Assessment in GST is mainly focused on self-assessment by the taxpayers themselves. Every taxpayer is required to self-assess the tax payable and furnish a return for each tax period i.e. the period for which return is required to be filed.

The compliance verification is done by the department through scrutiny of returns, audit and/or investigation. Thus the compliance verification is to be done through documentary checks rather than physical controls. This requires certain obligation to be cast on the taxpayer for keeping and maintaining accounts and records.

Section 35 of the CGST Act,2017and Rules 56, 57 and 58 of CGST Rules, 2017 [“Accounts and Records”] provide that every registered person shall keep and maintain all records at his principal place of business.

Further, irrespective of whether he is a registered person or not, the responsibility to maintain specified records has been put on the owner or operator of warehouse or godown or any other place used for storage of goods and on every transporter.

The section also empowers the Commissioner to notify a class of taxable persons to maintain additional accounts or documents for specified purpose or to maintain accounts in other prescribed manner. Similarly, the Commissioner can permit a class of taxable persons to maintain accounts in such manner as may be prescribed if that class of taxable person is not in a position to keep and maintain accounts in accordance with the provisions of GST Laws. It also provides that every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a chartered accountant or a cost accountant.

LIST OF DOCUMENTS/RECORDS: Section 35 of CGST Act, 2017 provides that every registered person shall keep and maintain, at his principal place of business, as mentioned in the certificate of registration, a true and correct account of:

(a) production or manufacture of goods;

(b) inward and outward supply of goods or services or both;

(c) stock of goods;

(d) input tax credit availed;

(e) output tax payable and paid; and

(f) such other particulars as may be prescribed.

In addition, the rules also provide that the registered person shall keep and maintain records of:

(a) goods or services imported or exported; or

(b) supplies attracting payment of tax on reverse charge along with relevant documents, including invoices, bills of supply, delivery challans, credit notes, debit notes, receipt vouchers, payment vouchers, refund vouchers and e-way bills; or

(c) accounts of stock in respect of goods received and supplied by him, and such account shall contain particulars of the opening balance, receipt, supply, goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples and balance of stock including raw materials, finished goods, scrap and wastage thereof;

(d) a separate account of advances received, paid and adjustments made thereto; (e) an account, containing the details of tax payable, tax collected and paid, input tax, input tax credit claimed, together with a register of tax invoice, credit note, debit note, delivery challan issued or received during any tax period;

(f) names and complete addresses of suppliers from whom goods or services, chargeable to tax under the Act, have been received;

(g) names and complete addresses of the persons to whom supplies have been made;

(h) the complete addresses of the premises where the goods

are stored including goods stored during transit along with

the particulars of the stock stored there in;

(i) monthly production accounts, showing the quantitative

details of raw materials or services used in the manufacture and quantitative details of the goods so manufactured including the waste and by products thereof;

(j) shall maintain the accounts showing the quantitative details of goods used in the provision of services, details of input services utilised and the services supplied;

(k) separate accounts for works contract showing:

• the names and addresses of the persons on whose behalf the works contract is executed;

• description, value and quantity (wherever applicable) of goods or services received for the execution of works contract;

• description, value and quantity (wherever applicable) of goods or services utilized in the execution of works contract;

• the details of payment received in respect of each works contract; and

• the names and addresses of suppliers from whom he has received goods or services.

(l) Separate records by agent referred to in clause (5) of section 2 of CGST Act, 2017 showing:

• particulars of authorisation received by him from each principal to receive or supply goods or services on behalf of such principal separately;

• particulars including description, value and quantity (wherever applicable) of goods or services received on behalf of every principal;

• particulars including description, value and quantity (wherever applicable) of goods or services supplied on behalf of every principal;

• details of accounts furnished to every principal; and

• tax paid on receipts or on supply of goods or services effected on behalf of every principal.

LOCATION OF THE RECORDS: The books of account shall be kept at the principal place of business and at every additional place(s) of business mentioned in the certificate of registration and such books of account shall include any electronic form of data stored on any electronic devices.

