UNIT 4

Customs act – I

Custom Duty is an indirect tax, imposed under the Customs Act formulated in 1962. The power to enact the law is provided under the Constitution of India under the Article 265, which states that ―no tax shall be levied or collected except by authority of law. Entry No. 83 of List I to Schedule VII of the Constitution empowers the Union Government to legislate and collect duties on import and exports. The Customs Act, 1962 is the basic statute which governs entry or exit of different categories of vessels, aircrafts, goods, passengers etc., into or outside the country. The Act extends to the whole of India. Customs Act, 1962 just like any other tax law is primarily for the levy and collection of duties but at the same time it has the other and equally important purposes such as:

(i) regulation of imports and exports;

(ii) protection of domestic industry;

(iii) prevention of smuggling;

(iv) conservation and augmentation of foreign exchange and so on. Section 12 of the Custom Act provides that duties of customs shall be levied at such rates as may be specified under the Customs Tariff Act, 1975 or other applicable Acts on goods imported into or exported from India.

STATUTORY PROVISIONS OF CUSTOMS ACT, 1962

Customs Act, 1962 came into force from 1-2-1963. It extends to whole of India. The whole Act is divided into XVII chapters comprising of 161 sections.

Customs Act, 1962 and Customs Tariff Act, 1975 are the two limbs of Customs Law in India which must be read with rules and regulations. The rule making power is delegated to the Central Government while the regulation making power delegated to the Central Board of Excise and Customs (CBEC). There are a number of rules and regulation prescribed from time to time to carry the objective of the Act. Some of the rules and regulations are enumerated here as follows:

Baggage Rules, 2016

Customs, Central Excise Duties and Service Tax Drawback Rules,1995

Re-Export of Imported Goods (Drawback of Customs Duties) Rules, 1995

Customs Valuation (Determination of Price of Imported Goods) Rules, 2007

Customs Valuation (Determination of Value of Export Goods) Rules, 2007

Customs (Advance Rulings) Rules, 2002

Customs (Appeals) Rules, 1982

Customs (Import of Goods at Concessional Rate of Duty for Manufacture of Excisable Goods) Rules, 1996

Specified Goods (Prevention of Illegal Export) Rules, 1969

Customs (Compounding of Offences) Rules, 2005

Customs (Settlement of Cases) Rules, 2007

Notified Goods (Prevention of Illegal Import) Rules, 1969

Bill of Entry (Electronic Declaration) Regulations, 2011

Customs (Provisional Duty Assessment) Regulations, 2011

Customs House Agents Licensing Regulations, 2004

Intellectual Property Rights (Imported Goods) Enforcement Rules, 2007

Differences between Rules and Regulations

(1) The Central Government is authorized to make the rules and the CBEC is authorized to make the regulations consistent with this Act.

(2) The powers to make the rules is contained in section 156 whereas the power to make regulations is prescribed under section 157.

(3) Rules may provide for all or any of the following matters, namely:

(a) the manner of determining the transaction value of the imported goods and export goods under subsection (1) of section 14;

(b) the conditions subject to which accessories of, and spare parts and maintenance and repairing implements for, any article shall be chargeable at the same rate of duty as that article;

(c) the detention and confiscation of goods the importation of which is prohibited and the conditions, if any, to be fulfilled before such detention and confiscation and the information, notices and security to be given and the evidence requisite for the purposes of such detention or confiscation and the mode of verification of such evidence;

(d) the reimbursement by an informant to any public officer of all expenses and damages incurred in respect of any detention of any goods made on his information and of any proceedings consequent on such detention;

(e) the information required in respect of any goods mentioned in a shipping bill or bill of export which are not exported, or which are exported and are afterwards re-landed;

(f) the publication, subject to such conditions as may be specified therein, of names and other particulars of persons who have been found guilty of contravention of any of the provisions of this Act or the rules.

(g) the amount to be paid for compounding and the manner of compounding under sub-section (3) of section 137.

