UNIT 6

Foreign trade policy

The Foreign Trade Policy, 2015-20, (as updated) w.e.f. 05.12.2017 is notified by Central Government, in exercise of powers conferred under Section 5 of the Foreign Trade (Development & Regulation) Act, 1992 (No. 22 of 1992) [FT (D&R) Act], as amended.

India’s Foreign Trade Policy (FTP) provides the basic framework of policy and strategy for promoting exports and trade. It is periodically reviewed to adapt to the changing domestic and international scenario.

The Department is also responsible for multilateral and bilateral commercial relations, special economic zones (SEZs), state trading, export promotion and trade facilitation, and development and regulation of certain export-oriented industries and commodities.

The current Foreign Trade Policy (2015-20) focusses on improving India’s market share in existing markets and products as well as exploring new products and new markets. India’s Foreign Trade Policy also envisages helping exporters leverage benefits of GST, closely monitoring export performances, improving ease of trading across borders, increasing realization from India’s agriculture-based exports and promoting exports from MSMEs and labour-intensive sectors. The DoC has also sought to make states active partners in exports. As a consequence, state governments are now actively developing export strategies based on the strengths of their respective sectors.

The following are the features of foreign trade:

(i) Change in the composition of exports:

After independence, many changes took place in export trade. India exported tea, jute, cloth, iron, spices and leather before independence. Now chemicals, readymade garments, gems, jewellery, electronic goods, processed foods, machines. Computer software etc. are exported along with tea, jute and cotton textiles.

(ii) Change in the composition of imports:

India imported consumer goods, medicines, textiles, motor vehicles and electrical goods before independence. After independence, imports are fertilizers, petroleum, steel, machines, industrial raw materials, edible oils and unfinished diamonds.

(iii) Direction of foreign trade:

Direction of foreign trade means those countries with which India has trade ties. Before independence, India has trade relations with England and Commonwealth Nations Now India has trade relations with U.S.A, Russia, Japan, European Union and Organization of Petroleum Exporting Countries (OPEC).

(iv) Balance of trade:

Simply speaking balance of trade means the difference between value of exports and imports. Balance of payments is favourable if exports exceed imports and un-favourable if imports exceed export. India’s balance of payment was favourable before Independence. It was favourable to Rs. 42 crores, but after independence it becomes un-favourable. It was Rs. 65741 crores adverse in 2003-04.

(v) Dependent trade:

Before independence, Indian foreign trade was dependent on foreign shipping, insurance and banking companies. After independence, cargo ships are being built in India. Banks and insurance companies have started taking interest in foreign trade.

(vi) Trade through sea routes:

India’s foreign trade is through sea routes. India has very little trade relations with neighbouring countries like Nepal, Afghanistan, Pakistan, Bhutan and Sri Lanka etc.

(vii) Dependence on a few Ports:

Indian foreign trade is through Chennai, Kolkata and Mumbai ports. These ports are always over-crowded. After independence ports like Kandla, Cochin and Vishakhapatnam have been developed.

(viii) Less percentage of world trade:

India’s share in world trade has been diminishing. It was 1.8% of world’s total imports and 2% of world’s total exports in 1950-51. In 2003-04 India’s share in total world imports was 1% and in total world exports was 0.8%.

(ix) Increased Share in Gross National Income:

Foreign trade has significant contribution in Indian national income. In 1950-51, India’s foreign trade contribution into national income was 12% and rose is 29% in 2003-04.

(x) Increase in value and volume of trade:

The value and volume of imports and exports increased many folds. In 1950-51 imports were Rs. 608 crores and exports were Rs. 606 crores. So total value was Rs. 1214 crores. In 2003-04, it increased to Rs. 6, 52,475 crores. Value of exports 2, 93,367 crore and of imports 3, 59,108 crores.

Key takeaway:

- Legal Basis of Foreign Trade Policy (FTP) The Foreign Trade Policy, 2015-20, (as updated) w.e.f. 05.12.2017 is notified by Central Government, in exercise of powers conferred under Section 5 of the Foreign Trade (Development & Regulation) Act, 1992 (No. 22 of 1992) [FT (D&R) Act], as amended.

The Government of India, Ministry of Commerce and Industry announced New Foreign Trade Policy on 01st April 2015 for the period 2015-2020, earlier this policy known as Export Import (Exim) Policy. After five years foreign trade policy needs amendments in general, aims at developing export potential, improving export performance, encouraging foreign trade and creating favorable balance of payments position. The Export Import Policy (EXIM Policy) or Foreign Trade Policy is updated every year on the 31st of March and the modifications, improvements and new schemes becomes effective from April month of each year.