The data so stored shall be authenticated by way of digital signature. Unless proved otherwise, if any documents, registers, or any books of account belonging to a registered person are found at any premises

other than those mentioned in the certificate of registration, they shall be presumed to be maintained by the said registered person. If any taxable goods are found to be stored at any place(s) other than those declared without the cover of any valid documents, the proper officer shall determine the amount of tax payable on such goods as if such goods have been supplied by the registered person.

• Following exceptions have been provided from maintenance of records at each additional place of business;

• Circular No. 23/23/2017-GST dated 21.12.2017 provides that principal and auctioneer of tea, coffee, rubber, etc. can maintain books of accounts relating to warehouse declared as additional place of business can be maintained at their principal place of business;

• Circular No. 61/35/2018-GST dated 04.09.2018 provides that books of accounts in relation to goods stored at the transporter’s godown (i.e. the recipient taxpayer’s additional place of business) by the recipient taxpayer may be maintained by him at his principal place of business instead of at the transporter’s godown declared as additional place of business.

CORRECTIONS IN THE RECORDS: Any entry in registers, accounts and documents shall not be erased, effaced, or overwritten, and all incorrect entries, otherwise than those of clerical nature, shall be scored out under attestation and thereafter correct entry shall be recorded, and where the registers and other documents are maintained electronically, a log of every entry edited or deleted shall be maintained. Further each volume of books of account maintained manually by the registered person shall be serially numbered.

All accounts maintained together with all invoices, bills of supply, credit and debit notes, and delivery challans relating to stocks, deliveries, inward supply, and outward supply shall be preserved for seventy-two months (six years) from the due date of furnishing of annual return for the year pertaining to such accounts and records and shall be kept at every related place of business mentioned in the certificate of registration.

• A registered person, who is a party to an appeal or revision or any other proceedings whether filed by him or by the Commissioner, or is under investigation for an offence, has to retain the records pertaining to the subject matter of such appeal or revision or proceedings or investigation for a period of one year after final disposal of such appeal or revision or proceedings or investigation, or for the period specified above (seventy-two months), whichever is later.

Books of accounts to be maintained:

- Cash flow statement

- Records of sales and purchases,

- Records of assets and liabilities

- Items of cost

- Deeds, vouchers, writing, documents, minutes, and registers whether in physical or electronic mode

Under GST Act

Every registered person has to maintain GST records at the principal place of business.

Records to be maintained:

- Production or manufacture of goods

- Inward and outward supply of goods or services or both

- Stock of goods

- Input tax credit availed

- Output tax payable and paid and

- Other particulars as may be prescribed

ELECTRONIC RECORDS: The following requirements have been prescribed for maintenance of records in electronic form:

• Proper electronic back-up of records in such manner that, in the event of destruction of such records due to accidents or natural causes, the information can be restored within a reasonable period of time.

• Produce, on demand, the relevant records or documents, duly authenticated, in hard copy or in any electronically readable format.

• Where the accounts and records are stored electronically by any registered person, he shall, on demand, provide the details of such files, passwords of such files and explanation for codes used, where necessary, for access and any other information which is required for such access along with a sample copy in print form of the information stored in such files.

RECORDS TO BE MAINTAINED BY OWNER OR OPERATOR OF GODOWN OR WAREHOUSE AND TRANSPORTERS OR A CARRIER OR A CLEARING AND FORWARDING AGENT:

• The transporters, owners or operators of godowns, if not already registered under the GST Act(s), shall submit the details regarding their business electronically on the Common Portal in FORM GST ENR-01. A unique enrolment number shall be generated and communicated to them. A person in any other State or Union territory shall be deemed to be enrolled in the State or Union Territory. For the purposes of Chapter XVI (E-Way Bill) of CGST Rules, a transporter who is registered in more than one State or Union Territory having the same Permanent Account Number, he may apply for a unique common enrolment number by submitting the details in FORM GST ENR-02 using any one of his GSTIN, and upon validation of the details furnished, a unique common enrolment number shall be generated and communicated to the said transporter.

• Any person engaged in the business of transporting goods shall maintain records of goods transported, delivered and goods stored in transit by him along with the Goods and Services Tax Identification Number of the registered consigner and consignee and for each of his branches. Every owner or operator of a warehouse or godown shall maintain books of accounts, with respect to the period for which particular goods remain in the warehouse, including the particulars relating to dispatch, movement, receipt, and disposal of such goods. The goods shall be stored in such manner that they can be identified item wise and owner wise and shall facilitate any physical verification or inspection, if required at any time.

