certain specified tobacco products vide the Finance Act, 2001. The Finance Act, 2003 extended this levy to polyester filament yarn, motor car, two-wheeler and multi-utility vehicle and crude petroleum oil.

(7) Education Cess: Education Cess is leviable @2% on the aggregate of duties of Excise and Secondary and Higher Education Cess is Leviable @1% on the aggregate of duties of Excise.

(8) Cess - A cess has been imposed on certain products.

Service Tax:

The service providers in India except those in the state of Jammu and Kashmir are required to pay a Service Tax under the provisions of the Finance Act of 1994. The provisions related to Service Tax came into effect on 1st July 1994. Under Section 67 of this Act, the Service Tax is levied on the gross or aggregate amount charged by the service provider on the receiver. However, in terms of Rule 6 of Service Tax Rules, 1994, the tax is permitted to be paid on the value received. The interesting thing about Service Tax in India is that the Government depends heavily on the voluntary compliance of the service providers for collecting Service Tax in India.

Sales Tax:

Sales Tax in India is a form of tax that is imposed by the Government on the sale or purchase of a particular commodity within the country. Sales Tax is imposed under both, Central Government (Central Sales Tax) and State Government (Sales Tax) Legislation. Generally, each State follows its own Sales Tax Act and levies tax at various rates. Apart from sales tax, certain States also imposes additional charges like works contracts tax, turnover tax and purchaser tax. Thus, Sales Tax Acts as a major revenue-generator for the various State Governments. From 10th April 2005, most of the States in India have supplemented sales tax with a new Value Added Tax (VAT).

Value Added Tax (VAT):

The practice of VAT executed by State Governments is applied on each stage of sale, with a particular apparatus of credit for the input VAT paid. VAT in India classified under the tax slabs are 0% for essential commodities, 1% on gold ingots and expensive stones, 4% on industrial inputs, capital merchandise and commodities of mass consumption, and 12.5% on other items. Variable rates (State-dependent) are applicable for petroleum products, tobacco, liquor, etc. VAT levy will be administered by the Value Added Tax Act and the rules made there-under and similar to a sales tax. It is a tax on the estimated market value added to a product or material at each stage of its manufacture or distribution, ultimately passed on to the consumer. Under the current single-point system of tax levy, the manufacturer or importer of goods into a State is liable to sales tax. There is no sales tax on the further distribution channel. VAT, in simple terms, is a multi-point levy on each of the entities in the supply chain. The value addition in the hands of each of the entities is subject to tax. VAT can be computed by using any of the three methods:

(a) Subtraction method: The tax rate is applied to the difference between the value of output and the cost of input.

(b) The Addition method: The value added is computed by adding all the payments that is payable to the factors of production (viz., wages, salaries, interest payments etc.).

(c) Tax credit method: This entails set-off of the tax paid on inputs from tax collected on sales.

Securities Transaction Tax (STT):

STT is a tax being levied on all transactions done on the stock exchanges. STT is applicable on purchase or sale of equity shares, derivatives, equity-orientedfunds, and equity oriented Mutual Funds. Current STT on purchase or sell of an equity share is 0.075%. A person becomes investor after payment of STT at the time of selling securities (shares). Selling the shares after 12 months comes under long term capital gains and one need not have to pay any tax on that gain. In the case of selling the shares before 12 months, one has to pay short term capital gains @10% flat on the gain. However, for a trader, all his gains will be treated as trading (Business) and he has to pay tax as per tax sables. In this case the transaction tax paid by him can be claimed back/adjusted in tax to be paid. The overall control for administration of Direct Taxes lies with the Union Finance Ministry which functions through Income Tax Department with the Central Board of Direct Taxes (CBDT) at its apex.

The CBDT is a statutory authority functioning under the Central Board of Revenue Act, 1963. It also functions as a division of the Ministry dealing with matters relating to levy and collection of Direct Taxes. The Central Excise Department spread over the entire country administers and collects the central excise duty. The apex body that is responsible for the policy and formulation of rules is the Central Board of Excise and Customs which functions under the control of the Union Finance Ministry. The Central Excise officers are also entrusted with the administration and collection of Service tax and the Customs duty. The information contained in this chapter is related to direct and indirect taxes imposed and collected by the Union Government. The tables giving data from 2000-01 onwards in respect direct taxes (corporation tax, income tax and other direct taxes) collected by Central Board of Direct Tax (CBDT) and indirect taxes (customs duties, union excise duties and service tax) collected by Central Board of Excise and Customs. Customs Collection Rate used in this chapter is defined as the ratio of revenue collection (basic customs duty + countervailing duty) to value of imports (in per cent) unadjusted for exemptions, expressed in percentage.

