UNIT 2

Returns

Section 139(1): - Obligation to File Return of Income. Every Person

a) Being a company or a firm; or

b) Being a person other than a company or a firm, if his total income or the total income of any other person in respect to which he is assessable under the income tax act during the previous year exceeded the maximum limit not chargeable to tax.

shall on or before the due date, furnish a return of his income in the prescribed form and verified in prescribed manner. Provided that a person, other than not ordinarily resident in India who is not required to furnish the return of income and who during the previous year has any asset (including any financial interest) located outside India or signing authority in any account located outside India, shall furnish on or before due date a return in respect to his Income.

Persons liable for registration

Custom Duty is to be paid by an importer or exporter for the goods imported or exported out of India.

Excise Duty is levied on goods which are manufactured in India. Till 30 June 2017, most of the goods came under its net. Later, GST was introduced which subsumed Excise duty. But there are some goods that still fall under the excise laws such as tobacco products, aviation turbine fuel, natural gas, high-speed diesel and petroleum crude.

Goods and Services Tax (GST) refers to the tax on supply of goods or services that must be paid by individuals or businesses who have a turnover more than the prescribed limit.

Following persons are liable to make application for Registration for service tax:

i. Service Provider: Every service provider providing taxable services make an application for registration within 30 days of commencement of his business with the Service Tax Authorities.

ii. Input service distributor Every input service distributor [as defined in clause (m) of rule 2 of the CENVAT Credit Rules, 2004 shall make an application for registration within a period of thirty days of the commencement of business.

iii. Small service provider having turnover of Rs. 9 lakhs: Small service providers having turnover upto Rs. 10 lakhs are not liable for service tax but any provider of taxable service whose aggregate value of taxable service in a financial year exceeds nine lakhs rupees shall make an application for registration within a period of thirty days of exceeding the aggregate value of taxable service of nine lakhs rupees. “Aggregate value of taxable service” means the sum total of first consecutive payments received during a financial year towards the gross amount charged by the service provider towards taxable services but does not include payments received towards such gross amount which are exempt from the whole of service tax leviable thereon.

iv. An unincorporated body of individuals is a person liable for service tax in respect of taxable services rendered to members or others

v. Registration by a recipient of services Ordinarily, liability for payment of service tax is that of the service provider. In some cases an exception is made, and the liability is shifted to the recipient of the services. In such cases the recipient of the services is required to make an application for registration. some of such case are:

- Importer of services from outside India is liable to pay in respect of the services imported by him in India. -S 66Ab. in case of services of a goods transport

- agency, the liability for the payment of service tax on freight paid to transporter is on the consignee, if the consignee is a factory, or a company or a statutory corporation, or a cooperative society or a dealer registered under the central excise or a body corporate or a registered partnership firm. For other consignees like individuals the transporter will continue to be liable for payment of service tax.

- The mutual fund or asset management company receiving business auxiliary service of distribution of mutual fund by distributors or agent is liable to pay service tax on the services received

- The body corporate or the firm receiving any sponsorship services is liable to pay service tax on the sponsorship services received by them e.g. IPL

Penalty: Section 77 prescribes heavy penalty of Rs. 200 per day for every day of default or Rs, 5,000, whichever higher. However, the penalty can be reduced under Section 80 on showing reasonable cause for default.

Procedure for registration

Registration is the starting point. It involves the following procedure:

1. Application for Registration is required to be filed within the prescribe time of 30 days of commencement of business on line by uploading Form ST-1 at www.aces.gov.in;

2. Within 15 days of uploading the application, the applicant has to file the required documents with the jurisdictional Superintendent of Central Excise. These documents are; Permanent Account Number (PAN), proof of residence , constitution of firm , companies etc. and a Power of Attorney in respect of authorized person(s).

3. Normally, the PAN based registration number is generated by system immediately. However, registration certificate is issued by Superintendent in form ST-2 after the documents are submitted.

4. Registration will be deemed to have been granted if not received within seven days of making the application. [Rule 4(5)] and the applicant can begin carrying on his activities.

5. If a person provides services from more than one places, following principles are followed: -

a) Ordinarily, Separate application is required to be made for each place of business if bills are raised separately.

b) If billing or accounting system is centralised in respect of all the places, and the bills are raised from a centralized place, premises or office, only one application needs to be made for such place from where the billing is done in respect of all types of services provides - [Rule 4(2)].

Illustration-1: A mandap keeper has multiple offices in Mumbai, Delhi and Kanpur. He does his billing from Mumbai only. In that case he would require service tax registration in Mumbai only.