• Every person having custody over the goods in the capacity of a carrier or a clearing and forwarding agent for delivery or dispatch thereof to a recipient on behalf of any registered person shall maintain true and correct records in respect of such goods handled by him on behalf of such registered person and shall produce the details thereof as and when required by the proper officer.

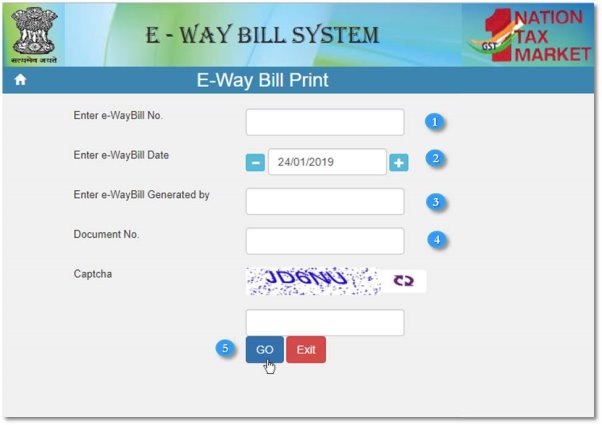

EWay Bill is an Electronic Way bill for movement of goods to be generated on the eWay Bill Portal. A GST registered person cannot transport goods in a vehicle whose value exceeds Rs. 50,000 (Single Invoice/bill/delivery challan) without an e-way bill that is generated on ewaybillgst.gov.in.

Alternatively, Eway bill can also be generated or cancelled through SMS, Android App and by site-to-site integration through API.

When an eway bill is generated, a unique Eway Bill Number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

|

Fig.1: Electronic way bill

eWay bill will be generated when there is a movement of goods in a vehicle/ conveyance of value more than Rs. 50,000 (either each Invoice or in aggregate of all invoices in a vehicle/conveyance) –

- In relation to a ‘supply’

- For reasons other than a ‘supply’ ( say a return)

- Due to inward ‘supply’ from an unregistered person.

It has two Components-

• Part A comprising of details of GSTIN of recipient, place of delivery (PIN Code), invoice or challan number and date, value of goods, HSN code, transport document number (Goods Receipt Number or Railway Receipt Number or Airway Bill Number or Bill of Lading Number) and reasons for transportation; and

• Part B –comprising of transporter details (Vehicle number).

For this purpose, a supply may be either of the following:

- A supply made for a consideration (payment) in the course of business

- A supply made for a consideration (payment) which may not be in the course of business

- A supply without consideration (without payment) In simpler terms, the term ‘supply’ usually means a:

- Sale – sale of goods and payment made

- Transfer – branch transfers for instance

- Barter/Exchange – where the payment is by goods instead of in money

Therefore, eWay Bills must be generated on the common portal for all these types of movements. For certain specified Goods, the eway bill needs to be generated mandatorily even if the value of the consignment of Goods is less than Rs. 50,000:

- Inter-State movement of Goods by the Principal to the Job-worker by Principal/ registered Job-worker,

- Inter-State Transport of Handicraft goods by a dealer exempted from GST registration

Who should Generate an eWay Bill?

- Registered Person – Eway bill must be generated when there is a movement of goods of more than Rs 50,000 in value to or from a registered person. A Registered person or the transporter may choose to generate and carry eway bill even if the value of goods is less than Rs 50,000.

- Unregistered Persons – Unregistered persons are also required to generate e-Way Bill. However, where a supply is made by an unregistered person to a registered person, the receiver will have to ensure all the compliances are met as if they were the supplier.

- Transporter – Transporters carrying goods by road, air, rail, etc. also need to generate e-Way Bill if the supplier has not generated an e-Way Bill.

Cases when eWay bill is Not Required

In the following cases it is not necessary to generate e-Way Bill:

- The mode of transport is non-motor vehicle

- Goods transported from Customs port, airport, air cargo complex or land customs station to Inland Container Depot (ICD) or Container Freight Station (CFS) for clearance by Customs.