Whereas regulations may provide for all or any of the following matters, namely: (a) the form of a bill of entry, shipping bill, bill of export, import manifest, import report, export manifest, export report, bill of transshipment, declaration for transshipment boat note and bill of coastal goods;

(b) the manner of export of goods, relinquishment of title to the goods and abandoning them to customs and destruction or rendering of goods commercially valueless in the presence of the proper officer under clause (d) of sub-section (1) of section 26A;

(c) the form and manner of making application for refund of duty under sub-section (2) of section 26A;

(d) the form and manner in which an application for refund shall be made under section 27;

(e) the conditions subject to which the transshipment of all or any goods under sub-section (3) of section 54, the transportation of all or any goods under section 56 and the removal of warehoused goods from one warehouse to another under section 67, may be allowed without payment of duty;

(f) The conditions subject to which any manufacturing process or other operations may be carried on in a warehouse under section 65.

(g) The manner of conducting audit of the assessment of duty of the imported or export goods at the office of the proper officer or the premises of the importer or exporter, as the case may be.

Establishments under customs

Section 7

(a)The ports and airports which alone shall be customs ports or customs airports for the unloading of imported goods and the loading of export goods or any class of such goods; the places which alone shall be inland 5[container depots or air freight stations] for the unloading of imported goods and the loading of export goods or any class of such goods;

(b) the places which alone shall be land customs stations for the clearance of goods imported or to be exported by land or inland water or class of such good

(c) the routes by which alone goods or any class of goods specified in the notification may pass by land or inland water into or out of India, or to or from any land customs station from or to any land frontier;

(d) the ports which alone shall be coastal ports for the carrying on of trade in coastal goods or any class of such goods with all or any specified ports in India.

(e) the post offices which alone shall be foreign post offices for the clearance of imported goods or export goods or any class of such goods;

(f) the places which alone shall be international courier terminals for the clearance of imported goods or export goods or any class of such goods. Every notification issued under this section and in force immediately before the commencement of the Finance Act, 2003 shall, on such commencement, be deemed to have been issued under the provisions of this section as amended by section 105 of the Finance Act, 2003 and shall continue to have the same force and effect after such commencement until it is amended, rescinded, or superseded under the provision of this section.

International courier terminals for the clearance of imported goods can be now appointed by the board.

Key takeaway:

- Customs Act, 1962 just like any other tax law is primarily for the levy and collection of duties but at the same time it has the other and equally important purposes such as:

(i) regulation of imports and exports;

(ii) protection of domestic industry;

(iii) prevention of smuggling;

(iv) conservation and augmentation of foreign exchange and so on. Section 12 of the Custom Act provides that duties of customs shall be levied at such rates as may be specified under the Customs Tariff Act, 1975 or other applicable Acts on goods imported into or exported from India.

A tax levied on imports and exports by the customs authorities of a country to raise state revenue, and/or to protect domestic industries from more efficient or predatory competitors from abroad.

In simple words, Customs Duty is a tax imposed on imports and exports of good.

Goods will be liable to be taxed if the same enter India from any of the either mentioned routes:

• Road/Rail

• Air

• Sea

Taxable event for import Duty – it is the day of crossing of customs barrier and not on the date when goods landed in India or had entered territorial waters.

Taxable event for export duty – export commences when goods cross customs barrier, but export is complete when it crosses territorial waters.

Territorial Water of India

- Territorial waters means that portion of sea which is adjacent to the shores of a country.

- President of India has extended upto 6 nautical miles from the base line in 1956.

- Levy of duty on imports and exports – sec 12 provides for levy of duty on imports and exports. Import duty is levied on all items. Export duty is levied only on a few items.

Dutiable goods. - (1) Except as otherwise provided in this Act, or any other law for the time being in force, duties of customs shall be levied at such rates as may be specified under [the Customs Tariff Act, 1975 (51 of 1975)], or any other law for the time being in force, on goods imported into, or exported from India.