GST

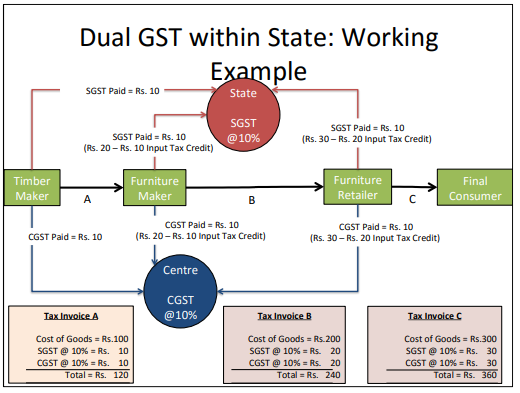

GST is one indirect tax for the whole nation, which will make India one unified common market. GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer. Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage. The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages.

The benefits of GST can be summarized as under:

For business and industry

o Easy compliance: A robust and comprehensive IT system would be the foundation of the GST regime in India. Therefore, all tax payer services such as registrations, returns, payments, etc. would be available to the taxpayers online, which would make compliance easy and transparent.

o Uniformity of tax rates and structures: GST will ensure that indirect tax rates and structures are common across the country, thereby increasing certainty andease of doing business. In other words, GST would make doing business in the country tax neutral, irrespective of the choice of place of doing business.

o Removal of cascading: A system of seamless tax-credits throughout the value-chain, and across boundaries of States, would ensure that there is minimal cascading of taxes. This would reduce hidden costs of doing business.

o Improved competitiveness: Reduction in transaction costs of doing business would eventually lead to an improved competitiveness for the trade and industry.

o Gain to manufacturers and exporters: The subsuming of major Central and State taxes in GST, complete and comprehensive set-off of input goods and services and phasing out of Central Sales Tax (CST) would reduce the cost of locally manufactured goods and services. This will increase the competitiveness of Indian goods and services in the international market and give boost to Indian exports. The uniformity in tax rates and procedures across the country will also go a long way in reducing the compliance cost.

For Central and State Governments

o Simple and easy to administer: Multiple indirect taxes at the Central and State levels are being replaced by GST. Backed with a robust end-to-end IT system, GST would be simpler and easier to administer than all other indirect taxes of the Centre and State levied so far.

o Better controls on leakage: GST will result in better tax compliance due to a robust IT infrastructure. Due to the seamless transfer of input tax credit from one stage to another in the chain of value addition, there is an inbuilt mechanism in the design of GST that would incentivize tax compliance by traders.

o Higher revenue efficiency: GST is expected to decrease the cost of collection of tax revenues of theGovernment, and will therefore, lead to higher revenue efficiency.

For the consumer

o Single and transparent tax proportionate to the value of goods and services: Due to multiple indirect taxes being levied by the Centre and State, with incomplete or no input tax credits available at progressive stages of value addition, the cost of most goods and services in the country today are laden with many hidden taxes. Under GST, there would be only one tax from the manufacturer to the consumer, leading to transparency of taxes paid to the final consumer.

o Relief in overall tax burden: Because of efficiency gains and prevention of leakages, the overall tax burden on most commodities will come down, which will benefit consumers.

Which taxes at the Centre and State level are being subsumed into GST

At the Central level, the following taxes are being subsumed: a. Central Excise Duty, b. Additional Excise Duty, c. Service Tax, d. Additional Customs Duty commonly known as Countervailing Duty, and e. Special Additional Duty of Customs. At the State level, the following taxes are being subsumed:

- Subsuming of State Value Added Tax/Sales Tax,

- Entertainment Tax (other than the tax levied by the local bodies), Central Sales Tax (levied by the Centre and collected by the States),

- Octroi and Entry tax,

- Purchase Tax,

- Luxury tax, and

- Taxes on lottery, betting and gambling.