- Goods transported under Customs supervision or under customs seal

- Goods transported under Customs Bond from ICD to Customs port or from one custom station to another.

- Transit cargo transported to or from Nepal or Bhutan

- Movement of goods caused by defence formation under Ministry of defence as a consignor or consignee

- Empty Cargo containers are being transported

- Consignor transporting goods to or from between place of business and a weighbridge for weighment at a distance of 20 kms, accompanied by a Delivery challan.

- Goods being transported by rail where the Consignor of goods is the Central Government, State Governments or a local authority.

- Goods specifed as exempt from E-Way bill requirements in the respective State/Union territory GST Rules.

- Transport of certain specified goods- Includes the list of exempt supply of goods, Annexure to Rule 138(14), goods treated as no supply as per Schedule III, Certain schedule to Central tax Rate notifications.

Note: Part B of e-Way Bill is not required to be filled where the distance between the consigner or consignee and the transporter is less than 50 Kms and transport is within the same state.

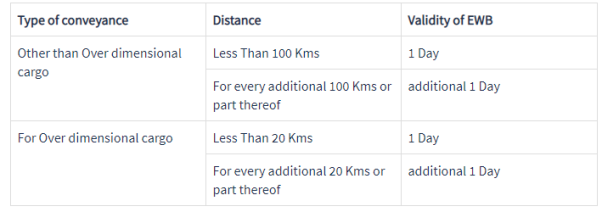

Validity of eWay Bill

An e-way bill is valid for periods as listed below, which is based on the distance travelled by the goods. Validity is calculated from the date and time of generation of e-way bill

|

Table 1: Validity of eWay Bill

Validity of Eway bill can be extended also. The generator of such Eway bill has to either four hours before expiry or within four hours after its expiry can extend Eway bill validity.

Documents or Details required to generate eWay Bill

- Invoice/ Bill of Supply/ Challan related to the consignment of goods

- Transport by road – Transporter ID or Vehicle number

- Transport by rail, air, or ship – Transporter ID, Transport document number, and date on the document

A supplier will come to know the extent of his tax liability which has to be discharged on a continuous and regular basis only after assessment.

Assessment means determination of tax liability and includes self-assessment, re-assessment, provisional assessment, summary assessment and best judgment assessment. The major determinants of the tax liability are generally the applicable tax rate and the value. There might be situations when these determinants might not be readily ascertainable and may be subject to the outcome of a process that requires deliberation and time. Hence like under the previous laws, when due to various circumstances it might not be always possible, at that point of time, to carry out an assessment and determine the exact duty liability, the GST law also provides for provisional assessment.

The Asst. Commissioner/Dy. Commissioner of Central Tax provisionally determines the amount of tax payable by the supplier and is subject to final determination. On provisional assessment, the supplier can pay tax on provisional basis but only after he executes a bond with security, binding them for payment of the difference between the amount of tax as may be finally assessed and the amount of tax provisionally assessed.

On finalization of the provisional assessment, any amount that has been paid on the basis of such assessment is to be adjusted against the amount that has been finally determined as payable. In case of short payment, the same has to be paid with interest and incase of excess payment, the same will be refunded with interest.

Procedure

In case a supplier is unable to determine the value of goods or services or both or to determine the rate of tax applicable thereto, he can request the Asst. Commissioner/Dy. Commissioner of Central Tax in writing, giving reasons for payment of tax on a provisional basis. The supplier requesting for payment of tax on a provisional basis has to furnish an application along with the documents in support of his request, electronically in FORM GST ASMT-01 on the common portal, either directly or through a Facilitation Centre notified by the Commissioner.

The Asst. Commissioner/Dy. Commissioner of Central Tax will scrutinize the application in FORM GST ASMT-01. In case, additional information or documents in support is required by the Asst. Commissioner/Dy. Commissioner of Central Tax to decide the case, notice in FORM GST ASMT-02 will be issued to the supplier requesting for submission of the same. The supplier has to file a reply to the notice in FORM GST ASMT – 03, and if he desires can also appear in person before the Asst. Commissioner/Dy. Commissioner of Central Tax to explain his case. The Asst. Commissioner/Dy. Commissioner of Central Tax will then issue an order in FORM GST ASMT-04 within a period not later than ninety days from the date of receipt of the request, allowing the payment of tax on a provisional basis.