Duty on pilfered goods - If any imported goods are pilfered after the unloading thereof and before the proper officer has made an order for clearance for home consumption or deposit in a warehouse, the importer shall not be liable to pay the duty leviable on such goods except where such goods are restored to the importer after pilferage.

There are four stages in any tax structure, viz., levy, assessment, collection, and postponement. The basis of levy of tax is specified in Section 12, charging section of the Customs Act. It identifies the person or properties in respect of which tax or duty is to be levied or charged. Under assessment, the liability for payment of duty is quantified and the last stage is the collection of duty which is may be postponed for administrative convenience. As per Section 12, customs duty is imposed on goods imported into or exported out of India as per the rates specified under the Customs Tariff Act, 1975 or any other law.

On analysis of Section 12, we derive the following points:

(i) Customs duty is imposed on goods when such goods are imported into or exported out of India;

(ii) The levy is subject to other provisions of this Act or any other law;

(iii) The rates of Basic Custom Duty are as specified under the Tariff Act, 1975 or any other law;

(iv) Even goods belonging to Government are subject to levy, though they may be exempted by notification(s) under Section 25. Custom Tariff Act, 1975 has two schedules. Schedule I prescribes tariff rates for imported goods, known as ―Import Tariff‖ and Schedule II contains tariff for export goods known as ―Export Tariff.

Levy of duties of customs:

Subject to the conditions as may be specified in the rules made in this behalf -

(a) any goods admitted to a special economic zone from the domestic tariff area shall be chargeable to export duties at such rates as are leviable on such goods when exported;

(b) any goods removed from a special economic zone for home consumption shall be chargeable to duties of customs including anti-dumping, countervailing and safeguard duties under the Customs Tariff Act, 1975, where applicable, as leviable on such goods when imported; and

(c) the rate of duty and tariff valuation, if any, applicable to goods admitted to, or removed from, a special economic zone shall be the rate and tariff valuation in force as on the date of such admission or removal, as the case may be, and where such date is not ascertainable, on the date of payment of the duty.

Objectives of Customs Act

- Safeguarding domestic trade

- Reducing Imports

- Revenue resources

- Protection of Indian Industry

- Prevention smuggling activities

- To prevent dumping of goods.

Authorised operations.

All goods admitted to a special economic zone shall undergo such operations including processing or manufacturing as may be specified in the rules made in this behalf.

Goods utilised with a special economic zone.

(1) The Central Government may make rules in this behalf to enumerate the cases in which goods to be utilised inside a special economic zone may be admitted free of duties of customs and lay down the requirements which shall be fulfilled.

(2) Goods utilised contrary to the provisions of rules made under sub-section

(1) shall be chargeable to duties of customs in the same manner as provided und er clause (b) of section 76F as if they have been removed for home consumption.

Drawback on goods admitted to a special economic zone.

Any goods admitted to a special economic zone from the domestic tariff area for the purposes authorised under this Chapter shall be eligible for drawback under section 75 as if such goods are export goods for the purposes of that section.

Duration of stay.

Any goods admitted to a special economic zone shall not be allowed to remain within such zone beyond such time as may be specified in the rules made in this behalf.

Security.

Any goods admitted free of duty to a special economic zone or goods under transshipment to and from such zone without payment of duty shall be subject to execution of such bond and such surety or security as may be specified in the rules made in this behalf.

Transfer of ownership.

Any goods admitted to, or produced or manufactured in, a special economic zone shall be allowed for transfer of ownership subject to such conditions as may be specified in the rules made in this behalf.

Removal of goods.

Any goods admitted to, or produced or manufactured in, a special economic zone may be removed in accordance with such procedure as may be specified in the rules made in this behalf.

Closure of a special economic zone.

In the event of closure of a special economic zone by the Central Government, by notification in the Official Gazette, the goods admitted to, or produced or manufactured in, such zone shall be removed within such time and in such manner as may be specified in the rules made in this behalf.