HIGHLIGHTS OF THE FOREIGN TRADE POLICY 2015-2020

Export from India Schemes:

A. MERCHANDISE EXPORTS FROM INDIA SCHEME

1. Merchandise Exports from India Scheme (MEIS)

- Earlier there were 5 different schemes (Focus Product Scheme, Market Linked Focus Product Scheme, Focus Market Scheme, Agri. Infrastructure Incentive Scrip, VKGUY) for rewarding merchandise exports with different kinds of duty scrips with varying conditions (sector specific or actual user only) attached to their use. Now all these schemes have been merged into a single scheme, namely Merchandise Export from India Scheme (MEIS) and there would be no conditionality attached to the scrips issued under the scheme. The main features of MEIS, including details of various groups of products supported under MEIS and the country groupings are at Annexure-1.

- Rewards for export of notified goods to notified markets under ‘Merchandise Exports from India Scheme (MEIS) shall be payable as percentage of realized FOB value (in free foreign exchange). The debits towards basic customs duty in the transferable reward duty credit scrips would also be allowed adjustment as duty drawback. At present, only the additional duty of customs / excise duty / service tax is allowed adjustment as CENVAT credit or drawback, as per Department of Revenue rules.

2. Service Exports from India Scheme (SEIS)

- Served From India Scheme (SFIS) has been replaced with Service Exports from India Scheme (SEIS). SEIS shall apply to ‘Service Providers located in India’ instead of ‘Indian Service Providers’. Thus, SEIS provides for rewards to all Service providers of notified services, who are providing services from India, regardless of the constitution or profile of the service provider. The list of services and the rates of rewards under SEIS are at Annexure-2.

- The rate of reward under SEIS would be based on net foreign exchange earned. The reward issued as duty credit scrip, would no longer be with actual user condition and will no longer be restricted to usage for specified types of goods but be freely transferable and usable for all types of goods and service tax debits on procurement of services / goods. Debits would be eligible for CENVAT credit or drawback.

3. Incentives (MEIS & SEIS) to be available for SEZs

4. Duty credit scrips to be freely transferable and usable for payment of custom duty, excise duty and service tax.

- All scrips issued under MEIS and SEIS and the goods imported against these scrips would be fully transferable.

- Scrips issued under Exports from India Schemes can be used for the following:-

(i) Payment of customs duty for import of inputs / goods including capital goods, except items listed in Appendix 3A.

(ii) Payment of excise duty on domestic procurement of inputs or goods, including capital goods as per DoR notification.

(iii) Payment of service tax on procurement of services as per DoR notification.

c. Basic Customs Duty paid in cash or through debit under Duty Credit Scrip can be taken back as Duty Drawback as per DoR Rules, if inputs so imported are used for exports.

5. Status Holders

- Business leaders who have excelled in international trade and have successfully contributed to country’s foreign trade are proposed to be recognized as Status Holders and given special treatment and privileges to facilitate their trade transactions, in order to reduce their transaction costs and time.

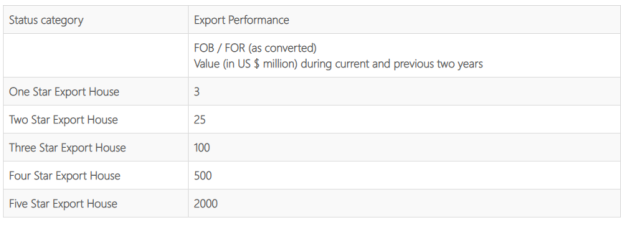

- The nomenclature of Export House, Star Export House, Trading House, Star Trading House, Premier Trading House certificate has been changed to One, Two, Three, Four, Five Star Export House.

- The criteria for export performance for recognition of status holder have been changed from Rupees to US dollar earnings. The new criteria is as under:-

|

Table no.1 export performance

(d) Approved Exporter Scheme - Self certification by Status Holders

Manufacturers who are also Status Holders will be enabled to self-certify their manufactured goods as originating from India with a view to qualify for preferential treatment under different Preferential Trading Agreements [PTAs], Free Trade Agreements [FTAs], Comprehensive Economic Cooperation Agreements [CECAs] and Comprehensive Economic Partnerships Agreements [CEPAs] which are in operation. They shall be permitted to self-certify the goods as manufactured as per their Industrial Entrepreneur Memorandum (IEM) / Industrial Licence (IL)/ Letter of Intent (LOI).

B. BOOST TO "MAKE IN INDIA"

6. Reduced Export Obligation (EO) for domestic procurement under EPCG scheme:

Specific Export Obligation under EPCG scheme, in case capital goods are procured from indigenous manufacturers, which is currently 90% of the normal export obligation (6 times at the duty saved amount) has been reduced to 75%, in order to promote domestic capital goods manufacturing industry.

7. Higher level of rewards under MEIS for export items with high domestic content and value addition.

It is proposed to give higher level of rewards to products with high domestic content and value addition, as compared to products with high import content and less value addition.