The order will indicate the value or the rate or both on the basis of which the assessment is to be allowed on a provisional basis and the amount (this amount shall include the amount of integrated tax, central tax, State tax or Union territory tax and cess payable in respect of the transaction) for which the bond is to be executed along with the security to be furnished. The security will not exceed twenty-five percent of the amount covered under the bond. The supplier has to execute the bond in FORM GST ASMT-05 along with a security in the form of a bank guarantee for an amount as mentioned in FORM GST ASMT-04.A bond furnished to the proper officer under the State Goods and Services Tax Act or Integrated Goods and Services Tax Act shall be deemed to be a bond furnished under Central Goods and Services Tax Act. On executing the bond the process of the provisional assessment is complete and the supplier can supply the goods or services or both and pay the tax at the rate or on the value that has been indicated in the order in FORM GST ASMT-04.

Finalization of provisional assessment

The provisional assessment will be finalized, within a period not exceeding six months from the date of issuance of FORM GST ASMT-04. The Asst. Commissioner/Dy. Commissioner of Central Tax will issue a notice in FORM GST ASMT-06, calling for information and records required for finalization of assessment and shall issue a final assessment order, specifying the amount payable by the registered person or the amount refundable, if any, in FORM GST ASMT-07. On sufficient cause being shown and for reasons to be recorded in writing, the time limit for finalization of provisional assessment can be, extended by the Joint Commissioner or Additional Commissioner for a further period not exceeding six months and by the Commissioner for such further period not exceeding four years.

Interest liability

In case any tax amount becomes payable subsequent to finalization of the provisional assessment, then interest at the specified rate will also be payable by the supplier from the first day after the due date of payment of the tax till the date of actual payment, whether such amount is paid before or after the issuance of order for final assessment. In case any tax amount becomes refundable subsequent to finalization of the provisional assessment, then interest (subject to the eligibility of refund and absence of unjust enrichment) at the specified rate will be payable to the supplier.

Release of Security consequent to Finalization

Once the order in FORM GST ASMT-07 is issued, the supplier has to file an application in FORM GST ASMT- 08 for the release of the security furnished. On receipt of this application the Asst. Commissioner/Dy. Commissioner of Central Tax will issue an order in FORM GST ASMT–09 within a period of seven working days from the date of the receipt of the application, releasing the security after the amount payable if any as specified in FORM GST ASMT-07 has been paid.

Key takeaways-

- Provisional assessment provides a method for determining the tax liability in case the correct tax liability cannot be determined at the time of supply.

- The payment of provisional tax is allowed only against a bond and security. The provisional assessment has to be finalized within six months unless extended.

- On finalization, the tax liability can either be more or less as compared to the provisionally paid tax.

- In case of increase in the tax liability, the difference is payable along with interest and in case of decrease in the tax liability the amount will be refunded with interest.

Section 61 GST Act, 2017 – Scrutiny Assessment

GST Officers can scrutinize a GST return and related particulars furnished by the registered person to verify the correctness of the return. This is called a scrutiny assessment. In case there is any discrepancies noticed by the officer, he/she would inform the same to the registered person and seek his explanation on the same. On the basis of the explanation received from the registered person, the officer can take following action:

- If the explanation provided is satisfactory, the officer will inform about the same to the registered person and no further action will be taken in this regard.

- If the explanation provided is not satisfactory or the registered person has failed to take corrective measures after accepting the discrepancies, the proper officer will initiate appropriate action like conducting audit of registered person, conducting special audit, inspect and search the place of business of registered person, or initiate demand and recovery provisions.

The proper officer may scrutinize the same along with related particulars furnished by registered person, to verify the correctness of return. In case of any discrepancy is noticed, he shall issue a notice in b informing him of discrepancy and seeking explanation thereto within 30 days of service of notice. Wherever possible proper officer will quantify the amount of tax, interest and other dues in relation to discrepancy.

If proper officer agrees with explanation furnished by registered person in form ASMT-11, no further action will be taken. If registered person agrees with discrepancy, he will deposit the amount specified in notice and take the corrective action as specified in notice. And if registered person does not furnish explanation or satisfactory explanation is not furnished or does not take corrective measures in return for the month in which discrepancy is communicated, the proper officer may take appropriate action in accordance with section-65, 66 and 67.