|

Fig.2: Dual GST

|

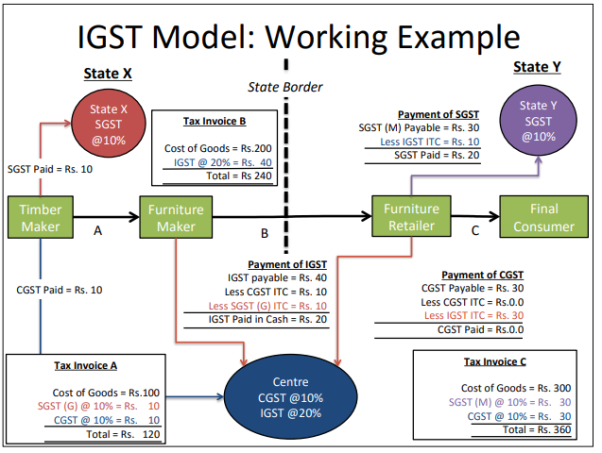

Fig.3: IGST Model

Key Takeaways:

- Direct Taxes are broadly classified as:

Income Tax &Corporate Tax

2. Indirect taxes take many forms: service tax on restaurant bills and movie tickets, value-added tax or VAT on goods such as clothes and electronics.

3. Examples of indirect taxes are excise tax, VAT, and service tax. Examples of direct taxes are income tax, personal property tax, real property tax, and corporate tax.

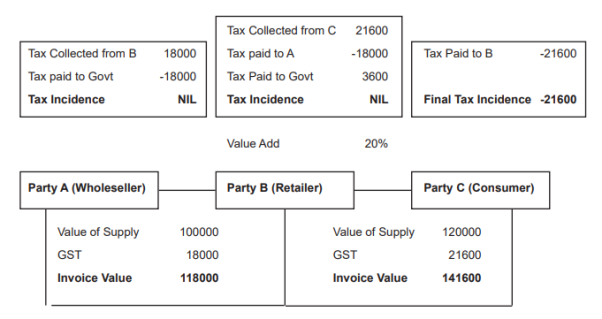

GST is a single, unified tax on every value-add, right from manufacture to sale / consumption of goods / services. Hence, with the advent of GST, the legacy taxes on manufacture (Excise), Inter-state sales (CST), Intra-state sales (VAT) and Service Tax have been subsumed. There has been a paradigm shift in the way the tax is being levied. We have now moved from source based to destination-based taxation, with GST coming into foray. Hence GST is also labelled as a destination-based / consumption-based tax. GST also does away with the cascading effects of taxation, by providing a comprehensive and continuous chain of tax credits, end to end and taxing only the value-added at every stage. The final tax is borne by the end consumer, as all the parties in the interim can extinguish their respective collections against their respective liabilities and the tax already paid by them (Input Tax Credit). A numerical example of the same below helps understand the concept better:

|

Fig.4: Tax calculation

Note:

- There is no tax incidence on any interim party, i.e., neither on the wholesaler nor the retailer

- The reason is simple, the tax that each of them have paid, can be set off against their respective output tax liabilities (Input Tax Credit)

- The final incidence is only on the end consumer, clearly reiterating the manner in which the cascading effects of the legacy taxation methodologies have been done away with.

|

Fig.5: Types of tax

TAXABLE EVENT

The crux of any taxation system is the incidence, i.e., the point at which the liability to charge tax arises, and that event is nomenclated as the taxable event. Goods and Services Tax, with its introduction and in the process of subsuming the other Acts, has overcome 25 many shortcomings of the legacy system too, one of them being, the definition of taxable event. The multitude of tax laws that prevailed earlier, that is Central Excise, Sales Tax, Service Tax, VAT etc., were prone to ambiguity and controversies which has been overcome to a great extent by the comprehensive approach and definition as laid down by GST. GST has kept it not only simple, but also robust, by stating that the entire value of supply of goods / services are taxed in an integrated manner.

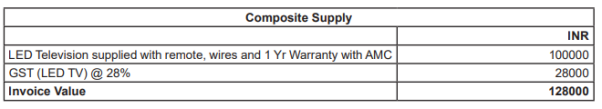

Composite Supply

Section 2(30) defines “composite supply” as a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply;

The features of a composite supply are:

- Two or more taxable supplies of goods / services / both which are supplied in conjunction with each other

- They are naturally bundled

- A single price is charged for the supply

- One of the supplies within the package is identifiable as a principal supply

Example: On buying a LED Television, along with it, the remote control, the wires and all the accessories that go with it along with the warranty and the maintenance services are provided. It is evident here that the LED Television is the principal supply and the others (remote / wires / warranty are all ancillaries).