C. TRADE FACILITATION & EASE OF DOING BUSINESS

8. Online filing of documents/ applications and Paperless trade in 24x7 environment:

- DGFT already provides facility of Online filing of various applications under FTP by the exporters/importers. However, certain documents like Certificates issued by Chartered Accountants/ Company Secretary / Cost Accountant etc. have to be filed in physical forms only. In order to move further towards paperless processing of reward schemes, it has been decided to develop an online procedure to upload digitally signed documents by Chartered Accountant / Company Secretary / Cost Accountant. In the new system, it will be possible to upload online documents like annexure attached to ANF 3B, ANF 3C and ANF 3D, which are at present signed by these signatories and submitted physically.

- Henceforth, hardcopies of applications and specified documents would not be required to be submitted to RA, saving paper as well as cost and time for the exporters. To start with, applications under Chapter 3 & 4 of FTP are being covered (which account for nearly 70% of total applications in DGFT). Applications under Chapter-5 would be taken up in the next phase.

- As a measure of ease of doing business, landing documents of export consignment as proofs for notified market can be digitally uploaded in the following manner:-

(i) Any exporter may upload the scanned copy of Bill of Entry under his digital signature.

(ii) Status holders falling in the category of Three Star, Four Star or Five Star Export House may upload scanned copies of documents.

9. Online inter-ministerial consultations:

It is proposed to have Online inter-ministerial consultations for approval of export of SCOMET items, Norms fixation, Import Authorisations, Export Authorisation, in a phased manner, with the objective to reduce time for approval. As a result, there would not be any need to submit hard copies of documents for these purposes by the exporters.

10. Simplification of procedures/processes, digitisation and e-governance

- Under EPCG scheme, obtaining and submitting a certificate from an independent Chartered Engineer, confirming the use of spares, tools, refractory and catalysts imported for final redemption of EPCG authorizations has been dispensed with.

- At present, the EPCG Authorisation holders are required to maintain records for 3 years after redemption of Authorisations. Now the EPCG Authorization Holders shall be required to maintain records for a period of two years only. Government’s endeavour is to gradually phase out this requirement as the relevant records such as Shipping Bills, e-BRC are likely to be available in electronic mode which can be archived and retrieved whenever required.

- Exporter Importer Profile: Facility has been created to upload documents in Exporter/Importer Profile. There will be no need to submit copies of permanent records/ documents (e.g. IEC, Manufacturing licence, RCMC, PAN etc.) repeatedly with each application, once uploaded.

- Communication with Exporters/Importers: Certain information, like mobile number, e-mail address etc. has been added as mandatory fields, in IEC data base. This information once provided by exporters, would help in better communication with exporters. SMS/ email would be sent to exporters to inform them about issuance of authorisations or status of their applications.

- Online message exchange with CBDT and MCA: It has been decided to have online message exchange with CBDT for PAN data and with Ministry of Corporate Affairs for CIN and DIN data. This integration would obviate the need for seeking information from IEC holders for subsequent amendments/ updating of data in IEC data base.

- Communication with Committees of DGFT: For faster and paperless communication with various committees of DGFT, dedicated e-mail addresses have been provided to each Norms Committee, Import Committee and Pre-Shipment Inspection Agency for faster communication.

- Online applications for refunds: Online filing of application for refund of TED is being introduced for which a new ANF has been created.

11. Forthcoming e-Governance Initiatives

(a) DGFT is currently working on the following EDI initiatives:

- Message exchange for transmission of export reward scrips from DGFT to Customs.

- Message exchange for transmission of Bills of Entry (import details) from Customs to DGFT.

- Online issuance of Export Obligation Discharge Certificate (EODC).

- Message exchange with Ministry of Corporate Affairs for CIN & DIN.

- Message exchange with CBDT for PAN.

- Facility to pay application fee using debit card / credit card.

- Open API for submission of IEC application.

- Mobile applications for FTP

D. Other new Initiatives

12. New initiatives for EOUs, EHTPs and STPs

- EOUs, EHTPs, STPs have been allowed to share infrastructural facilities among themselves. This will enable units to utilize their infrastructural facilities in an optimum way and avoid duplication of efforts and cost to create separate infrastructural facilities in different units.

- Inter unit transfer of goods and services have been allowed among EOUs, EHTPs, STPs, and BTPs. This will facilitate group of those units which source inputs centrally in order to obtain bulk discount. This will reduce cost of transportation, other logistic costs and result in maintaining effective supply chain.

- EOUs have been allowed facility to set up Warehouses near the port of export. This will help in reducing lead time for delivery of goods and will also address the issue of un-predictability of supply orders.

- STP units, EHTP units, software EOUs have been allowed the facility to use all duty-free equipment/goods for training purposes. This will help these units in developing skills of their employees.

- 100% EOU units have been allowed facility of supply of spares/ components up to 2% of the value of the manufactured articles to a buyer in domestic market for the purpose of after sale services.