Illustration-2: XYZ Coaching Classes have one regional and multiple branch offices but does billing from the regional office in respect of all the branches within that region the classes may be permitted to register his regional office only.

6. If a person provides multiple services from a single place, a common application needs to be made for all the services provided by the service provider from a single place. However, if multiple services are provided from multiple places and billing is done separately, separate application is required to be made for each such place needs.

7. Input Service Distributors (ISD) are required to make application for registration at the Head Office, branch or depot as ISD and distribute credit to centres which are providing taxable services.

8. When a registered assessee transfers his business to another person, the transferee should obtain a fresh certificate of registration.

9. When a registered assessee ceases to carry on the service activity for which he is registered, he should surrender his registration certificate immediately to the department.

10. Any change in the particulars of the certificate, shall be intimated to the Service Tax Officer in Form ST-1 with in thirty days of change taking place, who, will issue a fresh certificate after making the necessary change within 4 days. There is no penalty if change is not notified. but in that case liability to file return will continue even if the tax payable in nil.

GST is imposed at every point of supply. Also, State GST and Central GST are applicable when intra-state sales take place. However, in the case of inter-state sales, an Integrated GST is applicable.

Since its implementation, GST has been able to remove the ‘cascading effect or the 'tax on tax' dilemma in the country. With the elimination of the tax-on-tax quandary, the markets have witnessed a considerable drop in prices.

Also, with GST being more of a technology-driven process, the need for a physical interface has been brought down considerably. An online GST portal which allows registration, GST return filing, application for refund ensure a smooth and transparent GST filing process.

Filing of returns

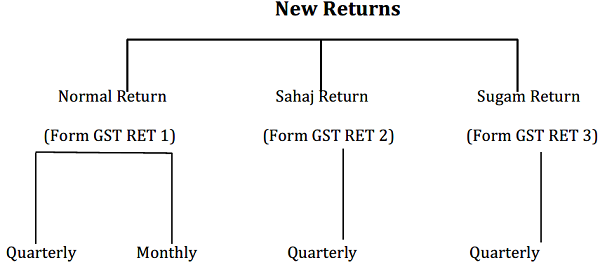

Figure 1: GST returns

A return is a document containing details of income which a taxpayer is required to file with the tax administrative authorities. This is used by tax authorities to calculate tax liability.

Under GST, a registered dealer has to file GST returns that include:

- Purchases

- Sales

- Output GST (On sales)

- Input tax credit (GST paid on purchases)

To file GST returns or GST filing, GST compliant sales and purchase invoices are required.

Table No.1: GSTR-1 filling dates

Late Fees for not Filing Return on Time

If GST Returns are not filed within time, you will be liable to pay interest and a late fee.

Interest is 18% per annum. It has to be calculated by the taxpayer on the amount of outstanding tax to be paid. The time period will be from the next day of filing to the date of payment.

Late fees is Rs. 100 per day per Act. So, it is 100 under CGST & 100 under SGST. Total will be Rs. 200/day. Maximum is Rs. 5,000. There is no late fee on IGST.

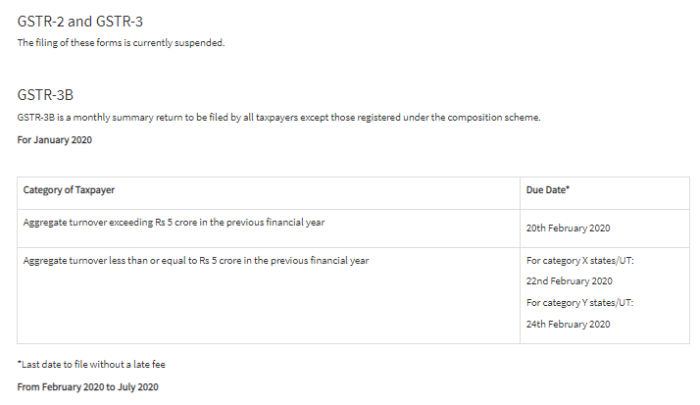

Table No.2: GSTR-2 and 3 filling dates

Excise Duty

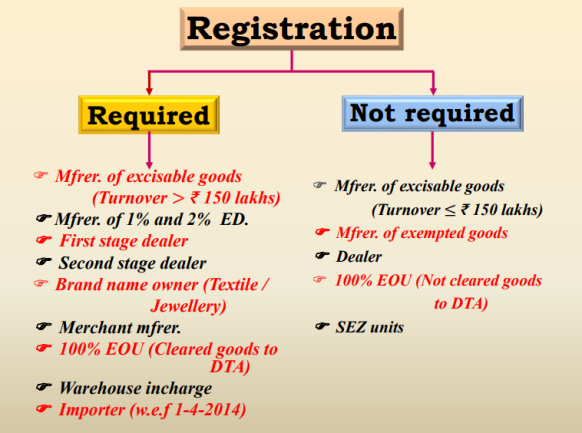

Registration

As per Sec. 6, any person who is engaged in –

- Production (or) manufacture of specified excisable goods;

- First stage dealers – wholesale dealers – purchase the goods directly from the manufacturer.