Section 62 – Failure to File GST Return

When a registered person fails to furnish the required returns, even after service of notice under Section 46 an assessment would be conducted by the GST Officer. In such cases, the GST officer would proceed to assess the tax liability of the taxpayer to the best of his judgement taking into account all the relevant material which is available or which he has gathered and issue an assessment order within a period of five years from the date for furnishing of the annual return for the financial year to which the tax not paid relates. On receipt of the said assessment order, if the registered person furnishes a valid return within a period of 30 days from the date of issuance of assessment order, then in such case, the assessment order would deemed to have withdrawn. However, the registered person will be liable to pay interest under Section 50 (1) and/or liable to pay late fee under Section 47. The proper officer may proceed to determine the tax liability of such person to the best of his judgment considering all the relevant material he has gathered and pass the assessment order in form ASMT-13 within 5 years from the due date of furnishing annual return for the financial year for which tax not paid relates.

If registered person furnishes the valid return within 30 days of service of assessment order, then the said assessment order deemed to be withdrawn (But liability to pay interest and late fees still be applicable).

Section 63 – Assessment of Unregistered Person

When a taxable person fails to obtain GST registration even though liable to do so or whose registration has been cancelled under section 29 (2) but who was liable to pay tax, the GST officer can proceed to assess the tax liability of such taxable person to the best of his judgment for the relevant tax periods and issue an assessment order within a period of five years from the date specified under section 44 for furnishing of the annual return for the financial year to which the tax not paid relates. The proper officer may proceed to assess the tax liability of such person to the best of his judgment considering all the relevant material he has gathered within a period of 5 years from the due date of furnishing annual return for the financial year for which tax not paid relates.

For passing the assessment order under this section, the proper officer will issue a notice in form ASMT-14, containing the grounds on which assessment is proposed to be made and after considering the reply proper officer will issue order in form ASMT-15.

Section 64

A GST Officer can on any evidence showing a tax liability of a person coming to his notice, proceed to assess the tax liability of such person to protect the interest of revenue and issue an assessment order, if he has sufficient grounds to believe that any delay in doing so may adversely affect the interest of revenue. In order to undertake assessment under section 64, the proper officer is required to obtain previous permission of additional commissioner or joint commissioner. Such an assessment is called summary assessment. The summary assessment order shall be issued in form GST ASMT-16.The taxable person may file an application in form ASMT-17, within 30 days from receipt of order or commissioner may on his motion withdraw such order if he considers that such order is erroneous and follow the procedure laid down in section 73 to 74.

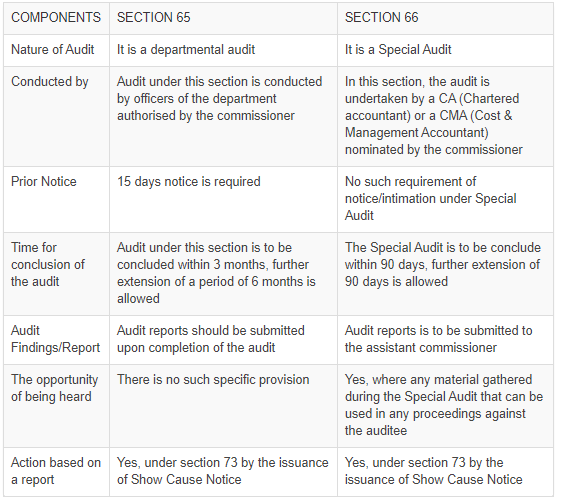

GST tax regime relies on self-assessment and self-compliance. In order to promote and ensure compliance of law by taxable person, Audit Mechanism has been introduced under GST act.

There are three types of audit. First audit is to be conducted u/s 35(5) of the act by Chartered Accountant or by Cost Accountant, of registered person whose aggregate turnover has exceeded prescribed limit.

Second audit, special audit has been provided u/s 66. This audit is to be conducted by nominated Chartered Accountant or Cost accountant, on direction of Assistant Commissioner in a case, where he is of opinion that value has not been correctly declared or credit availed is not within normal limit. Special audit provides lawful and legal way for Departmental authorities to take assistance of Chartered accountant or Cost accountant to determine tax liability in complex cases.