Taxability The composite supply will be charged at the rate which is applicable to the principal supply.

|

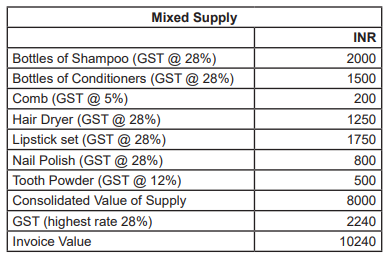

Mixed Supply

Under Section 2(74) of CGST Act, 2017, “mixed supply” means two or more individual supplies of goods or services, or any combination thereof, made in conjunction with each other by a taxable person for a single price where such supply does not constitute a composite supply. The features of a mixed supply are:

- Two or more taxable supplies of goods / services / both which are supplied in conjunction with each other

- They are deliberately bundled

- A single price is charged for the supply

- None of the supplies within the package is identifiable as a principal supply

Example: One buys a consolidated package of beauty products (that is shampoo, comb, conditioner, nail polish, lipstick and tooth powder). It is evident here that the products can all be independently supplied and any one of them cannot be singled out as a principal supply and these are deliberately bundled and sold together.

Taxability The mixed supply will be charged at the rate applicable to the supply that attracts the highest rate of tax from within the consolidated package.

|

LEVY & COLLECTION OF TAX

GST is levied at the point of supply, that is at the time and place of supply and that’s when the liability to charge GST arises. As explained under Section 15 to Central Goods & Services tax Act, 2017, such GST would be levied on the transaction value.

Rates (Goods) Rates are broadly 0.25%, 3%, 5%, 12%, 18% and 28% and that is split into CGST and SGST equally for Intrastate sales and fully leviable as IGST for Inter-state sale.

Rates (Services) Rates are broadly 5%, 12%, 18% and 28% and that is split in to CGST and SGST equally for Intra-state sales and fully leviable as IGST for Inter-state sale.

Key Takeaways:

In India, we have four tax brackets each with an increasing tax rate.

Interest on delayed payment of tax – Section 50 of CGST, 2017

18% rate of interest was notified vide Notification No. 13/2017-C.T., dated 28-6-2017, for payment of interest under Section 50(1) of the CGST Act.

Now phrase ‘’on his own’’ means that interest liability is automatic. The taxpayer is obliged to pay interest immediately on defaulting the payment of tax on due date. The interest under sub-section (1) shall be calculated, in such manner as may be prescribed, from the day succeeding the day on which such tax was due to be paid. Although no separate method has been prescribed for calculating interest, the relevant rules make it abundantly clear that Interest is to be paid on per day basis, for the period of delay from the due date of payment of tax.

Failure to deposit tax in govt. account after deduction

Where the employer has deducted the tax at source but failed to deposit wholly or partly, the tax so deducted in government account, the following statutory provisions are attracted: -

a) Interest u/s 201(1A)- The deductor is treated as an assessee in default and interest u/s 201(1A) is leviable @ 1.5% for every month or part of the month on the amount of such tax from the date on which such tax was deducted to the date on which such tax is actually paid. Further, the tax along with the simple interest u/s 201(1A) becomes a charge upon all the assets of the deductor.

b) Penalty u/s 221- Penalty to the extent of tax not deposited is leviable by the A.O. as discussed earlier.

c) Prosecution proceedings u/s 276 B- Where the deductor has failed to deposit tax deducted at source, in Government account without a reasonable cause then he is punishable with rigorous imprisonment for a term.

which shall not be less than 3 months, but which may extend to 7 years and with fine.

Failure to apply for T.A.N or to quote T.A.N.

Where a person who is responsible to deduct tax at source has failed, without reasonable cause: -

a) To apply for T.A.N. within prescribed period or

b) After allotment, failed to quote such TAN in challans for payment of tax or TDS certificate or returns of TDS (as required u/s 206)-

then a penalty u/s 272BB of a sum of Rs.10,000 and is imposable by the assessing officer. However, a reasonable opportunity of hearing must be given to the employer/deductor.

Key Takeaways:

- Interest on delayed payment of tax – Section 50 of CGST, 2017

- 18% rate of interest was notified vide Notification No. 13/2017-C.T., dated 28-6-2017, for payment of interest under Section 50(1) of the CGST Act.