- At present, in a period of 5 years EOU units have to achieve Positive Net Foreign Exchange Earning (NEE) cumulatively. Because of adverse market condition or any ground of genuine hardship, then such period of 5 years for NFE completion can be extended by one year.

- Time period for validity of Letter of Permission (LOP) for EOUs/EHTP/ STPI/BTP Units has been revised for faster implementation and monitoring of projects. Now, LOP will have an initial validity of 2 years to enable the unit to construct the plant and install the machinery. Further extension can be granted by the Development Commissioner up to one year. Extension beyond 3 years of the validity of LOP, can be granted, in case unit has completed 2/3rd of activities, including the construction activities.

- At present, EOUs/EHTP/STPI units are permitted to transfer capital goods to other EOUs, EHTPs, STPs, SEZ units. Now a facility has been provided that if such transferred capital goods are rejected by the recipient, then the same can be returned to the supplying unit, without payment of duty.

- A simplified procedure will be provided to fast track the de-bonding / exit of the STP/ EHTP units. This will save time for these units and help in reduction of transaction cost.

- EOUs having physical export turnover of Rs.10 crore and above, have been allowed the facility of fast-track clearances of import and domestic procurement. They will be allowed fast tract clearances of goods, for export production, on the basis of pre-authenticated procurement certificate, issued by customs / central excise authorities. They will not have to seek procurement permission for every import consignment.

13. Facilitating & Encouraging Export of dual use items (SCOMET).

Validity of SCOMET export authorisation has been extended from the present 12 months to 24 months. It will help industry to plan their activity in an orderly manner and obviate the need to seek revalidation or relaxation from DGFT.

- Authorisation for repeat orders will be considered on automatic basis subject to certain conditions.

- Verification of End User Certificate (EUC) is being simplified if SCOMET item is being exported under Defence Export Offset Policy.

- Outreach programmes will be conducted at different locations to raise awareness among various stakeholders.

14 Facilitating & Encouraging Export of Defence Exports

- Normal export obligation period under advance authorization is 18 months. Export obligation period for export items falling in the category of defence, military store, aerospace and nuclear energy shall be 24 months from the date of issue of authorization or co-terminus with contracted duration of the export order, whichever is later. This provision will help export of defence items and other high technology items.

- A list of military stores requiring NOC of Department of Defence Production has been notified by DGFT recently. A committee has been formed to create ITC (HS) codes for defence and security items for which industrial licenses are issued by DIPP.

15. e-Commerce Exports

- Goods falling in the category of handloom products, books / periodicals, leather footwear, toys and customized fashion garments, having FOB value up to Rs.25000 per consignment (finalized using e-Commerce platform) shall be eligible for benefits under FTP. Such goods can be exported in manual mode through Foreign Post Offices at New Delhi, Mumbai and Chennai.

- Export of such goods under Courier Regulations shall be allowed manually on pilot basis through Airports at Delhi, Mumbai and Chennai as per appropriate amendments in regulations to be made by Department of Revenue. Department of Revenue shall fast track the implementation of EDI mode at courier terminals.

16. Duty Exemption

- Imports against Advance Authorization shall also be eligible for exemption from Transitional Product Specific Safeguard Duty.

- In order to encourage manufacturing of capital goods in India, import under EPCG Authorisation Scheme shall not be eligible for exemption from payment of anti-dumping duty, safeguard duty and transitional product specific safeguard duty.

17. Additional Ports allowed for Export and import

Calicut Airport, Kerala and Arakonam ICD, Tamil Nadu have been notified as registered ports for import and export.

18. Duty Free Tariff Preference (DFTP) Scheme

India has already extended duty-free tariff preference to 33 Least Developed Countries (LDCs) across the globe. This is being notified under FTP.

19. Quality complaints and Trade Disputes

- In an endeavour to resolve quality complaints and trade disputes, between exporters and importers, a new chapter, namely, Chapter on Quality Complaints and Trade Disputes has been incorporated in the Foreign Trade Policy.

- For resolving such disputes at a faster pace, a Committee on Quality Complaints and Trade Disputes (CQCTD) is being constituted in 22 offices and would have members from EPCs/FIEOs/APEDA/EICs.

20. Vishakhapatnam and Bhimavaram added as Towns of Export Excellence

Government has already recognized 33 towns as export excellence towns. It has been decided to add Vishakhapatnam and Bhimavaram in Andhra Pradesh as towns of export excellence (Product Category– Seafood)

Annexure-1

I. Merchandise Exports from India Scheme

- Merchandise Exports from India Scheme has replaced 5 different schemes of earlier FTP (Focus Product Scheme, Market Linked Focus Product Scheme, Focus Market Scheme, Agri. Infrastructure Incentive Scrip, VKGUY) for rewarding merchandise exports which had varying conditions (sector specific or actual user only) attached to their use.