Third and most important audit is audit by tax authorities u/s 65 of the act.

OBJECTIVE OF AUDIT

Main objectives of audit are as under

a) to increase and measure the level of compliance of taxable person in the light of provision of the act and rules .

b) to discover under declared liabilities by omission , error or deliberate deception.

c) to increase taxpayers voluntary compliance and facilitates tax administration’s aim getting “ the right tax at right time “

DEFINITION OF AUDIT

As per section 2(13) of the act, audit means detailed examination of record, returns and other documents maintained or furnished by registered person, under the provisions of act and rules or any other laws, for verification of correctness of turnover declared, taxes paid, refund claimed, ITC availed and assessment of compliance with the provision of act and rules .

PROVISION TO CONDUCT AUDIT BY TAX AUTHORITIES

Section 65 of the act and rule prescribe procedure of conducting audit, audit authorities, powers of proper officer, responsibilities of registered person, corrective actions and consequential actions after completion of an audit.

AUDIT AUTHORITIES

Department, on the basis of revenue risk and other parameter select registered person for audit. It is not mandatory to conduct audit of every registered person for each and every tax period. Few cases originate for audit from other proceeding initiated under the act like scrutiny of returns. Commissioner or any Proper Officer authorised by him, is competent authority to conduct said audit. Accordingly, department authorise proper officer to conduct audit of selected registered person.

NOTICE FOR CONDUCTING AUDIT

As per provision of section of 65(3) and rule 101(2), authorised proper officer shall issue notice for conducting audit in FORM GST ADT 01 and intimate period covered under audit, date of audit and books of accounts, documents required for audit. The notice should be issued at least 15 working days prior to conduct audit. It is important to note that noncompliance of notice may be presumed that taxpayer is not in possession of books of accounts and record . Moreover, he liable for the penal action u/s 122 and 125 of the act .

RESPONSIBILITY OF TAXPAYER

During the course of audit, registered person is required to afford the necessary facility to proper officer, to verify the books of accounts or other required documents. It is also obligatory to such person to furnish such required information and render assistance for timely completion of the audit.

DURATION OF AUDIT

As per section 65(4) audit shall be completed within three months from the date of commencement of audit. However, where Commissioner is satisfied that audit cannot be completed within three months, he may for reason to be recorded in writing, extend further the period not exceeding six month. Thus, audit must be completed within six months.

PERIOD COVERED UNDER AUDIT

Rule 101(1) states that the period of audit shall be financial year or part thereof or multiple thereof. Thus, audit may be conducted for any tax period mentioned in the notice.

PLACE OF AUDIT

It is made clear in the section 65(2) of the act that audit may be conducted either at he places of business of such registered person or in the office of proper officer.

ACCESS TO BUSINESS PREMISES

As per provision of section 71 of the act, authorised proper officer shall have access to the place of business of registered person to inspect books of accounts, documents, computer for the purpose of carrying out audit u/s 65 of the act.

PREPARATION FOR AUDIT

Considering scope of audit, after receipt of notice for audit, such person has to keep available books of accounts, documents statements ready.

Section 35 prescribe record which is required to be maintained by registered person. Secondly, as per section 71 registered person is required to make available prescribed report for the audit. It is expected that these are likely to be demanded for verification . In view of above , following true and correct account of

a) production or manufacture of goods

b) inward and outward supply

c) stock of goods

d) ITC availed

e) output tax payable and paid .

f) such other applicable record as prescribed in rule 56, 57, and 58.

required to be keep ready along with other relevant statements and documents, return copies, annual return and audit report.