The Indian Income Tax Act provides for chargeability of tax on the total income of a person on an annual basis. The quantum of tax determined as per the statutory provisions is payable as:

a) Advance Tax

b) Self-Assessment Tax

c) Tax Deducted at Source (TDS)

d) Tax Collected at Source (TCS)

Tax deducted at source (TDS) and Tax collection at source (TCS), as the very names imply aim at collection of revenue at the very source of income. It is essentially an indirect method of collecting tax which combines the concepts of “pay as you earn” and “collect as it is being earned.” Its significance to the government lies in the fact that it prepones the collection of tax, ensures a regular source of revenue, provides for a greater reach and wider base for tax. At the same time, to the taxpayer, it distributes the incidence of tax and provides for a simple and convenient mode of payment.

The concept of TDS requires that the person on whom responsibility has been cast, is to deduct tax at the appropriate rates, from payments of specific nature which are being made to a specified recipient. The deducted sum is required to be deposited to the credit of the Central Government. The recipient from whose income, tax has been deducted at source, gets the credit of the amount deducted in his personal assessment on the basis of the certificate issued by the deductor.

While the statute provides for deduction of tax at source on a variety of payments of different nature, in this booklet, an attempt is being made to discuss various provisions of TDS on payments of nature other than salaries and of Tax collection at source.

Provisions enjoining deduction of tax at source

Interest on securities – Sec. 193 Where any payment is made in the nature of “Interest on Securities,” the person responsible for making such payment of income or crediting the income has to make deduction of tax at source before making such payment or crediting whichever is earlier. The deduction is to be done as per rates in force on the amount of interest payable. However, payments from certain categories of bonds, debentures etc. is exempt from TDS. These include the following: i) National Defence Bonds 1972 (4.1/4%),

a) National Defence Loan 1968, or National Defence Loan1972 (4.3/4%),

b) National Development Bonds,

ii) 7year (IV Issue) National Saving Certificates,

iii) Any interest payable on debentures issued by any institution or authority or any Public Sector Company or any Co-operative Land Mortgage Bank or Co-operative Land Development Bank, as may notified by Central Government in Gazette,

iv) Gold Bonds 1977 (6.1/2%), Gold Bonds 1980 (7%),

v) Interest on any Security of Central Government or State Government, (However, w.e.f. 1.6.07 exemption will not be available if interest payment exceeds rupees ten thousand during the F.Y. on 8% savings (Taxable) Bonds, 2003. 10 11

vi) Any interest payable to an individual, resident of India, on debentures issued by a Public Limited Company where the debentures issued by a Public Limited Company where the debentures are listed in a recognised stock exchange, if the interest is paid by an account payee cheque and its amount does not exceed Rs. 2500/- during the financial year,

vii) Any interest payable to LIC, viii) Any interest payable to GIC or any of its four companies, ix) Any interest payable to any insurer in respect of any securities owned by it or in which it has full beneficial interest. No TDS to be made from any Regimental Fund or non-public fund established by any Armed forces since income of these organizations is exempt u/s 10(23AA).

DEPOSITION OF TAX AND CREDIT OF TDS

Deposition of Tax Where tax has been deducted under Sections 193,194,194A,194B,194BB, 194C, 194D, 194E, 194EE, 194F, 194G, 194H, 194I, 194J, 194K, 195, 196A, 196B, 196C and 196D, it is duty of the person deducting tax at source to deposit the amount of tax so deducted within the prescribed time in any branch of Reserve Bank of India or State Bank of India or any authorised bank accompanied by prescribed Income-tax challans as per the time limit and mode specified in Rule 30. Vide Income-tax (6th Amendment) Rule, 2010 new Rule 30, 31, 31A and 21 AA, pertaining to time and mode of payment of TDS, Certificate of deduction of tax, statement of deduction of tax, statement of collection of tax etc. have been introduced w.e.f. 1/4/2010(Pl. ref. notification No. 41/2010 F. No. 142/27/2009-SO(TPL) dt. 31/5/2010. With respect to time and mode of deposition of tax new Rule 30 provides the following:

“Time and mode of payment to Government account of tax deducted at source or tax paid under sub-section (1A) of section 192.

(1) All sums deducted in accordance with the provisions of Chapter XVII-B by an office of the Government shall be paid to the credit of the Central Government.

(a) on the same day where the tax is paid without production of an income-tax challan; and

(b) on or before seven days from the end of the month in which the deduction is made or income-tax is due under sub-section (1A) of section 192, where tax is paid accompanied by an income-tax challan.

(2) All sums deducted in accordance with the provisions of Chapter XVII-B by deductors other than an office of the Government shall be paid to the credit of the Central Government.