- Now all these schemes have been merged into a single scheme, namely Merchandise Export from India Scheme (MEIS) and there would be no conditionality attached to the scrips issued under the scheme. Notified goods exported to notified markets would be rewarded on realised FOB value of exports.

A. Country Groups:

Category A: Traditional Markets (30) - European Union (28), USA, Canada.

Category B: Emerging & Focus Markets (139), Africa (55), Latin America and Mexico (45), CIS countries (12), Turkey and West Asian countries (13), ASEAN countries (10), Japan, South Korea, China, Taiwan,

Category C: Other Markets (70).

B. Products supported under MEIS

Level of Support:

Higher rewards have been granted for the following category of products:

- Agricultural and Village industry products presently covered under VKGUY.

- Value added and packaged products.

- Eco-friendly and green products that create wealth out of waste from agricultural and other waste products that generate additional income for the farmers, while improving the environment.

- Labour intensive Products with large employment potential and Products with large number of producers and /or exporters.

- Industrial Products from potential winning sectors.

- Hi-tech products with high export earning potential.

C. Markets Supported

- Most Agricultural products supported across the Globe.

- Industrial and other products supported in Traditional and/or Emerging markets only.

D. High potential products not supported earlier:

Support to 852 Tariff lines that fit in the product criteria but not provided support in the earlier FTP. Includes lines from Fruits, Vegetables, Dairy products, Oils meals, Ayush & Herbal Products, Paper, Paper Board Products.

Annexure-2

II. Services Exports from India Scheme

- Served from India Scheme (SFIS) has been replaced with Service Exports from India Scheme (SEIS). SEIS shall apply to Service Providers’ located in India’ instead of Indian Service Providers’. Thus SEIS provides for rewards to all Service providers of notified services, who are providing services from India, regardless of the constitution or profile of the service provider.

- The rate of reward under SEIS would be based on net foreign exchange earned. The reward issued as duty credit scrip, would no longer be with actual user condition and will no longer be restricted to usage for specified types of goods but be freely transferable and usable for all types of goods and service tax debits on procurement of services/goods. Debits would be eligible for CENVAT credit or drawback.

Sl No | SECTORS | Admissible rate |

1 | BUSINESS SERVICES |

|

A | Professional services Legal services, Accounting, auditing and bookkeeping services, Taxation services, Architectural services , Engineering services, Integrated engineering services, Urban planning and landscape architectural services, Medical and dental services, Veterinary services, Services provided by midwives, nurses, physiotherapists and paramedical personnel. | 5% |

B | Research and development services R&D services on natural sciences, R&D services on social sciences and humanities, Interdisciplinary R&D services | 5% |

C. | Rental/Leasing services without operators Relating to ships, Relating to aircraft, Relating to other transport equipment, Relating to other machinery and equipment | 5% |

D | Other business services Advertising services, Market research and public opinion polling services Management consulting service, Services related to management consulting, Technical testing and analysis services, Services incidental to agricultural, hunting and forestry, Services incidental to fishing, Services incidental to mining, Services incidental to manufacturing, Services incidental to energy distribution, Placement and supply services of personnel, Investigation and security, Related scientific and technical consulting services, Maintenance and repair of equipment (not including maritime vessels, aircraft or other transport equipment), Building- cleaning services, Photographic services, Packaging services, Printing, publishing and Convention services | 3% |

2 | COMMUNICATION SERVICES Audiovisual services Motion picture and video tape production and distribution service, Motion picture projection service, Radio and television services, Radio and television transmission services, Sound recording | 5% |

3 | CONSTRUCTION AND RELATED ENGINEERING SERVICES General Construction work for building, General Construction work for Civil Engineering, Installation and assembly work , Building completion and finishing work | 5% |

4 | EDUCATIONAL SERVICES (Please refer Note 1)Primary education services, Secondary education services, Higher education services, Adult education | 5% |

5 | ENVIRONMENTAL SERVICES Sewage services, Refuse disposal services, Sanitation and similar services | 5% |

6 | HEALTH-RELATED AND SOCIAL SERVICES Hospital services | 5% |

7 | TOURISM AND TRAVEL-RELATED SERVICES |

|

A. | Hotels and Restaurants (including catering) |

|

a. | Hotel | 3% |

b. | Restaurants (including catering) | 3% |

B. | Travel agencies and tour operators services | 5% |

C. | Tourist guides services | 5% |

8 | RECREATIONAL, CULTURAL AND SPORTING SERVICES (other than audio-visual services) Entertainment services (including theatre, live bands and circus services), News agency services, Libraries, archives, museums and other cultural services, Sporting and other recreational services | 5% |

9 | TRANSPORT SERVICES (Please refer Note 2) |

|

A. | Maritime Transport Services Passenger transportation*, Freight transportation* , Rental of vessels with crew *, Maintenance and repair of vessels, Pushing and towing services, Supporting services for maritime transport | 5% |

B. | Air transport services Rental of aircraft with crew, Maintenance and repair of aircraft, Airport Operations and ground handling | 5% |

Table no. 2 The present rates of reward are 3% and 5%. The list of services and the rates of rewards would be reviewed after 30.9.2015.