- Second stage dealers – Commission agents – who purchased goods from a First stage dealer.

- Importer.

- Every manufacturer of excisable goods including Central /State Govt. undertakings.

- Persons holding private warehouses.

- Persons who obtain excisable goods for availing end-use based exemption.

- Persons who wish to issue Cen vatable invoices is required to get registered. Separate registration is also required for each depot, godown, etc. in respect of persons issuing CENVAT invoices.

Fig No.2: Requirement for registration for excise duty

Exemption from registration

- Manufacture of excisable goods, which are chargeable to nil rate of excise duty (or) fully exempt from excise duty.

- Dealers who carry on wholesale trade (or) deals in excisable goods except 1 st and 2 nd stage dealers.

- SSI units availing the slab exemption based on value of clearances.

- 100% EOU (or) a unit FTZ (or) SEZ licensed (or) appointed under the Customs Act, 1962.

- In the case of readymade garments and branded jewelry, the job-worker need not get registered if the principal manufacturer undertakes to discharge the duty liability

- Persons manufacturing excisable goods by following the warehousing procedure under Customs Act, 1962.

- Persons who use excisable goods for any purpose other than for processing or manufacture of goods availing benefit of CENVAT exemption.

- A godown or retail outlet of a Duty-Free Shop licensed under the Customs Act, 1962.

- Other units of manufacturers of recorded smart cards exempt from registration when premises from where centralized billing is done is registered.

- Job worker who undertakes job work on behalf of any other person, who pays the excise duty on the said goods.

- 11. Unregistered premises used solely for affixing a sticker / reprinting / re-labeling / re-packing of pharmaceutical products with lower ceiling price.

Procedure of registration

The following procedure is followed by an assessee for obtaining certificate of registration.

1. They have to apply in revised form A-1 with a covering letter and enclosed the following documents.

a. Application in form A-1 and have duly signed by the proper person.

b. Submit copy of PAN card issued by the IT department.

c. Ground plan of the factory/business premises depicting the boundaries position of exit gate, entrance gate, etc.

d. Copy of ownership document or rental deed agreement.

e. Copy of Shops and Establishment Act certificate.

f. Brief manufacturing process of excisable goods along with their tariff classification.

2. The inspector will scrutinse the application and verifies the premises in respect of which the application has sought registration.

3. After proper verification the Registration Certificate in Form RC is granted.

4. Once RC is granted, it has permanent status unless it I suspended/revoked or surrendered by Registrant. The validity of the RC is indefinite and there is no need for renewal.

5. Separate registration is required if factories are located in different locations.

6. A single registration can be allowed for factories located in adjoining premises.

7. If the assessee ceases to carry on operations for which he is registered his RC will be cancelled. This is called De-registration.

Penalty for non-registration

Registration under central excise is required for a manufacturer, but not registered then, all such goods shall be liable to confiscation.

Such manufacturer is supposed to face the punishment and penalty.

Punishment

1. If the duty leviable on the excisable goods exceeds ₹ 30 lakhs –

a) Imprisonment up to 7 years and fine without any upper limit;

b) 6 months minimum imprisonment unless there are special and adequate reasons for granting lesser punishment.

2. If the duty leviable on the excisable goods is less than ₹ 30 lakhs –

a) Imprisonment up to 3 years or fine or both can be imposed;

b) 6 months minimum imprisonment unless there are special and adequate reasons for granting lesser punishment.

Penalty

The penalty for non-registration is amount of duty of contravening goods (or) ₹ 2,000 whichever is higher.

Excise Control Code (ECC)

New ECC has been introduced from 1-2-2000 and will be used from 1-4-2000 by all central excise assessees and registered dealers. The 15-digit ECC number is alphanumeric.

First 10 digits – PAN number;

Next 2 characters – XM for Manufacturer; XD for Dealers;

Last 3 digits – 001, 002, 003 … represents registered place like factory, warehouse etc. of the same registered person.