(a) On or before 30th day of April where the income or amount is credited or paid in the month of March; and

(b) In any other case, on or before seven days from the end of the month in which-

(i) the deduction is made; or

(ii) income tax is due under sub section (1A) of section 192

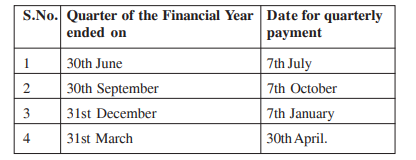

(3) Notwithstanding anything contained in sub rule (2), in special cases, the Assessing Officer may, with the prior approval of the Joint Commissioner, permit quarterly payment of the tax deducted under section 192 or section 194A or section 194D or section 194H for the quarters of the financial year specified to in column (2) of theTable below by the date referred to in column (3) of the said

|

Fig.3: Deposition of Tax

TAX DEDUCTION AND COLLECTION ACCOUNT NUMBER (TAN)

A person deducting tax at source, if not already allotted, a TAN(or a tax collection account number) should apply for allotment of TAN in Form No. 49B. The application has to be made in duplicate to the Assessing Officer (AO) or to any particular Assessing Officer where this duty is assigned by the Chief

Commissioner or the Commissioner to that A.O. The application should be made within one month from the end of the month in which the tax is deducted for the first time. TAN should be quoted in all the TDS Certificates, challans, quarterly statements, correspondence, etc. Non compliance with the provision of Section 203A invites rigorous imprisonment for a term not less than 3 months but which may extend to 7 years and with a fine of Rs.10,000/-.

Section 203 A, Rule 114 A; and Rule 114AA.

DUTIES OF PERSON DEDUCTING TAX AT SOURCE AND RIGHTS OF TAXPAYERS

- Deduct Tax at Correct Rate and deposit in Government Account – Sec. 200 Every person responsible for deducting tax at source shall at the time of payment or credit of income, whichever is earlier, verify whether the payment being made is to be subject to deduction of tax at source. If it is so, he must deduct such tax as per the prescribed rates. Further he is required to deposit such tax deducted in the Central Government Account within the prescribed time as specified in Rule 30.

- Issue a TDS certificate Further, such person is required to issue a certificate of tax deduction at source u/s 203 to the person from whose income the TDS has been done, in the prescribed proforma i.e. Form No.16A within prescribed time (as discussed earlier).

- File Prescribed Return/Quarterly Statement A return of TDS is a comprehensive statement containing details of payments made and taxes deducted thereon along with other prescribed details. For deductions made prior to 01.04.2005 earlier every deductor was required as per the provisions of Section 206 (read with Rule 36A and 37) to prepare and deliver an annual return, of tax deducted at source. However w.e.f. 01.04.2005 there is no requirement to file annual returns and instead Quarterly statements of T.D.S. are to 42 43 be submitted in form 26Q by the deductors.

TCS

The Finance Bill, 2020 has proposed a new sub-section (1H) under Section 206C requiring every seller whose total turnover in the business carried on exceed Rs.10 crore in the preceding financial year to collect tax at source at the rate of 0.1% of the sale consideration exceeding Rs.50 lakhs in respect of sale of any goods. Thus, under this provision, every seller whose turnover has been more than Rs.10 crore in the preceding year will be required to collect at source, from every buyer on purchase of goods by such buyer if the total purchases by such buyer exceeds Rs. 50 lakhs. It may be noted that the tax is required to be collected only in respect of the sale value exceeding Rs.50 lakhs during the year. In case such buyer does not have the PAN Number or Aadhar Number, then the rate of collection shall be 1% under Section 206CC of the Act. Further, the obligation to collect this TCS is on receipt of consideration for sale of any goods. Thus, the liability for depositing this TCS will be when the payment is received from the buyer. This provision thus it is different than the other provisions of TDS and TCS whereby obligation of the deductor or the collector arises at the time of credit or debit or payment or receipt whichever is earlier.

The Finance Act, 2020 has amended the provisions relating to TCS with effect from October 1, 2020 to provide that a seller of goods shall collect tax at the rate of 0.1 per cent (0.075 per cent up to March 31, 2021) if the receipt of sale consideration from a buyer exceeds Rs 50 lakh in the financial year.

Section 206C(1H) envisages that TCS at the rate of 0.10% of the sale consideration received in excess of ₹ 50 Lakhs shall be collected by the seller. As such, TCS shall be collected on Total Sale Value received less ₹ 50 lakh.

Rate of TCS is reduced 0.075% for the period from 01.10.2020 to 31.03.2021.

Who is liable for TCS?