Note:

(1) Under education services, SEIS shall not be available on Capitation fee.

(2) *Operations from India by Indian Flag Carriers only is allowed under Maritime transport services.

Key takeaway:

- The Government of India, Ministry of Commerce and Industry announced New Foreign Trade Policy on 01st April 2015 for the period 2015-2020, earlier this policy known as Export Import (Exim) Policy.

- After five years foreign trade policy needs amendments in general, aims at developing export potential, improving export performance, encouraging foreign trade and creating favorable balance of payments position.

- The Export Import Policy (EXIM Policy) or Foreign Trade Policy is updated every year on the 31st of March and the modifications, improvements and new schemes becomes effective from April month of each year.

Merchandise Exports from India Scheme (MEIS Scheme)

- The objective of the Merchandise Exports from India Scheme (MEIS) is to promote the manufacture and export of notified goods/products from India.

- Funds Allocated – 40,000 Cr. Annually (Approx)

- Under the MEIS Scheme, an incentive of 2% to 5% of the FOB value of exports is provided to all the exporters (merchant as well as manufacturer exporter), irrespective of their annual turnover.

- The export of products notified/listed in Appendix 3B is only eligible for MEIS benefits.

- There are more than 8000+ products that are eligible.

- There is no restriction of Country, i.e. eligible products exported to any country in the world can avail the MEIS Scheme.

- MEIS rate of incentives differs from product to product.

- Application for MEIS scheme is to be filed electronically to the jurisdictional DGFT office

- MEIS incentives are not given in the form of cash or Bank transfer. It is given in the form of duty credit scrips also known as MEIS licenses. These licenses can be used for payment of Import duties or can be sold in the open market at a discounted rate.

- MEIS is soon to be replaced with the new RoDTEP Scheme. However, shipments till December 2020 or March 2021 can still claim MEIS benefits.

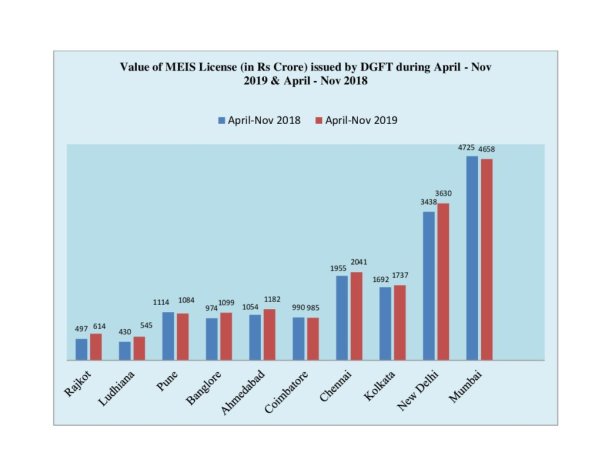

|

Fig No. 1 Value of MEIS

Rebate of Duties & Taxes on Export Products (RoDTEP Scheme)

- The new RoDTEP Scheme will replace the old MEIS Scheme in a phased manner from December 2020.

- The new scheme was necessary as the old MEIS Scheme was not WTO-compliant. It was against the International Trade rules.

- The RoDTEP scheme aims to refund all those hidden taxes and levies, which were earlier not refunded under any export incentive scheme, For example:

- Central & state taxes on the fuel (Petrol, Diesel, CNG, PNG, and coal cess, etc) used for transportation of export products.

- The duty levied by the state on electricity used for manufacturing.

- Mandi tax levied by APMCs.

- Toll tax & stamp duty on the import-export documentation. Etc.

- The entire application process will more or less remain the same as the MEIS Scheme, however, some changes in the rate of incentives are expected.

- The List of eligible products & the rate of benefit under the new RoDTEP Scheme is still not finalized.

Service Export from India Scheme (SEIS Scheme)

- The objective of Service Exports from India Scheme (SEIS) is to encourage and maximize export of notified Services from India.

- Service Exports also provides valuable foreign exchange to the country, therefore there is a need to motivate service exporters as well.

- Under the SEIS Scheme, an incentive of 3% to 7% of Net foreign exchange earnings is provided to services exporters of notified services in India.

- It requires the service providers to have an active Import-Export Code (IEC Code) with minimum net foreign exchange earnings of 15,000 USD to be eligible to claim under the scheme.

- Services listed in Appendix 3D are only eligible to claim the rewards.

- Similar to the MEIS scheme, rewards under the SEIS Scheme are given in the form of freely transferable duty credit scrips.