Valuation of goods for purposes of assessment. - For the purposes of # [the Customs Tariff Act, 1975 (51 of 1975)], or any other law for the time being in force whereunder a duty of customs is chargeable on any goods by reference to their value, the value of such goods shall be deemed to be the price at which such or like goods are ordinarily sold, or offered for sale, for delivery at the time and place of importation or exportation, as the case may be, in the course of [international trade, where-

(a) the seller and the buyer have no interest in the business of each other; or

(b) one of them has no interest in the business of other, and the price is the sole consideration for the sale or offer for sale.

Date for determination of rate of duty and tariff valuation of imported goods. (1) [The rate of duty 2 [Omitted]] and tariff valuation, if any, applicable to any imported goods, shall be the rate and valuation in force, -

(a) in the case of goods entered for home consumption under section 46, on the date on which a bill of entry in respect of such goods is presented under that section;

(b) in the case of goods cleared from a warehouse under section 68, on the date on which a *bill of entry for home consumption in respect of such goods is presented under that section;

(c) in the case of any other goods, on the date of payment of duty

(2) The provisions of this section shall not apply to baggage and goods imported by post.

Assessment of duty. –

(1) After an importer has entered any imported goods under section 46 or an exporter has entered any export goods under section 50 the imported goods or the export goods, as the case may be, or such part thereof as may be necessary may, without undue delay, be examined and tested by the proper officer.

(2) After such examination and testing, the duty, if any, leviable on such goods shall, save as otherwise provided in section 85, be assessed.

(3) For the purpose of assessing duty under sub -section (2), the proper officer may re quire the importer, exporter or any other person to produce any contract, broker's note, policy of insurance, catalogue or other document whereby the duty leviable on the imported goods or export goods, as the case may be, can be ascertained, and to furnish any information required for such ascertainment which it is in his power to produce or furnish, and thereupon the importer, exporter or such other person shall produce such document and furnish such information.

(4) Notwithstanding anything contained in this section, imported goods or export goods may, prior to the examination or testing thereof, be permitted by the proper officer to be assessed to duty on the basis of the statements made in the entry relating thereto and the documents produced and the information furnished under sub-section (3); but if it is found subsequently on examination or testing of the goods or otherwise that any statement in such entry or document or any information so furnished is not true in respect of any matter relevant to th e assessment, the goods may, without prejudice to any other action which may be taken under this Act, be re -assessed to duty.

Power to grant exemption from duty –

(1) If the Central Government is satisfied that it is necessary in the public interest so to do, it may, by notification in the Official Gazette, exempt generally either absolutely or subject to such conditions (to be fulfilled before or after clearance) as may be specified in the notification goods of any specified description from the whole or any part of duty of customs leviable thereon.

(2) If the Central Government is satisfied that it is necessary in the public interest so to do, it may, by special order in each case, exempt from the payment of duty, under circumstances of an exceptional nature to be stated in such order, any goods on which duty is leviable.

The Central Government may, if it considers it necessary or expedient so to do for the purpose of clarifying the scope of applicability of any notification issued under sub -section (1) or order issued under sub-section (2), insert an explanation in such notification or order, as the case may be, by notification in the official gazette, at any time within one year of issue of the notification under sub-section (1) or order under sub-section (2), and every such explanation shall have effect as if it had always been the part of the first such notification or order, as the case may be.

(3) An exemption under sub-section (1) or sub -section (2) in respect of any goods from any part of the duty of customs leviable thereon (the duty of customs leviable thereon being hereinafter referred to as the statutory duty) may be granted by providing for the levy of a duty on such goods at a rate expressed in a form or method different from the form or method in which the statutory duty is leviable and any exemption granted in relation to any goods in the manner provided in this sub -section shall have effect subject to the condition that the duty of customs chargeable on such goods shall in no case exceed the statutory duty.

(4) Every notification issued under sub-section (1) *[or sub-section 2A] shall, - (a) unless otherwise provided, come into force on the date of its issue by the Central Government for publication in the Official Gazette;

(b) also be published and offered for sale on the date of its issue by the Directorate of Publicity and Public Relations of the Board, New Delhi.