10 crores will be liable to collect tax at source from all the buyers whose purchases during the year is more than Rs. 50 lakhs. This will mean that on each and every invoice, where the sale exceeds Rs. 50 lakhs, there will be a separate charge of TCS from such buyer.

Existing Provision:

TCS currently applicable on the following:

- Sale of certain goods: liquor, scrap, tendu leaves, luxury motor vehicles etc.

- Grant of lease or licence for parking lot, toll plaza or mine or quarry

- TCS so collected is allowed as credit to the buyer of goods or lessee or licensee

- TCS not to apply if goods are used for manufacture or production of other articles or generation of power

Proposed Amendment:

- TCS is proposed to be extended to the following:

- Remittances made under Liberalized Remittance Scheme (LRS) of RBI

- Overseas Tour Program Packages

- Sale of goods (other than goods already subjected to TCS)

Sale of Goods

- Seller of all goods (other than those goods already covered under TCS)

- Gross receipts/ turnover of seller more than Rs. 10 Crores in previous financial year

- Liable to collect TCS @ 0.1% of sale consideration exceeding Rs. 50 Lakhs in a year from each buyer Rate of TCS will be 1% if buyer does not provide PAN or AADHAR. Please note Rate of TCS is reduced 0.075% for the period from 01.10.2020 to 31.03.2021.

- No exclusion provided for goods used by the buyer in manufacture or production of other articles or generation of power

Buyers/service recipients excluded from new TCS provisions

- TCS not to apply if buyer is liable to deduct TDS under any other provision and has deducted such amount

- Certain categories of buyers/service recipients excluded (Government empowered to notify more exclusions in due course)

Key Takeaways:

- Difference Between TDS and TCS

Tax Deducted at Source and Tax Collected at Source are both incurred at the source of income.

- TDS is the tax which is deducted on a payment made by a company to an individual, in case the amount exceeds a certain limit. TCS is the tax which is collected by sellers while selling something to buyers.

- TDS deduction is applicable on payments such as salaries, rent, professional fee, brokerage, commission, etc. TCS deduction is applicable on sales of goods like timber, scrap, mineral wood, and so on.

- TDS is applicable only on payments that exceed a certain amount. TCS is applicable on sales of specific goods which don’t include production or manufacturing material.

2. TDS and TCS under GST

This applies to e-commerce businesses. Every e-commerce company has to collect some tax on the net transaction value of their sales. This rule came into force in October 2018.

The rate for TCS in this situation would be 1% (0.5% CGST + 0.5% SGST). Alternatively, it could also be 1% of IGST.

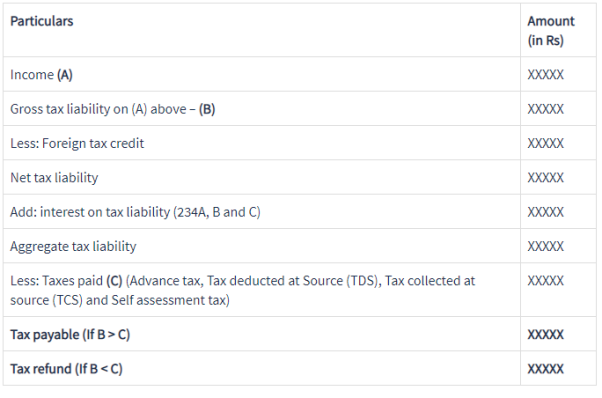

Tax Refund arises when taxes paid are higher than your actual tax liability (including interest). It could be in the form of advance tax, self-assessment tax, tax deducted at source, foreign tax credit etc. Given below is an illustration showing when and how a refund arises.

|

Fig.6: Income tax refund

A tax refund or tax rebate is a repayment on taxes when the tax liability is less than the taxes paid, and taxpayers can often get a tax repayment on their income tax if the tax they owe is less than the sum of the total amount of the withholding taxes as well as estimated taxes that they paid plus the refundable tax credits that they claim.

Taxpayers may select to have their refund directly deposited into their bank account have a check mailed to them, or have their refund applied to the year’s income tax. Tax filers may now split their tax refund with direct deposit in up to three different accounts with three separate financial institutions and this has given taxpayers an opportunity to save and spend some of their refund.

How to estimate your Tax Refund?

- Your tax refund is the amount of money you can expect to receive from the Internal Revenue Service (IRS) or your state tax authority after you file your return.

- A refund results when the amount of taxes you have paid in advance, along with tax credits for which you are eligible, exceed your tax liability.