Example: ADYPR4319LXM001 – Person has a Manufacturer with one factory;

ADYPR4319LXD002 – Person has a Dealer with two factories.

Service tax

The service tax assessee shall furnish a return to the jurisdictional Superintendent of Central Excise in Form ST-3 of Form ST- 3A in triplicate on a half-yearly basis within 25 days after the close of the half year. In other words, the return for the half-years i.e. 'April-September', and 'October-March' of the year should be filed by 25th October, & 25th April of the year respectively.

Input service distributors have to file return in form St3 on half yearly before the end on next month after the end of the half year

The returns should include all copies of T-6 challans issued in the half year. Assessees filling the return for the first time should also furnish to the Department the list of all the accounts maintained by them, relating to the Service Tax.

If the assessee has not provided any taxable services during the half year, he should submit a NIL return within the prescribed time.

The records, including computerized data if any being maintained by an assessee as required under any other laws in force (Income tax, Sales) from time to time shall be acceptable to the Central Excise Department for the purpose of Service Tax. The assessee should also ensure that he keeps a separate register for the service tax credit as availed by him.

A revised return can be filed within 90 days to correct any mistakes in the original return.

Non filing of return on time attracts penalty of Rs 500 for delay of 15 days or less, and Rs. 1000 for delay of 15 days to 30 days.

If delay is beyond 30 days from the due date penalty will be Rs. 1000 plus Rs, 100 per day for every day beyond 30 days subject to a maximum of Rs. 20000

E-filing of service tax return is mandatory for assessee with liability of Rs 10 lakhs or more inclusive of CENVAT consumed. For others its optional. However, if an assessee does not succeed in filing of return electronically or is unable to generate acknowledgement number, he should file manual return to avoid penal provisions

Table 1: Due date of filing of return of income

Sr. No. | Status of the taxpayer | Due date |

1. | who is required to furnish a report in Form No. 3CEB under section 92E (i.e., other than covered in 2 below) | the assessment year |

2 | Any person (may be corporate/non- corporate) who is required to furnish a report in Form No. 3CEB under section 92E | November 30 of the assessment year |

3 | Any person (other than a company) whose accounts are to be audited under the Income-tax Law or under any other law | September 30 of the assessment year |

4 | A working partner of a firm whose accounts are required to be audited under this Act or under any other law. | September 30 of the assessment year |

5 | Any other assessee | July 31 of the assessment year |

Illustration

Mr. Rupen is a doctor. Gross receipts for the year 2019-20 came to Rs. 18,40,000. He opts for the presumptive taxation scheme of section 44ADA. What will be the due date for filing of return of income by Mr. Rupen for the financial year 2019-20?

The gross receipts for the year are less than Rs. 50,00,000 and Mr. Rupen has opted for the presumptive taxation scheme of section 44ADA. Hence Mr. Rupen will not be liable to get his accounts audited i.e. he is not covered by audit. He will be covered in Sr. No. 5 of the table discussed earlier and, hence, the due date for filing the return of income of the year 2019-20 will be 31st July 2020.

Illustration

Mr. Rahul is running a garments factory. Turnover of his business for the year 2019-20 amounted to Rs. 1,84,00,000. He opts for the presumptive taxation scheme of section 44AD. What will be the due date for filing of return of income by Mr. Rahul for the financial year 2019-20?

The turnover for the year is less than Rs. 2,00,00,000 and hence Mr. Rahul will not be liable to get his accounts audited i.e. he is not covered by audit as he opts for the presumptive taxation scheme of section 44AD. Mr. Rahul will be covered in Sr. No. 5 of the table discussed earlier and, hence, the due date of filing the return of income of the year 2019-20 will be 31st July, 2020.

Illustration

Mr. Kaushal is a partner in Essem Trading Company. The turnover of the firm for the financial year 2019-20 amounted to Rs. 2,84,00,000. Apart from remuneration, interest and share of profit from the firm, Mr. Kaushal is not having any other source of income. What will be the due date for filing the return of income by the partnership firm and by Mr. Kaushal for the financial year 2019-20?

The turnover of the firm exceeds Rs. 2,00,00,000 and, hence, the firm will not be eligible for presumptive taxation scheme under section 44AD. Further, the firm shall be liable to get its accounts audited under section 44AB. Thus, the firm as well as Mr. Kaushal will be covered in Sr. No. 4 of the table discussed earlier and, hence, the due date for filing the return of income of the year 2019-20 (in case of the firm as well as Mr. Kaushal) will be 30th September, 2020.