- An application under the SEIS scheme is to be filed electronically to the jurisdictional DGFT office

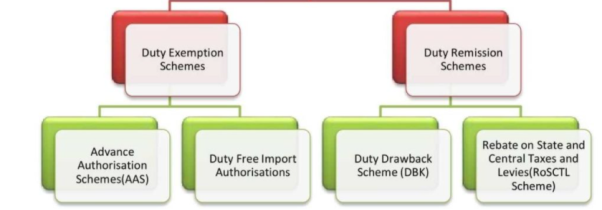

|

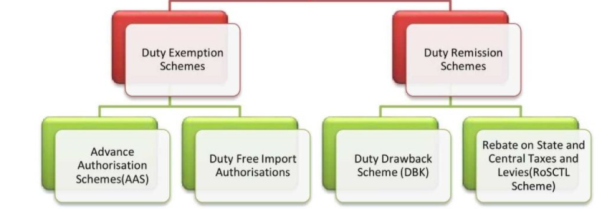

Fig no.2 Schemes under FTP

Advance Authorisation Scheme (AAS)

- Advance License scheme was introduced to allow duty-free import of raw materials required for the production of export goods.

- It means that one can import raw materials at 0% Import duty if those raw materials are going to be used in the manufacture of the export products.

- An Advance License can be issued for physical export (including supply to SEZ) & Deemed Exports as well (For Ex. Supply to EOU units or supply to any AA/EPCG holder)

- Advance License comes with an obligation to maintain a minimum of 15% value addition and to export the goods within 18 months from the License issue date.

- The materials imported under the Advance Authorisation Scheme comes with “Actual User condition”. i.e. It cannot be transferred or sold to any other entity.

- This scheme is implemented by the DGFT office.

Duty-free Import Authorisation (DFIA Scheme)

- The purpose of this scheme is the same as the Advance License scheme i.e. to allow duty-free import of raw materials.

- However, unlike the AA, DFIA Scheme is a post-export scheme. It means that duty-free import is allowed only after the export is made.

- DFIA scheme is applicable to only those products which are covered under the Standard Input-Output Norms (SION).

- Another important feature of the DFIA Scheme is that the DFIA License is transferable. It does not come with actual user condition.

- Similar to Advance Authorisation Scheme, this scheme is implemented by the DGFT office. Below is the image covering all the important points related to DFIA license issuance.

|

Fig no.3 DFIA Scheme

Duty Drawback Scheme (DBK Scheme)

- It is a refund of the duties given by the Govt. This scheme is implemented & monitored by the Department of Revenue [Customs Department].

- In the DBK scheme, duties of customs & central excise that are chargeable on imported and indigenous materials used in the manufacture of exported goods are refunded back.

- The rate of duty drawback for each product is different.

- Unlike the other schemes, Duty Drawback is directly credited into the Bank account of the exporter within 2 months from the shipment date.

- If you are availing the benefit of a GST refund, then you must opt for a lower rate of the Duty Drawback.

- DBK can be clubbed with any other export promotion scheme, but it cannot be clubbed with the Advance Authorisation scheme or DFIA Scheme.

Scheme for Rebate on State and Central Taxes and Levies (RoSCTL Scheme)

- The old RoSL scheme was replaced by the new RoSCTL Scheme from 07.03.2019.

- RoSCTL scheme is only applicable to the Apparels & made-up Industry covering Chapters 61, 62 & 63 of ITC (HS).

- It gives a refund of State and Central Taxes and Levies such as VAT on transportation fuel, Captive Power, Mandi Tax, Electricity Duty. Etc.

- It is implemented by the Directorate General of Foreign Trade (DGFT) and rewards are given in the form of MEIS like duty credit scrips.

- The RoSCTL scheme will be soon merged with the new RoDTEP Scheme for all sectors.

Export Promotion Capital Goods Scheme (EPCG Scheme)

- The objective of the EPCG Scheme is to facilitate the import of capital goods/machinery for producing quality goods and services and enhance India’s manufacturing competitiveness.

- Under the EPCG Scheme, Manufacturer exporter or a merchant exporter tied with a supporting manufacturer can import capital goods/machinery required for pre-production, production & post-production of export goods at 0% duty.

- Application to get an EPCG License must be made to the jurisdictional DGFT office.

- The Service exporters earning in foreign currencies are also eligible to apply for an EPCG License. Various service exporters can take the benefit of the EPCG scheme to reduce capital costs. Service Exporters like Hotels, Travel & Tour Operators, Taxi Operators, Logistics Companies, Construction Companies can utilize the EPCG Scheme by importing capital goods/equipment at 0% duty.

- EPCG scheme comes with an export obligation. The obligation is to export goods/services worth 6 times the duty saved value in a period of 6 years from the License issue date.