(5) Notwithstanding anything contained in sub-section (4), where a notification com es into force on a date later than the date of its issue, the same shall be published and offered for sale by the said Directorate of Publicity and Public Relations on a date on or before the date on which the said notification comes into force.

(6) Notwithstanding anything contained in this Act, no duty shall be collected if the amount of duty leviable is equal to, or less than, one hundred rupees.

Exemption from duties of customs.

Without prejudice to the provisions of sections 76F, 76G and 76H, any goods admitted to a special economic zone shall be exempt from duties of customs.

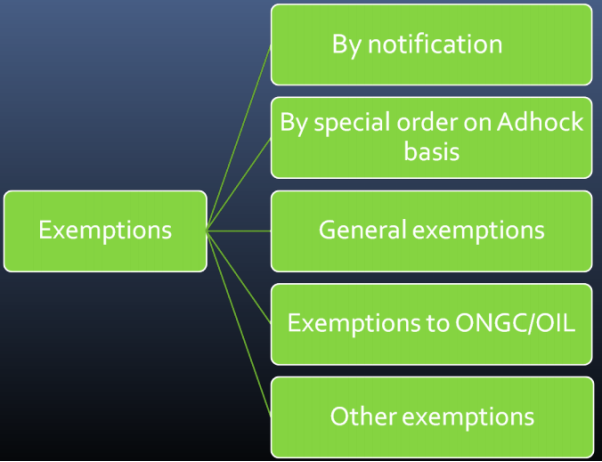

Section 25 of the customs Act empowers the central government to issue notification granting exemption from customs duty partially or wholly on any goods.

• The exemptions may be in respect of basic duty or auxiliary duty.

• General or specific exemptions may be granted.

• While general exemptions are in respect of user of goods, specific exemptions are in respect of various products.

• The exemptions are also granted subject to fulfillment of certain conditions.

|

Fig 1: Types of exception

Key takeaway:

Goods will be liable to be taxed if the same enter India from any of the either mentioned routes:

• Road/Rail

• Air

• Sea

Objectives of Customs Act

- Safeguarding domestic trade

- Reducing Imports

- Revenue resources

- Protection of Indian Industry

- Prevention smuggling activities

- To prevent dumping of goods.

(1) Basic Customs Duty (BCD)

(2) Additional Duty of Customs/ Counter Veiling Duty (CVD)/ Section 3(1)

(3) Education and Secondary and Higher Education Cess

(4) Special Additional Duty (SAD) of Customs/ Special CVD/ Section 3(5)

(5) Safeguard Duty

(6) Anti-Dumping Duty

(1) Basic Customs Duty (BCD)

Basic custom duty is applicable on imported items that fall under the ambit of Section 12 of the Customs Act, 1962. These duties are levied at the rates prescribed in First Schedule to Customs Tariff Act, 1975, under the terms specified in Section 2 of the act. The levied rates may be standard or preferential as per the country of import.

Example:

Assessable Value 10,00,000

Add: 10% of AV 1,00,000

11,00,000

(2) Additional Duty of Customs/ Counter Veiling Duty (CVD)/

This duty is levied on imported items under Section 3 of Customs Tariff Act, 1975. It is equal to the Central Excise Duty that is levied on similar goods produced within India. This duty is calculated on the aggregate value of goods including BDC and landing charges.

Example:

Assessable Value 10,00,000

Add: 10% of AV 1,00,000

11,00,000

Add: CVD 12.5% 1,37,500

12,37,500

(3) Education and Secondary and Higher Education Cess

This duty is levied at 2% and higher education cess at another 1% of aggregate of customs duties.