Illustration

Mr. Kiran is a partner in SM Enterprises. The turnover of the firm for the financial year 2019-20 amounted to Rs. 1,84,00,000. The firm has declared income @ 8% on presumptive basis under section 44AD of the Act. Apart from remuneration, interest and share of profit from the firm, Mr. Kiran is not having any other source of income. What will be the due date of filing of return of income by the partnership firm and by Mr. Kiran for the financial year 2019-20?

The turnover of the firm is below Rs. 2,00,00,000 and, hence, it will not be liable to get its accounts audited. Thus, the firm as well as Mr. Kiran will be covered in Sr. No. 5 of the table discussed earlier and, hence, the due date for filing the return of income of the year 2019-20 (in case of firm as well as Mr. Kiran) will be 31st July 2019.

Illustration

Essem Minerals Pvt. Ltd. is a company engaged in trading of minerals. What will be the due date for filing the return of income for the financial year 2019-20?

In this case Essem Ltd. will be covered in Sr. No. 1 of the table discussed earlier and, hence, the due date for filing the return of income of the year 2019-20 will be 30th September 2020.

Payment of service tax

Following are some important points in relation to payment of service tax;

a. Service tax payable on receipt or arrear basis Service tax is not payable on basis of amounts charged in the bills/invoice, but only on amounts actually received during the relevant period, except in case of associated enterprises. If partial amount is received, tax will be payable on pro rata basis. With effect 01-05-2011 service tax is payable on receipt, accrual or raising of the bill, whichever point is earlier in time. Except in case of some professional, GTA, Individual and partnership with turnover of Rs 50 lakh etc.]

b. Associated Enterprises In case of service provided to associated enterprises, service tax is payable as soon as book entry is made in the books of service provider (when he is liable) or service receiver (when he is liable to pay service tax under reverse charge method).

c. Time for payment-Monthly /Quarterly: The service tax on the value of taxable services received during any calendar month shall be paid to the credit of the Central Govt. by the 5th of the month immediately following the said calendar month.

Where the assessee is an individual or proprietary firm or partnership firm, the service tax on the value of taxable services received during any quarter shall be paid to the credit of the Central Government by the 5th of the month immediately following the said quarter. Those with liability for payment of Rs 10 lakh or more have to make payment electronically. In that case the due date is extended by one day i.e. 6th of next month / quarter. In the last month /quarter, tax has to be paid before 31 March. d. Procedure –Challan and payment

Tax is payable by GAR-7 challan using appropriate accounting code. (earlier TR-6 challan) . E-payment is compulsory to those who are paying service tax of more than Rs 10 lakhs per annum.

For others, e-payment is optional. In such cases, tax can be deposited in any of the banks specified by the jurisdictional Commissionerate of Central Excise by the 25th of the following month or quarter as the case may be, in appropriate Form (yellow colour and in quintriplicate) which prescribes different heads of accounts for different taxable services.

e. Mandatory interest: If the payment is made after prescribed date, then assessee is liable to pay the interest at the simple rate of 1.5% per month or part of the month by which payment has been delayed under section 75. (1.25% for service providers upto turnover of Rs 60 lakhs.

f. Advance payment of service tax: A person liable to pay service tax can pay any amount in advance towards future service tax liability. After such payment he should inform Superintendent of Central Excise within 15 days [Rule 6(1A)]. When he adjusts the advance, he should indicate details in the subsequent return filed.

VAT Return

Value-added tax is a kind of tax levied on goods and services added at each stage of production or distribution cycle. Firstly, the value-added amount is identified, and then tax is levied accordingly on all the interstate purchases and sales. The introduction of VAT has helped traders, businessmen and the government by making the taxation process more efficient and transparent.

VAT is to be paid by all enterprises an annual turnover of Rs. 5 lakh or more. To do so, you must apply for a VAT registration, which takes around 20 to 40 days for approval. Once the approval is done, you can both make e-payment online for the amount collected and e-file VAT returns on the Commercial Taxes website for your state. VAT returns must be filed once every month or quarter (depending on turnover or the state).

Who Needs to File VAT Returns?

VAT Returns must be filed by all producers of goods and services to the Government of India. Any dealer regardless of manufacturing or trading business, a partnership firm, sole proprietorship or a private limited company whose turnover annually is over Rs.5 lakhs will have to get registered with the VAT Department. However, this amount is a subject to State laws and can be modified by the State Government.