Key takeaway:

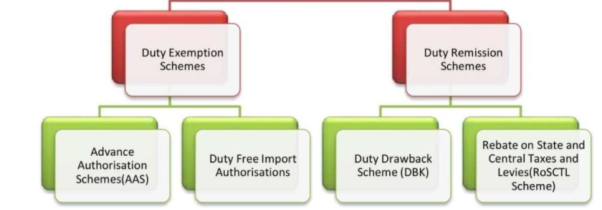

|

Schemes under FTP

An EOU / EHTP / STP unit may export all goods and services except items that are prohibited in ITC (HS). Export of Special Chemicals, Organisms, Materials, Equipment and Technologies (SCOMET) shall be subject to fulfillment of the conditions indicated in the ITC (HS).

All imports (Capital Goods and Raw material) in an EOU are duty free.

An EOU / EHTP / STP unit may import without payment of duty, all types of goods, including capital goods, as defined in the Policy, required by it for its activities or in connection therewith, provided they are not prohibited items of imports in the ITC (HS). The units are also permitted to import goods required for the approved activity, including capital goods, free of cost or on loan from clients.

Supplies to EOU etc. from DTA (Domestic Tariff Area) are considered deemed exports.

This gives rise to certain interesting benefits to the suppliers to the EOUs etc. They can get the Advance Authorization for their imports for the purpose of supplies to EOUs. They can also get the drawbacks for their supplies. This benefit can also be claimed by the EOU after required documentation.

CST paid on supplies to EOU is refundable

Fuel procured by EOUs are eligible for Duty Drawback.

EOUs can also avail of Promotional Schemes like FMS, FPS, VKGUY, HTPEPS if they are not availing of the direct tax benefits

- A 100% exporting company, has an option to register under the EOU Scheme [Export-oriented Units]

- The EOU scheme was introduced in 1981, with an aim to increase exports from India.

- The EOU scheme aims to provide a favorable ecosystem to the companies indulging in 100% exports by giving them certain waivers and concessions in compliance and taxation matters, thereby making it easier for them to conduct business.

- The major benefits of the EOU Scheme are – No Import duties while procuring raw materials or capital goods, faster custom clearance facilities, it can be set up anywhere in the country, unlike an SEZ unit.

- An application has to be made to the Board of approval to set up an EOU unit.

- The minimum investment in plants & machinery required is 1 Cr with exemptions to certain sectors.

- Around 2011-12, the EOU scheme became less prominent due to the removal of tax benefits given to it under the Income Tax Act.

GST Refund for Exporters / LUT Bond facility / 0.1% GST benefit for Merchant Exporters.

- Exporters are given a host of preferential facilities under the GST Act.

- They can make an export supply either “on payment of GST” or “without paying any GST” under the LUT bond facility.

- LUT Bond Facility – Exporters can export goods without paying any GST by obtaining a letter of undertaking/bond.

- IGST Refund – Exporters can export goods “on payment of GST” and claim the refund of the same from the Customs Department.

- 1% GST benefit for Merchant Exporters. – Merchant exporters/traders can obtain goods meant for export from the domestic supplier at a 0.1% concessional GST rate. This reduces the burden of GST & solves the working capital issues for merchant exporters to a great extent.

- Every exporter can take the above GST benefits.

Transport and Marketing Assistance Scheme (TMA Scheme)

- This scheme is introduced only for the agricultural export products and it came into effect from 01.03.2019.

- Under the TMA Scheme, freight cost up to a certain amount is reimbursed by the Govt. to make Indian agricultural products competitive in the global market.

- The TMA scheme is eligible for all the export products covered under chapters 1 to 24 of the ITC HS Code, including marine and plantation products. However, some specific products falling under Chapter 1 to 24 would not be covered under the Scheme for assistance

- Assistance under the TMA scheme will be provided in cash through a direct bank transfer (DBT) as a part of reimbursement of freight paid by the exporter.

- This scheme is implemented by the DGFT office.

Key takeaway

All imports (Capital Goods and Raw material) in an EOU are duty free.

An EOU / EHTP / STP unit may import without payment of duty, all types of goods, including capital goods, as defined in the Policy, required by it for its activities or in connection therewith, provided they are not prohibited items of imports in the ITC (HS). The units are also permitted to import goods required for the approved activity, including capital goods, free of cost or on loan from clients.

Supplies to EOU etc. from DTA (Domestic Tariff Area) are considered deemed exports.

This gives rise to certain interesting benefits to the suppliers to the EOUs etc. They can get the Advance Authorization for their imports for the purpose of supplies to EOUs. They can also get the drawbacks for their supplies. This benefit can also be claimed by the EOU after required documentation.

CST paid on supplies to EOU is refundable

Fuel procured by EOUs are eligible for Duty Drawback.

EOUs can also avail of Promotional Schemes like FMS, FPS, VKGUY, HTPEPS if they are not availing of the direct tax benefits

|

Schemes under FTP

Reference:

- Indirect Tax - Introduction of Goods and Services Tax by Manan Prakashan

- Indirect Tax by Kalyani Publisher