Example:

Assessable Value 1,00,000

Add: 10% of AV 10,000

1,10,000

Add: CVD 12% 13,200

1,23,200

Add: Edu. Cess 3% 696

1,23,869

(4) Special Additional Duty (SAD) of Customs/ Special CVD/ Section 3(5)

Example:

Assessable Value 1,00,000

Add: 10% of AV 10,000

1,10,000

Add: CVD 12% 13,200

1,23,200

Add: Edu. Cess 3% 696

1,23,869

Add: SAD 4% 4,956

1,28,852

(5) Safeguard Duty:

Safeguard duty is levied if the government feels that a sudden increase in exports can potentially damage the domestic industry

(6) Anti-dumping duty may be imposed if the good being imported is at below fair market price and is limited to the difference between export and normal price (dumping margin).

Key takeaway:

Types of customs duty

(1) Basic Customs Duty (BCD)

(2) Additional Duty of Customs/ Counter Veiling Duty (CVD)/ Section 3(1)

(3) Education and Secondary and Higher Education Cess

(4) Special Additional Duty (SAD) of Customs/ Special CVD/ Section 3(5)

(5) Safeguard Duty

(6) Anti-Dumping Duty

The Harmonized System (HS) is an international nomenclature of goods classification developed by the World Customs Organization in 1988. It has been adopted by more than 190 countries. The HS consists of 6-digit codes for all traded goods, which are used to satisfy customs requirements worldwide. In most cases, in order to import or export a product, it must be assigned an HS code that corresponds with the Harmonized Tariff Schedule of the country of import. Most countries have added additional digits to classify goods more specifically. A code with six digits is a universal standard (HS Code) and a code with 7-10 digits (HTS Code) is often unique after the 6th digit and determined by individual countries of import. These codes are important because they not only determine the tariff/duty rate of the traded product, but they also keep a record of international trade statistics that are used in most countries.

The Indian Trade Classification (Harmonized System) (ITC) (HS) code has 8 digits (the first 6 digits are common as per WCO with an additional 2 digits for added specificity). There are two schedules to the ITC HS: Schedule 1 – Import tariff, and Schedule 2 – Export tariff. Both tariffs are a key instrument for establishing the customs duty rate applicable to imported goods per the First Schedule. The Second Schedule incorporates items that are subject to export duties and the rates of duties thereon in the Indian Customs Tariff Act of 1975. Import permissibility in terms of Foreign Trade Policy, duties that can be levied on the goods, benefits like applicability of various duty exemption notifications, identification of applicable incentives for export goods, and determining a product’s eligibility under a trade agreement are also based on HS code classification. The classification of goods for import and export purposes has always been a challenge for corporations due to the very nature of the classification process and its interpretation between customs and corporations.

Classification of Exports Goods

- Prohibited Goods: There are certain items in the Indian market that are prohibited from any type of export in the outside world. The goods that do not have the government’s permission to be exported out of the country fall into this category. Unlike other goods, these goods and items do not have the export license. You cannot take these goods out of the country by any means whatsoever. Wild animals, beef, exotic birds, human skeleton, seashells, narcotics drugs, aero models etc., fall under the prohibited goods category. Unlike other types of export goods, these goods cannot be exported under any circumstances without special license and permission from the authority.

- Restricted Goods: There are certain goods that can be exported to other countries but need a legal license for the export. Various conditions are required to be complied with in order to export these goods from India. A restricted good would only be transported if it complies with the conditions and processes for restricted export. These conditions should be fulfilled in addition to the general export conditions and required licenses for the export. Items like firearms, medicines, live birds & animals, sand/soil, sandalwood, endangered species of plants & animals etc., are categorized as restricted goods in India.

- State Trading Enterprise: There are various goods that are subjected to trading and export only by the state authority. This type of export performed by the State Trading Enterprises does not require an export license as well. This type of trade, managed by the state bodies, is done to safeguard the national interests of the nation. These goods are also conditioned to the EXIM Policy of India.