However, dealers who are not under compulsion can also obtain registration and benefits of issuing tax invoice.

VAT is collected at each phase of production, therefore, some of the amounts that have been collected by the customers will be retained by the producers and the rest will have to be paid to the government through designated banks every month.

Provisions

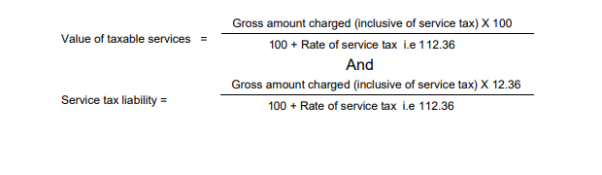

Section 67 of Finance Act, 1994 contains provisions for valuation of taxable services for charging service tax. It provides that service tax is payable on "the gross amount charged by the service provider for such service provided or to be provided by him" and it includes "any amount received towards the taxable service before, during or after provision of such service"." Thus, service tax is payable when advance is received in respect of a taxable service to be provided.

Gross Amount charged Under section 67(2)], with effect from 10.9.2004 , ‘gross amount charged’ is equal to value of taxable service’ plus service tax payable, where the gross amount charged is inclusive of service tax payable. Accordingly tax is calculated by making back calculations. In other words when charges for services are inclusive of service tax, the value of taxable service shall be arrived at as follows:

A Chartered Accountant raises a bill for audit service at a gross amount of Rs. 55,150 inclusive of service tax. Find out the value of taxable services rendered and the service tax payable on the services.

Solution:

section 67, the value taxable service and the service tax are deemed to be equal to the gross amount charged. Since the service tax rate is 12.36%, the gross amount will be 100 + 12.36 = 112.36% inclusive of service tax. Therefore Value of Taxable service will be 55150/112.36% = Rs. 49,083 and service tax will be Rs. 6,067 being 12.36 on Rs. 49,083.

Deductions under Income Tax Act 1961

- Section 80C to 80: Under Section 80C, 80CCC & 80CCD of the Income Tax Act 1961, you can reduce your taxable income by 1,50,000

- Section 80CCD: Section 80CCD of the Income Tax Act, 1961 focuses on income tax deductions that individual income tax assesses are eligible to avail on contributions made towards the New Pension Scheme (NPS) and Atal Pension Yojana (APY)

- Section 80D: Under section 80D, you can claim income tax deduction for medical expenses and health insurance premiums

- Section 80DD: Tax deduction under Section 80DD of the Income Tax Act can be claimed by individuals who are residents of India and HUFs for the medical treatment of a dependant with disability(ies) or differently abled

- Section 80DDB: Tax deductions under section 80DDB of Income Tax Act 1961 can be claimed for medical expenses incurred for medical treatment of specific illnesses

- Section 80TTA: Section 80TTA provides a deduction of Rs 10,000 on interest income. This deduction is available to an Individual and HUF.

- Section 80U: Under Section 80U, physically disabled persons can claim deductions up to Rs.1,00,000.

GST Provisions

1. GST Provisions related to Threshold Limit for Registration in case of goods, Services and Both Goods & Services

2. Changes in GST Composition Scheme

3. Supply with or without consideration – treated as supply under GST, Changes in TCS Provisions and

4. Proposed New GST Return Formats.

Provisions After 1st April 2019

Composition Scheme-

- For Trader, Manufacturer – Rs. 1.5 Crore

- For Restaurant Service – Rs. 1.5 Crore

- For Other Service Providers subject to threshold limit of turnover in the preceding Financial Year Rs. 50 lakhs – Rs. 1.5 Crore.

- Rate – For Trader, Manufacturer – 1%

For Restaurant Service – 5%

For Other Service Providers whose

turnover in the preceding Financial Year Rs. 50 lakhs – 3% CGST & 3% SGST

- Supply with consideration – treated as supply under GST

- Supply without consideration except activity under schedule I – not treated as supply under GST

TCS Provisions

Section 15(2) of CGST Act specifies that the value of supply shall include any taxes, duties, cesses, fees and charges levied under any law for the time being in force other than this Act, the SGST Act, The UTGST Act, The GST Act if charged separately by the supplier

For the purpose of determination of value of supply under GST, Tax collected at source under the provisions of Income Tax Act, 1961 would not be includible as it an interim levy not having character of Tax

Figure No.3: Examples of TCS Provisions

Reference:

- Indirect Tax - Introduction of Goods and Services Tax by Manan Prakashan

- Indirect Taxation by Kalyani Publishers