Steps to Determine Your Tax Refund?

- Calculate your income: For starters, you will need to gather documentation of your taxable income for the year. This includes salary, commissions, bonuses and so on from your job, money received from renting out property, gains on investments, gambling winnings, unemployment benefits and so on.

- Itemized or Standard Deduction: Common itemized deductions include expenses such as real estate taxes, medical expenses, mortgage interest, and student loan interest. You can choose to either claim your itemized deductions or claim the standard deduction, which is the following for tax returns

- Determine Your tax Liability: Take your total income from step one and subtract either your standard deduction amount or the sum of the itemized deductions you calculated in step 2. Compare the result to the 2016 federal tax brackets listed below, and this will allow you to estimate your tax liability.

- Subtract tax Credits: A tax credit is an amount of money a taxpayer is able to subtract from taxes owed to the government. ... Unlike deductions and exemptions, which reduce the amount of taxable income, tax credits reduce the actual amount of tax owed.

- Calculate tax withholding: To determine the total amount of taxes withheld, you will need a pay stub and any other documents showing how much you have paid in taxes to date. Multiply this amount as necessary to cover the entire year.

- Compute the amount of your refund: Subtract the total taxes withheld you determined in Step 5 from your tax liability after credits as calculated in step 4. If the result is a negative number, that amount is what you overpaid in taxes and can expect to have refunded.

1. Process to claim income tax refund

Process of income tax refund is There is no separate procedure as such in order to claim an income tax refund due to you. You can claim tax refund by simply filing the return of income in the usual manner. Ensure your return is electronically verified through aadhar number otp, EVC generated through bank account or physically verified by posting the signed ITR-V (acknowledgement) to Centralised Processing Centre (CPC) within 120 days of filing the return.

2. Early processing of return leads to early refund receipt

No doubt, a taxpayer has a time limit of 120 days from the date of return filing to verify his return. The earlier you get the verification done, the earlier CPC will process your return. Once the returns are processed by CPC at primary level for arithmetical errors etc, refund will be issued to the taxpayer. If verification of return itself is delayed, processing of return and issue of refund too will be delayed. Further, e-verification is faster compared to physical verification.

Key Takeaways:

1.A tax refund or tax rebate is a repayment on taxes when the tax liability is less than the taxes paid, and taxpayers can often get a tax repayment on their income tax if the tax they owe is less than the sum of the total amount of the withholding taxes as well as estimated taxes that they paid plus the refundable tax credits that they claim.

Section 55 - Refund in certain cases

The Government may, on the recommendations of the Council, by notification, specify any specialised agency of the United Nations Organisation or any Multilateral Financial Institution and Organisation notified under the United Nations (Privileges and Immunities) Act, 1947, Consulate or Embassy of foreign countries and any other person or class of persons as may be specified in this behalf, who shall, subject to such conditions and restrictions as may be prescribed, be entitled to claim a refund of taxes paid on the notified supplies of goods or services or both received by them.

Key Takeaways:

1. Section 55 - Refund in certain cases

Section 56 of Central Goods and Services Act 2017 - Interest on delayed refunds

If any tax ordered to be refunded under sub-section (5) of section 54 to any applicant is not refunded within sixty days from the date of receipt of application under subsection (1) of that section, interest at such rate not exceeding six per cent. as may be specified in the notification issued by the Government on the recommendations of the Council shall be payable in respect of such refund from the date immediately after the expiry of sixty days from the date of receipt of application under the said sub-section till the date of refund of such tax:

Provided that where any claim of refund arises from an order passed by an adjudicating authority or Appellate Authority or Appellate Tribunal or court which has attained finality and the same is not refunded within sixty days from the date of receipt of application filed consequent to such order, interest at such rate not exceeding nine per cent. as may be notified by the Government on the recommendations of the Council shall be payable in respect of such refund from the date immediately after the expiry of sixty days from the date of receipt of application till the date of refund.

Explanation. -For the purposes of this section, where any order of refund is made by an Appellate Authority, Appellate Tribunal or any court against an order of the proper officer under sub-section (5) of section 54, the order passed by the Appellate Authority, Appellate Tribunal or by the court shall be deemed to be an order passed under the said sub-section (5).

Key Takeaways

1. Section 56 of Central Goods and Services Act 2017 - Interest on delayed refund

Reference:

- Indirect Tax - Introduction of Goods and Services Tax by Manan Prakashan

- Indirect Tax by Kalyani Publisher