- Restricted Country Goods: There are certain countries where goods can only be exported after fulfilling the conditions set in the EXIM policy. Various organizations and institutions are restricted to export certain goods to certain countries. There can be a number of reasons behind the restriction and many countries are put under the restricted countries for goods export. For example, the export to Iraq is only possible once the conditions mentioned under the EXIM Policy are fulfilled. These conditions are listed under the title ITC (HS) Classification of Export and Import items.

VALUATION OF GOODS FOR LEVY OF CUSTOMS DUTY

The method of valuation of goods for both import and export for the purposes of levy of customs duty on the basis of transaction value has been set out under Section 14 of the Customs Act, 1962 (effective from 10.10.2007). The transaction value is the price actually paid or payable for the goods when sold for export to India for delivery at the time and place of importation, or for export from India for delivery at the time and place of exportation, where the buyer and seller of the goods are not related and the price is the sole consideration for sale, subject to such other conditions as may be specified in the rules made in this behalf. Accordingly, the old Customs Valuation (Determination of Imported Goods) Rules, 1988 (relevant for old section 14) have also been replaced by new Customs Valuation (Determination of Value of Imported Goods) Rules, 2007 and Customs Valuation (Determination of Value of Export Goods) Rules, 2007.

VALUATION OF IMPORTED GOODS

Section 14(1) provides that the value of imported goods shall also include various items of costs and services to the extent provided by the rules. Proviso to section 14(1) states that the price shall be calculated as per the rate of exchange as in force on the date of presentation of bill of entry or shipping bill or bill of export under section 46 or section 50, as the case may be. Further, if transaction value is not determinable (in case of no sale or buyer or seller being related or price not being sole consideration), value is determined in accordance with valuation rules. Hence, the value of imported goods shall be computed in accordance with section 14(1) read with the Customs Valuation (Determination of Value of imported Goods) Rules, 2007.

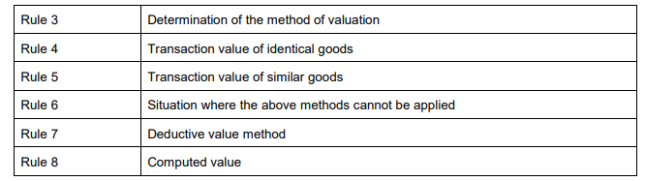

As per Notification No. 94/2007-Customs (N.T.), dated 13.9.2007, in exercise of the powers conferred by Section 156 read with Section 14 of the Customs Act, 1962 (62 of 1962), the Central Government hereby makes the following rules, namely

|

Table no. 1 Customs Valuation (Determination of Value of Imported Goods) Rules, 2007

VALUATION OF EXPORT GOODS

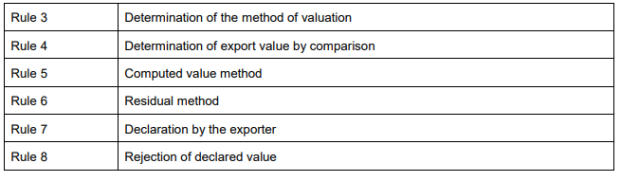

Customs value of export goods, whether liable to ad valorem duty or not is to be determined under Section 14(1) of the Customs Act, 1962 read with Section 2(41) thereof. By virtue of Section 2(41), value ‘in relation to any goods will mean the value thereof determined under Section 14(1) read with Customs Valuation (Determination of Value of Export Goods) Rules, 2007.

|

Table no. 1 CUSTOMS VALUATION (DETERMINATION OF VALUE OF EXPORT GOODS) RULES, 2007

Key takeaway:

- The Harmonized System (HS) is an international nomenclature of goods classification developed by the World Customs Organization in 1988. It has been adopted by more than 190 countries. The HS consists of 6-digit codes for all traded goods, which are used to satisfy customs requirements worldwide.

- The method of valuation of goods for both import and export for the purposes of levy of customs duty on the basis of transaction value has been set out under Section 14 of the Customs Act, 1962 (effective from 10.10.2007).

Reference:

- Indirect Tax - Introduction of Goods and Services Tax by Manan Prakashan

- Indirect Tax by Kalyani Publishers