As per provision of section 71(2), it is obligatory to registered person to produce following record and reports to the authorised proper officer for audit .

a) such record prepared and maintained by the registered person and declared to proper officer in such manner as may be prescribed.

b) trial balance and its equivalent

c) statement of annual financial accounts , duly audited , wherever required

d) cost audit report , if any under section 148 of companies act 2013

e) the income tax audit report if any under section 144AB of Income tax act 1961

f) any other relevant record

EXAMINATION OF RECORDS BY PROPER OFFICER

During the course of audit, proper officer examines aforesaid records, books of accounts and various reports. Rule 100(3) prescribe the procedure to conduct audit. Accordingly, authorised proper officer has to verify

a) the documents on the basis of which books of are maintained and returns and statements furnished under the provisions of the act and rules .

b) correctness of turnover , exemption and deductions claimed

c) rate of tax applicable on supply

d) ITC availed and utilised

e) refund claimed

f) tax paid

g) other relevant issues

He has to also assess taxpayers compliance with provision of act and rules. During the course of audit, said officer always make through scrutiny with intention to detect, short payment of taxes, refund erroneously granted and wrong availment of ITC.

INTIMATION OF DISCREPANCIES NOTICED

During the course of audit, proper officer may notice certain discrepancies. As per Rule 101(4) proper officer has to intimate discrepancies observed in the audit, to the registered person and after considering his reply and corrective measure taken finalise finding of audit.

COMMUNICATION OF FINDINGS OF AUDIT

It is provided in the section 65(6) of the act and rule 101(5) that on conclusion of audit proper officer should inform the registered person within 30 days, findings of audit, his obligation and responsibility and reason for each finding in FORM GST ADT 02. This is audit report u/s 65. It includes details of short payment of tax, interest and penalty which is to be discharge by the said person. However, if registered person failed to take corrective action as per notice and audit resulted into detection of tax not paid or short paid or erroneously refund or ITC wrongly availed or utilised then proper officer may initiate proceeding u/s 73 or 74 of the act for passing adjudication order.

TIME LIMIT TO CONDUCT AUDIT

No time limit has been prescribed in the section for conducting audit of registered person. However, this audit may result into short payment of tax, wrongful availment of ITC by such person or erroneous grant of refund to him. In this situation, adjudication proceeding u/s 73 or 74 required to be initiate. Therefore, time limit prescribed under said sections will automatically applicable to the audit proceeding .

Key takeaways-

- Audit by tax authorities is one of the important instruments for verification of correctness of returns furnished and to promote self-tax compliance by the registered person.

- It is reassessment of self-assessment done by taxpayers. Effective audit mechanism has its own preventive and deterrent effects. All other audit reports are reviewed during the course of this audit.

- The ultimate aim of this audit is to increase level of tax compliance by registered person Therefore it has great significance in the implementation of GST laws .

A Special Audit under GST can be initiated by the Assistant Commissioner of CGST/SGST, considering the nature and complexity involved in the case and interest of revenue. During any stage of scrutiny/ inquiry/investigation, if the assistant commissioner is of the opinion that the value of the taxable supplies declared by the registered person is incorrect or the input tax credit has been wrongly availed then special audit can be initiated.

The officer will give his direction in Form GST ADT-03 to the taxable person in this regard. The CA (Chartered Accountant) or a (Cost & Management Accountant) nominated by the Commissioner shall submit a report within 90 days duly signed and certified by him to the said Assistant Commissioner. A special audit can be initiated against the registered person even if the accounts of the taxable person have been audited under any other provisions of the GST Act or under any other law. Once the special audit is concluded, the taxable person shall be informed by the department about the findings of the special audit in FORM GST ADT-04.

GST Audit requires the verification of the certain things mentioned below

- The correctness of turnover declared;

- Refund claimed and;

- Taxes paid;

- Input Tax Credit (ITC) availed and utilised.

Who will order and conduct a special audit?

The Assistant Commissioner of the CGST/SGST (with the prior permission of the Commissioner) can pass an order for special audit. The special audit will be undertaken by a qualified CA (Chartered Accountant) or a (Cost & Management Accountant) nominated by the Commissioner.

Time limit for Special Audit under GST

The auditor appointed for conducting the special audit shall submit the report within 90 days. However, this period can be extended by the proper officer by a further period not exceeding 90 days on an application made by the registered person or the auditor.

Cost of Special Audit under GST

The remuneration of the auditor (conducting the special audit) and the allied cost of the special audit will be determined and paid by the Commissioner.

|

Table no.2 Difference Between Audits under Section 65 and Section 66

Reference:

- Indirect Tax - Introduction of Goods and Services Tax by Manan Prakashan

- Indirect Tax by Kalyani Publisher